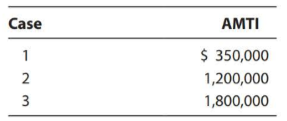

Question: Calculate the exemption amount for the following

Calculate the exemption amount for the following cases in 2018 for a married taxpayer filing jointly and for a married taxpayer filing separately In addition, use Microsoft Excel to express your solutions for the taxpayer who is married filing jointly. Place any parameter that could change annually in a separate cell, and incorporate the cell references into the formula.

Transcribed Image Text:

Case AMTI 1 $ 350,000 2 1,200,000 3 1,800,000

> For 2018, Ashley has gross income of $38,350 and a $5,000 long-term capital loss. She claims the standard deduction. Ashley is 35 years old and unmarried with two dependent children. How much of Ashley's $5,000 capital loss carries over to 2019?

> Phil and Susan Hammond are married taxpayers filing a joint return. The couple have two dependent children. Susan has wages of $34,000 in 2017 Phil does not work due to a disability, but he is a buyer and seller of stocks. He generally buys and ho1ds for

> Roger inherited 100 shares of Periwink1e stock when his mother, Emily, died Emily had acquired the stock for a total of $60,000 on November 15, 2014. She died on August 10, 2018, and the shares were worth a total of $55,000 at that time. Roger sold the s

> Consuela was a tenant in a campus apartment. She is a student at State University. Her lease began on August 1, 2018, and was due to expire on July 31, 2019. However, her landlord sold the building, and the new owner wanted to demolish it to build a reta

> Hilde purchased all of the rights to patent on a new garden tool developed by a friend of hers who was an amateur inventor. The inventor had obtained the patent rights, set up a manufacturing company to produce and sell the garden tool, and produced subs

> Benny purchased $400,000 of Peach Corporation face value bonds for $320,000 on November 13, 2017. The bonds had been issued with $80,000 of original issue discount because Peach was in financial difficulty in 2017. On December 3, 2018, Benny sold the bon

> Melaney has had a bad year with her investments. She 1ent a friend $8,000; the friend did not repay the loan when it was due and then declared bankruptcy. The 10an is totally uncollectible. Me1aney a1so was notified by her broker that the Oak corporate b

> Maria meets all of the requirements (subdivided realty). In 2018, she begins selling lots and sells four separate lots to four different purchasers. She also sells two contiguous lots to another purchaser. The sales price of each lot is $30,000. Maria's

> Determine the additional Medicare taxes for the individuals. a. Mario, who is single, earns wages of $440,000 in 2018. b. George and Shirley are married and file a joint return in 2018. During the year, George earns wages of $138,000, and Shirley earns w

> Cisco, a calendar year taxpayer who is age 63, owns a residence in which he has lived for 21 years. The residence is destroyed by fire on August 8, 2018. The adjusted basis is $190,000, and the fair market value is $320,000. Cisco receives insurance proc

> Karl purchased his residence on January 2, 2017, for $260,000, after having lived in it during 2016 as a tenant under a lease with an option to buy clause. On August 1, 2018, Karl sells the residence for $315,000. On June 13, 2018, Karl purchases a new r

> Wanda, a calendar year taxpayer, owned a building (adjusted basis of $250,000) in which she operated a bakery that was destroyed by fire in December 2018. She receives insurance proceeds of $290,000 for the building the following March. Wanda is consider

> Cabel’s warehouse, which has an adjusted basis of $380,000 and a fair market value of $490,000 is condemned by an agency of the Federal government to make way for a highway interchange. The initial condemnation offer is $425,000 After substantial negotia

> Stephanie’s owns a land (adjusted basis of $90,000; fair market value of $125,000) that she uses in her business. She exchanges it for another parce1 of 1 and (worth $100,000) and stock (worth $25,000). Determine Stephanie’s: a. Realized and recognized g

> In two unrelated transactions, Laura exchanges property that qualifies for like-kind exchange treatment. In the first exchange, Laura gives up land purchased in May 2016 (adjusted basis of $20,000; fair market value of $17,000) in exchange for a differen

> Kareem owns a pickup truck that he uses exclusively in his business. The adjusted basis is $22,000, and the fair market value is $14,000. In March 2018, Kareem exchanges the truck for another truck (worth $14,000) that he will use exclusively in his busi

> Hun age 93, has accumulated substantia1 assets during his life. Among his many assets are the following, which he is considering giving to Koji, his grandson Hun has been in ill hea1th for the past five years. His physician has informed him that he pro

> On December 28, 2018, Kramer sells 150 shares of Lavender, Inc. stock for $77,000. On January 10, 2019, he purchases 100 shares of the same stock for $82,000. a. Assuming that Kramer's adjusted basis for the stock sold is $65,000, what is his recognized

> Helene and Pauline are twin sisters who live in Louisiana and Mississippi, respectively. Helene is married to Frank, and Pauline is married to Richard. Frank and Richard are killed in an auto accident in 2018 while returning from a sporting event. Helene

> In 2018, Bianca earned a salary of $164,000 from her employer. Determine the amount of FICA taxes and Medicare taxes withheld from her salary.

> Karen Samue1s (Socia1 Security number 123-45-6789) makes the following purchases and sales of stock: Assuming that Karen is unable to identify the particular lots that are sold with the original purchase, determine the recognized gain or l0ss on each t

> Chee purchases Tan, Inc. bonds for $108,000 on January 2m 2018. The face value of the bonds is $100,000; the maturity date is December 31, 2022; and the annual interest rate is 5%. Chee will amortize the premium only if he is required to do so. Chee sell

> Ricky owns stock in Dove Corporation. His adjusted basis for the stock is $90,000. During the year, he receives a distribution from the corporation of $75,000 that is labeled a return of capital (i.e., Dove has no earnings and profits) a. Determine the t

> Nissa owns a building (adjusted basis On January 1, 2018) that she rents to Len, who operates a restaurant in the building. The municipal hea1th department closed the restaurant for three months during 2018 because of health code violations. Under MACRS,

> Kareem bought a renta1 house in March 2013 for $300,000, which $50,000 is allocated to the 1and and $250,000 to the building. Early in 2015, he had a tennis court built in the backyard at a cost of $7,500. Kareem has deducted $30,900 for depreciation on

> Anne sold her home for $290,000 in 2018. Selling expenses were $17,400. She purchased it in 2012 for $200,000. During the period of ownership, Anne did the following: • Deducted $50,500 office-in-home expenses, which included $4,500 in depreciation. (Ref

> In 2018, Maria records self-employed earnings of $135,000. Using the format illustrated in the tax, compute Maria's self-employment tax liability and the allowable income tax deduction for the self-employment tax paid

> Julie, being self-employed, is required to make estimate payments of her tax liability for the year. Her tax liability for 2017 was $ 25,000, and her AGI was less than $150,000. For 2018, Julie ultimately determines that her income tax liability is $18,0

> Jane, who is expecting to finish college in May 2018, is fortunate to have already arranged full-time employment after graduation. She will begin work on July 1, 2018, as a staff accountant at a nearby professional services firm with a starting salary of

> In each of the following independent situations, determine the maximum withholding allowances that Eli (an employee) is permitted on Form w-4. a. Eli is single with no dependents b. Eli is married to a non employed spouse, and they have no dependents. c.

> Rafael and Lucy, married taxpayers, each contribute $29,00 to their respective 401(k) plans offered through their employers. The AGI reported on the couple's joint return is $39,000. Determine their credit for retirement plan contributions (the Saver's C

> During 2018, Greg Cruz (1401 Orangedale Road, Troy, MI 48084) works for Maple Corporation and Gray Company. He earns $90,000 at Maple Corporation, where he is a full-time employee. Greg also works part-time for Gray Company for wages of $50,000. a. Did G

> In each of the following independent situations, determine the amount of FICA that should be withheld from the employee’s 2018 salary by the employer. a. Harry earns a $50,000 salary, files a joint return, and claims four withho1ding allowances b. Haze1

> Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $27,40o during 2018 and uses the standard deduction. Calculate the amount, if any, of Jason's earned income credit.

> Which of the following individuals qualifies for the earned income credit for 2018? a. Thomas is single, is 21 years of age, and has no qualifying children. His income consists of $9,000 in wages. b. Shannon, who is 27 years old, maintains a household fo

> Bonnie, who is single and itemizes deductions, reports a zero taxable income for 2018. She incurs positive timing adjustments of $200,000 and AMT exclusion items of $100,000 for the year. What is Bonnie's AMT credit carry over to 2019?

> Lynn, age 45, is single and has no dependents. Her income and expenses for 2018 are reported as follows. The $64,000 business income is from Apex Office Supplies Company, a sole proprietorship that Lynn owns and operates. Apex claimed MACRS depreciatio

> Farr is single, has no dependents and does not itemize her deductions She reports the following items on her 2018 tax return. a. Determine Farr's AMT adjustments and preferences for 2018. b. Calculate Farr's AMT for 2018. Bargain element from the e

> Amos incurred and expensed intangible drilling costs (IDC) of $70,000 His net oil and gas income was $60,000. What is the amount of Amos's preference for IDC?

> Emily owns a coal mine (basis of $12,000 at the beginning of the year) that qualifies for a 15% depletion rate. Gross income from the property was $140,000, and net income before the percentage depletion deduction was $60,000 What is Emily's tax preferen

> During the current year, Yoon earned $10,000 in interest on corporate bonds and incurred $13,000 of investment interest expense related to the bond holdings. Yoon also earned $5,000 interest on private activity bonds that were issued in 2014 and incurred

> Elijah is single. He holds a $12,000 AMT credit from 2017. In 2018, his regular tax liability is $28,000 and his tentative minimum tax is $24,000 Does Elijah owe AMT in 2018? How much (if any) of the AMT credit can Elijah use in 2018?

> Christopher regularly invests in internet company stocks, hoping to become wealthy by making an early investment in the next high-tech phenomenon In 2012, Christopher purchased 3,000 shares of Flicks Net, a film rental company, for $15 per share shortly

> In 2018, Liza exercised an incentive stock option that had been granted to her in 2015 by her employer, Weather Corporation. Liza acquired 100 shares of Weather stock for the option price of $190 per share. The fair market value of the stock at the date

> Burt, the CFO of Amber, Inc., was granted incentive stock options in 2013. Burt exercised the stock options in February 2017 when the exercise price was $75,00o and the fair market value of the stock was $90,000. He sold the stock in September 2018 for $

> In 2018, Geoff incurred $900,000 of mine and exploration expenditures. He elects to deduct the expenditures as quickly as the tax law allows for regular income tax purposes. a. How will Geoff's treatment of mine and exploration expenditures affect his re

> Archie runs a small mineral exploration business (as a sole proprietorship) In 2016, he purchased land (for $68,000) where he suspected a magnesium deposit was located. He incurred $18,000 of exploration cost related to the development of the magnesium m

> Angela, who is single, incurs circulation expenditures of $270,000 during 2018. She is deciding whether to deduct the entire $270,000 or to capitalize the expenses and deduct them over a three-year period. Angela is in the 37% bracket for regular income

> Lisa records nonrefundable Federal income tax credits of $65,000 for the year. Her regular income tax liability before credits is $190,000, and her TMT is $150,000 a. What is Lisa's AMT? b. What is Lisa's regular income tax liability after credits?

> Arthur Wesson, an unmarried individual who is age 68, reports taxable income of $510,000 in 2018. He records positive AMT adjustments of $80,000 and preferences of $35,000. Arthur itemizes his deductions, and his regular tax liability in 2018 is $109,390

> Five years ago Gerald invested $150,000 in a passive activity, his sole investment venture. On January 1, 2017, his amount at risk in the activity was $30,000. His shares of the income and losses were as follows: Gerald holds no suspended at-risk or pa

> Yanni, who is single, provides you with the following information 2018. a. What is Yanni's 2018 taxable income? b. What is Yanni's 2018 AMT1? c. What is Yanni's 2018 TMT? Salary $250,000 State income taxes 25,000 Mortgage interest expense ($480,000

> Seojun acquired an activity several years ago, and in the current year, it generates a loss of $ 50,000. Seojun has AGI of $140,000 before considering the 10ss from the activity. If the activity is a bakery and Seojun is not a materia1 participant, what

> Dorothy acquired a 100% interest in two passive activities: Activity A in January 2013 and Activity B in 2014. Through 2016, Activity A was profitab1e, but it produced 10sses of $200,000 in 2017 and $100,000 in 2018. Dorothy has passive activity income f

> For calendar year 2018, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows: Calculate the amount of itemized deductions the Gibsons may claim for the year $48,600 Casualty loss in a Fed

> Evan is single and has AGI of $277,300 in 2018. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: After all necessary adjustments are made, what is the amount of itemized deductions Evan m

> Bart and Elizabeth Forrest are married and have no dependents They have asked you to advise them whether they should file jointly or separately in 2018. They present you with the following information: If they file separately Bart and Elizabeth will sp

> On December 27, 2018, Roberta purchased four tickets to a charity ball sponsored by the city of San Diego for the benefit of underprivileged children Each ticket cost $200 and had a fair market value of $35. On the same day as the purchase, Roberta gave

> Liz have AGI of $130,000 in 2018. She donated Bluebird Corporation stock with a basis of $10,000 to a qualified charitable organization on July 5, 2018 a. What is the amount of Liz's deduction assuming that she purchased the stock on December 3, 2017, an

> This year, Nadia donates $4,000 to Eastern University’s athletic department. The payment guarantee’s that Nadia will have preferred seating at football games near the 50-yard line. Assume that Nadia subsequently buys four $100 game tickets. How much can

> Malcolm owns 60% and Buddy owns 40% of Magpie Corporation. On July 1, 2018, each lends the corporation $30,000 at an annual interest rate of 5% Malcolm and Buddy are not related. Both shareholders use the cash method of accounting, and Magpie Corporation

> Norma, who is single and uses the cash method of accounting, lives in a state that imposes an income tax. In April 2018, she files her state income tax return for 2017 and pays an additional $1,000 in state income taxes. During 2018, her withholdings for

> Zhou owns a non rental business with two separate departments. Department A generates net income of $70,000, and Department B generates a net loss of $58,000. Zhou participates 800 hours in the operations of Department A and 300 hours in the operations o

> During 2018, Susan incurred and paid the following expenses for Beth (her daughter), Ed (her father), and herself: Beth qualifies as Susan's dependent, and Ed would also qualify except that he receives $7,400 of taxable retirement benefits from his for

> Complete the following table by classifying each of the independent expenditures (assume that no reimbursement takes place and that employee business expenses are not deductible) Deductible Deductible Not Expense Item for AGI from AGI Deductible a.

> Ava recently graduated from college and is interviewing for a position in marketing. Gull Corporation has offered her a job as a sales Decision Making representative that will require extensive travel and entertainment but provide valuable experience. Un

> Ben and Molly are married and will file jointly. Ben earns $300,000 from his single-member LLC (a law firm). He reports his business as a sole proprietorship Wages paid by the law firm amount to $40,000; the law firm has no significant property. Molly is

> Stella Watters is a CPA who operates her own accounting firm (Watters CPA LLC). As a single-member LLC, Stella reports her accounting firm operations as a sole proprietor. Stella has QBI from her accounting firm of $540,000, she reports W- 2 wages of $15

> Scott and Laura are married and will file a joint tax return. Scott has a sole proprietorship (not a specified services" business) that reports net income of $300,000. The proprietorship pays W-2 wages of $40,000 and holds property with an unadjusted bas

> Donald owns a wide variety of commercial rental properties held in a single-member LLC. Donald's LLC reports rental income of $1,500,000. The LLC pays no W- 2 wages; rather, it pays a management fee to an S corporation that Donald controls. The managemen

> Peter Samuels owns and manages his single-member LLC that provides a wide variety of financial services to his clients. He is married and will file a joint tax return with his spouse, Amy. His LLC reports $300,000 of net income, W- 2 wages of $120,000, a

> Shelly has $200,000 of QBI from her local jewelry store (a sole proprietorship). Shelly's proprietorship paid $30,000 in W- 2 wages and has $20,000 of qualified property. Shelly's spouse earned $74,000 of wages as an employee, they earned $20,000 of inte

> Christine is a full-time teacher of the fourth grade at Vireo Academy. During the current year, she spends $1,400 for classroom supplies. On the submission of adequate substantiation, Vireo reimburses her for $ 500 of these expenses the maximum reimburse

> In 2018, Ava, an employee, has AGI of $58000 and the following itemized deductions: What is Ava's total itemized deduction related to these items? Home office expenses $1,200 Union dues and work uniforms 350 Unreimbursed employee expenses Gambling

> Which of the following is a deduction for AGI? a. Charitable contributions b. Alimony paid c. Tax preparation fees d. Mortgage interest paid on your primary residence

> Melanie is employed full-time as an accountant for a national hardware chain. She recently started a private consulting practice, which provides tax advice, and financial planning to the general public. For this purpose, she maintains an office in her ho

> Stork Associates paid $60,000 for a 20-seat skybox at Veterans Stadium for eight professional football games. Regu1ar seats to these games range from $80 to $250 each. At one game, an employee of Stork entertained 18 clients. Stork furnished food and bev

> Monica travels from her office in Boston to Lisbon, Portugal, on business. Her Decision Making absence of 13 days was spent as follows: a. For tax purposes, how many days has Monica spent on business? b. What difference does it make? c. Could Monica h

> Kim works for a clothing manufacturer as a dress designer. During 2018, she travels to New York City to attend five days of fashion shows and then spends three days sightseeing. Her expenses are as follows: [Assume that lodging/meals are the same amoun

> Martha was considering starting a new business. During her preliminary investigation, related to the new venture, she incurred the following expenditures. Martha begins the business on July 1 of the current year. If Martha elects 195 treatment, determi

> Oleander Corporation, a calendar year entity, begins business on March 1, 2018. The corporation incurs startup expenditures of $64,000. If Oleander elects 195 treatment, determine the total amount of startup expenditures that it may deduct for 2018.

> Dennis Harding is considering acquiring a new automobile that he will use 100% for business. The purchase price of the automobile would be $48,500. If Dennis leased the car for five years, the lease payment would be $375 per month. Dennis will acquire th

> Sally purchased a new computer (5-year property) on June 1, 2018, for $4,000. Sally could use the computer 100% of the time in her business, or she could allow her family to use the computer as well. Sally estimates that if her family uses the computer,

> On March 15, 2018, Helen purchased and placed in service a new Escalade. The purchase price was $62,000, and the vehicle had a rating of 6,500 GVW. The vehicle was used 100% for business. a. Assuming that Helen does not use additional first-year deprecia

> On April 3, 2018, Terry purchased and placed in service a building that cost $2 million. An appraisal determined that 25% of the total cost was attributed to the value of the land. The bottom floor of the building is leased to a retail business for $32,0

> On Mark 25, 2018, Prascale Company purchases the rights to a mineral interest for 8 million. At that time, the remaining recoverable units in the mineral interest are estimated to be 500,000 tons. If 80,000 tons are mined and 75,000 tons are sold this ye

> On August 2, 2018, Wendy purchased a new office building for $3.8 million On October 1, 2018, she began to rent out office space in the building. On July 15, 2022, Wendy sold the office building. a. Determine Wendy's cost recovery deduction for 2018. b.

> Weston acquires a new office machine (7-year class asset) on August 2, 2017, for $75,000. This is the only asset Weston acquired during the year. He does not elect immediate expensing under 179. He claims the maximum additional first-year depreciation de

> Orange Corporation acquired new office furniture on August 15, 2018, for $130,000. Orange does not elect immediate expensing under 179. Orange claims any available additional first-year depreciation a. Determine Orange's cost recovery for 2018. b. How wo

> In 2015, Jose purchased a house for $325,000 ($300,000 relates to the house; $25,000 relates to the land). He used the house as his personal residence. In March 2018, when the fair market value of the house was $400,000, he converted the house to rental

> Jed, age 55, is married with no children. During 2018, Jed had the following income and expense items: a. Three years ago, Jed loaned a friend $10,000 to help him purchase a new car In June of the current year, Jed learned that his friend had been declar

> Assume that in addition to the information in Problems 49 and 50, Nell had the following items in 2018: The casualty loss is net of the $100-per-event floor. Determine Nell's taxable income and NOL for 2018. Data from Problem 49: Nell, single and age

> Assume that in addition to the information in Problem 49, Nell had the following items in 2018: The casualty gains and losses are net of the $100-per-event floor. Determine Nell's AGI for 2018. Data from Problem 49: Nell, single and age 38, had the f

> Nell, single and age 38, had the following income and expense items in 2018: Determine Nell's AGI for 2018. Nonbusiness bad debt $ 6,000 Business bad debt 2,000 Nonbusiness long-term capital gain Nonbusiness short-term capital loss Salary 4,000 3,0

> Soong, single and age 32, had the following items for the tax year 2018: • Salary of $ 30,000. • Interest income from U.S. government bonds of $2,000. • Dividends from a foreign corporation of $ 500 • Sale of small business 1244 stock on October 20, 2018

> Javiera and Magda are married and file a joint return. They had the following income and deductions for 2019: a. What is Javiera and Magda's taxable income for 2019? b What is Javiera and Magda's NOL for 2019? Salary Interest from savings account $

> On September 30, 2018, Priscilla purchased a business. Of the purchase price, $60,000 is allocated to a patent and $375,000 is allocated to goodwill. Calculate Priscilla's 2018 § 197 amortization deduction.

> During 2018, Rick and his wife, Sara had the following items of income and expense to report: a. Assuming that Rick and Sara file a joint return, what is their taxable income for 2018? b. What is the amount of Rick and Sara's NOL for 2018? c. To what y

> Xinran, who is married and files a joint return, ow ns a grocery store. In 2018 his gross sales were $276,000, and operating expenses were $320,000. Other items on his 2018 return were as follows: In 2019, Xinran provides the following information: a

> Sam, age 45, is single. For 2018, he has the following items: a. Determine Sam's taxab1e income for 2018. b. Determine Sam's NOL for 2018. Business income $70,000 Business expenses 75,000 Alimony paid (divorce occurred in 2014) 11,000 Interest inco