Question: At the beginning of the year, Albers,

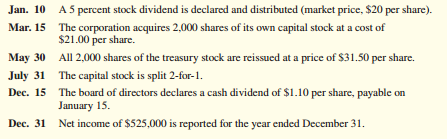

At the beginning of the year, Albers, Inc., has total stockholders’ equity of $840,000 and 40,000outstanding shares of a single class of capital stock. During the year, the corporation completes thefollowing transactions affecting its stockholders’ equity accounts.

Instructions:Compute the amount of total stockholders’ equity, the number of shares of capital stock outstanding, and the book value per share following each successive transaction. Organize your solutionas a three-column schedule with these separate column headings: (1) Total Stockholders’ Equity,(2) Number of Shares Outstanding, and (3) Book Value per Share.

> Hot Water, Inc., manufactures a variety of dry cleaning equipment. The following are five eventsthat occurred during the current year.1. Declared a $5 per share cash dividend.2. Paid the cash dividend.3. Purchased 1,000 shares of treasury stock for $37 p

> Procter & Gamble sells Gillette razors near or below their manufacturing cost. It also sells razor blades that have a relatively high contribution margin. Explain why P&G does not eliminate its unprofitable razor line and sell only blades.

> Listed as follows are eight events or transactions of Lone Star Corporation. a. Made an adjusting entry to record interest on a short-term note payable. b. Made a monthly installment payment of a fully amortizing, six-month, interest-bearing installmen

> Listed are six technical accounting terms introduced or emphasized in this chapter. Each of the following statements may or may not describe these technical terms. For each statement, indicate the term described, or answer “Noneâ

> What is the difference between an international licensing agreement and an international joint venture?

> Distinguish between a stock split and a stock dividend. Is there any reason for the difference in accounting treatment of these two events?

> Define opportunity costs and explain why they represent a common source of error in making cost analyses.

> Discuss the importance of incremental costs and revenue when considering alternative courses of action.

> On September 1, 2021, Evansville Lumber Company issued $80 million in 20-year, 10 percent bonds payable. Interest is payable semiannually on March 1 and September 1. Bond discounts and premiums are amortized at each interest payment date and at year-end.

> Tootsie Roll Industries has two business segments, one for operations in the United States and one for operations in Mexico and Canada. The following information (in thousands) comes from a recent annual report. Find the ROI for each segment for each yea

> There is a business saying that “You shouldn’t be in business if your company doesn’t earn higher than bank rates.” This means that if a company is to succeed, its return on assets should be significantly higher than its cost of borrowing. Why is this so

> Identify various product characteristics that distinguish job costing systems from process costing systems.

> You have recently taken a position with Albers, Inc., a wholesale company that relies heavily on sales outside the United States. In order to facilitate sales worldwide, the company has warehouses at several non–U.S. locations from which it services impo

> When Delta Airlines sells tickets for future flights, it debits Cash and credits an account entitled Air Traffic Liability (Passenger Revenue Earned is recorded only when passengers are provided flight services). The Air Traffic Liability account, report

> Tyge Corporation recorded the following activities during its first month of operations. Purchased materials costing $300,000. Used direct materials in production costing $280,000. Incurred direct labor costs of $220,000, of which $190,000 had actually

> Using the search approach of your choice, find the 2018 annual report of Johnson & Johnson. Locate the company’s 2018 balance sheet. Instructions: Answer the following questions. a. Does the company report preferred stock in its balance sheet? If so,

> Rachel’s Costume Creations has two product lines: machine-made costumes and hand-made costumes. The company assigns $96,000 in manufacturing overhead costs to two cost pools: power costs and inspection costs. Of this amount, the power c

> What would be the effect, if any, on book value per share of common stock as a result of each of the following independent events: (a) A corporation obtains a bank loan; (b) a dividend is declared (to be paid in the next accounting period)?

> An analysis of the income statement and the balance sheet accounts of Mary’s Fashions at December 31 of the current year, provides the following information. Additional Information: 1. Except as noted in 4, payments and proceeds relati

> Foding Corporation has supplied the following information obtained from its standard cost system in May. Instructions: a. Determine the actual quantity of materials purchased and used in production during May. b. Determine the standard quantity of mater

> On March 31, 2021, Gardner Corporation received authorization to issue $50,000 of 9 percent, 30-year bonds payable. The bonds pay interest on March 31 and September 30. The entire issue was dated March 31, 2021, but the bonds were not issued until April

> Is the cost of disposing of hazardous waste materials resulting from factory operations a product cost or a period cost? Explain.

> Thompson Plumbing Inc. is a wholesaler of plumbing accessories. Thompson Plumbing began operations in September of the current year and engaged in the following transactions during September and October of this year. Thompson Plumbing uses a perpetual in

> In a process costing system that uses a FIFO cost flow assumption, how is the number of units started and completed during the period computed?

> Year after year two huge supermarket chains—Publix Super Markets, Inc., and Safeway, Inc.— consistently report gross profit rates between 26 percent and 29 percent. Each uses a sophisticated perpetual inventory system to account for billions of dollars i

> What is the difference between a sunk cost and an out-of pocket cost?

> Assuming no change in the expected amount of future cash flows, what factors may cause the present value of a financial instrument to change? Explain fully

> Briefly explain the relationships between present value and (a) the length of time until the future cash flow occurs, and (b) the discount rate used in determining present value

> What does book value per share of common stock represent? Does it represent the amount common stockholders would receive in the event of liquidation of the corporation? Explain briefly.

> Percale Farms raises marine fish for sale in the aquarium trade. Each year, Percale obtains a batch of approximately one million eggs from a local supplier. Percale’s manager is trying to decide whether to use the farm’s facilities to raise Maroon Clownf

> Why would a company use multiple cost accounting systems?

> Define the term activity base.

> Frost, Inc., acquired land by issuing $770,000 of capital stock. No cash changed hands in this transaction. Will the transaction be included in the company’s statement of cash flows? Explain.

> Tots-To-Go, Inc., has two divisions—the seat division and the stroller division. The seat division supplies the seat frames used by the stroller division to make its strollers. The stroller division produces approximately 10,000 strollers for young child

> Kendahl Plastics Corporation contracts with NASA to manufacture component parts used in commedications satellites. NASA reimburses Kendahl on the basis of the actual manufacturing costs it incurs, plus a fixed percentage. Prior to being awarded a contrac

> Briefly describe the rationale for using a cost flow assumption, rather than the specific identification method, to value an inventory

> With a group of two or three students, choose a publicly traded global company that you think you might want to invest in sometime in the future. Use the Internet or annual report data to answer the following questions. a. In which geographical regions d

> Early in 2018, Sear Foss, Inc., was organized with authorization to issue 2,000 shares of $100 par value preferred stock and 300,000 shares of $1 par value common stock. Five hundred shares of the preferred stock were issued at par, and 80,000 shares of

> How do cash effects differ among out-of-pocket costs, sunk costs, and opportunity costs?

> A recent balance sheet of Denver Tours is provided as follows. Other information provided by the company is as follows Compute and discuss briefly the significance of the following measures as they relate to Denver Tours. a. Net income percentage in c

> An American company is considering entering into a joint venture with a Korean firm. Describe what cultural differences each party should consider.

> Wells Enterprises manufactures a component that is processed successively by Department I and Department II. Manufacturing overhead is applied to units produced at the following budget costs. These budgeted overhead costs per unit are based on the norma

> General Electric Company has had its financial ups and downs. Recently, the CFO for General Electric helped turn its problems around by analyzing the amount of value each product was providing to the company’s bottom line. The analysis ultimately determi

> The Ski Factory provided the following information at December 31, year 1. Marketable Securities The company invested $52,000 in a portfolio of marketable securities on December 22, year 1. The portfolio’s market value on December 31,

> A financial analyst notes that Collier Corporation’s earnings per share have been rising steadily for the past five years. The analyst expects the company’s net income to continue to increase at the same rate as in the past. In forecasting future basic e

> Taylor & Malone is a law firm. Would the concepts of job order costing be appropriate for this type of service business? Explain

> The common stock of Fido Corporation was trading at $45 per share on October 15 of the previous year. A year later, on October 15 of the current year, it was trading at $80 per share. On this date, Fido’s board of directors decided to split the company’s

> Xerox Company applies manufacturing overhead on the basis of machine-hours using a predetermined overhead rate. At the end of the current year, the Manufacturing Overhead account has a credit balance. What are the possible explanations for this? What dis

> Is management accounting information developed in conformity with generally accepted accounting principles or some other set of prescribed standards? Explain.

> Mentor Company sells kitchen appliances to contractors to install in newly constructed houses. Mentor sold appliances to a single contractor for ten homes at a total price of $150,000. Mentor extends the manufacturer’s warrants for one year beyond the ma

> Provide an example showing how the following environmental forces affect accounting Practices. a. Political and legal systems. b. Economic systems. c. Culture. d. Technology and infrastructure.

> Describe how activity-based costing can improve overhead cost allocations in companies that produce diverse product lines.

> Sea Travel sells motor boats. One of Sea Travel’s most popular models is the Wing. During the current year, Sea Travel purchased 12 Wings at the following costs. On April 28, Sea Travel sold five Wings to the Jack Sport racing team. Th

> Eastrise Corporation has two divisions—the motor division and the mower division. The motor division supplies the motors used by the mower division. The mower division produces approximately 10,000 mowers annually. Thus, it receives 10,000 motors from th

> What is the International Accounting Standards Board? Why has the board been unable to obtain uniform global application of its standards?

> Why is the use of a single activity base inappropriate for some companies?

> Six events relating to liabilities follow. a. Paid the liability for interest payable accrued at the end of the last accounting period. b. Made the current monthly payment on a 12-month installment note payable, including interest and a partial repayme

> When Torretti Company began business on August 1, it purchased a one-year fire insurance policy and debited the entire cost of $7,200 to Unexpired Insurance. Torretti adjusts its accounts at the end of each month and closes its books at the end of the ye

> Why might the unit cost of those items started and completed during the period differ from the unit cost of all items completed and transferred during the period?

> What is meant by the year-end cutoff of transactions? If merchandise in transit at year-end is material in dollar amount, what determines whether these goods should be included in the inventory of the buyer or the seller? Explain

> Haywood, Inc., purchased a truck to use for deliveries and is attempting to determine how much depreciation expense would be recognized under three different methods. The truck cost $24,000and is expected to have a value of $6,000 at the end of its 6-yea

> Giant Chef Equipment Company is organized into two divisions—commercial sales and home products. During June, sales for the commercial sales division totaled $1,500,000, and its contribution margin ratio averaged 34 percent. Sales generated by the home p

> Kelp Company produces three joint products from seaweed. At the split-off point, three basic products emerge: Sea Tea, Sea Paste, and Sea Powder. Each of these products can either be sold at the split-off point or be processed further. If they are proces

> Moffett Company earned a 8 percent return on its total assets. Current liabilities are 5 percent of total assets. Longterm bonds carrying a 5.5 percent coupon rate are equal to 30 percent of total assets. There is no preferred stock. Is this application

> Bottom-Shelf Provisions uses standard costs in its process costing system. At the end of the current month, the following information is prepared by the company’s cost accountant The total standard cost per unit of finished product is

> A U.S.-based company, Global Products Inc., has wholly owned subsidiaries across the world. Global Products Inc. sells products linked to major holidays in each country. The president and board members of Global Products Inc. believe that the managers of

> This case is based on the statement of cash flows for Allison Corporation, illustrated in Exhibit 13–1. Use this statement to evaluate the company’s ability to continue paying the current level of dividends—$40,000 per year. The following information als

> Tucker Technology is considering two alternative proposals for modernizing its production facilities. To provide a basis for selection, the cost accounting department has developed the following data regarding the expected annual operating results for th

> Nashville Do-It-Yourself owns a chain of nine retail stores that sell building materials, hardware, and garden supplies. In early October, the company’s current ratio is 1.7 to 1. This is about normal for the company, but it is lower than the current rat

> A manufacturing firm has three inventory control accounts. Name each of the accounts, and describe briefly what the balance in each at the end of any accounting period represents.

> Compute the following ratios and comment on the trend you can observe from the limited two years of data you have available. a. Gross profit rate. b. Net income as a percentage of sales. c. Current ratio. Hal Holcomb reports the business and economic ne

> The following items were taken from the accounting records of Nevada Utility Company for the year ended December 31, 2021 (dollar amounts are in thousands). Information 1. The 10 percent bonds due in April 2022 will be refinanced in March 2023 through

> King Enterprises is a book wholesaler. King hired a new accounting clerk on January 1 of the current year. The new clerk does not understand accrual accounting and recorded the following transactions based on when cash receipts and disbursements changed

> In a recent annual report, Procter & Gamble reports that product-related inventories are primarily maintained on the FIFO method. Minor amounts of product inventories, including certain cosmetics, are maintained on the LIFO method. The spare parts invent

> At December 31, year 1, Westport Manufacturing Co. owned the following investments in the capital stock of publicly owned companies. Instructions: a. Illustrate the presentation of marketable securities and the unrealized holding gain or loss in Westp

> Bring Company’s inventory is subject to shrinkage via evaporation. At the end of the current financial reporting period, the company’s inventory had a cost of $100,000. Management estimates that evaporation has resulte

> Locate the table titled “Selected Financial Data” in the Home Depot Financial Information in Appendix A. Assume Home Depot identifies each store as a profit center. Identify the categories of information in the “Store Data” section of the table that woul

> Assume that you will have a 10-year, $10,000 loan to repay when you graduate from college next month. The loan, plus 8 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $1,490 each, beginning one year after you g

> Budgets are essential for the successful operation of an organization. Finding the resources to implement budget goals requires extensive use of human resources. How managers perceive their roles in the budgeting process is important to the successful an

> A recent balance sheet of Sweet Tooth, Inc., included the following items, among others. (Dollar amounts are stated in thousands.) The company also reported total assets of $353,816 thousand, total liabilities of $81,630 thousand, and a return on total

> Indicate whether each of the companies or individuals in the following independent cases would benefit more from a strong U.S. dollar (relatively low foreign exchange rates) or a weak U.S. dollar (relatively high foreign exchange rates). Provide a brief

> Monster Toys is considering a new toy monster called Garga. Annual sales of Garga are estimated at 100,000 units at a price of $8 per unit. Variable manufacturing costs are estimated at $3 per unit, incremental fixed manufacturing costs (excluding deprec

> Harvey Corporation produces several joint products from common materials and shared production processes. Why are costs incurred up to the split-off point not relevant in deciding which products Harvey sells at the split-off point and which products it p

> These selected statistics are from recent annual reports of two well-known retailers. a. Explain the significance of each of these three measures. b. Evaluate briefly the performance of each company on the basis of these three measures

> Identify the variances from standard cost that are generally computed for direct materials, direct labor, and manufacturing overhead.

> Heritage Furniture Co. uses a standard cost system. One of the company’s most popular products is an oak entertainment center that looks like an old icebox but houses a television, stereo, or other electronic components. The per-unit st

> Blind River, Inc., recently hired Neil Young as its bookkeeper. Mr. Young is somewhat inexperienced and has made numerous errors recording daily business transactions. Indicate the effects of the errors described as follows on each of the financial state

> Briefly state the purposes of a statement of cash flows.

> Sci-Fi Labs is a publicly owned company with several issues of capital stock outstanding. Over the past decade, the company has consistently earned modest profits and has increased its common stock dividend annually by 5 or 10 cents per share. Recently t

> Define the term free cash flow. Explain the significance of this measurement to (1) short-term creditors, (2) long-term editors, (3) stockholders, and (4) management.

> Tech Process, Inc., manufactures a variety of computer peripherals, such as tape drives and printers. Listed are five events that occurred during the current year.1. Declared a $1.00 per share cash dividend.2. Paid the cash dividend.3. Purchased 1,000 sh

> A recent annual report of Lowe’s indicates that property is capitalized at cost if it is expected to yield future benefits and has an original useful life that exceeds one year. Cost includes all applicable expenditures to deliver and install the propert

> Georgia Woods, Inc., manufactures furniture to customers’ specifications and uses job order cosign. A predetermined overhead rate is used in applying manufacturing overhead to individual jobs. In Department One, overhead is applied on t

> Selected items from successive annual reports of Middlebrook, Inc., appear as follows. Dividends of $16,000 were declared and paid in year 2. Compute the following: a. Current ratio for year 2 and year 1. b. Debt ratio for year 2 and year 1. c. Earnings

> Alexander, Inc., declared and distributed a 10 percent stock dividend on its 700,000 shares of outstanding $5 par value common stock when the stock was selling for $12 per share. The outstanding shares had originally been sold at $8 per share. The balanc

> Timberlake Corporation is a publicly owned company. The following information is taken from a recent balance sheet. Dollar amounts (except for per-share amounts) are stated in thousands Instructions: From this information, compute answers to the follow

> Dyelot Industries manufactures dyes and uses cost standards. The dye is produced in 1,000 pound batches; the normal level of production is 500 batches of dye per month. The standard costs per batch are as follows. Instructions: You have been engaged to

> Anton Company manufactures wooden magazine stands. An accountant for Anton just completed the variance report for the current month. After printing the report, his computer’s hard drive crashed, effectively destroying most of the actual

> Briefly distinguish between management and financial accounting information in terms of (a) the intended users of the information, and (b) the purpose of the information.

> In the Home Depot 2018 annual report, the following statement is included in explaining the primary risks facing the company. (This statement is an excerpt from a section of the annual report that is not included in Appendix A at the end of this textbook