Question: PCG, Ltd. is in the process of

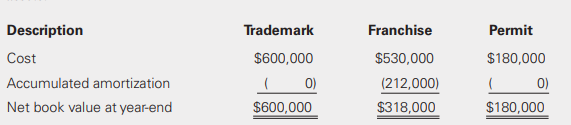

PCG, Ltd. is in the process of assessing the valuation of its intangible assets. At the end of the current year, management reported the following intangible assets.

The firm acquired the franchise 2 years ago and estimates that it has a 5-year useful life with no residual value. PCG uses the straight-line depreciation method. The permit is renewable every three years for an indefinite period of time. PCG management is concerned about the value of its franchise. The products sold under the franchise agreement have been experiencing sales declines over the past 2 years, prompting the company to test for impairment. It classifies the trademark and the renewable permit as indefinite-life intangible assets and must test for impairment on an annual basis. Management is unable to determine fair values from the market for the intangibles but provides the following cash-flow projections related to each of its

intangible assets; The company’s cost of capital is 5%.

Required:

a. Conduct an impairment test for PCG’s intangible assets.

b. Prepare the journal entries required to record the impairment loss, if any.

c. Compute the amount of the annual amortization for the franchise for years subsequent to the impairment test.

> When a bond is issued at a discount, will its periodic interest expense be greater or less than the interest payment? Explain.

> What method of amortization must companies use to amortize a bond discount or premium when reporting?

> What is included in bond issue costs and how should a company account for them?

> If the market rate of interest exceeds the face or stated rate on a long-term debt obligation, will the company issue the debt at a discount or premium? Explain.

> Does a company have to disclose the total amount of debt that matures each year for all long-term debt? Explain.

> Barney Equipment Corporation acquired the following equity investments at the beginning of Year 1. Barney does not have significant influence over the investees. Both companies are publicly traded. Required: a. Prepare the journal entry to record the

> If a company elects the fair value option for long-term liabilities, can it report unrealized gains and losses in other comprehensive income? Explain

> Using the information provided in BE14-34, how should Megga classify the $1,500,000 note payable on the December 31 balance sheet under IFRS? Provide any necessary journal entries. Data from BE14-34: U.S. GAAP. Megga Brands, Inc. borrowed $1,500,000 fr

> Can a company choose the fair value option for any long-term financial liability under IFRS? Explain

> Can a company choose the fair value option for any long-term financial liability? Explain

> Do companies always reclassify long-term debt that becomes callable by the creditor as a short-term obligation? Explain

> Under IFRS, can companies reclassify short-term debt expected to be refinanced on a long-term basis during the post-balance sheet period as long-term debt? Explain

> Can companies reclassify short-term debt expected to be refinanced on a long-term basis after the balance sheet date as long-term debt? Explain.

> What conditions or terms does a note payable contain?

> Do firms always accrue and record loss contingencies in the financial statements? Explain.

> What is a gain contingency? Is it accrued and recorded in the financial statements? Explain.

> Using the information provided in E16-2, prepare the fair value adjustment journal entries at the end of the second and third years after the acquisition of the investment assuming that the fair value of the bonds is equal to $5,100,000 at the end of Yea

> How do companies accrue compensated absences?

> Why are all compensated absences accrued as long as the obligation for future payment is due to services already performed by the employee and the benefits to be paid vest?

> U.S. GAAP. Megga Brands, Inc. borrowed $1,500,000 from Telcity Bank. The note payable has a term of 15 years and carries a 4% coupon interest. Because it had an inadequate credit score, Megga Brands agreed to several restrictive debt covenants. The debt

> Why are all compensated absences accrued as long as the obligation for future payment is due to services already performed by the employee and the benefits to be paid vest?

> Do sellers recognize sales taxes as expenses on their income statement? Explain

> Are advance collections from customers considered liabilities? Explain

> How are unearned revenues classified?

> What must firms use when estimating the amount of a loss contingency in a range of estimates to report in the financial statements?

> If the probability of a loss contingency is remote, is it necessary for a firm to accrue or disclose it? Explain

> Under IFRS, do firms always accrue and record loss contingencies in the financial statements? Explain

> Coral Boutique sold $1,400 of gift cards and received cash on May 25. On June 29, customers redeemed $800 of the gift cards, purchasing merchandise that cost Coral $425. The store uses a perpetual inventory system. Prepare the journal entries to record t

> IFRS. Use the same information from E15-15, assume that Fontlyn is an IFRS reporter. Prepare the journal entry for Fontlyn’s issue of the preferred shares. Data from E15-15: Fontlyn Inc. issued $20 million of $10 par preferred stock on February 1, 2018.

> When is a liability classified as current?

> Does an employer recognize payroll taxes as expenses on its income statement? Explain

> When does a company record an asset retirement obligation?

> IFRS. Using the information provided in BE14-32, prepare the journal entry to record the effect of the call on the debtor’s financial statements under IFRS. Data from BE14-32: U.S. GAAP. Braylon Brands, Inc. borrowed $2,000,000 from Home Town Bank. The

> Are all warranty costs accounted for under the accrual basis of accounting? Explain.

> Under IFRS, what must firms use when estimating the amount of a loss contingency in a range of estimates to report in the financial statements?

> Under IFRS, when do firms test plant assets and finite-life intangible assets for impairment?

> When measuring an impairment loss for a long-term operating asset, must firms determine the fair value using a discounted cash-flow model? Explain.

> Under IFRS, when do firms test plant assets and finite-life intangible assets for impairment?

> Under IFRS, if a firm recovers an impairment loss on a long-term operating asset, does it report the asset at its current fair value? Explain.

> Bronze Company, an IFRS reporter, holds a debt investment measured at fair value through OCI with a carrying value of $45,000. The current fair value of the investment is $38,000, and the appropriate expected credit loss is $1,000. There has not been a s

> Are firms required to test goodwill acquired in a business combination for impairment on an annual basis? Explain.

> After recording an impairment of an indefinite-life operating asset, can a firm recover the impairment loss in subsequent accounting periods? Explain.

> When measuring an impairment loss for a long-term operating asset, must firms determine the fair value using a discounted cash-flow model? Explain.

> Do firms follow the same steps for impairment testing of finite- and indefinite-life intangible assets? Explain

> Braylon Brands, Inc. borrowed $2,000,000 from Home Town Bank. The note payable had a term of 5 years and carried a 6% coupon interest. Because of an inadequate credit score, Braylon Brands agreed to several restrictive debt covenants. The debt agreement

> Events and circumstances indicate the need for Lenny Schaeffer Bakeries to undertake quantitative testing of goodwill. The current carrying value of the reported goodwill for the reporting unit is $800,000. The goodwill pertains to the reporting unit. Th

> Peter Gordon, Ltd., an IFRS reporter, is in the process of assessing the valuation of its intangible assets. At the end of the current year, management reported the following intangible assets: The firm acquired the franchise 2 years ago and estimates t

> Use the same information from P12-1 with three modifications: • Chrispian Cookies, Inc. is an IFRS reporter. • Similar baking equipment could be sold for $5,100,000. • Chrispian estimates that costs t

> Green River Company acquired 100% of the voting stock of the AutoStyle Group on January 1 of the current year for a total acquisition cost of $250,000. The trial balance of AutoStyle on the date of acquisition follows. The AutoStyle Group acquired the i

> Repeat E16-23 assuming that Regal Inc. reports under IFRS. Data from E16-23: Regal Inc., a U.S. GAAP reporter, holds an equity investment with a carrying value of $107,250. This investment is not publicly traded and Regal has elected to carry it at adju

> Cupcakes-R-Us, Inc. is reviewing all available information regarding the future use of its baking equipment, which it intends to use for the foreseeable future. The company has observed a decline in the demand for its products. The information also indic

> Chrispian Cookies, Inc. is reviewing all available information regarding the future use of its baking equipment, which it intends to use for the foreseeable future. The information indicates that this equipment may be obsolete and could be impaired. Chri

> Orlando Incorporated provided the following comparative balance sheets and the results of operations for the current year. Additional Information: • Orlando sold available-for-sale investments that had been acquired for the cost of $74

> Prepare the cash flow statement for Norwich Manufacturing, Inc. under the direct method using the information provided in P22-7. Provide all required disclosures. Data from P22-7:

> Norwich Manufacturing, Inc. provided you with the following comparative balance sheets and income statement. Additional Information: • Norwich sold available-for-sale investments that had been acquired for $55,000 at a gain of $40,500.

> Using the information provided in BE14-30, prepare the journal entry required on December 31, 2017, to reflect the refinancing agreement under IFRS. Data from BE14-30: U.S. GAAP. Saxon Woods, Inc. has a fiscal year-end of December 31, 2017. The company

> Using the data provided in P22-5, prepare the statement of cash flows for The Khan Group using the direct method. Provide all required disclosures. Data from P22-5:

> The Khan Group provided its balance sheet and income statement as of December 31 of the current year. Additional Information: • The company classifies its current investments as trading securities. During the current year, it sold tradi

> Repeat the requirements in P22-3 using the indirect method. Data from P22-3:

> Regal Inc., a U.S. GAAP reporter, holds an equity investment with a carrying value of $107,250. This investment is not publicly traded and Regal has elected to carry it at adjusted cost. At December 31, 2016, the fair value of the investment is $98,000,

> Westhoff, Incorporated provided the following balance sheets and income statement for the current year. Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to selling, general,

> Repeat the requirements of P22-1 under the indirect method. Data from P22-1:

> Using the information provided in P22-13, prepare the cash flow statement and all required disclosures for American Safety Products using the direct method. Data from P22-13:

> American Safety Products, Inc. provided the following comparative balance sheets and income statement for the current year. Additional Information: • American Safety Products sold trading securities at a loss. • The

> Prepare the cash flow statement and all required disclosures for Barry’s Clothing Stores, Inc. from P22-11 using the direct method. Data from P22-11:

> Barry’s Clothing Stores, Inc. released its annual report for the current year and included the following comparative balance sheets and income statement. Additional Information: • Barry’s sold avail

> Using the information provided in P22-9, prepare the cash flow statement for Orlando Incorporated using the direct method. Provide all required disclosures. Data from P22-9:

> U.S. GAAP. Saxon Woods, Inc. has a fiscal year-end of December 31, 2017. The company reported $124,500 in short-term notes payable due on April 1, 2018, on its year-end balance sheet. Saxon Woods extended the due date for this debt to January 31, 2019, d

> Shark Company provided the following balance sheet and income statement for the current year. Prepare the operating activities section of the cash flow statement using the direct method. Assume that accrued expenses relate to selling, general, and admini

> Jupiter Electric Company provided the following financial statement information for 2018 before considering the accounting changes that follow: • The company failed to record $7,000 interest expense on a zero-coupon bond in 2014. The bo

> Repeat E16-21 assuming that Gretta measures the debt security at fair value through OCI. Assume for simplicity that the carrying value is not reduced by amortization during 2017; thus, the carrying value on December 31, 2017, is $8,000 (accounting for th

> Rocket Man, Incorporated provided the following financial statement information for 2018: • On January 1, 2018, Rocket Man changed its plant and equipment accounting for depreciation from the double-declining balance method to the strai

> Porco Construction Company initiated operations on January 1, 2016. At that time, Porco’s management used the percentage-of-completion method to account for its contracts. The estimates used indicated that the contracts would generate i

> Romer Corporation began operations on January 1, 2015. The company decided to lease all plant assets rather than purchase them. Romer used the operating method for all leased assets in 2015 and 2016. On January 1, 2017, a new accountant joined the compan

> Welsh, Inc. began operations January 1, 2017. During 2019, management changed its method of accounting for inventories from the average-cost method to the first-in, first-out (FIFO) method. This change is effective as of January 1, 2019. If cost of goods

> J&S Arnez Company began operations in 2017 and initially adopted the weighted-average method for inventory valuation. In 2019, in accordance with the inventory valuation policies followed by other companies in its industry, Arnez changed its inventor

> Second Thought Products (STP) began operations on January 1, 2017, and adopted the FIFO method of inventory valuation at that time. Management elected to change its inventory method to the average-cost method effective January 1, 2020. The new method mor

> The following is a partial income statement for Sonata Enterprises for the current year. Sonata provided you the following information about its capital structure: • It issued 3%, $1,500,000 convertible debt 2 years ago at par value.

> Teek Bank, NA started the year with 600,000 common shares outstanding and issued 48,000, 840,000, and 72,000 shares on February 1, May 1, and September 1, respectively. Teek acquired 12,000 treasury shares on March 1. The company has employee stock optio

> Andy Corporation borrowed $1,500,000 on January 1, 2016. The note agreement specifies that it will pay interest quarterly at 8% on March 31, June 30, September 30 and December 31. The principal will be due on December 31, 2021. The company’s fiscal year

> The following is a partial income statement for City Line Enterprises for the current year. City Line provided the following information about its capital structure. The company had employee options to acquire 500,000 shares at an exercise price of $7 pe

> Gretta Company purchased a debt investment on June 15, 2016, and classified it as available for sale. On December 31, 2016, the investment had a carrying value of $8,500 and a fair value of $8,000. On that date, the present value of the future cash flows

> Merion Company provided the following share information for the current year. Merion reported income from continuing operations of $1,000,000 and a $430,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. The co

> Note the following partial income statement for Cassie Corporation for the current year. The company is subject to a 40% tax rate. We present share information for the current year in the following table. Cassie had 360,000 options outstanding all year

> Baroke Bank, NA started the year with 600,000 common shares outstanding and issued 48,000, 840,000, and 72,000 shares on February 1, May 1, and September 1, respectively. Baroke acquired 12,000 treasury shares on March 1. The company has employee options

> Daphne Company provided the following share information for the current year. Daphne reported income from continuing operations of $1,100,000 and a $450,000 loss from discontinued operations, net of tax. The company is subject to a 40% tax rate. Daphne

> Assume that Kollins issued the convertible bonds described in P20-1 on February 1. Using the other information from P20-1, complete the following. Required: a. Compute basic and diluted earnings per share for the current year. b. Prepare the earnings

> Kollins Kids, Ltd. began the current year with 320,000 common shares outstanding and issued an additional 120,000 shares on August 1. The firm has $8,000,000, 5% convertible bonds outstanding at the beginning of the year (i.e., $400,000 coupon interest p

> Botburry Sheet Company offers all employees a defined-benefit pension plan. At the end of the current year, Boxberry’s pension plan trustee reported the following information regarding the changes in the PVDBO, the plan assets at fair v

> Roweburry Blanket Company offers all employees a defined-benefit pension plan. At the end of the current year, Roweburry’s pension plan trustee reported the following information regarding the changes in the PBO, the plan assets at fair

> Repeat P19-6 now assuming that Bruce-West Advertising, Inc. follows IFRS and expected a return on plan assets equal to its settlement rate. Assume that there are no past service costs. Bruce-West reports service cost as an operating expense and all other

> Using the information provided in BE14-28, prepare the journal entry to record the issuance of the bonds assuming that the incremental method is used and the market value of the warrants is not reasonably determinable. Data from BE14-28: Crow Company is

> Repeat E16-19 assuming that Gretta Company reports under IFRS and measures the debt security at amortized cost. Gretta determines that there has not been a significant increase in credit risk in 2017 or 2018. In 2017, Gretta determines that the probabili

> Bruce-West Advertising, Inc., initiated a defined-benefit pension plan 5 years ago. All prior service costs are for vested employees. The beginning balances related to the company’s pension plan follow: Required: a. Compute the total

> Tony Joe Restaurants, Inc., provided the following information related to its defined-benefit plan for the current year: Required: (Hint: You must analyze prior-year results in full to complete the following requirements.) a. Compute the total pension

> Fiar Company started a share appreciation plan on January 1, 2018, when it granted 100,000 rights to its executives. The vesting period is 3 years. The rights are settled for cash. The plan expires on January 1, 2021. The SARs fair value for the years en

> Eagle Builders, Inc. initiated a stock option plan for its employees on January 1 of the current year. The terms of the plan grant each employee 10 options to acquire 10 shares of the company’s $1 par value, common stock at an exercise price of $45 per s

> On January 1 of the current year, Brendan B Fashions granted 100,000 stock options to its division managers. The options are equity-classified awards. The plan permits the division managers to acquire the shares at an exercise price of $12 per share. Eac

> Penn Manufacturing Company offers a defined-benefit pension plan to its salaried employees. The following information summarizes events related to the Penn pension plan for 2018 through 2020. Required: a. Provide the necessary computations and journal

> Prepare the footnote required for Botburry Sheet Company in P19-9 for the current year that includes the following components of the pension disclosure: Required: a. The plan obligations, the plan assets, and the funded status of the plan at the end o