Question: Tucker Technology is considering two alternative

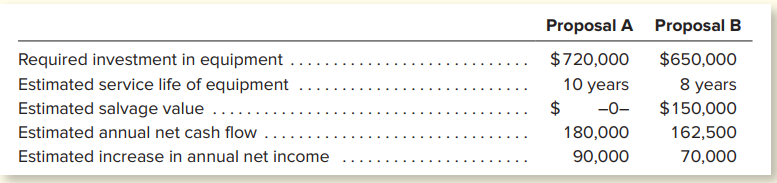

Tucker Technology is considering two alternative proposals for modernizing its production facilities. To provide a basis for selection, the cost accounting department has developed the following data regarding the expected annual operating results for the two proposals. Items in addition to depreciation may have attributed to differences in the estimated annual cash flow and net income figures shown below.

Instructions:

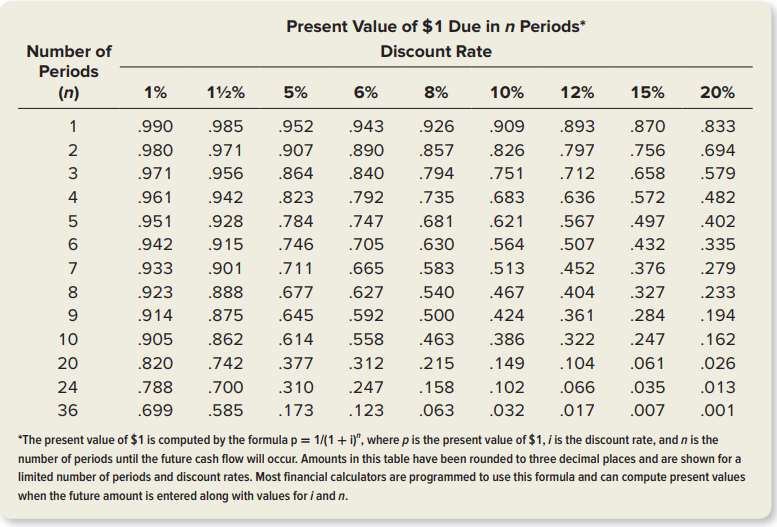

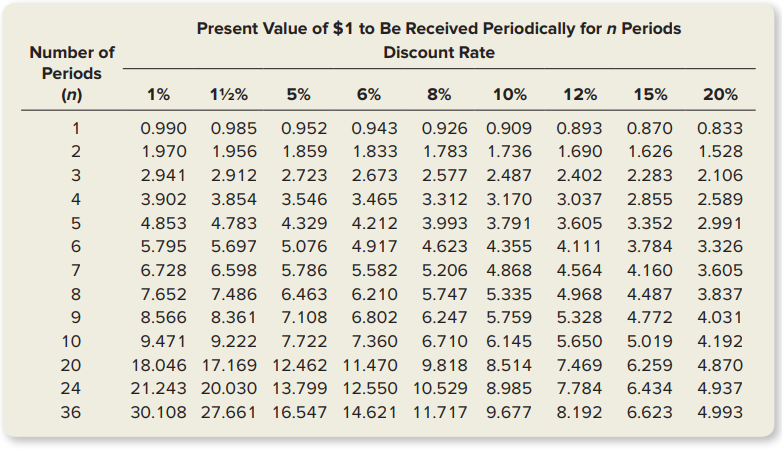

a. For each proposal, compute the (1) payback period, (2) return on average investment, and (3) net present value, discounted at an annual rate of 15 percent. (Round the return on investment to the nearest tenth of a percent.) Use Exhibits 26–3 and 26–4 where necessary.

b. On the basis of your analysis in part a, state which proposal you would recommend and explain the reasons for your choice.

> Foding Corporation has supplied the following information obtained from its standard cost system in May. Instructions: a. Determine the actual quantity of materials purchased and used in production during May. b. Determine the standard quantity of mater

> On March 31, 2021, Gardner Corporation received authorization to issue $50,000 of 9 percent, 30-year bonds payable. The bonds pay interest on March 31 and September 30. The entire issue was dated March 31, 2021, but the bonds were not issued until April

> Is the cost of disposing of hazardous waste materials resulting from factory operations a product cost or a period cost? Explain.

> Thompson Plumbing Inc. is a wholesaler of plumbing accessories. Thompson Plumbing began operations in September of the current year and engaged in the following transactions during September and October of this year. Thompson Plumbing uses a perpetual in

> In a process costing system that uses a FIFO cost flow assumption, how is the number of units started and completed during the period computed?

> Year after year two huge supermarket chains—Publix Super Markets, Inc., and Safeway, Inc.— consistently report gross profit rates between 26 percent and 29 percent. Each uses a sophisticated perpetual inventory system to account for billions of dollars i

> What is the difference between a sunk cost and an out-of pocket cost?

> Assuming no change in the expected amount of future cash flows, what factors may cause the present value of a financial instrument to change? Explain fully

> Briefly explain the relationships between present value and (a) the length of time until the future cash flow occurs, and (b) the discount rate used in determining present value

> What does book value per share of common stock represent? Does it represent the amount common stockholders would receive in the event of liquidation of the corporation? Explain briefly.

> Percale Farms raises marine fish for sale in the aquarium trade. Each year, Percale obtains a batch of approximately one million eggs from a local supplier. Percale’s manager is trying to decide whether to use the farm’s facilities to raise Maroon Clownf

> Why would a company use multiple cost accounting systems?

> Define the term activity base.

> Frost, Inc., acquired land by issuing $770,000 of capital stock. No cash changed hands in this transaction. Will the transaction be included in the company’s statement of cash flows? Explain.

> Tots-To-Go, Inc., has two divisions—the seat division and the stroller division. The seat division supplies the seat frames used by the stroller division to make its strollers. The stroller division produces approximately 10,000 strollers for young child

> Kendahl Plastics Corporation contracts with NASA to manufacture component parts used in commedications satellites. NASA reimburses Kendahl on the basis of the actual manufacturing costs it incurs, plus a fixed percentage. Prior to being awarded a contrac

> Briefly describe the rationale for using a cost flow assumption, rather than the specific identification method, to value an inventory

> With a group of two or three students, choose a publicly traded global company that you think you might want to invest in sometime in the future. Use the Internet or annual report data to answer the following questions. a. In which geographical regions d

> Early in 2018, Sear Foss, Inc., was organized with authorization to issue 2,000 shares of $100 par value preferred stock and 300,000 shares of $1 par value common stock. Five hundred shares of the preferred stock were issued at par, and 80,000 shares of

> How do cash effects differ among out-of-pocket costs, sunk costs, and opportunity costs?

> A recent balance sheet of Denver Tours is provided as follows. Other information provided by the company is as follows Compute and discuss briefly the significance of the following measures as they relate to Denver Tours. a. Net income percentage in c

> An American company is considering entering into a joint venture with a Korean firm. Describe what cultural differences each party should consider.

> Wells Enterprises manufactures a component that is processed successively by Department I and Department II. Manufacturing overhead is applied to units produced at the following budget costs. These budgeted overhead costs per unit are based on the norma

> General Electric Company has had its financial ups and downs. Recently, the CFO for General Electric helped turn its problems around by analyzing the amount of value each product was providing to the company’s bottom line. The analysis ultimately determi

> The Ski Factory provided the following information at December 31, year 1. Marketable Securities The company invested $52,000 in a portfolio of marketable securities on December 22, year 1. The portfolio’s market value on December 31,

> A financial analyst notes that Collier Corporation’s earnings per share have been rising steadily for the past five years. The analyst expects the company’s net income to continue to increase at the same rate as in the past. In forecasting future basic e

> Taylor & Malone is a law firm. Would the concepts of job order costing be appropriate for this type of service business? Explain

> The common stock of Fido Corporation was trading at $45 per share on October 15 of the previous year. A year later, on October 15 of the current year, it was trading at $80 per share. On this date, Fido’s board of directors decided to split the company’s

> Xerox Company applies manufacturing overhead on the basis of machine-hours using a predetermined overhead rate. At the end of the current year, the Manufacturing Overhead account has a credit balance. What are the possible explanations for this? What dis

> Is management accounting information developed in conformity with generally accepted accounting principles or some other set of prescribed standards? Explain.

> At the beginning of the year, Albers, Inc., has total stockholders’ equity of $840,000 and 40,000outstanding shares of a single class of capital stock. During the year, the corporation completes thefollowing transactions affecting its s

> Mentor Company sells kitchen appliances to contractors to install in newly constructed houses. Mentor sold appliances to a single contractor for ten homes at a total price of $150,000. Mentor extends the manufacturer’s warrants for one year beyond the ma

> Provide an example showing how the following environmental forces affect accounting Practices. a. Political and legal systems. b. Economic systems. c. Culture. d. Technology and infrastructure.

> Describe how activity-based costing can improve overhead cost allocations in companies that produce diverse product lines.

> Sea Travel sells motor boats. One of Sea Travel’s most popular models is the Wing. During the current year, Sea Travel purchased 12 Wings at the following costs. On April 28, Sea Travel sold five Wings to the Jack Sport racing team. Th

> Eastrise Corporation has two divisions—the motor division and the mower division. The motor division supplies the motors used by the mower division. The mower division produces approximately 10,000 mowers annually. Thus, it receives 10,000 motors from th

> What is the International Accounting Standards Board? Why has the board been unable to obtain uniform global application of its standards?

> Why is the use of a single activity base inappropriate for some companies?

> Six events relating to liabilities follow. a. Paid the liability for interest payable accrued at the end of the last accounting period. b. Made the current monthly payment on a 12-month installment note payable, including interest and a partial repayme

> When Torretti Company began business on August 1, it purchased a one-year fire insurance policy and debited the entire cost of $7,200 to Unexpired Insurance. Torretti adjusts its accounts at the end of each month and closes its books at the end of the ye

> Why might the unit cost of those items started and completed during the period differ from the unit cost of all items completed and transferred during the period?

> What is meant by the year-end cutoff of transactions? If merchandise in transit at year-end is material in dollar amount, what determines whether these goods should be included in the inventory of the buyer or the seller? Explain

> Haywood, Inc., purchased a truck to use for deliveries and is attempting to determine how much depreciation expense would be recognized under three different methods. The truck cost $24,000and is expected to have a value of $6,000 at the end of its 6-yea

> Giant Chef Equipment Company is organized into two divisions—commercial sales and home products. During June, sales for the commercial sales division totaled $1,500,000, and its contribution margin ratio averaged 34 percent. Sales generated by the home p

> Kelp Company produces three joint products from seaweed. At the split-off point, three basic products emerge: Sea Tea, Sea Paste, and Sea Powder. Each of these products can either be sold at the split-off point or be processed further. If they are proces

> Moffett Company earned a 8 percent return on its total assets. Current liabilities are 5 percent of total assets. Longterm bonds carrying a 5.5 percent coupon rate are equal to 30 percent of total assets. There is no preferred stock. Is this application

> Bottom-Shelf Provisions uses standard costs in its process costing system. At the end of the current month, the following information is prepared by the company’s cost accountant The total standard cost per unit of finished product is

> A U.S.-based company, Global Products Inc., has wholly owned subsidiaries across the world. Global Products Inc. sells products linked to major holidays in each country. The president and board members of Global Products Inc. believe that the managers of

> This case is based on the statement of cash flows for Allison Corporation, illustrated in Exhibit 13–1. Use this statement to evaluate the company’s ability to continue paying the current level of dividends—$40,000 per year. The following information als

> Nashville Do-It-Yourself owns a chain of nine retail stores that sell building materials, hardware, and garden supplies. In early October, the company’s current ratio is 1.7 to 1. This is about normal for the company, but it is lower than the current rat

> A manufacturing firm has three inventory control accounts. Name each of the accounts, and describe briefly what the balance in each at the end of any accounting period represents.

> Compute the following ratios and comment on the trend you can observe from the limited two years of data you have available. a. Gross profit rate. b. Net income as a percentage of sales. c. Current ratio. Hal Holcomb reports the business and economic ne

> The following items were taken from the accounting records of Nevada Utility Company for the year ended December 31, 2021 (dollar amounts are in thousands). Information 1. The 10 percent bonds due in April 2022 will be refinanced in March 2023 through

> King Enterprises is a book wholesaler. King hired a new accounting clerk on January 1 of the current year. The new clerk does not understand accrual accounting and recorded the following transactions based on when cash receipts and disbursements changed

> In a recent annual report, Procter & Gamble reports that product-related inventories are primarily maintained on the FIFO method. Minor amounts of product inventories, including certain cosmetics, are maintained on the LIFO method. The spare parts invent

> At December 31, year 1, Westport Manufacturing Co. owned the following investments in the capital stock of publicly owned companies. Instructions: a. Illustrate the presentation of marketable securities and the unrealized holding gain or loss in Westp

> Bring Company’s inventory is subject to shrinkage via evaporation. At the end of the current financial reporting period, the company’s inventory had a cost of $100,000. Management estimates that evaporation has resulte

> Locate the table titled “Selected Financial Data” in the Home Depot Financial Information in Appendix A. Assume Home Depot identifies each store as a profit center. Identify the categories of information in the “Store Data” section of the table that woul

> Assume that you will have a 10-year, $10,000 loan to repay when you graduate from college next month. The loan, plus 8 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $1,490 each, beginning one year after you g

> Budgets are essential for the successful operation of an organization. Finding the resources to implement budget goals requires extensive use of human resources. How managers perceive their roles in the budgeting process is important to the successful an

> A recent balance sheet of Sweet Tooth, Inc., included the following items, among others. (Dollar amounts are stated in thousands.) The company also reported total assets of $353,816 thousand, total liabilities of $81,630 thousand, and a return on total

> Indicate whether each of the companies or individuals in the following independent cases would benefit more from a strong U.S. dollar (relatively low foreign exchange rates) or a weak U.S. dollar (relatively high foreign exchange rates). Provide a brief

> Monster Toys is considering a new toy monster called Garga. Annual sales of Garga are estimated at 100,000 units at a price of $8 per unit. Variable manufacturing costs are estimated at $3 per unit, incremental fixed manufacturing costs (excluding deprec

> Harvey Corporation produces several joint products from common materials and shared production processes. Why are costs incurred up to the split-off point not relevant in deciding which products Harvey sells at the split-off point and which products it p

> These selected statistics are from recent annual reports of two well-known retailers. a. Explain the significance of each of these three measures. b. Evaluate briefly the performance of each company on the basis of these three measures

> Identify the variances from standard cost that are generally computed for direct materials, direct labor, and manufacturing overhead.

> Heritage Furniture Co. uses a standard cost system. One of the company’s most popular products is an oak entertainment center that looks like an old icebox but houses a television, stereo, or other electronic components. The per-unit st

> Blind River, Inc., recently hired Neil Young as its bookkeeper. Mr. Young is somewhat inexperienced and has made numerous errors recording daily business transactions. Indicate the effects of the errors described as follows on each of the financial state

> Briefly state the purposes of a statement of cash flows.

> Sci-Fi Labs is a publicly owned company with several issues of capital stock outstanding. Over the past decade, the company has consistently earned modest profits and has increased its common stock dividend annually by 5 or 10 cents per share. Recently t

> Define the term free cash flow. Explain the significance of this measurement to (1) short-term creditors, (2) long-term editors, (3) stockholders, and (4) management.

> Tech Process, Inc., manufactures a variety of computer peripherals, such as tape drives and printers. Listed are five events that occurred during the current year.1. Declared a $1.00 per share cash dividend.2. Paid the cash dividend.3. Purchased 1,000 sh

> A recent annual report of Lowe’s indicates that property is capitalized at cost if it is expected to yield future benefits and has an original useful life that exceeds one year. Cost includes all applicable expenditures to deliver and install the propert

> Georgia Woods, Inc., manufactures furniture to customers’ specifications and uses job order cosign. A predetermined overhead rate is used in applying manufacturing overhead to individual jobs. In Department One, overhead is applied on t

> Selected items from successive annual reports of Middlebrook, Inc., appear as follows. Dividends of $16,000 were declared and paid in year 2. Compute the following: a. Current ratio for year 2 and year 1. b. Debt ratio for year 2 and year 1. c. Earnings

> Alexander, Inc., declared and distributed a 10 percent stock dividend on its 700,000 shares of outstanding $5 par value common stock when the stock was selling for $12 per share. The outstanding shares had originally been sold at $8 per share. The balanc

> Timberlake Corporation is a publicly owned company. The following information is taken from a recent balance sheet. Dollar amounts (except for per-share amounts) are stated in thousands Instructions: From this information, compute answers to the follow

> Dyelot Industries manufactures dyes and uses cost standards. The dye is produced in 1,000 pound batches; the normal level of production is 500 batches of dye per month. The standard costs per batch are as follows. Instructions: You have been engaged to

> Anton Company manufactures wooden magazine stands. An accountant for Anton just completed the variance report for the current month. After printing the report, his computer’s hard drive crashed, effectively destroying most of the actual

> Briefly distinguish between management and financial accounting information in terms of (a) the intended users of the information, and (b) the purpose of the information.

> In the Home Depot 2018 annual report, the following statement is included in explaining the primary risks facing the company. (This statement is an excerpt from a section of the annual report that is not included in Appendix A at the end of this textbook

> The following income statement was prepared by a new and inexperienced employee in theaccounting department of Dexter, Inc., a business organized as a corporation Instructions:a. Prepare a corrected income statement for the year ended December 31, 2021,

> On August 1, year 1, Hampton Construction received a 4.5 percent, 6-month note receivable from Dusty Roads, one of Hampton Construction’s problem credit customers. Roads had owed $43,200 on an outstanding account receivable. The note re

> A recent balance sheet of Sweet as Sugar included the following items, among others. (Dollar amounts are stated in thousands.) The company also reported total assets of $600,000, total liabilities of $90,000, and a return on total assets of 20 percent.

> Many companies have established business codes of conduct outlining procedures that enable employees, suppliers, customers, and members of the Board of Directors to report illegal and or unethical circumstances. Coca-Cola Company provides a Code of Busin

> Explain the meaning of an impairment of an asset. Provide several examples. What accounting event should occur when an asset has become substantially impaired?

> You’ve just read in The Wall Street Journal that the U.S. dollar has strengthened relative to the euro. All else equal, what would you expect to happen to the quantity of Italian leather jackets sold in the United States? Why?

> The following journal entry summarizes for the current year the income tax expense of Sophie’s Software Warehouse. a. Briefly explain the term deferred income tax. b. What is the amount of income tax that the company has paid or expec

> Starting with the most general and moving to the more specific, what are the three primary objectives of financial reporting?

> At the beginning of the year, Gannon, Inc., had 100,000 shares of common stock outstanding. During the current year, the company distributed a 10 percent stock dividend and subsequently paid a $0.50 per share cash dividend. Calculate the number of shares

> The following information has been excerpted from the statement of stockholders’ equity includedin a recent annual report of Thompson Supply Company. (Dollar figures are in millions.) Instructions:Use the information about Thompson Sup

> Arietta Inc. produces a popular brand of air conditioner that is backed by a five-year warranty. In year 1, Arietta began implementing a total quality management program that has resulted in significant changes in its cost of quality. Listed as follows i

> The following is a series of related transactions between Isogon Shoes, a shoe wholesaler, and Sole Mates, a chain of retail shoe stores. Instructions: a. Record this series of transactions in the general journal of Isogon Shoes. (The company records s

> What factors should be considered in drawing up an agreement as to the way in which income shall be shared by two or more partners

> Distinguish between trend percentages and component percentages. Which would be better suited for analyzing the change in sales over several years?

> The following are responsibility income statements for Sotheby, Inc., for the month of June. Instructions: a. The company plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $8,000 per month and i

> What factors should be considered when comparing the net income figure of a partnership to that of a corporation of similar size?

> Under what circumstances might a company have a high p/e ratio even when investors are not optimistic about the company’s future prospects?

> Meager Mining, Inc., has just discovered two new mining sites for iron ore. Geologists and engineers have come up with the estimates on the following page regarding costs and ore yields if the mines are opened. Meier’s owners currently

> Stevens Manufacturing Company obtained authorization to issue 10-year bonds with a face value of $5 million. The bonds are dated June 1, 2021, and have a contract rate of interest of 6 percent. They pay interest on December 1 and June 1. The bonds are is