Question: Use the following information from the balance

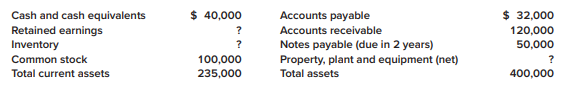

Use the following information from the balance sheet of Rainier Plumbing to determine the missing amounts.

> Your client, Hazelton Mining, recently entered into an agreement to obtain the rights to operate a copper mine in West Virginia for $15 million. Hazelton incurred development costs of $6 million in preparing the mine for extraction, which began on July 1

> Mayfair Department Stores, Inc., operates over 30 retail stores in the Pacific Northwest. Prior to 2024, the company used the FIFO method to value its inventory. In 2024, Mayfair decided to switch to the dollar-value LIFO retail inventory method. One of

> The Brenly Paint Company, your client, manufactures paint. The company’s president, Mr. Brenly, decided to open a retail store to sell paint as well as wallpaper and other items that would be purchased from other suppliers. He has asked you for informati

> The lower of cost or net realizable value (LCNRV) approach to valuing inventory is a departure from the accounting principle of reporting assets at their historical costs. There are those who believe that inventory, as well as other assets, should be val

> Eddie’s Galleria sells billiard tables. The company has the following purchases and sales for 2024. Eddie is worried about the company’s financial performance. He has noticed an increase in the purchase cost of billiar

> Danville Bottlers is a wholesale beverage company. Danville uses the FIFO inventory method to determine the cost of its ending inventory. Ending inventory quantities are determined by a physical count. For the accounting yearend December 31, 2024, ending

> Fred’s Inc. operates general merchandise retail discount stores and full-service pharmacies in the Southeastern United States. Access the company’s 10-K for the fiscal year ended January 28, 2017. You can find the 10-K by using EDGAR at www.sec.gov (Hint

> Action and Fashion (A&F) Company is a specialty retail company operating over 1,000 stores globally. The following disclosure note was included in the financial statements: Required: 1. What approach should A&F take to account for its change in

> York Co. sells one product, which it purchases from various suppliers. York’s trial balance at December 31, 2024, included the following accounts: York Co.’s inventory purchases during 2024 were as follows: Additional

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are available in Connect. This m

> Refer to the situation described in BE 8–10. Prepare the necessary journal entries assuming that VTC uses the net method to account for purchase discounts.

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, are available in Connect. This material is also available under the Investor Relations li

> Hudson Company, which is both a wholesaler and a retailer, purchases its inventories from various suppliers. Additional facts for Hudson’s wholesale operations are as follows: a. Hudson incurs substantial warehousing costs. b. Hudson values inventory at

> Maxi Corporation uses the unit LIFO inventory method. The costs of the company’s products have been steadily rising since the company began operations in 2008, and cost increases are expected to continue. The chief financial officer of the company would

> An accounting intern for a local CPA firm was reviewing the financial statements of a client in the electronics industry. The intern noticed that the client used the FIFO method of determining ending inventory and cost of goods sold. When she asked a col

> You have just been hired as a consultant to Tangier Industries, a newly formed company. The company president, John Meeks, is seeking your advice as to the appropriate inventory method Tangier should use to value its inventory and cost of goods sold. Mr.

> You were recently hired to work in the controller’s office of the Balboa Lumber Company. Your boss, Alfred Eagleton, took you to lunch during your first week and asked a favor. “Things have been a little slow lately, and we need to borrow a little cash t

> The table below contains selected financial information included in the financial statements of Kohl’s Corporation and Dillards, Inc., two companies in the department store industry. Required: Calculate the 2019 gross profit ratio, inv

> Using EDGAR (Electronic Data Gathering, Analysis, and Retrieval system), find the annual report (10-K) for Coca- Cola and Pepsico for the year ended December 2019. Locate the “Consolidated Statements of Income” (income statement) and “Consolidated Balanc

> Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc., appears below: The significant accounting policies note disclosure contained the following: Required: 1. Is Wolverine disclosing the FIF

> In 2023, the Moncrief Company purchased from Jim Lester the right to be the sole distributor in the western states of a product called Zelenex. In payment, Moncrief agreed to pay Lester 20% of the gross profit recognized from the sale of Zelenex in 2024.

> On December 28, 2024, Video tech Corporation (VTC) purchased 10 units of a new satellite uplink system from Tristar Communications for $25,000 each. The terms of each sale were 1/10, n/30. VTC uses the gross method to account for purchase discounts and a

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are available in Connect. This m

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, are available in Connect. This material is also available under the Investor Relations li

> Determining the physical quantity that should be included in inventory normally is a simple matter because that amount consists of items in the possession of the company. The cost of inventory includes all necessary expenditures to acquire the inventory

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from t

> The table below contains selected financial information included in the 2016 financial statements of Tyson Foods Inc. and Pilgrim’s Pride Corp. Required: 1. Calculate the 2019 receivables turnover ratio and average collection period fo

> You are spending the summer working for a local wholesale furniture company, Samson Furniture, Inc. The company is considering a proposal from a local financial institution, Old Reliant Financial, to factor Samson’s receivables. The company controller is

> Search on the Internet for the 2019 annual report for Sanofi-Aventis. Find the accounts receivable disclosure note. Required: 1. Has Sanofi-Aventis factored or securitized accounts receivable? How do you know? 2. Assume that Sanofi-Aventis decided to in

> McLaughlin Corporation uses the allowance method to account for bad debts. At the end of the company’s fiscal year, accounts receivable are analyzed and the allowance for uncollectible accounts is adjusted. At the end of 2024, the compa

> EDGAR, the Electronic Data Gathering, Analysis, and Retrieval system, performs automated collection, validation, indexing, and forwarding of submissions by companies and others who are required by law to file forms with the U.S. Securities and Exchange C

> Tough built Industries, Inc., designs, manufactures, and distributes tools and accessories to the do-it-yourself and professional building industry. Required: 1. Access EDGAR on the Internet. The web address is www.sec.gov. 2. Search for Tough built Ind

> Refer to the situation described in BE 8–8. Record (1) the purchase of inventory on account and (2) the purchase return, assuming the company uses a periodic inventory system.

> Hogan Company uses the net method of accounting for sales discounts. Hogan offers trade discounts to various groups of buyers. On August 1, 2024, Hogan factored some accounts receivable on a without recourse basis. Hogan incurred a finance charge. Hogan

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended February 1, 2020, are available in Connect. This material also is available under the Investor Relations li

> You have recently been hired as the assistant controller for Stanton Industries, a large, publicly held manufacturing company. Your immediate superior is the controller, who, in turn, is responsible to the vice president of finance. The controller has as

> You have been hired as a consultant by a parts manufacturing firm to provide advice as to the proper accounting methods the company should use in some key areas. In the area of receivables, the company president does not understand your recommendation to

> For each of the following independent situations, indicate whether there is an apparent internal control weakness, and, if one exists, suggest alternative procedures to eliminate the weakness. 1. John Smith is the petty cash custodian. John approves all

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2019, are available in Connect. This m

> Horizon Corporation manufactures personal computers. The company began operations in 2019 and reported profits for the years 2019 through 2022. Due primarily to increased competition and price slashing in the industry, 2023’s income statement reported a

> Jerry’s Ice Cream Parlor is considering a marketing plan to increase sales of ice cream cones. The plan will give customers a free ice cream cone if they buy 10 ice cream cones at regular prices. Customers will be issued a card that will be punched each

> The following Trueblood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from th

> The following Trueblood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from th

> A company purchased inventory on account for $250,000. The company returned $20,000 of the inventory to the supplier for credit. Record (1) the purchase of inventory on account and (2) the purchase return, assuming the company uses a perpetual inventory

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from t

> The following True blood case is recommended for use with this chapter. The case provides an excellent opportunity for class discussion, group projects, and writing assignments. The case, along with Professor’s Discussion Material, can be obtained from t

> Consider the following excerpts from revenue recognition disclosure notes: 1. eBay: “The transaction price is allocated to each performance obligation based on its stand alone selling price (SSP). In instances where SSP is not directly observable, we gen

> The following is an excerpt from Note 2 of Deere & Company’s annual report: “Under the terms of sales agreements with dealers, interest-free periods are determined based on the type of equipment sold and the time of year of the sale. These periods range

> For each of the following note disclosures, indicate whether the disclosure would likely appear in (A) environmental, (B) social, or (C) governance disclosures: (1) ratio of pay of chief executive offer to median full-time employee; (2) ratio of independ

> You have been asked to review the December 31, 2024, balance sheet for Champion Cleaning. After completing your review, you list the following three items for discussion with your superior: 1. An investment of $30,000 is included in current assets. Manag

> The following is a December 31, 2024, post-closing trial balance for Culver City Lighting, Inc. Prepare a classified balance sheet for the company

> Refer to the situation described in BE 3–2. Prepare a classified balance sheet for K and J Nursery, Inc. The equipment originally cost $140,000.

> Refer to the situation described in BE 3–2. Determine the year-end balance in retained earnings for K and J Nursery, Inc.

> On June 30, 2024, Countryside Farms purchased custom-made harvesting equipment from a local producer. In payment, Countryside signed a noninterest-bearing note requiring the payment of $60,000 in two years. The fair value of the equipment is not known, b

> The trial balance for K and J Nursery, Inc., listed the following account balances at December 31, 2024, the end of its fiscal year: cash, $16,000; accounts receivable, $11,000; inventory, $25,000; equipment (net), $80,000; accounts payable, $14,000; sal

> Indicate whether each of the following assets and liabilities typically should be classified as current or long-term: (a) accounts receivable within the next 60 days; (b) prepaid rent for the next six months; (c) notes receivable due in two years; (d) no

> Refer to the situation described in BE 19–3. Suppose that the options expire without being exercised. What journal entry will National record?

> Refer to the situation described in BE 19–3. Suppose that the options are exercised on April 3, 2027, when the market price is $19 per share. What journal entry will National record?

> On January 1, 2024, Hugh Morris Comedy Club (HMCC) granted 1 million stock options to key executives exercisable for 1 million shares of the company’s common stock at $20 per share. The stock options are intended as compensation for the next three years.

> Refer to the situation described in BE 19–3. Suppose that unexpected turnover during 2025 caused the forfeiture of 5% of the stock options. What is the effect on earnings in 2025? In 2026?

> Garcia Company granted 9 million of its no par common shares to executives, subject to forfeiture if employment is terminated within three years. The common shares have a market price of $5 per share on January 1, 2023, the grant date of the restricted s

> Arnsberg Corporation had 800,000 shares of common stock issued and outstanding at January 1. No common shares were issued during the year, but on January 1, Arnsberg issued 100,000 shares of convertible preferred stock. The preferred shares are convertib

> Fully vested incentive stock options exercisable at $50 per share to obtain 24,000 shares of common stock were outstanding during a period when the average market price of the common stock was $60 and the ending market price was $60. What will be the net

> At December 31, 2023 and 2024, Funk & Noble Corporation had outstanding 820 million shares of common stock and 2 million shares of 8%, $100 par value cumulative preferred stock. No dividends were declared on either the preferred or common stock in 2023 o

> Refer to the information in BE 10–6. Now assume that instead of purchasing the patent, Advanced Technologies spent $1,200,000 to develop the patent internally, consisting of personnel ($800,000), equipment ($300,000), and materials ($100,000). All additi

> McDonnell-Myer Corporation reported net income of $741 million. The company had 544 million common shares outstanding at January 1 and sold 36 million shares on February 28. As part of an annual share repurchase plan, 6 million shares were retired on Apr

> Under its executive stock option plan, National Corporation granted 12 million options on January 1, 2024, that permit executives to purchase 12 million of the company’s $1 par common shares within the next six years, but not before December 31, 2026 (th

> On January 1, 2024, Medical Transport Company’s accumulated postretirement benefit obligation was $25 million. At the end of 2024, retiree benefits paid were $3 million. Service cost for 2024 is $7 million. Assumptions regarding the trend of future heal

> Prince Distribution Inc. has an unfunded postretirement benefit plan. Medical care and life insurance benefits are provided to employees who render 10 years’ service and attain age 55 while in service. At the end of 2024, Jim Luka wits is 31. He was hire

> Craned Corp had been a very profitable company until the current tax year, in which it generated an NOL because a competitor launched a product that is much better than Grand’s. Craned recognized a deferred tax asset associated with the NOL carry forward

> Hwang Inc. had taxable income of $100,000 in 2017, no income or loss in 2018 and 2019, and an NOL of $50,000 in 2020. The applicable tax rate was 40% in 2017 and 25% in 2018 and thereafter. Prepare the journal entry that Hwang would make in 2020, assumin

> Loss Co reported a net operating loss of $25 million for financial reporting and tax purposes. Taxable income last year and the previous year, respectively, was $20 million and $15 million. The enacted tax rate each year is 25%. Assume that Loss Co quali

> Superior Developers sells lots for residential development. When lots are sold, Superior recognizes income for financial reporting purposes in the year of the sale. For some lots, Superior recognizes income for tax purposes when the cash is collected. In

> J-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in 2024. The only difference between accounting and taxable income is estimated product warranty costs of $9,000 for sales in 2024. Warranty payments are expected to b

> A company reports 2024 pretax accounting income of $10 million, but because of a single temporary difference, taxable income is only $7 million. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Prepare the appropria

> On March 17, Advanced Technologies purchased a patent related to laser surgery techniques. The purchase price of the patent is $1,200,000. The patent is expected to benefit the company for the next five years. The company had the following additional cos

> On January 1, 2024, Jaspers Corporation leased equipment under a finance lease designed to earn the lessor a 12% rate of return for providing long-term financing. The lease agreement specified ten annual payments of $75,000 beginning January 1 and each D

> Manning Imports is contemplating an agreement to lease equipment to a customer for five years. Manning normally sells the asset for a cash price of $100,000. Assuming that 8% is a reasonable rate of interest, what must be the amount of quarterly lease pa

> At March 13, 2025, the Securities Exchange Commission is in the process of investigating a possible securities law violation by Now Chemical. The SEC has not yet proposed a penalty assessment. Now’s fiscal year ends on December 31, 2024, and its financia

> Das Medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. Based on industry experience with similar product introductions, warranty costs are expected to approximate 1% of sales. Sales were $15 million and act

> Flexner Company is in the process of refinancing some long-term debt. Its fiscal year ends on December 31, 2024, and its financial statements will be issued on March 15, 2025. Under current IFRS, how would the debt be classified if the refinancing is com

> Coulson Company is in the process of refinancing some long-term debt. Its fiscal year ends on December 31, 2024, and its financial statements will be issued on March 15, 2025. Under current U.S. GAAP, how would the debt be classified if the refinancing i

> Consider the following liabilities of Future Brands, Inc., at December 31, 2024, the company’s fiscal year-end. Should they be reported as current liabilities or long-term liabilities? 1. $77 million of 8% notes are due on May 31, 2028. The notes are cal

> During December, Rainey Equipment made a $600,000 credit sale. The state sales tax rate is 6% and the local sales tax rate is 1.5%. Prepare the appropriate journal entry.

> In Lizzie Shoes’ experience, gift cards that have not been redeemed within 12 months are not likely to be redeemed. Lizzie Shoes sold gift cards for $18,000 during August 2024. $4,000 of cards were redeemed in September 2024, $3,000 in October, $2,500 in

> On December 12, 2021, Park Electronics received $24,000 from a customer toward a cash sale of $240,000 of diodes to be completed on January 16, 2025. What journal entries should Park record on December 12 and January 16?

> In March 2024, Price Company began developing a new software system to be used internally for managing its inventory. The software integrates customer orders with inventory on hand to automatically place orders for additional inventory when needed. The s

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements According to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 20

> Wang Corporation issued $12 million of commercial paper on March 1 on a nine-month note. Interest was discounted at issuance at a 9% discount rate. Prepare the journal entry for the issuance of the commercial paper and its repayment at maturity.

> Refer to the situation described in BE 5–8. Suppose the opportunity requires you to invest $13,200 today. What is the interest rate you would earn on this investment?

> You have an investment opportunity that promises to pay you $16,000 in four years. You could earn a 6% annual return investing elsewhere. What is the maximum amount you would be willing to invest in this opportunity?

> You believe you have discovered a new medical device. You anticipate it will take additional time to get the device fully operational, run clinical trials, obtain FDA approval, and sell to a buyer for $250,000. Assume a discount rate of 7% compounded ann

> You have entered into an agreement for the purchase of land. The agreement specifies that you will take ownership of the land immediately. You have agreed to pay $50,000 today and another $50,000 in three years. Calculate the total cost of the land today

> Refer to the situation described in BE 5–4. Assume that the trip will cost $26,600. What interest rate, compounded annually, must be earned to accumulate enough to pay for the trip?

> Suppose a husband wants to take his wife on a trip three years from now to Europe to celebrate their 40th anniversary. He has just received a $20,000 inheritance from an uncle and intends to invest it for the trip. The husband estimates the trip will cos

> You are saving for a new boat. You place $25,000 in an investment account today that earns 6% compounded annually. How much will be in the account after (a) three years, (b) four years, or (c) five years?

> On September 30, 2024, a company leased a warehouse. Terms of the lease require 10 annual lease payments of $55,000 with the first payment due immediately. Accounting standards require the company to record a lease liability when recording this type of l

> You are saving for a new car. You place $10,000 into an investment account today. How much will you have after four years if the account earns (a) 4%, (b) 6%, or (c) 8% compounded annually?

> In February 2024, Culverson Company began developing a new software package to be sold to customers. The software allows people to enter health information and daily eating and exercise habits to track their health status. The project was completed in No

> On December 31, 2024, a company issued 6% stated rate bonds with a face amount of $100 million. The bonds mature on December 31, 2054. Interest is payable annually on each December 31, beginning in 2025. Determine the price of the bonds on December 31, 2