Question: Sharma Company has three process departments:

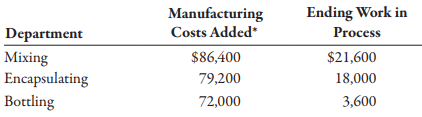

Sharma Company has three process departments: Mixing, Encapsulating, and Bottling. At the beginning of the year, there were no work-in-process or finished goods inventories. The following data are available for the month of July:

Required:

1. Prepare journal entries that show the transfer of costs from one department to the next (including the entry to transfer the costs of the final department).

2. Prepare T-accounts for the entries made in Requirement 1. Use arrows to show the flow of costs.

> Olympus, Inc., manufactures three models of mattresses: the Sleepeze, the Plushette, and the Ultima. Forecast sales for next year are 15,000 for the Sleepeze, 12,000 for the Plushette, and 5,000 for the Ultima. Gene Dixon, vice president of sales, has pr

> At the end of the year, Engersol, Inc., actually produced 305,000 units of the commercial cleaner and 120,000 of the deluxe model. The actual overhead costs incurred were: Maintenance $ 56,900 Power 10,000 Indirect labor 108,700 Rent 28,000 Required: Pre

> In an attempt to improve budgeting, the controller for Engersol, Inc., has developed a flexible budget for overhead costs. Engersol, Inc., makes two types of products, commercial floor cleaners and household floor cleaners. The company expects to produce

> Ingles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other institutions. The table tops are manufactured by Ingles, but the table legs are purchased from an outside supplier. The Assembly Department takes a manufacture

> Del Spencer’s purchases clothing evenly throughout the month. All purchases are on account. On the first of every month, Jana Spencer, Del’s wife, pays for all of the previous month’s purchases. Terms are 2/10, n/30 (i.e., a 2 percent discount can be tak

> Del Spencer is the owner and founder of Del Spencer’s Men’s Clothing Store. Del Spencer’s has its own house charge accounts and has found from past experience that 10 percent of its sales are for cash. The remaining 90 percent are on credit. An aging sch

> Historically, Ragman Company has had no significant bad debt experience with its customers. Cash sales have accounted for 20 percent of total sales, and payments for credit sales have been received as follows: 40 percent of credit sales in the month of t

> LeeAnn Ortiz owns a retail store that sells new and used sporting equipment. LeeAnn has requested a cash budget for October. After examining the records of the company, you find the following: a. Cash balance on October 1 is $980. b. Actual sales for Aug

> Rosita thinks that it may be time to refuse to accept checks and to start accepting credit cards. She is negotiating with VISA/MasterCard and American Express, and she would start the new policy on April 1. Rosita estimates that with the drop in sales fr

> Rosita Flores owns Rosita’s Mexican Restaurant in Tempe, Arizona. Rosita’s is an affordable restaurant near campus and several hotels. Rosita accepts cash and checks. Checks are deposited immediately. The bank charges $0.50 per check; the amount per chec

> Gunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December: Required: 1. Calculate the unit cost for December, using the FIFO method. 2. Calculate the cost of goods transferred ou

> Tiger Drug Store carries a variety of health and beauty aids, including 500-count bottles of vitamins. The sales budget for vitamins for the first six months of the year is presented below. The owner of Tiger Drug believes that ending inventories should

> Video-Forward, Inc., designs and manufactures wearable video cameras. Models A-1, A-2, and A-3 are lightweight video cameras that can be used on arms and headbands. Models A-4 and A-5 have larger memory, better resolution, and more Wi-Fi-related features

> Macchu Company produces stuffed toy animals; one of these is “Andie the Llama.” Each Andie takes 0.30 yard of fabric and eight ounces of polyfiberfill. Fabric costs $3.50 per yard and polyfiberfill is $0.05 per ounce.

> Archer Company produces two products: the custom and the basic. The custom sells for $30, and the basic sells for $8. Projected sales of the two models for the coming four quarters are given below. The president of the company believes that the projected

> Palmgren Company produces consumer products. The sales budget for four months of the year is presented below. Company policy requires that ending inventories for each month be 25 percent of next month’s sales. At the beginning of July,

> Arvin, Inc., produces two products, ins and outs, in a single process. The joint costs of this process were $77,300, and 14,000 units of ins and 36,000 units of outs were produced. Separable processing costs beyond the split-off point were as follows: in

> Refer to Exercise 7-25 and allocate the joint costs using the sales-value-at-split-off method. Data from Exercise 7-25: Alomar Company manufactures four products from a joint production process: barlon, selene, plicene, and corsol. The joint costs for o

> Alomar Company manufactures four products from a joint production process: barlon, selene, plicene, and corsol. The joint costs for one batch are as follows: Direct materials $67,900 Direct labor 34,000 Overhead 25,500 At the split-off point, a batch yie

> Refer to the data in Exercise 7-22. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the costs of the support departments using the sequential method. (Round allocation ratios to four significant digits. R

> The company has decided to simplify its method of allocating support service costs by switching to the direct method. Required: 1. Allocate the costs of the support departments to the producing departments using the direct method. (Round allocation ratio

> Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follo

> Eilers Company has two producing departments and two support departments. The following budgeted data pertain to these four departments: Required: 1. Allocate the overhead costs of the support departments to the producing departments using the reciprocal

> The company has decided to use the sequential method of allocation instead of the direct method. The support departments are ranked in order of highest cost to lowest cost. Required: 1. Allocate the overhead costs to the producing departments using the s

> Belami Company manufactures shampoo and hair conditioner, with each product manufactured in separate departments. Three support departments support the production departments: Power, General Factory, and Purchasing. Budgeted data on the five departments

> When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 direct labor hours. This usage is also the amount of activity planned for the two departments in Year 1 and Year 2. Required: 1. A

> Kumar, Inc., evaluates managers of producing departments on their ability to control costs. In addition to the costs directly traceable to their departments, each production manager is held responsible for a share of the costs of a support center, the Hu

> Jeff McMillan owns a small neighborhood shopping mall. Of the 10 store spaces in the building, seven are rented by boutique owners and three are vacant. Jeff has decided that offering more services to stores in the mall would enable him to increase occup

> Samantha and Rashida are planning a trip to Padre Island, Texas, during spring break. Members of the varsity volleyball team, they are looking forward to four days of beach volleyball and parasailing. They will drive Samantha’s car and estimate that they

> Dr. Fred Poston, “Dermatologist to the Stars,” has a practice in southern California. The practice includes three dermatologists, three medical assistants, an office manager, and a receptionist. The office space, which is rented for $5,000 per month, is

> Identify some possible causal factors for the following support departments: a. Cafeteria b. Custodial services c. Laundry d. Receiving, shipping, and stores e. Maintenance f. Personnel g. Accounting h. Power i. Building and grounds

> Classify each of the following departments in a large metropolitan law firm as a producing department or a support department. a. Copying b. WESTLAW computer research c. Tax planning d. Environmental law e. Oil and gas law f. Custodians g. Word processin

> Dulce Company produces 70 percent dark chocolate truffles. Conversion costs are added uniformly. For the first week in March, EWIP is 80 percent complete with respect to conversion costs. Materials are added at the beginning of the process. The following

> Classify each of the following departments in a factory that produces crème-filled snack cakes as a producing department or a support department. a. Janitorial b. Baking c. Inspection d. Mixing e. Engineering f. Grounds g. Purchasing h. Packaging i. Icin

> Tasty Bread makes and supplies bread throughout the state of Kansas. Three types of bread are produced: loaves, rolls, and buns. Seven operations describe the production process. a. Mixing: Flour, milk, yeast, salt, butter, and so on, are mixed in a larg

> Baxter Company has two processing departments: Assembly and Finishing. A predetermined over-head rate of $10 per DLH is used to assign overhead to production. The company experienced the following operating activity for April: a. Materials issued to Asse

> Using the same data found in Exercise 6-22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Data from Exercise 6-22: Brown Company has a product that passes

> Brown Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was $40,000

> Dama Company produces women’s blouses and uses the FIFO method to account for its manufacturing costs. The product Dama makes passes through two processes: Cutting and Sewing. During April, Dama’s controller prepared t

> Holmes Products, Inc., produces plastic cases used for video cameras. The product passes through three departments. For April, the following equivalent units schedule was prepared for the first department: Costs assigned to beginning work in process: dir

> Using the data from Exercise 6-18, compute the equivalent units of production for each of the four departments using the FIFO method. Data from Exercise 6-18: The following data are for four independent process-costing departments. Inputs are added cont

> The following data are for four independent process-costing departments. Inputs are added continuously. Required: Compute the equivalent units of production for each of the preceding departments using the weighted average method.

> McCourt Company uses the FIFO method to account for the costs of production. For the first processing department, the following equivalent units schedule has been prepared: The cost per equivalent unit for the period was as follows: Direct materials $ 4.

> Limpiar Company produces a liquid household cleaning product. The Mixing Department, the first process department, mixes the ingredients required for the cleaning product. The following data are for May: Work in process, May 1 — Quarts started 270,000 Qu

> Middelton Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for October: a. All materials are added at the beginning of the process. b. Beginn

> Softkin Company manufactures sun protection lotion. The Mixing Department, the first process department, mixes the chemicals required for the repellant. The following data are for the current year: Work in process, January 1 — Gallons started 450,000 Gal

> McKay, Inc., produces a subassembly used in the production of hydraulic cylinders. The subassemblies are produced in three departments: Plate Cutting, Rod Cutting, and Welding. Materials are added at the beginning of the process. Overhead is applied usin

> Friedman Company uses JIT manufacturing. There are several manufacturing cells set up within one of its factories. One of the cells makes stands for flat-screen televisions. The cost of production for the month of April is given below. Cell labor $ 60,00

> A local barbershop cuts the hair of 1,200 customers per month. The clients are men, and the barbers offer no special styling. During the month of May, 1,200 customers were serviced. The cost of haircuts includes the following: Direct labor $ 9,000 Direct

> Reggie Wilmore has just started a new business—building and installing custom garage organization systems. Reggie builds the cabinets and work benches in his workshop, then installs them in clients’ garages. Reggie figures his overhead for the coming yea

> Vince Kim, owner of EcoScape, noticed that the watering systems for many houses in a local subdivision had the same layout and required virtually identical amounts of prime cost. Vince met with the subdivision builders and offered to install a basic wate

> Vince Kim, of EcoScape Company, designs and installs custom lawn and garden irrigation systems for homes and businesses throughout the state. Each job is different, requiring different materials and labor for installing the systems. EcoScape estimated th

> Classify the following types of firms as either manufacturing or service. Explain the reasons for your choice in terms of the four features of service firms (heterogeneity, inseparability, intangibility, and perishability). a. Bicycle production b. Pharm

> During October, McCourt Associates incurred total production costs of $60,000 for copyediting manuscripts and had the following equivalent units schedule: Units completed = 285 Units in EWIP * Fraction complete: 25 * 0.60 = 15 Equivalent units = 300 Re

> Salazar Company is a job-order costing firm that uses activity-based costing to apply overhead to jobs. Salazar identified three overhead activities and related drivers. Budgeted information for the year is as follows: Salazar worked on five jobs in Marc

> Kapoor Company uses job-order costing. During January, the following data were reported: a . Materials purchased on account: direct materials, $98,500; indirect materials, $14,800. b. Materials issued: direct materials, $82,500; indirect materials, $8,80

> Feldspar Company uses an ABC system to apply overhead. There are three activity rates: Setting up $20 per setup Machining $5.10 per machine hour Other overhead 80% of direct labor cost During September, Feldspar worked on three jobs. Data relating to the

> During August, Skyler Company worked on three jobs. Data relating to these three jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of $2.30 per direct labor hour. During August, Jobs 39 and 40 were completed and transferred t

> Lincoln Brothers Company makes jobs to customer order. During the month of May, the following occurred: a . Materials were purchased on account for $51,200. b. Materials totaling $43,600 were requisitioned for use in producing various jobs. c . Direct la

> Refer to Exercise 5-14. Cairle’s selling and administrative expenses for August were $1,200. Required: Prepare an income statement for Cairle Company for August. Data from Exercise 5-14: On August 1, Cairle Company’s

> On August 1, Cairle Company’s work-in-process inventory consisted of three jobs with the following costs: During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows: Before th

> Refer to Exercise 5-12. Required: 1. Prepare journal entries for the April transactions. 2. Calculate the ending balances of each of the inventory accounts as of April 30. Data from Exercise 5-12: On April 1, Sangvikar Company had the following balances

> On April 1, Sangvikar Company had the following balances in its inventory accounts: Materials Inventory $12,730 Work-in-Process Inventory 21,340 Finished Goods Inventory 8,700 Work-in-process inventory is made up of three jobs with the following costs: D

> During March, Estes Company worked on three jobs. Data relating to these three jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of $8.40 per direct labor hour. During March, Jobs 86 and 87 were completed and transferred to F

> Fleming, Fleming, and Garcia, a local CPA firm, provided the following data for individual returns processed for March (output is measured in number of returns): Units, beginning work in process — Units started 6,000 Units completed 5,000 Units, ending w

> Refer to Exercise 5-9. Required: 1. What source documents will Reggie need to account for costs in his new business? 2. Suppose Reggie’s business grows, and he expands his workshop and hires three additional carpenters to help him. What source documents

> For each of the following requirements, identify the data analytic type (descriptive, diagnostic, predictive, or prescriptive) that will help provide the needed answers. Note: More than one data analytic type might appear in any requirement. Required: 1

> A consulting firm has recently installed a TDABC system for the Shawnee University Library. The consulting firm identified four major processes or departments for the library: Acquisition, Cataloging, Circulation, and Document Delivery. The Acquisition D

> Gee Manufacturing produces two models of camshafts used in the production of automobile engines: Regular and High Performance. Gee currently uses an ABC system to assign costs to the two products. For the coming year, the company has the following overhe

> Refer to Exercise 4-22. Required: 1. Calculate the global consumption ratios for the two products. 2. Using the activity consumption ratios for number of orders and number of setups, show that the same cost assignment can be achieved using these two driv

> Silven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Silven produces two models of cell phones with the following expected activity demands: Required: 1. Determine the total overhead assigned t

> Bob Russo, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company’s Manufacturing Engineering Department. The department has the following activities: creating bills

> Calzado Company produces leather shoes in batches. The shoes are produced in one plant located on 20 acres. The plant operates two shifts, five days per week. Each time a batch is produced, just in-time suppliers deliver materials to the plant. When the

> Bob Russo, cost accounting manager for Hemple Products, was asked to determine the costs of the activities performed within the company’s Manufacturing Engineering Department. The department has the following activities: creating bills of materials (BOMs

> Refer to the interview in Exercise 4-17 (especially to Questions 4 and 7). The general ledger reveals the following annual costs: Supervisor’s salary $ 64,600 Clerical salaries 210,000 Computers, desks, and printers 32,000 Computer supplies 7,200 Tel

> Lising Therapy has a physical therapist who performs electro-mechanical treatments for its patients. During April, Lising had the following cost and output information: Direct materials $ 750 Hygienist’s salary $4,250 Overhead $5,000 Number of treatments

> Golding Bank is in the process of implementing an activity-based costing system. A copy of an interview with the manager of Golding’s Credit Card Department follows. QUESTION 1: How many employees are in your department? RESPONSE: There are eight employe

> Deoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Deoro produces two models of dishwashers with the following expected prime costs and activity demands: The company’s normal

> McCourt Company produces two types of leather purses: standard and handcrafted. Both purses use equipment for cutting and stitching. The equipment also has the capability of creating standard designs. The standard purses use only these standard designs.

> Mariposa, Inc., produces machine tools and currently uses a plantwide overhead rate, based on machine hours. Alice Chen, the plant manager, has heard that departmental overhead rates can offer significantly better cost assignments than can a plantwide ra

> Craig Company uses a predetermined overhead rate to assign overhead to jobs. Because Craig’s production is machine intensive, overhead is applied on the basis of machine hours. The expected overhead for the year was $5.7 million, and the practical level

> Findley Company and Lemon Company both use predetermined overhead rates to apply manufacturing overhead to production. Findley’s is based on machine hours, and Lemon’s is based on materials cost. Budgeted production an

> Gomez, Inc., costs products using a normal costing system. The following data are available for last year: Budgeted: Overhead $ 285,600 Machine hours 84,000 Direct labor hours 10,200 Actual: Overhead $ 285,000 Machine hours 82,200 Direct labor hour

> Classify the following costs of activity inputs as variable, fixed, or mixed. Identify the activity and the associated activity driver that allow you to define the cost behavior. For example, assume that the resource input is “cloth in

> Ginnian and Fitch, a regional accounting firm, performs yearly audits on a number of different for-profit and not-for-profit entities. Two years ago, Luisa Mellina, Ginnian’s partner in charge of operations, became concerned about the a

> Sweet Dreams Bakery was started five years ago by Della Fontera who was known for her breads, sweet rolls, and personalized cakes. Della had kept her accounting system simple, believing that she had a good intuitive handle on costs. She had been using th

> Morrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown below. Required: 1. Calculate the unit cost for December, using the weighted average method. 2. Calculate the cost of go

> Lassiter Company used the method of least squares to develop a cost equation to predict the cost of moving materials. There were 80 data points for the regression, and the following computer output was generated: Intercept $17,350 Slope 12.00 Coefficient

> The controller of the South Charleston plant of Ravinia, Inc., monitored activities associated with materials handling costs. The high and low levels of resource usage occurred in September and March for three different resources associated with material

> Refer to the data in Exercise 3-18. Required: 1. Compute the cost formula for radiology services using the method of least squares. 2. Using the formula computed in Requirement 1, what is the predicted cost of radiology services for October for 3,500 app

> Deepa Dalal opened a free-standing radiology clinic. She had anticipated that the costs for the radiological tests would be primarily fixed, but she found that costs increased with the number of tests performed. Costs for this service over the past nine

> Shirrell Blackthorn is the accountant for several pizza restaurants based in a tri-city area. The president of the chain wanted some help with budgeting and cost control, so Shirrell decided to analyze the accounts for the past year. She divided the acco

> Penny Hassan runs the Shear Beauty Salon near a college campus. Several months ago, Penny used some unused space at the back of the salon and bought two used tanning beds. She hired a receptionist and kept the salon open for extended hours each week so t

> J. Klompus, Inc., produces industrial machinery. J. Klompus has a machining department and a group of direct laborers called machinists. Each machinist is paid $25,000 and can machine up to 500 units per year. Klompus also hires supervisors to develop ma

> EcoBrite Labs performs tests on water samples supplied by outside companies to ensure that their waste water meets environmental standards. Customers deliver water samples to the lab and receive the lab reports via the Internet. The EcoBrite Labs facilit

> For the following activities and their associated resources, identify the following: (1) a cost driver, (2) flexible resources, and (3) committed resources. Also, label each resource as one of the following with respect to the cost driver: (a) variable a

> Washington Theater System entered into a three-year agreement with a local civic organization such that the organization would provide 5,000 of its patrons each month with a special ticket to attend a movie at Washington’s theaters. Each special ticket p

> Lamont Company produced 80,000 machine parts for diesel engines. There were no beginning or ending work-in-process inventories in any department. Lamont incurred the following costs for May: Required: 1. Calculate the costs transferred out of each depart

> Cashion Company produces chemical mixtures for veterinary pharmaceutical companies. Its factory has four mixing lines that mix various powdered chemicals together according to specified formulas. Each line can produce up to 5,000 barrels per year. Each l

> Fresh Powder, Inc., manufactures snowboards. Based on past experience, Fresh Powder has found that its total annual overhead costs can be represented by the following formula: Overhead cost 5 $2,500,000 1 $125X, where X equals number of snowboards. Last