Question: Daryl Kearns saved $240,000 during the

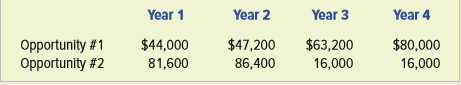

Daryl Kearns saved $240,000 during the 30 years that he worked for a major corporation. Now he has retired at the age of 60 and has begun to draw a comfortable pension check every month. He wants to ensure the financial security of his retirement by investing his savings wisely and is currently considering two investment opportunities. Both investments require an initial payment of $160,000. The following table presents the estimated cash inflows for the two alternatives.

Mr. Kearns decides to use his past average return on mutual fund investments as the discount rate; it is 8 percent.

Required:

Round your computation to two decimal points.

a. Compute the net present value of each opportunity. Which should Mr. Kearns adopt based on the net present value approach?

b. Compute the payback period for each project. Which should Mr. Kearns adopt based on the payback approach?

c. Compare the net present value approach with the payback approach. Which method is better in the given circumstances?

Transcribed Image Text:

Year 1 Year 2 Year 3 Year 4 Opportunity # 1 Opportunity #2 $44,000 $47,200 $63,200 $80,000 81,600 86,400 16,000 16,000

> What is the objective of allocating indirect manufacturing overhead costs to the product?

> Why are some manufacturing costs not directly traceable to products?

> If Company A has a projected margin of safety of 22 percent while Company B has a margin of safety of 52 percent, which company is at greater risk when actual sales are less than budgeted?

> How does a contribution margin income statement differ from the income statement used in financial reporting?

> Larry Kwang insists that the costs of his school’s fund-raising project should be determined after the project is complete. He argues that only after the project is complete can its costs be determined accurately and that it is a waste of time to try to

> Verna Salsbury tells you that she thinks the terms fixed cost and variable cost are confusing. She notes that fixed cost per unit changes when the number of units changes. Furthermore, variable cost per unit remains fixed regardless of how many units a

> Espada Real Estate Investment Company (EREIC) purchases new apartment complexes, establishes a stable group of residents, and then sells the complexes to apartment management companies. The average holding time is three years. EREIC is currently investig

> All costs are variable because if a business ceases operations, its costs fall to zero. Do you agree with the statement? Explain.

> The president of Bright Corporation tells you that he sees a dim future for his company. He feels that his hands are tied because fixed costs are too high. He says that fixed costs do not change and therefore the situation is hopeless. Do you agree? Expl

> Which cost structure has the greater risk? Explain.

> How is the relevant range of activity related to fixed and variable cost? Give an example of how the definitions of these costs become invalid when volume is outside the relevant range.

> Are companies with predominately fixed cost structures likely to be most profitable?

> What are the important factors in determining the appropriate cost driver to use in allocating a cost?

> If volume is increasing, would a company benefit more from a pure variable or a pure fixed cost structure? Which cost structure would be advantageous if volume is decreasing?

> Why are the terms direct cost and indirect cost independent of the terms fixed cost and variable cost? Give an example to illustrate.

> How is operating leverage calculated?

> Define the term operating leverage and explain how it affects profits.

> In recent years, there has been a lot of media coverage about the funding status of pension plans for state employees. In many states, the amount of money invested in employee pension plans is far less than the amount estimated to be needed to pay them t

> The following events apply to Pearson Service Co. for 2018, its first year of operation: 1. Received cash of $50,000 from the issue of common stock. 2. Performed $90,000 worth of services on account. 3. Paid $64,000 cash for salaries expense. 4. Purchase

> How can knowing cost behavior relative to volume fluctuations affect decision making?

> Define fixed cost and variable cost and give an example of each.

> How can present value “what-if” analysis be enhanced by using software programs?

> Why are present value tables frequently used to convert future values to present values?

> If you wanted to have $500,000 one year from today and desired to earn a 10 percent return, what amount would you need to invest today? Which amount has more value, the amount today or the $500,000 a year from today?

> How does a company establish its minimum acceptable rate of return on investments?

> Define the term return on investment. How is the return normally expressed? Give an example of a capital investment return.

> “A dollar today is worth more than a dollar in the future.” “The present value of a future dollar is worth less than one dollar.” Are these two statements synonymous? Explain.

> What is a post audit? How is it useful in capital budgeting?

> How do capital investments affect profitability?

> Melody Lovelady is the most highly rewarded sales representative at Swift Corporation. Her secret to success is always to understate her abilities. Ms. Lovelady is assigned to a territory in which her customer base is increasing at approximately 25 perce

> What are three reasons that cash is worth more today than cash to be received in the future?

> What is the relationship between desired rate of return and internal rate of return?

> Paul Henderson is a manager for Spark Company. He tells you that his company always maximizes profitability by accepting the investment opportunity with the highest internal rate of return. Explain to Mr. Henderson how his company may improve profitabili

> Which is the best capital investment evaluation technique for ranking investment opportunities?

> Two investment opportunities have positive net present values. Investment A’s net present value amounts to $40,000 while B’s is only $30,000. Does this mean that A is the better investment opportunity? Explain.

> Maria Espinosa borrowed $15,000 from the bank and agreed to repay the loan at 8 percent annual interest over four years, making payments of $4,529 per year. Because part of the bank’s payment from Ms. Espinosa is a recovery of the original investment, wh

> What is a capital investment? How does it differ from an investment in stocks or bonds?

> What factors could lead to an increase in sales revenues that would not merit congratulations to the marketing manager?

> Ritchie Manufacturing Company makes a product that it sells for $150 per unit. The company incurs variable manufacturing costs of $60 per unit. Variable selling expenses are $18 per unit, annual fixed manufacturing costs are $480,000, and fixed selling a

> Arnold Vimka is a venture capitalist facing two alternative investment opportunities. He intends to invest $800,000 in a start-up firm. He is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the

> The following excerpt is from Coca-Cola Company’s 2014 annual report filed with the SEC: Management evaluates the performance of our operating segments separately to individually monitor the different factors affecting financial perform

> Kenton and Denton Universities offer executive training courses to corporate clients. Kenton pays its instructors $5,000 per course taught. Denton pays its instructors $250 per student enrolled in the class. Both universities charge executives a $450 tui

> Franklin Training Services (FTS) provides instruction on the use of computer software for the employees of its corporate clients. It offers courses in the clients’ offices on the clients’ equipment. The only major expense FTS incurs is instructor salarie

> Rita Jekyll operates a sales booth in computer software trade shows, selling an accounting software package, Abacus. She purchases the package from a software company for $210 each. Booth space at the convention hall costs $8,400 per show. Required: a.

> Seattle Bank’s start-up division establishes new branch banks. Each branch opens with three tellers. Total teller cost per branch is $96,000 per year. The three tellers combined can process up to 90,000 customer transactions per year. If a branch does no

> Janice Huffman has decided to start Janice Cleaning, a residential housecleaning service company. She is able to rent cleaning equipment at a cost of $600 per month. Labor costs are expected to be $50 per house cleaned and supplies are expected to cost $

> Identify the following costs as fixed or variable: Costs related to plane trips between Boston, Massachusetts, and San Diego, California, follow. Pilots are paid on a per-trip basis. a. Pilots’ salaries relative to the number of trips flown. b. Depreciat

> Barlae Auto Repair, Inc. is evaluating a project to purchase equipment that will not only expand the company’s capacity but also improve the quality of its repair services. The board of directors requires all capital investments to meet or exceed the min

> Harper Electronics is considering investing in manufacturing equipment expected to cost $250,000. The equipment has an estimated useful life of four years and a salvage value of $25,000. It is expected to produce incremental cash revenues of $125,000 per

> Seth Fitch owns a small retail ice cream parlor. He is considering expanding the business and has identified two attractive alternatives. One involves purchasing a machine that would enable Mr. Fitch to offer frozen yogurt to customers. The machine would

> Obtain the income statements for Target Corporation for the fiscal years ending in 2011, 2012, 2013, 2014, and 2015. Target’s fiscal year ends near the end of January or the beginning of February. The 2013–2015 statem

> Dwight Donovan, the president of Donovan Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the ma

> Brett Collins is reviewing his company’s investment in a cement plant. The company paid $12,000,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether th

> Antonio Melton, the chief executive officer of Melton Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $500,000 cash at the beginning of the investment and the cash inflow for each

> Swift Delivery is a small company that transports business packages between New York and Chicago. It operates a fleet of small vans that moves packages to and from a central depot within each city and uses a common carrier to deliver the packages between

> The manager of the Cranston Division of Wynn Manufacturing Corporation is currently producing a 20 percent return on invested capital. Wynn’s desired rate of return is 16 percent. The Cranston Division has $6,000,000 of capital invested in operating asse

> Helena Corporation operates three investment centers. The following financial statements apply to the investment center named Bowman Division. BOWMAN DIVISION Income Statement For the Year Ended December 31, 2018 Sales revenue ……………………………………………………………..$

> Sorrento Corporation’s balance sheet indicates that the company has $500,000 invested in operating assets. During 2018, Sorrento earned operating income of $50,000 on $1,000,000 of sales. Required: a. Compute Sorrento’s profit margin for 2018. b. Comput

> Use the standard price and cost data supplied in Problem 15-20. Assume that Narcisco actually produced and sold 32,000 books. The actual sales price and costs incurred follow. Actual price and variable costs Sales price………………………………

> Narcisco Publications established the following standard price and costs for a hardcover picture book that the company produces. Standard price and variable costs Sales price…………………………………………………………………………$90.00 Materials cost………………

> Howard Cooper, the president of Glacier Computer Services, needs your help. He wonders about the potential effects on the firm’s net income if he changes the service rate that the firm charges its customers. The following basic data pertain to fiscal yea

> Kemp Tables, Inc. (KTI) makes picnic tables of 2 × 4 planks of treated pine. It sells the tables to large retail discount stores such as Walmart. After reviewing the following data generated by KTI’s chief accountant, the c

> Yalaha National Bank is a large municipal bank with several branch offices. The bank’s computer department handles all data processing for bank operations. In addition, the bank sells the computer department’s expertise in systems development and excess

> Camden Company is a retail company that specializes in selling outdoor camping equipment. The company is considering opening a new store on October 1, 2019. The company president formed a planning committee to prepare a master budget for the first three

> Jasper Fruits Corporation wholesales peaches and oranges. Barbara Jasper is working with the company’s accountant to prepare next year’s budget. Ms. Jasper estimates that sales will increase 5 percent for peaches and 1

> Top executive officers of Tildon Company, a merchandising firm, are preparing the next year’s budget. The controller has provided everyone with the current year’s projected income statement.

> Fayette Medical Clinic has budgeted the following cash flows: Fayette Medical had a cash balance of $16,000 on January 1. The company desires to maintain a cash cushion of $10,000. Funds are assumed to be borrowed, in increments of $2,000, and repaid o

> Malcolm is a retail company specializing in men’s hats. Its budget director prepared the list of expected operating expenses that follows. All items are paid when incurred except sales commissions and utilities, which are paid in the mo

> Humboldt, Inc. sells fireworks. The company’s marketing director developed the following cost of goods sold budget for April, May, June, and July. Humboldt had a beginning inventory balance of $1,800 on April 1 and a beginning balance

> Spalding Pointers Corporation expects to begin operations on January 1, 2019; it will operate as a specialty sales company that sells laser pointers over the Internet. Spalding expects sales in January 2019 to total $120,000 and to increase 5 percent per

> Amherst Corporation has three divisions, each operating as a responsibility center. To provide an incentive for divisional executive officers, the company gives divisional management a bonus equal to 15 percent of the excess of actual net income over bud

> Sturdy Bike Company makes the frames used to build its bicycles. During 2018, Sturdy made 20,000 frames; the costs incurred follow. Unit-level materials costs (20,000 units × $35.00)……………….$ 700,000 Unit-level labor costs (20,000 units × $42.50)…………………

> David Catrow is the manufacturing production supervisor for Faraday Motor Works (FMW), a company that manufactures electrical motors for industrial applications. Trying to explain why he did not get the year-end bonus that he had expected, he told his wi

> Bain Corporation makes and sells state-of-the-art electronics products. One of its segments produces The Math Machine, an inexpensive calculator. The company’s chief accountant recently prepared the following income statement showing annual revenues and

> Lenox Manufacturing Co. produces and sells specialized equipment used in the petroleum industry. The company is organized into three separate operating branches: Division A, which manufactures and sells heavy equipment; Division B, which manufactures and

> Western Boot Co. sells men’s, women’s, and children’s boots. For each type of boot sold, it operates a separate department that has its own manager. The manager of the men’s departme

> Townsend Chemical Company makes a variety of cosmetic products, one of which is a skin cream designed to reduce the signs of aging. Townsend produces a relatively small amount (15,000 units) of the cream and is considering the purchase of the product fro

> Dalton Quilting Company makes blankets that it markets through a variety of department stores. It makes the blankets in batches of 1,000 units. Dalton made 20,000 blankets during the prior accounting period. The cost of producing the blankets is summariz

> Continent Construction Company is a building contractor specializing in small commercial buildings. The company has the opportunity to accept one of two jobs; it cannot accept both because they must be performed at the same time and Continent does not ha

> Respond to each requirement independently. a. Describe two decision-making contexts, one in which unit-level materials costs are avoidable, and the other in which they are unavoidable. b. Describe two decision-making contexts, one in which batch-level se

> Clement Manufacturing Company uses two departments to make its products. Department I is a cutting department that is machine intensive and uses very few employees. Machines cut and form parts and then place the finished parts on a conveyor belt that car

> Hannah Ortega is considering expanding her business. She plans to hire a salesperson to cover trade shows. Because of compensation, travel expenses, and booth rental, fixed costs for a trade show are expected to be $7,500. The booth will be open 30 hours

> Velez Corporation estimated its overhead costs would be $50,000 per month except for January when it pays the $30,000 annual insurance premium on the manufacturing facility. Accordingly, the January overhead costs were expected to be $80,000 ($30,000 + $

> John Dillworth is in charge of buying property used as building sites for branch offices of the National Bank of Commerce. Mr. Dillworth recently paid $110,000 for a site located in a growing section of the city. Shortly after purchasing this lot, Mr. Di

> Camp Manufacturing Company makes tents that it sells directly to camping enthusiasts through a mail order marketing program. The company pays a quality control expert $80,000 per year to inspect completed tents before they are shipped to customers. Assum

> Eagle Airlines is a small airline that occasionally carries overload shipments for the overnight delivery company Never-Fail, Inc. Never-Fail is a multimillion-dollar company started by Wes Never immediately after he failed to finish his first accounting

> The Huffman School of Vocational Technology has organized the school training programs into three departments. Each department provides training in a different area as follows: nursing assistant, dental hygiene, and office technology. The schoolâ&#

> Yalland Manufacturing Company makes two different products, M and N. The company’s two departments are named after the products; for example, Product M is made in Department M. Yalland’s Financial data Salary of vice presiden

> Hampton Company is considering the addition of a new product to its cosmetics line. The company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. Relevant information and budgeted annual income statements for each

> Gletchen Cough Drops operates two divisions. The following information pertains to each division for 2018. Required: a. Compute each division’s residual income. b. Which division increased the company’s profitability

> Climax Corporation has a desired rate of return of 7.50 percent. William Tobin is in charge of one of Climax’s three investment centers. His center controlled operating assets of $4,000,000 that were used to earn $480,000 of operating income. Required:

> An investment center of Tribune Corporation shows an operating income of $7,500 on total operating assets of $125,000. Required: Compute the return on investment. Round the computation to two decimal points.

> Garrison Rentals can purchase a van that costs $54,000; it has an expected useful life of three years and no salvage value. Garrison uses straight-line depreciation. Expected revenue is $36,000 per year. Assume that depreciation is the only expense assoc

> Rainbow Painting Company is considering whether to purchase a new spray paint machine that costs $16,000. The machine is expected to save labor, increasing net income by $1,200 per year. The effective life of the machine is 15 years according to the manu

> State law permits the State Department of Revenue to collect taxes for municipal governments that operate within the state’s jurisdiction and allows private companies to collect taxes for municipalities. To promote fairness and to ensure the financial we

> The Monarch Division of Allgood Corporation has a current ROI of 12 percent. The company target ROI is 8 percent. The Monarch Division has an opportunity to invest $4,800,000 at 10 percent but is reluctant to do so because its ROI will fall to 11.25 perc

> Supply the missing information in the following table for Unify Company. Sales………………………………………………….$605,000 ROI………………………………………………………………..? Operating assets……………………………………………..? Operating income……………………………………………? Turnover…………………………………………………….2.2 Residual i

> Eastevan Company calculated its return on investment as 10 percent. Sales are now $300,000, and the amount of total operating assets is $320,000. Required: a. If expenses are reduced by $28,000 and sales remain unchanged, what return on investment will

> Secor Educational Services had budgeted its training service charge at $120 per hour. The company planned to provide 30,000 hours of training services during 2019. By lowering the service charge to $114 per hour, the company was able to increase the actu

> Muskrat Medical Equipment Company makes a blood pressure measuring kit. Jason McCoy is the production manager. The production department’s static budget and actual results for 2019 follow. Required: a. Convert the static budget into a