Question: Alex, Inc., buys 40 percent of Steinbart

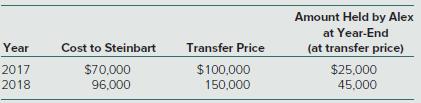

Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable to a trade name with a 20-year remaining life. Steinbart immediately begins supplying inventory to Alex as follows:

Inventory held at the end of one year by Alex is sold at the beginning of the next. Steinbart reports net income of $80,000 in 2017 and $110,000 in 2018 and declares $30,000 in dividends each year. What is the equity income in Steinbart to be reported by Alex in 2018?

a. $34,050

b. $38,020

c. $46,230

d. $51,450

Transcribed Image Text:

Amount Held by Alex at Year-End Year Transfer Price (at transfer price) Cost to Steinbart 2017 $70,000 $100,000 $25,000 2018 96,000 150,000 45,000

> On January 1, 2018 Casey Corporation exchanged $3,300,000 cash for 100 percent of the outstanding voting stock of Kennedy Corporation. Casey plans to maintain Kennedy as a wholly owned subsidiary with separate legal status and accounting information syst

> On June 30, 2017, Wisconsin, Inc., issued $300,000 in debt and 15,000 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company. Wisconsin shares had a fair value of $40 per share. Prior

> On May 1, Soriano Co. reported the following account balances along with their estimated fair values: On that day, Zambrano paid cash to acquire all of the assets and liabilities of Soriano, which will cease to exist as a separate entity. To facilitate

> Because of the acquisition of additional investee shares, an investor will now change from the fair-value method to the equity method. Which procedures are applied to accomplish this accounting change?

> Following are preacquisition financial balances for Padre Company and Sol Company as of December 31. Also included are fair values for Sol Company accounts. Parentheses indicate a credit balance. On December 31, Padre acquires Sol’s o

> Use the same facts as in problem (22), but assume instead that Arturo pays cash of $4,200,000 to acquire Westmont. No stock is issued. Prepare Arturo’s journal entries to record its acquisition of Westmont. Data from problem (22) The f

> The following book and fair values were available for Westmont Company as of March 1. Arturo Company pays $4,000,000 cash and issues 20,000 shares of its $2 par value common stock (fair value of $50 per share) for all of Westmont’s co

> Prycal Co. merges with InterBuy, Inc., and acquires several different categories of intangible assets including trademarks, a customer list, copyrights on artistic materials, agreements to receive royalties on leased intellectual property, and unpatented

> In the December 31, 2017, consolidated balance sheet of Patrick and its subsidiary, what amount of total assets should be reported? a. $1,375,000 b. $1,395,000 c. $1,520,000 d. $1,980,000 The separate condensed balance sheets of Patrick Corporation and

> On its acquisition-date consolidated balance sheet, what amount should TruData report as retained earnings as of July 1? a. $130,000 b. $210,000 c. $260,000 d. $510,000 On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par va

> On its acquisition-date consolidated balance sheet, what amount should TruData report as common stock? a. $70,000 b. $300,000 c. $350,000 d. $370,000 On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value and a $40 fair

> On its acquisition-date consolidated balance sheet, what amount should TruData report as patented technology (net)? a. $200,000 b. $230,000 c. $410,000 d. $430,000 On July 1, TruData Company issues 10,000 shares of its common stock with a $5 par value a

> On its acquisition-date consolidated balance sheet, what amount should TruData report as goodwill? a. –0– b. $15,000 c. $35,000 d. $100,000 On July 1, TruData Company issues 10,000 shares of its common stock with a $5

> Prior to being united in a business combination, Atkins, Inc., and Waterson Corporation had the following stockholders’ equity figures: Atkins issues 51,000 new shares of its common stock valued at $3 per share for all of the outstand

> Although the equity method is a generally accepted accounting principle (GAAP), recognition of equity income has been criticized. What theoretical problems can opponents of the equity method identify? What managerial incentives exist that could influence

> How much should Beasley record as total assets acquired in the Donovan merger? a. $400,000 b. $420,000 c. $410,000 d. $480,000 On May 1, Donovan Company reported the following account balances: Current assets . . . . . . . . . . . . . . . . . . . $ 90,0

> What should Beasley record as total liabilities incurred or assumed in connection with the Donovan merger? a. $15,000 b. $75,000 c. $95,000 d. $150,000 On May 1, Donovan Company reported the following account balances: Current assets . . . . . . . . . .

> On June 1, Cline Co. paid $800,000 cash for all of the issued and outstanding common stock of Renn Corp. The carrying amounts for Renn’s assets and liabilities on June 1 follow: Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . $150,000 Accoun

> On May 1, Burns Corporation acquired 100 percent of the outstanding ownership shares of Quigley Corporation in exchange for $710,000 cash. At the acquisition date, Quigley’s book and fair values were as follows: Burns directs Quigley

> What is a business combination?

> To obtain all of the stock of Molly, Inc., Harrison Corporation issued its own common stock. Harrison had to pay $98,000 to lawyers, accountants, and a stock brokerage firm in connection with services rendered during the creation of this business combina

> Sloane, Inc., issues 25,000 shares of its own common stock in exchange for all of the outstanding shares of Benjamin Company. Benjamin will remain a separately incorporated operation. How does Sloane record the issuance of these shares?

> What is the accounting valuation basis for consolidating assets and liabilities in a business combination?

> What does the term consolidated financial statements mean?

> Morgan Company acquires all of the outstanding shares of Jennings, Inc., for cash. Morgan transfers consideration more than the fair value of the company’s net assets. How should the payment in excess of fair value be accounted for in the consolidation p

> Smith, Inc., has maintained an ownership interest in Watts Corporation for a number of years. This investment has been accounted for using the equity method. What transactions or events create changes in the Investment in Watts Corporation account as rec

> How should a parent consolidate its subsidiary’s revenues and expenses?

> Jones Company obtains all of the common stock of Hudson, Inc., by issuing 50,000 shares of its own stock. Under these circumstances, why might the determination of a fair value for the consideration transferred be difficult?

> Within the consolidation process, what is the purpose of a worksheet?

> Describe the different types of legal arrangements that can take place to create a business combination.

> Catron Corporation is having liquidity problems, and as a result, it sells all of its outstanding stock to Lambert, Inc., for cash. Because of Catron’s problems, Lambert is able to acquire this stock at less than the fair value of the company’s net asset

> On January 1, 2018, Acme Co. is considering purchasing a 40 percent ownership interest in PHC Co., a privately held enterprise, for $700,000. PHC predicts its profit will be $185,000 in 2018, projects a 10 percent annual increase in profits in each of th

> Consolidated financial reporting is appropriate when one entity has a controlling financial interest in another entity. The usual condition for a controlling financial interest is ownership of a majority voting interest. But in some circumstances, contro

> Wolf Pack Transport Co. has a 25 percent equity investment in Maggie Valley Depot (MVD), Inc., which owns and operates a warehousing facility used for the collection and redistribution of various consumer goods. Wolf Pack paid $1,685,000 for its 25 perce

> Access The Coca-Cola Company’s SEC 10-K filing at www.coca-cola.com and address the following: 1. What companies does Coca-Cola describe as significant equity method investments? How do these investments help Coca-Cola? 2. What criteria does Coca-Cola us

> On January 1, Intergen, Inc., invests $200,000 for a 40 percent interest in Ryan, a new joint venture with two other partners, each investing $150,000 for 30 percent interest. Intergen plans to sell all of its production to Ryan, which will resell the in

> Jones Company owns a 25 percent interest in shares of Sandridge Company common stock. Under what circumstances might Jones decide that the equity method would not be appropriate to account for this investment?

> When an investor uses the equity method to account for investments in common stock, the investor’s share of cash dividends from the investee should be recorded as a. A deduction from the investor’s share of the investee’s profits. b. Dividend income. c.

> Perez, Inc., applies the equity method for its 25 percent investment in Senior, Inc. During 2018, Perez sold goods with a 40 percent gross profit to Senior, which sold all of these goods in 2018. How should Perez report the effect of the intra-entity sal

> When an equity method investment account is reduced to a zero balance a. The investor should establish a negative investment account balance for any future losses reported by the investee. b. The investor should discontinue using the equity method until

> Under fair-value accounting for an equity investment, which of the following affects the income the investor recognizes from its ownership of the investee? a. The investee’s reported income adjusted for excess cost over book value amortizations. b. Chang

> Hawkins Company has owned 10 percent of Larker, Inc., for the past several years. This ownership did not allow Hawkins to have significant influence over Larker. Recently, Hawkins acquired an additional 30 percent of Larker and now will use the equity me

> Which of the following does not indicate an investor company’s ability to significantly influence an investee? a. Material intra-entity transactions. b. The investor owns 30 percent of the investee but another owner holds the remaining 70 percent. c. Int

> On January 1, 2018, Alamar Corporation acquired a 40 percent interest in Burks, Inc., for $210,000. On that date, Burks’s balance sheet disclosed net assets with both a fair and book value of $360,000. During 2018, Burks reported net income of $80,000 an

> On January 1, 2017, Alison, Inc., paid $60,000 for a 40 percent interest in Holister Corporation’s common stock. This investee had assets with a book value of $200,000 and liabilities of $75,000. A patent held by Holister having a $5,000 book value was a

> On January 1, 2017, Ridge Road Company acquired 20 percent of the voting shares of Sauk Trail, Inc., for $2,700,000 in cash. Both companies provide commercial Internet support services but serve markets in different industries. Ridge Road made the invest

> On January 1, 2018, Fisher Corporation paid $2,290,000 for 35 percent of the outstanding voting stock of Steel, Inc., and appropriately applies the equity method for its investment. Any excess of cost over Steel’s book value was attributed to goodwill. D

> Why does the equity method record dividends from an investee as a reduction in the investment account, not as dividend income?

> On January 3, 2018, Matteson Corporation acquired 40 percent of the outstanding common stock of O’Toole Company for $1,160,000. This acquisition gave Matteson the ability to exercise significant influence over the investee. The book value of the acquired

> Panner, Inc., owns 30 percent of Watkins and applies the equity method. During the current year, Panner buys inventory costing $54,000 and then sells it to Watkins for $90,000. At the end of the year, Watkins still holds only $20,000 of merchandise. What

> Evan Company reports net income of $140,000 each year and declares an annual cash dividend of $50,000. The company holds net assets of $1,200,000 on January 1, 2017. On that date, Shalina purchases 40 percent of Evan’s outstanding common stock for $600,0

> Franklin purchases 40 percent of Johnson Company on January 1 for $500,000. Although Franklin did not use it, this acquisition gave Franklin the ability to apply significant influence to Johnson’s operating and financing policies. Johnson reports assets

> In January 2017, Domingo, Inc., acquired 20 percent of the outstanding common stock of Martes, Inc., for $700,000. This investment gave Domingo the ability to exercise significant influence over Martes, whose balance sheet on that date showed total asset

> On January 1, Puckett Company paid $1.6 million for 50,000 shares of Harrison’s voting common stock, which represents a 40 percent investment. No allocation to goodwill or other specific account was made. Significant influence over Harrison is achieved b

> On January 1, 2017, Stream Company acquired 30 percent of the outstanding voting shares of Q-Video, Inc., for $770,000. Q-Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of

> On January 1, 2017, Fisher Corporation purchased 40 percent (80,000 shares) of the common stock of Bowden, Inc., for $982,000 in cash and began to use the equity method for the investment. The price paid represented a $60,000 payment in excess of the boo

> On July 1, 2016, Killearn Company acquired 88,000 of the outstanding shares of Shaun Company for $13 per share. This acquisition gave Killearn a 25 percent ownership of Shaun and allowed Killearn to significantly influence the investee’s decisions. As of

> What indicates an investor’s ability to significantly influence the decision-making process of an investee?

> On January 1, 2018, Pine Company owns 40 percent (40,000 shares) of Seacrest, Inc., which it purchased several years ago for $182,000. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment a

> Harper, Inc. acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2017, for $210,000 in cash. The book value of Kinman’s net assets on that date was $400,000, although one of the company’s buildings, with a $60,000 carrying

> Belden, Inc. acquires 30 percent of the outstanding voting shares of Sheffield, Inc. on January 1, 2017, for $312,000, which gives Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $800,000 at January 1, 2017. She

> On December 31, 2016, Akron, Inc. purchased 5 Percent of Zip Company’s common shares on the open market in exchange for $16,000. On December 31, 2017, Akron, Inc., acquires an additional 25 percent of Zip Company’s out

> Matthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee’s operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $335,000. Amor

> Several years ago, Einstein, Inc., bought 40 percent of the outstanding voting stock of Brooks Company. The equity method is appropriately applied. On August 1 of the current year, Einstein sold a portion of these shares. a. How does Einstein compute the

> Parrot Corporation holds a 42 percent ownership of Sunrise, Inc., and applies the equity method to account for its investment. Parrot assigned the entire original excess purchase price over book value to goodwill. During 2017, the two companies made intr

> Echo, Inc., purchased 10 percent of ProForm Corporation on January 1, 2017, for $345,000 and accounted for the investment using the fair-value method. Echo acquires an additional 15 percent of ProForm on January 1, 2018, for $580,000. The equity method o

> On January 1, 2016, Halstead, Inc., purchased 75,000 shares of Sedgwick Company common stock for $1,480,000, giving Halstead 25 percent ownership and the ability to apply significant influence over Sedgwick. Any excess of cost over book value acquired wa

> BuyCo, Inc. holds 25 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $10,000 per year. For 2017, Ma

> What accounting treatments are appropriate for investments in equity securities without readily determinable fair values?

> Tiberend, Inc., sold $150,000 in inventory to Schilling Company during 2017 for $225,000. Schilling resold $105,000 of this merchandise in 2017 with the remainder to be disposed of during 2018. Assuming that Tiberend owns 25 percent of Schilling and appl

> Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2017, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2018, Milani purchased an additional 30 percent of Seida for $600,000 which

> What is the fair-value option for reporting equity method investments? How do the equity method and fair-value accounting differ in recognizing income from an investee?

> How are intra-entity transfers reported in an investee’s separate financial statements if the investor is using the equity method?

> How is the investor’s share of gross profit on intra-entity sales calculated? Under the equity method, how does the deferral of gross profit affect the recognition of equity income?

> What is the difference between downstream and upstream sales? How does this difference affect application of the equity method?

> Princeton Company holds a 40 percent interest in shares of Yale Company common stock. On June 19 of the current year, Princeton sells part of this investment. What accounting should Princeton make on June 19? What accounting will Princeton make for the r

> In a stock acquisition accounted for by the equity method, a portion of the purchase price often is attributed to goodwill or to specific assets or liabilities. How are these amounts determined at acquisition? How are these amounts accounted for in subse

> Wilson Company acquired 40 percent of Andrews Company at a bargain price because of losses expected to result from Andrews’s failure in marketing several new products. Wilson paid only $100,000, although Andrews’s corresponding book value was much higher

> NaviNow Company agrees to pay $20 million in cash to the four former owners of TrafficEye for all of its assets and liabilities. These four owners of TrafficEye developed and patented a technology for realtime monitoring of traffic patterns on the nation

> In February 2015, Arctic Cat, Inc., acquired the assets and liabilities of MotorFist, LLC, a privately owned company based in Idaho Falls, Idaho, in exchange for $9.118 million in cash and contingent consideration. Referring to Arctic Cat’s 2015 annual 1

> On August 27, 2015, Celgene Corporation acquired all of the outstanding stock of Receptos, Inc., in exchange for $7.6 billion in cash. Referring to Celgene’s 2015 financial statements and its July 14, 2015, press release announcing the acquisition, answe

> Ahorita Company manufactures wireless transponders for satellite applications. Ahorita has recently acquired Zelltech Company, which is primarily known for its software communications development but also manufactures a specialty transponder under the tr

> What is push-down accounting? a. A requirement that a subsidiary must use the same accounting principles as a parent company. b. Inventory transfers made from a parent company to a subsidiary. c. A subsidiary’s recording of the fair-value allocations as

> In the December 31, 2017, consolidated balance sheet of Patrick and its subsidiary, what amount of total stockholders’ equity should be reported? a. $1,100,000 b. $1,125,000 c. $1,150,000 d. $1,355,000 The separate condensed balance sh

> An acquired firm’s financial records sometimes show goodwill from previous business combinations. How does a parent company account for the preexisting goodwill of its newly acquired subsidiary? a. The parent tests the preexisting goodwill for impairment

> When negotiating a business acquisition, buyers sometimes agree to pay extra amounts to sellers in the future if performance metrics are achieved over specified time horizons. How should buyers account for such contingent consideration in recording an ac

> During the current year, Davis Company’s common stock suffers a permanent drop in market value. In the past, Davis has made a significant portion of its sales to one customer. This buyer recently announced its decision to make no further purchases from D

> A company acquires a rather large investment in another corporation. What criteria determine whether the investor should apply the equity method of accounting to this investment?

> Ryan Boot Company (review of Chapters 2 through 5) (multiple LO’s from Chapters 2 through 5) *Fixed costs include (a) Lease expense of $200,000 and (b) Depreciation of $500,000. Note: Ryan Boots also has $65,000 per year in sinking fu

> What is the significance to working capital management of matching sales and production?

> Explain how rapidly expanding sales can drain the cash resources of a firm.

> Since the mid-1960s, corporate liquidity has been declining. What reasons can you give for this trend?

> Austin Electronics expects sales next year to be $900,000 if the economy is strong, $650,000 if the economy is steady, and $375,000 if the economy is weak. The firm believes there is a 15 percent probability the economy will be strong, a 60 percent proba

> Esquire Products, Inc., expects the following monthly sales: Cash sales are 40 percent in a given month, with the remainder going into accounts receivable. All receivables are collected in the month following the sale. Esquire sells all of its goods for

> Bombs Away Video Games Corporation has forecasted the following monthly sales: Bombs Away Video Games sells the popular Strafe and Capture video game. Its sells for $5 per unit and costs $2 per unit to produce. A level production policy is followed. Eac

> Eastern Auto Parts, Inc. has 20 percent of its sales paid for in cash and 80 percent on credit. All credit accounts are collected in the following month. Assume the following sales: January $60,000 February 50,000 March 95,000 April 40,000 Sales in De

> In Problem 18, what long-term interest rate would represent a break-even point between using short-term financing as described in part a and long-term financing? Hint: Divide the interest payments in 18a by the amount of total funds provided for the six

> Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows: Short-term financing will be utilized for the next six months. Projected annual interest rates are: a. Compute total dollar interest

> Using the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Do an analysis similar to that in the right-hand po

> Vitale Hair Spray had sales of 8,000 units in March. A 50 percent increase is expected in April. The company will maintain 5 percent of expected unit sales for April in ending inventory. Beginning inventory for April was 400 units. How many units should