Question: Calculate the missing amounts for each of

> National Leasing is evaluating the cost of capital to use in its capital budgeting process. Over the recent past, the company has averaged a return on equity of 13% and a return on investment of 10%. The company can currently borrow short-term money for

> Capital budgeting analysis involves the use of many estimates. Required: For each of the following estimation errors, state whether the net present value of the project will be too high or too low: a. The investment is too high. b. The cost of capital is

> Use the appropriate factors from Table 6.4 or Table 6.5 to answer the following questions. Required: a. Spencer Co.’s common stock is expected to have a dividend of $5 per share for each of the next 10 years, and it is estimated that the market value per

> ABC Company produces product X, product Y, and product Z. All three products require processing on specialized finishing machines. The capacity of these machines is 1,800 hours per month. ABC Company wants to determine the product mix that should be achi

> Product X has a contribution margin of $150 per unit and requires three hours of machine time. Product Y requires four hours of machine time and provides $200 of contribution margin per unit. Required: If the capacity of machine time is limited to 600 ho

> Redbud Company uses a certain part in its manufacturing process that it buys from an outside supplier for $36 per part plus another $5 for shipping and other purchasing-related costs. The company will need 18,000 of these parts in the next year and is co

> Waterway Engine Inc. produces engines for the watercraft industry. An outside manufacturer has offered to supply several component parts used in the engine assemblies, which are currently being produced by Waterway. The supplier will charge Waterway $620

> Rainbow Cruises operates a weeklong cruise tour through the Hawaiian Islands. Passengers currently pay $1,500 for a two-person cabin, which is an all-inclusive price that includes food, beverages, and entertainment. The current cost to Rainbow per two pe

> At the beginning of the current fiscal year, the balance sheet for Davis Co. showed liabilities of $160,000. During the year, liabilities decreased by $9,000, assets increased by $33,000, and paid-in capital increased from $15,000 to $96,000. Dividends d

> EagleEye Ltd., a manufacturer of digital cameras, is considering entry into the digital binocular market. EagleEye currently does not produce binoculars of any style, so this venture would require a careful analysis of relevant manufacturing costs to cor

> SureLock Manufacturing Co. makes and sells several models of locks. The cost records for the ZForce lock show that manufacturing costs total $23.25 per lock. An analysis of this amount indicates that $13.40 of the total cost has a variable cost behavior

> ADP Mining Company mines an iron ore called Alpha. During the month of August, 350,000 tons of Alpha were mined and processed at a cost of $675,000. As the Alpha ore is mined, it is processed into Delta and Pi, where 60% of the Alpha output becomes Delta

> The cost formula for the maintenance department of Rambo Ltd. is $9,700 per month plus $3.85 per machine hour used by the production department. Required: a. Calculate the maintenance cost that would be budgeted for a month in which 13,400 machine hours

> Romano Corporation has three operating divisions and requires a 12% return on all investments. Selected information is presented here: Required: a. Calculate the missing amounts for each division. b. Comment on the relative performance of each division.

> The Northern Division of Allied Inc. has operating income of $32,000 on sales revenue of $320,000. Divisional operating assets are $160,000, and management of Allied has determined that a minimum return of 15% should be expected from all investments. Req

> Vogel Co. produces three models of heating and air conditioning thermostat components. The following table summarizes data about each model: Required: a. Criticize the preceding presentation. On what basis does the $10,000 of company fixed expenses appea

> The president of Eaglesway Inc. attended a seminar about the contribution margin model and returned to her company full of enthusiasm about it. She requested that last year’s traditional model income statement be revised, and she receiv

> Fiberworks Company is a manufacturer of fiberglass toy boats. The company has recently implemented a standard cost system and has designed the system to isolate variances as soon as possible. During the month of May, the following results were reported f

> Oakton Inc. manufactures end tables, armchairs, and other wood furniture products from high-quality materials. The company uses a standard costing system and isolates variances as soon as possible. The purchasing manager is responsible for controlling di

> At the beginning of its current fiscal year, Willie Corp.’s balance sheet showed assets of $67,600 and liabilities of $33,000. During the year, liabilities decreased by $5,000. Net income for the year was $20,400, and net assets at the

> Four Seasons Industries has established direct labor performance standards for its maintenance and repair shop. However, some of the labor records were destroyed during a recent fire. The actual hours worked during August were 3,000, and the total direct

> Smallman’s Garage uses standards to plan and control labor time and expense. The standard time for an engine tune-up is 4 hours, and the standard labor rate is $20 per hour. Last week, 36 tune-ups were completed. The labor efficiency variance was 12 hour

> For the stamping department of a manufacturing firm, the standard cost for direct labor is $15 per hour, and the production standard calls for 1,000 stampings per hour. During February, 198 hours were required for actual production of 186,000 stampings.

> Following is a partially completed performance report for a recent week for direct labor in the binding department of a book publisher: The original budget is based on the expectation that 4,000 books would be bound; the standard is 25 books per hour at

> Western Manufacturing produces a single product. The original budget for April was based on expected production of 17,500 units; actual production for April was 16,600 units. The original budget and actual costs incurred for the manufacturing department

> Olympia Productions Inc. makes award medallions that are attached to ribbons. Each medallion requires 18 inches of ribbon. The sales forecast for March is 4,000 medallions. Estimated beginning inventories and desired ending inventories for March are as f

> A cost analyst for Stamper Manufacturing Co. has assembled the following data about the Model 24 stamp pad: The piece of sheet metal from which eight pad cases can be made costs $0.18. This amount is based on the number of sheets in a 4,000- pound bundle

> MDA Inc. processes corn into corn starch and corn syrup. The company’s productivity and cost standards follow: From every bushel of corn processed, ten pounds of starch and five pounds of syrup should be produced. Standard direct labor and variable overh

> Lakeway Manufacturing Co. manufactures and sells household cleaning products. The company’s research department has developed a new cleaner for which a standard cost must be determined. The new cleaner is made by mixing 15 quarts of triphate solution and

> Oakwood Creations Co. makes decorative candle pedestals. An industrial engineer consultant developed ideal time standards for one unit of the Berkley model pedestal. The standards follow, along with the cost accountant’s determination o

> McDonald’s Corp. McDonald’s conducts operations worldwide and is managed in two primary geographic segments: U.S., and International Operated Markets, which is comprised of Australia, Canada, France, Germany, Italy, th

> Scottsdale Co. has actual sales for July and August and forecast sales for September, October, November, and December as follows: Based on past experience, it is estimated that 40% of a month’s sales are collected in the month of sale,

> Brooklyn Studio’s sales are all made on account. The firm’s collection experience has been that 25% of a month’s sales are collected in the month the sale is made, 60% are collected in the month follo

> Osage Inc. has actual sales for May and June and forecast sales for July, August, September, and October as follows: Required: a. The firm’s policy is to have finished goods inventory on hand at the end of the month that is equal to 80%

> Each gallon of Old Brut, a popular aftershave lotion, requires three ounces of ocean scent. Budgeted production of Old Brut for the first three quarters of 2022 is as follows: Management’s policy is to have on hand at the end of every q

> Gillman Co. is forecasting sales of 80,600 units of product for August. To make one unit of finished product, five pounds of raw materials are required. Actual beginning and desired ending inventories of raw materials and finished goods are as follows: R

> Colorado Business Tools manufactures calculators. Costs incurred in making 12,500 calculators in February included $42,500 of fixed manufacturing overhead. The total absorption cost per calculator was $11.75. Required: a. Calculate the variable cost per

> Angora Creations Co. manufactures wool sweaters. Costs incurred in making 45,000 sweaters in September included $180,000 of fixed manufacturing overhead. The total absorption cost per sweater was $34.80. Required: a. Calculate the variable cost per sweat

> Staley Toy Co. makes toy flutes. Two manufacturing overhead application bases are used; some overhead is applied on the basis of machine hours at a rate of $7.20 per machine hour, and the balance of the overhead is applied at the rate of 250% of direct l

> Trendy Creations Tie Co. manufactures neckties and scarves. Two overhead application bases are used; some overhead is applied on the basis of raw material cost at a rate of 150% of material cost, and the balance of the overhead is applied at the rate of

> Creative Lighting Inc. makes specialty table lamps. Manufacturing overhead is applied to production on a direct labor hours basis. During June, the first month of the company’s fiscal year, $110,880 of manufacturing overhead was applied to Work in Proces

> From the following data, calculate the retained earnings balance as of December 31, 2022:

> Janson Inc. produces pickup truck bumpers. Overhead is applied on the basis of machine hours required for cutting and fabricating. A predetermined overhead application rate of $25.40 per machine hour was established for 2022. Required: a. If 5,000 machin

> Nautical Footwear Inc. manufactures women’s boating shoes. Manufacturing overhead is assigned to production on a machine-hour basis. For 2022, it was estimated that manufacturing overhead would total $487,200 and that 33,600 machine hours would be used.

> Ironstone Inc. produces ceramic coffee mugs and pencil holders. Manufacturing overhead is assigned to production using an application rate based on direct labor hours. Required: a. For 2022, the company’s cost accountant estimated that total overhead co

> The management of Rocko’s Pizzeria is considering a special promotion for the last two weeks of May, which is normally a relatively low-demand period. The special promotion would involve selling two medium pizzas for the price of one, plus 1 cent. The me

> Jen and Barry’s ice cream shop charges $2.20 for a cone. Variable expenses are $0.66 per cone, and fixed costs total $2,600 per month. A Valentine’s Day promotion is being planned for the second week of February. During this week, a person buying a cone

> D&R Corp. has annual revenues of $375,000, an average contribution margin ratio of 32%, and fixed expenses of $150,000. Required: a. Management is considering adding a new product to the company’s product line. The new item will have $9.52 of variable co

> O’Reilly Inc. makes and sells many consumer products. The firm’s average contribution margin ratio is 25%. Management is considering adding a new product that will require an additional $18,000 per month of fixed expenses and will have variable expenses

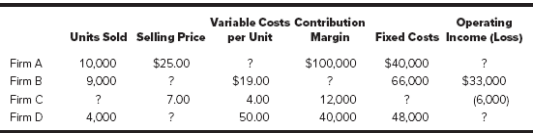

> Calculate the missing amounts for each of the following firms:

> The following information provides the amount of cost incurred in March for the cost items indicated. During March, 4,000 units of the firm’s single product were manufactured. Required: a. How much cost would you expect to be incurred f

> The information presented here represents selected data from the December 31, 2022, balance sheets and income statements for the year then ended for three firms: Required: Calculate the missing amounts for each firm.

> Thomas estimates that the costs of insurance, license, and depreciation to operate his car total $580 per month and that the gas, oil, and maintenance costs are 40 cents per mile. Thomas also estimates that, on average, he drives his car 1,800 miles per

> A friend has accumulated $10,000 and has decided to invest that hard earned money in the common stock of a publicly owned corporation. What data about that company would you suggest that she be most interested in, and how would you suggest to arrange tho

> During the fiscal year ended September 30, 2023, Worrell Inc. had a 2-for-1 stock split and a 5% stock dividend. In its annual report for 2023, the company reported earnings per share for the year ended September 30, 2022, on a restated basis, of $1.80.

> During the year ended December 31, 2023, Gluco Inc. split its stock on a 3-for-1 basis. In its annual report for 2022, the firm reported net income of $442,890 for 2022, with an average 155,400 shares of common stock outstanding for that year. There was

> For the year ended December 31, 2021, Finco Inc. reported earnings per share of $3.30. During 2022, the company had a 5-for-1 stock split. Calculate the 2021 earnings per share that will be reported in Finco’s 2022 annual report for comparative purposes.

> For several years Orbon Inc. has followed a policy of paying a cash dividend of $0.45 per share and having a 10% stock dividend. In the 2023 annual report, Orbon reported restated earnings per share for 2021 of $2.70. Required: a. Calculate the originall

> Kirkland Theater sells season tickets for six events at a price of $240. In pricing the tickets, the planners assigned the leadoff event a value of $60 because the program was an expensive symphony orchestra. The last five events were priced equally; 1,8

> Big Blue University has a fiscal year that ends on June 30. The 2022 summer session of the university runs from June 1 through July 20. Total tuition paid by students for the summer session amounted to $152,000. Required: a. How much revenue should be re

> Refer to the Consolidated Statements of Cash Flows in the Campbell Soup Company annual report within the appendix. Required: a. Identify the three most significant sources of cash from operating activities during 2020. How much of a net cash source amou

> Refer to the Consolidated Statements of Earnings in the Campbell Soup Company annual report in the appendix. Required: a. Does Campbell’s use the single-step format or the multiple-step format? Which format do you prefer? Explain your answer. b. Refer to

> The information presented here represents selected data from the December 31, 2022, balance sheets and income statements for the year then ended for three firms: Required: Calculate the missing amounts for each firm.

> For each of the following items, calculate the amount of revenue or expense that should be recognized on the income statement for Pelkey Co. for the year ended December 31, 2022: a. Cash collected from customers during the year amounted to $147,000, and

> For each of the following items, calculate the cash sources or cash uses that should be recognized on the statement of cash flows for Baldin Co. for the year ended December 31, 2022: a. Sales on account (all are collectible) amounted to $420,000, and ac

> Mamba Metals, Ltd. reported net income of $573,650 for its fiscal year ended January 31, 2023. At the beginning of that fiscal year, 100,000 shares of common stock were outstanding. On October 31, 2022, an additional 30,000 shares were issued. No other c

> Mechforce, Inc. had net income of $151,800 for the year ended December 31, 2022. At the beginning of the year, 15,000 shares of common stock were outstanding. On April 1, an additional 10,000 shares were issued. On October 1, the company purchased 3,000

> Refer to the selected financial data (five-year financial summary) in the Campbell Soup Company annual report in the appendix. Required: Compare the trend of the operating income (earnings before interest and taxes) data with the trend of net income (net

> If you were asked to assist an investor in the evaluation of the profitability of a company and could have only limited historical data, would you prefer to provide your advice and assistance on the basis of operating income or net income data for the pa

> MBI Inc. had sales of $900 million for fiscal 2022. The company’s gross profit ratio for that year was 37.5%. Required: a. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. b. Assume that a new product is developed and that it wi

> Refer to the Consolidated Statements of Earnings in the Campbell Soup Company annual report in the appendix. Required: a. Calculate the gross profit ratio for each of the past three years. b. Assume that Campbell’s net sales for the first four months of

> From the following data, calculate the Retained Earnings balance as of December 31, 2023:

> At the beginning of the current fiscal year, the balance sheet of Cummings Co. showed liabilities of $657,000. During the year, liabilities decreased by $108,000, assets increased by $231,000, and paid-in capital increased by $30,000 to $570,000. Dividen

> A number of financial statement captions are listed in the following table. Indicate in the spaces to the right of each caption the category of each item and the financial statement(s) on which the item can usually be found. Use the following abbreviatio

> Total assets were $58,000 and total liabilities were $35,000 at the beginning of the year. Net income for the year was $11,000, and dividends of $3,000 were declared and paid during the year. Required: Calculate total stockholders’ equity at the end of t

> Why do entrepreneurs have trouble remaining objective when writing their business plans?

> If successful companies like Pizza Hut have been started without a business plan, why does the author claim they are so important?

> Who should write the business plan?

> Should you write a business plan even if you do not need outside financing? Why or why not?

> Why is environmental analysis more crucial to the small business owner than to larger corporations?

> Write a mission statement for a small business that not only functions as a strategic planning guide but also incorporates the company’s philosophy of social responsibility and ethical standards.

> What does strategic planning mean to the small business owner? How does the size of the organization affect the strategic planning process, and how much input should be sought from outside sources while outlining the strategic plan?

> Goal setting is a major part of the entrepreneur’s business plan. Outline specific methods for setting goals that are realistic, fit into the overall mission of the company, and can be related to the strategic planning process that is in place at the org

> What is the value of competitive analysis to the small business owner? What sorts of things should you know about your competition, and what analytical methods can you use to find out this information?

> You are an entrepreneur and wish to perform a “self-evaluation” of your business environment. How would you go about this task? Be specific about what you hope to discover through the evaluation of your employees, product, management, and so on.

> From strictly a small business perspective (not social or emotional perspectives), why is diversity important?

> Define the purpose of a code of ethics, and write a brief code that would be suitable for a small business.

> Although a certain practice may be widely accepted in the business community and be perfectly legal, does that necessarily mean it is always moral? Qualify your answer with examples.

> Discuss the four groups of laws that generally regulate business activity in this country, and give some historical background on the major laws that affect all entrepreneurs today.

> How can a small business show that it is socially responsible? Think of evidence of social responsibility (like sponsoring a Little League team) that a small business can demonstrate.

> Explain how cultural differences between countries can have either a positive or negative effect on an entrepreneur who is pursuing a contract either outside the United States or with persons of different ethnic backgrounds in the United States.

> Write a brief summary of the connection between social responsibility, ethics, and strategic planning in a small business setting.

> What do entrepreneurs do that distinguishes them from any other person involved in business?

> Imagine that the principal from the high school you attended (and graduated from) called to invite you to make a presentation to the newly founded entrepreneurship club. What would you tell this group of high school students about owning their own busine

> What problems such as lawsuits, reputation, and public image would GarageTek face if they closed failing franchises? 2. Was shuttering the failed franchises the right move for Shuman? What are his other options?

> If you were in Rappaport and Harrison’s situation, how would you change your business plan for the future? 2. Is Flocabulary’s problem a) the wrong target market, b) a bad product, c) too few products, or d) something else? What are their alternative

> Large businesses depend on small businesses. Why?

> Using the strategic planning process discussed in this chapter, what was the core problem to be solved by Millennium? What are all of the potential alternative solutions to that problem? 2. Apply Porter's Five Forces Model to this case. 3. What would you

> What alternatives does the Pastorius family have to resolve their conflict? 2. What operations management principles would apply to running a microbrewery? 3. What would your recommendation be to Tom and Mary Beth?

> Put yourself in Larry Cohen's position. What would you see as your most immediate problem? What are your long-term problems? 2. Would you keep Aaron Kamins as CEO? Why or why not? If you fire him, who would do the job? 3. What do you recommend Cohen do t