Question: Botburry Sheet Company offers all employees a

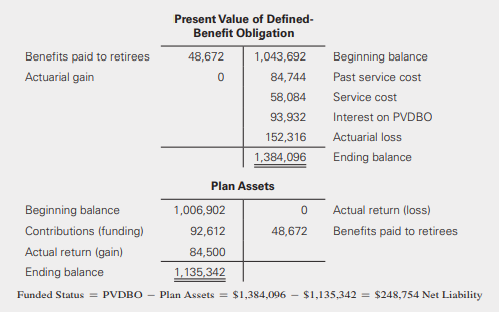

Botburry Sheet Company offers all employees a defined-benefit pension plan. At the end of the current year, Boxberry’s pension plan trustee reported the following information regarding the changes in the PVDBO, the plan assets at fair value, and the funded status of the plan.

The beginning balance in the accumulated other comprehensive income account was $18,252 due to accumulated net actuarial losses. Botburry Sheet reports service cost as an operating expense and all other pension expenses as non-operating. The expected rate of return is 9%.

Required:

a. Compute the total pension cost for the current year.

b. Compute pension-related other comprehensive income for the current year

> Are firms required to test goodwill acquired in a business combination for impairment on an annual basis? Explain.

> After recording an impairment of an indefinite-life operating asset, can a firm recover the impairment loss in subsequent accounting periods? Explain.

> When measuring an impairment loss for a long-term operating asset, must firms determine the fair value using a discounted cash-flow model? Explain.

> Do firms follow the same steps for impairment testing of finite- and indefinite-life intangible assets? Explain

> Braylon Brands, Inc. borrowed $2,000,000 from Home Town Bank. The note payable had a term of 5 years and carried a 6% coupon interest. Because of an inadequate credit score, Braylon Brands agreed to several restrictive debt covenants. The debt agreement

> Events and circumstances indicate the need for Lenny Schaeffer Bakeries to undertake quantitative testing of goodwill. The current carrying value of the reported goodwill for the reporting unit is $800,000. The goodwill pertains to the reporting unit. Th

> Peter Gordon, Ltd., an IFRS reporter, is in the process of assessing the valuation of its intangible assets. At the end of the current year, management reported the following intangible assets: The firm acquired the franchise 2 years ago and estimates t

> Use the same information from P12-1 with three modifications: • Chrispian Cookies, Inc. is an IFRS reporter. • Similar baking equipment could be sold for $5,100,000. • Chrispian estimates that costs t

> Green River Company acquired 100% of the voting stock of the AutoStyle Group on January 1 of the current year for a total acquisition cost of $250,000. The trial balance of AutoStyle on the date of acquisition follows. The AutoStyle Group acquired the i

> PCG, Ltd. is in the process of assessing the valuation of its intangible assets. At the end of the current year, management reported the following intangible assets. The firm acquired the franchise 2 years ago and estimates that it has a 5-year useful l

> Repeat E16-23 assuming that Regal Inc. reports under IFRS. Data from E16-23: Regal Inc., a U.S. GAAP reporter, holds an equity investment with a carrying value of $107,250. This investment is not publicly traded and Regal has elected to carry it at adju

> Cupcakes-R-Us, Inc. is reviewing all available information regarding the future use of its baking equipment, which it intends to use for the foreseeable future. The company has observed a decline in the demand for its products. The information also indic

> Chrispian Cookies, Inc. is reviewing all available information regarding the future use of its baking equipment, which it intends to use for the foreseeable future. The information indicates that this equipment may be obsolete and could be impaired. Chri

> Orlando Incorporated provided the following comparative balance sheets and the results of operations for the current year. Additional Information: • Orlando sold available-for-sale investments that had been acquired for the cost of $74

> Prepare the cash flow statement for Norwich Manufacturing, Inc. under the direct method using the information provided in P22-7. Provide all required disclosures. Data from P22-7:

> Norwich Manufacturing, Inc. provided you with the following comparative balance sheets and income statement. Additional Information: • Norwich sold available-for-sale investments that had been acquired for $55,000 at a gain of $40,500.

> Using the information provided in BE14-30, prepare the journal entry required on December 31, 2017, to reflect the refinancing agreement under IFRS. Data from BE14-30: U.S. GAAP. Saxon Woods, Inc. has a fiscal year-end of December 31, 2017. The company

> Using the data provided in P22-5, prepare the statement of cash flows for The Khan Group using the direct method. Provide all required disclosures. Data from P22-5:

> The Khan Group provided its balance sheet and income statement as of December 31 of the current year. Additional Information: • The company classifies its current investments as trading securities. During the current year, it sold tradi

> Repeat the requirements in P22-3 using the indirect method. Data from P22-3:

> Regal Inc., a U.S. GAAP reporter, holds an equity investment with a carrying value of $107,250. This investment is not publicly traded and Regal has elected to carry it at adjusted cost. At December 31, 2016, the fair value of the investment is $98,000,

> Westhoff, Incorporated provided the following balance sheets and income statement for the current year. Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to selling, general,

> Repeat the requirements of P22-1 under the indirect method. Data from P22-1:

> Using the information provided in P22-13, prepare the cash flow statement and all required disclosures for American Safety Products using the direct method. Data from P22-13:

> American Safety Products, Inc. provided the following comparative balance sheets and income statement for the current year. Additional Information: • American Safety Products sold trading securities at a loss. • The

> Prepare the cash flow statement and all required disclosures for Barry’s Clothing Stores, Inc. from P22-11 using the direct method. Data from P22-11:

> Barry’s Clothing Stores, Inc. released its annual report for the current year and included the following comparative balance sheets and income statement. Additional Information: • Barry’s sold avail

> Using the information provided in P22-9, prepare the cash flow statement for Orlando Incorporated using the direct method. Provide all required disclosures. Data from P22-9:

> U.S. GAAP. Saxon Woods, Inc. has a fiscal year-end of December 31, 2017. The company reported $124,500 in short-term notes payable due on April 1, 2018, on its year-end balance sheet. Saxon Woods extended the due date for this debt to January 31, 2019, d

> Shark Company provided the following balance sheet and income statement for the current year. Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to selling, general, and admini

> Jupiter Electric Company provided the following financial statement information for 2018 before considering the accounting changes that follow: • The company failed to record $7,000 interest expense on a zero-coupon bond in 2014. The bo

> Repeat E16-21 assuming that Gretta measures the debt security at fair value through OCI. Assume for simplicity that the carrying value is not reduced by amortization during 2017; thus, the carrying value on December 31, 2017, is $8,000 (accounting for th

> Rocket Man, Incorporated provided the following financial statement information for 2018: • On January 1, 2018, Rocket Man changed its plant and equipment accounting for depreciation from the double-declining balance method to the strai

> Porco Construction Company initiated operations on January 1, 2016. At that time, Porco’s management used the percentage-of-completion method to account for its contracts. The estimates used indicated that the contracts would generate i

> Romer Corporation began operations on January 1, 2015. The company decided to lease all plant assets rather than purchase them. Romer used the operating method for all leased assets in 2015 and 2016. On January 1, 2017, a new accountant joined the compan

> Welsh, Inc. began operations January 1, 2017. During 2019, management changed its method of accounting for inventories from the average-cost method to the first-in, first-out (FIFO) method. This change is effective as of January 1, 2019. If cost of goods

> J&S Arnez Company began operations in 2017 and initially adopted the weighted-average method for inventory valuation. In 2019, in accordance with the inventory valuation policies followed by other companies in its industry, Arnez changed its inventor

> Second Thought Products (STP) began operations on January 1, 2017, and adopted the FIFO method of inventory valuation at that time. Management elected to change its inventory method to the average-cost method effective January 1, 2020. The new method mor

> The following is a partial income statement for Sonata Enterprises for the current year. Sonata provided you the following information about its capital structure: • It issued 3%, $1,500,000 convertible debt 2 years ago at par value.

> Teek Bank, NA started the year with 600,000 common shares outstanding and issued 48,000, 840,000, and 72,000 shares on February 1, May 1, and September 1, respectively. Teek acquired 12,000 treasury shares on March 1. The company has employee stock optio

> Andy Corporation borrowed $1,500,000 on January 1, 2016. The note agreement specifies that it will pay interest quarterly at 8% on March 31, June 30, September 30 and December 31. The principal will be due on December 31, 2021. The company’s fiscal year

> The following is a partial income statement for City Line Enterprises for the current year. City Line provided the following information about its capital structure. The company had employee options to acquire 500,000 shares at an exercise price of $7 pe

> Gretta Company purchased a debt investment on June 15, 2016, and classified it as available for sale. On December 31, 2016, the investment had a carrying value of $8,500 and a fair value of $8,000. On that date, the present value of the future cash flows

> Merion Company provided the following share information for the current year. Merion reported income from continuing operations of $1,000,000 and a $430,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. The co

> Note the following partial income statement for Cassie Corporation for the current year. The company is subject to a 40% tax rate. We present share information for the current year in the following table. Cassie had 360,000 options outstanding all year

> Baroke Bank, NA started the year with 600,000 common shares outstanding and issued 48,000, 840,000, and 72,000 shares on February 1, May 1, and September 1, respectively. Baroke acquired 12,000 treasury shares on March 1. The company has employee options

> Daphne Company provided the following share information for the current year. Daphne reported income from continuing operations of $1,100,000 and a $450,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. Daphne

> Assume that Kollins issued the convertible bonds described in P20-1 on February 1. Using the other information from P20-1, complete the following. Required: a. Compute basic and diluted earnings per share for the current year. b. Prepare the earnings

> Kollins Kids, Ltd. began the current year with 320,000 common shares outstanding and issued an additional 120,000 shares on August 1. The firm has $8,000,000, 5% convertible bonds outstanding at the beginning of the year (i.e., $400,000 coupon interest p

> Roweburry Blanket Company offers all employees a defined-benefit pension plan. At the end of the current year, Roweburry’s pension plan trustee reported the following information regarding the changes in the PBO, the plan assets at fair

> Repeat P19-6 now assuming that Bruce-West Advertising, Inc. follows IFRS and expected a return on plan assets equal to its settlement rate. Assume that there are no past service costs. Bruce-West reports service cost as an operating expense and all other

> Using the information provided in BE14-28, prepare the journal entry to record the issuance of the bonds assuming that the incremental method is used and the market value of the warrants is not reasonably determinable. Data from BE14-28: Crow Company is

> Repeat E16-19 assuming that Gretta Company reports under IFRS and measures the debt security at amortized cost. Gretta determines that there has not been a significant increase in credit risk in 2017 or 2018. In 2017, Gretta determines that the probabili

> Bruce-West Advertising, Inc., initiated a defined-benefit pension plan 5 years ago. All prior service costs are for vested employees. The beginning balances related to the company’s pension plan follow: Required: a. Compute the total

> Tony Joe Restaurants, Inc., provided the following information related to its defined-benefit plan for the current year: Required: (Hint: You must analyze prior-year results in full to complete the following requirements.) a. Compute the total pension

> Fiar Company started a share appreciation plan on January 1, 2018, when it granted 100,000 rights to its executives. The vesting period is 3 years. The rights are settled for cash. The plan expires on January 1, 2021. The SARs fair value for the years en

> Eagle Builders, Inc. initiated a stock option plan for its employees on January 1 of the current year. The terms of the plan grant each employee 10 options to acquire 10 shares of the company’s $1 par value, common stock at an exercise price of $45 per s

> On January 1 of the current year, Brendan B Fashions granted 100,000 stock options to its division managers. The options are equity-classified awards. The plan permits the division managers to acquire the shares at an exercise price of $12 per share. Eac

> Penn Manufacturing Company offers a defined-benefit pension plan to its salaried employees. The following information summarizes events related to the Penn pension plan for 2018 through 2020. Required: a. Provide the necessary computations and journal

> Prepare the footnote required for Botburry Sheet Company in P19-9 for the current year that includes the following components of the pension disclosure: Required: a. The plan obligations, the plan assets, and the funded status of the plan at the end o

> Prepare the footnote required for Roweburry Blanket Company in P19-8 for the current year that includes the following components of the pension disclosure: Required: a. The plan obligations, the plan assets, and the funded status of the plan at the end

> The board of directors of Simon Art Supplies Company approved a plan to grant 150,000 options to its key executives to acquire 150,000 shares of no-par common stock at an exercise price of $20 per share. The effective date of the grant is January 1 of Ye

> Lori-Ann Fashions, Inc. entered into a 5-year lease with Krishnan Rentals to use equipment. The economic life of the equipment is 30 years. The equipment had a fair value of $8,500,000. Lori-Ann has an option to purchase the equipment at the end of the l

> John Quinn Associates acquired $7,550,000 par value, 6%, 20-year bonds on their date of issue, January 1 of the current year. The market rate at the time of issue is 10%, and interest is paid semiannually on June 30 and December 31. Quinn uses the effect

> Crow Company issued 6,000 of its $1,000 par value bonds for $1,580, providing total cash proceeds of $9,480,000. The market price of Crow’s common shares on the date that it issued the bonds was $20 per share. It sold the bonds with 240,000 detachable wa

> Barisi Equipment Company leases nonspecialized cutting machinery to Bastone, Inc. over a 4-year term. The lease commencement date is January 1, 2019. The first payment is due on January 1, 2019. The remaining payments are due on December 31, 2019, Decemb

> On May 1, 2018, Gia Equipment Manufacturers (GEM) agreed to lease nonspecialized machinery to Jason Associates. GEM paid $2,000,000 to produce the machine and carries it at this amount in its inventory. The fair value (current selling price) of the machi

> On January 1, 2018, Moorecraft Finance Company agreed to lease a piece of machinery to Ward Construction Products, Inc. Moorecraft paid $1,554,516 to acquire the machine from the manufacturer and carries it at this amount in its financial statements. The

> Using the same information as found in P18-4, assume that the lease contains a guaranteed residual value of $15,000. The lessee guarantees the residual value. Required: a. Compute the annual rent payment needed to ensure that the lessor company recover

> On January 1, 2018, JLOU Company leases a fleet of stock delivery vehicles from Dolt Motors, Inc. Under the terms of the lease, JLOU must pay $65,000 on January 1 of each year, beginning on January 1, 2018, over a 4-year term. The delivery vehicles have

> Florida Energy Restoration, Ltd. (FER) enters into a lease agreement on January 1, 2018, to lease standard power generators from R&R Electric, Inc. The terms of the lease follow. • The term of the lease is 7 years with no renewal option. The seven annua

> On January 1, 2018, the lease commencement date, Curran Manufacturing Corporation (CMC) agreed to lease a piece of nonspecialized, heavy equipment to Oates Products, Inc. CMC paid $900,000 to manufacture the machine and carries it at this amount in its i

> Crabtree Products, Inc. leases machinery to Beane Poll Enterprises. The machinery is not specialized. The lease is for 3 years requiring payments of $22,500 at the beginning of each lease year (April 1). The equipment has a fair value of $82,833 and is c

> Walker Power Washing Services, Inc. leases nonspecialized equipment from McCoy Equipment. The lease term is 3 years with no renewal or purchase options, and title to the underlying asset is retained by the lessor at the end of the lease term. The lease r

> Gretta Company purchased a debt investment on June 15, 2017, and classified it as held to maturity. On December 31, 2017, the investment had a carrying value of $8,500 and a fair value of $8,000. On that date, the present value of the future cash flows f

> Use the information from P18-9 to complete the following requirements. Required: a. Compute the implicit rate. b. Classify this lease for Lori-Ann Fashions. c. Prepare the journal entry necessary for Lori-Ann Fashions to record this transaction on t

> Determine whether each of the following convertible bonds has a beneficial conversion option. Each bond has a $1,000 face value and is issued at par. a. Eight-year, 5% convertible bond converts to 50 shares of common stock. The market price of the commo

> Locatelli Partners (LP) agreed to lease a piece of heavy equipment to Sonata Company on January 1. LP paid $195,100 to produce the machine and carried it at this amount in its inventory. This machine is routinely produced by LP and is part of its standar

> CPF Corporation reported the following results for its first 3 years of operation: There were no permanent or temporary differences during these 3 years. Assume a corporate tax rate of 46% for 2018, 40% for 2019, and 34% for 2020. CPF elects to use the

> In 2018, its first year of operations, Genius Corp. had a $700,000 net operating loss when the tax rate was 30%. There are no differences between book (GAAP) income and taxable income. In 2018, the management of Genius Corp. determined that it was more l

> Michael’s Incorporated reported the following tax information for its first 3 years of operations. Assume that in 2018, there are no uncertainties regarding the realization of the NOL carryforward benefits. All tax rates were enacted a

> Andrew, Inc. provides DJ services for corporate parties. Andrew reported a net operating loss of $750,000 on its 2018 tax return. During the 3 preceding years, Andrew had taxable income and paid taxes at various tax rates as follows: Although Andrew had

> Kimm-Mills Incorporated (KMI) acquired a piece of equipment at a total cost of $5,400,000. KMI uses the straight-line method of depreciation for financial reporting purposes and an accelerated method for tax purposes. The asset has a 6-year life for book

> The following information is available for the first 4 years of operations for Shooting Star Corporation: On January 2, 2018, the firm acquired heavy equipment costing $200,000 in a cash transaction. The equipment had a useful life of 5 years and no scra

> Early in 2018, Bicycle Messenger Service Corporation (BMSC) purchased a multiline/multifunction telephone system at a cost of $50,000. At that time, BMSC estimated that the system had a useful life of 5 years with no salvage value expected at the end of

> On January 1, 2018, Racine Company accepted a 10% note, dated January 1, 2018, with a face amount of $2,400,000 in exchange for cash. The note is due in 10 years. For notes of similar risk and maturity, the market interest rate is 12%. Interest is paid e

> Simm-Mills Incorporated (SMI) acquired a piece of equipment at a total cost of $4,200,000. SMI uses the straight-line method for financial reporting and an accelerated method for tax purposes. The asset has a 6-year life for book and tax purposes. There

> Simply Syrup Incorporated, a maple syrup maker, reported the following events causing differences between pretax accounting income and taxable income during its first full year of operations: • In 2018, Simply Syrup purchased equipment costing $440,000

> Walsh Beverages has outstanding convertible debt with a book value of $325,700 at the end of the current year. The bonds have a total par value of $300,000 and an unamortized premium of $25,700. Each $1,000 bond is convertible into 20 shares of $1 par va

> The following information is from the financial statements of the Core Products Group for the first 3 years of its operations. Required: a. Identify all book-tax differences and classify each difference as temporary or permanent. b. Prepare the foot

> Graham Department Stores reported the following year-end balances on its current balance sheet. Graham is subject to a 40% tax rate. The beginning cumulative balances of the deferred tax accounts are as follows: Taxable income is $2,500,000 and book in

> Assume that Kenne Diagnostics, Inc. makes an $800,000 capital investment and elects an immediate expense deduction for tax purposes. Management designated this treatment to be an uncertain tax position. The uncertainty of this tax position is whether the

> Bradley Manufacturing uses long-term installment contracts to market its building products. It uses the accrual basis for financial reporting and the cash basis for tax purposes. The company also sells several products without offering installment contra

> IFRS. Repeat P16-8 assuming that Pugh Company is an IFRS reporter and would like to elect to report the investment at fair value through other comprehensive income if it qualifies for this treatment. Pugh is not holding the investments for trading, nor i

> Pugh Company purchased 1,800 shares of the Kramer Group common stock for $64,800 (i.e., $36 per share) at the beginning of the current year. There were 36,000 outstanding Kramer shares on the date of acquisition. Total stockholders’ equity of Kramer Comp

> Bullet Bob Company has the following securities in its portfolio on December 31 of Year 1. Bullet Bob Company does not have a significant influence over the investees. All securities are purchased during Year 1: Required: a. Prepare the entry to record

> Each of the following three columns refers to an independent case. All data represent amounts as of January 1, the date on which the long-term notes receivable were issued except for the interest income, which is for the life of the note. Assume annual i

> Fontlyn Inc. issued $20 million of $10 par preferred stock on February 1, 2018. The company issued 1 million shares. The preferred stock has a 4% fixed annual cash dividend and no maturity date. Assume that the holder of the preferred shares has the opti

> K&Z Potato Chip Company, a U.S. GAAP reporter, provides you with the following information regarding its investments in equity securities during the current year. Required: Prepare all journal entries necessary to record K&€™s investme

> Repeat P16-4 assuming that DeNault Aircraft Corporation is an IFRS reporter and would like to elect to report the investments at fair value through other comprehensive income if it qualifies for this treatment. DeNault is not holding the investments for