Question: A pension fund manager is considering three

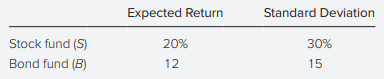

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows:

The correlation between the fund returns is .10.

What are the investment proportions in the minimum-variance portfolio of the two risky funds, and what are the expected value and standard deviation of its rate of return?

> Bugs Bunny, a wholesale dealer in ready-made menswear, achieves a gross profit ratio of 50 per cent. The statement of financial position of the business as at 30 June 20X8 was as follows: Since this date the accounting function has been neglected. Howe

> David Denton set up in business as a plumber a year ago, and he has asked you to act as his accountant. His instructions to you are in the form of the following letter. Dear Henry I was pleased when you agreed to act as my accountant and look forward to

> A year ago, you prepared financial statements for A. Wilson, a retailer. His closing position was then: Mr Wilson does not keep full records (despite your advice) and once again you have to use what information is available to prepare his financial sta

> The draft trial balance of Regent Ltd as at 31 May 20X9 agreed. The business proceeded with the preparation of the draft final financial statements and these showed a profit of £305,660. However, a subsequent audit revealed the following errors: 1. Bank

> Chocolate is a confectionery shop owned by Thomas McKee. Thomas operates a manual bookkeeping system and employs a cashier and a bookkeeper. When writing up the books of account for the year ended 31 December 20X9, the following errors were discovered: 1

> Arthur started a new business on 1 January 20X9. You are supplied with the following nominal ledger accounts, which have been closed off and a trial balance extracted. These are Arthur’s only transactions in this period. Trial balan

> Write journals to correct the following errors (suspense account errors): 1. The debit side of the cash book is undercast by £3,000. 2. A payment of £475 for an electricity bill is correctly entered in the cash book but debited to the telephone account a

> A colleague from the sales department has approached you with an idea for an expansion plan for the car dealership where you both work. Second-hand cars have higher margins. Therefore, he suggests that we change the current system which would mean that w

> Write journals to correct the following errors. These errors are not suspense account errors. 1. A payment of £4,000 for rent was incorrectly posted to the insurance account. 2. The cost of purchasing a delivery van, £12,400, is incorrectly debited to th

> Write journals to correct the following errors. These errors are not suspense account errors. 1. £150 sales invoice posted to the credit customer, D. Brown’s account – should have been posted to the credit customer, D. Black’s account. 2. £50 stationery

> Jacobs Ltd has recently completed its draft financial statements for the year ended 30 December 20X9, which showed a draft profit for the year of £300,000. During the audit a number of mistakes and omissions were uncovered. These are listed

> The draft final financial statements of RST Ltd for the year ended 30 April 20X9 showed a net profit for the year of £78,263. During the subsequent audit, the following errors and omissions were discovered. At the draft stage a suspense account had been

> Chi Knitwear Ltd is an old-fashioned firm with a handwritten set of books. A trial balance is extracted at the end of each month, and a statement of profit or loss and statement of financial position are computed. This month, however, the trial balance d

> At the end of January 20X9 a trial balance extracted from the ledger of Gerald Ltd did not balance and a suspense account was opened for the amount of the difference. Subsequently, the following matters came to light: 1. £234 had been receiv

> The following particulars relating to the year ended 31 March 20X9 have been extracted from the books of a trader: Prepare the sales ledger control account for the year ended 31 March 20X9, using relevant figures selected from the data shown above.

> Formica purchases inventory on credit from a large number of suppliers. The company maintains a purchases ledger control account as an integral part of its double-entry system and in addition maintains supplier accounts on a memorandum basis in a purchas

> A list of balances on the individual customer accounts in the sales ledger did not agree with the balance on the sales ledger control account. You are told that: 1. A sales invoice of £12,900 included in the sales day book had not been pos

> The books of original entry for James Plc showed the following for the month ended 31 March 20X9: Previous trade receivable/trade payable balances were £53,450/£42,150. Required Prepare the sales ledger and the purchases ledg

> Using the information from question 7.8, re-prepare J. Magee’s statement of financial position, using the horizontal format, as at 31 December 20X9.

> Complete the following table showing which ledger account is to be debited and which is to be credited:

> You are a consultant to a large manufacturing corporation that is considering a project with the following net after-tax cash flows (in millions of dollars): Years from Now After-Tax Cash Flow 0 ………………………………………..−40 1–10 ………………………………………15 The

> Characterize each company in the previous problem as underpriced, overpriced, or properly priced.

> Are the following true or false? Explain. a. Stocks with a beta of zero offer an expected rate of return of zero. b. The CAPM implies that investors require a higher return to hold highly volatile securities. c. You can construct a portfolio with beta of

> Outline how you would incorporate the following into the CCAPM: a. Liquidity. b. Nontraded assets. (Do you have to worry about labor income?)

> a. A mutual fund with beta of .8 has an expected rate of return of 14%. If rf = 5%, and you expect the rate of return on the market portfolio to be 15%, should you invest in this fund? What is the fund’s alpha? b. What passive portfolio comprised of a ma

> Suppose the rate of return on short-term government securities (perceived to be risk-free) is about 5%. Suppose also that the expected rate of return required by the market for a portfolio with a beta of 1 is 12%. According to the capital asset pricing m

> Two investment advisers are comparing performance. One averaged a 19% rate of return and the other a 16% rate of return. However, the beta of the first investor was 1.5, whereas that of the second investor was 1. a. Can you tell which investor was a bett

> The market price of a security is $50. Its expected rate of return is 14%. The risk-free rate is 6%, and the market risk premium is 8.5%. What will be the market price of the security if its correlation coefficient with the market portfolio doubles (and

> Assume that the risk-free rate of interest is 6% and the expected rate of return on the market is 16%. I am buying a firm with an expected perpetual cash flow of $1,000 but am unsure of its risk. If I think the beta of the firm is .5, when in fact the be

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> Wilson is now evaluating the expected performance of two common stocks, Furhman Labs Inc. and Garten Testing Inc. He has gathered the following information: The risk-free rate is 5%. The expected return on the market portfolio is 11.5%. The beta of Furhm

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> If the simple CAPM is valid, which of the following situations are possible? Explain. Consider each situation independently.

> Consider the two (excess return) index model regression results for A and B: RA = 1% + 1.2RM R-square = .576 Residual standard deviation = 10.3% RB = −2% + .8RM R-square = .436 Residual standard deviation = 9.1% a. Which stock has more firm-specific risk

> Consider the following two regression lines for stocks A and B in the following figure. a. Which stock has higher firm-specific risk? b. Which stock has greater systematic (market) risk? c. Which stock has higher R2? d. Which stock has higher alpha? e. W

> The following are estimates for two stocks. The market index has a standard deviation of 22% and the risk-free rate is 8%. a. What are the standard deviations of stocks A and B? b. Suppose that we were to construct a portfolio with proportions: Stock A:&

> A portfolio management organization analyzes 60 stocks and constructs a mean-variance efficient portfolio using only these 60 securities. a. How many estimates of expected returns, variances, and covariances are needed to optimize this portfolio? b. If o

> Why do we call alpha a “nonmarket” return premium? Why are high-alpha stocks desirable investments for active portfolio managers? With all other parameters held fixed, what would happen to a portfolio’s Sharpe ratio as the alpha of its component securiti

> How does the magnitude of firm-specific risk affect the extent to which an active investor will be willing to depart from an indexed portfolio?

> Suppose that the alpha forecasts in row 39 of Spreadsheet 8.1 are doubled. All the other data remain the same. a. Use the Summary of Optimization Procedure to estimate back-of-the-envelope calculations of the information ratio and Sharpe ratio of the new

> Suppose that on the basis of the analyst’s past record, you estimate that the relationship between forecast and actual alpha is: Actual abnormal return = .3 × Analyst’s forecast of alpha a. Redo Problem 17 using appropriately adjusted forecasts of alpha.

> You manage an equity fund with an expected risk premium of 10% and an expected standard deviation of 14%. The rate on Treasury bills is 6%. Your client chooses to invest $60,000 of her portfolio in your equity fund and $40,000 in a T-bill money market fu

> Recalculate Problem 17 for a portfolio manager who is not allowed to short sell securities. a. What is the cost of the restriction in terms of Sharpe’s measure? b. What is the utility loss to the investor (A = 2.8) given his new complet

> A portfolio manager summarizes the input from the macro and micro forecasters in the following table: a. Calculate expected excess returns, alpha values, and residual variances for these stocks. b. Construct the optimal risky portfolio. c. What is the S

> A stock recently has been estimated to have a beta of 1.24: a. What will a beta book compute as the “adjusted beta” of this stock? b. Suppose that you estimate the following regression describing the evolution of beta over time: βt = .3 + .7βt−1 What wou

> Suppose that the index model for stocks A and B is estimated from excess returns with the following results: For portfolio P with investment proportions of .60 in A and .40 in B, rework Problems 9, 10, and 12.

> What are the advantages of the index model compared to the Markowitz procedure for obtaining an efficiently diversified portfolio? What are its disadvantages?

> A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: The c

> A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: / T

> Convert the asset returns by decade presented in the table into real rates. Repeat Problem 20 for the real rates of return.

> Input the data from the table into a spreadsheet. Compute the serial correlation in decade returns for each asset class and for inflation. Also find the correlation between the returns of various asset classes. What do the data indicate?

> a. John Wilson is a portfolio manager at Austin & Associates. For all of his clients, Wilson manages portfolios that lie on the Markowitz efficient frontier. Wilson asks Mary Regan, CFA, a managing director at Austin, to review the portfolios of two of h

> When adding real estate to an asset allocation program that currently includes only stocks, bonds, and cash, which of the properties of real estate returns most affects portfolio risk? Explain. a. Standard deviation. b. Expected return. c. Covariance wit

> The correlation coefficients between several pairs of stocks are as follows: Corr(A, B) = .85; Corr(A, C) = .60; Corr(A, D) = .45. Each stock has an expected return of 8% and a standard deviation of 20%. If your entire portfolio is now composed of stock

> True or false: The standard deviation of the portfolio is always equal to the weighted average of the standard deviations of the assets in the portfolio.

> Suppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows: / Suppose that it is possible to borrow at the risk-free rate, rf . What must be the value of the riskfree rate? (Hint: Think

> Stocks offer an expected rate of return of 18% with a standard deviation of 22%. Gold offers an expected return of 10% with a standard deviation of 30%. a. In light of the apparent inferiority of gold with respect to both mean return and volatility, woul

> A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the third is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: The c

> Now draw the indifference curve corresponding to a utility level of .05 for an investor with risk aversion coefficient A = 4. Comparing your answer to Problem 6, what do you conclude?

> Draw the indifference curve in the expected return–standard deviation plane corresponding to a utility level of .05 for an investor with a risk aversion coefficient of 3. (Hint: Choose several possible standard deviations, ranging from 0 to .25, and find

> Consider a portfolio that offers an expected rate of return of 12% and a standard deviation of 18%. T-bills offer a risk-free 7% rate of return. What is the maximum level of risk aversion for which the risky portfolio is still preferred to T-bills?

> Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $70,000 or $200,000 with equal probabilities of .5. The alternative risk-free investment in T-bills pays 6% per year. a. If you require a risk premium of 8%,

> When the annualized monthly percentage excess rates of return for a stock market index were regressed against the excess returns for ABC and XYZ stocks over the most recent 5-year period, using an ordinary least squares regression, the following results

> You estimate that a passive portfolio, for example, one invested in a risky portfolio that mimics the S&P 500 stock index, offers an expected rate of return of 13% with a standard deviation of 25%. You manage an active portfolio with expected return 18%

> You estimate that a passive portfolio, for example, one invested in a risky portfolio that mimics the S&P 500 stock index, offers an expected rate of return of 13% with a standard deviation of 25%. You manage an active portfolio with expected return 18%

> Suppose that the borrowing rate that your client faces is 9%. Assume that the equity market index has an expected return of 13% and standard deviation of 25%, that rf = 5%, and that your fund has the parameters given in Problem 21. What is the largest p

> Suppose that the borrowing rate that your client faces is 9%. Assume that the equity market index has an expected return of 13% and standard deviation of 25%, that rf = 5%, and that your fund has the parameters given in Problem 21. What is the range of

> Look at the data in Table 6.7 on the average excess return of the U.S. equity market and the standard deviation of that excess return. Suppose that the U.S. market is your risky portfolio. a. If your risk-aversion coefficient is A = 4 and you believe tha

> Which of the following statements are true? Explain. a. A lower allocation to the risky portfolio reduces the Sharpe (reward-to-volatility) ratio. b. The higher the borrowing rate, the lower the Sharpe ratios of levered portfolios. c. With a fixed risk-f

> You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%. The T-bill rate is 8%. Suppose that your client decides to invest in your portfolio a proportion y of the total investment budget so that the overall por

> You’ve just stumbled on a new dataset that enables you to compute historical rates of return on U.S. stocks all the way back to 1880. What are the advantages and disadvantages in using these data to help estimate the expected rate of return on U.S. stock

> The Fisher equation tells us that the real interest rate approximately equals the nominal rate minus the inflation rate. Suppose the inflation rate increases from 3% to 5%. Does the Fisher equation imply that this increase will result in a fall in the re

> Consider these long-term investment data: The price of a 10-year $100 face value zero-coupon inflation-indexed bond is $84.49. A real-estate property is expected to yield 2% per quarter (nominal) with a SD of the (effective) quarterly rate of 10%. a. Com

> Hennessy & Associates manages a $30 million equity portfolio for the multimanager Wilstead Pension Fund. Jason Jones, financial vice president of Wilstead, noted that Hennessy had rather consistently achieved the best record among Wilstead’s six equity m

> You are faced with the probability distribution of the HPR on the stock market index fund given in Spreadsheet 5.1 of the text. Suppose the price of a put option on a share of the index fund with exercise price of $110 and time to expiration of 1 year is

> Suppose that the inflation rate is expected to be 3% in the near future. Using the historical data provided in this chapter, what would be your predictions for: a. The T-bill rate? b. The expected rate of return on the Big/Value portfolio? c. The risk pr

> Visit Professor Kenneth French’s data library Web site: http://mba.tuck.dartmouth.edu/pages/ faculty/ken.french/data_library.html and download the monthly returns of “6 portfolios formed on size and book-to-market (2 × 3).” Choose the value-weighted seri

> Suppose your expectations regarding the stock price are as follows: Use Equations 5.11 and 5.12 to compute the mean and standard deviation of the HPR on stocks.

> You are considering the choice between investing $50,000 in a conventional 1-year bank CD offering an interest rate of 5% and a 1-year “Inflation-Plus” CD offering 1.5% per year plus the rate of inflation. a. Which is the safer investment? b. Can you tel

> Use Figure 5.1 in the text to analyze the effect of the following on the level of real interest rates: a. Businesses become more pessimistic about future demand for their products and decide to reduce their capital spending. b. Households are induced to

> You have $5,000 to invest for the next year and are considering three alternatives: a. A money market fund with an average maturity of 30 days offering a current yield of 3% per year. b. A 1-year savings deposit at a bank offering an interest rate of 4%.

> Describe the likely effect on the yield to maturity of a bond resulting from: a. An increase in the issuing firm’s times-interest-earned ratio. b. An increase in the issuing firm’s debt-to-equity ratio. c. An increase in the issuing firm’s quick ratio.

> Probabilities for three states of the economy and probabilities for the returns on a particular stock in each state are shown in the table below. What is the probability that the economy will be neutral and the stock will experience poor performance?

> The coupon rate on a tax-exempt bond is 5.6%, and the rate on a taxable bond is 8%. Both bonds sell at par. At what tax bracket (marginal tax rate) would an investor be indifferent between the two bonds?

> If you place a limit order to sell 100 shares of stock at $55 when the current price is $62, how much will you receive for each share if the price drops to $50? a. $50. b. $55. c. $54.87. d. Cannot tell from the information given.

> Which is the most risky transaction to undertake in the stock index option markets if the stock market is expected to increase substantially after the transaction is completed? a. Write a call option. b. Write a put option. c. Buy a call option. d. Buy a

> A municipal bond carries a coupon of 6.75% and is trading at par. What is the equivalent taxable yield to a taxpayer in a combined federal plus state 34% tax bracket?

> A firm’s preferred stock often sells at yields below its bonds because a. Preferred stock generally carries a higher agency rating. b. Owners of preferred stock have a prior claim on the firm’s earnings. c. Owners of preferred stock have a prior claim on

> Find the after-tax return to a corporation that buys a share of preferred stock at $40, sells it at year-end at $40, and receives a $4 year-end dividend. The firm is in the 21% tax bracket.

> Suppose investors can earn a return of 2% per 6 months on a Treasury note with 6 months remaining until maturity. What price would you expect a 6-month-maturity Treasury bill to sell for?

> Hennessy & Associates manages a $30 million equity portfolio for the multimanager Wilstead Pension Fund. Jason Jones, financial vice president of Wilstead, noted that Hennessy had rather consistently achieved the best record among Wilstead’s six equity m

> An open-end fund has a net asset value of $10.70 per share. It is sold with a front-end load of 6%. What is the offering price?

> Greta has risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The

> Why are high-tax-bracket investors more inclined to invest in municipal bonds than low-bracket investors?

> Greta has risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The

> Greta has risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The

> Greta has risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The

> Greta has risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The

> Greta has risk aversion of A = 3 when applied to return on wealth over a one-year horizon. She is pondering two portfolios, the S&P 500 and a hedge fund, as well as a number of one-year strategies. (All rates are annual and continuously compounded.) The

> The correlation coefficients between several pairs of stocks are as follows: Corr(A, B) = .85; Corr(A, C) = .60; Corr(A, D) = .45. Each stock has an expected return of 8% and a standard deviation of 20%. Suppose that in addition to investing in one more