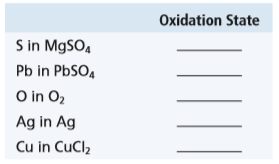

Question: Assign the oxidation state for the element

Assign the oxidation state for the element listed in each of the following compounds:

Transcribed Image Text:

Oxidation State S in M9SO, Pb in PBSO, O in O2 Ag in Ag Cu in CuCl2

> What is the oxidation state of sulfur in each of the following substances? a. S8 c. NaHSO4 b. H2SO4 d. Na2S

> The chains in normal alkanes are not really straight but zigzag because the bond angles around the carbon atoms are .

> What makes carbon able to form so many different compounds?

> Rank these organic compounds in terms of increasing water solubility (from least water soluble to most water soluble). CH;CH;CH2COH CH3 b. CH;CH2CH=¢ ČH3 CH;CH2CH¿CH3 c.

> Esterification reactions are carried out in the presence of a strong acid such as H2SO4. A carboxylic acid is warmed with an alcohol, and an ester and water are formed. You may have made a fruity-smelling ester in the lab when studying organic functional

> Name each of the following organic compounds.

> Name each of the following alkenes and alkynes. CH3 a. CH3CH2-C==CH2 CH3 CH3 b. CH2=ċ-CH2-ċ=CH2 CH3 c. CH3CH2CH-CH=CH-CH2CH CH2CH3 CH3 d. CH;CH,CH,CH;CH-C=CH Br CH3 CH3 e. CH3-Ċ-C=C-CH ČH;CH2 CH3 CI CH,CH3 f. HC=C-CH-CH CH3 CH2CH2CH2CH3

> Name each of the following alkanes. Br a. CH3-Č-CH–CH2-CH3 Br CH3 CH3 CH2-CH3 b. CH3-CH-CH–CH ČH;-CH3 с. F CH3-CH-CH2-ĊH–CH2-CH2-CH2-CH2-CH3 ČH3

> The decay series from uranium-238 to lead-206 is indicated in Fig. 19.1. For each step of the process indicated in the figure, specify what type of particle is produced by the particular nucleus involved at that point in the series. From figure 19.1:

> A certain nuclide has a half-life of 45 years. After 225 years, 4.00 g remains. What was the original mass of the nuclide sample?

> A self-sustaining nuclear process, in which the bombarding particles needed to produce the fission of further material are themselves produced as the product of the initial fission, is called a reaction.

> Assign oxidation states to all of the atoms in each of the following. a. NBr3 b. SeF6 c. PBr5 d. CH4

> Combining two small nuclei to form a larger nucleus is referred to as the process of nuclear .

> The radioactive nuclide that has been used in determining the age of historical wooden artifacts is .

> The time required for half of an original sample of a radioactive nuclide to decay is referred to as the of the nuclide.

> A counter contains argon gas, which is ionized by radiation, making possible the measurement of radioactive decay rates.

> The elements with atomic numbers of 93 or greater are referred to as the elements.

> Machines that increase the speed of species used for nuclear bombardment processes are called .

> When a nucleus undergoes ______, the mass number of the nucleus decreases by four units.

> When a nuclide produces a beta particle, the atomic number of the resulting new nuclide is one unit than that of the original nuclide.

> When a nuclide decomposes through a series of steps before reaching stability, the nuclide is said to have gone through a series.

> In addition to particles, many radioactive nuclei also produce high-energy rays when they decay.

> Assign oxidation states to all of the atoms in each of the following. a. CBr4 b. HClO4 c. K3PO4 d. N2O

> The net effect of the production of a beta particle is to convert a to a .

> Production of a helium nucleus from a heavy atom is referred to as decay.

> In a nuclear equation, both the mass number and the ______ number must be conserved.

> A(n) , when it is produced by a nucleus at high speed, is more commonly called a beta particle.

> A nucleus that spontaneously decomposes is said to be .

> Write the nuclear symbol for an alpha particle.

> The number of protons contained in a given nucleus is called the .

> Describe the relative penetrating powers of alpha, beta, and gamma radiation.

> The sun radiates vast quantities of energy as a consequence of the nuclear fusion reaction of to form nuclei.

> What are some reasons why no practical fusion reactor has yet been developed?

> What must be the sum of the oxidation states of all the atoms in a polyatomic ion? For example, the sum of all the oxidation states of all the atoms in PO43- is .

> What is the nuclear fusion of small nuclei? How does the energy released by fusion compare in magnitude with that released by fission?

> A(n) is a self-sustaining fission process caused by the production of neutrons that proceed to split other nuclei.

> Write an equation for the fission of 92 235

> How do the energies released by nuclear processes compare in magnitude with the energies of ordinary chemical processes?

> The “Chemistry in Focus” segment PET, the Brain’s Best Friend discusses the use of radiotracers to monitor the functioning of organs or to trace the path and final destination of a drug. The isotope 18F is cited as a possible radiotracer and has a half-l

> Cobalt-62 ( 27 62

> Nitrogen-13 7 13

> A list of several important radionuclides is given in Table 19.4. Which is the “hottest”? Which is the most stable to decay? From table 19.4: Half-life Area of the Body Studied Nucdlide 8.1 days thyroid 131 45.1 d

> An instrument that measures the rate of radioactive decay by registering the ions and electrons produced as a radioactive particle passes through a gas-filled chamber is called a(n) . An instrument that measures radioactive decay by sensin

> Which of the following nuclear equations is(are) correct? a. 4 7

> The sum of all the oxidation states of all the atoms in H3PO4 is .

> Each of the following nuclides is known to undergo radioactive decay by production of an alpha particle, /. Write a balanced nuclear equation for each process. a. / b. / c. /

> The most common reaction used in breeder reactors involves the bombardment of uranium-238 with neutrons: 238U is converted by this bombardment to 239U. The uranium-239 then undergoes two beta decays, first to 239Np, and then to 239Pu, which is a fissiona

> Which of the following statement(s) is(are) true? a. A radioactive nuclide that decays from 1.00 * 1010 atoms to 2.5 * 109 atoms in 10 minutes has a half-life of 5.0 minutes. b. Nuclides with large Z values are observed to be a-particle producers. c.

> A certain radioactive nuclide has a half-life of 80.9 years. How long does it take for 87.5% of a sample of this substance to decay?

> The “Chemistry in Focus” segment Yellow Jeans? discusses the oxidation–reduction reaction required to turn the dye used in denim jeans from yellow to blue. The reaction is from leucoindigo to indigo. The reaction can be expressed as Na2C16N2H10O2

> How have 53 131

> During the research that led to production of the two atomic bombs used against Japan in World War II, different mechanisms for obtaining a supercritical mass of fissionable material were investigated. In one type of bomb, what is essentially a gun was u

> Balance each of the following oxidation–reduction reactions, which take place in acidic solution, by using the “half-reaction” method. a. I-(aq) + MnO4-(aq) / I2(aq) + Mn2+(aq) b. S2O82-(aq) + Cr3+(aq) / SO42-(aq) + Cr2O72-(aq) c. BiO3-(aq) + Mn2+(aq)

> Balance each of the following half-reactions, which take place in acidic solution. a. SiO2(s) / Si(s) b. S(s) / H2S(g) c. NO3–(aq) / HNO2(aq) d. NO3–(aq) / NO(g)

> Why is fluorine always assigned an oxidation state of -1? What oxidation number is usually assigned to the other halogen elements when they occur in compounds? In an interhalogen compound involving fluorine (such as ClF), which atom has a negative oxidat

> Give some examples of how we make good use of oxidation– reduction reactions in everyday life.

> Required: Indicate whether each of the following transactions is an asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE) transaction. a. Acquired cash from the issue of stock. b. Paid a cash dividend to the stockholders. c. Pai

> Required: Identify each of the following events as an accrual, a deferral, or neither: a. Paid cash in advance for a one-year insurance policy. b. Paid cash to settle an account payable. c. Collected accounts receivable. d. Paid cash for current salaries

> Arnett Company was started in Year 1 when it acquired $30,000 cash by issuing common stock to Dan Arnett. Required: a. Was this event an asset source, use, or exchange transaction for Arnett Company? b. Was this event an asset source, use, or exchange t

> Riley Company paid $60,000 cash to purchase land from Smally Company. Smally originally paid $60,000 for the land. Required: a. Was this event an asset source, use, or exchange transaction for Riley Company? b. Was this event an asset source, use, or ex

> Lakeside, Inc. purchased land in January Year 1 at a cost of $250,000. The estimated market value of the land is $425,000 as of December 31, Year 8. Required: a. Name the December 31, Year 8, financial statement(s) on which the land will be shown. b. At

> Nevada Company experienced the following events during its first year of operations: 1. Acquired an additional $1,000 cash from the issue of common stock. 2. Paid $2,400 cash for utilities expense. 3. Paid a $1,500 cash dividend to the stockholders. 4. P

> Olive Enterprises experienced the following events during Year 1: 1. Acquired cash from the issue of common stock. 2. Paid cash to reduce the principal on a bank note. 3. Sold land for cash at an amount equal to its cost. 4. Provided services to clients

> Assume that Clayton Company acquires $1,200 cash from creditors and $1,700 cash from investors. Required: a. Explain the primary differences between investors and creditors. b. If Clayton has a net income of $800 and then liquidates, what amount of cash

> The following table shows the transactions experienced by Walter Enterprises during Year 8. The table contains missing data that are labeled with alphabetic characters (a) through (i). Assume all transactions shown in the accounting equation are cash tra

> The financial condition of White Inc. is expressed in the following accounting equation: Required: a. Are dividends paid to creditors or investors? Explain why. b. How much cash is in the Retained Earnings account? c. Determine the maximum dividend Whi

> Lewis Enterprises was started when it acquired $4,000 cash from creditors and $6,000 from owners. The company immediately purchased land that cost $9,000. Required: a. Record the events under an accounting equation. b. After all events have been 183 rec

> The following account titles were drawn from the general ledger of Pest Control, Incorporated (PCI): Cash, Notes Payable, Land, Accounts Payable, Office Furniture, Salaries Expense, Common Stock, Service Revenue, Interest Expense, Utilities Payable, Util

> As of December 31, Year 1, Dunn Company had total cash of $156,000, notes payable of $85,600, and common stock of $52,400. During Year 2, Dunn earned $36,000 of cash revenue, paid $20,000 for cash expenses, and paid a $3,000 cash dividend to the stockhol

> At the beginning of Year 2, Master Corp.’s accounting records had the following general ledger accounts and balances: Master Corp. completed the following transactions during Year 2: 1. Purchased land for $12,000 cash. 2. Acquired $2

> Morrison Co. experienced the following events during Year 1: 1. Acquired cash from the issue of common stock. 2. Borrowed cash. 3. Collected cash from providing services. 4. Purchased land with cash. 5. Paid operating expenses with cash. 6. Paid a cash d

> The following events apply to Lewis and Harper, a public accounting firm, for the Year 1 accounting period: 1. Performed $70,000 of services for clients on account. 2. Performed $40,000 of services for cash. 3. Incurred $36,000 of other operating expense

> As of December 31, Year 1, Moss Company had total cash of $195,000, notes payable of $90,500, and common stock of $84,500. During Year 2, Moss earned $42,000 of cash revenue, paid $24,000 for cash expenses, and paid a $3,000 cash dividend to the stockhol

> Required: Obtain the Target Corporation’s annual report at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. Which accounts on Target’s balance sheet are accrual type accounts? b. Which acc

> At the beginning of Year 2, Better Corp.’s accounting records had the following general ledger accounts and balances: Better Corp. completed the following transactions during Year 2: 1. Purchased land for $5,000 cash. 2. Acquired $25,

> Milea Inc. experienced the following events in Year 1, its first year of operations: 1. Received $20,000 cash from the issue of common stock. 2. Performed services on account for $56,000. 3. Paid the utility expense of $2,500. 4. Collected $48,000 of the

> Required: a. Match the terms (identified as a through g) with the definitions and phrases (marked 1 through 7). For example, the term “a. Assets” matches with definition 7. Economic resources that will be used by a bus

> Karen White helped organize a charity fund to help cover the medical expenses of her friend, Vicky Hill, who was seriously injured in a bicycle accident. The fund was named the Vicky Hill Recovery Fund (VHRF). Karen contributed $1,000 of her own money to

> During Year 1, Chung Corporation earned $8,000 of cash revenue and accrued $5,000 of salaries expense. Required: Based on this information alone: a. Prepare the December Year 1, balance sheet. b. Determine the amount of net income that Chung would report

> Holloway Company earned $18,000 of service revenue on account during Year 1. The company collected $14,000 cash from accounts receivable during Year 1. Required: Based on this information alone, determine the following for Holloway Company. a. The balan

> Sammy’s Pizza opened on January 1, Year 1. Sammy’s reported the following for cash revenues and cash expenses for the years Year 1 to Year 3: Required: a. What would Sammy’s Pizza report for net inc

> As of December 31, Year 1, Flowers Company had total assets of $130,000, total liabilities of $50,000, and common stock of $70,000. The company’s Year 1 income statement contained revenue of $30,000 and expenses of $18,000. The Year 1 statement of change

> As of January 1, Year 2, Room Designs Inc. had a balance of $9,900 in Cash, $3,500 in Common Stock, and $6,400 in Retained Earnings. These were the only accounts with balances in the ledger on January 1, Year 2. Further analysis of the companyâ

> On January 1, Year 2, the following information was drawn from the accounting records of Carter Company: cash of $800; land of $3,500; notes payable of $600; and common stock of $1,000. Required: a. Determine the amount of retained earnings as of Januar

> This chapter defined and discussed accrual and deferral transactions. Complete the requirements below using the most recent financial statements available on the Internet for Netflix, Inc. Obtain the statements by following the steps below. (Be aware tha

> Charlene Rose tells you that accountants where she works are real hair splitters. For example, they make a big issue over the difference between a cost and an expense. She says the two terms mean the same thing to her. Required: a. Explain to Charlene t

> Dakota Company experienced the following events during Year 2: 1. Acquired $30,000 cash from the issue of common stock. 2. Paid $12,000 cash to purchase land. 3. Borrowed $10,000 cash. 4. Provided services for $20,000 cash. 5. Paid $1,000 cash for utilit

> All-Star Automotive Company experienced the following accounting events during Year 1: 1. Performed services for $25,000 cash. 2. Purchased land for $6,000 cash. 3. Hired an accountant to keep the books. 4. Received $50,000 cash from the issue of common

> On January 1, Year 1, Moore, a fast-food company, had a balance in its Cash account of $45,800. During the Year 1 accounting period, the company had (1) net cash inflow from operating activities of $24,800, (2) net cash outflow for investing activities o

> Sung Company purchased land in April Year 1 at a cost of $500,000. The estimated market value of the land is $800,000 as of December 31, Year 7. Sung purchased marketable equity securities (bought the common stock of a company that is independent of Sung

> Majka Company was started on January 1, Year 1. During Year 1, the company experienced the following three accounting events: (1) earned cash revenues of $33,700, (2) paid cash expenses of $14,900, and (3) paid a $3,200 cash dividend to its stockholders.

> The December 31, Year 1, balance sheet for Deen Company showed total stockholders’ equity of $156,000. Total stockholders’ equity increased by $65,000 between December 31, Year 1, and December 31, Year 2. During Year 2, Deen Company acquired $20,000 cash

> Yard Professionals Inc. experienced the following events in Year 1, its first year of operation: 1. Performed services for $35,000 cash. 2. Purchased $6,000 of supplies on account. 3. A physical count on December 31, Year 1, found that there was $1,800 o

> Pizza Express Inc. began the Year 2 accounting period with $2,500 cash, $1,400 of common stock, and $1,100 of retained earnings. Pizza Express was affected by the following accounting events during Year 2: 1. Purchased $3,600 of supplies on account. 2. E

> The following table shows the transactions experienced by J G Gutter Works (JGGW), during Year 7. The table contains missing data which are labeled with alphabetic characters (a) through (j). Assume all transactions shown in the accounting equation are c

> This chapter introduced the basic four financial statements companies use annually to keep their stakeholders informed of their accomplishments and financial situation. Complete the requirements below using the most recent (20xx) financial statements ava

> Required: a. Based on this information alone, can you determine whether White can pay a $2,000 cash dividend? Why or why not? b. Reconstruct the accounting equation for each company using percentages on the right side of the equation instead of dollar va

> The following information was drawn from the accounting records of Wyckoff Company as of December 31, Year 2, before the temporary accounts had been closed. The Cash balance was $3,600, and Notes Payable amounted to $4,000. The company had revenues of $7

> Davos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1, and the remaining $40,000 was collected in cash during Year 2. Required: a. Record the Year 1 transactions in T-acc

> Required Record each of the following Fred Co. events in T-accounts, and then explain how the event affects the accounting equation: a. Received $20,000 cash by issuing common stock. b. Purchased supplies for $1,000 cash c. Purchased land for $10,000 ca