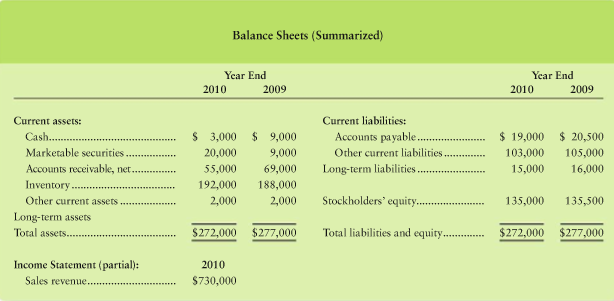

Question: Cherokee, Inc., reported the following items at

Cherokee, Inc., reported the following items at December 31, 2010 and 2009:

Requirement

1. Compute Cherokees

(a) acid-test ratio and

(b) days sales in average receivables for 2010. Evaluate each ratio value as strong or weak. Cherokee sells on terms of net 30 days

Transcribed Image Text:

Balance Sheets (Summarized) Year End Year End 2010 2009 2010 2009 Current assets: Current liabilities: $ 3,000 $ 9,000 Accounts payable. Other current liabilities. Long-term liabilities. Cash... $ 19,000 $ 20,500 Marketable securities 20,000 9,000 103,000 105,000 Accounts receivable, net. 55,000 69,000 15,000 16,000 Inventory. 192,000 188,000 Other current assets 2,000 2,000 Stockholders' equity. 135,000 135,500 Long-term assets Total assets...... $272,000 $277,000 Total liabilities and equity .. $272,000 $277,000 Income Statement (partial): 2010 Sales revenue... $730,000

> During Heaton Company’s first two years of operations, it reported absorption costing net operating income as follows The company’s $18 unit product cost is computed as follows: Direct materials ......................

> You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president has asked that you review the company’s costing system and “do what you can to help us get

> Morton Company’s budgeted variable manufacturing overhead is $4 50 per direct labor-hour and its budgeted fixed manufacturing overhead is $270,000 per year. The company manufactures a single product whose standard direct labor-hours per

> Ray Company provided the following excerpts from its Production Department’s flexible budget performance report: Required: Complete the Production Department’s Flexible Budget Performance Report by filling in all the

> Deacon Company is a merchandising company that is preparing a budget for the three-month period ended June 30.The following information is available: Deacon Company Balance Sheet March 31 Assets Cash......................................................

> Refer to the data for Garden Sales, Inc., in Problem 8–24. The company’s president is interested in knowing how reducing inventory levels and collecting accounts receivable sooner will impact the cash budget. He revise

> Springfield Corporation operates on a calendar-year basis. It begins the annual budgeting process in late August, when the president establishes targets for total sales dollars and net operating income before taxes for the next year. The sales target is

> Refer to the data for Minden Company. The company is considering making the following changes to the assumptions underlying its master budget: 1.Sales are budgeted for $220,000 for May. 2.Each month’s credit sales are collected 60% in the month of sale a

> Hi-Tek Manufacturing, Inc., makes two types of industrial component parts—the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Inc. Income Statement Sales ……&hel

> Toxaway Company is a merchandiser that segments its business into two divisions—Commercial and Residential. The company’s accounting intern was asked to prepare segmented income statements that the companyâ€

> During Heaton Company’s first two years of operations, it reported absorption costing net operating income as follows The company’s $18 unit product cost is computed as follows: Direct materials ......................

> Haas Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations: Variable costs per unit: Manufacturing: Direct materials ......................................................

> Refer to the financial statements for Castile Products, Inc., in Exercise 15–8. Assets at the beginning of the year totaled $280,000, and the stockholders’ equity totaled $161,600. Data given in Exercise 15–8: The financial statements for Castile Produc

> Lasser Company plans to produce 10,000 units next period at a denominator activity of 30,000 direct labor-hours. The direct labor wage rate is $12 per hour. The company’s standards allow 2.5 yards of direct materials for each unit of pr

> Below are several transactions that took place in Seneca Company last year: a. Paid suppliers for inventory purchases. b. Bought equipment for cash. c. Paid cash to repurchase its own stock. d. Collected cash from customers. e. Paid wages to employees. f

> The following changes took place last year in Pavolik Company’s balance sheet accounts: Long-term investments that cost the company $6 were sold during the year for $16 and land that cost $15 was sold for $9. In addition, the company

> Below are certain events that took place at Hazzard, Inc., last year: a. Collected cash from customers. b. Paid cash to repurchase its own stock. c. Borrowed money from a creditor. d. Paid suppliers for inventory purchases. e. Repaid the principal amount

> Henrie’s Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $137,320, including freight and installation. Henrie’s estimated the new machine would increase the company’s cash inflows, n

> A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Ltd., could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow: Purchase cost of the equipment…………………………………….. $432,00

> The Cambro Foundation, a nonprofit organization, is planning to invest $104,950 in a project that will last for three years. The project will produce net cash inflows as follows: Year 1 …………………………………………………………….$30,000 Year 2……………………………………………………………..$40,

> Derrick Iverson is a divisional manager for Holston Company. His annual pay raises are largely determined by his division’s return on investment (ROI), which has been above 20% each of the last three years. Derrick is considering a capi

> Lukow Products is investigating the purchase of a piece of automated equipment that will save $400,000 each year in direct labor and inventory carrying costs. This equipment costs $2,500,000 and is expected to have a 15-year useful life with no salvage v

> Wendell’s Donut Shoppe is investigating the purchase of a new $18,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $3,800 per year. In addition, the n

> The management of Kunkel Company is considering the purchase of a $27,000 machine that would reduce operating costs by $7,000 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of ret

> Phoenix Company manufactures only one product and uses a standard cost system. The company uses a plantwide predetermined overhead rate that relies on direct labor-hours as the allocation base The predetermined overhead rate is based on a cost formula th

> Zola Company manufactures and sells one product. The following information pertains to the company’s first year of operations: Variable cost per unit: Direct materials ....................................................................$18 Fixed costs p

> Assume Shoes-R-Us Corporation completed the following transactions: a. Sold a store building for $610,000. The building had cost Shoes-R-Us $1,300,000, and at the time of the sale its accumulated depreciation totaled $690,000. b. Lost a store building

> Lavallee Self Storage purchased land, paying $155,000 cash as a down payment and signing a $195,000 note payable for the balance. Lavallee also had to pay delinquent property tax of $4,000, title insurance costing $3,500, and $5,000 to level the land and

> Assume Shoe Warehouse Corporation completed the following transactions: a. Sold a store building for $650,000. The building had cost Shoe Warehouse $1,700,000, and at the time of the sale its accumulated depreciation totaled $1,050,000. b. Lost a store

> Ayer Self Storage purchased land, paying $175,000 cash as a down payment and signing a $190,000 note payable for the balance. Ayer also had to pay delinquent property tax of $3,500, title insurance costing $3,000, and $9,000 to level the land and remove

> Crescent Artichoke Growers (CAG) is a major food cooperative. Suppose CAG begins 2010 with cash of $11 million. CAG estimates cash receipts during 2010 will total $104 million. Planned payments will total $93 million. To meet daily cash needs next year,

> Northend Bank & Trust Company lent $130,000 to Sylvia Peters on a six-month, 9% note. Record the following for bank (explanations are not required): a. Lending the money on May 6. b. Collecting the principal and interest at maturity. Specify the date.

> Gray and Dumham, a law firm, started 2010 with accounts receivable of $31,000 and an allowance for uncollectible accounts of $4,000. The 2010 service revenues on account totaled $175,000, and cash collections on account totaled $128,000. During 2010, Gra

> After preparing Randell Corp.s bank reconciliation in Short Exercise 4-8, make the companys journal entries for transactions that arise from the bank reconciliation. Date each transaction October 31, and include an explanation with each entry

> Suppose Diamond, Inc., reported net receivables of $2,586 million and $2,268 million at January 31, 2011, and 2010, after subtracting allowances of $70 million and $64 million at these respective dates. Diamond earned total revenue of $53,333 million (al

> Newsome Corp. holds a portfolio of trading securities. Suppose that on November 1, Newsome paid $87,000 for an investment in Quark shares to add to its portfolio. At December 31, the market value of Quark shares is $98,000. For this situation, show every

> Refer to Amazon.com, Inc. s Consolidated Balance Sheets as well as Note 1 Description of Business and Accounting Policies, in Appendix A at the end of this book. 1. The fourth account listed on Amazon.coms Consolidated Balance Sheet is called accounts r

> Amazon.com, Inc. like all other businesses adjusts accounts prior to year end to get correct amounts for the financial statements. Examine Amazon.com, Inc.s Consolidated Balance Sheets in Appendix A, and pay particular attention to accrued expenses and o

> Foot Locker, Inc.s consolidated financial statements in Appendix B at the end of this book report a number of liabilities. Show amounts in thousands. 1. The current liability section of Foot Locker, Inc.s Consolidated Balance Sheet as of February 2, 200

> Refer to the Foot Locker, Inc., Consolidated Financial Statements in Appendix B at the end of this book. This case leads you through a comprehensive analysis of Foot Locker, Inc.s long-term assets. Its purpose is to show you how to account for plant asse

> Refer to the Foot Locker, Inc., consolidated financial statements in Appendix B at the end of this book. Show amounts in millions and round to the nearest $1 million. 1. Three important pieces of inventory information are (a) the cost of inventory on h

> Use the data for Kens in Exercise 6-16A to answer the following: Requirements 1. Compute cost of goods sold and ending inventory, using each of the following methods: a. Specific unit cost, with three $150 units and six $160 units still on hand at th

> Refer to Exercise 5-34B. From 34: On April 30, Hilltop Party Planners had a $33,000 balance in Accounts Receivable and a $4,000 credit balance in Allowance for Uncollectible Accounts. During May, the store made credit sales of $156,000. May collections

> On April 30, Hilltop Party Planners had a $33,000 balance in Accounts Receivable and a $4,000 credit balance in Allowance for Uncollectible Accounts. During May, the store made credit sales of $156,000. May collections on account were $132,000, and write

> At December 31, 2010, Whites Travel has an accounts receivable balance of $92,000. Allowance for Doubtful Accounts has a credit balance of $820 before the year-end adjustment. Service revenue for 2010 was $500,000. Whites Travel estimates that doubtful-a

> Eastern Corporation reports short-term investments on its balance sheet. Suppose a division of Eastern completed the following short-term investment transactions during 2010: Requirement 1. Prepare T-accounts for Cash, Short-Term Investment, Dividend R

> The net income of Solas Photography Company decreased sharply during 2010. Lisa Almond, owner of the company, anticipates the need for a bank loan in 2011. Late in 2010, Almond instructed Brad Lail, the accountant and a personal friend of yours, to recor

> Modern Co., Inc., the electronics and appliance chain, reported these figures in millions of dollars: Requirements 1. Compute Moderns average collection period during 2011. 2. Is Moderns collection period long or short? Viflex Networks takes 40 days

> Assume Tradesmen Credit Union completed these transactions: Show what the company would report for these transactions on its 2010 and 2011 balance sheets and income statements. 2010 Apr 1 Loaned $50,000 to Leanne Harold on a one-year, 7% note. Dec 3

> Record the following note receivable transactions in the journal of Celtic Realty. How much interest revenue did Celtic earn this year? Use a 365-day year for interest computations, and round interest amounts to the nearest dollar. Apr 1 Jun 6 Loaned

> Assume Kaledan paid $18 million to purchase Southwest.com. Assume further that Southwest had the following summarized data at the time of the Kaledan acquisition (amounts in millions): Southwests long-term assets had a current market value of only $17 m

> 1. Miracle Printers purchased for $700,000 a patent for a new laser printer. Although the patent gives legal protection for 20 years, it is expected to provide Miracle Printers with a competitive advantage for only eight years. Assuming the straight-line

> Mighty Mines paid $432,000 for the right to extract ore from a 425,000-ton mineral deposit. In addition to the purchase price, Mighty Mines also paid a $150 filing fee, a $2,700 license fee to the state of Colorado, and $92,150 for a geologic survey of t

> Trusty Truck Company is a large trucking company that operates throughout the United States. Trusty Truck Company uses the units-of-production (UOP) method to depreciate its trucks. Trusty Truck Company trades in trucks often to keep driver morale high a

> Assume that on January 2, 2010, McKnight of Wyoming purchased fixtures for $8,300 cash, expecting the fixtures to remain in service for five years. McKnight has depreciated the fixtures on a double-declining-balance basis, with $1,700 estimated residua

> Assume B 1 Accounting Consultants purchased a building for $435,000 and depreciated it on a straightline basis over 40 years. The estimated residual value was $73,000. After using the building for 20 years, B 1 realized that the building will remain usef

> For each of the following situations, answer the following questions: 1. What is the ethical issue in this situation? 2. What are the alternatives? 3. Who are the stakeholders? What are the possible consequences to each? Analyze from the following sta

> On June 30, 2010, Roy Corp. paid $200,000 for equipment that is expected to have an eight-year life. In this industry, the residual value is approximately 10% of the assets cost. Roys cash revenues for the year are $140,000 and cash expenses total $100

> Assume that in January 2010, an International Eatery restaurant purchased a building, paying $52,000 cash and signing a $106,000 note payable. The restaurant paid another $62,000 to remodel the building. Furniture and fixtures cost $57,000, and dishes an

> During 2010, Tao Book Store paid $488,000 for land and built a store in Detroit. Prior to construction, the city of Detroit charged Tao $1,800 for a building permit, which Tao paid. Tao also paid $15,800 for architect’s fees. The construction cost of $71

> Assume Delicious Desserts, Inc., purchased conveyor-belt machinery. Classify each of the following expenditures as a capital expenditure or an immediate expense related to machinery: a. Sales tax paid on the purchase price b. Transportation and insuranc

> Eastwood Manufacturing bought three used machines in a $216,000 lump-sum purchase. An independent appraiser valued the machines as shown in the table. What is each machines individual cost? Immediately after making this purchase, Eastwood sold machine 2

> Assume Haledan paid $16 million to purchase Northshore.com. Assume further that Northshore had the following summarized data at the time of the Haledan acquisition (amounts in millions): Northshores long-term assets had a current market value of only $1

> 1. Morris Printers purchased for $900,000 a patent for a new laser printer. Although the patent gives legal protection for 20 years, it is expected to provide Morris Printers with a competitive advantage for only 10 years. Assuming the straight-line meth

> Rocky Mines paid $426,000 for the right to extract ore from a 275,000-ton mineral deposit. In addition to the purchase price, Rocky Mines also paid a $120 filing fee, a $2,100 license fee to the state of Colorado, and $64,030 for a geologic survey of the

> Honest Truck Company is a large trucking company that operates throughout the United States. Honest Truck Company uses the units-of-production (UOP) method to depreciate its trucks. Honest Truck Company trades in trucks often to keep driver morale high a

> Assume that on January 2, 2010, Maxwell of Michigan purchased fixtures for $8,800 cash, expecting the fixtures to remain in service for five years. Maxwell has depreciated the fixtures on a double-declining-balance basis, with $1,300 estimated residual v

> United Jersey Bank of Princeton purchased land and a building for the lump sum of $6.0 million. To get the maximum tax deduction, the banks managers allocated 80% of the purchase price to the building and only 20% to the land. A more realistic allocation

> Assume G-1 Designing Consultants purchased a building for $400,000 and depreciated it on a straight-line basis over 40 years. The estimated residual value was $55,000. After using the building for 20 years, G-1 realized that the building will remain us

> On June 30, 2010, Rockwell Corp. paid $220,000 for equipment that is expected to have an eight-year life. In this industry, the residual value of equipment is approximately 10% of the assets cost. Rockwells cash revenues for the year are $115,000 and cas

> Assume that in January 2010, an Oatmeal House restaurant purchased a building, paying $56,000 cash and signing a $107,000 note payable. The restaurant paid another $61,000 to remodel the building. Furniture and fixtures cost $53,000, and dishes and suppl

> During 2010, Chun Book Store paid $487,000 for land and built a store in Akron. Prior to construction, the city of Akron charged Chun $1,400 for a building permit, which Chun paid. Chun also paid $15,320 for architect’s fees. The construction cost of $69

> Deadwood Manufacturing bought three used machines in a $167,000 lump-sum purchase. An independent appraiser valued the machines as shown in the table. What is each machines individual cost? Immediately after making this purchase, Deadwood sold machine 2

> Harbour Master Marine Supply reported the following comparative income statement for the years ended September 30, 2010, and 2009: Harbour Masters president and shareholders are thrilled by the company’s boost in sales and net income

> Durkin & Davis, a partnership, had these inventory data: Durkin & Davis need to know the company’s gross profit percentage and rate of inventory turnover for 2010 under 1. FIFO 2. LIFO Which method makes the business look be

> Refer to the data in Exercise 6-35B. Compute all ratio values to answer the following questions: Which company has the highest, and which company has the lowest, gross profit percentage? Which company has the highest, and the lowest rate of inventory t

> Ontario Garden Supplies uses a perpetual inventory system. Ontario Garden Supplies has these account balances at May 31, 2010, prior to making the year-end adjustments: A year ago, the replacement cost of ending inventory was $13,400, which exceeded th

> Suppose a Williams store in Cleveland, Ohio, ended September 2010 with 1,100,000 units of merchandise that cost an average of $9.00 each. Suppose the store then sold 1,000,000 units for $9.7 million during October. Further, assume the store made two larg

> During 2010, Vanguard, Inc., changed to the LIFO method of accounting for inventory . Suppose that during 2011, Vanguard changes back to the FIFO method and the following year Vanguard switches back to LIFO again. Requirements 1. What would you think

> MusicLife.net specializes in sound equipment. Because each inventory item is expensive, MusicLife uses a perpetual inventory system. Company records indicate the following data for a line of speakers: Requirements 1. Determine the amounts that MusicLif

> Use the data for Rons, Inc., in Exercise 6-29B to illustrate Rons income tax advantage from using LIFO over FIFO. Sales revenue is $8,750, operating expenses are $2,000, and the income tax rate is 32%. How much in taxes would Rons save by using the LIFO

> Rons, Inc.s inventory records for a particular development program show the following at May 31: At May 31, 10 of these programs are on hand. Journalize for Rons: 1. Total May purchases in one summary entry. All purchases were on credit. 2. Total May

> Accounting records for Rockford Corporation yield the following data for the year ended December 31, 2010: Requirements 1. Journalize Rockfords inventory transactions for the year under the perpetual system. 2. Report ending inventory, sales, cost of

> Big Blue Sea Marine Supply reported the following comparative income statement for the years ended September 30, 2010, and 2009: Big Blue Seas president and shareholders are thrilled by the company’s boost in sales and net income duri

> Thurston & Talty, a partnership, had the following inventory data: Thurston & Talty need to know the company’s gross profit percentage and rate of inventory turnover for 2010 under 1. FIFO 2. LIFO Which method makes the busin

> Refer to the data in Exercise 6-22A. Compute all ratio values to answer the following questions: Which company has the highest, and which company has the lowest, gross profit percentage? Which company has the highest, and the lowest rate of inventory t

> Supply the missing income statement amounts for each of the following companies (amounts adapted, in millions or billions): Requirement 1. Prepare the income statement for Crane Company, for the year ended December 31, 2010. Use the cost-of-goods-sold

> Thames Garden Supplies uses a perpetual inventory system. Thames Garden Supplies has these account balances at July 31, 2010, prior to making the year-end adjustments: A year ago, the replacement cost of ending inventory was $12,000, which exceeded cos

> Suppose a Waldorf store in Atlanta, Georgia, ended November 2010 with 900,000 units of merchandise that cost an average of $5 each. Suppose the store then sold 800,000 units for $4.8 million during December. Further, assume the store made two large purch

> Sunnyvale Loan Company is in the consumer loan business. Sunnyvale borrows from banks and loans out the money at higher interest rates. Sunnyvales bank requires Sunnyvale to submit quarterly financial statements to keep its line of credit. Sunnyvales mai

> MusicPlace.net specializes in sound equipment. Because each inventory item is expensive, MusicPlace uses a perpetual inventory system. Company records indicate the following data for a line of speakers: Requirements 1. Determine the amounts that Music

> Wilson Corporation reported the following for property and equipment (in millions, adapted): During 2011, Wilson paid $2,510 million for new property and equipment. Depreciation for the year totaled $1,546 million. During 2011, Wilson sold property and

> Buff Gym purchased exercise equipment at a cost of $107,000. In addition, Buff paid $3,000 for a special platform on which to stabilize the equipment for use. Freight costs of $1,600 to ship the equipment were borne by the seller. Buff will depreciate th

> All French Press (AFP) is a major French telecommunication conglomerate. Assume that early in year 1, AFP purchased equipment at a cost of 8 million euros (*8 million). Management expects the equipment to remain in service for four years and estimated re

> Norzani, Inc., has a popular line of sunglasses. Norzani reported net income of $66 million for 2010. Depreciation expense for the year totaled $32 million. Norzani, Inc., depreciates plant assets over eight years using the straight-line method and no re

> Suppose Trendy Now Fashions, a specialty retailer, had these records for ladies evening gowns during 2010. Assume sales of evening gowns totaled 130 units during 2010 and that Trendy Now uses the LIFO method to account for inventory. The income tax rat

> T Mart, Inc., declared bankruptcy. Let’s see why. T Mart reported these figures: Requirement 1. Evaluate the trend of T Marts results of operations during 2008 through 2010. Consider the trends of sales, gross profit, and net income.

> Radical Shirt Company sells on credit and manages its own receivables. Average experience for the past three years has been as follows: Jack Ryan, the owner, is considering whether to accept bankcards (VISA, MasterCard). Ryan expects total sales to incr

> Contemporary Co., Inc., the electronics and appliance chain, reported these figures in millions of dollars: Requirements 1. Compute Contemporarys average collection period during 2011. 2. Is Contemporarys collection period long or short? Kurzwel Netwo

> Navajo, Inc., reported the following items at December 31, 2010 and 2009: Requirement 1. Compute Navajos (a) acid-test ratio and (b) days sales in average receivables for 2010. Evaluate each ratio value as strong or weak. Navajo sells on terms of net