Question: Data for Brecker Inc. are presented in

Data for Brecker Inc. are presented in E23-13.

Instructions

Prepare a statement of cash flows using the indirect method.

From E23-13:

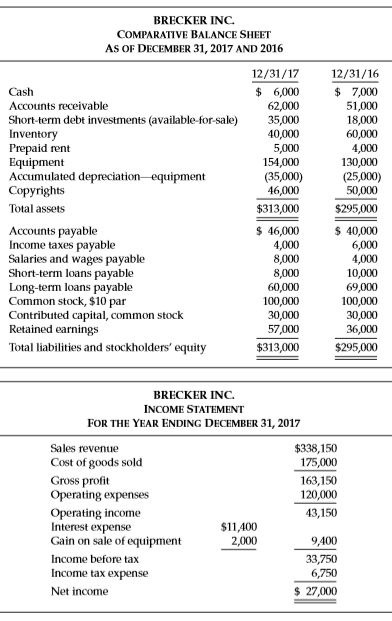

Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2017.

Additional information:

1. Dividends in the amount of $6,000 were declared and paid during 2017.

2. Depreciation expense and amortization expense are included in operating expenses.

3. No unrealized gains or losses have occurred on the investments during the year.

4. Equipment that had a cost of $20,000 and was 70% depreciated was sold during 2017.

Transcribed Image Text:

BRECKER INC. COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2017 AND 2016 12/31/17 12/31/16 $ 6,000 62,000 35,000 40,000 5,000 154,000 (35,000) 46,000 $ 7,000 51,000 18,000 60,000 4,000 130,000 (25,000) 50,000 Cash Accounts receivable Short-term debt investments (available-for-sale) Inventory Prepaid rent Equipment Accumulated depreciation-equipment Copyrights Total assets $313,000 $295,000 Accounts payable Income taxes payable Salaries and wages payable Short-term loans payable Long-term loans payable Common stock, $10 par Contributed capital, common stock Retained earnings $ 46,000 4,000 8,000 8,000 60,000 100,000 30,000 57,000 $ 40,000 6,000 4,000 10,000 69,000 100,000 30,000 36,000 Total liabilities and stockholders' equity $313,000 $295,000 BRECKER INC. INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2017 Sales revenue $338,150 Cost of goods sold 175,000 Gross profit Operating expenses 163,150 120,000 Operating income Interest expense Gain on sale of equipment 43,150 $11,400 2,000 9,400 33,750 6,750 Income before tax Income tax expense Net income $ 27,000

> Following are selected balance sheet accounts of Allman Bros. Corp. at December 31, 2017 and 2016, and the increases or decreases in each account from 2016 to 2017. Also presented is selected income statement information for the year ended December 31, 2

> Presented below are the comparative income and retained earnings statements for Denise Habbe Inc. for the years 2017 and 2018. The following additional information is provided: 1. In 2018, Denise Habbe Inc. decided to switch its depreciation method fr

> Kathleen Cole Inc. acquired the following assets in January of 2015. Equipment, estimated service life, 5 years; salvage value, $15,000………$525,000 Building, estimated service life, 30 years; no salvage value…………………$693,000 The equipment has been depreci

> Below is the net income of Anita Ferreri Instrument Co., a private corporation, computed under the three inventory methods using a periodic system. Instructions (Ignore tax considerations.) a. Assume that in 2018 Ferreri decided to change from the FI

> Gordon Company started operations on January 1, 2012, and has used the FIFO method of inventory valuation since its inception. In 2018, it decides to switch to the average-cost method. You are provided with the following information. Instructions a. W

> At January 1, 2017, Beidler Company reported retained earnings of $2,000,000. In 2017, Beidler discovered that 2016 depreciation expense was understated by $400,000. In 2017, net income was $900,000 and dividends declared were $250,000. The tax rate is 4

> Michaels Company had available at the end of 2017 the following information. Instructions Prepare a statement of cash flows for Michaels Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are de

> The first audit of the books of Bruce Gingrich Company was made for the year ended December 31, 2018. In examining the books, the auditor found that certain items had been overlooked or incorrectly handled in the last 3 years. These items are: 1. At the

> Dan Aykroyd Corp. was a 30% owner of Steve Martin Company, holding 210,000 shares of Martin’s common stock on December 31, 2016. The investment account had the following entries. On January 2, 2017, Aykroyd sold 126,000 shares of Mart

> On January 1, 2017, Beyonce Co. purchased 25,000 shares (a 10% interest) in Elton John Corp. for $1,400,000. At the time, the book value and the fair value of John’s net assets were $13,000,000. On July 1, 2018, Beyonce paid $3,040,000

> Gerald Englehart Industries changed from the double-declining-balance to the straight-line method in 2018 on all its equipment. There was no change in the assets’ salvage values or useful lives. Plant assets, acquired on January 2, 2015, had an original

> The before-tax income for Lonnie Holdiman Co. for 2017 was $101,000 and $77,400 for 2018. However, the accountant noted that the following errors had been made: 1. Sales for 2017 included amounts of $38,200 which had been received in cash during 2017, b

> A partial trial balance of Julie Hartsack Corporation is as follows on December 31, 2018. Additional adjusting data: 1. A physical count of supplies on hand on December 31, 2018, totaled $1,100. 2. Through oversight, the Salaries and Wages Payable ac

> Peter Henning Tool Company’s December 31 year-end financial statements contained the following errors. An insurance premium of $66,000 was prepaid in 2017 covering the years 2017, 2018, and 2019. The entire amount was charged to expen

> The reported net incomes for the first 2 years of Sandra Gustafson Products, Inc., were as follows: 2017, $147,000; 2018, $185,000. Early in 2019, the following errors were discovered. 1. Depreciation of equipment for 2017 was overstated $17,000. 2. De

> The following are four independent situations. a. On December 31, 2017, Zarle Inc. sold computer equipment to Daniell Co. and immediately leased it back for 10 years. The sales price of the equipment was $520,000, its carrying amount is $400,000, and it

> Assume that on January 1, 2017, Elmer’s Restaurants sells a computer system to Liquidity Finance Co. for $680,000 and immediately leases the computer system back. The relevant information is as follows. 1. The computer was carried on Elmer’s books at a

> The following are Sullivan Corp.’s comparative balance sheet accounts at December 31, 2017 and 2016, with a column showing the increase (decrease) from 2016 to 2017. Additional information: 1. On December 31, 2016, Sullivan acquire

> Mathys Inc. has recently hired a new independent auditor, Karen Ogleby, who says she wants “to get everything straightened out.” Consequently, she has proposed the following accounting changes in connection with Mathys Inc.’s 2017 financial statements.

> On February 20, 2017, Barbara Brent Inc. purchased a machine for $1,500,000 for the purpose of leasing it. The machine is expected to have a 10-year life, no residual value, and will be depreciated on the straight-line basis. The machine was leased to Ru

> On January 1, 2014, Jackson Company purchased a building and equipment that have the following useful lives, salvage values, and costs. Building, 40-year estimated useful life, $50,000 salvage value, $800,000 cost Equipment, 12-year estimated useful lif

> On January 1, 2017, Doug Nelson Co. leased a building to Patrick Wise Inc. The relevant information related to the lease is as follows. 1. The lease arrangement is for 10 years. 2. The leased building cost $4,500,000 and was purchased for cash on Janua

> Laura Leasing Company signs an agreement on January 1, 2017, to lease equipment to Plote Company. The following information relates to this agreement. 1. The term of the noncancelable lease is 5 years with no renewal option. The equipment has an estimat

> Morgan Leasing Company signs an agreement on January 1, 2017, to lease equipment to Cole Company. The following information relates to this agreement. 1. The term of the noncancelable lease is 6 years with no renewal option. The equipment has an estimat

> A lease agreement between Mooney Leasing Company and Rode Company is described in E21-8. Instructions (Round all numbers to the nearest cent.) Refer to the data in E21-8 and do the following for the lessor. a. Compute the amount of the lease receivab

> The following facts pertain to a noncancelable lease agreement between Mooney Leasing Company and Rode Company, a lessee. Inception date…………………………………………………………….May 1, 2017 Annual lease payment due at the beginning of each year, beginning with May 1, 2

> On January 1, 2017, Bensen Company leased equipment to Flynn Corporation. The following information pertains to this lease. 1. The term of the noncancelable lease is 6 years, with no renewal option. The equipment reverts to the lessor at the termination

> Cullen Construction Company, which began operations in 2017, changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2018. For tax purposes, the company employs the completed-co

> Ashley Company is a young and growing producer of electronic measuring instruments and technical equipment. You have been retained by Ashley to advise it in the preparation of a statement of cash flows using the indirect method. For the fiscal year ended

> Presented below are income statements prepared on a LIFO and FIFO basis for Kenseth Company, which started operations on January 1, 2016. The company presently uses the LIFO method of pricing its inventory and has decided to switch to the FIFO method in

> Albertsen Corporation is considering proposals for either leasing or purchasing aircraft. The proposed lease agreement involves a twin-engine turboprop Viking that has a fair value of $1,000,000. This plane would be leased for a period of 10 years beginn

> Castle Leasing Company signs a lease agreement on January 1, 2017, to lease electronic equipment to Jan Way Company. The term of the noncancelable lease is 2 years, and payments are required at the end of each year. The following information relates to t

> Edna Millay Inc. is a manufacturer of electronic components and accessories with total assets of $20,000,000. Selected financial ratios for Millay and the industry averages for firms of similar size are presented below. Millay is being reviewed by seve

> Picasso Company is a wholesale distributor of packaging equipment and supplies. The company’s sales have averaged about $900,000 annually for the 3-year period 2015–2017. The firm’s total assets at th

> Madrasah Corporation issued its financial statements for the year ended December 31, 2017, on March 10, 2018. The following events took place early in 2018. a. On January 10, 10,000 shares of $5 par value common stock were issued at $66 per share. b. O

> Los Lobos Corp. uses the direct method to prepare its statement of cash flows. Los Lobos’s trial balances at December 31, 2017 and 2016, are as follows. Additional information: 1. Los Lobos purchased $5,000 in equipment during 2017.

> Ballard Co. reported $145,000 of net income for 2017. The accountant, in preparing the statement of cash flows, noted the following items occurring during 2017 that might affect cash flows from operating activities. 1. Ballard purchased 100 shares of tr

> Presented below are two independent situations. Situation A: Annie Lennox Co. reports revenues of $200,000 and operating expenses of $110,000 in its first year of operations, 2017. Accounts receivable and accounts payable at year-end were $71,000 and $

> Data for Krauss Company are presented in E23-5. Instructions Prepare the operating activities section of the statement of cash flows using the indirect method. From E23-5: Krauss Company’s income statement for the year ended December

> Lowell Corporation has used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced bookkeeper. Income sta

> Krauss Company’s income statement for the year ended December 31, 2017, contained the following condensed information. Krauss’s balance sheet contained the following comparative data at December 31. (Accounts payab

> Below is the comparative balance sheet for Stevie Wonder Corporation. Dividends in the amount of $15,000 were declared and paid in 2017. Instructions From this information, prepare a worksheet for a statement of cash flows. Make reasonable assumptions

> Tedesco Company changed depreciation methods in 2017 from double-declining-balance to straight-line. Depreciation prior to 2017 under double-declining-balance was $90,000, whereas straight-line depreciation prior to 2017 would have been $50,000. Tedesco’

> The transactions below took place during the year 2017. 1. Convertible bonds payable with a par value of $300,000 were exchanged for unissued common stock with a par value of $300,000. The market price of both types of securities was par. 2. The net in

> Data for Anita Baker Company are presented in E23-18. Instructions Prepare entries in journal form for all adjustments that should be made on a worksheet for a statement of cash flows. From E23-18 The accounts below appear in the ledger of Anita Baker

> The accounts below appear in the ledger of Anita Baker Company. Instructions From the postings in the accounts above, indicate how the information is reported on a statement of cash flows by preparing a partial statement of cash flows using the indire

> Jobim Inc. had the following condensed balance sheet at the end of operations for 2016. During 2017, the following occurred. 1. A tract of land was purchased for $9,000. 2. Bonds payable in the amount of $15,000 were redeemed at par. 3. An additiona

> The balance sheet data of Brown Company at the end of 2017 and 2016 follow. Land was acquired for $30,000 in exchange for common stock, par $30,000, during the year; all equipment purchased was for cash. Equipment costing $10,000 was sold for $3,000; b

> The following data are taken from the records of Alee Company. Additional information: 1. Held-to-maturity securities carried at a cost of $43,000 on December 31, 2016, were sold in 2017 for $34,000. The loss (not unusual) was incorrectly charged dir

> On March 5, 2018, you were hired by Hemingway Inc., a closely held company, as a staff member of its newly created internal auditing department. While reviewing the company’s records for 2016 and 2017, you discover that no adjustments h

> Brecker Inc., a greeting card company, had the following statements prepared as of December 31, 2017. Additional information: 1. Dividends in the amount of $6,000 were declared and paid during 2017. 2. Depreciation expense and amortization expense ar

> Data for Pat Metheny Company are presented in E23-11. Instructions Prepare a statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.) From E23-11: Condensed financial data of Pat Metheny Company for 2017 and 2016 a

> Condensed financial data of Pat Metheny Company for 2017 and 2016 are presented below. Additional information: During the year, $70 of common stock was issued in exchange for plant assets. No plant assets were sold in 2017. Instructions Prepare a sta

> Morlan Corporation is preparing its December 31, 2017, financial statements. Two events that occurred between December 31, 2017, and March 10, 2018, when the statements were issued, are described below. 1. A liability, estimated at $160,000 at December 3

> Various types of accounting changes can affect the financial statements of a business enterprise differently. Assume that the following list describes changes that have a material effect on the financial statements for the current year of your business e

> On January 1, 2017, Evans Company entered into a noncancelable lease for a machine to be used in its manufacturing operations. The lease transfers ownership of the machine to Evans by the end of the lease term. The term of the lease is 8 years. The minim

> Each of the following items must be considered in preparing a statement of cash flows for Cruz Fashions Inc. for the year ended December 31, 2017. 1. Fixed assets that had cost $20,000 6½ years before and were being depreciated on a 10-year basis, with

> Teresa Ramirez and Lenny Traylor are examining the following statement of cash flows for Pacific Clothing Store’s first year of operations. Teresa claims that Pacific’s statement of cash flows is an excellent portray

> The following statement was prepared by Maloney Corporation’s accountant. The following additional information relating to Maloney Corporation is available for the year ended September 30, 2017. 1. Salaries and wages expense attribut

> On January 1, 2017, Perriman Company sold equipment for cash and leased it back. As seller-lessee, Perriman retained the right to substantially all of the remaining use of the equipment. The term of the lease is 8 years. There is a gain on the sale porti

> You have been assigned to examine the financial statements of Zarle Company for the year ended December 31, 2017. You discover the following situations. 1. Depreciation of $3,200 for 2017 on delivery vehicles was not recorded. 2. The physical inventory

> In 2016, Grishell Trucking Company negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were erected to the company’s specifications on land owned by the co

> For each of the unrelated transactions described below, present the entry(ies) required to record each transaction. 1. Grand Corp. issued $20,000,000 par value 10% convertible bonds at 99. If the bonds had not been convertible, the company’s inves

> If the bonds in Question 8 are classified as available-forsale and they have a fair value at December 31, 2017, of $3,604,000, prepare the journal entry (if any) at December 31, 2017, to record this transaction.

> On July 1, 2017, Wheeler Company purchased $4,000,000 of Duggen Company’s 8% bonds, due on July 1, 2024. The bonds, which pay interest semiannually on January 1 and July 1, were purchased for $3,500,000 to yield 10%. Determine the amount of interest reve

> Kalin Corporation had 2017 net income of $1,000,000. During 2017, Kalin paid a dividend of $2 per share on 100,000 shares of preferred stock. During 2017, Kalin had outstanding 250,000 shares of common stock. Compute Kalin’s 2017 earnings per share.

> The book basis of depreciable assets for Erwin Co. is $900,000, and the tax basis is $700,000 at the end of 2018. The enacted tax rate is 34% for all periods. Determine the amount of deferred taxes to be reported on the balance sheet at the end of 2018.

> Explain how trading debt securities are accounted for and reported.

> When should a debt security be classified as held-to-maturity?

> A headline in the Wall Street Journal stated, “Firms Increasingly Tap Their Pension Funds to Use Excess Assets.” What is the accounting issue related to the use of these “excess assets” through plan terminations?

> Boey Company reported net income of $25,000 in 2018. It had the following amounts related to its pension plan in 2018: Actuarial liability gain $10,000; Unexpected asset loss $14,000; Accumulated other comprehensive income (G/L) (beginning balance), zero

> Addison Co. has one temporary difference at the beginning of 2017 of $500,000. The deferred tax liability established for this amount is $150,000, based on a tax rate of 30%. The temporary difference will provide the following taxable amounts: $100,000 i

> Feagler Company’s current income taxes payable related to its taxable income for 2017 is $460,000. In addition, Feagler’s deferred tax asset decreased $20,000 during 2017. What is Feagler’s income tax expense for 2017?

> Lee Company’s current income taxes payable related to its taxable income for 2017 is $320,000. In addition, Lee’s deferred tax liability increased $40,000 and its deferred tax asset increased $10,000 during 2017. What is Lee’s income tax expense for 2017

> Hanson Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2017, the following balances related to this plan. Plan assets (market-related value)………….$520,000 Projected benefit obligation………………………700,000 Pension asset/liability

> Hollenbeck Foods Inc. sponsors a postretirement medical and dental benefit plan for its employees. The following balances relate to this plan on January 1, 2017. Plan assets……………………………………………………………$200,000 Expected postretirement benefit obligation………………8

> On January 1, 2017 (the date of grant), Lutz Corporation issues 2,000 shares of restricted stock to its executives. The fair value of these shares is $75,000, and their par value is $10,000. The stock is forfeited if the executives do not complete 3 year

> Kramer Co. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks related to the pension pl

> Youngman Corporation has temporary differences at December 31, 2017, that result in the following deferred taxes. Deferred tax asset…………$24,000 Deferred tax liability……….69,000 Indicate how these balances would be presented in Youngman’s December 31, 20

> Ramirez Company has a held-for-collection investment in the 6%, 20-year bonds of Soto Company. The investment was originally purchased for $1,200,000 in 2016. Early in 2017, Ramirez recorded an impairment of $300,000 on the Soto investment, due to Soto’s

> Rode Inc. incurred a net operating loss of $500,000 in 2017. Combined income for 2015 and 2016 was $350,000. The tax rate for all years is 40%. Rode elects the carryback option. Prepare the journal entries to record the benefits of the loss carryback and

> At December 31, 2017, Hillyard Corporation has a deferred tax asset of $200,000. After a careful review of all available evidence, it is determined that it is probable that $60,000 of this deferred tax asset will not be realized. Prepare the necessary jo

> Buhl Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2017, the following balances relate to this plan. Plan assets……………………….$480,000 Defined benefit obligation…..600,000 Pension asset/liability…………..120,000 As a result of

> The following defined pension data of Doreen Corp. apply to the year 2017. Defined benefit obligation, 1/1/17 (before amendment)……….$560,000 Plan assets, 1/1/17………………………………………………………………..546,200 Pension asset/liability………………………………………………………..13,800 Cr. On

> Tevez Company experienced an actuarial loss of $750 in its defined benefit plan in 2017. For 2017, Tevez’s revenues are $125,000, and expenses (excluding pension expense of $14,000, which does not include the actuarial loss) are $85,000. Prepare Tevez’s

> Villa Company has experienced tough competition, leading it to seek concessions from its employees in the company’s pension plan. In exchange for promises to avoid layoffs and wage cuts, the employees agreed to receive lower pension benefits in the futur

> Use the information for Rode Inc. given in IFRS19-7. Assume that it is probable that the entire net operating loss carryforward will not be realized in future years. Prepare the journal entry(ies) necessary at the end of 2017. From IFRS19-7: Rode Inc. i

> Refer to the data for Barwood Corporation in BE16-6. Repeat the requirements assuming that instead of options, Barwood granted 2,000 shares of restricted stock. From BE16-6: On January 1, 2017, Barwood Corporation granted 5,000 options to executives. Ea

> At December 31, 2017, Cascade Company had a net deferred tax liability of $450,000. An explanation of the items that compose this balance is as follows. Temporary Differences in Deferred Taxes…………………Resulting Balances 1. Excess of tax depreciation over b

> Petrenko Corporation has outstanding 2,000 $1,000 bonds, each convertible into 50 shares of $10 par value ordinary shares. The bonds are converted on December 31, 2017. The bonds payable has a carrying value of $1,950,000 and conversion equity of $20,000

> At December 31, 2016, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows. Resulting Balances………………………Temporary Differences in Deferred Taxes 1. Excess of tax depreciation over

> Using the information in E20-2, prepare a pension worksheet inserting January 1, 2017, balances, showing December 31, 2017, balances, and the journal entry recording pension expense. From E20-2: Veldre Company provides the following information about it

> The following facts apply to the pension plan of Boudreau Inc. for the year 2017. Plan assets, January 1, 2017………………………………..$490,000 Projected benefit obligation, January 1, 2017………….490,000 Settlement rate…………………………………………………………….8% Service cost……………………

> In 2017, Steinrotter Construction Corp. began construction work under a 3-year contract. The contract price was $1,000,000. Steinrotter uses the percentage-of-completion method for financial accounting purposes. The income to be recognized each year is b

> Capulet Company establishes a stock-appreciation rights program that entitles its new president Ben Davis to receive cash for the difference between the market price of the stock and a pre-established price of $30 (also market price) on December 31, 2013

> On May 1, 2017, Richardson Inc. entered into a contract to deliver one of its specialty mowers to Kickapoo Landscaping Co. The contract requires Kickapoo to pay the contract price of $900 in advance on May 15, 2017. Kickapoo pays Richardson on May 15, 20

> On December 31, 2013, Beckford Company issues 150,000 stock-appreciation rights to its officers entitling them to receive cash for the difference between the market price of its stock and a pre-established price of $10. The fair value of the SARs is esti

> Winsor Inc. recently purchased Holiday Corp., a large midwestern home painting corporation. One of the terms of the merger was that if Holiday’s income for 2017 was $110,000 or more, 10,000 additional shares would be issued to Holiday’s stockholders in 2

> On January 1, 2017, Barwood Corporation granted 5,000 options to executives. Each option entitles the holder to purchase one share of Barwood’s $5 par value common stock at $50 per share at any time during the next 5 years. The market price of the stock

> Sarazan Company issues a 4-year, 7.5% fixed-rate interest only, nonprepayable $1,000,000 note payable on December 31, 2016. It decides to change the interest rate from a fixed rate to variable rate and enters into a swap agreement with M&S Corp. The swap