Question: Refer to the information given in Case

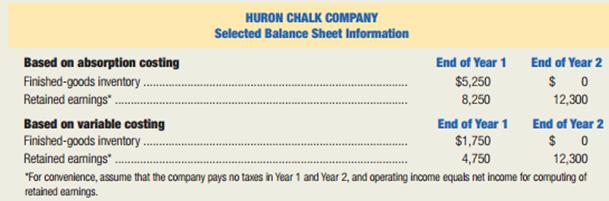

Refer to the information given in Case 2 for Huron Chalk Company. Selected information from Huron’s year-end balance sheets for its first two years of operation is as follows:

Information in case 2:

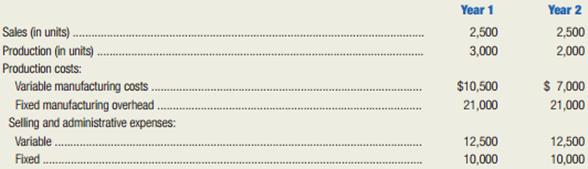

Huron Chalk Company manufactures sidewalk chalk which it sells online by the box at $25 per unit. Huron uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Huron’s first two years of operations is as follows:

Required:

1. Why is the year 1 ending balance in finished-goods inventory higher if absorption costing is used than if variable costing is used?

2. Why is the year 2 ending balance in finished-goods inventory the same under absorption and variable costing?

3. Notice that the ending balance of finished-goods inventory under absorption costing is greater than or equal to the ending finished-goods inventory balance under variable costing for both years 1 and 2. Will this relationship always hold true at any balance sheet date? Explain.

4. Compute the amount by which the year-end balance in finished-goods inventory declined during year 2 (i.e., between December 31 of year 1 and December 31 of year 2):

• Using the data from the balance sheet prepared under absorption costing.

• Using the data from the balance sheet prepared under variable costing.

5. Refer to your calculations from requirement (4). Compute the difference in the amount by which the year-end balances in finished-goods inventory declined under absorption versus variable costing. Then compare the amount of this difference with the difference in the company’s reported operating income for year 2 under absorption versus variable costing. (Refer to the operating income statements prepared in Case 2.)

6. Notice that the retained earnings balance at the end of both years 1 and 2 on the balance sheet prepared under absorption costing is greater than or equal to the corresponding retained earnings balance on the statement prepared under variable costing. Will this relationship hold true at any balance sheet date? Explain.

Transcribed Image Text:

HURON CHALK COMPANY Selected Balance Sheet Information Based on absorption costing Finished-goods inventory. Retained eamings". End of Year 1 End of Year 2 $5,250 $ 0 8,250 12,300 Based on variable costing Finished-goods inventory .. Retained eamings" End of Year 1 End of Year 2 $1,750 4,750 $ 0 12,300 "For convenience, assume that the company pays no taxes in Year 1 and Year 2, and operating income equals net income for computing of retained eamings. Year 1 Year 2 Sales (in units). 2,500 2,500 Production (in units). 3,000 2,000 Production costs: $10,500 $ 7,000 Variable manufacturing costs . Fixed manufacturing overhead. Selling and administrative expenses: 21,000 21,000 Variable.. Fixed -- 12,500 12,500 10,000 10,000 ...... ...

> The following information is from White Mountain Furniture Showroom’s financial records. Collections from customers are normally 70 percent in the month of sale, 20 percent in the month following the sale, and 9 percent in the second m

> Alder Company budgets on an annual basis. The following beginning and ending inventory levels (in units) are planned for the next year. Two units of raw material are required to produce each unit of finished product Required: 1. If Alder Company plans t

> Fill in the missing amounts in the following schedules. 2. Accounts payable, 12/31/x0 ................................................ €600,000‡ Purchase of goods and services on account during 20x1 .. 2,400,000 Payme

> Coyote Loco, Inc., a distributor of salsa, has the following historical collection pattern for its credit sales. 70 percent collected in the month of sale. 15 percent collected in the first month after sale. 10 percent collected in the second month after

> San Fernando Fertilizer Company plans to sell 40,000 units of finished product in July and anticipates a growth rate in sales of 5 percent per month. The desired monthly ending inventory in units of finished product is 80 percent of the next month’s esti

> Sea Star Company manufactures diving masks with a variable cost of $12.50. The masks sell for $17.00. Budgeted fixed manufacturing overhead for the most recent year was $396,000. Actual production was equal to planned production. Required: Under each o

> Three Rivers Dental Associates (TRDA) is a large dental practice in Pittsburgh. The firm’s controller is preparing the budget for the next year. The controller projects a total of 48,000 office visits, to be evenly distributed throughout the year. Eighty

> Jay Rexford, president of Photo Artistry Company, was just concluding a budget meeting with his senior staff. It was November of 20x4, and the group was discussing preparation of the firm’s master budget for 20x5. “I&a

> Triple-F Health Club (Family, Fitness, and Fun) offers tennis, swimming, and other physical fitness facilities to its members. There are four of these clubs in the metropolitan area. Each club has between 1,700 and 2,500 members. Revenue is derived from

> Jack Riley, controller in the division of social services for the state, recognizes the importance of the budgetary process for planning, control, and motivational purposes. He believes that a properly implemented participative budgetary process for plan

> Define the following types of environmental costs: private, social, visible, hidden, monitoring, abatement, and both on-site and off-site remediation.

> What is meant by a product’s grade, as a characteristic of quality? Give an example in the service industry.

> What is the purpose of a budget manual?

> Describe the role of a budget director

> Why do proponents of variable costing prefer variable costing when making pricing decisions?

> Explain the difference between observable and hidden quality costs

> What manager is usually in the best position to influence the direct-material price variance?

> Choose a city or state in the United States (or a Canadian city or province), and use the Internet to explore the annual budget of the governmental unit you selected. For example, you could check out the budget for Los Angeles at www.losangeles.com . Alt

> Explain why some management accountants believe that absorption costing may provide an incentive for managers to overproduce inventory.

> Why do many managers prefer variable costing over absorption costing?

> What is meant by the phrase management by exception?

> List the three parts of a control system, and explain how such a system works.

> Explain how a budget facilitates communication and coordination.

> Briefly explain the difference between absorption costing and variable costing

> List four potential pitfalls in decision making, which represent common errors.

> What is meant by the term contribution margin per unit of scarce resource?

> List and define four types of product quality costs.

> Are allocated joint processing costs relevant when making a decision to sell a joint product at the split-off point or process it further? Why?

> What is meant by the term differential cost analysis?

> How does the existence of excess production capacity affect the decision to accept or reject a special order?

> Give an example of an irrelevant future cost. Why is it irrelevant?

> Explain why the book value of equipment is not a relevant cost.

> Explain what is meant by the term decision model.

> Distinguish between qualitative and quantitative decision analyses.

> Describe the managerial accountant’s role in the decision-making process.

> List the seven steps in the decision-making process

> Visit the website of one of the following companies, or a different company of your choosing. Burger King www.burgerking.com Compaq www.compaq.com Corning www.corning.com Kmart www.kmart.com Kodak www.kodak.com NBC www.nbc.com Required: Read about the

> Explain how the accounting definition of an asset is related to the choice between absorption and variable costing.

> Explain the significance of excess capacity in the transferring division when transfer prices are set using the general transfer-pricing rule.

> How do organizations use pay for performance to motivate managers?

> What is the managerial accountant’s primary objective in designing a responsibility-accounting system?

> Give an example of a gain sharing plan that could be implemented by an airline.

> Define the term manufacturing cycle efficiency.

> List seven areas in which nonfinancial, operational performance measures are receiving increased emphasis in today’s manufacturing environment.

> List and explain three key features of the segmented income statement shown in Exhibit 12–7. Exhibit 12–7: Segment of Company Segment of Oahu Division Aloha Hotels Maul Oahu Walmea Beach Dlamond Head Walkiki Sands

> Why do some managers and accountants choose not to allocate common costs in segmented reports?

> Explain what is meant by a segmented income statement.

> Under what circumstances would it be appropriate to change the Waikiki Sands Hotel from a profit center to an investment center?

> Which is more consistent with cost-volume-profit analysis, variable costing or absorption costing? Why

> Data Screen Corporation is a highly automated manufacturing firm. The vice president of finance has decided that traditional standards are inappropriate for performance measures in an automated environment. Labor is insignificant in terms of the total co

> What types of organizations use flexible budgets?

> What is the fixed-overhead budget variance?

> Jeffries Company’s only variable-overhead cost is electricity. Does an unfavorable variable-overhead spending variance imply that the company paid more than the anticipated rate per kilowatt-hour

> Explain the advantage of using a flexible budget.

> Distinguish between static and flexible budgets.

> Describe five factors that managers often consider when determining the significance of a variance.

> Refer to Review Question 10–11. Why does an analogous question not arise in the context of the direct-labor variances?

> What manager is generally in the best position to influence the direct-labor efficiency variance?

> What is the interpretation of the direct-labor efficiency variance?

> Why do proponents of absorption costing argue that absorption costing is preferable as the basis for pricing decisions?

> What manager is usually in the best position to influence the direct-material quantity variance?

> What is the interpretation of the direct-material quantity variance?

> Explain how standard material prices and quantities are set

> Describe how a bank might use standards.

> Briefly explain the purpose of a cause-and-effect (or fishbone) diagram

> “An ounce of prevention is worth a pound of cure.” Interpret this old adage in light of Exhibit 8-6 Exhibit 8-6: May 20x2 Quality Costs Percent of Total Prevention costs Quality training Relability engineering-

> How can an organization help to reduce the problems caused by budgetary slack?

> Distinguish between a product’s quality of design and its quality of conformance

> What manager is generally in the best position to influence the direct-labor rate variance?

> Visit the website of Interface, Inc., at http://www.interfaceglobal.com. Read about its efforts toward sustainable development by clicking on the “Sustainability” link. Required: What is Interface’s product? Describe the company’s efforts toward sustai

> Will variable and absorption costing result in significantly different income measures in a JIT setting? Why?

> “Accounting systems should produce only relevant data and forget about the irrelevant data. Then I’d know what was relevant and what wasn’t!” Comment on this remark by a company president.

> Give two examples of sunk costs, and explain why they are irrelevant in decision making.

> Why can unitized fixed costs cause errors in decision making?

> There is an important link between decision making and managerial performance evaluation. Explain

> How is sensitivity analysis used to cope with uncertainty in decision making?

> Briefly describe the proper approach to making a production decision when limited resources are involved.

> What is a joint production process? Describe a special decision that commonly arises in the context of a joint production process. Briefly describe the proper approach for making this type of decision.

> Briefly describe the proper approach for making a decision about adding or dropping a product line.

> What behavioral tendency do people often exhibit with regard to opportunity costs?

> Define the term opportunity cost, and give an example of one.

> When inventory increases, will absorption-costing or variable-costing income be greater? Why?

> Why might a manager exhibit a behavioral tendency to inappropriately consider sunk costs in making a decision?

> Is the book value of inventory on hand a relevant cost? Why?

> List and explain two important criteria that must be satisfied in order for information to be relevant.

> What is meant by each of the following potential characteristics of information: relevant, accurate, and timely? Is objective information always relevant? Accurate?

> A quantitative analysis enables a decision maker to put a “price” on the sum total of the qualitative characteristics in a decision situation. Explain this statement, and give an example.

> Are the concepts underlying a relevant-cost analysis still valid in an advanced manufacturing environment? Are these concepts valid when activity-based costing is used? Explain.

> Refer to the data given in the preceding exercise for Plato Corporation. Assume that the d irect-labor rate is $12 per hour, and 11,000 labor hours are available per year. In addition, the company has a short supply of machine time. Only 9,000 hours are

> Plato Corporation manufactures two products, Alpha and Beta. Contribution margin data follow. Plato Corporation’s production process uses highly skilled labor, which is in short supply. The same employees work on both products and earn

> Global’s special order also requires 1,000 kilograms of genatope, a solid chemical regularly used in the company’s products. The current stock of genatope is 8,000 kilograms at a book value of 12.15 p per kilogram. If the special order is accepted, the f

> Global Chemical Company, located in Buenos Aires, Argentina, recently received an order for a product it does not normally produce. Since the company has excess production capacity, management is considering accepting the order. In analyzing the decision

> The term direct costing is a misnomer. Variable costing is a better term for the product-costing method. Do you agree or disagree? Why?

> Juarez Corporation produces cleaning compounds and solutions for industrial and household use. While most of its products are processed independently, a few are related. Grit 337, a coarse cleaning powder with many industrial uses, costs $3.20 a pound to

> Thorpe Industries produces chemicals for the swimming pool industry. In one joint process, 10,000 gallons of GSX are processed into 7,000 gallons of xenolite and 3,000 gallons of banolide. The cost of the joint process, including the GSX, is $17,500. The

> Armstrong Corporation manufactures bicycle parts. The company currently has a $19,500 inventory of parts that have become obsolete due to changes in design specifications. The parts could be sold for $7,000, or modified for $10,000 and sold for $20,300.

> College Town Pizza’s owner bought his current pizza oven two years ago for $10,500, and it has one more year of life remaining. He is using straight-line depreciation for the oven. He could purchase a new oven for $2,200, but it would last only one year.

> If Toon Town Toy Company closes its Packaging Department, the department manager will be appointed manager of the Cutting Department. The Packaging Department manager makes $51,000 per year. To hire a new Cutting Department manager will cost Toon Town $6

> Toon Town Toy Company is considering the elimination of its Packaging Department. Management has received an offer from an outside firm to supply all Toon Town’s packaging needs. To help her in making the decision, Toon Town’s president has asked the con

> Day Street Deli’s owner is disturbed by the poor pr o fit performance of his ice cream counter. He has prepared the following profit analysis for the year just ended. Required: Criticize and correct the owner’s analys