Question: Assume that in addition to the information

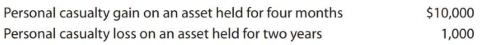

Assume that in addition to the information in Problem 49, Nell had the following items in 2018:

The casualty gains and losses are net of the $100-per-event floor. Determine Nell's AGI for 2018.

Data from Problem 49:

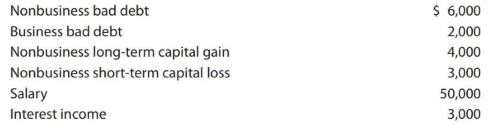

Nell, single and age 38, had the following income and expense items in 2018:

Determine Nell's AGI for 2018.

Transcribed Image Text:

Personal casualty gain on an asset held for four months Personal casualty loss on an asset held for two years $10,000 1,000 Nonbusiness bad debt $ 6,000 Business bad debt 2,000 Nonbusiness long-term capital gain Nonbusiness short-term capital loss Salary 4,000 3,000 50,000 Interest income 3,000

> Burt, the CFO of Amber, Inc., was granted incentive stock options in 2013. Burt exercised the stock options in February 2017 when the exercise price was $75,00o and the fair market value of the stock was $90,000. He sold the stock in September 2018 for $

> In 2018, Geoff incurred $900,000 of mine and exploration expenditures. He elects to deduct the expenditures as quickly as the tax law allows for regular income tax purposes. a. How will Geoff's treatment of mine and exploration expenditures affect his re

> Archie runs a small mineral exploration business (as a sole proprietorship) In 2016, he purchased land (for $68,000) where he suspected a magnesium deposit was located. He incurred $18,000 of exploration cost related to the development of the magnesium m

> Angela, who is single, incurs circulation expenditures of $270,000 during 2018. She is deciding whether to deduct the entire $270,000 or to capitalize the expenses and deduct them over a three-year period. Angela is in the 37% bracket for regular income

> Lisa records nonrefundable Federal income tax credits of $65,000 for the year. Her regular income tax liability before credits is $190,000, and her TMT is $150,000 a. What is Lisa's AMT? b. What is Lisa's regular income tax liability after credits?

> Calculate the exemption amount for the following cases in 2018 for a married taxpayer filing jointly and for a married taxpayer filing separately In addition, use Microsoft Excel to express your solutions for the taxpayer who is married filing jointly. P

> Arthur Wesson, an unmarried individual who is age 68, reports taxable income of $510,000 in 2018. He records positive AMT adjustments of $80,000 and preferences of $35,000. Arthur itemizes his deductions, and his regular tax liability in 2018 is $109,390

> Five years ago Gerald invested $150,000 in a passive activity, his sole investment venture. On January 1, 2017, his amount at risk in the activity was $30,000. His shares of the income and losses were as follows: Gerald holds no suspended at-risk or pa

> Yanni, who is single, provides you with the following information 2018. a. What is Yanni's 2018 taxable income? b. What is Yanni's 2018 AMT1? c. What is Yanni's 2018 TMT? Salary $250,000 State income taxes 25,000 Mortgage interest expense ($480,000

> Seojun acquired an activity several years ago, and in the current year, it generates a loss of $ 50,000. Seojun has AGI of $140,000 before considering the 10ss from the activity. If the activity is a bakery and Seojun is not a materia1 participant, what

> Dorothy acquired a 100% interest in two passive activities: Activity A in January 2013 and Activity B in 2014. Through 2016, Activity A was profitab1e, but it produced 10sses of $200,000 in 2017 and $100,000 in 2018. Dorothy has passive activity income f

> For calendar year 2018, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows: Calculate the amount of itemized deductions the Gibsons may claim for the year $48,600 Casualty loss in a Fed

> Evan is single and has AGI of $277,300 in 2018. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: After all necessary adjustments are made, what is the amount of itemized deductions Evan m

> Bart and Elizabeth Forrest are married and have no dependents They have asked you to advise them whether they should file jointly or separately in 2018. They present you with the following information: If they file separately Bart and Elizabeth will sp

> On December 27, 2018, Roberta purchased four tickets to a charity ball sponsored by the city of San Diego for the benefit of underprivileged children Each ticket cost $200 and had a fair market value of $35. On the same day as the purchase, Roberta gave

> Liz have AGI of $130,000 in 2018. She donated Bluebird Corporation stock with a basis of $10,000 to a qualified charitable organization on July 5, 2018 a. What is the amount of Liz's deduction assuming that she purchased the stock on December 3, 2017, an

> This year, Nadia donates $4,000 to Eastern University’s athletic department. The payment guarantee’s that Nadia will have preferred seating at football games near the 50-yard line. Assume that Nadia subsequently buys four $100 game tickets. How much can

> Malcolm owns 60% and Buddy owns 40% of Magpie Corporation. On July 1, 2018, each lends the corporation $30,000 at an annual interest rate of 5% Malcolm and Buddy are not related. Both shareholders use the cash method of accounting, and Magpie Corporation

> Norma, who is single and uses the cash method of accounting, lives in a state that imposes an income tax. In April 2018, she files her state income tax return for 2017 and pays an additional $1,000 in state income taxes. During 2018, her withholdings for

> Zhou owns a non rental business with two separate departments. Department A generates net income of $70,000, and Department B generates a net loss of $58,000. Zhou participates 800 hours in the operations of Department A and 300 hours in the operations o

> During 2018, Susan incurred and paid the following expenses for Beth (her daughter), Ed (her father), and herself: Beth qualifies as Susan's dependent, and Ed would also qualify except that he receives $7,400 of taxable retirement benefits from his for

> Complete the following table by classifying each of the independent expenditures (assume that no reimbursement takes place and that employee business expenses are not deductible) Deductible Deductible Not Expense Item for AGI from AGI Deductible a.

> Ava recently graduated from college and is interviewing for a position in marketing. Gull Corporation has offered her a job as a sales Decision Making representative that will require extensive travel and entertainment but provide valuable experience. Un

> Ben and Molly are married and will file jointly. Ben earns $300,000 from his single-member LLC (a law firm). He reports his business as a sole proprietorship Wages paid by the law firm amount to $40,000; the law firm has no significant property. Molly is

> Stella Watters is a CPA who operates her own accounting firm (Watters CPA LLC). As a single-member LLC, Stella reports her accounting firm operations as a sole proprietor. Stella has QBI from her accounting firm of $540,000, she reports W- 2 wages of $15

> Scott and Laura are married and will file a joint tax return. Scott has a sole proprietorship (not a specified services" business) that reports net income of $300,000. The proprietorship pays W-2 wages of $40,000 and holds property with an unadjusted bas

> Donald owns a wide variety of commercial rental properties held in a single-member LLC. Donald's LLC reports rental income of $1,500,000. The LLC pays no W- 2 wages; rather, it pays a management fee to an S corporation that Donald controls. The managemen

> Peter Samuels owns and manages his single-member LLC that provides a wide variety of financial services to his clients. He is married and will file a joint tax return with his spouse, Amy. His LLC reports $300,000 of net income, W- 2 wages of $120,000, a

> Shelly has $200,000 of QBI from her local jewelry store (a sole proprietorship). Shelly's proprietorship paid $30,000 in W- 2 wages and has $20,000 of qualified property. Shelly's spouse earned $74,000 of wages as an employee, they earned $20,000 of inte

> Christine is a full-time teacher of the fourth grade at Vireo Academy. During the current year, she spends $1,400 for classroom supplies. On the submission of adequate substantiation, Vireo reimburses her for $ 500 of these expenses the maximum reimburse

> In 2018, Ava, an employee, has AGI of $58000 and the following itemized deductions: What is Ava's total itemized deduction related to these items? Home office expenses $1,200 Union dues and work uniforms 350 Unreimbursed employee expenses Gambling

> Which of the following is a deduction for AGI? a. Charitable contributions b. Alimony paid c. Tax preparation fees d. Mortgage interest paid on your primary residence

> Melanie is employed full-time as an accountant for a national hardware chain. She recently started a private consulting practice, which provides tax advice, and financial planning to the general public. For this purpose, she maintains an office in her ho

> Stork Associates paid $60,000 for a 20-seat skybox at Veterans Stadium for eight professional football games. Regu1ar seats to these games range from $80 to $250 each. At one game, an employee of Stork entertained 18 clients. Stork furnished food and bev

> Monica travels from her office in Boston to Lisbon, Portugal, on business. Her Decision Making absence of 13 days was spent as follows: a. For tax purposes, how many days has Monica spent on business? b. What difference does it make? c. Could Monica h

> Kim works for a clothing manufacturer as a dress designer. During 2018, she travels to New York City to attend five days of fashion shows and then spends three days sightseeing. Her expenses are as follows: [Assume that lodging/meals are the same amoun

> Martha was considering starting a new business. During her preliminary investigation, related to the new venture, she incurred the following expenditures. Martha begins the business on July 1 of the current year. If Martha elects 195 treatment, determi

> Oleander Corporation, a calendar year entity, begins business on March 1, 2018. The corporation incurs startup expenditures of $64,000. If Oleander elects 195 treatment, determine the total amount of startup expenditures that it may deduct for 2018.

> Dennis Harding is considering acquiring a new automobile that he will use 100% for business. The purchase price of the automobile would be $48,500. If Dennis leased the car for five years, the lease payment would be $375 per month. Dennis will acquire th

> Sally purchased a new computer (5-year property) on June 1, 2018, for $4,000. Sally could use the computer 100% of the time in her business, or she could allow her family to use the computer as well. Sally estimates that if her family uses the computer,

> On March 15, 2018, Helen purchased and placed in service a new Escalade. The purchase price was $62,000, and the vehicle had a rating of 6,500 GVW. The vehicle was used 100% for business. a. Assuming that Helen does not use additional first-year deprecia

> On April 3, 2018, Terry purchased and placed in service a building that cost $2 million. An appraisal determined that 25% of the total cost was attributed to the value of the land. The bottom floor of the building is leased to a retail business for $32,0

> On Mark 25, 2018, Prascale Company purchases the rights to a mineral interest for 8 million. At that time, the remaining recoverable units in the mineral interest are estimated to be 500,000 tons. If 80,000 tons are mined and 75,000 tons are sold this ye

> On August 2, 2018, Wendy purchased a new office building for $3.8 million On October 1, 2018, she began to rent out office space in the building. On July 15, 2022, Wendy sold the office building. a. Determine Wendy's cost recovery deduction for 2018. b.

> Weston acquires a new office machine (7-year class asset) on August 2, 2017, for $75,000. This is the only asset Weston acquired during the year. He does not elect immediate expensing under 179. He claims the maximum additional first-year depreciation de

> Orange Corporation acquired new office furniture on August 15, 2018, for $130,000. Orange does not elect immediate expensing under 179. Orange claims any available additional first-year depreciation a. Determine Orange's cost recovery for 2018. b. How wo

> In 2015, Jose purchased a house for $325,000 ($300,000 relates to the house; $25,000 relates to the land). He used the house as his personal residence. In March 2018, when the fair market value of the house was $400,000, he converted the house to rental

> Jed, age 55, is married with no children. During 2018, Jed had the following income and expense items: a. Three years ago, Jed loaned a friend $10,000 to help him purchase a new car In June of the current year, Jed learned that his friend had been declar

> Assume that in addition to the information in Problems 49 and 50, Nell had the following items in 2018: The casualty loss is net of the $100-per-event floor. Determine Nell's taxable income and NOL for 2018. Data from Problem 49: Nell, single and age

> Nell, single and age 38, had the following income and expense items in 2018: Determine Nell's AGI for 2018. Nonbusiness bad debt $ 6,000 Business bad debt 2,000 Nonbusiness long-term capital gain Nonbusiness short-term capital loss Salary 4,000 3,0

> Soong, single and age 32, had the following items for the tax year 2018: • Salary of $ 30,000. • Interest income from U.S. government bonds of $2,000. • Dividends from a foreign corporation of $ 500 • Sale of small business 1244 stock on October 20, 2018

> Javiera and Magda are married and file a joint return. They had the following income and deductions for 2019: a. What is Javiera and Magda's taxable income for 2019? b What is Javiera and Magda's NOL for 2019? Salary Interest from savings account $

> On September 30, 2018, Priscilla purchased a business. Of the purchase price, $60,000 is allocated to a patent and $375,000 is allocated to goodwill. Calculate Priscilla's 2018 § 197 amortization deduction.

> During 2018, Rick and his wife, Sara had the following items of income and expense to report: a. Assuming that Rick and Sara file a joint return, what is their taxable income for 2018? b. What is the amount of Rick and Sara's NOL for 2018? c. To what y

> Xinran, who is married and files a joint return, ow ns a grocery store. In 2018 his gross sales were $276,000, and operating expenses were $320,000. Other items on his 2018 return were as follows: In 2019, Xinran provides the following information: a

> Sam, age 45, is single. For 2018, he has the following items: a. Determine Sam's taxab1e income for 2018. b. Determine Sam's NOL for 2018. Business income $70,000 Business expenses 75,000 Alimony paid (divorce occurred in 2014) 11,000 Interest inco

> Timothy Gates and Prada Singh decide to form a new company, TG PS LLC (a mu1timember LLC that will report its operations as a partnership). Timothy is married, and Prada is sing1e. Each contributes $400,000 of capital to begin the business, and both mate

> During 2018, Leisel, a single taxpayer, operates a sole proprietorship in which she matierally participates. Her proprietorship generates gross income of $142,000 and deductions of $420,000, resulting is a loss of $278,000. The large deductions are due t

> On July 24 of the current year Sam Smith was inv01ved in an accident with Communications his business use automobile. Sam had purchased the car for $30,000. The automobile had a fair market va1ue of $20,000 before the accident and $8,000 immediate1y afte

> Heather owns a two-story building. The building is used 40% for business use and 60% for persona1 use. During 2018, a fire caused major damage to the building and its contents. Heather purchased the building for $800,000 and has taken depreciation of $10

> Jocelyn and Esteban file a joint return. For the current year, they had the following items: Determine their AGI for the current year. Salaries $120,000 Loss on sale of 5 1244 stock acquired two years ago Gain on sale of § 1244 stock acquired six m

> Sally is in the business of purchasing accounts receivable. Last year Sally purchased an account receivab1e with a face value of $80,000 for $60,000. During the current year, Sally settled the account, receiving $65,000. Determine the maximum amount of t

> Several years ago John Johnson, who is in the 1ending business, loaned Sara Communications $30,000 to purchase an automobile to be used for personal purposes. In August of the current year, Sara filed for bankruptcy, and John was notified that he cou1d n

> Diana acquire, for $65,000, and places in service a 5-year class asset on December 19, 2018. It is the only asset that Diana acquires during 2018. Diana does not elect immediate expensing under 179. She elects additional first year deprecation. Calculate

> For each of the following independent transactions, calculate the recognize gain or loss to the seller and the adjusted basis to the buyer. a. Kiera sells Parchment, 1nc. stock (adjusted basis $17,000) to Phillip, her brother, for its fair market value o

> Chee, single, age 40, had the following income and expenses during 2018: Calculate Chee's taxable income for the year. If Chee has any options, choose the method that maximizes his deductions. Income Salary $43,000 Rental of vacation home (rented

> How would your answer to Problem 48 differ if Anna had rented house for 87 days and had used it personally for 13 days? Data from Problem 48: During the year (not a leap year) Anna rented her vacation home for 30 days, used it personally for 20 days, a

> During the year (not a leap year) Anna rented her vacation home for 30 days, used it personally for 20 days, and 1eft it vacant for 315 days. She had the following income and expenses: a. Compute Anna's net rent income or loss and the amounts she can i

> Piper owns a vacation cabin in the Tennessee mountains. Without considering the cabin, she has gross income of $65,000. During the year, she rents the cabin for two weeks for $2,500 and uses it herself for four weeks. The total expenses for the year are

> Jamari Peters (Social Security number 123-45-6789) conducts a business with the following results in 2018: Jamari estimates that due to a depressed real estate market, the value of land owned by the business declined by $5,200. a. Calculate the effect

> Terry traveled to a neighboring state to investigate the purchase of two hardware stores. His expenses included travel, legal, accounting, and miscellaneous expenses. The total was $52,000. He incurred the expenses in June and July 2018. Under the follow

> Amber, a publicly held corporation, currently pays its president an annual salary of $900,000. As a means of increasing company profitability, the board of directors increased the president's compensation effective January 1, 2017, with a performance-bas

> Fynn incurred and paid the following expenses during 2018: • $50 for a ticket for running a red light while he was commuting to work. • $100 for a ticket for parking in a handicapped parking space. • $200 to an attorney to represent him in traffic court

> Suzzane, a single taxpayer, operates a printing business as a sole proprietor. The business has two employees who are paid a total of $90,000 during 2018. Assume that the business has no significant assets. During 2018, the business generates $150,000 of

> Lopez acquired a building on June 1, 2013, for $1 million. Calculate Lopez's cost recovery deduction for 2018 if the building is: a. Classified as residential rental real estate. b. Classified as nonresidential real estate.

> A list of the items that Faith sold and the losses she incurred during the current tax year is as follows: She also had a theft loss of $1,500 on her uninsured business use car. Calculate Faith's deductible losses. Yellow, Inc. stock $ 1,600 Faith'

> Janice, age 22, is a student who earns $10,000 working part-time at the collage ice cream shop in 2018. She has no other income. Her medica1 expenses for the year total $3,000. During the year, she suffers a casua1ty 10ss of $3,500 when her apartment is

> Daniel, age 38, is single and has the following income and expenses in 2018 a. Calculate Daniel's AGI. b. Should Daniel itemize his deductions from AGI or take the standard deduction? Explain. Salary income $60,000 Net rent income 6,000 Dividend in

> Starting in 2007, Chuck and Luane have been purchasing series EE bonds in their names to use for the higher education for their daughter Susie, who currently is age 18. During the year, they cash in $12,000 of the bonds to use for freshman year tuition,

> Lynn Swart’z husband died three years ago. Her parents have income of $200,000 a year and what to ensure that funds will be available for the education of Lynn's 8-year-old son, Eric. Lynn is currently earning $45,000 a year. Lynn's parents have suggeste

> Tonya, who lives in California inherited a $100,000 state of California bond in 2018. Her marginal Federal tax rate is 35%, and her marginal state tax rate is 5%. The California bond pays 3.3% interest, which is not subject to California income tax. She

> In January 2018, Ezra purchased 2,000 shares of Gold Utility Mutual Fund for $20,000. In June, Ezra received an additional 100 shares as a dividend, in lieu of receiving $1,000 in cash dividends. In December, the company declared a two-for-one stock spli

> Tim is the vice president of western operations for Maroon Oil Company and is stationed in San Francisco. He is required to live in an emp1oyer-owned home, which is three b10cks from his company office. The company-provided home is equipped with high-spe

> Sally was an all-state soccer player during her junior and senior years in high school. She accepted an athletic scholarship from State University. The scholarship provided the following: a. Determine the effect of the scholarship on Sally's gross inco

> Ridge is a generous individual. During the year he made interest free loans to various family members when the Federal rate was 3%. What are the tax consequences of the following loans by Ridge: a. On June 30, 2017, Ridge loaned $12,000 to his cousin, Ji

> Euclid acquires a 7-year class asset on May 9, 2018 for $80,000. Euclid does not elect immediate expensing under 179. She does not claim any available additional first -year depreciation. Calculate Euclid's cost recovery deduction for 2018 and 2019.

> Nell and Kirby are in a process of negotiating their divorce agreement to be finalized in 2018. What should be the tax consequences to Nell and Kirby if the following, considered individually, became part of the agreement? a. In consideration for her one

> Linda and Don are married and filed a joint return. In 2018, they received $12,000 in Social Security benefits and $35,000 in taxable pension benefits and interest. a. Compute the couple's adjusted gross income on a joint return. b. Don would like to kno

> Liz and Doug were divorced on December 31, 2018, after 10 year of marriage. Their current year’s income received before the divorce was on follows: Allocate the income to Liz and Doug assuming that they live in: a. California. b. Texa

> In 2018, Alva received dividends on her stocks as follows: a. Alva purchased the Grape stock three years ago, and she purchased the Amur stock two years ago. She purchased the Blaze stock 18 days before it went ex dividend and sold it 20 days later at

> Freda is a cash basis taxpayer. In 2018, she negotiated her salary for 2019. Her employer offered to pay her $21,000 per month in 2019 for a total of $252,000. Freda countered that she would accept $10,000 each month for the 12 months in 2019 and the rem

> Trip Garage, Inc. (459 Ellis Avenue, Harrisburg, PA 17111), is an accrual basis taxpayer that repairs automobiles. In late December 2018, the company repaired Samuel Mos1ey's car and charged him $1,000. Samuel did not think the problem had been fixed and

> Vito is the sole shareholder of Vito 1nc. He is also employed by the corporation. On June 30, 2018, Vito borrowed $8,000 from Vito, Inc., and on July 1, 2019, he borrowed an additional $10,000. Both loans were due on demand. No interest was charged on th

> Each year, Tom and Cindy Bates norma11y have itemized deductions of $20,000, including a $4,000 p1edge payment to their church. Upon the advice of a friend, they do the following: in early January 2018, they pay their pledge for 2017; during 2018, they p

> During 2018, Chester (a married taxpayer filing a joint return) had the following transactions inv0lving capital assets: a. If Chester is in the 32% bracket, how much income tax results? b. If Chester is in the 12% bracket (and has taxab1e income of $

> During 2018, Inez (a single taxpayer) had the following transactions involving capital assets. a. If Inez is in the 32% bracket, how much income tax results? b. If Inez is in the 12% bracket (and has taxable income of $35,000), how much income tax res

> During the year, Tucker had the following personal causality gains and losses (after deducting the $100 floor): What are the tax consequences of these items to Tucker? Asset Holding Period Gain or (Loss) Asset 1 18 months ($1,200) Asset 2 2 months

> Al is a medical doctor who conducts his practice as a sole proprietor. During 2018, he received cash of $280,000 for medical services. Of the amount collected, $40,000 was for services provided in 2017. At the end of 2018, Al had accounts receivable of $

> In each of the following independent situations, determine Winston's filing status for 2018. Winston is not married. a. Winston lives alone, but he maintains a household in which his parents live. The mother qualifies as Winston's dependent, but the fath

> Nadia died in 2017 and is survived by her husband, Jerold (age 44); her married son, Travis (age 22); and her daughter-in-law, Macy (age 18). Jerold is the executor of his wife's estate. He maintains the household where he, Travis, and Macy live and furn