Question:

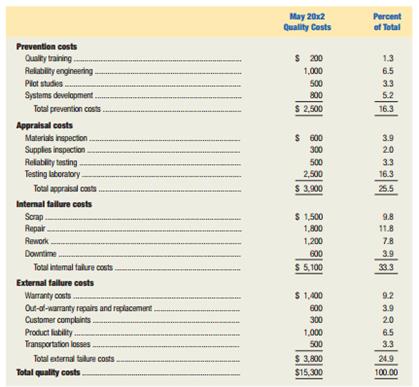

“An ounce of prevention is worth a pound of cure.†Interpret this old adage in light of Exhibit

8-6

Exhibit 8-6:

Transcribed Image Text:

May 20x2 Quality Costs Percent of Total Prevention costs Quality training Relability engineering- Piot studies Systems development S 200 1,000 1.3 6.5 500 800 33 5.2 Total prevention costs $ 2,500 16.3 Appraisal costs Materials inspection. Supples inspaction Relablity testing Testing laboratory S 800 3.9 300 20 500 3.3 2,500 16.3 Total appraisal costs $ 3.900 25.5 Internal fallure costs $ 1,500 9.8 Scrap. Repair. 1,800 11.8 Rework Downtime Total intemal talure costs. 1,200 7.8 600 3.9 $ 5,100 33.3 External fallure costs Warranty costs. Out-at-warranty rapairs and replacement. Customer complaints Product lability. Transportation losses $ 1,00 9.2 3.9 20 600 300 1,000 6.5 500 3.3 $ 3,800 $15,300 Total atarnal talure costs 24.9 Total quality costs 100.00

> Choose a city or state in the United States (or a Canadian city or province), and use the Internet to explore the annual budget of the governmental unit you selected. For example, you could check out the budget for Los Angeles at www.losangeles.com . Alt

> Explain why some management accountants believe that absorption costing may provide an incentive for managers to overproduce inventory.

> Why do many managers prefer variable costing over absorption costing?

> What is meant by the phrase management by exception?

> List the three parts of a control system, and explain how such a system works.

> Explain how a budget facilitates communication and coordination.

> Briefly explain the difference between absorption costing and variable costing

> List four potential pitfalls in decision making, which represent common errors.

> What is meant by the term contribution margin per unit of scarce resource?

> List and define four types of product quality costs.

> Are allocated joint processing costs relevant when making a decision to sell a joint product at the split-off point or process it further? Why?

> What is meant by the term differential cost analysis?

> How does the existence of excess production capacity affect the decision to accept or reject a special order?

> Give an example of an irrelevant future cost. Why is it irrelevant?

> Explain why the book value of equipment is not a relevant cost.

> Explain what is meant by the term decision model.

> Distinguish between qualitative and quantitative decision analyses.

> Describe the managerial accountant’s role in the decision-making process.

> List the seven steps in the decision-making process

> Visit the website of one of the following companies, or a different company of your choosing. Burger King www.burgerking.com Compaq www.compaq.com Corning www.corning.com Kmart www.kmart.com Kodak www.kodak.com NBC www.nbc.com Required: Read about the

> Explain how the accounting definition of an asset is related to the choice between absorption and variable costing.

> Explain the significance of excess capacity in the transferring division when transfer prices are set using the general transfer-pricing rule.

> How do organizations use pay for performance to motivate managers?

> What is the managerial accountant’s primary objective in designing a responsibility-accounting system?

> Give an example of a gain sharing plan that could be implemented by an airline.

> Define the term manufacturing cycle efficiency.

> List seven areas in which nonfinancial, operational performance measures are receiving increased emphasis in today’s manufacturing environment.

> List and explain three key features of the segmented income statement shown in Exhibit 12–7. Exhibit 12–7: Segment of Company Segment of Oahu Division Aloha Hotels Maul Oahu Walmea Beach Dlamond Head Walkiki Sands

> Why do some managers and accountants choose not to allocate common costs in segmented reports?

> Explain what is meant by a segmented income statement.

> Under what circumstances would it be appropriate to change the Waikiki Sands Hotel from a profit center to an investment center?

> Which is more consistent with cost-volume-profit analysis, variable costing or absorption costing? Why

> Refer to the information given in Case 2 for Huron Chalk Company. Selected information from Huron’s year-end balance sheets for its first two years of operation is as follows: Information in case 2: Huron Chalk Company manufactures sid

> Data Screen Corporation is a highly automated manufacturing firm. The vice president of finance has decided that traditional standards are inappropriate for performance measures in an automated environment. Labor is insignificant in terms of the total co

> What types of organizations use flexible budgets?

> What is the fixed-overhead budget variance?

> Jeffries Company’s only variable-overhead cost is electricity. Does an unfavorable variable-overhead spending variance imply that the company paid more than the anticipated rate per kilowatt-hour

> Explain the advantage of using a flexible budget.

> Distinguish between static and flexible budgets.

> Describe five factors that managers often consider when determining the significance of a variance.

> Refer to Review Question 10–11. Why does an analogous question not arise in the context of the direct-labor variances?

> What manager is generally in the best position to influence the direct-labor efficiency variance?

> What is the interpretation of the direct-labor efficiency variance?

> Why do proponents of absorption costing argue that absorption costing is preferable as the basis for pricing decisions?

> What manager is usually in the best position to influence the direct-material quantity variance?

> What is the interpretation of the direct-material quantity variance?

> Explain how standard material prices and quantities are set

> Describe how a bank might use standards.

> Briefly explain the purpose of a cause-and-effect (or fishbone) diagram

> How can an organization help to reduce the problems caused by budgetary slack?

> Distinguish between a product’s quality of design and its quality of conformance

> What manager is generally in the best position to influence the direct-labor rate variance?

> Visit the website of Interface, Inc., at http://www.interfaceglobal.com. Read about its efforts toward sustainable development by clicking on the “Sustainability” link. Required: What is Interface’s product? Describe the company’s efforts toward sustai

> Will variable and absorption costing result in significantly different income measures in a JIT setting? Why?

> “Accounting systems should produce only relevant data and forget about the irrelevant data. Then I’d know what was relevant and what wasn’t!” Comment on this remark by a company president.

> Give two examples of sunk costs, and explain why they are irrelevant in decision making.

> Why can unitized fixed costs cause errors in decision making?

> There is an important link between decision making and managerial performance evaluation. Explain

> How is sensitivity analysis used to cope with uncertainty in decision making?

> Briefly describe the proper approach to making a production decision when limited resources are involved.

> What is a joint production process? Describe a special decision that commonly arises in the context of a joint production process. Briefly describe the proper approach for making this type of decision.

> Briefly describe the proper approach for making a decision about adding or dropping a product line.

> What behavioral tendency do people often exhibit with regard to opportunity costs?

> Define the term opportunity cost, and give an example of one.

> When inventory increases, will absorption-costing or variable-costing income be greater? Why?

> Why might a manager exhibit a behavioral tendency to inappropriately consider sunk costs in making a decision?

> Is the book value of inventory on hand a relevant cost? Why?

> List and explain two important criteria that must be satisfied in order for information to be relevant.

> What is meant by each of the following potential characteristics of information: relevant, accurate, and timely? Is objective information always relevant? Accurate?

> A quantitative analysis enables a decision maker to put a “price” on the sum total of the qualitative characteristics in a decision situation. Explain this statement, and give an example.

> Are the concepts underlying a relevant-cost analysis still valid in an advanced manufacturing environment? Are these concepts valid when activity-based costing is used? Explain.

> Refer to the data given in the preceding exercise for Plato Corporation. Assume that the d irect-labor rate is $12 per hour, and 11,000 labor hours are available per year. In addition, the company has a short supply of machine time. Only 9,000 hours are

> Plato Corporation manufactures two products, Alpha and Beta. Contribution margin data follow. Plato Corporation’s production process uses highly skilled labor, which is in short supply. The same employees work on both products and earn

> Global’s special order also requires 1,000 kilograms of genatope, a solid chemical regularly used in the company’s products. The current stock of genatope is 8,000 kilograms at a book value of 12.15 p per kilogram. If the special order is accepted, the f

> Global Chemical Company, located in Buenos Aires, Argentina, recently received an order for a product it does not normally produce. Since the company has excess production capacity, management is considering accepting the order. In analyzing the decision

> The term direct costing is a misnomer. Variable costing is a better term for the product-costing method. Do you agree or disagree? Why?

> Juarez Corporation produces cleaning compounds and solutions for industrial and household use. While most of its products are processed independently, a few are related. Grit 337, a coarse cleaning powder with many industrial uses, costs $3.20 a pound to

> Thorpe Industries produces chemicals for the swimming pool industry. In one joint process, 10,000 gallons of GSX are processed into 7,000 gallons of xenolite and 3,000 gallons of banolide. The cost of the joint process, including the GSX, is $17,500. The

> Armstrong Corporation manufactures bicycle parts. The company currently has a $19,500 inventory of parts that have become obsolete due to changes in design specifications. The parts could be sold for $7,000, or modified for $10,000 and sold for $20,300.

> College Town Pizza’s owner bought his current pizza oven two years ago for $10,500, and it has one more year of life remaining. He is using straight-line depreciation for the oven. He could purchase a new oven for $2,200, but it would last only one year.

> If Toon Town Toy Company closes its Packaging Department, the department manager will be appointed manager of the Cutting Department. The Packaging Department manager makes $51,000 per year. To hire a new Cutting Department manager will cost Toon Town $6

> Toon Town Toy Company is considering the elimination of its Packaging Department. Management has received an offer from an outside firm to supply all Toon Town’s packaging needs. To help her in making the decision, Toon Town’s president has asked the con

> Day Street Deli’s owner is disturbed by the poor pr o fit performance of his ice cream counter. He has prepared the following profit analysis for the year just ended. Required: Criticize and correct the owner’s analys

> Redo Exhibit 14–4 without the irrelevant data. Exhibit 14-1: 1. Clarity the decision problem 2. Specity the criterion Managerial accountant participates as part of Quantitative cross-functional Analysis 3. Identity the alternatives

> Choose an organization and a particular decision situation. Then give examples, u s ing that decision context, of each step illustrated in Exhibit 14–1. Exhibit 14-1: 1. Clarity the decision problem 2. Specity the criterion Manager

> New Jersey Chemical Company manufactures two industrial chemical products, called zanide and kreolite. Two machines are used in the process, and each machine has 24 hours of capacity per day. The following data are available: The company can produce and

> Timing is the key in distinguishing between absorption and variable costing. Explain this statement

> Why might income-tax laws affect the transfer-pricing policies of multinational companies?

> Describe four methods by which transfer prices may be set.

> Identify and explain the managerial accountant’s primary objective in choosing a transfer-pricing policy

> Discuss the importance of nonfinancial information in measuring investment-center performance.

> List three nonfinancial measures that could be used to evaluate a division of an insurance company.

> How does inflation affect investment-center performance measures?

> Describe an alternative to using ROI or residual income to measure investment-center performance

> Explain why it is important in performance evaluation to distinguish between investment centers and their managers.

> Why do some companies use gross book value instead of net book value to measure a division’s invested capital?

> Distinguish between the following measures of invested capital, and briefly explain when each should be used: (a) total assets, (b) total productive assets, and (c) total assets less current liabilities.

> Explain three strategies of environmental cost management.

> Define the term economic value added. How does it differ from residual income?

> Why is there typically a rise in ROI or residual income across time in a division? What undesirable behavioral implications could this phenomenon have?