Question: The adjusted trial balances of Victory Corporation

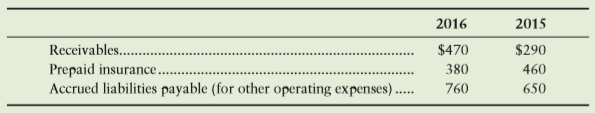

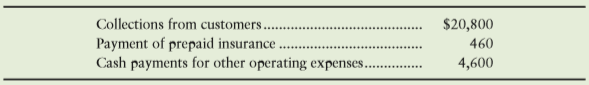

The adjusted trial balances of Victory Corporation at August 31, 2016, and August 31, 2015, include these amounts (in millions):

Victory Corporation completed these transactions (in millions) during the year ended August 31, 2016.

Compute the amount of sales revenue, insurance expense, and other operating expenses to report on the income statement for the year ended August 31, 2016.

Transcribed Image Text:

2016 2015 Receivables.. $470 $290 Prepaid insurance. Accrued liabilities payable (for other operating expenses). 380 460 760 650 ..... Collections from customers. Payment of prepaid insurance. Cash payments for other operating expenses.. $20,800 460 4,600

> Assume Olson Foods, Inc., experienced the following revenue and accounts receivable write-offs: Suppose Olson estimates that 4% of (gross) revenues will become uncollectible. Assume all revenues are on credit. Requirement 1. Journalize service rev

> At December 31, 2016, before any year-end adjustments, the Accounts Receivable balance of Foley Distribution Service is $320,000. The Allowance for Doubtful Accounts has a $22,200 credit balance. Foley Distribution Service prepares the following aging sc

> On June 30, Maloney Party Planners had a $43,000 balance in Accounts Receivable and a $2,493 credit balance in Allowance for Uncollectible Accounts. During July, Maloney made credit sales of $200,000. July collections on account were $169,000, and write-

> At December 31, 2016, Canning Travel Agency has an Accounts Receivable balance of $89,000. Allowance for Doubtful Accounts has a credit balance of $840 before the year-end adjustment. Service revenue (all on account) for 2016 was $600,000. Canning estima

> Perform the following accounting for the receivables of Laksmana and Li, a CPA firm, at December 31, 2016. Requirements 1. Set up T-accounts and start with the beginning balances for these T-accounts: ■ Accounts Receivable, $303,000 ■ Allowance for U

> Wolford Interiors reported the following transactions in November: Requirements 1. Record the foregoing transactions in the journal of Wolford Interiors. (You do not need to make the cost of sales, estimated refunds, or cost of estimated returns journ

> Northern Corporation, the investment banking company, often has extra cash to invest. Suppose Northern buys 1,000 shares of Twister, Inc., stock at $46 per share. Assume Northern expects to hold the Twister stock for one month and then sell it. The purch

> Stark Co., Inc., an electronics and appliance chain, reported these figures in millions of dollars: Requirements 1. Compute Stark’s days’ sales in receivables or days’ sales outstand

> Marshall, Inc., reported the following items at December 31, 2016, and 2015: Requirements 1. Compute Marshall’s a. quick (acid-test) ratio and b. days’ sales outstanding for 2016. Evaluate each ratio value as stro

> Record the following note receivable transactions in the journal of Celtic Services. How much interest revenue did Celtic earn this year? Use a 365-day year for interest computations, and round interest amounts to the nearest dollar. Celtic Services has

> Assume Birch Foods, Inc., experienced the following revenue and accounts receivable write-offs: Suppose Birch estimates that 4% of (gross) revenues will become uncollectible. Assume all revenues are on credit. Requirement 1. Journalize service revenu

> At December 31, 2016, before any year-end adjustments, the Accounts Receivable balance of Turf Trimmers, Inc., is $350,000. The Allowance for Doubtful Accounts has an $18,700 credit balance. Turf Trimmers prepares the following aging schedule for Account

> On June 30, Paisley Party Planners had a $35,000 balance in Accounts Receivable and a $3,252 credit balance in Allowance for Uncollectible Accounts. During July, Paisley made credit sales of $198,000. July collections on account were $169,000, and write-

> At December 31, 2016, Fako Travel Agency has an Accounts Receivable balance of $96,000. Allowance for Doubtful Accounts has a credit balance of $830 before the year-end adjustment. Service revenue (all on account) for 2016 was $550,000. Fako estimates th

> Perform the following accounting for the receivables of Bronson and Moore, a law firm, at December 31, 2016. Requirements 1. Set up T-accounts and start with the beginning balances for these T-accounts: ■ Accounts Receivable, $97,000 ■ Allowance for

> Chic Interiors reported the following transactions in November: Requirements 1. Record the foregoing transactions in the journal of Chic Interiors. (You do not need to make the cost of sales, estimated refunds, or cost of estimated returns journal ent

> Riverton Corporation, the investment banking company, often has extra cash to invest. Suppose Riverton buys 1,000 shares of Switzer, Inc., stock at $48 per share. Assume Riverton expects to hold the Switzer stock for one month and then sell it. The purch

> Ayers Communications, Inc., is preparing its cash budget for the year ending December 31, 2017. Ayers ended 2016 with cash of $62 million and managers need to keep a cash balance of at least $71 million for operations. Collections from customers are expe

> Greentown Company manufactures a popular brand of footballs. Greentown employs 142 workers and keeps its employment records on time sheets that show how many hours the employee works each week. On Friday the shop foreman collects the time sheets, checks

> Rally Stores use point-of-sale terminals as cash registers. The register shows the amount of each sale, the cash received from the customer, and any change returned to the customer. The machine also produces a customer receipt but keeps no record of tran

> Use the data from Exercise 4-29B to make the journal entries that Neal should record on October 31 to update his Cash account. Include an explanation for each entry. From Exercise 4-29B Rick Neal operates a roller skating center, Neal’s Rinks. He has j

> Rick Neal operates a roller skating center, Neal’s Rinks. He has just received the monthly bank statement at October 31 from Sandstone National Bank, and the statement shows an ending balance of $750. Listed on the statement are an EFT rent collection of

> F.L. Hill’s checkbook lists the following: The October bank statement shows: Requirement 1. Prepare Hill’s bank reconciliation at July 31, 2016. Date Check No. Item Check Deposit Balance 7/1 $ 525 4 622 Sun Ca

> Sue Valentine served as executive director of Downtown Wooster, an organization created to revitalize Wooster, Ohio. Over the course of 14 years, Valentine embezzled $236,000. How did Valentine do it? She did it by depositing subscriber cash receipts in

> The following situations describe two cash payment situations and two cash receipt situations. In each pair, one set of internal controls is better than the other. Evaluate the internal controls in each situation as strong or weak, and give the reason fo

> Identify the internal control weakness in the following situations. State how the person can hurt the company. a. Mandy Morrison works as a security guard at POST parking in Oklahoma City. Morrison has a master key to the cash box where customers pay for

> Byer Communications, Inc., is preparing its cash budget for the year ending December 31, 2017. Byer ended 2016 with cash of $65 million and managers need to keep a cash balance of at least $68 million for operations. Collections from customers are expec

> Linus Manufacturing Company manufactures a popular line of work clothes. Linus Manufacturing employs 125 workers and keeps their employment records on time sheets that show how many hours the employee works each week. On Friday the shop foreman collects

> Orchard Stores use point-of-sale terminals as cash registers. The register shows the amount of each sale, the cash received from the customer, and any change returned to the customer. The machine also produces a customer receipt but keeps no record of tr

> Use the data from Exercise 4-20A to make the journal entries that White should record on March 31 to update his Cash account. Include an explanation for each entry. From Exercise 4-20A Dean White operates a roller skating center, Rinkland USA. He has j

> Dean White operates a roller skating center, Rinkland USA. He has just received the monthly bank statement at March 31 from Peoples National Bank, and the statement shows an ending balance of $740. Listed on the statement are an EFT rent collection of $3

> F. L. Hardy’s checkbook lists the following: The October bank statement shows: Requirement 1. Prepare Hardy’s bank reconciliation at October 31, 2017. Date Check No. Item Check Deposit Balance 10/1 $ 515 $ 25

> Rhonda Dunbar served as executive director of Downtown Forest Lake, an organization created to revitalize Forest Lake, Minnesota. Over the course of 11 years, Dunbar embezzled $444,000. How did Dunbar do it? By depositing subscriber cash receipts in her

> The following situations describe two cash payment situations and two cash receipt situations. In each pair, one set of internal controls is better than the other. Evaluate the internal controls in each situation as strong or weak, and give the reason fo

> Halston Consulting Company reported these ratios at December 31, 2016 (dollar amounts in millions): Halston Consulting completed these transactions during 2017: a. Purchased equipment on account, $8 b. Paid long-term debt, $10 c. Collected cash from

> Refer to Exercise 3-38B. Requirements 1. Use the data in the partial worksheet to prepare Emerson Production Company’s classified balance sheet at December 31 of the current year. Use the report format. First you must compute the adjusted balance for s

> The unadjusted trial balance and income statement amounts from the December 31 adjusted trial balance of Emerson Production Company follow: / Requirement 1. Journalize the adjusting and closing entries of Emerson Production Company at December 31. Th

> Prepare the closing entries from the following selected accounts from the records of Hector, Inc., at December 31, 2016: How much net income did Hector earn during 2016? Prepare a T-account for Retained Earnings to show the December 31, 2016, balance o

> The adjusted trial balances of Bova Corporation at August 31, 2016, and August 31, 2015, include these amounts (in millions): Bova completed these transactions (in millions) during the year ended August 31, 2016. Compute the amount of sales revenue,

> The adjusted trial balance of Marshall, Inc., follows: Requirement 1. Prepare Marshall, Inc.’s, single-step income statement and statement of retained earnings for the year ended December 31, 2016, and its balance sheet on that date.

> McCool Floral Co. prepaid three years’ rent ($36,000) on January 1, 2016. At December 31, 2016, McCool prepared a trial balance and then made the necessary adjusting entry at the end of the year. McCool adjusts its accounts once each year—on December 31.

> Rockwell Company faced the following situations. Journalize the adjusting entry needed at December 31, 2016, for each situation. Consider each fact separately. a. The business has interest expense of $3,300 that it must pay early in January 2017. b. In

> Henry Corporation experienced four situations for its supplies. Compute the amounts that have been left blank for each situation. For situations 1 and 2, journalize the needed transaction. Consider each situation separately. Situation 3 4 $ 600 $ 60

> An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $600. Payments for insurance during the period, $2,000. Prepaid insurance, ending, $1,200. b. Interest revenue accrued, $2,1

> During 2016, Gibson Network, Inc., which designs network servers, earned revenues of $720 million. Expenses totaled $520 million. Gibson collected all but $20 million of the revenues and paid $570 million on its expenses. Gibson’s top managers are evalu

> Landry Company reported these ratios at December 31, 2016 (dollar amounts in millions): Landry Company completed these transactions during 2017: a. Purchased equipment on account, $7 b. Paid long-term debt, $10 c. Collected cash from customers in ad

> Refer to Exercise 3-27A. Requirements 1. Use the data in the partial worksheet to prepare Winwood Production Company’s classified balance sheet at December 31 of the current year. Use the report format. First you must compute the adjusted balance for s

> The unadjusted trial balance and income statement amounts from the December 31 adjusted trial balance of Winwood Production Company follow. Requirement 1. Journalize the adjusting and closing entries of Winwood Production Company at December 31. There

> Prepare the closing entries from the following selected accounts from the records of Wolf Enterprises at December 31, 2016: How much net income did Wolf Enterprises earn during 2016? Prepare a T-account for Retained Earnings to show the December 31, 20

> The adjusted trial balance of Honeybell, Inc., follows. Requirement 1. Prepare Honeybell, Inc.’s single-step income statement and statement of retained earnings for the year ended December 31, 2016, and its balance sheet on that date

> Childtime Toys prepaid three years’ rent ($54,000) on January 1, 2016. At December 31, 2016, Childtime prepared a trial balance and then made the necessary adjusting entry at the end of the year. Childtime adjusts its accounts once each year—on December

> Dellroy Rentals Company faced the following situations. Journalize the adjusting entry needed at December 31, 2016, for each situation. Consider each fact separately. a. The business has interest expense of $3,200 that it must pay early in January 2017.

> Rankle Corporation experienced four situations for its supplies. Compute the amounts that have been left blank for each situation. For situations 1 and 2, journalize the needed transaction. Consider each situation separately. Situation 1 2 3 4 $ 600

> An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $300. Payments for insurance during the period, $2,900. Prepaid insurance, ending, $600. b. Interest revenue accrued, $2,400

> During 2016, Nicholson Network, Inc., which designs network servers, earned revenues of $800 million. Expenses totaled $570 million. Nicholson collected all but $21 million of the revenues and paid $600 million on its expenses. Nicholson’s top managers a

> Assume that Wolf Products Company reported the following summarized data at May 31, 2016. Accounts appear in no particular order; dollar amounts are in millions. Requirements 1. Solve for Cash. 2. Prepare the trial balance of Wolf Products at May 31,

> Refer to Exercise 2-36B. Requirements 1. After recording the transactions in Exercise E2-36B, and assuming they all occurred in the month of December 2016, prepare the trial balance of Eric Newton, Attorney, at December 31, 2016. Use the T-accounts th

> Set up the following T-accounts: Cash, Accounts Receivable, Office Supplies, Office Furniture, Accounts Payable, Common Stock, Dividends, Service Revenue, Salary Expense, and Rent Expense. Record the following transactions directly in the T-accounts with

> The trial balance of Carver, Inc., at September 30, 2016, does not balance. The accounting records hold the following errors: a. Recorded a $200 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. b. Posted a $2,00

> The accounts of Deluxe Deck Service, Inc., follow with their normal balances at April 30, 2016. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at April 30, 2016, listing accounts i

> The first seven transactions of Big Horn Advertising, Inc., have been posted to the company’s accounts: Requirement 1. Prepare the journal entries that served as the sources for the seven transactions. Include an expla

> Refer to Exercises 2-30B and 2-31B. Requirements 1. Post the entries to the ledger, using T-accounts. Key transactions by date. 2. Prepare the trial balance of Dr. Sue Smith, P.C., at May 31, 2016. 3. From the trial balance, determine total assets,

> Refer to Exercise 2-30B. Requirement 1. Record the transactions in the journal of Dr. Sue Smith, P.C. List the transactions by date and give an explanation for each transaction.

> Sue Smith opened a medical practice specializing in surgery. During the first month of operation (May), the business, titled Dr. Sue Smith, Professional Corporation (P.C.), experienced the following events: Requirements 1. Analyze the e

> The following selected events were experienced by either Bishop Industries, Inc., a corporation, or Kate Bishop, the major stockholder. State whether each event 1. increased, 2. decreased, or 3. had no effect on the total assets of the business. Ident

> Assume Summertime Fashions opened a store in Orlando, starting with cash and common stock of $108,000. Gary Breen, the store manager, then signed a note payable to purchase land for $79,000 and a building for $200,000. Breen also paid $42,000 for equipme

> Assume that New Towne Company reported the following summarized data at September 30, 2016. Accounts appear in no particular order; dollar amounts are in millions. Requirements 1. Solve for Cash. 2. Prepare the trial balance of New Towne at September

> Refer to Exercise 2-25A. 1. After recording the transactions in Exercise 2-25A, and assuming they all occurred in the month of January 2016, prepare the trial balance of Leigh Hampton, Attorney, at January 31, 2016. Use the T-accounts that have been pre

> Set up the following T-accounts: Cash, Accounts Receivable, Office Supplies, Office Furniture, Accounts Payable, Common Stock, Dividends, Service Revenue, Salary Expense, and Rent Expense. Record the following transactions directly in the T-accounts with

> The trial balance of Harper, Inc., at September 30, 2016, does not balance: The accounting records hold the following errors: a. Recorded a $500 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. b. Posted a $3,000

> The accounts of Custom Patio Service, Inc., follow with their normal balances at April 30, 2016. The accounts are listed in no particular order. Requirements 1. Prepare the company’s trial balance at April 30, 2016, listing accounts

> The first seven transactions of Fournier Advertising, Inc., have been posted to the company’s accounts: Requirement 1. Prepare the journal entries that served as the sources for the seven transactions. Include an expla

> Refer to Exercises 2-19A and 2-20A. Requirements 1. After journalizing the transactions of Exercise 2-19A, post the entries to the ledger, using T-accounts. Key transactions by date. 2. Prepare the trial balance of Dr. Kristine Cohen, P.C., at July 3

> Refer to Exercise 2-19A. Requirement 1. Record the transactions in the journal of Dr. Kristine Cohen, P.C. List the transactions by date and give an explanation for each transaction. From Exercise 2-19A. Dr. Kristine Cohen opened a medical practice

> Dr. Kristine Cohen opened a medical practice specializing in physical therapy. During the first month of operation (July), the business, titled Dr. Kristine Cohen, Professional Corporation (P.C.), experienced the following events: Requir

> During 2016, Young Company earned revenues of $150 million. Young incurred, during that same year, salary expense of $30 million, rent expense of $14 million, and utilities expense of $29 million. Young declared and paid dividends of $10 million during t

> This exercise should be used in conjunction with Exercises 1-38B through 1-40B. The owner of Earl Coffee Roasters Corporation now seeks your advice as to whether she should cease operations or continue the business. Complete the report giving her your op

> Refer to the data in Exercises 1-38B and 1-39B. Requirement 1. Prepare the statement of cash flows of Earl Coffee Roasters Corporation for the month ended August 31, 2016. Using Exhibit 1-11 as a model, show with arrows the relationships among the inc

> Refer to the data in Exercise 1-38B. Requirement 1. Prepare the balance sheet of Earl Coffee Roasters Corporation at August 31, 2016. From Exercise 1-38B Assume Earl Coffee Roasters Corporation ended the month of August 2016 with these data: Pa

> Assume Earl Coffee Roasters Corporation ended the month of August 2016 with these data: Requirement 1. Prepare the income statement and the statement of retained earnings of Earl Coffee Roasters Corporation for the month ended August 31, 2016. Pay

> This exercise should be used with Exercise 1-36B. Requirements 1. Prepare the income statement of David Austin Realty Company for the year ended January 31, 2016. 2. What amount of dividends did David Austin Realty Company declare during the year end

> Amounts of the assets and liabilities of David Austin Realty Company, as of January 31, 2016, are as follows. Also included are revenue, expense, and selected stockholders’ equity figures for the year ended on that date (

> At December 31, 2016, Robinson Products has cash of $18,000, receivables of $20,000, and inventory of $82,000. The company’s equipment totals $183,000. Robinson owes accounts payable of $29,000 and long-term notes payable of $171,000. Common stock is $29

> Assume Flurrish, Inc., is expanding into India. The company must decide where to locate and how to finance the expansion. Identify the financial statement where these decision makers can find the following information about Flurrish, Inc. In some cases, mor

> Cranberry, Inc.’s, comparative balance sheet at January 31, 2017, and 2016, reports the following (in millions): Requirements Three situations about Cranberry’s issuance of stock and declaration and payment of divid

> Blackwell Services, Inc., has current assets of $240 million; property, plant, and equipment of $350 million; and other assets totaling $170 million. Current liabilities are $150 million, and long-term liabilities total $360 million. Requirements 1. U

> Compute the missing amount in the accounting equation for each company (amounts in billions): Which company appears to have the strongest financial position? Explain your reasoning. Assets Liabilities Stockholders' Equity Corner Groc

> During 2016, McFall Company earned revenues of $140 million. McFall incurred, during that same year, salary expense of $31 million, rent expense of $16 million, and utilities expense of $22 million. McFall declared and paid dividends of $12 million durin

> This exercise should be used in conjunction with Exercises 1-26A through 1-28A. The owner of Carson Coffee Roasters Corp. seeks your advice as to whether he should cease operations or continue the business. Complete the report, giving him your opinion of

> Refer to the data in Exercises 1-26A and 1-27A. Requirement 1. Prepare the statement of cash flows of Carson Coffee Roasters Corp., for the month ended August 31, 2017. Using Exhibit 1-11 as a model, show with arrows the relationships among the income

> Refer to the data in Exercise 1-26A. Requirement 1. Prepare the balance sheet of Carson Coffee Roasters Corp., for August 31, 2017. From Exercise 1-26A: Assume the Carson Coffee Roasters Corp. ended the month of August 2017 with these data: Pa

> Assume the Carson Coffee Roasters Corp. ended the month of August 2017 with these data: Requirement 1. Prepare the income statement and the statement of retained earnings of Carson Coffee Roasters Corp., for the month ended August 31, 2017. Paymen

> This exercise should be used with Exercise 1-24A. Refer to the data of Ellen Samuel Realty Company in Exercise 1-24A. Requirements 1. Prepare the income statement of Ellen Samuel Realty Company for the year ended May 31, 2016. 2. What amount of divid

> Amounts of the assets and liabilities of Ellen Samuel Realty Company, as of May 31, 2016, are given as follows. Also included are revenue, expense, and selected stockholders’ equity figures for the year ended on that date

> At December 31, 2016, Womack Products has cash of $23,000, receivables of $15,000, and inventory of $77,000. The company’s equipment totals $184,000. Womack owes accounts payable of $24,000 and long-term notes payable of $165,000. Common stock is $32,500

> Assume Malcolm Tech, Inc., is expanding into China. The company must decide where to locate and how to finance the expansion. Identify the financial statement where these decision makers can find the following information about Malcolm Tech, Inc. In some ca

> Franklin Company’s comparative balance sheet at January 31, 2017, and 2016, reports the following (in millions): Requirements Three situations about Franklin Company’s issuance of stock and declaration and payment o

> Hooper, Inc., has current assets of $200 million; property, plant, and equipment of $350 million; and other assets totaling $160 million. Current liabilities are $170 million and long-term liabilities total $320 million. Requirements 1. Use these data

> Compute the missing amount in the accounting equation for each company (amounts in billions): Which company appears to have the strongest financial position? Explain your reasoning. Assets Liabilities Stockholders' Equity Presto Dryc

> The following selected events were experienced by either Knox Eldercare Services, Inc., a corporation, or Steve Knox, the major stockholder. State whether each event 1. increased, 2. decreased, or 3. had no effect on the total assets of the business.