Question: Classify each of the following items found

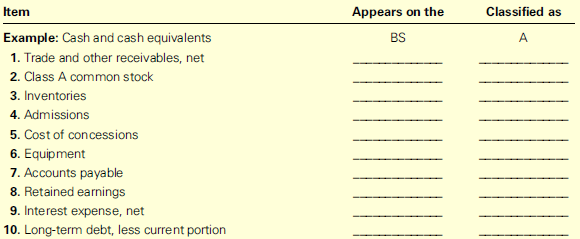

Classify each of the following items found in the company’s financial statements included in the Form 10-K for the year ended December 31, 2015, according to (1) whether it belongs on the income statement (IS) or balance sheet (BS) and (2) whether it is a revenue (R), expense (E), asset (A), liability (L), or stockholders’ equity (SE) item.

Transcribed Image Text:

Item Appears on the Classified as Example: Cash and cash equivalents BS A. 1. Trade and other receivables, net 2. Class A common stock 3. Inventories 4. Admissions 5. Cost of concessions 6. Equipment 7. Accounts payable 8. Retained earnings 9. Interest expense, net 10. Long-term debt, less current portion

> It takes Bradley Retailers 90 days on average to sell its inventory. The company began the year with $17,000 in inventory. Sales and cost of goods sold for the year amounted to $95,000 and $60,000, respectively. Required: Assuming 360 days in a year, de

> The following amounts are available from the 2015 financial statements in the Form 10-K for Nordstrom, Inc., the fashion retailer. (All amounts are in millions of dollars and January 30, 2016, is the end of the company’s 2015 fiscal year.) Cost of sales

> For each of the following transactions, indicate which company should include the inventory on its December 31, 2017, balance sheet: 1. Michelson Supplies Inc. shipped merchandise to PJ Sales on December 28, 2017, terms FOB destination. The merchandise

> For each of the following independent situations, fill in the blanks to indicate the effect of the error on each of the various financial statement items. Indicate an understatement (U), an overstatement (O), or no effect (NE). Assume that each of the co

> VanderMeer Inc. reported the following information for the month of February: Inventory, February 1 …………….………………………. 65 units @ $20 Purchases: February 7 ……………………………….……………………. 50 units @ $22 February 18 …………………………………………………… 60 units @ $23 February 27

> The president of SOS Inc. is concerned that the net income at year-end will not reach the expected figure. When the sales manager receives a large order on the last day of the fiscal year, the president tells the accountant to record the sale but to igno

> Put an X in the appropriate column next to the inventory item to indicate its most likely classification on the books of a company that manufactures furniture and then sells it in retail company stores. Classification Raw Work in Finished Goods Merc

> Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book for the information needed to answer the following questions. Chipotle reproduced: Panera Bread: Required: 1. Locate the note in each companyâ&

> Polk Corp. purchased new store fixtures for $55,000 on January 31, 2015. Polk depreciates assets using the straight-line method and estimated a salvage value for the machine of $5,000. On its December 31, 2017, balance sheet, Polk reported the following:

> On July 1, 2017, Dexter Corp. buys a computer system for $260,000 in cash. Assume that the computer is expected to have a four-year life and an estimated salvage value of $20,000 at the end of that time. Required: 1. Identify and analyze the transaction

> Somerville Corp. purchases office supplies once a month and prepares monthly financial statements. The asset account Office Supplies on Hand has a balance of $1,450 on May 1. Purchases of supplies during May amount to $1,100. Supplies on hand at May 31 a

> On April 1, 2017, Briggs Corp. purchases a 24-month property insurance policy for $72,000. The policy is effective immediately. Assume that Briggs prepares adjustments only once a year, on December 31. Required: 1. Compute the monthly cost of the insura

> Hudson Corp. has extra space in its warehouse and agrees to rent it out to Stillwater Company at the rate of $2,000 per month. The space was made available to Stillwater beginning on September 1. Under the terms of the agreement, Stillwater pays the mont

> On June 1, 2017, MicroTel Enterprises lends $60,000 to MaxiDriver Inc. The loan will be repaid in 60 days with interest at 10%. Required: 1. Identify and analyze the transaction on MicroTel’s books on June 1, 2017. 2. Identify and analyze the adjustment

> Lexington Builders owns property in Kaneland County. Lexington’s 2016 property taxes amounted to $50,000. Kaneland County will send out the 2017 property tax bills to property owners during April 2018. Taxes must be paid by June 1, 2018. Assume that Lexi

> Glendive takes out a 12%, 90-day, $100,000 loan with Second State Bank on March 1, 2017. Assume that Glendive prepares adjustments only four times a year: on March 31, June 30, September 30, and December 31. Required: 1. Identify and analyze the transac

> On July 1, 2017, Rogers Corp. took out a 60-day, $100,000 loan at the bank. On July 31, 2017, Rogers made the following adjustment: Required: 1. What is the interest rate on the loan? Explain your answer. 2. Identify and analyze the transaction on Roge

> Billings Company takes out a 12%, 90-day, $100,000 loan with First National Bank on March 1, 2017. Required: 1. Identify and analyze the transaction to take out the loan on March 1, 2017. 2. Identify and analyze the adjustments for the months of March a

> Carnival Corporation is the largest cruise company in the world. The following item appears in the current liabilities section of it’s balance sheet included in the Form 10-K for the year ended November 30, 2015: Customer deposits …………………………………………………………

> Denton Corporation employs 50 workers in its plant. Each employee is paid $10 per hour and works seven hours per day, Monday through Friday. Employees are paid every Friday. The last payday was Friday, September 19. Required: 1. Compute the dollar amoun

> The highway department contracted with a private company to collect tolls and maintain facilities on a turnpike. Users of the turnpike can pay cash as they approach the toll booth, or they can purchase a pass. The pass is equipped with an electronic sens

> Rock N Roll produces an outdoor concert festival that runs from June 28, 2017, through July 1, 2017. Concertgoers pay $80 for a four-day pass to the festival, and all 10,000 tickets are sold out by the May 1, 2017, deadline to buy tickets. Assume that Ro

> Wolfe & Wolfe collected $9,000 from a customer on April 1 and agreed to provide legal services during the next three months. Wolfe & Wolfe expects to provide an equal amount of services each month. Required: 1. Identify and analyze the transaction for t

> Horse Country Living publishes a monthly magazine for which a 12-month subscription costs $30. All subscriptions require payment of the full $30 in advance. On August 1, the balance in the Subscriptions Received in Advance account was $40,500. During the

> The following list of accounts was taken from the general ledger of Spencer Corporation on December 31. The bookkeeper thought it would be helpful if the accounts were arranged in alphabetical order. Each account contains the balance that is normal for t

> The new bookkeeper for Darby Corporation is getting ready to mail the daily cash receipts to the bank for deposit. Because his previous job was at a bank, he is aware that the bank ‘‘credits’â&#

> Each account has a normal balance. Classify each of the following items found on Vail Resorts’ 2015 financial statements included in the Form 10-K for the year ended July 31, 2015, according to (1) whether it is a revenue (R), expense (

> On December 31, 2017, Baxter Company reported $8,000 in prepaid insurance on its balance sheet. The insurer requires Baxter to pay the annual premium of $24,000 in advance. Required: 1. How much will Baxter recognize each month in insurance expense? 2.

> On September 1, Northhampton Industries signed a six-month lease for office space, which is effective September 1. Northhampton agreed to prepay the rent and mailed a check for $12,000 to the landlord on September 1. Assume that Northhampton prepares adj

> Refer to Panera Bread’s statement of cash flows for the year ended December 29, 2015, as reproduced at the end of the book. Panera Bread’s statement of cash flows: Required: 1. What amount did the company spend on a

> Prepare a table to summarize the following transactions as they affect the accounting equation. Use the format in Exhibit 3-1. Exhibit 3-1: 1. Services provided on account of $1,530 2. Purchases of supplies on account for $1,365 3. Services provided f

> Following are a number of users of accounting information and examples of questions they need answered before making decisions. Fill in each blank to indicate whether the user is most likely to find the answer by looking at the income statement (IS), the

> Gaynor Corporation’s partial income statement is as follows: Sales …………………………………………………………………………………………. $1,200,000 Cost of sales …………………………………………………………………………………… 450,000 Selling expenses ……………………………………………………………………………… 60,800 General and administrative ex

> Some headings and/or items are used on either the single- or multiple-step income statement. Some are used on both. Identify each of the following items as single-step (S), multiple-step (M), both formats (B), or not used on either income statement (N).

> Potential stockholders and lenders are interested in a company’s financial statements. Identify the statement—balance sheet (BS), income statement (IS), or retained earnings statement (RE)—on which ea

> Refer to Chipotle’s balance sheet reproduced in the chapter. Chipotle’s Balance Sheet: Balance sheets for Chipotle at the end of two recent years are shown in Exhibit 1-7. For comparative purposes, the company reports

> For each of the following cases, fill in the blank with the appropriate dollar amount. Sara's Coffee Shop Amy's Deli Jane's Bagels $ 35,000 $ $ 78,000 Net sales Cost of goods sold 45,000 Gross profit 7,000 18,000 Selling expenses 3,000 9,000 General

> Operating expenses are subdivided between selling expenses and general and administrative expenses when a multiple-step income statement is prepared. Identify each of the following items as a selling expense (S) or general and administrative expense (G&a

> Baldwin Corp. reported the following current accounts at the end of two recent years: Required: 1. Compute Baldwin’s current ratio at the end of each of the two years. 2. How has Baldwin’s liquidity changed at the en

> Two Wheeler Cycle Shop buys all of its bikes from one manufacturer, Baxter Bikes. On average, bikes are on hand for 45 days before Two Wheeler sells them. The company sells some bikes for cash but also extends credit to its customers for 30 days. Requir

> Refer to the income statements for Chipotle and Panera Bread reproduced at the back of the book. Chipotle reproduced: Panera Bread: Required: 1. Which is the largest expense for each company in the most recent year? What is its dollar amount? Explai

> Most financial reports contain the following list of basic elements. For each element, identify the person(s) who prepared the element and describe the information a user would expect to find in each element. Some information is verifiable; other informa

> Identify each of the following items as operating (O), investing (I), financing (F), or not on the statement of cash flows (N). 1. Paid for supplies 2. Collected cash from customers 3. Purchased land (held for resale) 4. Purchased land (for construc

> Landon Corporation was organized on January 2, 2015, with the investment of $100,000 by each of its two stockholders. Net income for its first year of business was $85,200. Net income increased during 2016 to $125,320 and to $145,480 during 2017. Landon

> The income statement of Holly Enterprises shows operating revenues of $134,800, selling expenses of $38,310, general and administrative expenses of $36,990, interest expense of $580, and income tax expense of $13,920. Holly’s stockholders’ equity was $28

> Using the accounting equation, answer each of the following independent questions. 1. Burlin Company starts the year with $100,000 in assets and $80,000 in liabilities. Net income for the year is $25,000, and no dividends are paid. How much is owners’ eq

> Ginger Enterprises began the year with total assets of $500,000 and total liabilities of $250,000. Using this information and the accounting equation, answer each of the following independent questions. 1. What was the amount of Ginger’s owners’ equity a

> Braxton Corp. was organized on January 1 to operate a limousine service to and from the airport. For each of the following business activities, indicate whether it is a financing (F), investing (I), or operating (O) activity. 1. Issued shares of sto

> The following information is available from the records of Prestige Landscape Design Inc. at the end of the year: Required: Use the previous information to answer the following questions. 1. What is Prestige’s net income for the year?

> For each of the following cases, fill in the blank with the appropriate dollar amount. Case 1 Case 2 Case 3 Case 4 Total assets, end of period Total liabilities, end of period $40,000 $4 $75,000 $50,000 15,000 25,000 10,000 Capital stock, end of per

> Refer to Panera Bread’s balance sheet reproduced at the back of the book to answer the following questions. Panera Bread’s balance sheet: Required: 1. Which is the largest of Panera Bread’s curren

> The following amounts are available from the records of Coaches and Carriages Inc. at the end of the years indicated: Required: 1. Compute the changes in Coaches and Carriages owners’ equity during 2016 and 2017. 2. Compute the amount

> Oak and Maple both provide computer consulting services to their clients. The following are the current assets for each company at the end of the year. (All amounts are in millions of dollars.) Required: As a loan officer for First National Bank of Ver

> R Montague and J Capulet distribute films to movie theatres. Following are the current assets for each distributor at the end of the year. (All amounts are in millions of dollars.) Required: As a loan officer for First National Bank of Verona Heights,

> You are the controller of a rapidly growing mass merchandiser. The company uses a periodic inventory system. As the company has grown and accounting systems have developed, errors have occurred in both the physical count of inventory and the valuation of

> You are the controller for Georgetown Company. At the end of its first year of operations, the company is experiencing cash flow problems. The following information has been accumulated during the year: Purchases January ……………………………………………………………………. 1,00

> Darrell Keith is starting a new business. He plans to keep a tight control over it. Therefore, he wants to know exactly how much gross profit he earns on each unit that he sells. Darrell sets up an elaborate numbering system to identify each item as it i

> Caroline’s Candy Corner sells gourmet chocolates. The company buys chocolates in bulk for $5 per pound plus 5% sales tax. Credit terms are 2/10, n/25, and the company always pays promptly to take advantage of the discount. The chocolates are shipped to C

> Emblems For You sells specialty sweatshirts. The purchase price is $10 per unit plus 10% tax and a shipping cost of 50¢ per unit. When the units arrive, they must be labeled, at an additional cost of 75¢ per unit. Emblems purchased, received, and labeled

> Jensen Inc., a graphic arts studio, is considering the purchase of computer equipment and software for a total cost of $18,000. Jensen can pay for the equipment and software over three years at the rate of $6,000 per year. The equipment is expected to la

> After you have gained five years of experience with a large CPA firm, one of your clients, Duke Inc., asks you to take over as chief financial officer for the business. Duke advises its clients on the purchase of software products and assists them in ins

> Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book for the information needed to answer the following questions. Chipotle reproduced: Panera Bread: Required: 1. Compute each company’

> Simon Fraser started a landscaping and lawn-care business in April by investing $20,000 cash in the business in exchange for capital stock. Because his business is in the Midwest, the season begins in April and concludes in September. He prepared the fol

> Shelia Young started a real estate business at the beginning of January. After approval by the state for a charter to incorporate, she issued 1,000 shares of stock to herself and deposited $20,000 in a bank account under the name Young Properties. Becaus

> As an investor, you are considering purchasing stock in a chain of theaters. The annual reports of several companies are available for comparison. Required: Prepare an outline of the steps you would follow to make your comparison. Start by listing the f

> Upon graduation from MegaState University, you and your roommate decide to start your respective careers in accounting and salmon fishing in Remote, Alaska. Your career as a CPA in Remote is going well, as is your roommate’s job as a commercial fisherman

> You have saved enough money to pay for your college tuition for the next three years when a high-school friend comes to you with a deal. He is an artist who has spent most of the past two years drawing on the walls of old buildings. The buildings are abo

> Charles, a financial consultant, has been self-employed for two years. His list of clients has grown, and he is earning a reputation as a shrewd investor. Charles rents a small office, uses the pool secretarial services, and has purchased a car that he i

> Mountain Home Health Inc. provides home nursing services in the Great Smoky Mountains of Tennessee. When contacted by a client or referred by a physician, nurses visit the patient and discuss needed services with the physician. Mountain Home Health earns

> Patterson Company is a large diversified business with a unit that sells commercial real estate. As a company, Patterson has been profitable in recent years with the exception of the real estate business, where economic conditions have resulted in weak s

> You were recently hired by a large retail bookstore chain. Your training involved spending a week at the largest and most profitable store in the district. The store manager assigned the head cashier to train you on the cash register and closing procedur

> As controller of a widely held public company, you are concerned with making the best decisions for the stockholders. At the end of its first year of operations, you are faced with the choice of method to value inventory. Specific identification is out o

> Refer to the financial information for Chipotle and Panera Bread reproduced at the back of the book and answer the following questions. Chipotle reproduced: Panera Bread: 1. What was the total revenue for each company for the most recent year? By wh

> As a newly hired staff accountant, you are assigned the responsibility of physically counting inventory at the end of the year. The inventory count proceeds in a timely fashion. The inventory is outdated, however. You suggest that the inventory cannot be

> You have won a lottery! You will receive $200,000, after taxes, each year for the next five years. Required: Describe the process you will go through in determining how to invest your winnings. Consider at least two options and make a choice. You may co

> The Financial Accounting Standards Board requires companies to supplement their consolidated financial statements with disclosures about segments of their businesses. To comply with this standard, the notes to the financial statements included in Time Wa

> The Coca-Cola Company and Subsidiaries reported the following amounts in various statements included in its Form 10-K for the year ended December 31, 2015. (All amounts are stated in millions of dollars.) Net income attributable to shareowners of The Co

> Hometown Cleaners Inc. operates a small dry-cleaning business. The company has always maintained a complete and accurate set of records. Unfortunately, the company’s accountant left in a dispute with the president and took the 2017 fina

> Century Company was organized 15 months ago as a management consulting firm. At that time, the owners invested a total of $50,000 cash in exchange for stock. Century purchased equipment for $35,000 cash and supplies to be used in the business. The equipm

> Green Bay Corporation began business in July 2017 as a commercial fishing operation and a passenger service between islands. Shares of stock were issued to the owners in exchange for cash. Boats were purchased by making a down payment in cash and signing

> The following list, in alphabetical order, shows the various items that regularly appear on the financial statements of Maple Park Theatres Corp. The amounts shown for balance sheet items are balances as of September 30, 2017 (with the exception of retai

> Dave is the president of Avon Consulting Inc. Avon began business at the beginning of the current year. The company’s controller is out of the country on business. Dave needs a copy of the company’s balance sheet for a

> The following items are available from records of Freescia Corporation at the end of the current year: Required: Prepare a balance sheet. Hint: Not all of the items listed should appear on a balance sheet. For each non-balance-sheet item, indicate wher

> Joe Hale opened a machine repair business in leased retail space, paying the first month’s rent of $300 and a $1,000 security deposit with a check on his personal account. He took the tools, worth about $7,500, from his garage to the sh

> Millie Abrams opened a ceramic studio in leased retail space, paying the first month’s rent of $300 and a $1,000 security deposit with a check on her personal account. She took molds and paint, worth about $7,500, from her home to the s

> Heidi’s Bakery Inc. operates a small pastry business. The company has always maintained a complete and accurate set of records. Unfortunately, the company’s accountant left in a dispute with the president and took the

> Fort Worth Corporation began business in January 2017 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable

> The following list, in alphabetical order, shows the various items that regularly appear on the financial statements of Sterns Audio Book Rental Corp. The amounts shown for balance sheet items are balances as of December 31, 2017 (with the exception of r

> Pete is the president of Island Enterprises. Island Enterprises began business at the beginning of the current year. The company’s controller is out of the country on business. Pete needs a copy of the company’s balanc

> Listum & Sellum Inc. is a medium-sized midwestern real estate company. It was founded five years ago by its two principal stockholders, Willie Listum and Dewey Sellum. Willie is president of the company, and Dewey is vice president of sales. Listum &

> The following items are available from the records of Victor Corporation at the end of the current year: Required: Prepare a balance sheet. Hint: Not all of the items listed should appear on a balance sheet. For each non-balance-sheet item, indicate wh

> You have inherited $1 million! Required: Describe the process you will go through in determining how to invest your inheritance. Consider at least two options and choose one. You may consider the stock of a certain company, bonds, real estate investment

> The Financial Accounting Standards Board requires companies to supplement their consolidated financial statements with disclosures about segments of their businesses. To comply with this standard, the notes to the financial statements included in Marriot

> Brunswick Corporation reported the following amounts in various statements included in its Form 10-K for the year ended December 31, 2015. (All amounts are stated in millions of dollars.) Net earnings for 2015 $ 241.4 Cash dividends paid in 2015 …………………

> The following balance sheet items, listed in alphabetical order, are available from the records of Ruth Corporation at December 31, 2017: Required: 1. Prepare in good form a classified balance sheet as of December 31, 2017. 2. Compute Ruthâ€

> The following costs are incurred by a retailer: 1. Display fixtures in a retail store 2. Advertising 3. Merchandise for sale 4. Incorporation (i.e., legal costs, stock issue costs) 5. Cost of a franchise 6. Office supplies 7. Wages and salaries 8. Comput

> Joseph Knapp, a newly hired accountant wanting to impress his boss, stayed late one night to analyze the office supplies expense. He determined the cost by month for the previous 12 months of each of the following: computer paper, copy paper, fax paper,

> Comparative income statements for Grammar Inc. are as follows: Required: The president and management believe that the company performed better in 2017 than it did in 2016. Write the president’s letter to be included in the 2017 annua

> Colorado Corporation was organized at the beginning of the year, with the investment of $250,000 in cash by its stockholders. The company immediately purchased an office building for $300,000, paying $210,000 in cash and signing a three-year promissory n

> Refer to the list of income statement items in Problem 2-6. Assume that Shaw Corporation classifies all operating expenses into two categories: (1) selling and (2) general and administrative. Problem 2-6: The following income statement items, arranged