Question: Data from the comparative balance sheet of

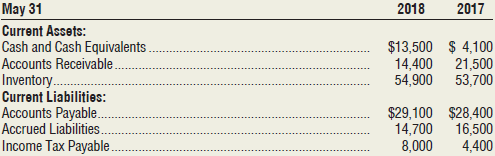

Data from the comparative balance sheet of Gibson’s Greenhouse, Inc., at May 31, 2018, follow:

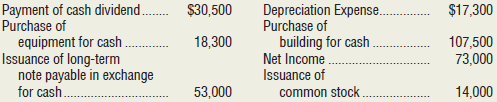

Gibson’s Greenhouse, Inc.’s transactions during the year ended May 31, 2018, included:

Requirements

1. Prepare Gibson’s Greenhouse, Inc.’s statement of cash flows for the year ended May 31, 2018, using the indirect method to report cash flows from operating activities.

2. Evaluate Gibson’s Greenhouse, Inc.’s cash flows for the year. Mention all three categories of cash flows and give the reason(s) for your evaluation

> Hibra, an EE student who is also taking a business minor, is studying depreciation in her engineering management and finance courses. The assignment in both classes is to demonstrate that shorter recovery periods require the same total taxes, but they of

> Guess which depreciation method will have the lower 10%-per-year PW of taxes between the following methods over a 6-year study period: P = $100, S = 0, and GI-OE = $50, and Te = 30%. Verify your answer via spreadsheet. I. Straight line with n = 4 years I

> Vibrations Dynamics uses vibrations sensitive equipment based on lithography to measure vibrations in building foundations caused by subway, rail, and automobile traffic in major cities of the world. Use a spreadsheet to (a) plot the annual tax curves, a

> Jensen Systems purchases several parts for the instruments it makes via a fixed-price contract of $155,000 per year from a local supplier. The new president of Jensen wants to make the parts in house through the purchase of equipment that will have a fir

> A company that manufactures clear PVC pipe is investigating the production options of batch and continuous processing. Estimated cash flows are: The chief operating officer (COO) has asked you to determine if the batch option would ever have a lower ann

> Elias wants to perform an after-tax evaluation of equivalent methods to electrostatically remove airborne particulate matter from clean rooms used to package liquid pharmaceutical products. Using the information shown, MACRS depreciation with n = 3 years

> Advanced Anatomists, Inc., researchers in medical science, is contemplating a commercial venture concentrating on proteins based on the new X-ray technology of free-electron lasers. To recover the huge investment needed, an annual $2.5 million CFAT is ne

> Four years ago, a division of Harcourt-Banks purchased an asset that was depreciated by the MACRS method using a 3-year recovery period. If the total revenue for year 2 was $48 million with depreciation of $8.2 million and operating expenses of $28 milli

> Four years ago, Sierra Instruments of Monterey, California, spent $200,000 for equipment for manufacturing standard gas flow calibrators. The equipment was depreciated by MACRS using a 3-year recovery period. For year 4, GI was $100,000, OE was $50,000,

> Perform a sensitivity analysis on the two parameters of M&O costs and number of households to determine if alternative 3 remains the best economic choice. Three estimates are made for each parameter in Table 18–6. M&O costs may vary up (pessimistic) or d

> Fill in the missing values for CFBT, D, TI, taxes, and CFAT in the following table. Depreciation amounts are based on the 3-year MACRS method and Te is 35%. Solve (a) by hand, and (b) by spreadsheet

> A new anti-theft system incorporating MEMS technology is being economically evaluated separately by three engineers at Dragon Technologies. The first cost of the equipment will be $75,000, and the life is estimated at 6 years with a salvage value of $900

> An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.

> George has been offered the opportunity to purchase a 9%, $10,000 bond due in 10 years. The bond dividend is paid semiannually. George expects an 8% per year, compounded semiannually return on his investments. Use a spreadsheet to graph the sensitivity i

> A young couple planning ahead for their retirement has decided that $3 million is the amount they will need in order to retire comfortably 20 years from now. For the past 5 years, they have been able to invest one of their salaries ($50,000 per year, whi

> A biofuel subsidiary of Petrofac, Inc. is planning to borrow $12 million to acquire a small technology- based company. The rate on a 5-year loan is highly variable; it could be as low as 7%, as high as 15%, but is expected to be 10% per year. The company

> Joyce and Vincent, both engineers, got married and raised three children over an 18-year period and the first one is now ready for college. There have been good and bad years financially; Joyce quit work for some years to raise small children, Vincent lo

> The production manager on the Ofon Phase 2 offshore platform operator by Total S.A. must purchase specialized environmental equipment or an equivalent service. The first cost is $250,000 with an AOC of $75,000. The manager has let it be known that he doe

> C. F. Jordon Management Services has operated for the last 26 years in a northern province where the provincial income tax on corporate revenue is 6% per year. C. F. Jordon pays an average federal tax of 23% and reports taxable income of $7 million. Beca

> Aquatech Microsystems reported a TI of $80,000 last year. If the state income tax rate is 6%, determine the (a) average federal tax rate, (b) overall effective tax rate, (c) total taxes to be paid based on the effective tax rate, and (d) total taxes paid

> By how much would the capital investment of alternative 4 have to decrease to make it more attractive than alternative 3?

> Borsberry Medical has a gross income of $6.5 million for the year. Depreciation and operating expenses total $4.1 million. The combined state and local tax rate is 7.6%. (a) Use an effective federal rate of 34% to estimate the income taxes. (b) Borsberry

> Two companies, ABC and XYZ, have the following values on their annual tax returns: (a) Calculate the exact federal income taxes for the year. (b) Determine the percentage of sales revenue each company will pay in federal income taxes. (c) Estimate the ta

> Determine if the selection of system GH or B3 is sensitive to variation in the return required by management. Depending on the type of project, the corporate MARR ranges from 8% to 16% per year on different projects. (a) Write the AW equations to find th

> Helical Products makes machined springs with elastic redundant elements so that a broken spring will continue to function. The company had GI of $450,000 with OE of $230,000 and depreciation of $48,000. (a) How much did the company owe in taxes if its ef

> A total of 100 maintenance costs, C, for groundmounted transformers in high-density housing areas were collected by the City Electricity Authority. The costs are clustered into $200 cells with midpoints ranging from $600 to $2000. The number of times (fr

> Home Automation is considering an investment of $500,000 in a new product line. The company will make the investment only if it will result in a rate of return of 15% per year or higher. The revenue is expected to be between $138,000 and $165,000 per yea

> Determine the single-value effective tax rate for a corporation that has a federal tax rate of 35% and state tax rate of 7%.

> Determine the taxable income for a company that had gross income of $36.7 million, earnings before interest and income taxes of $21.4 million, and depreciation of $9.5 million.

> For a company that had net operating income of $51.3 million and operating expenses of $23.6 million, what was the (a) gross income, and (b) earnings before interest and income taxes?

> For the events described below, select the taxrelated term from the following list that best applies: gross income, depreciation, operating expense, taxable income, income tax, or net operating profit after taxes. (a) A corporation reports that it had a

> If the ability-to-supply-area and relative-cost factors were each weighted 20% and the other four factors 15% each, which alternatives would be ranked in the top three?

> For each funding option, perform a spreadsheet analysis that shows the total CFAT and its present worth over a 6-year period, the time it will take to realize the full advantage of MACRS depreciation. An after-tax return of 10% is expected. Which funding

> Cal Spas, Inc., reported the following statement of stockholders’ equity for the year ended September 30, 2018: Requirements 1. What is the par value of the company’s common stock? 2. At what price per share did the

> The balance sheet of Johnson Supply, Inc., at December 31, 2017, reported 800,000 shares of $2 par common stock authorized, with 116,000 shares issued and outstanding. Paid-in Capital in Excess of Par—Common had a balance of $300,000. R

> Cho Sporting Goods, Inc., completed the following selected transactions during 2018: Requirement 1. Record the transactions in the journal.

> Kommeri Consulting, Inc., has 9,000 shares of $6, no-par preferred stock and 60,000 shares of no-par common stock outstanding for 2016–2018. Kommeri Consulting, Inc., declared and paid the following dividends during a three-year period: 2016, $22,000; 20

> The Davenport Hotel, Inc., included the following stockholders’ equity on its year-end balance sheet at December 31, 2018. Requirements 1. Identify the different issues of stock that the Davenport Hotel, Inc., has outstanding. 2. Give

> Gamma Corporation was organized in 2017. At December 31, 2017, Gamma Corporation’s balance sheet reported the following stockholders’ equity: Requirement Answer the following questions and make journal entries as nee

> Assume you are purchasing an investment and decide to invest in a company in the home remodeling business. You narrow the choice to Hudson, Inc., or Madison Corp. You assemble the following data: Selected income statement data for the current year: Sel

> Comparative financial statement data of Lodgepole Furniture Company follow: Other information follows: a. Market price of a share of common stock was $50.00 at December 31, 2018, and $33.00 at December 31, 2017. b. An average of 11,000 common shares w

> Financial statement data of Helgeson Enterprises, Inc., include the following items: Cash ……………………………………………………………………………………………. $ 24,300 Short-Term Investments ………………………………………………………….………. 28,100 Accounts Receivable, Net ………………………………………………………….……… 90,600

> Otto’s Auto Sales asked for your help in comparing the company’s profit performance and financial position with the average for the auto sales industry. The owner has given you the company’s income st

> To help you understand the importance of cash flows in the operation of a small business. You own a business, like Susan and Brian Miller of the Bold City Brewery. You just received your year-end financial statements from your CPA. Although receiving the

> Net sales, net income, and total assets for Schmitz Construction, Inc., for a four-year period follow: Requirements 1. Compute trend percentages for each item for 2015 through 2018. Use 2015 as the base year. 2. Compute the return on assets for 2016, 2

> To prepare the statement of cash flows, accountants for Kim & Associates, Inc., summarized 2018 activity in the Cash account as: Requirement 1. Prepare the statement of cash flows of Kim & Associates, Inc., for the year ended December 31, 2018,

> Use the Linderman Garden Supply, Inc., data from P11-39B. The cash amounts for Interest Revenue, Salaries Expense, Interest Expense, and Income Tax Expense are the same as the accrual amounts for these items. Requirements 1. Prepare the 2018 statement o

> The accounting records for Best Way Lumber, Inc., for the year ended November 30, 2018, contain the following information: a. Purchase of fixed assets, $88,400 b. Proceeds from issuance of common stock, $12,000 c. Payment of dividends, $45,400 d. Collect

> The 2018 comparative balance sheet and income statement of Linderman Garden Supply, Inc., follow: Linderman Garden Supply, Inc., had no noncash investing and financing transactions during 2018. During the year, Linderman Garden Supply, Inc., sold no l

> Fred’s Appliance, Inc.’s accountants assembled the following data for the year ended December 31, 2018: Requirement 1. Prepare Fred’s Appliance Inc.’s statement of cash flows usin

> To prepare the statement of cash flows, accountants for Houton & Associates, Inc., summarized 2018 activity in the Cash account as: Requirement 1. Prepare the statement of cash flows of Houton & Associates, Inc., for the year ended December 31,

> Use the Bone Appetit Pet Supply, Inc., data from P11-33A. The cash amounts for Interest Revenue, Salaries Expense, Interest Expense, and Income Tax Expense are the same as the accrual amounts for these items. Requirements 1. Prepare the 2018 statement o

> You have been hired as an investment analyst at Lancaster Securities, Inc. It is your job to recommend investments for your client. You have the following information for two different companies. Requirement 1. Write a memo to your client recommending

> Zepher, Inc., prepared the following stockholders’ equity section as of December 31, 2018. Requirement 1. Answer the following questions about Zepher, Inc.’s dividends: a. How much in dividends must Zepher, Inc., dec

> Assume you are purchasing an investment and decide to invest in a company in the home remodeling business. You narrow the choice to Skyview, Inc., or Vista Corp. You assemble the following data. Assume all sales are on credit. Selected income statement d

> Comparative financial statement data of Shabby Chic Furniture Company follow: Other information follows: 1. Market price of a share of common stock was $31.00 at December 31, 2018, and $48.50 at December 31, 2017. 2. Average common shares outstanding

> Financial statement data of New Brunswick Fence, Inc., include: Cash ……………………………………………..………………………………………………. $ 24,000 Short-Term Investments …………………..……………………………………….………. 30,000 Accounts Receivable, Net ………………………………………………………….……… 103,000 Inventory ………………

> Chelsey’s Auto Sales asked for your help in comparing the company’s profit performance and financial position with the average for the auto sales industry. The owner has given you the company’s income

> Net sales, net income, and total assets for Versacheki Construction, Inc., for a four-year period are: Requirements 1. Compute trend percentages for each item for 2015 through 2018. Use 2015 as the base year. 2. Compute the return on assets for 2016, 2

> Popovich Computers, Inc., reported the following statement of stockholders’ equity for the year ended September 30, 2018: Requirements 1. What is the par value of the company’s common stock? 2. At what price per shar

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Financial Statements starting on page 663. Now go online and access the 2016 Annual Report for Under Armour, Inc.. For instructions on how to access the report online,

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Selected Financial Data starting on page 647. Now access the 2016 Annual Report for Under Armour, Inc. from the Internet. For instructions on how to access the report

> Find the Columbia Sportswear Company Annual Report located in Appendix A and go to the Consolidated Statements of Cash Flows on page 666. Now access the 2016 Annual Report for Under Armour, Inc., from the Internet. For instructions on how to access the r

> This case continues our examination of Columbia Sportswear. Here we study the stockholders’ equity of Columbia Sportswear, which you will see titled as Shareholders’ Equity. Refer to the Columbia Sportswear financial statements in Appendix A. Look for th

> Watkins Enterprises earned net income of $95,000 during the year ended December 31, 2018. On December 15, 2018, Watkins Enterprises declared the annual cash dividend on its 2 percent preferred stock (total par value, $140,000) and a $0.70 per share cash

> This case focuses on the financial statement analysis of Columbia Sportswear. Recall from this chapter that stakeholders use numerous ways to analyze and so better understand the financial position and results of a company’s operations. Tools such as ver

> The following data are adapted from the financial statements of Tycom, Inc. Total Current Assets …………………â&#

> Evaluate the common stock of Build Right Incorporated as an investment. Utilize the four ratios that help determine whether a business is generating enough net income to reward the stockholders for the use of their money; use this information to determin

> Consider the following comparative income statement and additional balance sheet data for Classic Fashions, Inc. Additional data follow: Requirements 1. For 2017 and 2018, compute the five ratios that measure how the business is investing its money a

> Green Bluff Winery requested that you determine whether the company’s ability to pay its current liabilities and long-term debts improved or deteriorated during 2018. To answer this question, compute the following ratios for 2018 and 20

> Simpson Painting, Inc., requested that you perform a vertical analysis of its balance sheet to determine the component percentages of its assets, liabilities, and stockholders’ equity. Round to the nearest tenth of a percent.

> Below are net sales and net income data for a five-year period. Requirements 1. Compute trend percentages for net sales and net income for the five-year period, using year 1 as the base year. Round to the nearest percent. 2. Which grew faster during th

> Below is the comparative income statement of P. Donnelly, Inc. Requirements 1. Prepare a horizontal analysis of the comparative income statement of P. Donnelly, Inc. Round percentage changes to the nearest tenth of a percent. 2. Why did net income incr

> Based on the data below, what were the dollar and percentage changes in Fessler’s Fine Furnishings, Inc.’s net working capital during 2017 and 2018? Is this trend favorable or unfavorable?

> Assume that Pugliese Industrial Supply, Inc., has the following data: Net income for 2018 .......................................................................................... $ 149,000 Total stockholders’ equity, 12/31/2018........................

> Matrix, Inc., reported the following data for 2018: Compute Matrix, Inc.’s net cash provided by operating activities according to the indirect method.

> Universal Communications, Inc., began 2018 with 340,000 shares of $1 par common stock issued and outstanding. Beginning Paid-in Capital in Excess of Par—Common was $590,000, and Retained Earnings was $750,000. In June 2018, Universal Communications, Inc.

> At December 31, 2017, Gentili Corp. reported the following stockholders’ equity: During 2018, Gentili completed these transactions and events in this order: a. Sold 1,200 shares of treasury stock for $39 per share; the cost of these s

> Patterson Manufacturing Co. has the following selected account balances at September 30, Requirement 1. Prepare the stockholders’ equity section of the company’s balance sheet.

> The following data are adapted from the financial statements of Intermountain Leasing, Inc.: Total Current Assets ………………â€

> Evaluate the common stock of Pittsford Incorporated as an investment. Utilize the four ratios that help determine whether a business is generating enough net income to reward the stockholders for the use of their money; use this information to determine

> Walla Walla Winery requested that you determine whether the company’s ability to pay its current liabilities and long-term debts improved or deteriorated during 2018. To answer this question, compute the following ratios for 2018 and 2017: (a) current r

> The financial statements of Hernandez & Son, Inc., include the following items: Requirements 1. Compute the following ratios for the current year: (a) current ratio, (b) quick ratio, (c) cash conversion cycle, (d) accounts receivable turnover, (e)

> Prepare a comparative common-size income statement for Variline, Inc., using the 2018 and 2017 data from E12-12A. Round percentages to the nearest tenth of a percent. E12-12A: Below is the comparative income statement of Variline, Inc. Requirements 1.

> The stockholders’ equity for Coeur d’Alene Marina, Inc., on December 31, 2017, follows: On May 31, 2018, the market price of Coeur d’Alene Marina, Inc.’s common stock was $17 per s

> The following elements of stockholders’ equity are adapted from the balance sheet of Sacchetti Corporation: Sacchetti Corporation paid no preferred dividends in 2018 but paid the designated amount of cash dividends per share to prefer

> At December 31, 2018, Sugarland Company reported the following on its comparative balance sheet, which included 2017 amounts for comparison (adapted, with all amounts in millions except par value per share): 1. How much did Sugarland Companyâ

> Tri County Communications, Inc., has the following stockholders’ equity: Requirements 1. Assume the preferred stock is cumulative. Compute the amount of dividends to preferred and common shareholders for 2018 and 2019 if total dividen

> Below are net sales and net income data for a five-year period. Requirements 1. Compute trend percentages for net sales and net income for the five-year period, using year 1 as the base year. Round to the nearest percent. 2. Which grew faster during th

> Trudeau’s Marine, Inc., reported the following selected amounts in its financial statements for the year ended December 31, 2018: Requirement 1. Determine the following for Trudeau’s Marine, Inc., during 2018: a. Co

> The charter for Zealax, Inc., authorizes the company to issue 250,000 shares of $3, no-par preferred stock and 950,000 shares of common stock with $8 par value. During its start-up phase, Zealax, Inc., completed the following transactions: Requirements

> The income statement and additional data of Amalgamated Services, Inc., follow: Additional data: a. Collections from customers are $9,000 more than sales. b. Payments to suppliers are $3,000 more than the sum of cost of goods sold plus advertising expe

> Assume that Pembrook Industries, Inc., has the following data: Net income for 2018 ......................................................................................... $ 104,000 Total stockholder’s equity, 12/31/2018................................

> Century Communications, Inc., began 2018 with 290,000 shares of $1 par common stock issued and outstanding. Beginning Paid-in Capital in Excess of Par—Common was $580,000, and retained earnings was $730,000. In February 2018, Century Communications, Inc.

> At December 31, 2017, Gertner Corp. reported the following stockholders’ equity: During 2018, Gertner Corp. completed these transactions and events in this order: a. Sold 1,300 shares of treasury stock for $42 per share; the cost of t

> Tsongas Manufacturing Co. has the following selected account balances at July 31, 2018: Requirements 1. Prepare the stockholders’ equity section of the company’s balance sheet.

> The financial statements of Motion Auto Repair, Inc., include the following items: Requirement 1. Compute the following ratios for the current year: (a) current ratio, (b) quick ratio, (c) cash conversion cycle, (d) accounts receivable turnover, (e

> Buckeye, Inc., reported the following on its balance sheet at December 31, 2018: 1. Assume Buckeye, Inc., issued all of its stock during 2018 in one transaction. Journalize the company’s issuance of the stock for cash. 2. Was Buckeye,

> Prepare a comparative common-size income statement for P. Donnelly, Inc., using the 2018 and 2017 data of E12-22B. Round percentages to the nearest tenth of a percent. E12-22B: Below is the comparative income statement of P. Donnelly, Inc. Requirement

> The income statement and additional data of Amalgamated Services, Inc., follow: Additional data: a. Acquisition of fixed assets totaled $115,000. Of this amount, $85,000 was paid in cash; a $30,000 note payable was signed for the remainder. b. Proceeds