Question: Bonanza Trading Stamps, Inc., was formed early

Bonanza Trading Stamps, Inc., was formed early this year to sell trading stamps throughout the Southwest to retailers, who distribute the stamps free to their customers. Books for accumulating the stamps and catalogs illustrating the merchandise for which the stamps may be exchanged are given free to retailers for distribution to stamp recipients. Centers with inventories of merchandise premiums have been established for redemption of the stamps. Retailers may not return unused stamps to Bonanza.

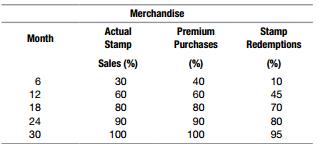

The following schedule expresses Bonanza’s expectations of the percentages of a normal month’s activity that will be attained. For this purpose, a normal month’s activity is defined as the level of operations expected when expansion of activities ceases or tapers off to a stable rate. Bonanza expects to attain this level in the third year and to average $2 million per month in stamp sales throughout the third year.

Required:

a. Discuss the factors to be considered in determining when revenue should be recognized in measuring the income of a business enterprise.

b. Discuss the accounting alternatives that should be considered by Bonanza Trading Stamps for the recognition of its revenues and related expenses.

c. For each accounting alternative discussed in (b), give balance sheet accounts that should be used and indicate how each account should be classified.

Answer:

a. Income results from economic activity in which one entity furnishes goods or services to another. To warrant revenue recognition, the earning process must be substantially complete and there must be realization--a change in assets that is capable of being objectively measured. Normally this involves an arm's length exchange transaction with a party external to the entity. The existence and terms of the transaction may be defined by operation of law, by established trade practice or may be stipulated in a contract.

Events that give rise to revenue recognition are: the completion of a sale; the performance of a service; the progress of a long-term construction project, as in shipbuilding; and the production of a standard interchangeable good (such as a precious metal or an agricultural product) which has an immediate market, a determinable market value, and only minor costs of marketing. The passing of time may also be the event that establishes the recognition of revenues, as in the case of interest or rental revenue.

As a practical consideration, there must be a reasonable degree of certainty in measuring the amount of revenue. Problems of measurement may arise in estimating the degree of completion of a contract, the net realizable value of a receivable, or the value of a nonmonetary asset received in an exchange transaction. In some cases, while the revenue may be readily measured, it may be impossible to reasonably estimate the related expenses. In such instances revenue recognition must be deferred until the matching process can be completed.

b. Bonanza, in effect, is a merchandising firm which collects cash (for stamps) far in advance of furnishing the goods. In addition, since the data indicates that about five percent of the stamps sold will never be redeemed, it also has revenue from this source unless the stamps escheat. Bonanza's revenues from these two sources could be recognized on one of three major bases. First, all revenue could be recognized when the stamps are sold--the sales basis or cash-collection basis if all sales are for cash. Secondly, amounts collected at the time stamps are sold could be treated as an advance (sometimes referred to as deferred or unearned revenue) until stamps are exchanged for the merchandise premiums at which time all of the revenue including that relating to the never-to-redeemed stamps could be recognized. Thirdly, some revenue could be recognized at the time of redemption--this treatment would be especially appropriate for approximately five percent of the total, the stamps that will never be redeemed. A modification of this basis would be to recognize the revenue from the never-to-be-redeemed stamps on a passageoftime basis.

The principal expense, merchandise premium costs, should be matched with the revenue. If all revenue is recognized when stamps are sold, and accrual of the cost of future premium redemptions would be necessary. In such a case, when stamp redemptions and related premium issuances occurred, the costs of the premiums would be charged to the accrued liability account. On the other hand, if stamp sales were treated as an advance, the deferred revenue would be recognized and the matching cost of the premiums issued would be recognized with the revenue at the time of redemption.

Under the third alternative, some predetermined portion, at least, of the revenue from the nevertoberedeemed stamps would be recognized when the stamps are sold, but the recognition of the merchandise premium expense would be deferred until time of redemption. Reasonable estimation is crucial to income determination. Under the first alternative it is necessary to estimate future costs of premium issuances well in advance of the actual occurrence. In the second case it is necessary to estimate the proportion of revenue which has already been earned on the basis of premium costs already incurred. It is a vital certainty that not all stamps sold will ultimately be presented for redemption. Such factors as the number of stamps required to fill a book, the types of customers who receive stamps, and the ease of exchanging stamp books for premiums will all affect the proportion of stamps actually redeemed in relation to the potential redemptions. The difference between the five percent initial estimate and the actual proportion of unredeemed stamps affects the accrual of a liability for redemption of stamps issued under the first method and the rate of transfer of revenue from the advances account under the second and third methods.

There will be other expenses aside from the costs of premiums issued but they should be relatively small after the initial promotion period and they should be accounted for under the usual principles which apply to accrualbasis accounting. Thus, premium catalogs printed but undistributed would ordinarily be treated as prepaid expenses; wages and salaries would be treated as expenses when incurred; depreciation, taxes, and similar expenses would be recognized in the usual manner.

c. Under all of the alternatives Bonanza's major asset (in terms of data given in the question) would be its inventory of premiums. Another inventory item, perhaps minor in amount, would be the cost of printing the stamps that were on hand awaiting sale to dealers. The major account with a credit balance would be either an estimated liability for cost of redeeming the outstanding stamps under the first alternative or an advance (deferred revenue) account under the second and third alternatives. In view of the nature of the operation, the inventory account(s) would be included in the current asset classification and the liability would be classified as current. The advances could be reported preferably as a current liability or possibly as deferred credit.

Transcribed Image Text:

Merchandise Actual Premium Stamp Redemptions Month Stamp Purchases Sales (%) (%) (%) 6 30 40 10 12 60 60 45 18 80 80 70 24 06 90 80 30 100 100 95

> Assume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.2 Return on assets (ROA) 4% Return on equity (ROE) 7% Calculate Haslam’s profit margin and l

> Ace Industries has current assets equal to $3 million. The company’s current ratio is 1.5, and its quick ratio is 1.0. What is the firm’s level of current liabilities? What is the firm’s level of inventories?

> Gardial & Son has an ROA of 12%, a 5% profit margin, and a return on equity equal to 20%. What is the company’s total assets turnover? What is the firm’s equity multiplier?

> Needham Pharmaceuticals has a profit margin of 3% and an equity multiplier of 2.0. Its sales are $100 million and it has total assets of $50 million. What is its ROE?

> Reno Revolvers has an EPS of $1.50, a cash flow per share of $3.00, and a price/cash flow ratio of 8.0. What is its P/E ratio?

> Winston Washers’s stock price is $75 per share. Winston has $10 billion in total assets. Its balance sheet shows $1 billion in current liabilities, $3 billion in long-term debt, and $6 billion in common equity. It has 800 million shares of common stock o

> Vigo Vacations has $200 million in total assets, $5 million in notes payable, and $25 million in long-term debt. What is the debt ratio?

> What is free cash flow? Why is it the most important measure of cash flow?

> Explain the difference between NOPAT and net income. Which is a better measure of the performance of a company’s operations?

> a. Multinational corporation b. Exchange rate; fixed exchange rate system; floating exchange rate c. Trade deficit; devaluation; revaluation d. Exchange rate risk; convertible currency; pegged exchange rate e. Interest rate parity; purchasing power parit

> If a “typical” firm reports $20 million of retained earnings on its balance sheet, can the firm definitely pay a $20 million cash dividend?

> Define each of the following terms: a. Annual report; balance sheet; income statement b. Common stockholders’ equity, or net worth; retained earnings c. Statement of stockholders’ equity; statement of cash flows d. Depreciation; amortization; EBITDA e

> If you were starting a business, what tax considerations might cause you to prefer to set it up as a proprietorship or a partnership rather than as a corporation?

> Define each of the following terms: a. Proprietorship; partnership; corporation b. Limited partnership; limited liability partnership; Professional Corporation c. Stockholder wealth maximization d. Production opportunities; time preferences for consumpti

> How do you think each of the following items would affect a company’s ability to attract new capital and the flotation costs involved in doing so? a. A decision of a privately held company to go public b. The increasing institutionalization of the “buy s

> The SEC attempts to protect investors who are purchasing newly issued securities by making sure that the information put out by a company and its investment banks is correct and is not misleading. However, the SEC does not provide an opinion about the re

> Define each of the following terms: a. Going public; new issue market; initial public offering (IPO) b. Public offering; private placement c. Venture capitalists; roadshow; spread d. Securities and Exchange Commission (SEC); registration statement; shelf

> Before entering a formal agreement, investment banks carefully investigate the companies whose securities they underwrite; this is especially true of the issues of firms going public for the first time. Because the banks do not themselves plan to hold th

> Define each of the following terms: a. Proxy; proxy fight; preemptive right; classified stock; founders’ shares b. Estimated value / market price / c. Required rate of return, / expected rate of return, / actual, or realized, rate of return, / d. Ca

> A bond that pays interest forever and has no maturity date is a perpetual bond, also called a perpetuity or a consol. In what respect is a perpetual bond similar to: (1) a no-growth common stock and (2) a share of preferred stock?

> Why might purchasing power parity fail to hold?

> A. Fethe Inc. is a custom manufacturer of guitars, mandolins, and other stringed instruments and is located near Knoxville, Tennessee. Fethe’s current value of operations, which is also its value of debt plus equity, is estimated to be $5 million. Fethe

> International Associates (IA) is about to commence operations as an international trading company. The firm will have book assets of $10 million, and it expects to earn a 16% return on these assets before taxes. However, because of certain tax arrangemen

> Schwarzentraub Industries’ expected free cash flow for the year is $500,000; in the future, free cash flow is expected to grow at a rate of 9%. The company currently has no debt, and its cost of equity is 13%. Its tax rate is 40%. (Hint: Use Equations 17

> Companies U and L are identical in every respect except that U is unlevered while L has $10 million of 5% bonds outstanding. Both firms have an EBIT of $2 million. Assume that all of the MM assumptions are met. a. Suppose that both firms are subject to

> Companies U and L are identical in every respect except that U is unlevered while L has $10 million of 5% bonds outstanding. Assume that: (1) all of the MM assumptions are met, (2) both firms are subject to a 40% federal-plus-state corporate tax rate,

> Companies U and L are identical in every respect except that U is unlevered while L has $10 million of 5% bonds outstanding. Assume that: (1) there are no corporate or personal taxes, (2) all of the other MM assumptions are met, (3) EBIT is $2 million,

> Air Tampa has just been incorporated, and its board of directors is grappling with the question of optimal capital structure. The company plans to offer commuter air services between Tampa and smaller surrounding cities. Jaxair has been around for a few

> An unlevered firm has a value of $800 million. An otherwise identical but levered firm has $60 million in debt at a 5% interest rate. Its cost of debt is 5% and its unlevered cost of equity is 11%. After Year 1, free cash flows and tax savings are expect

> An unlevered firm has a value of $600 million. An otherwise identical but levered firm has $240 million in debt. Under the Miller model, what is the value of the levered firm if the corporate tax rate is 34%, the personal tax rate on equity is 10%, and t

> Sheldon Corporation projects the following free cash flows (FCFs) and interest expenses for the next 3 years, after which FCF and interest expenses are expected to grow at a constant 7% rate. Sheldon’s unlevered cost of equity is 13% it

> Suppose that the exchange rate is 0.60 dollars per Swiss franc. If the franc appreciates 10% against the dollar, how many francs would a dollar buy tomorrow?

> What is an exchange rate? What is the difference between direct and indirect rates? What is a cross rate?

> On October 1, 2017, Harvey Company adopted a stock-option plan that granted options to key executives to purchase 30,000 shares of the company’s $10 par value common stock. The options were granted on January 2, 2018, and were exercisable 2 years after t

> The following information is available for the Albany Corporation for the year 2017: Actual and expected return on plan assets ……………………. $12,000 Benefits paid to retirees ……………………………………………… $40,000 Contributions to the fund ……………………………………………. $95,000 In

> George Company purchased land for use as its corporate headquarters. A small factory that was on the land when it was purchased was torn down, and before the new building’s foundation could be constructed, a substantial amount of rock had to be blasted a

> A company may acquire plant assets (among other ways) for cash, on a deferred payment plan, by exchanging other assets, or by a combination of these ways. Required: a. Identify six costs that should be capitalized as the cost of the land. For your answer

> Property, plant, and equipment (plant assets) generally represent a material portion of the total assets of most companies. Accounting for the acquisition and use of such assets is therefore an important part of the financial reporting process. Required:

> Your client found three suitable sites, each having certain unique advantages, for a new plant. To thoroughly investigate the advantages and disadvantages of each site, one‐year options were purchased for an amount equal to 5 percent of the contract pric

> Jay Manufacturing, Inc., began operations five years ago producing the probo, a new type of instrument it hoped to sell to doctors, dentists, and hospitals. The demand for probos far exceeded initial expectations, and the company was unable to produce en

> Depreciation continues to be one of the most controversial, difficult, and important problem areas in accounting. Required: a. Explain the conventional accounting concept of depreciation accounting. b. Discuss its conceptual merit with respect to i. The

> On October 10, 2016, Mason Engineering Company completed negotiations on a contract for the purchase of new equipment. Under the terms of the agreement, the equipment may be purchased now or Mason may wait until January 10, 2017, to make the purchase. Th

> The City of Martinsville donated land to Essex Company. The fair value of the land was $100,000. The land had cost the city $45,000. Required: a. Describe the current accounting treatment for the land. Include in your answer the amount at which the land

> The concept of conservatism has been influential in the development of accounting theory and practice. A major effect of conservatism is that accountants tend to recognize losses, but not gains. For example, when the value of an asset is impaired, it is

> The accounting profession has employed the matching concept to determine what to report in the income statement and to determine how to measure items reported in the income statement. This concept implies that expenses should be measured directly, and th

> Calculating the costs of pension plans, requires the understanding of certain terms. The components of pension costs that the terms represent must be dealt with appropriately if generally accepted accounting principles are to be reflected in the financia

> The FASB has issued SFAC No. 5, “Recognition and Measurement in Financial Statements of Business Enterprises.” In general, this statement sets recognition criteria and guidance for what information should be incorporated into financial statements and whe

> In 2013 Airbus announced a contract to deliver 50 A380 airplanes to Emirates for $20 billion to be delivered between 2016 and 2018. Required: Outline the five‐step revenue recognition process for this transaction.

> You are requested to deliver your auditor’s report personally to the board of directors of Sebal Manufacturing Corporation and answer questions posed about the financial statements. While reading the statements, one director asks, “What are the precise m

> Economic income is considered to be a better predictor of future cash flows than accounting income is. A technique used by securities analysts to determine the degree of correlation between a firm’s accounting earnings and its true economic income is qua

> Progresso Corporation, one of your new audit clients, has not reported EPS data in its annual reports to stockholders in the past. The president requested that you furnish information about the reporting of EPS data in the current year’s annual report in

> It is important in accounting theory to be able to distinguish the types of accounting changes. Required: a. If a public company desires to change from the sum‐of‐year’s‐ digits depreciation method to the straight‐line method for its fixed assets, what t

> Discuss how a company’s primary financial statements are useful to potential investors who are trying to decide whether to buy stock in the company. Support your discussion by citing objectives outlined in the Conceptual Framework.

> The motion picture industry has undergone significant changes since the 1960s. Originally, companies such as Paramount Pictures had to rely solely on domestic and foreign screenings of their movies for their revenues. The birth of the television industry

> Many business organizations have been concerned with providing for the retirement of employees since the end of WWII. This concern has resulted in the establishment of private pension plans in many companies. The substantial growth of these plans, both

> Earnings as defined in SFAC No. 5 are consistent with the current operating performance concept of income. Comprehensive income is consistent with the all‐inclusive concept of income. Required: a. Discuss the current operating performance concept of inco

> Morgan Company grows various crops and then processes them for sale to retailers. Morgan has changed its depreciation method for its processing equipment from the double‐declining‐balance method to the straight‐line method effective January 1 of this yea

> Sometimes a business entity changes its method of accounting for certain items. The change may be classified as a change in accounting principle, a change in accounting estimate, or a change in reporting entity. Following are three independent, unrelated

> APB Opinion No. 20 was concerned with accounting changes. SFAS No. 154 (see FASB ASC 250) changes the accounting treatment for some accounting changes. Required: a. Define, discuss, and illustrate each of the following in such a way that one can be disti

> Recent pronouncements of the FASB indicate that the FASB is moving away from historical cost accounting toward the use of current, or fair, value. In your debate on this issue, support your position with references to the conceptual framework and to conc

> FASB ASC 320 (generally effective until 2018) requires companies to assign their portfolio of investment securities into 1. Trading securities 2. Securities available for sale 3. Held‐to‐maturity securities Required: a. Define each of these categories of

> Short‐term deferrals (prepaids and unearned revenues) are classified as current assets and current liabilities. As such, they are included in working capital. Required: a. Some argue that prepaids will not generate cash and hence are not liquid assets. i

> The theoretical valuation of receivables is the present value of expected future cash flows. However, trade receivables are not discounted owing to materiality considerations; hence, their net realizable value is the closest practical approximation to th

> Specific identification is sometimes said to be the ideal method for assigning cost to inventory and to cost of goods sold. Required: a. List the arguments for and against the foregoing statement. b. FIFO, weighted average, and LIFO methods are often use

> Duffner Corporation is a medium-sized manufacturer of paperboard containers and boxes. The corporation sponsors a noncontributory, defined benefit pension plan that covers its 250 employees. Sid Caesar has recently been hired as president of Duffner Corp

> At the end of the first year of operations, Key Company had a current equity securities portfolio classified as available‐for‐sale securities with a cost of $500,000 and a fair value of $550,000. At the end of its second year of operations, Key had a cur

> On December 31, 2016, Carme Company had significant amounts of accounts receivables as a result of credit sales to its customers. Carme uses the allowance method based on credit sales to estimate bad debts. Based on experience, 1 percent of credit sales

> Accountants generally follow the lower of cost or market (LCM) basis of inventory valuations. Required: a. Define cost as applied to the valuation of inventories. b. Define market as applied to the valuation of inventories. c. Why are inventories valued

> Anth Company has significant amounts of trade accounts receivable. Anth uses the allowance method to estimate bad debts. During the year, some specific accounts were written off as uncollectible, and some that were previously written off as uncollectible

> Steel Company, a wholesaler that has been in business for two years, purchases its inventories from various suppliers. During the two years, each purchase has been at a lower price than the previous purchase. Steel uses the lower of FIFO cost or market m

> Cost for inventory purposes should be determined by the inventory cost‐flow method most clearly reflecting periodic income. Required: a. Describe the fundamental cost‐flow assumptions of the average cost, FIFO, and LIFO inventory cost‐flow methods. b. Di

> Entre Preneur found a site for his new haute cuisine restaurant. The site has a vacant gasoline station. He purchased the property for $900,000 and had the station demolished at a cost of $30,000. A government regulation required that he spend $40,000 to

> In the following debate, take the position of an investor who wants to evaluate the liquidity of a company. Team Debate: Team 1: Argue for including inventory, pre paids, and deferrals in working capital. Team 2: Argue against including inventory, prepa

> MVP Corp uses LIFO to value its inventory. The 2016 inventory records disclose the following: On December 26, 2016, the company had a special, nonrecurring opportunity to purchase 40,000 units at $17 per unit. The purchase can be made and the units deliv

> The statement of cash flows is intended to provide information about the investing, financing, and operating activities of an enterprise during an accounting period. In a statement of cash flows, cash inflows and outflows for interest expense, interest r

> What is the total cash the Ayer Corporation would receive if it issues 1,000 shares of $.02 par value per share common stock at a $9 market price per share? Issue 2 The Waltham Corporation is authorized to issue a total of 10,000 shares of $.10 par value

> The recent emphasis on capital maintenance concepts of income as seen in the FASB’s support for “comprehensive income” implies that balance sheet measurement should determine measures of income. That is, accrual accounting is to focus on measurements in

> Presenting information on cash flows has become an important part of financial reporting. Required: a. What goals are attempted to be accomplished by the presentation of cash‐flow information to investors? b. Discuss the following terms as they relate t

> The measurement of assets and liabilities on the balance sheet was previously a secondary goal to income determination. As a result, various measurement techniques arose to disclose assets and liabilities. Required: Discuss the various measurement techni

> The argument among accountants and financial statement users over the proper valuation procedures for assets and liabilities resulted in the release of SFAS No. 115 (see FASB ASC 320‐19). The statement requires current‐value disclosures for all investmen

> The following financial statement was prepared by employees of your client, Linus Construction Company. The statement is not accompanied by footnotes, but you have discovered the following: • The average completion period for the compan

> SFAS No. 95 (see FASB ASC 230) requires companies to prepare a statement of cash flows. Required: Describe how the FASB’s Conceptual Framework eventually led to the requirement that companies issue statements of cash flows.

> The FASB requires that financial statements report comprehensive income. Team Debate: Team 1: Defend comprehensive income. Your defense should relate to the conceptual framework and to the concept of capital maintenance where appropriate. Team 2: Oppose

> The all‐inclusive and current operating performance concepts of income represent opposing views regarding the inclusion of items to be reported in earnings on the income statement. Team Debate: Team 1: Defend the all‐inclusive concept of income. Team 2:

> According to SFAS No. 34, interest on self‐constructed assets should be capitalized. Team Debate: Team 1: Present arguments in favor of capitalizing interest. Tie your arguments to the concepts and definitions found in the conceptual framework. Team 2: C

> Under current U.S. GAAP, assets that have been donated to a company are recorded at fair value. Team Debate: Team 1: Argue that donated assets should not be reported in a company’s balance sheet. Base your arguments on the conceptual framework. You might

> The transactions listed below relate to Rice Inc. You are to assume that on the date on which each of the transactions occurred, the corporation's accounts showed only common stock ($100 par) outstanding, a current ratio of 2.7:1, and a substantial net i

> On January 1, 2017, Bostock Corporation lends Locker Company $100,000 at 7% interest with the principal payable on December 31, 2020. Interest is payable each December 31. The loan is not secured by collateral subject to foreclosure in the event Locker C

> On June 30, 2016, your client, Steinfield Company, was granted two patents covering plastic cartons that it had been producing and marketing profitably for the past 3 years. One patent covers the manufacturing process, and the other covers the related pr

> Furyk Co. is in the process of developing a revolutionary new product. A new division of the company was formed to develop, manufacture, and market this new product. As of year-end (December 31, 2017), the new product has not been manufactured for resale

> Garcia Co. has the following available-for-sale securities outstanding on December 31, 2016 (its first year of operations). Cost Fair Value Rossi Corp. Stock $20,000 $19,000 Barker Company Stock 9,500 8,800 Boliva Company Stock 20,000

> Newatit Company spent a substantial amount of money organizing and getting ready for business. These costs are considered organization costs. Required: a. Does the incurrence of organization costs meet the definition of assets found in the Conceptual Fra

> Fowler Corporation is a public company with a reporting unit operating in the telecommunications industry. In its qualitative screen, Fowler Corporation determined the following: • The fair value of the reporting unit in the prior year’s quantitative an

> SFAS No. 115 (see FASB ASC 320) was issued in response to concerns by regulators and others regarding the recognition and measurement of investments in debt securities. For the following debate, you may consider tying your arguments to theories of capita

> Under current U.S. GAAP, companies may opt to report financial assets and liabilities at fair value. Team Debate: Team 1: Present arguments in favor of the fair value option for financial assets and liabilities. Team 2: Present arguments against the fair

> Under current U.S. GAAP, goodwill is recorded when purchased. For the following debate, you may consider tying your arguments to theories of capital maintenance and/or the conceptual framework. Team Debate: Team 1: Present arguments in favor of the capit

> The use of derivative financial instruments by companies to manage risk or speculate has increased during the past several years. However, using derivative financial instruments also involves exposure to various types of risk. Required: Define the follow

> ASU 2013-07 required to use the requires organizations to use the liquidation basis for preparing financial statements when liquidation is “imminent.” Required: a. How is liquidation defined in this release? b. When is liquidation considered imminent c.

> Smyle Kaufman Company recently issued bonds with associated bond issue costs of $4.5 million. Required: How should these bond issue costs be accounted for and classified in Kaufman’s financial statements?

> Part I. The appropriate method of amortizing a premium or discount on issuance of bonds is the effective–interest method. Required: a. What is the effective-interest method of amortization and how is it different from and similar to the straight–line