Question: In Problem 18, what long-term interest

In Problem 18, what long-term interest rate would represent a break-even point between using short-term financing as described in part a and long-term financing? Hint: Divide the interest payments in 18a by the amount of total funds provided for the six months and multiply by 12.

Data from Problem 18:

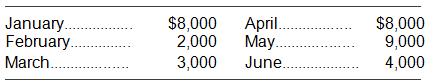

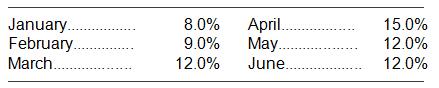

Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows:

Short-term financing will be utilized for the next six months. Projected annual interest rates are:

Transcribed Image Text:

January. February. $8,000 2,000 3,000 April. May. $8,000 9,000 4,000 March. June.. January. February. April. May. 8.0% 15.0% 9.0% 12.0% March. 12.0% June. 12.0%

> On January 3, 2018, Matteson Corporation acquired 40 percent of the outstanding common stock of O’Toole Company for $1,160,000. This acquisition gave Matteson the ability to exercise significant influence over the investee. The book value of the acquired

> Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $530,000. The equity method of accounting is to be used. Steinbart’s net assets on that date were $1.2 million. Any excess of cost over book value is attributable

> Panner, Inc., owns 30 percent of Watkins and applies the equity method. During the current year, Panner buys inventory costing $54,000 and then sells it to Watkins for $90,000. At the end of the year, Watkins still holds only $20,000 of merchandise. What

> Evan Company reports net income of $140,000 each year and declares an annual cash dividend of $50,000. The company holds net assets of $1,200,000 on January 1, 2017. On that date, Shalina purchases 40 percent of Evan’s outstanding common stock for $600,0

> Franklin purchases 40 percent of Johnson Company on January 1 for $500,000. Although Franklin did not use it, this acquisition gave Franklin the ability to apply significant influence to Johnson’s operating and financing policies. Johnson reports assets

> In January 2017, Domingo, Inc., acquired 20 percent of the outstanding common stock of Martes, Inc., for $700,000. This investment gave Domingo the ability to exercise significant influence over Martes, whose balance sheet on that date showed total asset

> On January 1, Puckett Company paid $1.6 million for 50,000 shares of Harrison’s voting common stock, which represents a 40 percent investment. No allocation to goodwill or other specific account was made. Significant influence over Harrison is achieved b

> On January 1, 2017, Stream Company acquired 30 percent of the outstanding voting shares of Q-Video, Inc., for $770,000. Q-Video manufactures specialty cables for computer monitors. On that date, Q-Video reported assets and liabilities with book values of

> On January 1, 2017, Fisher Corporation purchased 40 percent (80,000 shares) of the common stock of Bowden, Inc., for $982,000 in cash and began to use the equity method for the investment. The price paid represented a $60,000 payment in excess of the boo

> On July 1, 2016, Killearn Company acquired 88,000 of the outstanding shares of Shaun Company for $13 per share. This acquisition gave Killearn a 25 percent ownership of Shaun and allowed Killearn to significantly influence the investee’s decisions. As of

> What indicates an investor’s ability to significantly influence the decision-making process of an investee?

> On January 1, 2018, Pine Company owns 40 percent (40,000 shares) of Seacrest, Inc., which it purchased several years ago for $182,000. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment a

> Harper, Inc. acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2017, for $210,000 in cash. The book value of Kinman’s net assets on that date was $400,000, although one of the company’s buildings, with a $60,000 carrying

> Belden, Inc. acquires 30 percent of the outstanding voting shares of Sheffield, Inc. on January 1, 2017, for $312,000, which gives Belden the ability to significantly influence Sheffield. Sheffield has a net book value of $800,000 at January 1, 2017. She

> On December 31, 2016, Akron, Inc. purchased 5 Percent of Zip Company’s common shares on the open market in exchange for $16,000. On December 31, 2017, Akron, Inc., acquires an additional 25 percent of Zip Company’s out

> Matthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee’s operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $335,000. Amor

> Several years ago, Einstein, Inc., bought 40 percent of the outstanding voting stock of Brooks Company. The equity method is appropriately applied. On August 1 of the current year, Einstein sold a portion of these shares. a. How does Einstein compute the

> Parrot Corporation holds a 42 percent ownership of Sunrise, Inc., and applies the equity method to account for its investment. Parrot assigned the entire original excess purchase price over book value to goodwill. During 2017, the two companies made intr

> Echo, Inc., purchased 10 percent of ProForm Corporation on January 1, 2017, for $345,000 and accounted for the investment using the fair-value method. Echo acquires an additional 15 percent of ProForm on January 1, 2018, for $580,000. The equity method o

> On January 1, 2016, Halstead, Inc., purchased 75,000 shares of Sedgwick Company common stock for $1,480,000, giving Halstead 25 percent ownership and the ability to apply significant influence over Sedgwick. Any excess of cost over book value acquired wa

> BuyCo, Inc. holds 25 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $10,000 per year. For 2017, Ma

> What accounting treatments are appropriate for investments in equity securities without readily determinable fair values?

> Tiberend, Inc., sold $150,000 in inventory to Schilling Company during 2017 for $225,000. Schilling resold $105,000 of this merchandise in 2017 with the remainder to be disposed of during 2018. Assuming that Tiberend owns 25 percent of Schilling and appl

> Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2017, for $190,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2018, Milani purchased an additional 30 percent of Seida for $600,000 which

> What is the fair-value option for reporting equity method investments? How do the equity method and fair-value accounting differ in recognizing income from an investee?

> How are intra-entity transfers reported in an investee’s separate financial statements if the investor is using the equity method?

> How is the investor’s share of gross profit on intra-entity sales calculated? Under the equity method, how does the deferral of gross profit affect the recognition of equity income?

> What is the difference between downstream and upstream sales? How does this difference affect application of the equity method?

> Princeton Company holds a 40 percent interest in shares of Yale Company common stock. On June 19 of the current year, Princeton sells part of this investment. What accounting should Princeton make on June 19? What accounting will Princeton make for the r

> In a stock acquisition accounted for by the equity method, a portion of the purchase price often is attributed to goodwill or to specific assets or liabilities. How are these amounts determined at acquisition? How are these amounts accounted for in subse

> Wilson Company acquired 40 percent of Andrews Company at a bargain price because of losses expected to result from Andrews’s failure in marketing several new products. Wilson paid only $100,000, although Andrews’s corresponding book value was much higher

> NaviNow Company agrees to pay $20 million in cash to the four former owners of TrafficEye for all of its assets and liabilities. These four owners of TrafficEye developed and patented a technology for realtime monitoring of traffic patterns on the nation

> In February 2015, Arctic Cat, Inc., acquired the assets and liabilities of MotorFist, LLC, a privately owned company based in Idaho Falls, Idaho, in exchange for $9.118 million in cash and contingent consideration. Referring to Arctic Cat’s 2015 annual 1

> On August 27, 2015, Celgene Corporation acquired all of the outstanding stock of Receptos, Inc., in exchange for $7.6 billion in cash. Referring to Celgene’s 2015 financial statements and its July 14, 2015, press release announcing the acquisition, answe

> Ahorita Company manufactures wireless transponders for satellite applications. Ahorita has recently acquired Zelltech Company, which is primarily known for its software communications development but also manufactures a specialty transponder under the tr

> What is push-down accounting? a. A requirement that a subsidiary must use the same accounting principles as a parent company. b. Inventory transfers made from a parent company to a subsidiary. c. A subsidiary’s recording of the fair-value allocations as

> In the December 31, 2017, consolidated balance sheet of Patrick and its subsidiary, what amount of total stockholders’ equity should be reported? a. $1,100,000 b. $1,125,000 c. $1,150,000 d. $1,355,000 The separate condensed balance sh

> An acquired firm’s financial records sometimes show goodwill from previous business combinations. How does a parent company account for the preexisting goodwill of its newly acquired subsidiary? a. The parent tests the preexisting goodwill for impairment

> When negotiating a business acquisition, buyers sometimes agree to pay extra amounts to sellers in the future if performance metrics are achieved over specified time horizons. How should buyers account for such contingent consideration in recording an ac

> During the current year, Davis Company’s common stock suffers a permanent drop in market value. In the past, Davis has made a significant portion of its sales to one customer. This buyer recently announced its decision to make no further purchases from D

> A company acquires a rather large investment in another corporation. What criteria determine whether the investor should apply the equity method of accounting to this investment?

> Ryan Boot Company (review of Chapters 2 through 5) (multiple LO’s from Chapters 2 through 5) *Fixed costs include (a) Lease expense of $200,000 and (b) Depreciation of $500,000. Note: Ryan Boots also has $65,000 per year in sinking fu

> What is the significance to working capital management of matching sales and production?

> Explain how rapidly expanding sales can drain the cash resources of a firm.

> Since the mid-1960s, corporate liquidity has been declining. What reasons can you give for this trend?

> Austin Electronics expects sales next year to be $900,000 if the economy is strong, $650,000 if the economy is steady, and $375,000 if the economy is weak. The firm believes there is a 15 percent probability the economy will be strong, a 60 percent proba

> Esquire Products, Inc., expects the following monthly sales: Cash sales are 40 percent in a given month, with the remainder going into accounts receivable. All receivables are collected in the month following the sale. Esquire sells all of its goods for

> Bombs Away Video Games Corporation has forecasted the following monthly sales: Bombs Away Video Games sells the popular Strafe and Capture video game. Its sells for $5 per unit and costs $2 per unit to produce. A level production policy is followed. Eac

> Eastern Auto Parts, Inc. has 20 percent of its sales paid for in cash and 80 percent on credit. All credit accounts are collected in the following month. Assume the following sales: January $60,000 February 50,000 March 95,000 April 40,000 Sales in De

> Carmen’s Beauty Salon has estimated monthly financing requirements for the next six months as follows: Short-term financing will be utilized for the next six months. Projected annual interest rates are: a. Compute total dollar interest

> Using the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Do an analysis similar to that in the right-hand po

> Vitale Hair Spray had sales of 8,000 units in March. A 50 percent increase is expected in April. The company will maintain 5 percent of expected unit sales for April in ending inventory. Beginning inventory for April was 400 units. How many units should

> Using the expectations hypothesis theory for the term structure of interest rates, determine the expected return for securities with maturities of two, three, and four years based on the following data. Do an analysis similar to that in the right-hand po

> Lear, Inc., has $800,000 in current assets, $350,000 of which are considered permanent current assets. In addition, the firm has $600,000 invested in fixed assets. a. Lear wishes to finance all fixed assets and half of its permanent current assets with

> Collins Systems, Inc., is trying to develop an asset-financing plan. The firm has $300,000 in temporary current assets and $200,000 in permanent current assets. Collins also has $400,000 in fixed assets. a. Construct two alternative financing plans for t

> In Problem 12, assume the term structure of interest rates becomes inverted, with short-term rates going to 12 percent and long-term rates 4 percentage points lower than short-term rates. If all other factors in the problem remain unchanged, what will ea

> Winfrey Diet Food Corp. has $4,500,000 in assets. Short-term rates are 8 percent. Long-term rates are 13 percent. Earnings before interest and taxes are $960,000. The tax rate is 40 percent. If long-term financing is perfectly matched (synchronized) wit

> Assume that Atlas Sporting Goods, Inc., has $800,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 15 percent, but with a high-liquidity plan the return will be 12 percent. If the firm goes with a short-term fina

> Assume that Hogan Surgical Instruments Co. has $2,000,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 18 percent, but with a high liquidity plan, the return will be 14 percent. If the firm goes with a short-ter

> Stern Educational TV, Inc., has decided to buy a new computer system with an expected life of three years at a cost of $200,000. The company can borrow $200,000 for three years at 12 percent annual interest or for one year at 10 percent annual interest.

> Biochemical Corp. requires $500,000 in financing over the next three years. The firm can borrow the funds for three years at 10.60 percent interest per year. The CEO decides to do a forecast and predicts that if she utilizes short-term financing instead,

> Boatler Used Cadillac Co. requires $800,000 in financing over the next two years. The firm can borrow the funds for two years at 9 percent interest per year. Mr. Boatler decides to do forecasting and predicts that if he utilizes short-term financing inst

> Sales for Western Boot Stores are expected to be 40,000 units for October. The company likes to maintain 15 percent of unit sales for each month in ending inventory (i.e., the end of October). Beginning inventory for October is 8,500 units. How many unit

> Bambino Sporting Goods makes baseball gloves that are very popular in the spring and early summer season. Units sold are anticipated as follows: If seasonal production is used, it is assumed that inventory will directly match sales for each month and th

> Antonio Banderos & Scarves makes headwear that is very popular in the fall-winter season. Units sold are anticipated as: If seasonal production is used, it is assumed that inventory will directly match sales for each month and there will be no inven

> Antivirus, Inc., expects its sales next year to be $2,000,000. Inventory and accounts receivable will increase $430,000 to accommodate this sales level. The company has a steady profit margin of 12 percent with a 25 percent dividend payout. How much exte

> Axle Supply Co., expects sales next year to be $300,000. Inventory and accounts receivable will increase by $60,000 to accommodate this sales level. The company has a steady profit margin of 10 percent with a 30 percent dividend payout. How much external

> Sharpe Knife Company expects sales next year to be $1,500,000 if the economy is strong, $800,000 if the economy is steady, and $500,000 if the economy is weak. Mr. Sharpe believes there is a 20 percent probability the economy will be strong, a 50 percent

> Explain how combined leverage brings together operating income and earnings per share.

> How does the interest rate on new debt influence the use of financial leverage?

> What does risk taking have to do with the use of operating and financial leverage?

> What role does depreciation play in break-even analysis based on accounting flows? Based on cash flows? Which perspective is longer term in nature?

> Discuss the various uses for break-even analysis.

> Dodge Ball Bearings had sales of 10,000 units at $20 per unit last year. The marketing manager projects a 30 percent increase in unit volume sales this year with a 5 percent price decrease (due to a price reduction by a competitor). Returned merchandise

> Explain why operating leverage decreases as a company increases sales and shifts away from the break-even point.

> Discuss the limitations of financial leverage.

> Explain how the break-even point and operating leverage are affected by the choice of manufacturing facilities (labor intensive versus capital intensive).

> What factors would cause a difference in the use of financial leverage for a utility company and an automobile company?

> When you are considering two different financing plans, does being at the level where earnings per share are equal between the two plans always mean you are indifferent as to which plan is selected?

> Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows: The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the faci

> Mr. Gold is in the widget business. He currently sells 1 million widgets a year at $5 each. His variable cost to produce the widgets is $3 per unit, and he has $1,500,000 in fixed costs. His sales-to-assets ratio is five times, and 40 percent of his asse

> The Lopez-Portillo Company has $10 million in assets, 80 percent financed by debt and 20 percent financed by common stock. The interest rate on the debt is 15 percent and the par value of the stock is $10 per share. President Lopez-Portillo is considerin

> Edsel Research Labs has $24 million in assets. Currently half of these assets are financed with long-term debt at 8 percent and half with common stock having a par value of $10. Ms. Edsel, the vice-president of finance, wishes to analyze two refinancing

> Dickinson Company has $12 million in assets. Currently half of these assets are financed with long-term debt at 10 percent and half with common stock having a par value of $8. Ms. Smith, vice-president of finance, wishes to analyze two refinancing plans,

> Cyber Security Systems had sales of 3,000 units at $50 per unit last year. The marketing manager projects a 20 percent increase in unit volume sales this year with a 10 percent price increase. Returned merchandise will represent 6 percent of total sales.

> The Norman Automatic Mailer Machine Company is planning to expand production because of the increased volume of mailouts. The increased mailout capacity will cost $2,000,000. The expansion can be financed either by bonds at an interest rate of 12 percent

> Sinclair Manufacturing and Boswell Brothers Inc. are both involved in the production of brick for the homebuilding industry. Their financial information is as follows: a. If you combine Sinclair's capital structure with Boswell's operating plan, what is

> Firms in Japan often employ both high operating and financial leverage because of the use of modern technology and close borrower-lender relationships. Assume the Mitaka Company has a sales volume of 125,000 units at a price of $25 per unit; variable cos

> Sterling Optical and Royal Optical both make glass frames and each is able to generate earnings before interest and taxes of $120,000. The separate capital structures for Sterling and Royal are shown below: a. Compute earnings per share for both firms.

> Compute the stock price for Cain if it sells at 18 times earnings per share and EBIT is $40,000.

> Cain Auto Supplies and Able Auto Parts are competitors in the aftermarket for auto supplies. The separate capital structures for Cain and Able are presented below. a. Compute earnings per share if earnings before interest and taxes are $10,000, $15,000,

> U.S. Steal has the following income statement data: a. Compute DOL based on the formula below (see page 128 for an example): b. Confirm that your answer to part a is correct by recomputing DOL using formula 5–3 on page 129. There may

> International Data Systems information on revenue and costs is only relevant up to a sales volume of 100,000 units. After 100,000 units, the market becomes saturated and the price per unit falls from $4.00 to $3.80. Also, there are cost overruns at a pro

> United Snack Company sells 50-pound bags of peanuts to university dormitories for $10 a bag. The fixed costs of this operation are $80,000, while the variable costs of peanuts are $.10 per pound. a. What is the break-even point in bags? b. Calculate the

> Mo & Chris's Delicious Burgers, Inc., sells food to Military Cafeterias for $15 a box. The fixed costs of this operation are $80,000, while the variable cost per box is $10. a. What is the break-even point in boxes? b. Calculate the profit or loss on 15,

> Bronco Truck Parts expects to sell the following number of units at the prices indicated under three different scenarios in the economy. The probability of each outcome is indicated. What is the expected value of the total sales projection? Probabili

> The Harding Company manufactures skates. The company's income statement for 2010 is as follows: Given this income statement, compute the following: a. Degree of operating leverage. b. Degree of financial leverage. c. Degree of combined leverage. d. Brea

> The Sterling Tire Company's income statement for 2010 is as follows: Given this income statement, compute the following: a. Degree of operating leverage. b. Degree of financial leverage. c. Degree of combined leverage. d. Break-even point in units.

> Boise Timber co. computes its break-even point strictly on the basis of cash expenditures related to fixed costs. Its total fixed costs are $6,000,000, but 25 percent of this value is represented by depreciation. Its contribution margin (price minus vari

> Air Purifier, Inc., computes its break-even point strictly on the basis of cash expenditures related to fixed costs. Its total fixed costs are $2,400,000, but 15 percent of this value is represented by depreciation. Its contribution margin (price minus v