Question: Classify the following costs of activity inputs

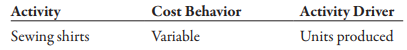

Classify the following costs of activity inputs as variable, fixed, or mixed. Identify the activity and the associated activity driver that allow you to define the cost behavior. For example, assume that the resource input is “cloth in a shirt.†The activity would be “sewing shirts,†the cost behavior “variable,†and the activity driver “units produced.†Prepare your answers in the following format:

a. Flu vaccine

b. Salaries, equipment, and materials used for moving materials in a factory

c. Forms used to file insurance claims

d. Salaries, forms, and postage associated with purchasing

e. Printing and postage for advertising circulars

f. Equipment, labor, and parts used to repair and maintain production equipment

g. Power to operate sewing machines in a clothing factory

h. Wooden cabinets enclosing audio speakers

i. Advertising

j. Sales commissions

k. Fuel for a delivery van

l. Depreciation on a warehouse

m. Depreciation on a forklift used to move partially completed goods

n. X-ray film used in the radiology department of a hospital

o. Rental car provided for a client

> Baxter Company has two processing departments: Assembly and Finishing. A predetermined over-head rate of $10 per DLH is used to assign overhead to production. The company experienced the following operating activity for April: a. Materials issued to Asse

> Using the same data found in Exercise 6-22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Data from Exercise 6-22: Brown Company has a product that passes

> Brown Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was $40,000

> Dama Company produces women’s blouses and uses the FIFO method to account for its manufacturing costs. The product Dama makes passes through two processes: Cutting and Sewing. During April, Dama’s controller prepared t

> Holmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: dir

> Using the data from Exercise 6-18, compute the equivalent units of production for each of the four departments using the FIFO method. Data from Exercise 6-18: The following data are for four independent process-costing departments. Inputs are added cont

> The following data are for four independent process-costing departments. Inputs are added continuously. Required: Compute the equivalent units of production for each of the preceding departments using the weighted average method.

> McCourt Company uses the FIFO method to account for the costs of production. For the first processing department, the following equivalent units schedule has been prepared: The cost per equivalent unit for the period was as follows: Direct materials $ 4.

> Limpiar Company produces a liquid household cleaning product. The Mixing Department, the first process department, mixes the ingredients required for the cleaning product. The following data are for May: Work in process, May 1 — Quarts started 270,000 Qu

> Middelton Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for October: a. All materials are added at the beginning of the process. b. Beginn

> Softkin Company manufactures sun protection lotion. The Mixing Department, the first process department, mixes the chemicals required for the repellant. The following data are for the current year: Work in process, January 1 — Gallons started 450,000 Gal

> McKay, Inc., produces a subassembly used in the production of hydraulic cylinders. The subassemblies are produced in three departments: Plate Cutting, Rod Cutting, and Welding. Materials are added at the beginning of the process. Overhead is applied usin

> Friedman Company uses JIT manufacturing. There are several manufacturing cells set up within one of its factories. One of the cells makes stands for flat-screen televisions. The cost of production for the month of April is given below. Cell labor $ 60,00

> A local barbershop cuts the hair of 1,200 customers per month. The clients are men, and the barbers offer no special styling. During the month of May, 1,200 customers were serviced. The cost of haircuts includes the following: Direct labor $ 9,000 Direct

> Sharma Company has three process departments: Mixing, Encapsulating, and Bottling. At the beginning of the year, there were no work-in-process or finished goods inventories. The following data are available for the month of July: Required: 1. Prepare jou

> Reggie Wilmore has just started a new business—building and installing custom garage organization systems. Reggie builds the cabinets and work benches in his workshop, then installs them in clients’ garages. Reggie figures his overhead for the coming yea

> Vince Kim, owner of EcoScape, noticed that the watering systems for many houses in a local subdivision had the same layout and required virtually identical amounts of prime cost. Vince met with the subdivision builders and offered to install a basic wate

> Vince Kim, of EcoScape Company, designs and installs custom lawn and garden irrigation systems for homes and businesses throughout the state. Each job is different, requiring different materials and labor for installing the systems. EcoScape estimated th

> Classify the following types of firms as either manufacturing or service. Explain the reasons for your choice in terms of the four features of service firms (heterogeneity, inseparability, intangibility, and perishability). a. Bicycle production b. Pharm

> During October, McCourt Associates incurred total production costs of $60,000 for copyediting manuscripts and had the following equivalent units schedule: Units completed = 285 Units in EWIP * Fraction complete: 25 * 0.60 = 15 Equivalent units = 300 Re

> Salazar Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Salazar identified three overhead activities and related drivers. Budgeted information for the year is as follows: Salazar worked on five jobs in Marc

> Kapoor Company uses job-order costing. During January, the following data were reported: a . Materials purchased on account: direct materials, $98,500; indirect materials, $14,800. b. Materials issued: direct materials, $82,500; indirect materials, $8,80

> Feldspar Company uses an ABC system to apply overhead. There are three activity rates: Setting up $20 per setup Machining $5.10 per machine hour Other overhead 80% of direct labor cost During September, Feldspar worked on three jobs. Data relating to the

> During August, Skyler Company worked on three jobs. Data relating to these three jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of $2.30 per direct labor hour. During August, Jobs 39 and 40 were completed and transferred t

> Lincoln Brothers Company makes jobs to customer order. During the month of May, the following occurred: a . Materials were purchased on account for $51,200. b. Materials totaling $43,600 were requisitioned for use in producing various jobs. c . Direct la

> Refer to Exercise 5-14. Cairle’s selling and administrative expenses for August were $1,200. Required: Prepare an income statement for Cairle Company for August. Data from Exercise 5-14: On August 1, Cairle Company’s

> On August 1, Cairle Company’s work-in-process inventory consisted of three jobs with the following costs: During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows: Before th

> Refer to Exercise 5-12. Required: 1. Prepare journal entries for the April transactions. 2. Calculate the ending balances of each of the inventory accounts as of April 30. Data from Exercise 5-12: On April 1, Sangvikar Company had the following balances

> On April 1, Sangvikar Company had the following balances in its inventory accounts: Materials Inventory $12,730 Work-in-Process Inventory 21,340 Finished Goods Inventory 8,700 Work-in-process inventory is made up of three jobs with the following costs: D

> During March, Estes Company worked on three jobs. Data relating to these three jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of $8.40 per direct labor hour. During March, Jobs 86 and 87 were completed and transferred to F

> Fleming, Fleming, and Garcia, a local CPA firm, provided the following data for individual returns processed for March (output is measured in number of returns): Units, beginning work in process — Units started 6,000 Units completed 5,000 Units, ending w

> Refer to Exercise 5-9. Required: 1. What source documents will Reggie need to account for costs in his new business? 2. Suppose Reggie’s business grows, and he expands his workshop and hires three additional carpenters to help him. What source documents

> For each of the following requirements, identify the data analytic type (descriptive, diagnostic, predictive, or prescriptive) that will help provide the needed answers. Note: More than one data analytic type might appear in any requirement. Required: 1

> A consulting firm has recently installed a TDABC system for the Shawnee University Library. The consulting firm identified four major processes or departments for the library: Acquisition, Cataloging, Circulation, and Document Delivery. The Acquisition D

> Gee Manufacturing produces two models of camshafts used in the production of automobile engines: Regular and High Performance. Gee currently uses an ABC system to assign costs to the two products. For the coming year, the company has the following overhe

> Refer to Exercise 4-22. Required: 1. Calculate the global consumption ratios for the two products. 2. Using the activity consumption ratios for number of orders and number of setups, show that the same cost assignment can be achieved using these two driv

> Silven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Silven produces two models of cell phones with the following expected activity demands: Required: 1. Determine the total overhead assigned t

> Bob Russo, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company’s Manufacturing Engineering Department. The department has the following activities: creating bills

> Calzado Company produces leather shoes in batches. The shoes are produced in one plant located on 20 acres. The plant operates two shifts, five days per week. Each time a batch is produced, just in-time suppliers deliver materials to the plant. When the

> Bob Russo, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company’s Manufacturing Engineering Department. The department has the following activities: creating bills of materials (BOMs

> Refer to the interview in Exercise 4-17 (especially to Questions 4 and 7). The general ledger reveals the following annual costs: Supervisor’s salary $ 64,600 Clerical salaries 210,000 Computers, desks, and printers 32,000 Computer supplies 7,200 Tel

> Lising Therapy has a physical therapist who performs electro-mechanical treatments for its patients. During April, Lising had the following cost and output information: Direct materials $ 750 Hygienist’s salary $4,250 Overhead $5,000 Number of treatments

> Golding Bank is in the process of implementing an activity-based costing system. A copy of an interview with the manager of Golding’s Credit Card Department follows. QUESTION 1: How many employees are in your department? RESPONSE: There are eight employe

> Deoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Deoro produces two models of dishwashers with the following expected prime costs and activity demands: The company’s normal

> McCourt Company produces two types of leather purses: standard and handcrafted. Both purses use equipment for cutting and stitching. The equipment also has the capability of creating standard designs. The standard purses use only these standard designs.

> Mariposa, Inc., produces machine tools and currently uses a plantwide overhead rate, based on machine hours. Alice Chen, the plant manager, has heard that departmental overhead rates can offer significantly better cost assignments than can a plantwide ra

> Craig Company uses a predetermined overhead rate to assign overhead to jobs. Because Craig’s production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $5.7 million, and the practical level

> Findley Company and Lemon Company both use predetermined overhead rates to apply manufacturing overhead to production. Findley’s is based on machine hours, and Lemon’s is based on materials cost. Budgeted production an

> Gomez, Inc., costs products using a normal costing system. The following data are available for last year: Budgeted: Overhead $ 285,600 Machine hours 84,000 Direct labor hours 10,200 Actual: Overhead $ 285,000 Machine hours 82,200 Direct labor hour

> Ginnian and Fitch, a regional accounting firm, performs yearly audits on a number of different for-profit and not-for-profit entities. Two years ago, Luisa Mellina, Ginnian’s partner in charge of operations, became concerned about the a

> Sweet Dreams Bakery was started five years ago by Della Fontera who was known for her breads, sweet rolls, and personalized cakes. Della had kept her accounting system simple, believing that she had a good intuitive handle on costs. She had been using th

> Morrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown below. Required: 1. Calculate the unit cost for December, using the weighted average method. 2. Calculate the cost of go

> Lassiter Company used the method of least squares to develop a cost equation to predict the cost of moving materials. There were 80 data points for the regression, and the following computer output was generated: Intercept $17,350 Slope 12.00 Coefficient

> The controller of the South Charleston plant of Ravinia, Inc., monitored activities associated with materials handling costs. The high and low levels of resource usage occurred in September and March for three different resources associated with material

> Refer to the data in Exercise 3-18. Required: 1. Compute the cost formula for radiology services using the method of least squares. 2. Using the formula computed in Requirement 1, what is the predicted cost of radiology services for October for 3,500 app

> Deepa Dalal opened a free-standing radiology clinic. She had anticipated that the costs for the radiological tests would be primarily fixed, but she found that costs increased with the number of tests performed. Costs for this service over the past nine

> Shirrell Blackthorn is the accountant for several pizza restaurants based in a tri-city area. The president of the chain wanted some help with budgeting and cost control, so Shirrell decided to analyze the accounts for the past year. She divided the acco

> Penny Hassan runs the Shear Beauty Salon near a college campus. Several months ago, Penny used some unused space at the back of the salon and bought two used tanning beds. She hired a receptionist and kept the salon open for extended hours each week so t

> J. Klompus, Inc., produces industrial machinery. J. Klompus has a machining department and a group of direct laborers called machinists. Each machinist is paid $25,000 and can machine up to 500 units per year. Klompus also hires supervisors to develop ma

> EcoBrite Labs performs tests on water samples supplied by outside companies to ensure that their waste water meets environmental standards. Customers deliver water samples to the lab and receive the lab reports via the Internet. The EcoBrite Labs facilit

> For the following activities and their associated resources, identify the following: (1) a cost driver, (2) flexible resources, and (3) committed resources. Also, label each resource as one of the following with respect to the cost driver: (a) variable a

> Washington Theater System entered into a three-year agreement with a local civic organization such that the organization would provide 5,000 of its patrons each month with a special ticket to attend a movie at Washington’s theaters. Each special ticket p

> Lamont Company produced 80,000 machine parts for diesel engines. There were no beginning or ending work-in-process inventories in any department. Lamont incurred the following costs for May: Required: 1. Calculate the costs transferred out of each depart

> Cashion Company produces chemical mixtures for veterinary pharmaceutical companies. Its factory has four mixing lines that mix various powdered chemicals together according to specified formulas. Each line can produce up to 5,000 barrels per year. Each l

> Fresh Powder, Inc., manufactures snowboards. Based on past experience, Fresh Powder has found that its total annual overhead costs can be represented by the following formula: Overhead cost 5 $2,500,000 1 $125X, where X equals number of snowboards. Last

> Examine the graphs in Exercise 3-26. Required: As explained in this chapter, cost behavior patterns can be described as fixed, variable, semi-variable, mixed, or step function in nature. Explain the exact type of cost behavior pattern represented by each

> The graphs below represent cost behavior patterns that might occur in a company’s cost structure. The vertical axis represents total cost, and the horizontal axis represents activity output. Required: Part 1: For each of the following s

> Sharon Glessing, controller for Janson Company, has noticed that the company faces a 75 percent learning rate for its specialty design line. In planning the cost of the latest design, Sharon assumed that the first set of units would take 1,000 direct lab

> Bordner Company manufactures HVAC (heating, ventilation, and air conditioning) systems for commercial buildings. For each new design, Bordner faces a 90 percent learning rate. On average, the first unit of a new design takes 600 hours. Direct labor is pa

> Last calendar year, Ellerson recognized revenue of $1,312,000 and had selling and administrative expenses of $204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year. 3. Ellerson’s chi

> Ellerson Company provided the following information for the last calendar year: Beginning inventory: Direct materials $68,000 Work in process 29,400 Finished goods 43,200 Ending inventory: Direct materials $70,400 Work in process 40,000 Finished goods 42

> Jazon Manufacturing produces two different models of cameras. One model has an automatic focus, whereas the other requires the user to determine the focus. The two products are produced in batches. Each time a batch is produced, the equipment must be con

> Millennium Pharmaceuticals, Inc. (MPI), designs and manufactures a variety of drugs. One new drug, Glaxane, has been in development for seven years. FDA approval has just been received, and MPI is ready to begin production and sales. Required: Which cost

> Now assume that the spoilage was due to the inherently fragile nature of the piece of stone picked out by the Flores family. Stanley had warned them that the chosen piece could require much more care and potentially additional work. As a result, Stanley

> Refer to Brief Exercise 2-2. Bob’s Bistro expects to produce 50,000 units and sell 50,500 units. Beginning inventory of finished goods is $13,000, and ending inventory of finished goods is expected to be $10,000. Required: 1. Prepare a

> Lakeesha Barnett owns and operates a package mailing store in a college town. Her store, Send It Packing, helps customers wrap items and send them via UPS, FedEx, and the USPS. Send It Packing also rents mailboxes to customers by the month. In May, purch

> Anglin Company, a manufacturing firm, has supplied the following information from its accounting records for the last calendar year: Required: 1. Prepare a cost of goods manufactured statement. 2. Prepare a cost of goods sold statement.

> Kildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for $52 each. The actual unit cost is as follows: Direct materials $14.70 Direct labor 5.80 Variable overhead 3.25 Fixed ove

> LeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: Direct materials inventory $62,400 Work-in-process inventory 33,900 Finished goods inventory 55,600 During

> For each of the following independent situations, calculate the missing values: 1. The Belen plant purchased $78,300 of direct materials during June. Beginning direct materials inventory was $2,500, and direct materials used in production were $73,500. W

> Picante, Inc., provided the following information for the last calendar year: Beginning inventory: Direct materials $150,500 Work in process 95,300 Ending inventory: Direct materials $145,300 Work in process 91,400 During the year, direct materials p

> Three possible product cost definitions were introduced: (1) value chain, (2) operating, and (3) product or manufacturing. Identify which of the three product cost definitions best fits the following situations (justify your choice): a. Determining which

> Nizam Company produces speaker cabinets. Recently, Nizam switched from a traditional departmental assembly line system to a manufacturing cell in order to produce the cabinets. Suppose that the cabinet manufacturing cell is the cost object. Assume that a

> Consider the following data analytic types (1 through 4): 1. Descriptive 2. Diagnostic 3. Predictive 4. Prescriptive Required: Read the following brief descriptions (a through f ) of various cost management analyses. Classify each description into the da

> The following items are associated with a cost accounting information system: a. Usage of direct materials b. Assignment of direct materials cost to each product c. Direct labor cost incurrence d. Depreciation on production equipment e. Cost accounting p

> Stanley Company installs granite countertops in customers’ homes. First, the customer chooses the particular granite slab, and then Stanley measures the countertop area at the customer’s home, cuts the granite to that shape, and installs it. The Flores j

> In general, systems are described by the following pattern: (1) interrelated parts, (2) processes, and (3) objectives. Operational models of systems also identify inputs and outputs. The dishwashing system of a college cafeteria consists of the following

> State University’s football team just received a bowl game invitation, and the students and alumni are excited. Holiday Travel Agency, located close to campus, decided to put together a bowl game package. For $50,000, a 737 jet could be chartered to take

> The job responsibilities of three employees of Ruido Speakers, Inc., are described as follows: Kaylin Hepworth, production manager, is responsible for production of the plastic casing in which the speaker components are placed. She supervises the line wo

> Sterling, Inc., is an export-import firm. On June 1, Sterling purchased goods from a British company costing £20,000. Payment is due in pounds on September 1. The spot rate on June 1 was $1.29 per pound, and on September 1, it was $1.34 per pound. Requir

> Pacific Rim, Inc., is considering opening a new warehouse to serve the northwest region. Darnell Florian, controller for Pacific Rim, has been reading about the advantages of FTZs. He wonders if locating in one would be of benefit to his company, which i

> Cajas, Inc., is considering opening a new warehouse to serve the Southwest region. Aaron Garcia, controller for Cajas, has been reading about the advantages of FTZs. He wonders if locating in one would be of benefit to his company, which imports about 90

> A close friend of yours is majoring in accounting and would like to work for an MNC upon graduation. Your friend is unsure just what courses would help prepare for that goal and wants your advice. Required: Advise your friend on the kind of courses that

> Yukon, Inc., has a division in Canada, the Exterior Stain Division, which makes long-lasting exterior wood stain. Yukon has another U.S. division, the Retail Division, which operates a chain of home improvement stores. The Retail Division would like to b

> Colorworld, Inc., has a division in Indonesia that makes dyestuff in a variety of colors used to dye denim for jeans and another division in the United States that manufactures denim clothing. The Dyestuff Division incurs manufacturing costs of $2.68 for

> Mitford Furniture Manufacturing, Inc., has a division in the United States that produces and sells furniture for discount furniture stores. One type of dining room set is made in the International Division in China. The dining room sets are sold external

> Reider Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Reider identified three overhead activities and related drivers. Budgeted information for the year is as follows: Reider worked on four jobs in July. D

> Ariana Stratford, vice president for Newtronics, Inc., was reviewing the latest results for two divisions. The first, located in Baja California, Mexico, had posted income of $150,000 on assets of $1,500,000. The second, in Punt-on-Thames, England, showe

> Permian Company engages in many foreign currency transactions. Company policy is to hedge exposure to exchange gains and losses using forward contracts. On July 1, Permian bought merchandise from a Canadian company for 120,000 Canadian dollars, payable o

> Refer to Exercise 21-9. If Sterling paid for the purchase using the September 1 spot rate, what was the exchange gain or loss? Data from Exercise 21-9: Sterling, Inc., is an export-import firm. On June 1, Sterling purchased goods from a British company