Question: Assume you have just been hired as

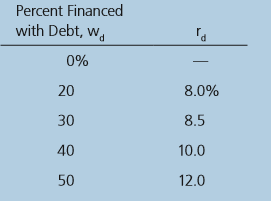

Assume you have just been hired as a business manager of Pizza Palace, a regional pizza restaurant chain. The company’s EBIT was $50 million last year and is not expected to grow. The firm is currently financed with all equity, and it has 10 million shares outstanding. When you took your corporate finance course, your instructor stated that most firms’ owners would be financially better off if the firms used some debt. When you suggested this to your new boss, he encouraged you to pursue the idea. As a first step, assume that you obtained from the firm’s investment banker the following estimated costs of debt for the firm at different capital structures:

If the company were to recapitalize, then debt would be issued and the funds received would be used to repurchase stock. Pizza Palace is in the 40% state-plus-federal corporate tax bracket, its beta is 1.0, the risk-free rate is 6%, and the market risk premium is 6%.

a. Using the free cash flow valuation model, show the only avenues by which capital structure can affect value.

b.(1) What is business risk? What factors influence a firm’s business risk?

(2) What is operating leverage, and how does it affect a firm’s business risk? Show the operating break-even point if a company has fixed costs of $200, a sales price of $15, and variable costs of $10.

c. Now, to develop an example that can be presented to Pizza Palace’s management to illustrate the effects of financial leverage, consider two hypothetical firms: Firm U, which uses no debt financing, and Firm L, which uses $10,000 of 12% debt. Both firms have $20,000 in assets, a 40% tax rate, and an expected EBIT of $3,000.

(1) Construct partial income statements, which start with EBIT, for the two firms.

(2) Now calculate ROE for both firms.

(3) What does this example illustrate about the impact of financial leverage on ROE?

d. Explain the difference between financial risk and business risk.

e. What happens to ROE for Firm U and Firm L if EBIT falls to $2,000? What does this imply about the impact of leverage on risk and return?

f. What does capital structure theory attempt to do? What lessons can be learned from capital structure theory? Be sure to address the MM models.

g. What does the empirical evidence say about capital structure theory? What are the implications for managers?

h. With the preceding points in mind, now consider the optimal capital structure for Pizza Palace.

(1) For each capital structure under consideration, calculate the levered beta, the cost of equity, and the WACC.

(2) Now calculate the corporate value for each capital structure.

i. Describe the recapitalization process and apply it to Pizza Palace. Calculate the resulting value of the debt that will be issued, the resulting market value of equity, the price per share, the number of shares repurchased, and the remaining shares. Considering only the capital structures under analysis, what is Pizza Palace’s optimal capital structure?

j. Suppose there is a large probability that L will default on its debt. For the purpose of this example, assume that the value of L’s operations is $4 million (the value of its debt plus equity). Assume also that its debt consists of 1-year, zero coupon bonds with a face value of $2 million. Finally, assume that L’s volatility, s, is 0.60 and that the risk-free rate rRF is 6%.

k. What is the value of L’s stock for volatilities between 0.20 and 0.95? What incentives might the manager of L have if she understands this relationship? What might debt holders do in response?

l. How do companies manage the maturity structure of their debt?

Transcribed Image Text:

Percent Financed with Debt, w. 0% 20 8.0% 30 8.5 40 10.0 50 12.0

> Thress Industries just paid a dividend of $1.50 a share (i.e., D0 5 $1.50). The dividend is expected to grow 5% a year for the next 3 years and then 10% a year thereafter. What is the expected dividend per share for each of the next 5 years?

> Winston Watch’s stock price is $75 per share. Winston has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock ou

> The first part of the case, presented in Chapter 6, discussed the situation of Computron Industries after an expansion program. A large loss occurred in 2018 rather than the expected profit. As a result, its managers, directors, and investors are concern

> Jenny Cochran, a graduate of the University of Tennessee with 4 years of experience as an equities analyst, was recently brought in as assistant to the chairman of the board of Computron Industries, a manufacturer of computer components. During the previ

> AA Corporation’s stock has a beta of 0.8. The risk-free rate is 4%, and the expected return on the market is 12%. What is the required rate of return on AA’s stock?

> Using Rhodes Corporation’s financial statements (shown after part f), answer the following questions. a. What is the net operating profit after taxes (NOPAT) for 2018? b. What are the amounts of net operating working capital for both ye

> You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: a. Calculate the average rate of return for each stock during the 5-

> Assume that you recently graduated and have just reported to work as an investment advisor at the brokerage firm of Balik and Kiefer, Inc. One of the firm’s clients is Michelle DellaTorre, a professional tennis player who has just come to the United Stat

> Absalom Energy’s 14% coupon rate, semiannual payment, $1,000 par value bonds that mature in 30 years are callable 5 years from now at a price of $1,050. The bonds sell at a price of $1,353.54, and the yield curve is flat. Assuming that interest rates in

> Indicate by a (1), (2), or (0) whether each of the following events would probably cause average annual inventory holdings to rise, fall, or be affected in an indeterminate manner: a. Our suppliers change from delivering by train to air freight. ________

> You have observed the following returns over time: Assume that the risk-free rate is 6% and the market risk premium is 5%. a. What are the betas of Stocks X and Y? b. What are the required rates of return on Stocks X and Y? c. What is the required rate

> The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of $6.56. What is the value of a put option written on the stock with the same exercis

> How could (accurate) balance sheet and in come statement information be used, along with other information, to make a statement of cash flows? What is the primary purpose of this statement?

> The Bookbinder Company has made $150,000 before taxes during each of the last 15 years, and it expects to make $150,000 a year before taxes in the future. However, in 2018, the firm incurred a loss of $650,000. The firm will claim a tax credit at the tim

> Corporate bonds issued by Johnson Corporation currently yield 8%. Municipal bonds of equal risk currently yield 6%. At what tax rate would an investor be indifferent between these two bonds?

> The Talley Corporation had taxable operating income of $365,000 (i.e., earnings from operating revenues minus all operating costs). Talley also had (1) interest charges of $50,000, (2) dividends received of $15,000, (3) dividends paid of $25,000, and (4)

> Explain the following statement: “Whereas the balance sheet can be thought of as a snapshot of the firm’s financial position at a point in time, the income statement reports on operations over a period of time.”

> The Jimenez Corporation’s forecasted 2019 financial statements follow, along with some industry average ratios. Calculate Jimenez’s 2019 forecasted ratios, compare them with the industry average data, and comment brief

> Data for Lozano Chip Company and its industry averages follow. a. Calculate the indicated ratios for Lozano. b. Construct the extended DuPont equation for both Lozano and the industry. c. Outline Lozano’s strengths and weaknesses as rev

> How might (a) seasonal factors and (b) different growth rates distort a comparative ratio analysis? Give some examples. How might these problems be alleviated?

> What types of risks are interest rate and exchange rate swaps designed to mitigate? Why might one company prefer fixed-rate payments while another company prefers floating-rate payments, or payments in one currency versus another?

> Reizenstein Technologies (RT) has just developed a solar panel capable of generating 200% more electricity than any solar panel currently on the market. As a result, RT is expected to experience a 15% annual growth rate for the next 5 years. By the end o

> Constant Growth Stock Valuation You are analyzing Jillian’s Jewelry (JJ) stock for a possible purchase. JJ just paid a dividend of $1.50 yesterday. You expect the dividend to grow at the rate of 6% per year for the next 3 years; if you buy the stock, you

> Crisp Cookware’s common stock is expected to pay a dividend of $3 a share at the end of this year (D1 5 $3.00); its beta is 0.8. The risk-free rate is 5.2%, and the market risk premium is 6%. The dividend is expected to grow at some constant rate g, and

> Current and projected free cash flows for Radell Global Operations are shown here. Growth is expected to be constant after 2020, and the weighted average cost of capital is 11%. What is the horizon (continuing) value at 2021 if growth from 2020 remains c

> In general, what are some characteristics of stocks for which a dividend growth model is appropriate? What are some characteristics of stocks for which dividend growth is not appropriate but a FCF model is? How could you evaluate this second type of stoc

> Nick’s Enchiladas has preferred stock outstanding that pays a dividend of $5 at the end of each year. The preferred sells for $50 a share. What is the stock’s required rate of return (assume the market is in equilibrium with the required return equal to

> Define each of the following terms: a. Proxy; proxy fight; preemptive right; classified stock; founders’ shares b. Free cash flow valuation model, value of operations; non operating assets c. Constant growth model; horizon date and horizon value d. Multi

> Broussard Skateboard’s sales are expected to increase by 15% from $8 million in 2018 to $9.2 million in 2019. Its assets totaled $5 million at the end of 2018. Broussard is already at full capacity, so its assets must grow at the same rate as projected s

> If you had a set of industry average ratios for the firm you were analyzing, how might you use these data?

> Garlington Technologies Inc.’s 2018 financial statements are shown here: Suppose that in 2019 sales increase by 10% over 2018 sales and that 2019 dividends will increase to $112,000. Forecast the financial statements using the foreca

> Hasting Corporation estimates that if it acquires Vandell Corporation, synergies will cause Vandell’s free cash flows to be $2.5 million, $2.9 million, $3.4 million, and $3.57 million at Years 1 through 4, respectively, after which the free cash flows wi

> Stevens Textile Corporation’s 2018 financial statements are shown here: a. Suppose 2019 sales are projected to increase by 15% over 2018 sales. Use the forecasted financial statement method to forecast a balance sheet and income stat

> Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Upton’s bal

> The Booth Company’s sales are forecasted to double from $1,000 in 2018 to $2,000 in 2019. Here is the December 31, 2018, balance sheet: Booth’s fixed assets were used to only 50% of capacity during 2018, but its curr

> At year-end 2018, Wallace Landscaping’s total assets were $2.17 million, and its accounts payable were $560,000. Sales, which in 2018 were $3.5 million, are expected to increase by 35% in 2019. Total assets and accounts payable are proportional to sales,

> Maggie’s Muffins Bakery generated $5 million in sales during 2018, and its year-end total assets were $2.5 million. Also, at year-end 2018, current liabilities were $1 million, consisting of $300,000 of notes payable, $500,000 of accounts payable, and $2

> Refer to Problem 9-1. Return to the assumption that the company had $5 million in assets at the end of 2018, but now assume that the company pays no dividends. Under these assumptions, what would be the additional funds needed for the coming year? Why is

> Refer to Problem 9-1. What would be the additional funds needed if the company’s year-end 2018 assets had been $7 million? Assume that all other numbers, including sales, are the same as in Problem 9-1 and that the company is operating at full capacity.

> Define each of the following terms: a. Operating plan; financial plan b. Spontaneous liabilities; profit margin; payout ratio c. Additional funds needed (AFN); AFN equation; capital intensity ratio; self-supporting growth rate d. Forecasted financial sta

> What is an agent, and what is a principal? What kinds of situations in companies give rise to conflicts between these two, called agency conflicts?

> Spencer Supplies’s stock is currently selling for $60 a share. The firm is expected to earn $5.40 per share this year and to pay a year-end dividend of $3.60. a. If investors require a 9% return, what rate of growth must be expected for Spencer? b. If Sp

> Four economic classifications of mergers are: (1) horizontal, (2) vertical, (3) conglomerate, and (4) congeneric. Explain the significance of these terms in merger analysis with regard to (a) the likelihood of governmental intervention and (b) possibili

> Shi Import-Export’s balance sheet shows $300 million in debt, $50 million in preferred stock, and $250 million in total common equity. Shi’s tax rate is 40%, rd 5 6%, rps 5 5.8%, and rs 5 12%. If Shi has a target capital structure of 30% debt, 5% preferr

> During the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion prog

> Davis Industries must choose between a gas-powered and an electric-powered forklift truck for moving materials in its factory. Because both forklifts perform the same function, the firm will choose only one. (They are mutually exclusive investments.) The

> Define each of the following terms: a. Capital budgeting; payback period; discounted payback period b. Independent projects; mutually exclusive projects c. Net present value (NPV) method; internal rate of return (IRR) method; profitability index (PI) d.

> Wansley Lumber is considering the purchase of a paper company, which would require an initial investment of $300 million. Wansley estimates that the paper company would provide net cash flows of $40 million at the end of each of the next 20 years. The co

> Integrated Waveguide Technologies (IWT) is a 6-yearold company founded by Hunt Jackson and David Smithfield to exploit meta material plasmonic technology to develop and manufacture miniature microwave frequency directional transmitters and receivers for

> What is the Free Cash Flow to Equity (FCFE) model? How might it be applied? When is it not appropriate?

> A company’s most recent free cash flow to equity was $100 and is expected to grow at 5% thereafter. The company’s cost of equity is 10%. Its WACC is 8.72%. What is its current intrinsic value?

> What’s the difference between an IPO and an SEO? Would you view purchasing a stock in an SEO to be more or less risky than purchasing a stock in an IPO? Would you expect the same first-day returns for an SEO purchase as for an IPO purchase? Why?

> In 1983, the Japanese yen–U.S. dollar exchange rate (USD/JPY) was 245 yen per dollar, and the dollar cost of a compact Japanese-manufactured car was $8,000. Suppose that now the exchange rate is 80 yen per dollar. Assume there has been no inflation in th

> Gary earns $42,990 per year. He is paid weekly. He currently has a $456-per-month car loan payment, and he pays $1,277.00 per year for auto insurance. Is one week’s paycheck enough to pay for his monthly auto loan and his monthly insurance bill? Explain.

> Max works x hours per week and has a 3-week vacation each year. Mindy works y hours per week and has a 4-week vacation each year. Express their combined number of work hours per year.

> Manuel works at Cheesecake King. He earns $15 per hour as a busboy. The waiters he helps give him 25% of their tips. a. If Manuel worked 6 hours today, how much did he earn, without tips? b. The waiters Manuel assisted waited on 16 tables, and the tota

> Julianne works as a waitress. She earns $13 per hour plus tips. a. Today she worked x hours. Express her pay for these hours algebraically. b. She served nine tables. The total bill for these nine tables was y dollars. Julianne received 18% in tips fro

> Jennifer did not pay her FlashCard bill in full in September. Her October bill showed a finance charge, and she wants to see whether or not it is correct. The average daily balance is $970.50, and the APR is 15.6%. Find the finance charge for her October

> Jim worked 40 regular hours last week, plus 8 overtime hours at the time-anda-half rate. His gross pay was $884. a. What was his hourly rate? b. What was his hourly overtime rate?

> Michael earns $21 per hour and works 40 hours per week. How many overtime hours would he have to work in a week for his time-and-a-half overtime pay to be greater than his regular gross pay?

> Ron earns x dollars per hour. He regularly works 40 hours per week. Express his annual salary algebraically.

> Colby and Cheryl work in different local factories. Colby regularly earns $18 per hour, and he is paid time-and-a-half for each hour of overtime he works. Cheryl regularly earns $16.60 per hour, and she is paid double time for an hour of overtime. Who ea

> Pedro works 35 regular hours per week at the Meadow Deli. His hours over 35 are considered overtime. He earns $15 per hour and receives time-and-a-half pay for each hour of overtime he works. Last week he worked 41 hours and received a gross pay of $305.

> Suni needs to repay her school loan in 4 years. How much must she semiannually deposit into an account that pays 0.9% interest, compounded semiannually, to have $100,000 to repay the loan?

> You can receive Social Security payments for being disabled even if you have not retired or reached age 62. You need a certain number of Social Security credits to qualify for this. • If you become disabled before age 24, you generally need six credits

> Desta wants to purchase “The Ultimate Plan” from her cell phone provider. If she enrolls in this plan, she can purchase the latest cell phone from the provider for $250. The plan consists of unlimited talk and text and 18GB of data for $100 per month. It

> The piecewise function below gives the cost f(x) of x text messages per month. Which would be the least expensive plan for a person who had d text messages: a plan in which 5 c 31 or a plan in which 5 c 40? Explain when x sd c + p(x – d) when x >d f

> Throughout this lesson you have used the greatest integer function 5yx [] . Use your graphing calculator to view the graph of this function and find the y-coordinate for each of the following x-values. a. 2.3 b. 2.99 c. 3 d. 3.01 e. 3.99

> The Fi-Zone cable TV/Internet/phone provider charges $100 per month for all three services for a new customer’s first year. Tobi normally pays p dollars for her monthly home phone service, i dollars for Internet service, and c dollars for cable televisio

> Lauren did not pay her January FlashCard bill in full, so her February bill has a finance charge added on. The average daily balance is $510.44, and the monthly periodic rate is 1.3%. What should Lauren’s finance charge be on her February statement?

> Write the profit function for the given expense and revenue functions. E = 22,500p +180,000 R = 2330p2 +19,000p

> Text-Time charges $45 for an international texting plan with 300 text messages included. If the customer goes over the 300 messages, the cost is $0.10 per message. They have an unlimited plan for $59 per month. a. If x represents the number of text mess

> A cable TV/Internet/phone provider charges Janet $110 per month for all three services. In addition, Janet’s monthly cell phone bill averages $98 per month. a. What does Janet pay annually for these services? b. What is her average cost per day for the

> A local cable TV/Internet/phone provider charges new customers $129 for all three services, per month, for the first year under their “3 for 129” promotion. Joanne normally pays $74 for her monthly home phone service, $59 for Internet service, and $69 fo

> Danielle is examining the change in the money flow for Yahoo! Inc. (YHOO) shares on two consecutive dates. The information is given in the table. Do the December 1 numbers reflect a positive or negative money flow? Explain. Date High Low Close Volum

> Vicki’s phone company charges x dollars for unlimited texting per month, or t dollars per text message sent or received. If she has m text messages for the month, express the difference in cost between the per-text plan and the unlimited plan algebraical

> Riley purchased a 30-day international cell phone plan for use during winter break. There is a one-time fee of $35 and it includes 150 MB of data usage. Each extra megabyte, or part thereof, of data costs $0.28. Find the cost of the plan if he uses 388 M

> The Tell-All Phone Company prepaid phone card has charges of $0.58 for the first 2 minutes and $0.21 for each extra minute (or part of a minute). Express their rate schedule as a piecewise function. Let m represent the number of minutes and let c(m) repr

> A phone company set the following rate schedule for an m-minute call from any of its pay phones. a. What is the cost of a call that is under 6 minutes? b. What is the cost of a 14-minute call? c. What is the cost of a 9½-minute call?

> A pay phone at a shopping mall charges $0.68 for the first 4 minutes and $0.21 for each extra minute (or part of a minute). a. Find the cost of a 10-minute call on this phone. b. Find the cost of a 13.44-minute call on this phone.

> Parisa’s cell phone plan has a monthly fee of $95, which includes unlimited free text messages and phone calls and 5GB of data. Each extra gigabyte of data, or part thereof, costs $14. a. Find the cost of a month in which Parisa used 6.2GB of data. b.

> Aaron’s cell phone plan includes 3GB of data. On the 21st day of his billing period, Aaron received a message from his service provider that he had already used 75% of his data allowance for the 31-day billing period. At this rate, will he use more than

> Ralph just received his June Flash Card bill. He did not pay his May bill in full, so his June bill shows a previous balance and a finance charge. The average daily balance is $470, and the monthly periodic rate is 1.5%. What should Ralph’s finance charg

> President Carter’s quote could have been revised in 2016 since, at that point in time, 46% of the world had Internet access. Interpret the quote in the context of what you know about the standard of living throughout the world today.

> Mazzeo’s Appliance Store requires a down payment of 13 on all installment purchases. Norton’s Depot requires a 30% down payment on installment purchases. Which store’s down payment rate is lower?

> Janine is 21 years old. She opens an account that pays 1.25% interest, compounded monthly. She sets a goal of saving $10,000 by the time she is 24 years old. How much must she deposit each month?

> Gary is buying a $1,250 computer on an installment plan. He makes a down payment of $150. He has to make monthly payments of $48.25 for 212 years. What is the total finance charge?

> Zeke bought a $2,300 bobsled on an installment plan. He made a $450 down payment, and he has to make monthly payments of $93.50 for the next 2 years. How much total interest will he pay?

> Interpret the quote in terms of what you have learned about essential and discretionary expenses.

> Jean bought a $1,980 snow thrower on an installment plan. The installment agreement included a 10% down payment and 18 monthly payments of $116 each. a. How much is the down payment? b. What is the total amount of the monthly payments? c. How much did

> Craig wants to purchase a boat that costs $1,420. He signs an installment agreement requiring a 20% down payment. He currently has $250 saved. Does he have enough for the down payment?

> Monique buys a $4,700 air conditioning system using an installment plan that requires 15% down. How much is the down payment?

> Bernie bought a refrigerator at a special sale. The refrigerator regularly sold for $986. No down payment was required. Bernie has to pay $69 per month for 1½ years. What is the average amount Bernie pays in interest each month?

> Chris purchases living room furniture for $4,345 from Halloran Gallery. She has a 1-year, no-interest, no-money-down, deferred payment plan. She does have to make a $15 monthly payment for the first 11 months. a. What is the sum of these monthly paymen

> How might the quote apply to what you have learned?

> If Tanya purchased a $1,700 set of golf clubs on a 9-month layaway plan and had to pay a monthly payment of $201, what is the sum of the monthly payments? What was the fee charged for the layaway plan?

> Mary wants to go on a $10,000 vacation in 6 months. She has a bank account that pays 2.25% interest, compounded monthly. How much must she deposit each month to afford the vacation?

> Kate is a professional musician. She wants to make an essential purchase of an upgraded used bass guitar for her work. She found the following prices for the same make and model bass guitar from various sellers: $699, $599, $699, $680, $590, $720, $650,

> Adam bought a $1,670 custom video game/sound system on a special no-interest plan. He made a $100 down payment and agreed to pay the entire purchase off in 1½ years. The minimum monthly payment is $10. If he makes the minimum monthly payment up until the

> Interpret the quote in the context of what you learned about consumer credit in this section. Solve each problem. Round monetary amounts to the nearest cent.