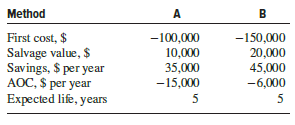

Question: Elias wants to perform an after-tax

Elias wants to perform an after-tax evaluation of equivalent methods to electrostatically remove airborne particulate matter from clean rooms used to package liquid pharmaceutical products. Using the information shown, MACRS depreciation with n = 3 years, a 5-year study period, after-tax MARR = 7% per year, and Te = 34% and a spreadsheet, he obtained the results AWA = $ − 2176 and AWB = $3545. Any tax effects when the equipment is salvaged were neglected. Method B is the better method.

Now, use classical SL depreciation with n = 5 years to select the better method. Is the decision different from that reached using MACRS? After solving by hand, verify your answer using a spreadsheet.

> A discrete variable X can take on integer values of 1 to 10. A sample of size 50 results in the following probability estimates: (a) Write out and graph the cumulative distribution. (b) Calculate the following probabilities using the cumulative distribut

> Carla is a statistician with a bank. She has collected debt-to-equity mix data on mature (M) and young (Y) companies. The debt percentages vary from 20% to 80%. Carla has defined DM as a variable for the mature companies from 0 to 1, with DM = 0 interpre

> Bob is working on two separate probability related projects. The first involves the variable N, which is the number of consecutively filled bottles of an anticancer drug that weigh in above the weight specification limit. The variable N is described by t

> Free Bird Software has developed partnerships with several large manufacturing corporations to use a Java-derivative software in their consumer and industrial products. A new corporation will be formed to manage these applications. One major project invo

> Triple Play Innovators Corporation (TPIC) plans to offer IPTV (Internet Protocol TV) service to North American customers starting soon. Perform an AW analysis of the EVA series for the two alternative suppliers available for the hardware and software. Us

> Cardenas and Moreno Engineering is evaluating a large flood control program for several southern cities. One component is a 4-year project for a special-purpose transport ship-crane for use in building permanent storm surge protection against hurricanes

> In conducting an EVA analysis for year 2 for new equipment on its primary product line, Analogy, Inc., manufacturers of preassembled blower packages and other water treatment components, determined the EVA to be $28,000. Analogy uses an after-tax interes

> Consider two air-conditioning systems with the estimates below. (a) Use AW analysis to determine the sensitivity of the economic decision to MARR values of 4%, 6%, and 8% per year. (b) Develop the spreadsheet functions that will display the six AW values

> A major equipment purchase is being economically evaluated by a team of three design engineers and one production engineer at Raytheon Aerospace. The agreed-upon estimates are P = $560,000, n = 6 years, and S = $100,000. The group disagrees, however, on

> Identify which of the following items are not included in the calculation of cash flow before taxes, CFBT: life of asset, operating expenses, salvage value, depreciation, initial investment, gross income, tax rate.

> Nuclear safety devices installed several years ago have been depreciated from a first cost of $200,000 to zero using MACRS. The devices can be sold on the used equipment market for an estimated $15,000, or they can be retained in service for 5 more years

> The Los Angeles, California, city engineer is analyzing a for-profit public works project at the port authority using an after-tax replacement analysis of the system installed 5 years ago (defender) and a challenger as detailed below. All values are in $

> Needco Supplies-Canada employee Stella Needleson was asked to determine if the current process of dying writing paper should be retained or a new, environment friendly process should be implemented. Estimates or actual values for the two processes are su

> After 8 years of use, the heavy-truck engine overhaul equipment at Pete’s Truck Repair was evaluated for replacement. Pete’s accountant used an after-tax MARR of 8% per year, Te of 30%, and a current market value of $25,000 to determine AW = $2100. The n

> Perform a PW-based after-tax replacement study from the information shown below using an after tax MARR of 12% per year, Te of 35%, and a study period of 4 years. All monetary values are in $1000 units. Assume the assets will be traded at their original

> A 2-year-old injection molding machine was expected to be kept in service for its projected life of 5 years, but a new challenger promises to be more efficient and have lower operating costs. You have been asked to determine if it would be economically a

> A nationwide real estate corporation is considering adding a new service line to sell the house of a client that buys another house through one of their agencies. It has determined that the first cost would be $80 million cash available for full implemen

> In an after-tax replacement study between a defender and a challenger, there may be a capital gain (CG) or loss (CL) when the defender is sold. (a) How is the gain or loss calculated, and (b) how does it affect the AW values in the study?

> AAA Pest Control uses the following: before-tax MARR = 14% per year, after-tax MARR = 7% per year, and Te = 50%. Two new spray machine options have the following estimates and will generate the same GI each year. Select A or B under the following conditi

> Elias wants to perform an after-tax evaluation of equivalent methods to electrostatically remove airborne particulate matter from clean rooms used to package liquid pharmaceutical products. Two alternatives are available, but others may be identified if

> An online patient diagnostics system for surgeons has the following point estimates: A first cost of $200,000 to install and $5000 annually to maintain over its expected life of 5 years. Added revenue is estimated to average $60,000 per year. Examine the

> Perform a PW-based evaluation of the two alternatives below using (a) by hand, and (b) by spreadsheet solutions. The after-tax MARR is 8% per year, MACRS depreciation applies, and Te = 40%. The (GI − OE) estimate is made for the first 3

> Process control equipment purchased for $78,000 by Debco, Incorporated generated a CFBT of $26,080 during the first year of its 10-year estimated life. This would represent a return of 31.2% per year if maintained throughout the 10 years. However, the co

> A European candy manufacturing plant manager must select a new irradiation system to ensure the safety of specific ingredients, while being economical. The two alternatives available have the following estimates: The company is in the 35% tax bracket and

> When JJ and Sons was awarded a contract to pour a skyscraper’s foundation, the father had to choose between two pieces of equipment needed to supplement pumping of concrete into foundation settings. Estimates are below. Both machines ha

> A division of Midland Oil & Gas has a TI of $8.95 million for a tax year. If the state tax rate averages 5% for all states in which the corporation operates, find the equivalent after-tax ROR required of projects that are justified only if they can demon

> The president of ChemTech is trying to decide whether to start a new product line or purchase a small company. It is not financially possible to do both. To make the product for a 3-year period will require an initial investment of $250,000. The expected

> Jeremy has $6000 to invest. If he puts the money in a certificate of deposit (CD), he is assured of receiving an effective 2.35% per year for 5 years. If he invests the money in stocks, he has a 50-50 chance of one of the following cash flow sequences fo

> (a) Determine the expected present worth of the following cash flow series if each series may be realized with the probability shown at the head of each column. Let i = 20% per year. (b) Determine the expected AW value for the same cash flow series.

> When the country’s economy is expanding, AB Investment Company is optimistic and expects a MARR of 15% on new investments. However, in a receding economy the expected return is 8%. Normally a 10% per year return is anticipated. An expan

> Thomas completed a study of a $1 million 3-yearold DNA analysis and modeling system that DynaScope Enterprises wants to keep for 1 more year or dispose of now. His table (in $1000 units) details the analysis, including an anticipated $100,000 selling pri

> The Johnson’s had two children, both of them are married and now have their own families, call them Family A and Family B. They both file their U.S. income taxes as married, filing jointly. Information collected for a year for each fami

> Abby has just negotiated a $15,000 price on a 2-year-old car and is with the salesman closing the deal. There is a 1-year sales warranty with the purchase; however, an extended warranty is available for $2500 that will cover the same repairs and componen

> An expansion of the current BIM (Building Information Model) software has been proposed to First Financial, the building’s owner. A total installed cost of $120,000 is expected to generate additional savings of $40,000 per year for 10 years, after which

> A nanotube forming asset was purchased 3 years ago for $240,000. It was just sold for $285,000. The asset was depreciated by the MACRS method with n = 5 years and has a current book value of $69,120. Determine the amount of (a) CG and DR, and (b) prepare

> An engineer has been offered an investment opportunity that will require a cash outlay of $40,000 now for a cash inflow of $3500 for each year of investment. However, she must state now the number of years she plans to retain the investment. Additionally

> Determine the amount of any DR, CG, or CL generated by each event described below. Use the result to determine the income tax effect, if Te = 30%. (a) A strip of land zoned as “Commercial A” purchased 8 years ago for $2.6 million was just sold at a 15% p

> Five thousand new smart camera systems are needed annually to expand the security surveillance of roads, buildings, airports, parks, etc. in a large metropolitan area. The system components can be obtained in one of three ways: (1) Make them in one of th

> Decision D6, which has three possible choices (X, Y, or Z), must be made in year 3 of a 6-year study period in order to maximize E(PW). Using a MARR of 15% per year, the investment required in year 3, and the estimated cash flows for years 4 through 6, d

> A large decision tree has an outcome branch detailed below. If decisions D1, D2, and D3 are all options in a 1-year time period, find the decision path that maximizes the outcome value. There are specific dollar investments necessary for decision nodes D

> Use an effective tax rate of 32% to determine three parameters: CFAT, NOPAT, and PW of taxes (i = 6% per year) associated with a new-technology MRI machine (first cost of $30,000) recently located at the county-government-funded Zendra Hospital in San Fr

> An asset with a first cost of $9000 is depreciated using 5-year MACRS recovery. The CFBT is estimated at $10,000 for the first 4 years and $5000 thereafter as long as the asset is retained. The effective tax rate is 40%, and money is worth 10% per year.

> If the environmental-considerations factor is to have a weighting of twice as much as any of the other five factors, what is its percentage weighting?

> Complete the last four columns of the table below using an effective tax rate of 40% for an asset that has a first cost of $20,000, no salvage value, and a 3-year recovery period. Use (a) straight line depreciation, and (b) MACRS depreciation. (All cash

> Hibra, an EE student who is also taking a business minor, is studying depreciation in her engineering management and finance courses. The assignment in both classes is to demonstrate that shorter recovery periods require the same total taxes, but they of

> Guess which depreciation method will have the lower 10%-per-year PW of taxes between the following methods over a 6-year study period: P = $100, S = 0, and GI-OE = $50, and Te = 30%. Verify your answer via spreadsheet. I. Straight line with n = 4 years I

> Vibrations Dynamics uses vibrations sensitive equipment based on lithography to measure vibrations in building foundations caused by subway, rail, and automobile traffic in major cities of the world. Use a spreadsheet to (a) plot the annual tax curves, a

> Jensen Systems purchases several parts for the instruments it makes via a fixed-price contract of $155,000 per year from a local supplier. The new president of Jensen wants to make the parts in house through the purchase of equipment that will have a fir

> A company that manufactures clear PVC pipe is investigating the production options of batch and continuous processing. Estimated cash flows are: The chief operating officer (COO) has asked you to determine if the batch option would ever have a lower ann

> Advanced Anatomists, Inc., researchers in medical science, is contemplating a commercial venture concentrating on proteins based on the new X-ray technology of free-electron lasers. To recover the huge investment needed, an annual $2.5 million CFAT is ne

> Four years ago, a division of Harcourt-Banks purchased an asset that was depreciated by the MACRS method using a 3-year recovery period. If the total revenue for year 2 was $48 million with depreciation of $8.2 million and operating expenses of $28 milli

> Four years ago, Sierra Instruments of Monterey, California, spent $200,000 for equipment for manufacturing standard gas flow calibrators. The equipment was depreciated by MACRS using a 3-year recovery period. For year 4, GI was $100,000, OE was $50,000,

> Perform a sensitivity analysis on the two parameters of M&O costs and number of households to determine if alternative 3 remains the best economic choice. Three estimates are made for each parameter in Table 18–6. M&O costs may vary up (pessimistic) or d

> Fill in the missing values for CFBT, D, TI, taxes, and CFAT in the following table. Depreciation amounts are based on the 3-year MACRS method and Te is 35%. Solve (a) by hand, and (b) by spreadsheet

> A new anti-theft system incorporating MEMS technology is being economically evaluated separately by three engineers at Dragon Technologies. The first cost of the equipment will be $75,000, and the life is estimated at 6 years with a salvage value of $900

> An engineer must decide between two ways to pump concrete to the top of a seven-story building. Plan 1 requires the leasing of equipment for $60,000 initially and will cost between $0.40 and $0.95 per metric ton to operate, with a most likely cost of $0.

> George has been offered the opportunity to purchase a 9%, $10,000 bond due in 10 years. The bond dividend is paid semiannually. George expects an 8% per year, compounded semiannually return on his investments. Use a spreadsheet to graph the sensitivity i

> A young couple planning ahead for their retirement has decided that $3 million is the amount they will need in order to retire comfortably 20 years from now. For the past 5 years, they have been able to invest one of their salaries ($50,000 per year, whi

> A biofuel subsidiary of Petrofac, Inc. is planning to borrow $12 million to acquire a small technology- based company. The rate on a 5-year loan is highly variable; it could be as low as 7%, as high as 15%, but is expected to be 10% per year. The company

> Joyce and Vincent, both engineers, got married and raised three children over an 18-year period and the first one is now ready for college. There have been good and bad years financially; Joyce quit work for some years to raise small children, Vincent lo

> The production manager on the Ofon Phase 2 offshore platform operator by Total S.A. must purchase specialized environmental equipment or an equivalent service. The first cost is $250,000 with an AOC of $75,000. The manager has let it be known that he doe

> C. F. Jordon Management Services has operated for the last 26 years in a northern province where the provincial income tax on corporate revenue is 6% per year. C. F. Jordon pays an average federal tax of 23% and reports taxable income of $7 million. Beca

> Aquatech Microsystems reported a TI of $80,000 last year. If the state income tax rate is 6%, determine the (a) average federal tax rate, (b) overall effective tax rate, (c) total taxes to be paid based on the effective tax rate, and (d) total taxes paid

> By how much would the capital investment of alternative 4 have to decrease to make it more attractive than alternative 3?

> Borsberry Medical has a gross income of $6.5 million for the year. Depreciation and operating expenses total $4.1 million. The combined state and local tax rate is 7.6%. (a) Use an effective federal rate of 34% to estimate the income taxes. (b) Borsberry

> Two companies, ABC and XYZ, have the following values on their annual tax returns: (a) Calculate the exact federal income taxes for the year. (b) Determine the percentage of sales revenue each company will pay in federal income taxes. (c) Estimate the ta

> Determine if the selection of system GH or B3 is sensitive to variation in the return required by management. Depending on the type of project, the corporate MARR ranges from 8% to 16% per year on different projects. (a) Write the AW equations to find th

> Helical Products makes machined springs with elastic redundant elements so that a broken spring will continue to function. The company had GI of $450,000 with OE of $230,000 and depreciation of $48,000. (a) How much did the company owe in taxes if its ef

> A total of 100 maintenance costs, C, for groundmounted transformers in high-density housing areas were collected by the City Electricity Authority. The costs are clustered into $200 cells with midpoints ranging from $600 to $2000. The number of times (fr

> Home Automation is considering an investment of $500,000 in a new product line. The company will make the investment only if it will result in a rate of return of 15% per year or higher. The revenue is expected to be between $138,000 and $165,000 per yea

> Determine the single-value effective tax rate for a corporation that has a federal tax rate of 35% and state tax rate of 7%.

> Determine the taxable income for a company that had gross income of $36.7 million, earnings before interest and income taxes of $21.4 million, and depreciation of $9.5 million.

> For a company that had net operating income of $51.3 million and operating expenses of $23.6 million, what was the (a) gross income, and (b) earnings before interest and income taxes?

> For the events described below, select the taxrelated term from the following list that best applies: gross income, depreciation, operating expense, taxable income, income tax, or net operating profit after taxes. (a) A corporation reports that it had a

> If the ability-to-supply-area and relative-cost factors were each weighted 20% and the other four factors 15% each, which alternatives would be ranked in the top three?

> For each funding option, perform a spreadsheet analysis that shows the total CFAT and its present worth over a 6-year period, the time it will take to realize the full advantage of MACRS depreciation. An after-tax return of 10% is expected. Which funding

> Cal Spas, Inc., reported the following statement of stockholders’ equity for the year ended September 30, 2018: Requirements 1. What is the par value of the company’s common stock? 2. At what price per share did the

> The balance sheet of Johnson Supply, Inc., at December 31, 2017, reported 800,000 shares of $2 par common stock authorized, with 116,000 shares issued and outstanding. Paid-in Capital in Excess of Par—Common had a balance of $300,000. R

> Cho Sporting Goods, Inc., completed the following selected transactions during 2018: Requirement 1. Record the transactions in the journal.

> Kommeri Consulting, Inc., has 9,000 shares of $6, no-par preferred stock and 60,000 shares of no-par common stock outstanding for 2016–2018. Kommeri Consulting, Inc., declared and paid the following dividends during a three-year period: 2016, $22,000; 20

> The Davenport Hotel, Inc., included the following stockholders’ equity on its year-end balance sheet at December 31, 2018. Requirements 1. Identify the different issues of stock that the Davenport Hotel, Inc., has outstanding. 2. Give

> Gamma Corporation was organized in 2017. At December 31, 2017, Gamma Corporation’s balance sheet reported the following stockholders’ equity: Requirement Answer the following questions and make journal entries as nee

> Assume you are purchasing an investment and decide to invest in a company in the home remodeling business. You narrow the choice to Hudson, Inc., or Madison Corp. You assemble the following data: Selected income statement data for the current year: Sel

> Comparative financial statement data of Lodgepole Furniture Company follow: Other information follows: a. Market price of a share of common stock was $50.00 at December 31, 2018, and $33.00 at December 31, 2017. b. An average of 11,000 common shares w

> Financial statement data of Helgeson Enterprises, Inc., include the following items: Cash ……………………………………………………………………………………………. $ 24,300 Short-Term Investments ………………………………………………………….………. 28,100 Accounts Receivable, Net ………………………………………………………….……… 90,600

> Otto’s Auto Sales asked for your help in comparing the company’s profit performance and financial position with the average for the auto sales industry. The owner has given you the company’s income st

> To help you understand the importance of cash flows in the operation of a small business. You own a business, like Susan and Brian Miller of the Bold City Brewery. You just received your year-end financial statements from your CPA. Although receiving the

> Net sales, net income, and total assets for Schmitz Construction, Inc., for a four-year period follow: Requirements 1. Compute trend percentages for each item for 2015 through 2018. Use 2015 as the base year. 2. Compute the return on assets for 2016, 2

> To prepare the statement of cash flows, accountants for Kim & Associates, Inc., summarized 2018 activity in the Cash account as: Requirement 1. Prepare the statement of cash flows of Kim & Associates, Inc., for the year ended December 31, 2018,

> Use the Linderman Garden Supply, Inc., data from P11-39B. The cash amounts for Interest Revenue, Salaries Expense, Interest Expense, and Income Tax Expense are the same as the accrual amounts for these items. Requirements 1. Prepare the 2018 statement o

> The accounting records for Best Way Lumber, Inc., for the year ended November 30, 2018, contain the following information: a. Purchase of fixed assets, $88,400 b. Proceeds from issuance of common stock, $12,000 c. Payment of dividends, $45,400 d. Collect

> The 2018 comparative balance sheet and income statement of Linderman Garden Supply, Inc., follow: Linderman Garden Supply, Inc., had no noncash investing and financing transactions during 2018. During the year, Linderman Garden Supply, Inc., sold no l

> Data from the comparative balance sheet of Gibson’s Greenhouse, Inc., at May 31, 2018, follow: Gibson’s Greenhouse, Inc.’s transactions during the year ended May 31, 2018, included: Requirements 1

> Fred’s Appliance, Inc.’s accountants assembled the following data for the year ended December 31, 2018: Requirement 1. Prepare Fred’s Appliance Inc.’s statement of cash flows usin

> To prepare the statement of cash flows, accountants for Houton & Associates, Inc., summarized 2018 activity in the Cash account as: Requirement 1. Prepare the statement of cash flows of Houton & Associates, Inc., for the year ended December 31,

> Use the Bone Appetit Pet Supply, Inc., data from P11-33A. The cash amounts for Interest Revenue, Salaries Expense, Interest Expense, and Income Tax Expense are the same as the accrual amounts for these items. Requirements 1. Prepare the 2018 statement o

> You have been hired as an investment analyst at Lancaster Securities, Inc. It is your job to recommend investments for your client. You have the following information for two different companies. Requirement 1. Write a memo to your client recommending

> Zepher, Inc., prepared the following stockholders’ equity section as of December 31, 2018. Requirement 1. Answer the following questions about Zepher, Inc.’s dividends: a. How much in dividends must Zepher, Inc., dec

> Assume you are purchasing an investment and decide to invest in a company in the home remodeling business. You narrow the choice to Skyview, Inc., or Vista Corp. You assemble the following data. Assume all sales are on credit. Selected income statement d

> Comparative financial statement data of Shabby Chic Furniture Company follow: Other information follows: 1. Market price of a share of common stock was $31.00 at December 31, 2018, and $48.50 at December 31, 2017. 2. Average common shares outstanding