Question: A manufacturing company owns a major piece

A manufacturing company owns a major piece of equip ment that depreciates at the (continuous) rate f = f (t), where is the time measured in months since its last overhaul. Because a fixed cost A is incurred each time the machine is overhauled, the company wants to determine the optimal time T (in months) between overhauls.

(a). Explain why ft0f (x) ds represents the loss in value of the machine over the period of time since the last overhaul.

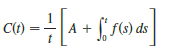

(b). Let C = C (t) be given by

What does C represent and why would the company want to minimize C?

(c). Show that C has a minimum value at the numbers r = T where C (T) = f (T).

> (a). Show that for cos (x2) > cos x for 0 < x < 1. (b). Deduce that for fπ/60 cos (x2) dx > 1/2.

> (a) Show that 1 < √1 + x3 < 1 + x3 for x > 0. (a) Show that 1 < f10 √1 + x3 dx < 1.25.

> A car dealer sells a new car for $18000. He also offers to sell the same car for payments of $375 per month for five years. What monthly interest rate is this dealer charging? To solve this problem, you will need to use the formula for the present value

> Use Part 1 of the Fundamental Theorem of Calculus to find the derivative of the function.

> In the figure, the length of the chord AB is 4 cm and the length of the arc AB is 5 cm. Find the central angle θ, in radians, correct to four decimal places. Then give the answer to the nearest degree.

> Water flows into and out of a storage tank. A graph of the rate of change r (t) of the volume of water in the tank, in liters per day, is shown. If the amount of water in the tank at time t = 0 is 25,000 L, use the Midpoint Rule to estimate the amount of

> The marginal cost of manufacturing x yards of a certain fabric is C'(x) = 3 – 0.01x + 0.000006x2 (in dollars per yard). Find the increase in cost if the production level is raised from 2000 yards to 4000 yards.

> (a). If f (x) = sin (sin x), use a graph to find an upper bound for f(4) (x). (b). Use Simpson’s Rule with n = 10 to approximate fπ0f (x) dx and use part (a) to estimate the error. (c). How large should n be to guarantee that the size of the error Sn in

> Suppose that a volcano is erupting and readings of the rate r (t) at which solid materials are spewed into the atmosphere are given in the table. The time is measured in seconds and the units for r (t) are tonnes (metric tons) per second. (a). Give upp

> The velocity of a car was read from its speedometer at 10-second intervals and recorded in the table. Use the Midpoint Rule to estimate the distance traveled by the car.

> A vertical plate is submerged (or partially submerged) in water and has the indicated shape. Explain how to approximate the hydrostatic force against one side of the plate by a Riemann sum. Then express the force as an integral and evaluate it.

> Water flows from the bottom of a storage tank at a rate of r (t) = 200 – 4t liters per minute, where 0 < t < 50. Find the amount of water that flows from the tank during the first 10 minutes.

> The linear density of a rod of length 4 m is given by ρ (x) = 9 + 2√x measured in kilograms per meter, where is measured in meters from one end of the rod. Find the total mass of the rod.

> The acceleration function (in m/s2) and the initial velocity are given for a particle moving along a line. Find (a) the velocity at time and (b) the distance traveled during the given time interval.

> The acceleration function (in m/s2) and the initial velocity are given for a particle moving along a line. Find (a) the velocity at time and (b) the distance traveled during the given time interval.

> The velocity function (in meters per second) is given for a particle moving along a line. Find (a) the displacement and (b) the distance traveled by the particle during the given time interval.

> Sketch the area represented by g (x). Then find g'(x) in two ways: (a) by using Part 1 of the Fundamental Theorem and (b) by evaluating the integral using Part 2 and then differentiating.

> The velocity function (in meters per second) is given for a particle moving along a line. Find (a) the displacement and (b) the distance traveled by the particle during the given time interval.

> A tank is full of water. Find the work required to pump the water out of the spout. In Exercises 21 and 22 use the fact that water weighs 62.5 lb/ft3.

> Use Newton’s method to find all the roots of the equation correct to eight decimal places. Start by drawing a graph to find initial approximations.

> Use Newton’s method to find all roots of the equation correct to six decimal places. 1/x = 1 + x3

> If f (x) is the slope of a trail at a distance of x miles from the start of the trail, what does f35 f (x) dx represent?

> (a). Graph the epitrochoid with equations x = 11 cos t – 4 cos (11t/2), x = 11 sin t – 4 sin (11t/2) What parameter interval gives the complete curve? (b). Use your CAS to find the approximate length of this curve.

> In Section 4.6 we defined the marginal revenue function R'(x) as the derivative of the revenue function R(x), where is the number of units sold. What does f10005000 R'(x) dx represent?

> A honeybee population starts with 100 bees and increases at a rate of n'(t) bees per week. What does 100 + f015 n'(t) dt represent?

> Express the limit as a definite integral

> The current in a wire is defined as the derivative of the charge: I (t) = Q'(t). (See Example 3 in Section 3.8.) What does fab I (t) dt represent?

> Use the properties of integrals to verify that 2 < f-11 √1 + x2 dx < 2 √2

> The boundaries of the shaded region are the y-axis, the line y = 1, and the curve y = 4√x. Find the area of this region by writing x as a function of y and integrating with respect to y

> Estimate the errors involved in Exercise 47, parts (a) and (b). How large should n be in each case to guarantee an error of less than 0.00001? Exercise 47: Use (a) the Trapezoidal Rule, (b) the Midpoint Rule, and (c) Simpson’s Rule wi

> Sketch the area represented by g (x). Then find g'(x) in two ways: (a) by using Part 1 of the Fundamental Theorem and (b) by evaluating the integral using Part 2 and then differentiating.

> The area of the region that lies to the right of the -axis and to the left of the parabola x = 2y – y2 (the shaded region in the figure) is given by the integral f02(2y – y2) dy. (Turn your head clockwise and think of

> Find the general indefinite integral. f sin 2x/sin x, dx

> Find the general indefinite integral. f sin x/1 – sin 2x, dx

> The curves with equations xn + yn = 1, n = 4, 6, 8, . . . , are called fat circles. Graph the curves with n = 2, 4, 6, 8, and 10 to see why. Set up an integral for the length L2k of the fat circle with n = 2k. Without attempting to evaluate this integral

> Find the general indefinite integral. f sec t (sec t + tan t) dt

> Find the general indefinite integral. f (1 + tan2a) da

> Find the general indefinite integral. f v (v2 + 2)2 dv

> Find the general indefinite integral. f (1 – t) (2 + t2) dt

> Find the general indefinite integral. Illustrate by graphing several members of the family on the same screen.

> A manufacturer determines that the cost of making units of a commodity is C (x) = 1800 + 25x – 0.2 x2 + 0.001 x3 and the demand function is p (x) = 48.2 – 0,03x. (a). Graph the cost and revenue functions and use the graphs to estimate the production leve

> Find the general indefinite integral. Illustrate by graphing several members of the family on the same screen.

> Evaluate the integral. f01 (1 + 1/2u4 – 2/5u9) du

> Evaluate the integral and interpret it as a difference of areas. Illustrate with a sketch.

> Evaluate the integral and interpret it as a difference of areas. Illustrate with a sketch.

> Repeat Exercise 35 for the curve y = (x2 + 1)-1 – x4. Exercise 35: Use a graph to estimate the x-intercepts of the curve y = 1 – 2x – 5x4. Then use this information to estimate the area of the region that lies under the curve and above the x-axis.

> A vertical plate is submerged (or partially submerged) in water and has the indicated shape. Explain how to approximate the hydrostatic force against one side of the plate by a Riemann sum. Then express the force as an integral and evaluate it.

> Use a graph to estimate the x-intercepts of the curve y = 1 – 2x – 5x4. Then use this information to estimate the area of the region that lies under the curve and above the x-axis.

> Use a graph to give a rough estimate of the area of the region that lies beneath the given curve. Then find the exact area.

> A high-tech company purchases a new computing system whose initial value is V. The system will depreciate at the rate f (t) and will accumulate maintenance costs at the rate g = g (t), where is the time measured in months. The company wants to determine

> A hockey team plays in an arena with a seating capacity of 15,000 spectators. With the ticket price set at $12, average attendance at a game has been 11,000. A market survey indicates that for each dollar the ticket price is lowered, average attendance w

> Find a function f and a number a such that 6 + fxaf (t)/t2 dt = 2√x for all x > 0.

> Let (a). Find an expression for g (x) similar to the one for f (x). (b). Sketch the graphs of f and g. (c). Where f is differentiable? Where is g differentiable?

> Let g (x) = fx0 f(t) dt, where f is the function whose graph is shown. (a). Evaluate g (x), g (1), g (2), g (3), and g (6). (b). On what interval is g increasing? (c). Where does g have a maximum value? (d). Sketch a rough graph of g.

> Find a function f such that f (1) = 0 and f'(x) = 2x/x.

> Evaluate the integral. f02 |2x – 1| dx

> Evaluate the integral. f01/√3 t2 – 1/t4 - 1 dt

> The figure shows graphs of the marginal revenue function R' and the marginal cost function C' for a manufacturer. [Recall from Section 4.6 that R (x) and C (x) represent the revenue and cost when x units are manufactured. Assume that R and C are measured

> TriStateCo, an Idaho corporation, has operated landfills in Washington (WA), Idaho (JD), and Oregon (OR) for the past 20 years. The states are changing their environmental Laws governing landfills, and it is cumbersome for each landfill to meet the req

> Ten years ago, Xio and Xandra each invested $300,000 to create Xava Corporation. Xava develops and manufactures rock climbing and bungee jumping equipment. The business has become very profitable (it now is valued at $3 million), and Xandra would like to

> Calabra, S.A., a Peruvian corporation, manufactures inventory in Peru. The inventory is sold to independent distributors in the United States, with title passing to the purchaser in the United States. Calabra has no employees or operations within the Uni

> CL LLC is a manufacturing business and reported taxable income of $40 million before interest expense, taxes, depreciation, and amortization ("tax EBITDA"), plus $1.5 million of separately stated investment income. CL incurred interest expense of $1 mill

> You are the head tax accountant for Venture Company, a U.S. corporation. The board of directors is considering expansion overseas and asks you to present a summary of the U.S. tax consequences of investing overseas through a foreign subsidiary. Prepare a

> The Giant consolidated group includes SubTwo, which was acquired as part of a § 382 ownership change. SubTwo brought with it to the group a large NOL carryforward, $3 million of which is available this year under the SRLY rules due to SubTwo's positive c

> Browne and Red, both C corporations, formed the BR Partnership on January 1, 2018. Neither Browne nor Red is a personal service corporation, and BR is not a tax shelter. BR's gross receipts were $22 million, $25 million, $31 n1illion, and S32 million, re

> Determine consolidated taxable income for the calendar year Yeti Group, which elected consolidated status immediately upon the creation of the two member corporations on January 1 of year 1. All recognized income is ordinary in nature, and no intercomp

> Compute consolidated taxable income for the calendar year Blue Group, which elected consolidated status immediately upon creation of the two member corporations in January of year 1. All recognized income relates to the consulting services of the firms.

> Continue with the facts of Problem 36. WhaleCo has determined that it will sell all of its MinnowCo stock at the end of year 3 for $250,000. Taking into account the rules regarding excess loss accounts, determine WhaleCo's gain/ loss from its sale of the

> Write an e-mail to a client describing situations in which the partnership entity form might be more advantageous (or disadvantageous) than operating as a C corporation. Use subheadings and bullet points to highlight your major thought5

> Continue with the facts presented in Problem 34. At the end of the first year, the LLC distributes $100,000 cash to Sam. No distribution is made to Drew. Assume there were no other income or loss transactions for the year that would affect San1's basis i

> Continue with the facts presented in Problem 34. a. Use Microsoft Excel to construct a balance sheet for SD LLC assuming that Drew's services are completed immediately after forming SD. The balance sheet should show two numeric columns, including the LLC

> Sam and Drew are equal partners in SD LLC formed on June 1 of the current year. Sam contributed land that he inherited from his uncle in 2012. Sam's uncle purchased the land in 1985 for $30,000. The land was worth $100,000 when Sam's uncle died. The fair

> Continue with the facts presented in Problem 32. Mike purchased the land (value of $100,000; adjusted basis of $136,000) several years ago as an investment (capital) asset. Mike and MM LLC are trying to decide between two alternatives. • In Alternative 1

> The Chief consolidated group reports the following result5 for the tax year. Dollar amounts are listed in millions. Determine each member's share of the consolidated tax liability. All of the members have consented to use the relative taxable income me

> Brutus Corporation transferred inventory (basis of $10, fair market value of $30) and machinery used in a U.S. factory (adjusted basis of S50, fair market value of $75) to MapleLeaf, a newly formed corporation in Canada, in exchange for all of MapleLeaf'

> USCo incorporated it5 foreign branch operations in Italy by transferring the branch's assets to a foreign corporation in return solely for stock in the new corporation. All of the branch's assets are located outside the United States and are used in the

> Locket, a U.S. C corporation, makes a sale to a customer in Sustainia, a country that applies a 25% income tax to business profits. The customer found out about Locket through an internet search. Locket has no facilities or employees outside the United S

> Eta Corporation approaches Lily White, the CEO and sole shareholder of MuCo, regarding the acquisition of MuCo's cat toy division assets (worth $1.3 million). As selling the assets would create a $600,000 gain, ($1.3 million value - $700,000 basis), Lily

> Butler Manufacturing, Inc., a calendar year domestic corporation, operates Communications a branch in Ireland. In the current year, the branch generated 750,000 euros in net profit. On December 31 of the current year, one euro equaled $1.15. The average

> Your firm has assigned you to work with Jeri Byers, the tax director of a small group of corporations. The group qualifies to file on a consolidated basis and plans to make its first election to file in that manner. In a memo for Jeri's tax file, describ

> Mila purchased a Zaffre Corporation $100,000 bond 10 years ago for its face value. The bond pays 5% interest annually. In a ''Type E" reorganization, Zaffre exchanges Mila's bond with 10 years ren1aining for a 15-year bond also having a face value of $10

> Through a "Type C" reorganization, Springer Corporation was merged into Spaniel Corporation last year. Springer shareholders received 40% of the Spaniel stock in exchange for all of their Springer shares. Springer liquidated immediately after the exchang

> PorCo, a foreign corporation not engaged in a U.S. trade or business, received a $600,000 dividend from USCo, a domestic corporation. ForCo incurred $45,000 in expenses related to earning the di vidend. All of USCo's income is from U.S. sources. Porco is

> B.I.G. Corporation sold a plot of undeveloped land to SubCo this year for Critical Thinking $100,000. B.I.G. had acquired the land several years ago for $40,000. T he consolidated return also reflects the operating resu lts of the parties: B.I.G. generat

> Indeco, a U.S. C corporation, operates Grange, a sales branch in Staccato. Indeco's U.S. corporate n1arginal tax rate is 21%; it is 15% for Staccato. Grange's pretax profit for the year is SI million. There is no income tax treaty between the United Stat

> WhaleCo acquired all of the common stock of MinnowCo early in year 1 for $900,000, and MinnowCo immediately elected to join WhaleCo's consolidated Federal income tax return. As part of the takeover, WhaleCo also acquired $300,000 of MinnowCo bonds. The r

> Continue with the facts of Problem 34. a. Assume instead that JuniorCo's tax year 2 produced a $6 million NOL. b. Same a5 part (a), except that JuniorCo's tax year 2 produced a $40 million NOL. c. Continue with the facts of part (b). Express as a Microso

> Senior, Ltd., acquires all of the stock of JuniorCo for $30 million at the beginning of year 1. The group immediately elects to file income tax returns on a consolidated basis. Senior's operations generate a $50 million profit every year. In year 2, Juni

> Assume the same facts as in Problem 32, except that the group members have adopted the relative tax liability tax-sharing method.

> Ramon and Sophie are the sole shareholders of Gull Corporation. Ramon and Sophie each have a basis of $100,000 in their 2,000 shares of Gull common stock. When its E & P was $700,000, Gull Corporation issued a preferred stock dividend on the common share

> The consolidated tax liability for most affiliated groups is assigned among die parent and its subsidiaries-each entity is responsible for "its share" of the tax. The Regulations allow several methods to be used to compute these allocations. In this cont

> Aqua Corporation is a retail operation specializing in pool equipment and outdoor furniture. It is very interested in merging with Icterine Corporation, a lamp manufacturer; Aqua is very profitable, and Icterine has large business credits that it has not

> Rufous Corporation just lost a $1.5 million product liability lawsuit. Its assets currently are worth $2 million, and its outstanding liabilities amount to $800,000 without considering the lawsuit loss. As a result of the lawsuit, Rufous's futu re revenu

> Puce has two individual shareholders, Abram and Carmella. The shareholders purchased their stock in Puce four years ago at a cost of $500,000 each. For the past nine years, Puce has been engaged in two lines of business, manufacturing and wholesale distr

> Shepherd Corporation i5 considering acquiring RentCo by exchanging its stock (value of $10 per share) for RentCo's only asset, a tract of land (adjusted basis of $150,000 and no liability). The yearly net rent that RentCo receives on the land is $50,000.

> Child Corporation joined the Thrust consolidated group in year 1. At the time it joined the group, Child held a $2 million NOL carryforward. On a consolidated basis, the members of Thrust generated significant profits for many years. Child's operating r

> Cougar, Jaguar, and Ocelot corporations have filed on a consolidated, calendar year basis for many years. At the beginning of the tax year, the group elects to de-consolidate. The group's S6 million NOL carryforward can be traced in the following manner:

> Grand Corporation owns all of the stock of Junior, Ltd., a corporation that has been declared bankrupt and holds no net assets. Junior still owes $1 million to wholesale, Inc., one of its suppliers, and $2.5 million to the IRS for unpaid Federal income t

> Boulder Corporation owns all of the stock of PebbleCo, so they constitute a Federal affiliated group and a parent-subsidiary controlled group. By completing the following chart, delineate for Boulder's tax department some of the effects of an election to

> Your client, Big Corporation, and its wholly owned subsidiary, LittleCo, file a consolidated return for Federal income tax purposes. Indicate both the financial accounting and the tax treatment of the following transactions. a. LittleCo pays a SI million