Question: Below is a variable costing income statement

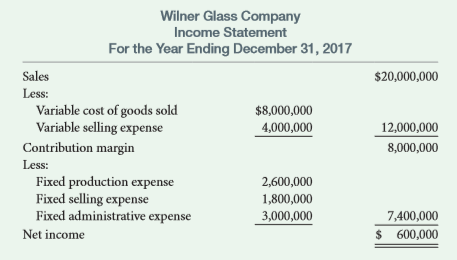

Below is a variable costing income statement for the Wilner Glass Company, a maker of bottles for the beverage industry. For the coming year, the company is considering hiring two additional sales representatives at $80,000 each for base salary. The company anticipates that each sales representative will generate $900,000 of incremental sales.

Required:

a. Calculate the impact on profit of the proposed hiring decision. Should the company hire the two additional sales representatives?

b. Consider the analysis of the decision performed by the company’s chief accountant and compare it to your analysis in part a. What is the fundamental flaw in the chief accountant’s work?

Analysis by Chief accountant

Incremental sales………………………$1,800,000

Income per dollar of sales in 2017

($600,000 ÷ $20,000,000)………………..0.03

54,000

Less increase in base salary…….…..160,000

Effect on profit……………………..($ 106,000)

Transcribed Image Text:

Wilner Glass Company Income Statement For the Year Ending December 31, 2017 Sales $20,000,000 Less: Variable cost of goods sold Variable selling expense $8,000,000 4,000,000 12,000,000 Contribution margin 8,000,000 Less: Fixed production expense Fixed selling expense Fixed administrative expense 2,600,000 1,800,000 3,000,000 7,400,000 Net income $ 600,000

> YSL Marketing Research is a small firm located in Seattle, Washington. On behalf of its clients, the firm conducts focus group meetings, telephone and mail opinion surveys, and evaluations of marketing strategies. The firm has three partners and six nonp

> The Wellington Hotel is a posh hotel in Manhattan that uses a customer relationship management (CRM) system to track customer preferences and purchases. Provide two examples of specific information the CRM system might capture and how the hotel could use

> List three examples of nonmonetary information that might appear in a managerial accounting report.

> In a performance report, current-period performance is compared with some benchmark. What might be a useful benchmark?

> What is the goal of managerial accounting?

> If an action is legal, is it necessarily ethical? Explain.

> What is meant by the statement “You get what you measure!”?

> What is incremental analysis? How is the concept used in decision making?

> Consider the manager of the home appliance department at a Sears store. For this manager, list a cost that is controllable and a cost that is noncontrollable.

> Explain the difference between fixed and variable costs.

> How have changes in information technology impacted management of the value chain?

> List three differences between financial and managerial accounting.

> Rachel Cook owns Campus Copies, a copy business with several high-speed copy machines. One is a color copier that was purchased just last year at a cost of $25,000. Recently a salesperson got Rachel to witness a demo of a new $23,000 color copier that pr

> Matthew Gabon, the sales manager of Office Furniture Solutions, prepared the following budget for 2017: After he submitted his budget, the president of Office Furniture Solutions reviewed it and recommended that advertising be increased to $100,000. Fur

> At the end of 2017, Cyril Fedako, CFO for Central Products, received a report comparing budgeted and actual production costs for the company’s plant in Forest Lake, Minnesota: His first thought was that costs must be out of control sin

> A performance report that compares budgeted and actual profit in the sporting goods department of Maxwell’s Department Store for the month of December follows: Required: a. Evaluate the department in terms of its increases in sales an

> Search the Web for the Code of Conduct for Sears Holdings Corporation (the parent company for Sears and Kmart). For each of the following cases, indicate whether it is allowable under the Code of Conduct. In your answer, cite specific language in the cod

> The Riverview Hotel is a deluxe four-star establishment. Late on Friday, it had 20 of its 300 rooms available when the desk clerk received a call from the Pines Hotel. The Pines Hotel made a booking error and did not have room for four guests (each of wh

> Each year the president of Smart-Toys Manufacturing selects a single performance measure and offers significant financial bonuses to all key employees if the company achieves a 10 percent improvement on the measure in comparison to the prior year. She re

> Linda Vendetto is the manager of contact lenses and related products sold online by a large retail chain (think Walmart.com). In this capacity, she is responsible for approximately 250 different products. Required: a. Explain why the level of detail in

> Guthrie Wilson is an accountant at Bellwether Systems, a company that sells and installs customer relationship management (CRM) systems. The company sells third party software at cost plus 25 percent and charges a fee of $300 per hour of installation/int

> Why would the difference between income computed under full costing and income computed under variable costing be relatively small if a company used a JIT inventory management system?

> What are the benefits of variable costing for internal reporting purposes?

> Explain the difference between variable costing and full costing.

> If fixed manufacturing overhead per unit under full costing is multiplied by the change units in inventory between the beginning of the period and the end of the period, what does the resulting number represent?

> Explain how fixed manufacturing costs are treated under variable costing. How are fixed manufacturing costs treated under full costing?

> If a company produces less than it sells (the extra units sold are from beginning inventory), which method of computing net income will result in the higher net income? Why?

> If a company produces 50,000 units and sells 46,000 units during a period, which method of computing net income will result in the higher net income? Why?

> A key idea in this book is that “You get what you measure!” Essentially, this means that performance measures have a great influence on the behavior of managers. Required: Select a company with which you are familiar. Identify three performance measure

> Explain why income computed under full costing will exceed income computed under variable costing if production exceeds sales.

> Explain how a manufacturing company can “bury” fixed production costs in ending inventory under full costing.

> Explain why the ending inventory balance (assuming it is not zero) computed under full costing will always be greater than the ending inventory balance computed under variable costing.

> The Octavius Company produces a 10-inch chef knife used by commercial chefs. The knives sell for $50 each. In 2017, the company produced 50,000 units and sold 45,000 units. There was no beginning inventory. Following are variable and full costing income

> Miller Heating is a small manufacturer of auxiliary heaters. The units sell for $300 each. In 2017, the company produced 1,000 units and sold 800 units. There was no beginning inventory. Below are variable and full costing income statements for 2017. Re

> The following information is available for Dunworth Canoes, a company that builds inexpensive aluminum canoes: In its first year of operation, the company produced 21,000 units but was able to sell only 18,000 units. In its second year, the company need

> The following information is available for Skipper Pools, a manufacturer of aboveground swimming pool kits: In its first year of operation, the company produced 12,000 units but was able to sell only 10,000 units. In its second year, the company needed

> Sampson Steel produces high-quality worktables. The company has been in operation for 3 years, and sales have declined each year due to increased competition. The following information is available: Required: a. Calculate profit and the value of ending

> Firemaster BBQ produces stainless steel propane gas grills. The company has been in operation for 3 years, and sales have declined each year due to increased competition. The following information is available: Required: a. Calculate profit and the val

> The following information relates to Axar Products for calendar year 2017, the company’s first year of operation: Units produced……………………………………………………………….20,000 Units sold………………………………………………………………………18,000 Selling price per unit……………………………………………………..$

> Search the Web for a company seeking to hire a controller. What duties does it specify, and what skills does it want the controller to have?

> Boswell Plumbing Products produces a variety of valves, connectors, and fixtures used in commercial and residential plumbing applications. Recently a senior manager walked into the cost accounting department and asked Nick Somner to tell her the cost of

> The following information relates to Jorgensen Manufacturing for calendar year 2017, the company’s first year of operation: Units produced………………………………………………………….8,000 Units sold………………………………………………………………….…7,000 Selling price per unit…………………………………………………$

> The following information relates to Dorian Industrial for fiscal 2017, the company’s first year of operation: Units produced………………………………………………..420,000 Units sold……………………………………………………….400,000 Selling price per unit………………………………………$ 50 Direct mate

> The following information relates to Porter Manufacturing for fiscal 2017, the company’s first year of operation: Selling price per unit……………………………………………..$150 Direct material per unit…………………………………………$75 Direct labor per unit…………………………………………….$30 Variabl

> The following information relates to Sinclair Industries for fiscal 2017, the company’s first year of operation: Units produced………………………………….…,500,000 Units sold……………………………………………...450,000 Units in ending inventory………………………...50,000 Fixed manufacturing

> The following information relates to Jarden Industries for fiscal 2017, the company’s first year of operation: Units produced…………………………..150,000 Units sold…………………………………..120,000 Units in ending inventory…………….30,000 Fixed manufacturing overhead…$900,000

> Hawthorne Golf, the maker of a sought-after set of golf clubs, was formed in 2012. The selling price for each golf club set is $1,700, variable production costs are $900 per unit, fixed production costs are $2,100,000 per year, and fixed selling and admi

> The Renton Tractor Company was formed at the start of 2015 and produces a small garden tractor. The selling price is $4,800, variable production costs are $2,000 per unit, fixed production costs are $6,400,000 per year, and fixed selling and administrati

> Below is a variable costing income statement for Trio Office Supplies, a company well known for its quality high-volume automatic staplers. For the coming year, the company is considering hiring three additional sales representatives at $150,000 each in

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is cost of goods sold using variable costing?

> Shauna Miller is an accountant at Western Building Supplies. Recently, in the course of her normal processing of transactions and related documents, she noticed that two of her company’s top sales executives were taking the purchasing agents of important

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is cost of goods sold using full costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is the value of ending inventory using variable costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is the value of ending inventory using full costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is net income using variable costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is net income using full costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is cost of goods sold using variable costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: Calculate the difference in full costing net income and variable costing net income without preparing either income statement.

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is the value of ending inventory using variable costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is net income using variable costing?

> During the year, Xenoc produces 1,500 pairs of speakers and sells 1,200 pairs. Required: What is net income using full costing?

> At LA Porsche, customers receive an online survey asking them to rate their satisfaction after every car service. How is this measure likely to affect the financial welfare of Hulmut Schmidt, manager of the service department? List three actions that Hul

> In a normal year, Wilson Industries has $24,000,000 of fixed manufacturing costs and produces 60,000 units. In the current year, demand for its product has decreased, and it appears that the company will be able to sell only 50,000 units. Senior managers

> A key idea in this book is that decision making relies on incremental analysis. Required: Explain how the use of variable costing can support appropriate decisions using incremental analysis.

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: How much fixed manufacturing overhead is in ending inventory under full costing? Compare this amount to the difference in the net incomes calculated in Exerci

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is cost of goods sold using full costing?

> During the year, Summit produces 50,000 snow shovels and sells 45,000 snow shovels. Required: What is the value of ending inventory using full costing?

> MicroImage Technology, Inc. produces miniature digital color cameras that can be attached to endoscopes and other medical devices. The cameras sell for $215 per unit and are disposed of after each use. For 2017, the company’s first full

> RainRuler Stains produces a variety of exterior wood stains that have excellent coverage and longevity. In 2017, the company produced and sold 310,000 gallons of stain. There was no beginning inventory. Income for the year was as follows: In the past, t

> Provide two examples of costs that are likely to be variable costs.

> Distinguish between discretionary and committed fixed costs.

> Define the term mixed cost and provide an example of such a cost.

> In the past year, Williams Mold & Machine had sales of $7,000,000 and total production costs of $5,000,000. In the coming year, the company believes that sales and production can be increased by 25 percent, but this will require adding a second productio

> In a multiproduct setting, when would it not be appropriate to focus on a weighted average contribution margin per unit?

> What is the difference between the contribution margin and the contribution margin ratio?

> Explain the concept of a relevant range.

> Explain why total compensation paid to the sales force is likely to be a mixed cost.

> Provide two examples of costs that are likely to be fixed costs.

> Explain how to use account analysis to estimate fixed and variable costs.

> Which company would have higher operating leverage: a software company that makes large investments in research and development or a trucking company that relies on owner- operators (i.e. individuals who own and drive their own truck). Why?

> Michael Bordellet is the owner/pilot of Bordellet Air Service. The company flies a daily round trip from Seattle’s Lake Union to a resort in Canada. In 2016, the company reported an annual income before taxes of $120,403, although that

> Lancer Audio produces a high-end DVD player that sells for $1,300. Total operating expenses for the past 12 months are as follows: Required: a. Use regression analysis to estimate fixed and variable costs. Round to two decimal places. b. Compare your

> Lancer Audio produces a high-end DVD player that sells for $1,300. Total operating expenses for the past 12 months are as follows: Required: a. Use the high-low method to estimate fixed and variable costs. b. Based on these estimates, calculate the br

> Wilmington Chemicals produces a chemical, PX44, which is used to retard fading in exterior house paint. In the past year, the company produced 200,000 gallons at a total cost of $1,200,000 ($6 per gallon). The company is currently considering an order fo

> Lancer Audio produces a high-end DVD player that sells for $1,300. Total operating expenses for July were as follows: Units produced and sold………………150 Component costs………………..$ 71,000 Supplies…………………………………..2,500 Assembly labor………………………25,000 Rent……………………

> The Hotel Majestic is interested in estimating fixed and variable costs so that the company can make more accurate projections of costs and profit. The hotel is in a resort area that is particularly busy from November through February. In July and August

> Cindy Havana is a vice president of finance for Captain Wesley’s Restaurant, a chain of 12 restaurants on the East Coast, including five restaurants in Florida. The company is considering a plan whereby customers will be mailed coupons

> Fleet Valley Shoes produces two models: the Nx100 (a shoe aimed at competitive runners) and the Mx100 (a shoe aimed at fitness buffs). Sales and costs for the most recent year are indicated: Required: a. Suppose the company has 200,000 assembly hours a

> For the past 3 years, Rhetorix, Inc., has produced the model X100 stereo speaker. The model is in high demand, and the company can sell as many pairs as it can produce. The selling price per pair is $900. Variable costs of production are $300, and fixed

> Equillion, Inc., and Storis, Inc., are two companies in the pharmaceutical industry. Equillion has relatively high fixed costs related to research and development. Storis, however, does little research and development. Instead, the company pays for the r

> National Tennis Racquet Co. produces and sells three models: Required: (Round all percentages to two decimal places and monetary calculations to the nearest dollar.) a. What is the weighted average contribution margin per unit? b. Calculate the break-

> Fidelity Multimedia sells audio and video equipment and car stereo products. After performing a study of fixed and variable costs in the prior year, the company prepared a product-line profit statement as follows: Required: a. Calculate the contributio

> Edison Entrepreneur Services, Inc., is a legal services firm that files the paperwork to incorporate a business. Edison charges $1,200 for the incorporation application package and plans to file 1,600 applications next year. The company’s projected incom

> FirstTown Mortgage specializes in providing mortgage refinance loans. Each loan customer is charged a $500 loan processing fee by FirstTown when the loan is processed. FirstTown’s costs over the past year associated with processing the

> Zachary made plans to visit a friend in New York during the Memorial Day weekend. However, before the trip, his employer asked him if he would work overtime for 16 hours at $35 per hour during the weekend. What will be the opportunity cost if Zachary dec

> Gaming Solutions is a small company that assembles PCs to gamer customer specifications. The company buys all of its component parts from Northern Oregon Computer Warehouse. In the past year, the company had the following before-tax profit: The company,

> Last year, Emily Sanford had a booth at the three-day Indianapolis Craft Expo, where she sold a variety of silver jewelry handcrafted in India. Her before-tax profit was as follows: Sales………&ac

> Information for three costs incurred at Boole Manufacturing in the first quarter follows: Required: Plot each cost, making the vertical axis cost and the horizontal axis units produced. Classify each cost (depreciation, direct labor, and telecommunicat

> Rhetorix, Inc., produces stereo speakers. The selling price per pair of speakers is $1,000. The variable cost of production is $300 and the fixed cost per month is $49,000. Required: Calculate the expected profit for November, assuming that the company

> Campus Copy & Printing wants to predict copy machine repair expense at different levels of copying activity (number of copies made). The following data have been gathered: Required: Determine the fixed and variable components of repair expense usin