Question: A performance report that compares budgeted and

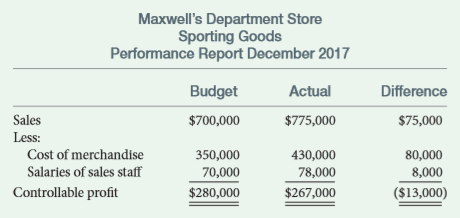

A performance report that compares budgeted and actual profit in the sporting goods department of Maxwell’s Department Store for the month of December follows:

Required:

a. Evaluate the department in terms of its increases in sales and expenses. Do you believe it would be useful to investigate either or both of the increases in expenses?

b. Consider storewide electricity cost. Would this cost be a controllable or a noncontrollable cost for the manager of sporting goods? Would it be useful to include a share of storewide electricity cost on the performance report for sporting goods?

Transcribed Image Text:

Maxwell's Department Store Sporting Goods Performance Report December 2017 Budget Actual Difference Sales $700,000 $775,000 $75,000 Less: Cost of merchandise 350,000 430,000 80,000 Salaries of sales staff 70,000 78,000 8,000 Controllable profit $280,000 $267,000 ($13,000)

> Custom Auto Parts manufactures parts to order for antique cars. Custom Auto Parts makes everything from fenders to engine blocks. Each customer order is treated as a job. The company currently has two jobs, Job 9823 and Job 9824, that are complete, altho

> Retter Shoe Company has expected overhead costs of $12,000,000. The majority of the overhead costs are incurred providing production support to the direct labor force. Direct labor rates vary from $10 to $20 per hour, and more complex tasks are assigned

> At Designs by Deirdre, the budgeted income statement for December 2017 indicated sales of $600,000 and cost of sales of $400,000. Actual sales and cost of sales were $700,000 and $425,000, respectively. Should Deirdre Nelson, owner of the company, be con

> Renton Custom Windows produces custom windows for business and residential customers who supply Renton with architectural specifications. At the start of 2017, three jobs were in process: Cost incurred as of 1/1/2017 Job 258……………………………….$5,000 Job 259……

> Terra Cotta Designs manufactures custom tiles. The following information relates to the fiscal year ending December 31, 2017: Beginning balance in Raw Material Inventory……………………$ 450,000 Purchases of raw material………………………………………………….1,500,000 Ending bala

> Southwest Community Hospital uses a job-order costing system to track charges for each patient. The following charges relate to Candice O’Dea, who had laparoscopic knee surgery: Pharmacy……………………………………………….$ 450 Sterile supply…………………………………………….1,500 Sup

> Rosemont Music is a musical instrument repair facility located in Akron, Ohio. The repair shop uses a job-order costing system and applies overhead costs to repair jobs on the basis of repair technician hours. The following estimates were used in prepari

> Lane Confectioners produces special orders of sugar candies and chocolates for airlines and hotels. During March, Lane purchased, on credit, 2,100 pounds of confectioner’s sugar at $.80 per pound, 2,300 pounds of granulated sugar at $.90 per pound, 900 p

> Vulcan Molding has three production departments: A, B, and C. At the start of the year, the company estimated that it would incur $3,080,000 of direct labor cost and $10,000,000 of manufacturing overhead as follows: Along with many others, Vulcan Moldin

> Vulcan Molding produces molded rubber components. At the start of the year, the company estimated that it would incur $3,500,000 of direct labor cost and $9,000,000 of manufacturing overhead. Overhead is allocated to production on the basis of direct lab

> LaPlatt & Associates is an accounting firm that provides audit, tax, and accounting services to medium-size retail companies. It employs 50 professionals (10 partners and 40 associates) who work directly with clients. The average expected total compensat

> World Window Company produces custom windows to specifications provided by architects. At the end of its accounting period, its account balances indicated the following: Raw Materials Inventory………………………………..$ 80,000 Work in Process Inventory……………………………….

> In the past year, Oak Crafters Cabinets had total revenue of $2,500,000, cost of goods sold of $1,000,000 (before adjustment for over- or underapplied overhead), administrative expenses of $600,000, and selling expenses of $400,000. During the year, over

> Which of the following statements related to performance reports is false? a. Performance reports may provide a comparison of actual performance with planned performance. b. Performance reports may provide a comparison of actual performance with perfor

> For the list of product manufacturers below, indicate whether a job-cost system (J) or a process-cost system (P) would be most appropriate. a. Chemicals processor b. Paint manufacturer c. Law firm d. Producer of molds used by other manufacturing firm

> At Precision Custom Molds, manufacturing overhead was estimated to be $20,000,000 at the start of the year and direct labor hours were estimated to be 200,000. Overhead is applied to jobs using a predetermined overhead rate with direct labor hours as the

> Just-in-time production systems seek to reduce the amount of material, work in process, and finished goods inventory. However, companies must hold some amount of inventory to buffer themselves from various negative events. List three such events and brie

> Milton Company is a steel fabricator, and job 325 consists of producing 500 steel supports for Wendell Construction Company. Overhead is applied on the basis of direct labor hours, using a predetermined overhead rate of $25 per hour. Direct costs associa

> During the month of August, Star Plastics applied overhead to jobs using an overhead rate of $3 per dollar of direct labor. Direct labor in August was $100,000. Actual overhead in August was $260,000. Assume that actual overhead was composed of the foll

> During the month of August, Star Plastics had $70,000 of labor costs that were traced to specific jobs. The company also had $50,000 of indirect labor related to supervisory pay. Required: Prepare journal entries to record labor cost during August. (H

> During the month of August, Star Plastics had material requisitions for $200,000 of materials related to specific jobs and $10,000 of miscellaneous materials classified as overhead. Required: Prepare journal entries to record the issuance of materials

> Place Y (yes) beside the general ledger accounts related to inventory in a job-order cost system and N (no) by those that are not. a. Raw Materials Inventory b. Administrative Expense c. Work in Process Inventory d. Finished Goods Inventory e. Presi

> Franklin Computer Repair treats each repair order as a job. Overhead is allocated based on the cost of technician time. At the start of the year, annual technician wages were estimated to be $800,000, and company overhead was estimated to be $500,000. R

> Lawler Manufacturing Company expects annual manufacturing overhead to be $900,000. The company also expects 60,000 direct labor hours costing $1,800,000 and machine run time of 30,000 hours. Required: Calculate predetermined overhead allocation rates b

> Megan Kelly is the chief financial officer of a chain of 25 drugstores. Explain how she can use budgets in both planning profit and controlling operations.

> At Star Plastics, the balance in manufacturing overhead (which represents over- or underapplied overhead) is always closed to Cost of Goods Sold. This is done even when the balance is relatively large. Suzette Barger, the controller, explains that this m

> Consider three very similar companies. Company A allocates manufacturing overhead to jobs using labor hours as the allocation base; Company B allocates manufacturing overhead to jobs using machine hours as the allocation base; and Company C allocates man

> Select one or two concepts from this chapter and describe how you might use those concepts in your future career. Briefly describe the career or job you will be performing. Then specifically describe the type of situation for which the concept could be a

> At the start of the year, Vencor Company estimated manufacturing overhead to be $2,000,000. Eighty percent of the overhead is fixed and relates to depreciation of equipment. The remaining 20 percent is variable. The company estimated machine hours to be

> Injection Molding Services uses a job-order costing system. The account balances at the end of the period for the product cost-related accounts are as follows: Raw Materials Inventory…………………..$300,000 Work in Process Inventory………………….500,000 Finished Go

> Smith and Baker Legal Services employs five full-time attorneys and nine paraprofessionals. Budgeted salaries are $100,000 for each attorney and $50,000 for each paraprofessional. Budgeted indirect costs (e.g., rent, secretarial support, copying, etc.) a

> Refer to the information in Exercise 2-13. Required: a. Determine the balance in manufacturing overhead, and prepare a journal entry to close the balance to cost of goods sold. b. Why is it important to close the balance in manufacturing overhead? c.

> Brixton Surgical Devices, a public company with sales of over $900,000,000, is one of the world’s largest producers of surgical clamps, saws, screws, and stents. Its business involves production of both stock items and custom pieces for doctors at resear

> DuPage Powder Coating applies powder coating finishes to a variety of materials and parts used by small and medium-size manufacturing firms. Essentially, powder coating involves the application of powder (finely divided particles of organic polymer conta

> YSL Marketing Research is a small firm located in Seattle, Washington. On behalf of its clients, the firm conducts focus group meetings, telephone and mail opinion surveys, and evaluations of marketing strategies. The firm has three partners and six nonp

> The Wellington Hotel is a posh hotel in Manhattan that uses a customer relationship management (CRM) system to track customer preferences and purchases. Provide two examples of specific information the CRM system might capture and how the hotel could use

> List three examples of nonmonetary information that might appear in a managerial accounting report.

> In a performance report, current-period performance is compared with some benchmark. What might be a useful benchmark?

> What is the goal of managerial accounting?

> If an action is legal, is it necessarily ethical? Explain.

> What is meant by the statement “You get what you measure!”?

> What is incremental analysis? How is the concept used in decision making?

> Consider the manager of the home appliance department at a Sears store. For this manager, list a cost that is controllable and a cost that is noncontrollable.

> Explain the difference between fixed and variable costs.

> How have changes in information technology impacted management of the value chain?

> List three differences between financial and managerial accounting.

> Rachel Cook owns Campus Copies, a copy business with several high-speed copy machines. One is a color copier that was purchased just last year at a cost of $25,000. Recently a salesperson got Rachel to witness a demo of a new $23,000 color copier that pr

> Matthew Gabon, the sales manager of Office Furniture Solutions, prepared the following budget for 2017: After he submitted his budget, the president of Office Furniture Solutions reviewed it and recommended that advertising be increased to $100,000. Fur

> At the end of 2017, Cyril Fedako, CFO for Central Products, received a report comparing budgeted and actual production costs for the company’s plant in Forest Lake, Minnesota: His first thought was that costs must be out of control sin

> Search the Web for the Code of Conduct for Sears Holdings Corporation (the parent company for Sears and Kmart). For each of the following cases, indicate whether it is allowable under the Code of Conduct. In your answer, cite specific language in the cod

> The Riverview Hotel is a deluxe four-star establishment. Late on Friday, it had 20 of its 300 rooms available when the desk clerk received a call from the Pines Hotel. The Pines Hotel made a booking error and did not have room for four guests (each of wh

> Each year the president of Smart-Toys Manufacturing selects a single performance measure and offers significant financial bonuses to all key employees if the company achieves a 10 percent improvement on the measure in comparison to the prior year. She re

> Linda Vendetto is the manager of contact lenses and related products sold online by a large retail chain (think Walmart.com). In this capacity, she is responsible for approximately 250 different products. Required: a. Explain why the level of detail in

> Guthrie Wilson is an accountant at Bellwether Systems, a company that sells and installs customer relationship management (CRM) systems. The company sells third party software at cost plus 25 percent and charges a fee of $300 per hour of installation/int

> Why would the difference between income computed under full costing and income computed under variable costing be relatively small if a company used a JIT inventory management system?

> What are the benefits of variable costing for internal reporting purposes?

> Explain the difference between variable costing and full costing.

> If fixed manufacturing overhead per unit under full costing is multiplied by the change units in inventory between the beginning of the period and the end of the period, what does the resulting number represent?

> Explain how fixed manufacturing costs are treated under variable costing. How are fixed manufacturing costs treated under full costing?

> If a company produces less than it sells (the extra units sold are from beginning inventory), which method of computing net income will result in the higher net income? Why?

> If a company produces 50,000 units and sells 46,000 units during a period, which method of computing net income will result in the higher net income? Why?

> A key idea in this book is that “You get what you measure!” Essentially, this means that performance measures have a great influence on the behavior of managers. Required: Select a company with which you are familiar. Identify three performance measure

> Explain why income computed under full costing will exceed income computed under variable costing if production exceeds sales.

> Explain how a manufacturing company can “bury” fixed production costs in ending inventory under full costing.

> Explain why the ending inventory balance (assuming it is not zero) computed under full costing will always be greater than the ending inventory balance computed under variable costing.

> The Octavius Company produces a 10-inch chef knife used by commercial chefs. The knives sell for $50 each. In 2017, the company produced 50,000 units and sold 45,000 units. There was no beginning inventory. Following are variable and full costing income

> Miller Heating is a small manufacturer of auxiliary heaters. The units sell for $300 each. In 2017, the company produced 1,000 units and sold 800 units. There was no beginning inventory. Below are variable and full costing income statements for 2017. Re

> The following information is available for Dunworth Canoes, a company that builds inexpensive aluminum canoes: In its first year of operation, the company produced 21,000 units but was able to sell only 18,000 units. In its second year, the company need

> The following information is available for Skipper Pools, a manufacturer of aboveground swimming pool kits: In its first year of operation, the company produced 12,000 units but was able to sell only 10,000 units. In its second year, the company needed

> Sampson Steel produces high-quality worktables. The company has been in operation for 3 years, and sales have declined each year due to increased competition. The following information is available: Required: a. Calculate profit and the value of ending

> Firemaster BBQ produces stainless steel propane gas grills. The company has been in operation for 3 years, and sales have declined each year due to increased competition. The following information is available: Required: a. Calculate profit and the val

> The following information relates to Axar Products for calendar year 2017, the company’s first year of operation: Units produced……………………………………………………………….20,000 Units sold………………………………………………………………………18,000 Selling price per unit……………………………………………………..$

> Search the Web for a company seeking to hire a controller. What duties does it specify, and what skills does it want the controller to have?

> Boswell Plumbing Products produces a variety of valves, connectors, and fixtures used in commercial and residential plumbing applications. Recently a senior manager walked into the cost accounting department and asked Nick Somner to tell her the cost of

> The following information relates to Jorgensen Manufacturing for calendar year 2017, the company’s first year of operation: Units produced………………………………………………………….8,000 Units sold………………………………………………………………….…7,000 Selling price per unit…………………………………………………$

> The following information relates to Dorian Industrial for fiscal 2017, the company’s first year of operation: Units produced………………………………………………..420,000 Units sold……………………………………………………….400,000 Selling price per unit………………………………………$ 50 Direct mate

> The following information relates to Porter Manufacturing for fiscal 2017, the company’s first year of operation: Selling price per unit……………………………………………..$150 Direct material per unit…………………………………………$75 Direct labor per unit…………………………………………….$30 Variabl

> The following information relates to Sinclair Industries for fiscal 2017, the company’s first year of operation: Units produced………………………………….…,500,000 Units sold……………………………………………...450,000 Units in ending inventory………………………...50,000 Fixed manufacturing

> The following information relates to Jarden Industries for fiscal 2017, the company’s first year of operation: Units produced…………………………..150,000 Units sold…………………………………..120,000 Units in ending inventory…………….30,000 Fixed manufacturing overhead…$900,000

> Hawthorne Golf, the maker of a sought-after set of golf clubs, was formed in 2012. The selling price for each golf club set is $1,700, variable production costs are $900 per unit, fixed production costs are $2,100,000 per year, and fixed selling and admi

> The Renton Tractor Company was formed at the start of 2015 and produces a small garden tractor. The selling price is $4,800, variable production costs are $2,000 per unit, fixed production costs are $6,400,000 per year, and fixed selling and administrati

> Below is a variable costing income statement for Trio Office Supplies, a company well known for its quality high-volume automatic staplers. For the coming year, the company is considering hiring three additional sales representatives at $150,000 each in

> Below is a variable costing income statement for the Wilner Glass Company, a maker of bottles for the beverage industry. For the coming year, the company is considering hiring two additional sales representatives at $80,000 each for base salary. The comp

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is cost of goods sold using variable costing?

> Shauna Miller is an accountant at Western Building Supplies. Recently, in the course of her normal processing of transactions and related documents, she noticed that two of her company’s top sales executives were taking the purchasing agents of important

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is cost of goods sold using full costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is the value of ending inventory using variable costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is the value of ending inventory using full costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is net income using variable costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is net income using full costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is cost of goods sold using variable costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: Calculate the difference in full costing net income and variable costing net income without preparing either income statement.

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is the value of ending inventory using variable costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is net income using variable costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is net income using full costing?

> At LA Porsche, customers receive an online survey asking them to rate their satisfaction after every car service. How is this measure likely to affect the financial welfare of Hulmut Schmidt, manager of the service department? List three actions that Hul

> In a normal year, Wilson Industries has $24,000,000 of fixed manufacturing costs and produces 60,000 units. In the current year, demand for its product has decreased, and it appears that the company will be able to sell only 50,000 units. Senior managers

> A key idea in this book is that decision making relies on incremental analysis. Required: Explain how the use of variable costing can support appropriate decisions using incremental analysis.

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: How much fixed manufacturing overhead is in ending inventory under full costing? Compare this amount to the difference in the net incomes calculated in Exerci

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is cost of goods sold using full costing?