Question: Cost data for Disksan Manufacturing Company for

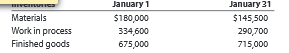

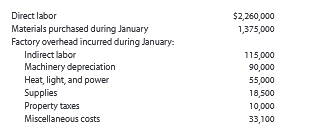

Cost data for Disksan Manufacturing Company for the month ended January 31 are as follows

a. Prepare a cost of goods manufactured statement for January.

b. Determine the cost of goods sold for January

Transcribed Image Text:

January 1 January 31 Materials $180,000 $145,500 290,700 Work in process Finished goods 334,600 675,000 715,000 Direct labor $2,260,000 Materials purchased during January Factory overhead incurred during January: 1,375,000 Indirect labor 115,000 90,000 Machinery depreciation Heat, light, and power Supplies Property taxes 55,000 18,500 10,000 Miscellaneous costs 33,100

> For each of the following service departments, select the activity base listed that is most appropriate for charging service expenses to responsible units: Service Department Activity Base 1. Number of employees trained 2. Number of payroll checks 3

> Discuss how the predetermined factory overhead rate can be used in job order cost accounting to assist management in pricing jobs.

> What is a job cost sheet?

> Describe how a job order cost system can be used for professional service businesses.

> Using the following revenue journal for Bowman Cleaners Inc., identify each of the posting references, indicated by a letter, as representing (1) posting to general ledger accounts or (2) posting to subsidiary ledger accounts: REVENUE JOURNAL Acco

> Pinnacle Consulting Company makes most of its sales and purchases on credit. It uses the five journals described in this chapter (revenue, cash receipts, purchases, cash payments, and general). Identify the journal most likely used in recording the posti

> Cromwell Furniture Company manufactures sofas for distribution to several major retail chains. The following costs are incurred in the production and sale of sofas: a. Fabric for sofa coverings b. Wood for framing the sofas c. Legal fees paid to attor

> Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department

> Sun Airlines is a commercial airline that targets business and nonbusiness travelers. In re- cent months, the airline has been unprofitable. The company has break-even sales volume of 75% of capacity, which is significantly higher than the industry avera

> AM Express Inc. is considering the purchase of an additional delivery vehicle for $55,000 on January 1, 20Y1. The truck is expected to have a five-year life with an expected residual value of $15,000 at the end of five years. The expected additional reve

> Parisian Cosmetics Company is planning a one-month campaign for September to promote sales of one of its two cosmetics products. A total of $140,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The fo

> Data related to the expected sales of two types of frozen pizzas for Norfolk Frozen Foods Inc. for the current year, which is typical of recent years, are as follows: The estimated fixed costs for the current year are $46,800. Instructions 1. Determ

> Last year Parr Co. had sales of $900,000, based on a unit selling price of $200. The variable cost per unit was $125, and fixed costs were $225,000. The maximum sales within Parr Co.’s relevant range are 7,500 units. Parr Co. is considering a proposal to

> For the coming year, Culpeper Products Inc. anticipates a unit selling price of $150, a unit variable cost of $110, and fixed costs of $800,000. Instructions 1. Compute the anticipated break-even sales (units). 2. Compute the sales (units) required t

> Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 20Y8, were as follows: Jan. 3. Issued a check to establish a petty cash fund of $4,500. Feb. 26. Replenished the petty cash fund, based on the following

> Aaron McKinney is a cost accountant for Majik Systems Inc. Martin Dodd, vice president of marketing, has asked Aaron to meet with representatives of Majik Systems’ major competitor to discuss product cost data. Martin indicates that the shari

> Describe sustainability and sustainable business practices.

> What three categories of manufacturing costs are included in the cost of finished goods and the cost of work in process?

> The following data are accumulated by Paxton Company in evaluating the purchase of $150,000 of equipment having a four-year useful life: a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. Use the table

> Name the three inventory accounts for a manufacturing business and describe what each balance represents at the end of an accounting period.

> What is the difference between a product cost and a period cost?

> Break-even analysis is an important tool for managing any business, including colleges and universities. In a group, identify three areas where break-even analysis might be used at your college or university. For each area, ide

> What are the major differences between financial accounting and managerial accounting?

> How does the Cost of goods sold section of the income statement differ between merchandising and manufacturing companies?

> Avett Manufacturing Company allows employees to purchase materials, such as metal and lumber, for personal use at a price equal to the company’s cost. To purchase materials, an employee must complete a materials requisition form, which must then be appro

> The following situations describe decision scenarios that could use managerial accounting information: 1. The manager of High Times Restaurant wants to determine the price to charge for various lunch plates. 2. By evaluating the cost of leftover materi

> Geek Chic Company provides computer repair services for the community. Obie Won’s computer was not working, and he called Geek Chic for a home repair visit. Geek Chic Company’s technician arrived at 2:00 pm to begin wo

> For each of the following managers, describe how managerial accounting could be used to satisfy strategic or operational objectives: 1. The vice president of the Information Systems Division of a bank. 2. A hospital administrator. 3. The chief executi

> Lily Products Company is considering an investment in one of two new product lines. The investment required for either product line is $540,000. The net cash flows associated with each product are as follows: a. Recommend a product offering to Lily Produ

> Todd Johnson is the vice president of Finance for Boz Zeppelin Industries, Inc. At a re- cent finance meeting, Todd made the following statement: “The managers of a company should use the same information as the shareholders of the firm. When managers us

> In teams, visit a local restaurant. As you observe the operation, consider the costs associated with running the business. As a team, identify as many costs as you can and classify them according to the following table headings: Cost Direct Materla

> The following is a list of costs that were incurred in the production and sale of large commercial airplanes: a. Cost of electronic guidance system installed in the airplane cockpit b. Special advertising campaign in Aviation World magazine c. Salary

> The following information is available for Robstown Corporation for 20Y8: Instructions 1. Prepare the statement of cost of goods manufactured. 2. Prepare the income statement. December 31 $31,700 Inventorles January 1 Materials $ 44,250 Work in proc

> The materials used by the North Division of Horton Company are currently purchased from outside suppliers at $60 per unit. These same materials are produced by Horton’s South Division. The South Division can produce the materials needed by the North Divi

> Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of May. Instructions 1. Determine the amounts of the missing items, identifying them by letter. 2. Prepare Yaki

> A partial list of Foothills Medical Center’s costs follows: Instructions 1. What would be Foothills Medical Center’s most logical definition for the final cost object? Explain. 2. Identify whether each of the cost

> The following is a list of costs incurred by several businesses: a. Cost of fabric used by clothing manufacturer b. Maintenance and repair costs for factory equipment c. Rent for a warehouse used to store raw materials and work in process d. Wages o

> Following is a list of various costs incurred in producing replacement automobile parts. With respect to the production and sale of these auto parts, classify each cost as variable, fixed, or mixed. 1. Cost of labor for hourly workers 2. Factory cleani

> In the following equations, based on the variable costing income statement, identify the items designated by X: a. Net Sales – X = Manufacturing Margin b. Manufacturing Margin – X = Contribution Margin c. Contribution Margin – X = Income from Operatio

> At a recent staff meeting, the management of Boost Technologies Inc. was considering discontinuing the Rocket Man line of electronic games from the product line. The chief financial analyst reported the following current monthly data for the Rocket Man:

> From the following list of activity bases for an automobile dealership, select the base that would be most appropriate for each of these costs: (1) preparation costs (cleaning, oil, and gasoline costs) for each car received, (2) salespersons’ commissio

> For a major university, match each cost in the following table with the activity base most appropriate to it. An activity base may be used more than once or not used at all. Activity Base: a. Student credit hours b. Number of students living on camp

> The following cost graphs illustrate various types of cost behavior: For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases: a. Total direct materials co

> Seymour Clothing Co. manufactures a variety of clothing types for distribution to several major retail chains. The following costs are incurred in the production and sale of blue jeans: a. Shipping boxes used to ship orders b. Consulting fee of $200,00

> The materials used by the Multinomah Division of Isbister Company are currently purchased from outside suppliers at $90 per unit. These same materials are produced by the Pembroke Division. The Pembroke Division can produce the materials needed by the Mu

> Wolsey Industries Inc. expects to maintain the same inventories at the end of 20Y8 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various

> Micro Tek Inc. is considering an investment in new equipment that will be used to manufacture a smartphone. The phone is expected to generate additional annual sales of 4,000 units at $450 per unit. The equipment has a cost of $940,000, residual value of

> Last year Hever Inc. had sales of $500,000, based on a unit selling price of $250. The variable cost per unit was $175, and fixed costs were $75,000. The maximum sales within Hever Inc.’s relevant range are 2,500 units. Hever Inc. is considering a propos

> The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured…………………………. $4,490,000 Selling expenses………………………………………………530,000 Administrative expenses…………………………………. 340,000 Sales……………

> Okaboji Manufacturing Company reported the following materials data for the month ending November 30: Materials purchased…………………………………. $490,900 Materials inventory, November 1……………………64,900 Materials inventory, November 30…………………. 81,300 Determine the

> The following events took place for Digital Vibe Manufacturing Company during January, the first month of its operations as a producer of digital video monitors: a. Purchased $168,500 of materials. b. Used $149,250 of direct materials in production. c.

> For apparel manufacturer Abercrombie & Fitch, Inc., classify each of the following costs as either a product cost or a period cost: a. Cost of information technology support i. Sales commissions for the corporate headquarters j. Salaries of dist

> Priceline.com allows customers to bid on hotel rooms by “naming their price.” This “name your price” process allows customers to obtain a better rate on a hotel room than they might be able to obtain by reserving their room directly from the hotel. The h

> Magnolia Candle Inc. pays 10% of its purchases on account in the month of the purchase and 90% in the month following the purchase. If purchases are budgeted to be $11,900 for March and $12,700 for April, what are the budgeted cash payments for purchases

> Daybook Inc. collects 30% of its sales on account in the month of the sale and 70% in the month following the sale. If sales on account are budgeted to be $105,000 for September and $116,000 for October, what are the budgeted cash receipts from sales on

> Sole Mates Inc. is planning a one-month campaign for July to promote sales of one of its two shoe products. A total of $100,000 has been budgeted for advertising, contests, redeemable coupons, and other promotional activities. The following data have bee

> At the end of May, Bergan Company had completed Jobs 200 and 305. Job 200 is for 2,390 units, and Job 305 is for 2,053 units. Using the data from Practice Exercises 19 1A, 19 2A, and 19 4A, determine (a) the balance on the job cost sheets for Jobs

> Ramsey Company issues an $800,000, 45-day note to Buckner Company for merchandise inventory. Buckner discounts the note at 7%. a. Journalize Ramsey’s entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. b. Journaliz

> Cosimo Enterprises issues a $260,000, 45-day, 5% note to Dixon Industries for merchandise inventory. a. Journalize Cosimo Enterprises’ entries to record: 1. the issuance of the note. 2. the payment of the note at maturity. b. Journalize Dixon Industr

> Bon Nebo Co. sold 25,000 annual subscriptions of Magazine 20XX for $85 during December 20Y8. These new subscribers will receive monthly issues, beginning in January 20Y9. In addition, the business had taxable income of $840,000 during th

> A borrower has two alternatives for a loan: (1) issue a $360,000, 60-day, 5% note or (2) issue a $360,000, 60-day note that the creditor discounts at 5%. a. Calculate the amount of the interest expense for each option. b. Determine the proceeds recei

> The cash flows from operating activities are reported by the direct method on the statement of cash flows. Determine the following: a. If sales for the current year were $753,500 and accounts receivable decreased by $48,400 during the year

> At the beginning of the school year, Katherine Malloy decided to prepare a cash budget for the months of September, October, November, and December. The budget must plan for enough cash on December 31 to pay the spring semester tuition, which is the same

> On January 1, 20Y2, the controller of Omicron Inc. is planning capital expenditures for the years 20Y2–20Y5. The following interviews helped the controller collect the necessary information for the capital expenditures budget: Director of Facilities: A

> EastGate Physical Therapy Inc. is planning its cash payments for operations for the first quarter (January–March). The Accrued Expenses Payable balance on January 1 is $15,000. The budgeted expenses for the next three months are as foll

> Flint Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follo

> SafeMark Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March ………..$78,400 April …………….83,500 May……………… 96,900 Depreciation, insurance, and pro

> Rothchild Company estimates that total factory overhead costs will be $810,000 for the year. Direct labor hours are estimated to be 90,000. For Rothchild Company, (a) determine the predetermined factory overhead rate using direct labor hours as the acti

> Office World Inc. has “cash and carry” customers and credit customers. Office World estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 40% pay their accounts in the month

> Furry Friends Supplies Inc., a pet wholesale supplier, was organized on May 1. Projected sales for each of the first three months of operations are as follows: May ………$156,000 June ………. 175,000 July ………. 180,000 All sales are on account. Seventy percent

> The controller of MingWare Ceramics Inc. wants to prepare a cost of goods sold budget for September. The controller assembled the following information for constructing the cost of goods sold budget: Use the preceding information to prepare a cost of go

> Wilmington Chemical Company uses oil to produce two types of plastic products, P1 and P2. Wilmington budgeted 50,000 barrels of oil for purchase in June for $50 per barrel. Direct labor budgeted in the chemical process was $300,000 for June. Factory over

> The following is a list of costs that were incurred in the production and sale of lawn mowers: a. Premiums on insurance policy for factory buildings b. Tires for lawn mowers c. Filter for spray gun used to paint the lawn mowers d. Paint used to coat

> Sweet Tooth Candy Company budgeted the following costs for anticipated production for August: Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only fixed fac

> Levi Strauss & Co. manufactures slacks and jeans under a variety of brand names, such as Dockers ® and 501 ® Jeans. Slacks and jeans are assembled by a variety of different sewing operations. Assume that the sales budget for Doc

> Ambassador Suites Inc. operates a downtown hotel property that has 300 rooms. On aver - age, 80% of Ambassador Suites’ rooms are occupied on weekdays and 40% are occupied during the weekend. The manager has asked you to develop a direct labor budget for

> MatchPoint Racket Company manufactures two types of tennis rackets, the Junior and Pro Striker models. The production budget for March for the two rackets is as follows: Both rackets are produced in two departments, Forming and Assembly. The direct labo

> On October 1, White Way Stores Inc. is considering leasing a building and purchasing the necessary equipment to operate a retail store. Alternatively, the company could use the funds to invest in $180,000 of 6% U.S. Treasury bonds that mature in 16 years

> Anticipated sales for Safety Grip Company were 42,000 passenger car tires and 19,000 truck tires. Rubber and steel belts are used in producing passenger car and truck tires as follows: The purchase prices of rubber and steel are $1.20 and $0.80 per poun

> Coca-Cola Enterprises is the largest bottler of Coca-Cola ® in Western Europe. The company purchases Coke ® and Sprite ® concentrate from The Coca-Cola Company, dilutes and mixes the concentrate with carbonated water, and then fills the blended beverage

> Bergan Company estimates that total factory overhead costs will be $620,000 for the year. Direct labor hours are estimated to be 80,000. For Bergan Company, (a) determine the predetermined factory overhead rate using direct labor hours as the activity b

> Lorenzo’s Frozen Pizza Inc. has determined from its production budget the following estimated production volumes for 12" and 16" frozen pizzas for September: Three direct materials are used in producing the two types of pizza. The quan

> Based on the data in Exercise 22-7 and assuming that the average compensation per hour for staff is $45 and for partners is $140, prepare a professional labor cost budget for each department for Rollins and Cohen, CPAs, for the year ending December 31,

> The following information is available for Shanika Company for 20Y6: Instructions 1. Prepare the statement of cost of goods manufactured. 2. Prepare the income statement Inventorles January 1 December 31 Materials $ 77,350 $ 95,550 Work in process 10

> Rollins and Cohen, CPAs, offer three types of services to clients: auditing, tax, and small business accounting. Based on experience and projected growth, the following billable hours have been estimated for the year ending December 31, 20Y7: The averag

> Sonic Inc. manufactures two models of speakers, Rumble and Thunder. Based on the following production and sales data for June, prepare (a) a sales budget and (b) a production budget: Rumble Thunder Estimated inventory (units), June 1 750 300 Desire

> Weightless Inc. produces a small and large version of its popular electronic scale. The anticipated unit sales for the scales by sales region are as follows: The finished goods inventory estimated for October 1 for the Bath and Gym scale models is 18,00

> Steelcase Inc. is one of the largest manufacturers of office furniture in the United States. In Grand Rapids, Michigan, it assembles filing cabinets in an Assembly Department. Assume the following information for the Assembly Department Direct labor pe

> The production supervisor of the Machining Department for Niland Company agreed to the following monthly static budget for the upcoming year: The actual amount spent and the actual units produced in the first three months in the Machining Department we

> Pure Cane Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the am

> Morningside Technologies Inc. uses flexible budgets that are based on the following data: Sales commissions ......................................... 15% of sales Advertising expense ........................................ 12% of sales Miscellaneous ad

> In what order should the three inventories of a manufacturing business be presented on the balance sheet?

> Distinguish between prime costs and conversion costs.

> During August, Rothchild Company incurred factory overhead costs as follows: indirect materials, $17,500; indirect labor, $22,000; utilities cost, $9,600; and factory depreciation, $17,500. Journalize the entry to record the factory overhead incurred dur

> What manufacturing cost term is used to describe the cost of materials that are an integral part of the manufactured end product?

> a. Differentiate between a department with line responsibility and a department with staff responsibility. b. In an organization that has a Sales Department and a Personnel Department, among others, which of the two departments has (1) line responsibil

> Tybee Industries Inc. uses a job order cost system. The following data summarize the operations related to production for January, the first month of operations: a. Materials purchased on account, $29,800. b. Materials requisitioned and factory labor u

> Munson Co. uses a job order cost system. The following data summarize the operations related to production for July: a. Materials purchased on account, $225,750 b. Materials requisitioned, $217,600, of which $17,600 was for general factory use c. Fact

> a. Where should a declared but unpaid cash dividend be reported on the balance sheet? b. Where should a declared but unissued stock dividend be reported on the balance sheet?

> Lexigraphic Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are