Question: Crocker Corp. owes D. Yaeger Corp. a

Crocker Corp. owes D. Yaeger Corp. a 10-year, 10% note in the amount of $330,000 plus $33,000 of accrued interest. The note is due today, December 31, 2017. Because Crocker Corp. is in financial trouble, D. Yaeger Corp. agrees to forgive the accrued interest, $30,000 of the principal, and to extend the maturity date to December 31, 2020. Interest at 10% of revised principal will continue to be due on 12/31 each year.

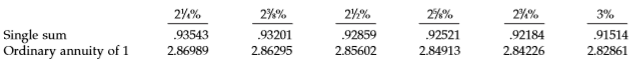

Assume the following present value factors for 3 periods.

Instructions

a. Compute the new effective-interest rate for Crocker Corp. following restructure. (Hint: Find the interest rate that establishes approximately $363,000 as the present value of the total future cash flows.)

b. Prepare a schedule of debt reduction and interest expense for the years 2017 through 2020.

c. Compute the gain or loss for D. Yaeger Corp. and prepare a schedule of receivable reduction and interest revenue for the years 2017 through 2020.

d. Prepare all the necessary journal entries on the books of Crocker Corp. for the years 2017, 2018, and 2019.

e. Prepare all the necessary journal entries on the books of D. Yaeger Corp. for the years 2017, 2018, and 2019.

Transcribed Image Text:

2% 2%% 24% 2%% 2%% 3% Single sum Ordinary annuity of 1 .93543 .93201 .92859 .92521 .92184 .91514 2.86989 2.86295 2.85602 2.84913 2.84226 2.82861

> Indicate whether the following items are capitalized or expensed in the current year. a. Purchase cost of a patent from a competitor. b. Research and development costs. c. Organizational costs. d. Costs incurred internally to create goodwill.

> Treasure Land Corporation incurred the following costs in 2017. Cost of laboratory research aimed at discovery of new knowledge …………. $120,000 Cost of testing in search for product alternatives ……………………………………... 100,000 Cost of engineering activity requ

> R. Wilson Corporation commenced operations in early 2017. The corporation incurred $60,000 of costs such as fees to underwriters, legal fees, state fees, and promotional expenditures during its formation. Prepare journal entries to record the $60,000 exp

> Taylor Swift Corporation purchases a patent from Salmon Company on January 1, 2017, for $54,000. The patent has a remaining legal life of 16 years. Taylor Swift feels the patent will be useful for 10 years. Prepare Taylor Swift’s journal entries to recor

> Holt Company purchased a computer for $8,000 on January 1, 2016. Straight-line depreciation is used, based on a 5-year life and a $1,000 salvage value. In 2018, the estimates are revised. Holt now feels the computer will be used until December 31, 2019,

> Cominsky Company purchased a machine on July 1, 2018, for $28,000. Cominsky paid $200 in title fees and county property tax of $125 on the machine. In addition, Cominsky paid $500 shipping charges for delivery, and $475 was paid to a local contractor to

> Steele Corporation purchased a significant amount of raw materials inventory for a new product that it is manufacturing. Steele uses the lower-of-average-cost-or-net realizable value (LCNRV) rule for these raw materials. The net realizable value of the r

> Use the information for Lockard Company given in BE11-2. a. Compute 2017 depreciation expense using the double-declining-balance method. b. Compute 2017 depreciation expense using the double-declining-balance method, assuming the machinery was purchase

> Use the information presented for Ottawa Corporation in BE10-14, but assume the machinery is sold for $5,200 instead of $10,500. Prepare journal entries to a. update depreciation for 2018 and b. record the sale. From BE 10-14: Ottawa Corporation owns

> Ottawa Corporation owns machinery that cost $20,000 when purchased on July 1, 2014. Depreciation has been recorded at a rate of $2,400 per year, resulting in a balance in accumulated depreciation of $8,400 at December 31, 2017. The machinery is sold on S

> Use the information for Lockard Company given in BE11-2. a. Compute 2017 depreciation expense using the sum-of-the-years’-digits method. b. Compute 2017 depreciation expense using the sum-of-the-years’-digits method, assuming the machinery was purchase

> Francis Corporation purchased an asset at a cost of $50,000 on March 1, 2017. The asset has a useful life of 8 years and a salvage value of $4,000. For tax purposes, the MACRS class life is 5 years. Compute tax depreciation for each year 2017–2022.

> In its 2015 annual report, Gap Inc. reported inventory of $1,889 million on January 31, 2015, and $1,928 million on February 1, 2014, cost of goods sold of $10,146 million for 2015, and net sales of $16,435 million. Compute Gap’s inventory turnover and t

> In its 2014 annual report, Campbell Soup Company reports beginning-of-the-year total assets of $8,113 million, end-of-the-year total assets of $8,323 million, total sales of $8,268 million, and net income of $807 million. a. Compute Campbell’s asset tur

> Lockard Company purchased machinery on January 1, 2017, for $80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years. a. Compute 2017 depreciation expense using the straight-line method. b. Compute 2017 depre

> Use the information for Kemper Company from BE9-7. In 2018, Kemper paid $1,000,000 to obtain the raw materials which were worth $950,000. Prepare the entry to record the purchase. From BE9-7: Kemper Company signed a long-term noncancelable purchase comm

> Kemper Company signed a long-term noncancelable purchase commitment with a major supplier to purchase raw materials in 2018 at a cost of $1,000,000. At December 31, 2017, the raw materials to be purchased have a market value of $950,000. Prepare any nece

> Ogala Corporation purchased a significant amount of raw materials inventory for a new product that it is manufacturing. Ogala uses the LCNRV rule for these raw materials. The net realizable value of the raw materials is below the original cost. Ogala us

> Fernandez Corporation purchased a truck at the beginning of 2017 for $50,000. The truck is estimated to have a salvage value of $2,000 and a useful life of 160,000 miles. It was driven 23,000 miles in 2017 and 31,000 miles in 2018. Compute depreciation e

> Kumar Inc. uses LIFO inventory costing. At January 1, 2017, inventory was $214,000 at both cost and market value. At December 31, 2017, the inventory was $286,000 at cost and $265,000 at market value. Prepare the necessary December 31 entry under a. the

> Presented below is information related to Rembrandt Inc.’s inventory, assuming Rembrandt uses lower-of-LIFO cost-or-market. Determine the following: a. the two limits to market value (i.e., the ceiling and the floor) that should be u

> Kumar Inc. uses a perpetual inventory system. At January 1, 2017, inventory was $214,000,000 at both cost and net realizable value. At December 31, 2017, the inventory was $286,000,000 at cost and $265,000,000 at net realizable value. Prepare the entry u

> Floyd Corporation has the following four items in its ending inventory. Determine the following: a. the LCNRV for each item, and b. the amount of write-down, if any, using 1. an item-by-item LCNRV evaluation and 2. a total category LCNRV evaluatio

> Presented below is information related to Rembrandt Inc.’s inventory. Determine the following: a. the net realizable value for each item, and b. the carrying value of each item under LCNRV. (per unit) Boots Skis Parkas Historic

> McNabb Corp. had $100,000 of 7%, $20 par value preferred stock and 12,000 shares of $25 par value common stock outstanding throughout 2017. a. Assuming that total dividends declared in 2017 were $64,000, and that the preferred stock is not cumulative bu

> An intangible asset with an estimated useful life of 30 years was acquired on January 1, 2007, for $540,000. On January 1, 2017, a review was made of intangible assets and their expected service lives, and it was determined that this asset had an estimat

> What is off-balance-sheet financing? Why might a company be interested in using off-balance-sheet financing?

> Explain the accounting for a service-type warranty.

> You have been asked by the financial vice president to develop a short presentation on the LCNRV method for inventory purposes. The financial VP needs to explain this method to the president because it appears that a portion of the company’s inventory ha

> Explain the accounting for an assurance-type warranty.

> At December 31, 2017, Ashley Co. has outstanding purchase commitments for 150,000 gallons, at $6.20 per gallon, of a raw material to be used in its manufacturing process. The company prices its raw material inventory at cost or market, whichever is lower

> Describe the accounting for the issuance for cash of no par value common stock at a price in excess of the stated value of the common stock.

> What is the nature of a “discount” on notes payable?

> Mickelson Inc. owns land that it purchased on January 1, 2000, for $450,000. At December 31, 2017, its current value is $770,000 as determined by appraisal. At what amount should Mickelson report this asset on its December 31, 2017, balance sheet? Explai

> Why are inventories valued at the lower-of-cost-or-net realizable value (LCNRV)? What are the arguments against the use of the LCNRV method of valuing inventories?

> The following is a summary of all relevant transactions of Vicario Corporation since it was organized in 2017. In 2017, 15,000 shares were authorized and 7,000 shares of common stock ($50 par value) were issued at a price of $57. In 2018, 1,000 shares we

> The books of Conchita Corporation carried the following account balances as of December 31, 2017. Cash…………………………………………………………………………………………. $ 195,000 Preferred Stock (6% cumulative, nonparticipating, $50 par) …………. 300,000 Common Stock (no-par value, 300,

> Washington Company has the following stockholders’ equity accounts at December 31, 2017. Common Stock ($100 par value, authorized 8,000 shares) …. $480,000 Retained Earnings………………………………………………………………294,000 Instructions a. Prepare entries in journal fo

> Hatch Company has two classes of capital stock outstanding: 8%, $20 par preferred and $5 par common. At December 31, 2017, the following accounts were included in stockholders’ equity. Preferred Stock, 150,000 shares…………………………..$ 3,000,000 Common Stock

> Mask Company has 30,000 shares of $10 par value common stock authorized and 20,000 shares issued and outstanding. On August 15, 2017, Mask purchased 1,000 shares of treasury stock for $18 per share. Mask uses the cost method to account for treasury stock

> Clemson Company had the following stockholders’ equity as of January 1, 2017. Common stock, $5 par value, 20,000 shares issued………. $100,000 Paid-in capital in excess of par—common stock………………. 300,000 Retained earnings…………………………………………………………. 320,000 Tot

> Penn Company was formed on July 1, 2015. It was authorized to issue 300,000 shares of $10 par value common stock and 100,000 shares of 8% $25 par value, cumulative and nonparticipating preferred stock. Penn Company has a July 1–June 30

> Earnhart Corporation has outstanding 3,000,000 shares of common stock with a par value of $10 each. The balance in its Retained Earnings account at January 1, 2017, was $24,000,000, and it then had Paid-in Capital in Excess of Par—Common Stock of $5,000,

> Sabonis Cosmetics Co. purchased machinery on December 31, 2016, paying $50,000 down and agreeing to pay the balance in four equal installments of $40,000 payable each December 31. An assumed interest of 8% is implicit in the purchase price. Instructions

> On December 31, 2017, Faital Company acquired a computer from Plato Corporation by issuing a $600,000 zero-interest-bearing note, payable in full on December 31, 2021. Faital Company’s credit rating permits it to borrow funds from its several lines of cr

> On April 1, 2017, Seminole Company sold 15,000 of its 11%, 15-year, $1,000 face value bonds at 97. Interest payment dates are April 1 and October 1, and the company uses the straight-line method of bond discount amortization. On March 1, 2018, Seminole t

> Presented below are selected transactions on the books of Simonson Corporation. May 1, 2017……………..Bonds payable with a par value of $900,000, which are dated January 1, 2017, are sold at 106 plus accrued interest. They are coupon bonds, bear interest at

> Holiday Company issued its 9%, 25-year mortgage bonds in the principal amount of $3,000,000 on January 2, 2003, at a discount of $150,000, which it proceeded to amortize by charges to expense over the life of the issue on a straight-line basis. The inden

> Good-Deal Inc. developed a new sales gimmick to help sell its inventory of new automobiles. Because many new car buyers need financing, Good-Deal offered a low downpayment and low car payments for the first year after purchase. It believes that this prom

> Wallace Computer Company is a small, closely held corporation. Eighty percent of the stock is held by Derek Wallace, president. Of the remainder, 10% is held by members of his family and 10% by Kathy Baker, a former officer who is now retired. The balanc

> Samantha Cordelia, an intermediate accounting student, is having difficulty amortizing bond premiums and discounts using the effective-interest method. Furthermore, she cannot understand why GAAP requires that this method be used instead of the straight-

> The following are four independent situations. a. On March 1, 2018, Wilke Co. issued at 103 plus accrued interest $4,000,000, 9% bonds. The bonds are dated January 1, 2018, and pay interest semiannually on July 1 and January 1. In addition, Wilke Co. in

> The following amortization and interest schedule reflects the issuance of 10-year bonds by Capulet Corporation on January 1, 2011, and the subsequent interest payments and charges. The company’s year-end is December 31, and financial st

> Sycamore Candy Company offers an MP3 download (seven-single medley) as a premium for every five candy bar wrappers presented by customers together with $2.50. The candy bars are sold by the company to distributors for 30 cents each. The purchase price of

> To stimulate the sales of its Alladin breakfast cereal, Loptien Company places 1 coupon in each box. Five coupons are redeemable for a premium consisting of a children’s hand puppet. In 2018, the company purchases 40,000 puppets at $1.50 each and sells 4

> Alvarado Company sells a machine for $7,400 with a 12-month warranty agreement that requires the company to replace all defective parts and to provide the repair labor at no cost to the customers. With sales being made evenly throughout the year, the com

> Dos Passos Company sells televisions at an average price of $900 and also offers to each customer a separate 3-year warranty contract for $90 that requires the company to perform periodic services and to replace defective parts. During 2017, the company

> Cedarville Company pays its office employee payroll weekly. Below is a partial list of employees and their payroll data for August. Because August is their vacation period, vacation pay is also listed. Assume that the federal income tax withheld is 10%

> Schmitt Company must make computations and adjusting entries for the following independent situations at December 31, 2018. 1. Its line of amplifiers carries a 3-year warranty against defects. On the basis of past experience the estimated warranty costs

> You are the independent auditor engaged to audit Millay Corporation’s December 31, 2017, financial statements. Millay manufactures household appliances. During the course of your audit, you discovered the following contingent liabilities. 1. Millay bega

> On March 1, 2017, Sealy Company sold its 5-year, $1,000 face value, 9% bonds dated March 1, 2017, at an effective annual interest rate (yield) of 11%. Interest is payable semiannually, and the first interest payment date is September 1, 2017. Sealy uses

> The net realizable value of Lake Corporation’s inventory has declined below its cost. Allyn Conan, the controller, wants to use the loss method to write down inventory because it more clearly discloses the decline in the net realizable value and does not

> Garison Music Emporium carries a wide variety of musical instruments, sound reproduction equipment, recorded music, and sheet music. Garison uses two sales promotion techniques—warranties and premiums—to attract customers. Musical instruments and sound e

> Polska Corporation, in preparation of its December 31, 2017, financial statements, is attempting to determine the proper accounting treatment for each of the following situations. 1. As a result of uninsured accidents during the year, personal injury su

> On November 24, 2017, 26 passengers on Windsor Airlines Flight No. 901 were injured upon landing when the plane skidded off the runway. Personal injury suits for damages totaling $9,000,000 were filed on January 11, 2018, against the airline by 18 injure

> During 2015, Wright Tool Company purchased a building site for its proposed research and development laboratory at a cost of $60,000. Construction of the building was started in 2015. The building was completed on December 31, 2016, at a cost of $320,000

> Montana Matt’s Golf Inc. was formed on July 1, 2016, when Matt Magilke purchased the Old Master Golf Company. Old Master provides video golf instruction at kiosks in shopping malls. Magilke plans to integrate the instructional business

> Information concerning Sandro Corporation’s intangible assets is as follows. 1. On January 1, 2017, Sandro signed an agreement to operate as a franchisee of Hsian Copy Service, Inc. for an initial franchise fee of $75,000. Of this amount, $15,000 was pa

> Reichenbach Co., organized in 2016, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2017 and 2018. Instructions Prepare the necessary entries to clear the Intangib

> Roland Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2016 for $10,000,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2017, new technology was introduced

> Darby Sporting Goods Inc. has been experiencing growth in the demand for its products over the last several years. The last two Olympic Games greatly increased the popularity of basketball around the world. As a result, a European sports retailing consor

> Bronson Paper Products purchased 10,000 acres of forested timberland in March 2017. The company paid $1,700 per acre for this land, which was above the $800 per acre most farmers were paying for cleared land. During April, May, June, and July 2017, Brons

> On January 1, 2017, Nichols Company issued for $1,085,800 its 20-year, 11% bonds that have a maturity value of $1,000,000 and pay interest semiannually on January 1 and July 1. The following are three presentations of the long-term liability section of t

> Conan O’Brien Logging and Lumber Company owns 3,000 acres of timberland on the north side of Mount Leno, which was purchased in 2005 at a cost of $550 per acre. In 2017, O’Brien began selectively logging this timber tract. In May 2017, Mount Leno erupted

> A depreciation schedule for semi-trucks of Ichiro Manufacturing Company was requested by your auditor soon after December 31, 2018, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period

> The following data relate to the Machinery account of Eshkol, Inc. at December 31, 2017. The following transactions occurred during 2018. a. On May 5, Machine A was sold for $13,000 cash. The company’s bookkeeper recorded this retire

> The cost of equipment purchased by Charleston, Inc., on June 1, 2017, is $89,000. It is estimated that the machine will have a $5,000 salvage value at the end of its service life. Its service life is estimated at 7 years, its total working hours are esti

> Kohlbeck Corporation, a manufacturer of steel products, began operations on October 1, 2016. The accounting department of Kohlbeck has started the fixed-asset and depreciation schedule presented on page 595. You have been asked to assist in completing th

> Laserwords Inc. is a book distributor that had been operating in its original facility since 1987. The increase in certification programs and continuing education requirements in several professions has contributed to an annual growth rate of 15% for Las

> Spitfire Company was incorporated on January 2, 2018, but was unable to begin manufacturing activities until July 1, 2018, because new factory facilities were not completed until that date. The Land and Buildings account reported the following items duri

> Klamath Company, a manufacturer of ballet shoes, is experiencing a period of sustained growth. In an effort to expand its production capacity to meet the increased demand for its product, the company recently made several acquisitions of plant and equipm

> Davenport Department Store converted from the conventional retail method to the LIFO retail method on January 1, 2017, and is now considering converting to the dollar-value LIFO inventory method. During your examination of the financial statements for th

> The following two independent situations involve loss contingencies. Part 1: Benson Company sells two products, Grey and Yellow. Each carries a 1-year warranty. 1. Product Grey—Product warranty costs, based on past experience, will normally be 1% of sa

> Diderot Stores Inc., which uses the conventional retail inventory method, wishes to change to the LIFO retail method beginning with the accounting year ending December 31, 2017. Amounts as shown below appear on the store’s books before

> Late in 2014, Joan Seceda and four other investors took the chain of Becker Department Stores private, and the company has just completed its third year of operations under the ownership of the investment group. Andrea Selig, controller of Becker Departm

> As of January 1, 2017, Aristotle Inc. adopted the retail method of accounting for its merchandise inventory. To prepare the store’s financial statements at June 30, 2017, you obtain the following data. Instructions a. Prepare a sched

> Maddox Specialty Company, a division of Lost World Inc., manufactures three models of gear shift components for bicycles that are sold to bicycle manufacturers, retailers, and catalog outlets. Since beginning operations in 1993, Maddox has used normal ab

> Fuque Inc. uses the retail inventory method to estimate ending inventory for its monthly financial statements. The following data pertain to a single department for the month of October 2018. Instructions a. Using the conventional retail method, prepa

> Presented below is information related to Waveland Inc. Instructions Assuming that Waveland Inc. uses the conventional retail inventory method, compute the cost of its ending inventory at December 31, 2018. Cost Retail Inventory, 12/31/17 Purchase

> Selected accounts included in the property, plant, and equipment section of Lobo Corporation’s balance sheet at December 31, 2016, had the following balances. Land…………………………...$ 300,000 Land improvements………. 140,000 Buildings……………………..1,100,000 Equipmen

> On April 15, 2018, fire damaged the office and warehouse of Stanislaw Corporation. The only accounting record saved was the general ledger, from which the balance sheet data below was prepared. The following data and information have been gathered. 1.

> Grieg Landscaping began construction of a new plant on December 1, 2017. On this date, the company purchased a parcel of land for $139,000 in cash. In addition, it paid $2,000 in surveying costs and $4,000 for a title insurance policy. An old dwelling on

> Fiedler Co. follows the practice of valuing its inventory at the lower-of cost-or-market. The following information is available from the company’s inventory records as of December 31, 2017. Instructions Greg Forda is an accounting

> Presented below is a note disclosure for Matsui Corporation. Litigation and Environmental: The Company has been notified, or is a named or a potentially responsible party in a number of governmental (federal, state and local) and private actions associat

> Presented below is a schedule of property dispositions for Hollerith Co. The following additional information is available. Land: On February 15, a condemnation award was received as consideration for unimproved land held primarily as an investment, a

> Malone Company determined its ending inventory at cost and at LCNRV at December 31, 2017, December 31, 2018, and December 31, 2019, as shown below. Instructions a. Prepare the journal entries required at December 31, 2018, and at December 31, 2019, as

> Garcia Home Improvement Company installs replacement siding, windows, and louvered glass doors for single-family homes and condominium complexes. The company is in the process of preparing its annual financial statements for the fiscal year ended May 31,

> Remmers Company manufactures desks. Most of the company’s desks are standard models and are sold on the basis of catalog prices. At December 31, 2017, the following finished desks (10 desks in each category) appear in the companyâ

> The financial statements of M&S are presented in Appendix E. The company’s complete annual report, including the notes to the financial statements, is available online. Instructions Refer to M&S’s financial statements and the accompanying notes to answ

> Hincapie Co. (a specialty bike-accessory manufacturer) is expecting growth in sales of some products targeted to the low-price market. Hincapie is contemplating a preference share issue to help finance this expansion in operations. The company is leaning