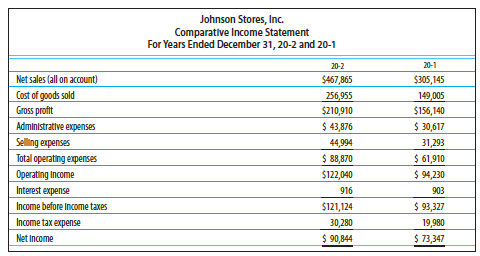

Question: Amounts from the comparative income statement and

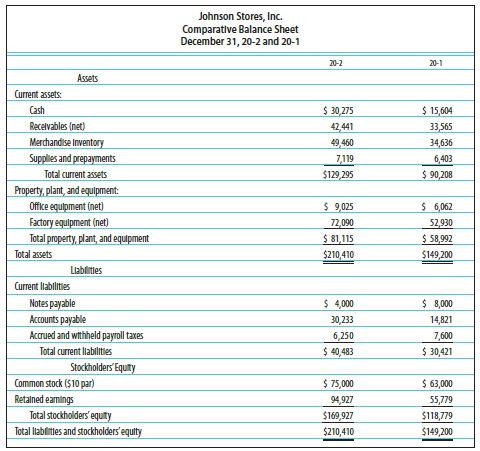

Amounts from the comparative income statement and balance sheet of Johnson Stores, Inc., for the last two years are as follows:

REQUIRED

Prepare a horizontal analysis of the statements. Add columns to show the amount of increase (decrease) and the percentage change. Round percentages to one decimal place.

Transcribed Image Text:

Johnson Stores, Inc. Comparative Income Statement For Years Ended December 31, 20-2 and 20-1 20-2 20-1 Net sales (all on account) $467,865 $305,145 Cost of goods sold Gross profit 149,005 256,955 $210,910 $ 43,876 $156,140 Administrative expenses $ 30,617 Selling expenses 31,293 $ 61,910 $ 94,230 44,994 Total operating expenses $ 88,870 Operating Income Interest expense $122,040 916 903 Income before income taxes $121,124 $ 93,327 Income tax expense 19,980 $ 73,347 30,280 Net Income $ 90,844 Johnson Stores, Inc. Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 20-1 Assets Current assets: Cash $ 30,275 $ 15,604 Recelvables (net) 42,441 33,565 Merchandise Inventory 49,460 34,636 Supplies and prepayments 7,119 6,403 $ 90,208 Total current assets $129,295 Property, plant, and equilpment: $ 9,025 $ 6,062 Office equipment (net) Factory equipment (net) Total property, plant, and equipment 72,090 $ 81,115 52,930 $ 58,992 $149,200 Total assets $210,410 Liablites Current labilities $ 4,000 $ 8,000 Notes payable Accounts payable 30,233 14,821 Accrued and withheld payroll taxes 6,250 7,600 Total current ltabilities $ 40,483 $ 30,421 Stockholders' Equity Common stock ($10 par) Retalned earnings Total Stockholders' Equity $ 75,000 $ 63,000 94,927 $169,927 55,779 $118,779 $149,200 Total lablites and stockholders'equity $210,410

> Describe a plant asset.

> If additional investments were made during the year, what information in addition to the work sheet would be needed to prepare the statement of owner’s equity?

> Explain the matching principle.

> Describe two approaches to listing the expenses in the income statement.

> What is the book value of an asset?

> Identify the source of the information needed to prepare the income statement.

> What is the useful life of an asset?

> What is a contra-asset?

> Explain the historical cost principle.

> Which inventory method always follows the actual physical flow of merchandise?

> Explain the expense recognition principle.

> Explain the revenue recognition principle.

> What are the main functions of an accounting clerk?

> Explain the primary advantage of a general ledger account.

> In what order are the accounts customarily placed in the ledger

> Describe the four steps required to journalize a business transaction in a general journal.

> Where the first formal accounting record of a business transaction is usually made?

> Name the five types of financial statement classifications for which it is ordinarily desirable to keep separate accounts.

> Explain the purpose of a chart of accounts.

> Identify four user groups normally interested in financial information about a business.

> What two factors are taken into account by the weighted-average method of merchandise cost allocation?

> Give three reasons why a corporation may distribute a stock dividend.

> What is a slide error?

> Explain why the ledger can still contain errors even though the trial balance is in balance. Give examples of two such types of errors.

> What information is entered in the Posting Reference column of the journal as an amount is posted to the proper account in the ledger?

> What is the purpose of accounting?

> Identify three types of businesses according to activities.

> What is impairment?

> What is the most important value reported on the statement of cash flows when evaluating the financial health of a company?

> List the two supplemental disclosures required under the indirect method.

> Provide an example of a noncash investing and financing activity.

> Under the indirect method of preparing a statement of cash flows, what adjustment is made for gains and losses on the sale of equipment?

> In a period of rising prices, which inventory method will result in: (a) The highest cost of goods sold? (b) The lowest cost of goods sold? (c) The highest ending inventory? (d) The lowest ending inventory? (e) The highest gross profit? (f) The lowest gr

> Under the indirect method of preparing a statement of cash flows, what adjustment is made for depreciation expense?

> What are cash equivalents?

> Briefly describe the difference between a job order cost system and a process cost system.

> What details about a particular asset are provided by a property, plant, and equipment record?

> What costs are entered on the job cost sheet?

> Explain how to calculate a predetermined overhead rate.

> What information is provided by the daily time sheet?

> What two purposes are served by a materials requisition form?

> Which adjusting entries are reversed by ToyJoy?

> Describe the procedures for closing the factory overhead account.

> Is a physical inventory necessary under the perpetual system? Why or why not?

> When the adjustment is made to apply overhead to ending work in process, why are no entries made in the job cost ledger?

> What are the three inventories needed in a manufacturing business?

> Why are the balances in the factory overhead account not extended to the Income Statement and Balance Sheet columns of the work sheet?

> What is the relationship between the debit and credit balances in the factory overhead account when the overhead is said to be underapplied? Overapplied?

> To the financial statements in Problem 24-8B. Problem 24-8B: Amounts from the comparative income statement and balance sheet of Johnson Stores, Inc., for the last two years are as follows: REQUIRED Prepare a vertical analysis of the income statement a

> Based on the financial statement data in Exercise 24-1B, Exercise 24-1B: Based on the comparative income statement and balance sheet for Falcon Designers, Inc., given on the next page, compute the following liquidity measures for 20-2 (round all calcu

> Based on the financial statement data in Exercise 24-1B, Exercise 24-1B: Based on the comparative income statement and balance sheet for Falcon Designers, Inc., given on the next page, compute the following liquidity measures for 20-2 (round all calcu

> Based on the financial statement data in Exercise 24-1B, Exercise 24-1B: Based on the comparative income statement and balance sheet for Falcon Designers, Inc., given on the next page, compute the following liquidity measures for 20-2 (round all calcu

> Based on the financial statement data in Exercise 24-1B, Exercise 24-1B: Based on the comparative income statement and balance sheet for Falcon Designers, Inc., given on the next page, compute the following liquidity measures for 20-2 (round all calcu

> Is a physical inventory necessary under the periodic system? Why or why not?

> Based on the financial statement data in Exercise 24-1B, Exercise 24-1B: Based on the comparative income statement and balance sheet for Falcon Designers, Inc., given on the next page, compute the following liquidity measures for 20-2 (round all calcu

> Based on the financial statement data in Exercise 24-1B, Exercise 24-1B: Based on the comparative income statement and balance sheet for Falcon Designers, Inc., given on the next page, compute the following liquidity measures for 20-2 (round all calcu

> Refer to the financial statements in Problem 24-8B. Problem 24-8B: Amounts from the comparative income statement and balance sheet of Johnson Stores, Inc., for the last two years are as follows: REQUIRED Calculate the following ratios and amounts for

> Based on the comparative income statement and balance sheet for Falcon Designers, Inc., given on the next page, compute the following liquidity measures for 20-2 (round all calculations to two decimal places): (a) Quick or acid-test ratio (b) Current rat

> Kennington Company’s condensed income statement for the year ended December 31, 20-2, was as follows: Net sales ……………â€&brvb

> Mulligan Company’s income statement for 20-2 reported interest expense of $2,190. The comparative balance sheet as of December 31, 20-2 and 20-1, reported the following: Compute the amount of cash paid for interest in 20-2. 20-2 20-

> Murry’s consulting services issued a two-year, $5,000 note payable to acquire new office furniture. Show how this transaction is reported on the statement of cash flows.

> Hansen Company’s comparative balance sheets as of December 31, 20-2 and 20-1, showed the following with regard to investing and financing activities: Net income for 20-2 was $80,000, and cash dividends of $20,000 were declared and pai

> The income statement for Leadbetter’s Golf Camp follows. Assume that all revenues and expenses were for cash and that land was sold for $600. There were no other investing or financing activities during the year. The Cash balances at th

> After adjusting net income for changes in current assets and current liabilities, Cha Cha Dance Company’s cash from operating activities is $60,000. However, Cha Cha reports $5,000 in patent amortization expense for the year. Compute cash from operating

> What is the main difference between the periodic system of accounting for inventory and the perpetual system of accounting for inventory?

> Roberts Company reported net income of $50,000 for 20-2. The December 31 balances of the current assets and current liabilities are shown below. Compute cash provided by operating activities. 20-2 20-1 $ 6,000 60,000 36,000 24,000 $10,000 50,000 40,0

> Pike Company’s balance sheets as of December 31, 20-2 and 20-1, showed the following with regard to cash and cash equivalents: Compute the amount of change in cash and cash equivalents and indicate whether it represented an increase or

> Refer to Problem 23-9B. The following additional information was obtained from Kennington’s financial statements and auxiliary records for the year ended December 31, 20-2. Acquired a new warehouse …………………………………………………………….. $90,000 Bought new warehouse

> The following activities took place in Tomberlin Company during the most recent year. Indicate whether each activity is a cash inflow (+) or cash outflow (–), and whether it is an operating activity (O), investing activity (I), or financing activity (F).

> Wang Corporation issued the following bonds at a premium: Date of issue and sale: ……………………………………………………………….. March 1, 20-1 Principal amount: …………………………………………………………………………….. $250,000 Sale price of bonds: ………………………………………………………………………………….. 103 Denomination

> Ramona Arroyo Co. issued the following bonds: Date of issue and sale: ………………………………………………………. April 1, 20-1 Principal amount: ………………………………………………………………… $250,000 Sale price of bonds: ……………………………………………………………………… 100 Denomination of bonds: ……………………………………………

> Miller & Miller sold bonds at a premium for $525,000 (premium of $25,000) eight years ago. (a) The corporation redeems $50,000 of this issue at 95. The unamortized premium is $500. (b) The corporation redeems $75,000 of this issue at 103. The unamortized

> On October 2, 20-1, the board of directors of Carr Company appropriated $400,000 of retained earnings for the purpose of buying a new yacht (used for entertaining clients). On July 15, 20-2, the yacht was purchased and the board of directors decided that

> Okano Medical Lab issued $300,000 in bonds at face value 10 years ago and has paid semiannual interest payments through the years. (a) Assume the bonds are redeemed at face value. (b) Assume that $25,000 of the bonds are redeemed at 103. (c) Assume that

> Okano Medical Lab issued $300,000 in bonds at face value 10 years ago and has paid semiannual interest payments through the years. (a) Assume the bonds are redeemed at face value. (b) Assume that $25,000 of the bonds are redeemed at 103. (c) Assume that

> What financial statements are affected by an error in the ending inventory?

> Beilke’s Supply Stores issued the following bonds at a discount: Date of issue and sale: ……………………………………………………………………… April 1, 20-1 Principal amount: ………………………………………………………………………………… $400,000 Sale price of bonds: ………………………………………………………………………………………… 97 Deno

> Bryant and Nelson Company issued the following bonds at a premium: Date of issue and sale: ………………………………………………………. May 1, 20-1 Principal amount: ………………………………………………………………… $500,000 Sale price of bonds: ……………………………………………………………………… 103 Denomination of bonds

> Ellis & Co. issued the following bonds at a discount: Date of issue and sale: ……………………………………………………………….. April 1, 20-1 Principal amount: ……………………………………………………………………….. $400,000 Sale price of bonds: ……………………………………………………………………………….. 97 Denomination of bond

> Blackwell Company issued the following bonds at a premium: Date of issue and sale: …………………………………………………………………… March 1, 20-1 Principal amount: ………………………………………………………………………………… $500,000 Sale price of bonds: ……………………………………………………………………………………… 103 Denominatio

> Brandon, Inc., issued the following bonds at a discount: Date of issue and sale: ………………………………………………………… April 1, 20-1 Principal amount: ………………………………………………………………….. $600,000 Sale price of bonds: ………………………………………………………………………….. 96 Denomination of bonds: ……

> Underwriters issued the following bonds: Date of issue and sale: ……………………………………………………………. April 1, 20-1 Principal amount: ……………………………………………………………………… $400,000 Sale price of bonds: ………………………………………………………………………….. 100 Denomination of bonds: ………………………………………

> During the year ended December 31, 20--, Baggio Company completed the following transactions: Apr. 15 Declared a semiannual dividend of $0.65 per share on preferred stock and $0.45 per share on common stock to shareholders of record on May 5, payable on

> During the year ended December 31, 20-2, Tatu Company completed the following selected transactions: Apr. 15 estimated that its 20-2 income tax will be $160,000. Based on this estimate, it will make four quarterly payments of $40,000 each on April 15, Ju

> Womack Company had the following balances and results for the current calendar year: Retained earnings, January 1 ……………………...………………. $80,000 Cash dividends declared ……………………………………………. 15,000 Net income for the year …………………………….………………. 40,000 Prepare a

> Rogerson Company has 40,000 shares of $2 par common stock outstanding. On July 1, the board of directors declared a two-for-one stock split. Prepare a memorandum entry in the general journal indicating the new par value and the total number of outstandin

> What steps are followed in posting from the purchases journal to the general ledger?

> Martinez Company currently has 200,000 shares of $1 par common stock outstanding. On March 15, a 5% stock dividend was declared to shareholders of record on April 2, distributable on April 14. Market value of the common stock was estimated at $13 per sha

> Ramirez Company currently has 100,000 shares of $1 par common stock outstanding and 5,000 shares of $50 par preferred stock outstanding. On July 10, the board of directors declared a semiannual dividend of $0.30 per share on common stock to shareholders

> Kennington Company had a net income of $90,000 and paid cash dividends of $18,000 for 20--. Mueller and Hanson Company had a net loss of $20,000 and distributed a 10% stock dividend with a market value of $15,000. 1. Prepare the journal entries for Kenni

> Bakery had the following transactions involving intangible assets: Jan. 1 Purchased a patent for a new pastry for $10,000 and estimated its useful life to be 10 years. Apr. 1 Purchased a copyright for a cookie cutter design for $5,000 with a life left on

> Mining Works Co. acquired a copper mine at a cost of $1,200,000. The estimated number of units available for production from the mine is 3,000,000 tons. (a) During the first year, 400,000 tons are mined and sold. (b) During the second year, 700,000 tons

> On January 1, 20--, Nguyen Company’s retained earnings accounts had the following balances: Appropriated for land acquisition ………... $ 75,000 Unappropriated retained earnings ………... 825,000 $900,000 During the year ended December 31, 20--, Nguyen comple

> On January 1, 20--, Krausert Company’s retained earnings accounts had the following balances: Appropriated for warehouse ………...………... 70,000 Unappropriated retained earnings ………..... 800,000 $870,000 During the year ended December 31, 20--, Krausert com

> Regis Company estimates that its 20-1 income tax will be $100,000. Based on this estimate, it will make four quarterly payments of $25,000 each on April 15, June 15, September 15, and December 15. 1. Prepare the journal entry for April 15. 2. Assume that

> Rogers & Hart formed a corporation and had the following organization costs and stock transactions during the year: June 30 Incurred the following costs of incorporation: Incorporation fees ………... $ 900 Attorneys’ fees ………... 6,000 Promotion fees ………...

> Athletics West had the following stock transactions during the year: (a) Received subscriptions for 100,000 shares of $1 par common stock for $118,000. (b) Received subscriptions for 5,000 shares of $18 par, 7% preferred stock for $92,000. (c) Received a

> List four items of information about each purchase entered in the purchases journal.

> Dan’s Hobby Stores had the following stock transactions during the year: (a) Issued 5,000 shares of no-par common stock with a stated value of $10 per share for $50,000 cash. (b) Issued 6,000 shares of no-par common stock with a stated value of $10 per s

> Valdez Company had the following stock transactions during the first 5 years of operations: (a) Issued 24,000 shares of $1 par common stock for $26,000 cash. (b) Issued 18,000 shares of $1 par common stock for $18,000 cash. (c) Issued 3,000 shares of $10