Question: Air France–KLM (AF), a Franco-Dutch

Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements According to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are available under the Finance link at the company’s website (www.airfranceklm.com). This case addresses a variety of characteristics of financial statements prepared using IFRS, often comparing and contrasting those attributes of statements prepared under U.S. GAAP. s are grouped in parts according to various sections of the textbook.

Part A: Financial Statements, Income Measurement, and Current Assets

A1. What amounts did AF report for the following items for the fiscal year ended

December 31, 2019?

a. Total revenues

b. Income from current operations

c. Net income or net loss (Group part)

d. Total assets

e. Total equity

A2. What was AF’s basic earnings or loss per share for the year ended December 31, 2019?

A3. What amount did AF report for total assets, total liabilities, and total equity in the balance sheet? Show that the basic accounting equation remains in balance.

A4. Find sales revenue (labeled “Salesâ€) in the income statement. Using this amount:

(a) Prepare the journal entry for the sale of tickets, assuming all tickets are sold for cash and before the day of the flight.

(b) Prepare the journal entry on the day of the flight.

A5. Among the items listed under “External expenses†in the income statement is aircraft fuel (see Note 7). Using this amount:

(a) Prepare the journal entry for the prepayment of aircraft fuel in advance of flights.

(b) Prepare the journal entry on the day of the flight.

A6. The statement of cash flows lists the purchase of property, plant, and equipment. Assuming this full amount was for the purchase of flight equipment, prepare the journal entry.

A7. Describe the similarities and differences in the order of presentation of the components of the balance sheet between IFRS as applied by Air France–KLM (AF) and a typical balance sheet prepared in accordance with U.S. GAAP.

A8. What amounts did Air France-KLM (AF) report for the following items:

(a) Current assets

(b) Long-term assets

(c) Total assets

(d) Current liabilities

(e) Long-term liabilities

(f) Total liabilities

(g) Total shareholders’ equity on December 31, 2019?

A9. What was Air France-KLM’s (AF) largest current asset other than “Other current liabilities�

A10. Compute Air France-KLM’s (AF) current ratio and debt to equity ratio in 2019.

A11. Assuming Air France-KLM’s (AF) industry had an average current ratio of 1.0 and an average debt to equity ratio of 2.5, comment on AF’s liquidity and long-term solvency.

A12. What amount does AF report in the income statement for:

(a) Sales and for external expenses related to.

(b) Aircraft fuel

(c) Aircraft maintenance (see Note 7)?

A13. What amount does AF report for amortization, depreciation, and provisions in the income statement? How is this amount listed in the statement of cash flows?

A14. Under which account title in the income statement does AF include interest expense and interest revenue?

A15. Under which activities in the statement of cash flows are interest paid and interest received included? Under IFRS, what other classifications for these items are allowed?

A16. Under which activities in the statement of cash flows are dividends paid and dividends received included? Under IFRS, what other classifications for these items are allowed?

A17. Refer to AF’s Note 29.2 “Description of the actuarial assumptions and related sensitivities.â€

a. What are the average discount rates used to measure AF’s (a) 10–15 year and

(b) 15-year and more pension obligations in the “euro†geographic zone in 2019?

b. If the rate used had been 1% (100 basis points) higher, what change would have occurred in the pension obligation in 2019? What if the rate had been 1% lower?

A18. In Note 4.6, AF indicates that “Sales related to air transportation, which consist of passenger and freight transportation, are recognized when the transportation service is provided, so passenger and freight tickets are consequently recorded as ‘Deferred revenue upon issuance.’â€

a. Examine AF’s balance sheet. What is the total amount of deferred revenue on ticket sales as of December 31, 2019?

b. When transportation services are provided with respect to the deferred revenue on ticket sales, what journal entry would AF make to reduce deferred revenue?

c. Does AF’s treatment of deferred revenue under IFRS appear consistent with how these transactions would be handled under U.S. GAAP? Explain.

A19. Assume that AF is forced to cancel a flight due to mechanical trouble, requiring it to promise €50,000 of compensation to affected passengers. Prepare the journal entry that AF would make to record this event.

A20. AF has a frequent flyer program (also called a “loyalty programâ€), “Flying Blue,†which allows members to acquire “miles†as they fly on Air France or partner airlines that are redeemable for free flights or other benefits.

a. Does AF treat “Miles†as a separate performance obligation?

b. Does AF report any liability associated with these miles as of December 31, 2019?

c. Is AF’s accounting for its frequent flier program consistent with IFRS 15?

A21. In Note 4.11, AF describes how it values trade receivables. Is this approach consistent with U.S. GAAP?

A22. In Note 25, AF reconciles the beginning and ending balances of its valuation allowance for trade accounts receivable. Prepare a T-account for the valuation allowance and include entries for the beginning and ending balances and any reconciling items that affected the account during 2019.

A23. Examine Note 27. Does AF have any bank overdrafts? If so, are the overdrafts shown in the balance sheet the same way they would be shown under U.S. GAAP?

A24. What method does the company use to value its inventory? What other alternatives are available under IFRS? Under U.S. GAAP?

A25. AF’s inventories are valued at the lower of cost or net realizable value. Does this approach differ from U.S. GAAP?

Part B: Property, Plant, and Equipment and Intangible Assets

B1. How does AF account for information technology (IT) development costs before and during its development phase?

B2. AF does not report any research and development expenditures. If it did, its approach to accounting for research and development would be significantly different from U.S. GAAP. Describe the differences between IFRS and U.S. GAAP in accounting for research and development expenditures.

B3. AF does not report the receipt of any government grants. If it did, its approach to accounting for government grants would be significantly different from U.S. GAAP. Describe the differences between IFRS and U.S. GAAP in accounting for government grants. If AF received a grant for the purchase of assets, what alternative accounting treatments are available under IFRS?

B4. AF’s property, plant, and equipment is reported at cost. The company has a policy of not revaluing property, plant, and equipment. Suppose AF decided to revalue its flight equipment on December 31, 2019, and that the fair value of the equipment on that date was €14,000 million. Prepare the journal entry to record the revaluation, assuming the journal entry to record annual depreciation had already been recorded. (Hint: You will need to locate the original cost and accumulated depreciation of the equipment at the end of the year in the appropriate disclosure note.)

B5. Under U.S. GAAP, what alternatives do companies have to value their property, plant, and equipment?

B6. AF calculates depreciation of plant and equipment on a straight-line basis, over the useful life of the asset. Describe any differences between IFRS and U.S. GAAP in the calculation of depreciation.

B7. When does AF test for the possible impairment of fixed assets? How does this approach differ from U.S. GAAP?

B8. Describe the approach AF uses to determine fixed asset impairment losses. (Hint: See Note 4.16.) How does this approach differ from U.S. GAAP?

B9. The following is included in AF’s Disclosure Note 4.13: “Intangible assets are recorded at initial cost less accumulated amortization and any accumulated impairment losses.†Assume that on December 31, 2019, AF decided to revalue its Other intangible assets (see Note 16), and that the fair value on that date was determined to be €500 million. Amortization expense for the year already has been recorded. Prepare the journal entry to record the revaluation.

Part C: Investments

C1. Read Notes 23 and 36.4. Focusing on debt investments accounted for at fair value through profit loss (FVPL):

a. As of December 31, 2019, what is the total balance of those investments in the balance sheet?

b. How much of that balance is classified as current and how much as noncurrent?

c. How much of the fair value of those investments is accounted for using level 1, level 2, and level 3 inputs of the fair value hierarchy? Given that information, assess the reliability (representational faithfulness) of this fair value estimate.

C2. Complete C1 again, but for equity investments accounted for as either FVPL or FVOVI.

C3. Read Notes 4.3. And 21.

a. When AF can exercise significant influence over an investee, what accounting approach does it use to account for the investment? How does AF determine if it can exercise significant influence?

b. If AF is involved in a joint venture, what accounting approach does it use to account for the investment?

c. What is the carrying value of AF’s equity-method investments in its December 31, 2019, balance sheet?

d. How did AF’s equity-method investments affect AF’s 2019 net income from continuing operations?

Part D: Liabilities

D1. Read Notes 4.6 and the Consolidated Balance Sheet. What do you think gave rise to total deferred income of €3,289 as of the end of fiscal 2019? Would transactions of this type be handled similarly under U.S. GAAP?

D2. Is the threshold for recognizing a provision under IFRS different than it is under U.S. GAAP? Explain.

D3. Note 30 lists “Return obligation liability and provision for leased aircraft and other provisions†(hereafter, “other provisionsâ€).

a. Do the beginning and ending balances of total provisions shown in Note 30 for fiscal 2019 tie to the balance sheet? By how much has the total amount of AF’s “other provisions†increased or decreased during fiscal 2019?

b. Write journal entries for the following changes in the litigation provision that occurred during fiscal 2019, assuming any amounts recorded on the income statement are recorded as “provision expense†and any use of provisions is paid for in cash. In each case, provide a brief explanation of the event your journal entry is capturing.

i. New provision.

ii. Use of provision.

iii. Reversal of unnecessary provisions

c. Is AF’s treatment of its litigation provision under IFRS similar to how it would be treated under U.S. GAAP?

D4. Note 30.2 lists a number of contingent liabilities. Are amounts for those items recognized as a liability on AF’s balance sheet? Explain.

D5. Examine the long-term borrowings described in AF’s Note 31.3. Note that AF has convertible bonds outstanding that it issued in 2019 (Ou d’Echange En Actions Novellas ou Existents—OCEANE). Prepare the journal entry AF would use to record the issue of convertible bonds. Prepare the journal entry AF would use to record the issue of the convertible bonds if AF used U.S. GAAP.

D6. AF does not elect the fair value option (FVO) to report its financial liabilities. Examine Note 36.3, “Market value of financial instruments.†If the company had elected the FVO for all of its debt measured at amortized cost, what would be the balance at December 31, 2019, in the fair value adjustment account?

Part E: Leases, Income Taxes, and Pensions

E1. In Note 4.15: Lease contracts, AF states that “leases recorded in the balance sheet and lead to the recognition of: - an asset representing a right of use of the asset leased during the lease term of the contract and - a liability related to the payment obligation.†Is this policy generally consistent with U.S. GAAP?

E2. From your reading of Note 4.15, “Lease Contracts,†what would you say is the primary difference between IFRS 16 and U.S. GAAP in the way lessees account for leases?

E3. What amounts are shown in AF’s December 31, 2019, balance sheet for deferred taxes?

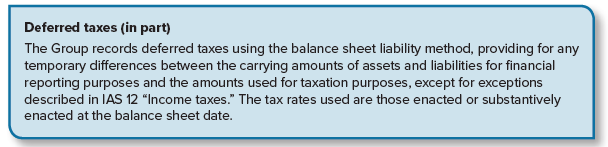

E4. Here’s an excerpt from one of AF’s notes to its financial statements:

Is this policy consistent with U.S. GAAP? Explain.

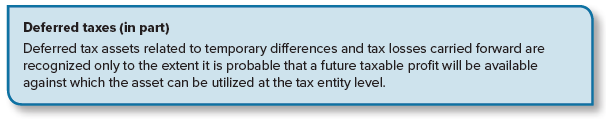

E5. Below is an excerpt from one of AF’s notes to its financial statements:

Is this policy consistent with U.S. GAAP? Explain.

E6. AF reported past service cost (called prior service cost under U.S. GAAP) in its income statement as part of net periodic pension cost. How does that reporting method compare with the way we report prior service cost under U.S. GAAP?

E7. Look at AF’s balance sheet. How does the way that AF reports Pension assets and Pension liabilities (provisions) compare with the way we report those amounts under U.S. GAAP?

E8. See Note 29.3, “Evolution of Commitments.†For its Netherlands operations, did AF report (a) Net interest cost

(b) Net interest income in 2019?

Part F: Shareholders’ Equity and Additional Financial Reporting Issues

F1. Locate Note 28.5 in AF’s financial statements. What items comprise “Reserves and retained earnings,†as reported in the balance sheet?

F2. In its presentation of the components of the balance sheet, which is listed first, current assets or non-current assets? Does this approach differ from U.S. GAAP?

F3. In its presentation of the components of the balance sheet, which are listed first, current liabilities or non-current liabilities? Does this approach differ from U.S. GAAP?

F4. In its presentation of the components of the balance sheet, which is listed first, liabilities or shareholders’ equity? Does this approach differ from U.S. GAAP?

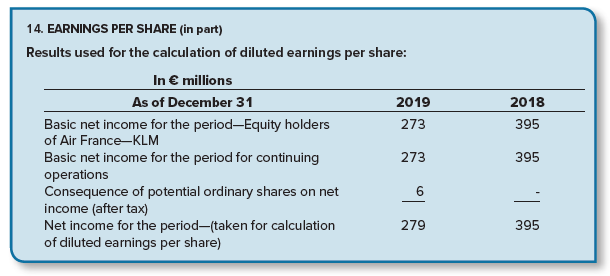

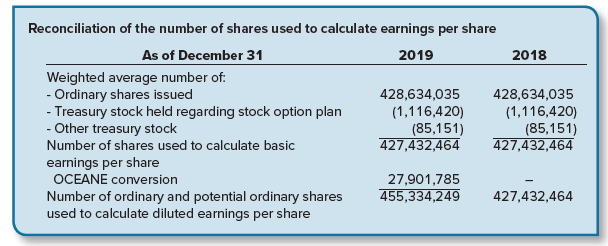

F5. Note 14 in the financial statements provides information on the calculation of earnings per share:

a. Based on the information provided, what was diluted earnings per share for 2019?

b. Using the information provided by the note, infer the reason for the €6 million “Consequence of potential ordinary shares on net income.â€

F6. Refer to AF’s disclosure notes, in particular Note 2, “Restatement of Accounts 2018.†Was the first of the two changes described in the note a change in estimate, a change in principle, a change in reporting entity, or an error correction?

F7. Is this the same approach AF would follow if using U.S. GAAP?

F8. In its statement of cash flows, what are the three primary classifications into which AF’s cash inflows and cash outflows are separated?

F9. Is this classification the same as or different from cash flow statements prepared in accordance with U.S. GAAP?

F10. In which classification are cash inflows from dividends included in AF’s cash flow statements?

F11. Is this classification different from cash flow statements prepared in accordance with U.S. GAAP?

F12. In Note 36.1, “Risk Management,†and Note 36.2, “Derivative Instruments,†AF discusses its various risk exposures and strategies to reduce its exposure to such risks. Based on the detailed disclosures in Note 36.2, what are the three largest risk exposures (based on the fair value of its derivative instruments)? For each risk exposure, list one derivative instrument it uses to hedge that risk.

F13. Per Note 36.2, what is the fair value of AF’s derivative instruments on the balance sheet? (Hint: This information is also provided in Notes 26 and 35.

> Horizon Corporation manufactures personal computers. The company began operations in 2019 and reported profits for the years 2019 through 2022. Due primarily to increased competition and price slashing in the industry, 2023’s income statement reported a

> Jerry’s Ice Cream Parlor is considering a marketing plan to increase sales of ice cream cones. The plan will give customers a free ice cream cone if they buy 10 ice cream cones at regular prices. Customers will be issued a card that will be punched each

> The following Trueblood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from th

> The following Trueblood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from th

> A company purchased inventory on account for $250,000. The company returned $20,000 of the inventory to the supplier for credit. Record (1) the purchase of inventory on account and (2) the purchase return, assuming the company uses a perpetual inventory

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from t

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from t

> Consider the following excerpts from revenue recognition disclosure notes: 1. eBay: “The transaction price is allocated to each performance obligation based on its stand alone selling price (SSP). In instances where SSP is not directly observable, we gen

> The following is an excerpt from Note 2 of Deere & Company’s annual report: “Under the terms of sales agreements with dealers, interest-free periods are determined based on the type of equipment sold and the time of year of the sale. These periods range

> For each of the following note disclosures, indicate whether the disclosure would likely appear in (A) environmental, (B) social, or (C) governance disclosures: (1) ratio of pay of chief executive offer to median full-time employee; (2) ratio of independ

> Use the following information from the balance sheet of Rainier Plumbing to determine the missing amounts.

> You have been asked to review the December 31, 2024, balance sheet for Champion Cleaning. After completing your review, you list the following three items for discussion with your superior: 1. An investment of $30,000 is included in current assets. Manag

> The following is a December 31, 2024, post-closing trial balance for Culver City Lighting, Inc. Prepare a classified balance sheet for the company

> Refer to the situation described in BE 3–2. Prepare a classified balance sheet for K and J Nursery, Inc. The equipment originally cost $140,000.

> Refer to the situation described in BE 3–2. Determine the year-end balance in retained earnings for K and J Nursery, Inc.

> On June 30, 2024, Countryside Farms purchased custom-made harvesting equipment from a local producer. In payment, Countryside signed a noninterest-bearing note requiring the payment of $60,000 in two years. The fair value of the equipment is not known, b

> The trial balance for K and J Nursery, Inc., listed the following account balances at December 31, 2024, the end of its fiscal year: cash, $16,000; accounts receivable, $11,000; inventory, $25,000; equipment (net), $80,000; accounts payable, $14,000; sal

> Indicate whether each of the following assets and liabilities typically should be classified as current or long-term: (a) accounts receivable within the next 60 days; (b) prepaid rent for the next six months; (c) notes receivable due in two years; (d) no

> Refer to the situation described in BE 19–3. Suppose that the options expire without being exercised. What journal entry will National record?

> Refer to the situation described in BE 19–3. Suppose that the options are exercised on April 3, 2027, when the market price is $19 per share. What journal entry will National record?

> On January 1, 2024, Hugh Morris Comedy Club (HMCC) granted 1 million stock options to key executives exercisable for 1 million shares of the company’s common stock at $20 per share. The stock options are intended as compensation for the next three years.

> Refer to the situation described in BE 19–3. Suppose that unexpected turnover during 2025 caused the forfeiture of 5% of the stock options. What is the effect on earnings in 2025? In 2026?

> Garcia Company granted 9 million of its no par common shares to executives, subject to forfeiture if employment is terminated within three years. The common shares have a market price of $5 per share on January 1, 2023, the grant date of the restricted s

> Arnsberg Corporation had 800,000 shares of common stock issued and outstanding at January 1. No common shares were issued during the year, but on January 1, Arnsberg issued 100,000 shares of convertible preferred stock. The preferred shares are convertib

> Fully vested incentive stock options exercisable at $50 per share to obtain 24,000 shares of common stock were outstanding during a period when the average market price of the common stock was $60 and the ending market price was $60. What will be the net

> At December 31, 2023 and 2024, Funk & Noble Corporation had outstanding 820 million shares of common stock and 2 million shares of 8%, $100 par value cumulative preferred stock. No dividends were declared on either the preferred or common stock in 2023 o

> Refer to the information in BE 10–6. Now assume that instead of purchasing the patent, Advanced Technologies spent $1,200,000 to develop the patent internally, consisting of personnel ($800,000), equipment ($300,000), and materials ($100,000). All additi

> McDonnell-Myer Corporation reported net income of $741 million. The company had 544 million common shares outstanding at January 1 and sold 36 million shares on February 28. As part of an annual share repurchase plan, 6 million shares were retired on Apr

> Under its executive stock option plan, National Corporation granted 12 million options on January 1, 2024, that permit executives to purchase 12 million of the company’s $1 par common shares within the next six years, but not before December 31, 2026 (th

> On January 1, 2024, Medical Transport Company’s accumulated postretirement benefit obligation was $25 million. At the end of 2024, retiree benefits paid were $3 million. Service cost for 2024 is $7 million. Assumptions regarding the trend of future heal

> Prince Distribution Inc. has an unfunded postretirement benefit plan. Medical care and life insurance benefits are provided to employees who render 10 years’ service and attain age 55 while in service. At the end of 2024, Jim Luka wits is 31. He was hire

> Craned Corp had been a very profitable company until the current tax year, in which it generated an NOL because a competitor launched a product that is much better than Grand’s. Craned recognized a deferred tax asset associated with the NOL carry forward

> Hwang Inc. had taxable income of $100,000 in 2017, no income or loss in 2018 and 2019, and an NOL of $50,000 in 2020. The applicable tax rate was 40% in 2017 and 25% in 2018 and thereafter. Prepare the journal entry that Hwang would make in 2020, assumin

> Loss Co reported a net operating loss of $25 million for financial reporting and tax purposes. Taxable income last year and the previous year, respectively, was $20 million and $15 million. The enacted tax rate each year is 25%. Assume that Loss Co quali

> Superior Developers sells lots for residential development. When lots are sold, Superior recognizes income for financial reporting purposes in the year of the sale. For some lots, Superior recognizes income for tax purposes when the cash is collected. In

> J-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in 2024. The only difference between accounting and taxable income is estimated product warranty costs of $9,000 for sales in 2024. Warranty payments are expected to b

> A company reports 2024 pretax accounting income of $10 million, but because of a single temporary difference, taxable income is only $7 million. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Prepare the appropria

> On March 17, Advanced Technologies purchased a patent related to laser surgery techniques. The purchase price of the patent is $1,200,000. The patent is expected to benefit the company for the next five years. The company had the following additional cos

> On January 1, 2024, Jaspers Corporation leased equipment under a finance lease designed to earn the lessor a 12% rate of return for providing long-term financing. The lease agreement specified ten annual payments of $75,000 beginning January 1 and each D

> Manning Imports is contemplating an agreement to lease equipment to a customer for five years. Manning normally sells the asset for a cash price of $100,000. Assuming that 8% is a reasonable rate of interest, what must be the amount of quarterly lease pa

> At March 13, 2025, the Securities Exchange Commission is in the process of investigating a possible securities law violation by Now Chemical. The SEC has not yet proposed a penalty assessment. Now’s fiscal year ends on December 31, 2024, and its financia

> Das Medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. Based on industry experience with similar product introductions, warranty costs are expected to approximate 1% of sales. Sales were $15 million and act

> Flexner Company is in the process of refinancing some long-term debt. Its fiscal year ends on December 31, 2024, and its financial statements will be issued on March 15, 2025. Under current IFRS, how would the debt be classified if the refinancing is com

> Coulson Company is in the process of refinancing some long-term debt. Its fiscal year ends on December 31, 2024, and its financial statements will be issued on March 15, 2025. Under current U.S. GAAP, how would the debt be classified if the refinancing i

> Consider the following liabilities of Future Brands, Inc., at December 31, 2024, the company’s fiscal year-end. Should they be reported as current liabilities or long-term liabilities? 1. $77 million of 8% notes are due on May 31, 2028. The notes are cal

> During December, Rainey Equipment made a $600,000 credit sale. The state sales tax rate is 6% and the local sales tax rate is 1.5%. Prepare the appropriate journal entry.

> In Lizzie Shoes’ experience, gift cards that have not been redeemed within 12 months are not likely to be redeemed. Lizzie Shoes sold gift cards for $18,000 during August 2024. $4,000 of cards were redeemed in September 2024, $3,000 in October, $2,500 in

> On December 12, 2021, Park Electronics received $24,000 from a customer toward a cash sale of $240,000 of diodes to be completed on January 16, 2025. What journal entries should Park record on December 12 and January 16?

> In March 2024, Price Company began developing a new software system to be used internally for managing its inventory. The software integrates customer orders with inventory on hand to automatically place orders for additional inventory when needed. The s

> Wang Corporation issued $12 million of commercial paper on March 1 on a nine-month note. Interest was discounted at issuance at a 9% discount rate. Prepare the journal entry for the issuance of the commercial paper and its repayment at maturity.

> Refer to the situation described in BE 5–8. Suppose the opportunity requires you to invest $13,200 today. What is the interest rate you would earn on this investment?

> You have an investment opportunity that promises to pay you $16,000 in four years. You could earn a 6% annual return investing elsewhere. What is the maximum amount you would be willing to invest in this opportunity?

> You believe you have discovered a new medical device. You anticipate it will take additional time to get the device fully operational, run clinical trials, obtain FDA approval, and sell to a buyer for $250,000. Assume a discount rate of 7% compounded ann

> You have entered into an agreement for the purchase of land. The agreement specifies that you will take ownership of the land immediately. You have agreed to pay $50,000 today and another $50,000 in three years. Calculate the total cost of the land today

> Refer to the situation described in BE 5–4. Assume that the trip will cost $26,600. What interest rate, compounded annually, must be earned to accumulate enough to pay for the trip?

> Suppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their 40th anniversary. He has just received a $20,000 inheritance from an uncle and intends to invest it for the trip. The husband estimates the trip will cos

> You are saving for a new boat. You place $25,000 in an investment account today that earns 6% compounded annually. How much will be in the account after (a) three years, (b) four years, or (c) five years?

> On September 30, 2024, a company leased a warehouse. Terms of the lease require 10 annual lease payments of $55,000 with the first payment due immediately. Accounting standards require the company to record a lease liability when recording this type of l

> You are saving for a new car. You place $10,000 into an investment account today. How much will you have after four years if the account earns (a) 4%, (b) 6%, or (c) 8% compounded annually?

> In February 2024, Culverson Company began developing a new software package to be sold to customers. The software allows people to enter health information and daily eating and exercise habits to track their health status. The project was completed in No

> On December 31, 2024, a company issued 6% stated rate bonds with a face amount of $100 million. The bonds mature on December 31, 2054. Interest is payable annually on each December 31, beginning in 2025. Determine the price of the bonds on December 31, 2

> Refer to the situation described in BE 5–16. What amount did the company borrow, assuming that the first of the five annual $10,000 payments was not due for three years?

> Refer to the situation described in BE 5–16. What amount did the company borrow, assuming that the first $10,000 payment was due immediately?

> A company borrowed money from a local bank. The note the company signed requires five annual installment payments of $10,000 beginning one year from today. The interest rate on the note is 7%. What amount did the company borrow?

> You have been issued a patent giving you exclusive rights to sell a new type of software. You believe the patent will produce sales of $200,000 each year as long as the software remains in demand. Assume a discount rate of 7% compounded annually. What is

> You have entered into an agreement to purchase a local accounting firm. The agreement specifies you will pay the seller $150,000 each year for six years. What is the cost today of the purchase, assuming a discount rate of (a) 8%, (b) 10%, or (c) 12%?

> Refer to the situation described in BE 5–12. How much will accumulate in three years by depositing $500 at the beginning of each of the next 12 quarters?

> You would like to contribute to a savings account over the next three years in order to accumulate enough money to take a trip to Europe. Assuming an interest rate of 4%, compounded quarterly, how much will accumulate in three years by depositing $500 at

> You want to buy a nice road bike. You place $3,000 each year in an investment account that earns 8% compounded annually. How much will be in the account after (a) two years, (b) three years, or (c) four years

> You are saving for a new house. You place $40,000 into an investment account each year for five years. How much will you have after five years if the account earns (a) 3%, (b) 6%, or (c) 9% compounded annually?

> Huebert Corporation and Winslow Corporation reported the following information: Calculate each companies fixed-asset turnover ratio and determine which company utilizes its fixed assets most efficiently to generate sales.

> You have two investment opportunities. The interest rate for both investments is 8%. Interest on the first investment will compound annually, while interest on the second will compound quarterly. Which investment opportunity should you choose? Why?

> Refer to the situation described in BE 4–8. Assume instead that the estimated fair value of the segment’s assets, less costs to sell, on December 31 was $7 million rather than $10 million. Prepare the lower portion of the 2024 income statement beginning

> Refer to the situation described in BE 4–7. Assume that the semiconductor segment was not sold during 2024 but was held for sale at year-end. The estimated fair value of the segment’s assets, less costs to sell, on December 31 was $10 million. Prepare th

> On December 31, 2024, the end of the fiscal year, California Micromesh Corporation completed the sale of its semiconductor business for $10 million. The semiconductor business segment qualifies as a component of the entity according to GAAP. Consider the

> On December 31, 2024, the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business for $9 million. The robotics business segment qualifies as a component of the entity, according to GAAP. Consider the following additio

> The following are partial income statement account balances taken from the December 31, 2024, year-end trial balance of White and Sons, Inc.: restructuring costs, $300,000; interest revenue, $40,000; before-tax loss on discontinued operations, $400,000;

> The following is a partial year-end adjusted trial balance. Income tax expense has not yet been recorded. The income tax rate is 25%. Determine the following: (a) operating income (loss), (b) income (loss) before income taxes, and (c) net income (loss).

> Refer to the situation described in BE 4–1. Using the account balances, prepare a multiple-step income statement. An example of a multiple-step income statement can be found in Illustration 4–4 of this chapter.

> Refer to the situation described in BE 4–1. If the company’s accountant prepared a multiple-step income statement, what amount would appear in that statement for (a) operating income and (b) no operating income?

> Refer to the situation described in BE 4–11. Prepare the cash flows from investing and financing activities sections of HHC’s statement of cash flows

> Diamond Corporation acquired a patent in exchange for 50,000 shares of the company’s no-par common stock. On the date of the exchange, the common stock had a fair value of $22 per share. Determine the cost of the patent.

> The adjusted trial balance of Pacific Scientific Corporation on December 31, 2024, the end of the company’s fiscal year, contained the following income statement items ($ in millions): sales revenue, $2,106; cost of goods sold, $1,240; selling expense, $

> During 2024, Rogue Corporation reported net sales of $600,000. Inventory at both the beginning and end of the year totaled $75,000. The inventory turnover ratio for the year was 6.0. What amount of gross profit did the company report in its 2024 income s

> Refer to the facts described in BE 4–16. Show the DuPont framework’s calculation of the three components of the 2024 return on equity for Circuit TV and Appliance.

> The 2024 income statement for Circuit TV and Appliance reported net sales of $420,000 and net income of $65,000. Average total assets for 2024 was $800,000. Shareholders’ equity at the beginning of the year was $500,000, and $20,000 was paid to sharehold

> Net income of Trout Company was $45,000. The accounting records reveal depreciation expense of $80,000 as well as increases in prepaid rent, salaries payable, and income taxes payable of $60,000, $15,000, and $12,000, respectively. Prepare the cash flows

> At the end of 2024, Barker Corporation’s preliminary trial balance indicated a current ratio of 1.2. Management is contemplating paying some of its accounts payable balance before the end of the fiscal year. Determine whether the effect of this transacti

> Refer to the trial balance information in BE 3–5. Calculate the (a) current ratio, (b) acid-test ratio, and (c) debt to equity ratio.

> If the adjusting entries prepared in BE 2–11 were not recorded, would net income be higher or lower and by how much?

> Post the journal entries prepared in BE 2–8 to T-accounts. Assume that the opening balances in each of the accounts is zero except for cash, accounts receivable, and accounts payable that had opening balances of $65,000, $43,000, and $22,000, respectivel

> Prepare journal entries for each of the transactions listed in BE 2–7.

> On September 30, 2024, Crown Corporation purchased franchise rights from a national restaurant chain. In payment, Crown has the option of paying $356,000 immediately or $400,000 in two years by signing a noninterest- bearing note. Crown chooses the optio

> Post the following transactions to the Cash T-account and calculate the ending balance. The beginning balance in the Cash T-account is $5,000. 1. Receive cash from customers, $15,000. 2. Pay cash for employee salaries, $9,000. 3. Pay cash for rent, $3,00

> Prepare journal entries for each of the following transactions: 1. Issue common stock for $21,000. 2. Obtain $9,000 loan from the bank by signing a note. 3. Purchase construction equipment for $25,000 cash. 4. Purchase advertising for the current month f

> Prepare journal entries for each of the following transactions: 1. Pay $700 for radio advertising for the current month. 2. Purchase supplies of $1,300 on account. 3. Provide services of $2,900 to customers and receive cash. 4. Pay employee salaries for

> Prepare journal entries for each of the following transactions: 1. Purchase equipment in exchange for cash of $23,400. 2. Provide services to customers and receive cash of $6,800. 3. Pay the current month’s rent of $1,300. 4. Purchase office supplies on

> Analyze each of the following transactions and show the effect on the accounting equation. 1. Issue 10,000 shares of common stock in exchange for $32,000 in cash. 2. Purchase land for $19,000. A note payable is signed for the full amount. 3. Purchase equ

> For each situation, determine the date for which the company recognizes the expense under (a) accrual-basis accounting and (b) cash-basis accounting. 1. American Airlines operates a flight from Dallas to Los Angeles on August 16. The pilots’ salaries ass

> For each situation, determine the date for which the company recognizes the revenue under (a) accrual-basis accounting and (b) cash-basis accounting. 1. American Airlines collects cash on June 12 from the sale of a ticket to a customer. The flight occurs