Question: Assume Earl Coffee Roasters Corporation ended the

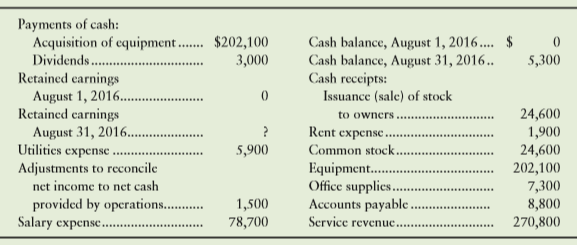

Assume Earl Coffee Roasters Corporation ended the month of August 2016 with these data:

Requirement

1. Prepare the income statement and the statement of retained earnings of Earl Coffee Roasters Corporation for the month ended August 31, 2016.

Transcribed Image Text:

Payments of cash: Acquisition of equipment.. $202,100 Dividends. Retained earnings August 1, 2016.. Retained carnings August 31, 2016. Utilities expense . Adjustments to reconcile net income to net cash Cash balance, August 1, 2016.... $ Cash balance, August 31, 2016.. Cash receipts: Issuance (sale) of stock 3,000 5,300 24,600 1,900 24,600 202,100 7,300 to owners Rent expense. 5,900 Common stock... provided by operations. . Salary expense. Equipment.. Office supplies.. Accounts payable . Service revenue... 1,500 78,700 8,800 270,800

> F. L. Hardy’s checkbook lists the following: The October bank statement shows: Requirement 1. Prepare Hardy’s bank reconciliation at October 31, 2017. Date Check No. Item Check Deposit Balance 10/1 $ 515 $ 25

> Rhonda Dunbar served as executive director of Downtown Forest Lake, an organization created to revitalize Forest Lake, Minnesota. Over the course of 11 years, Dunbar embezzled $444,000. How did Dunbar do it? By depositing subscriber cash receipts in her

> The following situations describe two cash payment situations and two cash receipt situations. In each pair, one set of internal controls is better than the other. Evaluate the internal controls in each situation as strong or weak, and give the reason fo

> Halston Consulting Company reported these ratios at December 31, 2016 (dollar amounts in millions): Halston Consulting completed these transactions during 2017: a. Purchased equipment on account, $8 b. Paid long-term debt, $10 c. Collected cash from

> Refer to Exercise 3-38B. Requirements 1. Use the data in the partial worksheet to prepare Emerson Production Company’s classified balance sheet at December 31 of the current year. Use the report format. First you must compute the adjusted balance for s

> The unadjusted trial balance and income statement amounts from the December 31 adjusted trial balance of Emerson Production Company follow: / Requirement 1. Journalize the adjusting and closing entries of Emerson Production Company at December 31. Th

> Prepare the closing entries from the following selected accounts from the records of Hector, Inc., at December 31, 2016: How much net income did Hector earn during 2016? Prepare a T-account for Retained Earnings to show the December 31, 2016, balance o

> The adjusted trial balances of Bova Corporation at August 31, 2016, and August 31, 2015, include these amounts (in millions): Bova completed these transactions (in millions) during the year ended August 31, 2016. Compute the amount of sales revenue,

> The adjusted trial balance of Marshall, Inc., follows: Requirement 1. Prepare Marshall, Inc.’s, single-step income statement and statement of retained earnings for the year ended December 31, 2016, and its balance sheet on that date.

> McCool Floral Co. prepaid three years’ rent ($36,000) on January 1, 2016. At December 31, 2016, McCool prepared a trial balance and then made the necessary adjusting entry at the end of the year. McCool adjusts its accounts once each year—on December 31.

> Rockwell Company faced the following situations. Journalize the adjusting entry needed at December 31, 2016, for each situation. Consider each fact separately. a. The business has interest expense of $3,300 that it must pay early in January 2017. b. In

> Henry Corporation experienced four situations for its supplies. Compute the amounts that have been left blank for each situation. For situations 1 and 2, journalize the needed transaction. Consider each situation separately. Situation 3 4 $ 600 $ 60

> An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $600. Payments for insurance during the period, $2,000. Prepaid insurance, ending, $1,200. b. Interest revenue accrued, $2,1

> During 2016, Gibson Network, Inc., which designs network servers, earned revenues of $720 million. Expenses totaled $520 million. Gibson collected all but $20 million of the revenues and paid $570 million on its expenses. Gibson’s top managers are evalu

> Landry Company reported these ratios at December 31, 2016 (dollar amounts in millions): Landry Company completed these transactions during 2017: a. Purchased equipment on account, $7 b. Paid long-term debt, $10 c. Collected cash from customers in ad

> Refer to Exercise 3-27A. Requirements 1. Use the data in the partial worksheet to prepare Winwood Production Company’s classified balance sheet at December 31 of the current year. Use the report format. First you must compute the adjusted balance for s

> The unadjusted trial balance and income statement amounts from the December 31 adjusted trial balance of Winwood Production Company follow. Requirement 1. Journalize the adjusting and closing entries of Winwood Production Company at December 31. There

> Prepare the closing entries from the following selected accounts from the records of Wolf Enterprises at December 31, 2016: How much net income did Wolf Enterprises earn during 2016? Prepare a T-account for Retained Earnings to show the December 31, 20

> The adjusted trial balances of Victory Corporation at August 31, 2016, and August 31, 2015, include these amounts (in millions): Victory Corporation completed these transactions (in millions) during the year ended August 31, 2016. Compute the amount

> The adjusted trial balance of Honeybell, Inc., follows. Requirement 1. Prepare Honeybell, Inc.’s single-step income statement and statement of retained earnings for the year ended December 31, 2016, and its balance sheet on that date

> Childtime Toys prepaid three years’ rent ($54,000) on January 1, 2016. At December 31, 2016, Childtime prepared a trial balance and then made the necessary adjusting entry at the end of the year. Childtime adjusts its accounts once each year—on December

> Dellroy Rentals Company faced the following situations. Journalize the adjusting entry needed at December 31, 2016, for each situation. Consider each fact separately. a. The business has interest expense of $3,200 that it must pay early in January 2017.

> Rankle Corporation experienced four situations for its supplies. Compute the amounts that have been left blank for each situation. For situations 1 and 2, journalize the needed transaction. Consider each situation separately. Situation 1 2 3 4 $ 600

> An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $300. Payments for insurance during the period, $2,900. Prepaid insurance, ending, $600. b. Interest revenue accrued, $2,400

> During 2016, Nicholson Network, Inc., which designs network servers, earned revenues of $800 million. Expenses totaled $570 million. Nicholson collected all but $21 million of the revenues and paid $600 million on its expenses. Nicholson’s top managers a

> Assume that Wolf Products Company reported the following summarized data at May 31, 2016. Accounts appear in no particular order; dollar amounts are in millions. Requirements 1. Solve for Cash. 2. Prepare the trial balance of Wolf Products at May 31,

> Refer to Exercise 2-36B. Requirements 1. After recording the transactions in Exercise E2-36B, and assuming they all occurred in the month of December 2016, prepare the trial balance of Eric Newton, Attorney, at December 31, 2016. Use the T-accounts th

> Set up the following T-accounts: Cash, Accounts Receivable, Office Supplies, Office Furniture, Accounts Payable, Common Stock, Dividends, Service Revenue, Salary Expense, and Rent Expense. Record the following transactions directly in the T-accounts with

> The trial balance of Carver, Inc., at September 30, 2016, does not balance. The accounting records hold the following errors: a. Recorded a $200 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. b. Posted a $2,00

> The accounts of Deluxe Deck Service, Inc., follow with their normal balances at April 30, 2016. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at April 30, 2016, listing accounts i

> The first seven transactions of Big Horn Advertising, Inc., have been posted to the company’s accounts: Requirement 1. Prepare the journal entries that served as the sources for the seven transactions. Include an expla

> Refer to Exercises 2-30B and 2-31B. Requirements 1. Post the entries to the ledger, using T-accounts. Key transactions by date. 2. Prepare the trial balance of Dr. Sue Smith, P.C., at May 31, 2016. 3. From the trial balance, determine total assets,

> Refer to Exercise 2-30B. Requirement 1. Record the transactions in the journal of Dr. Sue Smith, P.C. List the transactions by date and give an explanation for each transaction.

> Sue Smith opened a medical practice specializing in surgery. During the first month of operation (May), the business, titled Dr. Sue Smith, Professional Corporation (P.C.), experienced the following events: Requirements 1. Analyze the e

> The following selected events were experienced by either Bishop Industries, Inc., a corporation, or Kate Bishop, the major stockholder. State whether each event 1. increased, 2. decreased, or 3. had no effect on the total assets of the business. Ident

> Assume Summertime Fashions opened a store in Orlando, starting with cash and common stock of $108,000. Gary Breen, the store manager, then signed a note payable to purchase land for $79,000 and a building for $200,000. Breen also paid $42,000 for equipme

> Assume that New Towne Company reported the following summarized data at September 30, 2016. Accounts appear in no particular order; dollar amounts are in millions. Requirements 1. Solve for Cash. 2. Prepare the trial balance of New Towne at September

> Refer to Exercise 2-25A. 1. After recording the transactions in Exercise 2-25A, and assuming they all occurred in the month of January 2016, prepare the trial balance of Leigh Hampton, Attorney, at January 31, 2016. Use the T-accounts that have been pre

> Set up the following T-accounts: Cash, Accounts Receivable, Office Supplies, Office Furniture, Accounts Payable, Common Stock, Dividends, Service Revenue, Salary Expense, and Rent Expense. Record the following transactions directly in the T-accounts with

> The trial balance of Harper, Inc., at September 30, 2016, does not balance: The accounting records hold the following errors: a. Recorded a $500 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. b. Posted a $3,000

> The accounts of Custom Patio Service, Inc., follow with their normal balances at April 30, 2016. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at April 30, 2016, listing accounts

> The first seven transactions of Fournier Advertising, Inc., have been posted to the company’s accounts: Requirement 1. Prepare the journal entries that served as the sources for the seven transactions. Include an expla

> Refer to Exercises 2-19A and 2-20A. Requirements 1. After journalizing the transactions of Exercise 2-19A, post the entries to the ledger, using T-accounts. Key transactions by date. 2. Prepare the trial balance of Dr. Kristine Cohen, P.C., at July 3

> Refer to Exercise 2-19A. Requirement 1. Record the transactions in the journal of Dr. Kristine Cohen, P.C. List the transactions by date and give an explanation for each transaction. From Exercise 2-19A. Dr. Kristine Cohen opened a medical practice

> Dr. Kristine Cohen opened a medical practice specializing in physical therapy. During the first month of operation (July), the business, titled Dr. Kristine Cohen, Professional Corporation (P.C.), experienced the following events: Requir

> During 2016, Young Company earned revenues of $150 million. Young incurred, during that same year, salary expense of $30 million, rent expense of $14 million, and utilities expense of $29 million. Young declared and paid dividends of $10 million during t

> This exercise should be used in conjunction with Exercises 1-38B through 1-40B. The owner of Earl Coffee Roasters Corporation now seeks your advice as to whether she should cease operations or continue the business. Complete the report giving her your op

> Refer to the data in Exercises 1-38B and 1-39B. Requirement 1. Prepare the statement of cash flows of Earl Coffee Roasters Corporation for the month ended August 31, 2016. Using Exhibit 1-11 as a model, show with arrows the relationships among the inc

> Refer to the data in Exercise 1-38B. Requirement 1. Prepare the balance sheet of Earl Coffee Roasters Corporation at August 31, 2016. From Exercise 1-38B Assume Earl Coffee Roasters Corporation ended the month of August 2016 with these data: Pa

> This exercise should be used with Exercise 1-36B. Requirements 1. Prepare the income statement of David Austin Realty Company for the year ended January 31, 2016. 2. What amount of dividends did David Austin Realty Company declare during the year end

> Amounts of the assets and liabilities of David Austin Realty Company, as of January 31, 2016, are as follows. Also included are revenue, expense, and selected stockholders’ equity figures for the year ended on that date (

> At December 31, 2016, Robinson Products has cash of $18,000, receivables of $20,000, and inventory of $82,000. The company’s equipment totals $183,000. Robinson owes accounts payable of $29,000 and long-term notes payable of $171,000. Common stock is $29

> Assume Flurrish, Inc., is expanding into India. The company must decide where to locate and how to finance the expansion. Identify the financial statement where these decision makers can find the following information about Flurrish, Inc. In some cases, mor

> Cranberry, Inc.’s, comparative balance sheet at January 31, 2017, and 2016, reports the following (in millions): Requirements Three situations about Cranberry’s issuance of stock and declaration and payment of divid

> Blackwell Services, Inc., has current assets of $240 million; property, plant, and equipment of $350 million; and other assets totaling $170 million. Current liabilities are $150 million, and long-term liabilities total $360 million. Requirements 1. U

> Compute the missing amount in the accounting equation for each company (amounts in billions): Which company appears to have the strongest financial position? Explain your reasoning. Assets Liabilities Stockholders' Equity Corner Groc

> During 2016, McFall Company earned revenues of $140 million. McFall incurred, during that same year, salary expense of $31 million, rent expense of $16 million, and utilities expense of $22 million. McFall declared and paid dividends of $12 million durin

> This exercise should be used in conjunction with Exercises 1-26A through 1-28A. The owner of Carson Coffee Roasters Corp. seeks your advice as to whether he should cease operations or continue the business. Complete the report, giving him your opinion of

> Refer to the data in Exercises 1-26A and 1-27A. Requirement 1. Prepare the statement of cash flows of Carson Coffee Roasters Corp., for the month ended August 31, 2017. Using Exhibit 1-11 as a model, show with arrows the relationships among the income

> Refer to the data in Exercise 1-26A. Requirement 1. Prepare the balance sheet of Carson Coffee Roasters Corp., for August 31, 2017. From Exercise 1-26A: Assume the Carson Coffee Roasters Corp. ended the month of August 2017 with these data: Pa

> Assume the Carson Coffee Roasters Corp. ended the month of August 2017 with these data: Requirement 1. Prepare the income statement and the statement of retained earnings of Carson Coffee Roasters Corp., for the month ended August 31, 2017. Paymen

> This exercise should be used with Exercise 1-24A. Refer to the data of Ellen Samuel Realty Company in Exercise 1-24A. Requirements 1. Prepare the income statement of Ellen Samuel Realty Company for the year ended May 31, 2016. 2. What amount of divid

> Amounts of the assets and liabilities of Ellen Samuel Realty Company, as of May 31, 2016, are given as follows. Also included are revenue, expense, and selected stockholders’ equity figures for the year ended on that date

> At December 31, 2016, Womack Products has cash of $23,000, receivables of $15,000, and inventory of $77,000. The company’s equipment totals $184,000. Womack owes accounts payable of $24,000 and long-term notes payable of $165,000. Common stock is $32,500

> Assume Malcolm Tech, Inc., is expanding into China. The company must decide where to locate and how to finance the expansion. Identify the financial statement where these decision makers can find the following information about Malcolm Tech, Inc. In some ca

> Franklin Company’s comparative balance sheet at January 31, 2017, and 2016, reports the following (in millions): Requirements Three situations about Franklin Company’s issuance of stock and declaration and payment o

> Hooper, Inc., has current assets of $200 million; property, plant, and equipment of $350 million; and other assets totaling $160 million. Current liabilities are $170 million and long-term liabilities total $320 million. Requirements 1. Use these data

> Compute the missing amount in the accounting equation for each company (amounts in billions): Which company appears to have the strongest financial position? Explain your reasoning. Assets Liabilities Stockholders' Equity Presto Dryc

> The following selected events were experienced by either Knox Eldercare Services, Inc., a corporation, or Steve Knox, the major stockholder. State whether each event 1. increased, 2. decreased, or 3. had no effect on the total assets of the business.

> Assume Designs Unlimited opened a store in Columbus, Ohio, starting with cash and common stock of $98,000. Laura Sprague, the store manager, then signed a note payable to purchase land for $76,000 and a building for $199,000. Sprague also paid $36,000 fo

> Identify the internal control weakness in the following situations. State how the person can hurt the company. a. Julie Sweitzer works as a security guard at SPEEDY parking in Denver. Sweitzer has a master key to the cash box where customers pay for par

> Use the data in E6A-3. Requirements Journalize the following for the periodic system: 1. Total October purchases in one summary entry. All purchases were on credit. 2. Total October sales in a summary entry. Assume that the selling price was $275 per

> Suppose Synthetix Corporation’s inventory records for a particular computer chip indicate the following at October 31: The physical count of inventory at October 31 indicates that five units of inventory are on hand. Requirements Co

> The Organic Soda Company reported the following comparative information at December 31, 2016, and December 31, 2015 (amounts in millions and adapted): Requirements 1. Calculate the following ratios for 2016 and 2015: a. Current ratio b. Debt ratio

> The top management of Parker Marketing Services examines the following company accounting records at August 29, immediately before the end of the year, August 31: 1. Suppose Parker’s management wants to achieve a current ratio of 2.8.

> FedEx Corporation provides a broad portfolio of transportation, e-commerce, and business services. FedEx reported the following information in its 2015 annual report: NOTE 1: DESCRIPTION OF BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Prop

> Acorn-France is a major telecommunication conglomerate. Assume that early in year one, Acorn-France purchased equipment at a cost of 5 million euros (€5 million). Management expects the equipment to remain in service for four years and the estimated resi

> Yentun, Inc., has a popular line of boogie boards. Yentun reported net income of $62 million for 2016. Depreciation expense for the year totaled $28 million. Yentun, Inc., depreciates plant assets over eight years using the straight-line method and no re

> Rollyson Financial Management believes that the biotechnology industry is a good investment and is considering investing in one of two companies. However, one company, FutureNow, Inc., uses the FIFO method of inventory, and another company, LifeTech, Inc

> A Mart, Inc., declared bankruptcy. Let’s see why. A Mart reported these figures: Requirement 1. Evaluate the trend of A Mart’s results of operations during 2014 through 2016. Consider the trends of sa

> Suppose Uptown Fashions, a specialty retailer, had these records for evening gowns during 2016: Assume that Uptown sold 131 gowns during 2016 and uses the LIFO method to account for inventory. The income tax rate is 35%. Requirements 1. Compute Upt

> For each of the following situations, identify the inventory method that you would use; or, given the use of a particular method, state the strategy that you would follow to accomplish your goal. a. Inventory costs are decreasing, and your company’s boar

> Which option is better: receive $120,000 now or $25,000, $45,000, $35,000, $15,000, and $50,000, respectively, over the next five years? Requirements 1. Assuming an 8% interest rate, which investment opportunity would you choose? 2. If you could earn

> Big-Box Retail Corporation reported stockholders’ equity on its balance sheet at December 31: Requirements 1. Identify the two components that typically make up accumulated other comprehensive income. 2. For each component of accumu

> Suppose PlaySpace owns the following investments at December 31, 2016: a. 100% of the common stock of PlaySpace United Kingdom, which holds assets of £700,000 and owes a total of £400,000. At December 31, 2016, the current exchange rate of the pound (£)

> Frontland Advertising creates, plans, and handles advertising campaigns in a three-state area. Recently, Frontland had to replace an inexperienced office worker in charge of bookkeeping because of some serious mistakes that had been uncovered

> This question concerns the items and the amounts that two entities, Henderson Co. and Goodland Hospital, should report in their financial statements. During November, Goodland provided Henderson with medical exams for Henderson employees and sent a bill f

> The trial balance of 4AC, Inc., at October 31, 2016, does not balance. Requirements 1. Prepare a trial balance for the ledger accounts of 4AC, Inc., as of October 31, 2016. 2. Determine the out-of-balance amount. The error lies in the Accounts Receiv

> The manager of Sadie Industries Furniture needs to compute the following amounts: a. Total cash paid during December. b. Cash collections from credit customers during December. Analyze Accounts Receivable. c. Cash paid on a note payable during Decembe

> The balance sheet of Libra, Inc., a world leader in the design and sale of telescopic equipment, reported the following information on its balance sheets for 2016 and 2015 (figures are in thousands): In 2016, Libra recorded $13,200 (gros

> Suppose Carat, Inc., reported net receivables of $2,584 million and $2,265 million at January 31, 2017, and 2016, respectively, after subtracting allowances of $68 million and $65 million at these respective dates. Carat earned total revenue of $46,667 m

> Ripley Shirt Company sells on credit and manages its own receivables. Average experience for the past three years has been the following: Jack Rivers, the owner, is considering whether to accept bankcards (VISA, MasterCard). Rivers expects total sales

> The president of The Parkview Company has recently become concerned that the bookkeeper has embezzled cash from the company. She asks you, confidentially, to look over the bank reconciliation that the bookkeeper has prepared to see if you

> Megan Williams, the chief financial officer, is responsible for Dollar Depot’s cash budget for 2017. The budget will help Williams determine if long-term borrowing is needed to end the year with a cash balance of $175,000

> Julie Brown, the owner of Julie’s Party Sandwiches, has delegated management of the business to Stacie Wood, a friend. Brown drops by to meet customers and check up on cash receipts, but Wood buys the merchandise and handles cash payments. Business has b

> During 2016, Vanguard, Inc., changed to the LIFO method of accounting for inventory. Suppose that during 2015, Vanguard changes back to the FIFO method and the following year Vanguard switches back to LIFO again. Requirements 1. What would you think o

> Rockville Loan Company is in the consumer loan business. Rockville borrows from banks and loans out the money at higher interest rates. Rockville’s bank requires Rockville to submit quarterly financial statements to keep its line of credit. Rockville’s ma

> Community Bank has a loan receivable from IMS Chocolates. IMS is six months late in making payments to the bank, and Jan French, a Community Bank vice president, is assisting IMS to restructure its debt. French learns that IMS is depending on landing a

> Barry Galvin is executive vice president of Community Bank. Active in community affairs, Galvin serves on the board of directors of The Salvation Army. The Salvation Army is expanding rapidly and is considering relocating. At a recent meeting, The Salvat

> Sunrise Bank recently appointed the accounting firm of Smith, Godfroy, and Hannaford as the bank’s auditor. Sunrise quickly became one of Smith, Godfroy, and Hannaford’s largest clients. Subject to banking regulations, Sunrise must provide for any expecte