Question: During 2014, Jinnah Furniture Limited purchased a

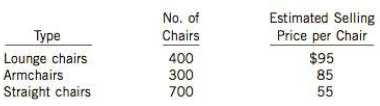

During 2014, Jinnah Furniture Limited purchased a railway carload of wicker chairs. The manufacturer of the chairs sold them to Jinnah for a lump sum of $59,850 because it was discontinuing manufacturing operations and wanted to dispose of its entire stock. Three types of chairs are included in the carload. The three types and the estimated selling price for each are as follows:

Jinnall estimates that the costs to sell this inventory would amount to 52 per chair. During 2014, Jinnah sells 350 lounge chairs, 210 armchairs, and 120 straight chairs, all at the same prices as estimated. At December 31, 2014, the remaining chairs were put on sale: the lounge chairs at 25% off the regular price, the armchairs at 30% off, and the straight chairs at 40% off. All were expected to be sold at these prices.

Instructions

(a) Rounding percentages to one decimal place and all other amounts to two decimal places, what is the total cost of the chairs remaining in inventory at the end of 2014 using the relative sales value method?

(b) What is the net realizable value of the chairs remaining in inventory?

(c) What is the appropriate inventory value to be reported on the December 31, 2014 statement of financial position assuming the lower of cost and NRV is applied on an individual item basis?

Transcribed Image Text:

Estimated Selling Price per Chair No. of Туре Lounge chairs Armchairs Straight chairs Chairs 400 300 $95 85 700 55

> Information follows for Patuanak Company: 1. The beginning of the year Accounts Receivable balance was 525,000. 2. Net sales for the year were $410,000. (Credit sales were $200,000 of the total sales.) Patuanak does not offer cash discounts. 3. Collectio

> The following information is for Takin Enterprises Ltd. Instructions (a) Using the above information, prepare monthly income statements (as far as the data permit) in columnar form for February, March, and April. Show the inventory in the statement at c

> Lute Retail Ltd. follows ASPE, it transfers $355,000 of its accounts receivable to an independent trust in a securitization transaction on July 11, 2014, receiving 96% of the receivables balance as proceeds. Lute will continue to manage the customer acco

> The trial balance before adjustment for Sinatra Company shows the following balances. The following cases are independent: 1. To obtain cash, Sinatra factors without recourse $20,000 of receivables with Stills Finance. The finance charge is 10% of the a

> On April 1, 2014, Ibrahim Corporation assigns $400,000 of its accounts receivable to First National Bank as collateral for a $200,000 loan that is due July 1, 2014. The assignment agreement calls for Ibrahim to continue to collect the receivables. First

> On July 1, 2014, Agincourt Inc. made two sales: 1. It sold excess land in exchange for a four-year, non-interest-bearing promissory note in the face amount of $1,101,460. The land's carrying value is $590,000. 2. It rendered services in exchange for an

> On September 1, 2014, Myo Inc. sold goods to Khin Corporation, a new customer. Prior to shipment of the goods, Myo's credit and collections department conducted a procedural credit check and determined that Khin is a high credit risk customer. As a resul

> Little Corp. was experiencing cash flow problems and was unable to pay its $ 105,000 account payable to Big Corp. when it fell due on September 30, 2014. Big agreed to substitute a one-year note for the open account. The following two options were presen

> Stowe Enterprises owns the following assets at December 31, 2014: If Stowe follows ASPE, what amount should be reported as cash and cash equivalents? Explain how your answer would differ if Stowe followed IFRS. Cash in bank savings account Cash on h

> Lenai Co. has the following account among its trade receivables: Instructions Age the Hopkins Co. account at December 31 and specify any items that may need particular attention at year end. 1/1 1/20 3/14 4/12 9/5 10/17 11/18 12/20 Hopkins Co. $ 850

> Bartho Products sold used equipment with a cost of $15,000 and a carrying amount of $2,500 to Vardy Corp. in exchange for a $5,000, three-year non-interest-bearing note receivable. Although no interest was specifed, the market rate for a Joan of that ris

> The chief accountant for Dickinson Corporation provides you with the following list of accounts receivable that were written off in the current year: Dickinson Corporation follows the policy of debiting Bad Debt Expense as accounts are written off. The

> At January 1, 2014, the credit balance of Andy Corp.'s Allowance for Doubtful Accounts was $400,000. During 2014, the bad debt expense entry was based on a percentage of net credit sales. Net sales for 2014 were $80 million, of which 90% were on account.

> As a result of its annual inventory count, Tarweed Corp. determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2014, and December 31, 2015. This information is as follows: Instructions (a) Prepare the jour

> At the end of 2013, Perez Corporation has accounts receivable of $1.2 million and an allowance for doubtful accounts of $80,000. On January 16, 2014, Perez determined that its $ 16,000 receivable from Morganfield Ltd. will not be collected, and managemen

> Eli Corp. has just received its August 31, 2014 bank statement, which is summarized as follows: The general ledger Cash account contained the following entries for the month of August: Deposits in transit at August 31 are $3,800, and cheques outstandin

> Use the information for Jaguar Corporation in BE7-25. Prepare any entries that are necessary to make Jaguar's accounting records correct and complete. In BE7-25. Jaguar Corporation is preparing a bank reconciliation and has identified the following poten

> Jaguar Corporation is preparing a bank reconciliation and has identified the following potential reconciling items. For each item, indicate if it is (a) Added to the balance per bank statement, (b) Deducted from the balance per bank statement, (c) Add

> The financial statements of BCE Inc. report net sales of $ 19,497 million for its year ended December 31, 2011, and $18,069 million for its year ended December 31, 2010. Accounts receivable (net) was $2,964 million at December 31, 2011, $2,525 million at

> The financial statements of Magnotta Winery Corporation report net sales of $23,223,804 for its year ended January 31, 20ll. Accounts receivable are $616,797 at January 31, 2011, and $590,322 at January 31, 2010. Calculate the company's accounts receivab

> Keyser Woodcrafters sells $600,000 of receivables with a fair value of $620,000 to Keyser Trust in a securitization transaction that meets the criteria for a sale. Keyser Woodcrafters receives full fair value for the receivables and agrees to continue to

> Stora Enso Oyj describes its business in its annual report as the "global rethinker of the biomaterials, paper, packaging and wood products industry." Instructions Access the financial statements of Stora Enso Oyj for the year ended December 31, 2011, f

> Identify a company in your local community that develops a product through some form of manufacturing process. Consider a farming operation, bakery, cement supplier, or other company that converts or assembles inputs to develop a different product. Inst

> From SEDAR (www.sedar.com), or the company websites, access the financial statements of Loblaw Companies Limited for its year ended December 31, 2011, and of Empire Company Limited for its year ended May 5, 2012. Review the financial statements and answe

> Access the annual financial statements of Andrew Peller Limited for the year ended March 31, 2012, on SEDAR (www.sedar.com), or the company's website (www.andrewpeller.com). Instructions Refer to these financial statements and the accompanying notes to

> Many companies, such as HydroMississauga and Matsushita Electric of Canada Ltd., have Invested in technology to improve their inventory management systems. Instructions Research the topic of improvements to inventory management systems, and focus in par

> Jack McDowell, the controller for McDowell Lumber Corporation, has recently hired you as assistant controller. He wishes to determine your expertise in the area of inventory accounting and therefore asks you to answer the following unrelated questions.

> Schonfeld Corporation began operations on December 1, 2014. The only inventory transaction in 2014 was the purchase of inventory on December 10, 2014, at a cost of $20 per unit. None of this inventory was sold in 2014. Relevant information for fiscal 201

> Assume the role of the ethical accountant. The company you work for manufactures pharmaceuticals and has a large stock of inventory for a new drug as the fiscal year end approaches. The company has a compensation system that relies partially on individua

> IFRS requires greater disclosure for inventory compared with ASPE. List the additional requirements and explain what benefit each one might serve for the users of the financial statements.

> Write a brief essay highlighting the differences between IFRS and ASPE noted in this chapter, discussing the conceptual justification for each.

> There are many forms of inventory that are not covered under the basic accounting standards for inventory: Instructions For each of the following forms of inventory, briefly explain how the inventory would be reported and where guidance would be found

> Lin Du Corp. lent $30,053 to Prefax Ltd., accepting Prefax's $40,000, three-year, zero-interest-bearing note. The implied interest is 10%. (a) Prepare Lin Du’s journal entries for the initial transaction, recognition of interest each year assuming use o

> PERO Lun1ber Limited is a private company. It operates in the forestry sector and owns timber lots. The company produces and sells specialty lumber to distributors and retailers. The company has a management bonus plan, which is based on net earnings and

> Local Drilling Inc. is a Canadian drilling-site company. All of the company's drilling material is purchased by the head office and stored at a local warehouse before being shipped to the drilling sites. The price of drilling material has been steadily d

> Grappa Grapes Inc. (GGI) grows grapes and produces fine champagne. The company is located in a very old area of town with easy access to fertile farmland that is excellent for growing grapes. It is owned by the Grappa family. The company has been in oper

> Findit Gold Inc. (FGI) was created in 2005 and is 25% owned by Findit Mining Corporation (FMC). FGI's shares trade on the local exchange and its objective is to become a substantial low-cost mineral producer in developing countries. FMC has provided subs

> Tobacco Group Inc. (TGI) is in the consumer packaged goods industry. Its shares are widely held and key shareholders include several very large pension funds. In the current year, 59% of the net revenues and 61% of operating income came from tobacco prod

> Aquind Corporation is a multi -product firm. The following information concerns one of its products, the Trinton: Instructions Calculate cost of goods sold, assuming Aquind uses: (a) A periodic inventory system and FIFO cost formula (b) A periodic inven

> Some of the transactions of Spandrel Corp. during August follow. Spandrel uses the periodic inventory method. Instructions (a) Assuming that purchases are recorded at gross amounts and that discounts are to be recorded when taken: 1. Prepare general jou

> Halm Skidoos Limited, a private company that began operations in 2010, always values its inventories at their current net realizable value. The company uses ASPE. Its annual inventory figure is arrived at by taking a physical count and then pricing each

> On February 1, 2014, Quass Ltd. began selling electric scooters that it purchased exclusively from lonone Motors Inc. Ionone Motors offers vendor rebates based on the volume of annual sales to its customers, and calculates and pays the rebates at its fis

> The following independent situations relate to inventory accounting: 1. Draper Co. purchased goods with a list price of $175,000 and a trade discount of 20% based on the quantity purchased, with terms 2/10, net 30. 2. Assayer Company's inventory of $1.1

> Aero Acrobats lent $47,573 to Afterburner Limited, accepting Afterburner's $49,000, three-month, zero interest-bearing notes. The implied interest is approximately 12%. Prepare Aero’s journal entries for the initial transaction and the collection of $49,

> The records for the Clothing Department of Ji-Woon's Department Store are summarized as follows for the month of January: 1. Inventory, January 1: at retail, $28,000; at cost, $l8, 000 2. Purchases in January: at retail, $147,000; at cost, $110,000 3. Fr

> The Eserine Wood Corporation manufactures desks. Most of the company's desks are standard models that are sold at catalogue prices. At December 31, 2014, the following finished desks appear in the company's inventory: The 2014 catalogue was in effect th

> Sube Specialty Corp., a division of FH Inc., manufactures three models of gearshift components for bicycles that are sold to bicycle manufacturers, retailers, and catalogue outlets. Since beginning operations in 1969, Sube has used normal absorption cost

> Reena Corp. lost most of its inventory in a fire in December just before the year-end physical inventory was taken. The corporation's books disclosed the following: Merchandise with a selling price of $42,000 remained undamaged after the fire. Damaged m

> Schonfeld Company determined its ending inventory at cost and at lower of cost and net realizable value at December 31, 2012, 2013, and 2014, as follows: Instructions (a) Prepare the journal entries that are required at December 31, 2013 and 2014, assum

> Astro Languet established Languet Products Co. as a sole proprietorship on January 5, 2014. At the company's year end of December 31, 2014, the accounts had the following balances (in thousands): A count of ending inventory on December 31, 2014, showed

> The summary financial statements of KwikMart Ltd. on December 31, 2014, are as follows: The following errors were made by the inexperienced accountant on December 31, 2013, and were not corrected. l. The inventory was overstated by $ 13,000. 2. A prepai

> Jaeco Corporation asks you to review its December 31, 2014 inventory values and prepare the necessary adjustments to the books. The following information is given to you. 1. Jaeco uses the periodic method of recording inventory. A physical count reveals

> Emil Family Importers sold goods to Acme Decorators for $20,000 on November 1, 2014, accepting Acme's $20,000, six-month, 6% note. (a) Prepare Emil’s; November 1 entry, December 31 annual adjusting entry, and May 1 entry for the collection of the note a

> The Motuto Equipment Corporation maintains a general ledger account for each class of inventory, debiting the individual accounts for increases during the period and crediting them for decreases. The transactions that follow are for the Raw Materials inv

> In an annual audit of Solaro Company Limited, you find that a physical inventory count on December 31, 2014, showed merchandise of $441,000. You also discover the following items were excluded from the $441,000. 1. Merchandise of $61,000 is held by Solar

> Transactions follow for Whitehall Limited: March 10 Purchased goods billed at $25,000, terms 3/10, n/60. 11 Purchased goods billed at $26,575, terms 1115, n/30. 19 Paid invoice of March 10. 24 Purchased goods billed at $11,500, terms 3/10, n/30. Instruc

> In fiscal 2014, lvanjoh Realty Corporation purchased unimproved land for $55,000. The land was improved and subdivided into building lots at an additional cost of $34,460. These building lots were all the same size but, because of differences in location

> Two or more items are omitted in each of the following tabulations of income statement data. Fill in the amounts that are missing. 2013 2014 2015 $290,000 6,000 $. 13,000 347,000 32,000 Sales $410,000 Sales returns Net sales Beginning inventory Endi

> Ruggers Corporation sells one product, with information for July as follows: Ruggers uses the FIFO cost formula. All purchases and sales are on account. Instructions (a) Assume Ruggers uses a periodic system. Prepare all necessary journal entries, incl

> There are a few primary sources of GAAP for inventory under both ASPE and IFRS. List the sources of guidance in the table below. Type of Inventory Primary Guidance under ASPE Primary Guidance under IFRS Equipment manufactured Financial derivatives he

> Nicholas's Christmas Tree Farm Ltd. grows pine, fir, and spruce trees. The farm cuts and sells trees during the Christmas season and exports most of the trees to the United States. The remaining trees are sold to local tree lot operators. It normally tak

> The records of Monde Menswear report the following data for the month of September: Instructions (a) Estimate the ending inventory using the conventional retail inventory method. (b) Assuming that a physical count of the inventory determined that the ac

> Iqbal Corporation uses the lower of FIFO cost and net realizable value method on an individual item basis, applying the direct method. The inventory at December 31, 2014, included product AG. Relevant per-unit data for product AG follow: There were 1,00

> The net income per books of Lyondell Industries Limited was determined without any knowledge of the following errors. The 2008 year was Lyondell's first year in business. No dividends have been declared or paid. Instructions (a) Prepare a work sheet to

> Eureka Limited has a calendar-year accounting period. The following errors were discovered in 2014. 1. The December 31, 2012 merchandise inventory had been understated by $51,000. 2. Merchandise purchased on account in 2013 was recorded on the books for

> Salan1ander Limited makes the following errors during the current year. Each error is an independent case. l. Ending inventory is overstated by $1,020, but purchases are recorded correctly. 2. Both ending inventory and a purchase on account are understat

> The following is a list of items that may or may not be reported as inventory in Keesa Corp.'s December 31 balance sheet: l. Goods out on consignment at another company's store 2. Goods sold on an installment basis 3. Goods purchased FOB shipping point t

> Moorea Corp. uses a periodic inventory system. On June 24, the company sold 600 units. The following additional information is available: (a) Calculate the June 30 inventory and the June cost of goods sold using the weighted average cost formula. (b) Cal

> Garners World buys 1,000 computer game CDs from a distributor that is discontinuing those games. The purchase price for the lot is $7,500. Garners' World will group the CDs into three price categories for resale, as follows: Determine the cost per CD for

> Angus Enterprises Ltd. reported cost of goods sold for 2014 of $2.4 million and retained earnings of $4.2 million at December 31, 2014. Angus later discovered that it’s ending inventories at December 31, 2013 and 2014 were overstated by $155,000 and $45,

> Doors Unlimited Ltd. purchases units of wood frames that have manufacturer’s rebates from Traders Inc. The rebate requires Doors Unlimited to purchase a minimum number of units in a calendar year. The initial unit cost of each wood frame is $2.50 before

> Mayhelm Ltd. took a physical inventory on December 31 and determined that goods costing $2,000 were on hand. This amount included $500 of goods held on consignment for Delhi Corporation. Not included in the physical count were $400 of goods purchased fro

> Partial information follows for a Canadian manufacturing company: Instructions (a) Enter the missing amounts where indicated for years 8, 9, and 10 in the above schedule. (b) Comment on the profitability and inventory management trends, and suggest poss

> Use the information from BE7-8, assuming Yoshi Corp. uses the net method to account for cash discounts. Prepare the required journal entries for Yoshi Corp. In BE7-8 Yoshi Corp. uses the gross method to record sales made on credit. On June 1, the compan

> Serafina Corp. purchases inventory costing $4,000 on July 11 on terms 3/10, n/30, and pays the invoice in full on July 15. (a) Prepare the required entries to record the two transactions assuming Serafina uses (1) The gross method of recording purchases,

> Betadyne Corp. is a public company that manufactures and sells medical equipment. What kind of information would be useful for users of the company's financial statements?

> Indicate whether the following would be considered inventory for a public company like Toyota Motor Corporation. If so, indicate the inventory category to which that item would belong. (a) Engines purchased to make the Toyota Corolla (b) Nuts and bolts p

> Farmer John Industries Inc. is in the business of producing organic foods for sale to restaurants and in local markets. The company uses IFRS and has a June 30 fiscal year end. As an experiment, the company has decided to attempt raising organic free-ran

> What are the primary sources of GAAP relating to inventory (a) Under IFRS? (b) Under ASPE?

> Walmart uses a just-in-time inventory system to reduce its costs, allowing it to sell goods at lower prices to its customers. What are the benefits of a good inventory management system? What are the risks associated with a very tight inventory control s

> Which of the following would be included in inventory? For any amount not included in inventory, explain where the amount would be recorded. (a) Raw materials costs of leather, to a manufacturer of leather furniture (b) Cost of cans of corn held on the s

> Feretti Inc. had beginning inventory of $22,000 at cost and $30,000 at retail. Net purchases were $157,500 at cost and $215,000 at retail. Net markups were $10,000, net markdowns were $7,000, and sales were $184,500. Calculate the ending inventory at cos

> Sunny Valley Limited produces wine. Certain vintage wines take more than one year to age. The company has borrowed funds to cover the costs of this aging process. The company meets the interest capitalization criteria under IFRS. Capitalizable interest u

> The financial statements of Trifolium Corporation for fiscal 2012 to fiscal 2014 are as follows (in thousands): Instructions (a) Calculate Trifolium's (1) Inventory turnover and (2) Average days to sell inventory for each of the two years ending in 20

> Great Balls of Fire Inc.'s April 30 inventory was destroyed by an explosion of an underground oil tank. January 1 inventory was $310,000 and purchases for January through April totalled $780,000. Sales for the same period were $ 1.1 million. Great Balls

> Yoshi Corp. uses the gross method to record sales made on credit. On June 1, the company made sales of $45,000 with terms 1/15, n/45. On June 12, Yoshi received full payment for the June I sale. Prepare the required journal entries for Yoshi Corp.

> (a) Briefly explain the criteria that have to be met for inventory to be recorded at an amount greater than cost. (b) Briefly explain the accounting for the following inventory items under ASPE: 1. Sheep 2. Wool 3. Carpet (c) Briefly explain the accoun

> Beaver Corp., public company using IFRS, signed a long-term non-cancellable purchase commitment with a major supplier to purchase raw materials at an annual cost of $2 million. At December 31, 2013, the raw materials to be purchased in 2014 have a market

> Bluebell Enterprises Ltd.'s records reported an inventory cost of $55,600 and a net realizable value of $54,000 at December 31, 2012. At December 31, 2013, the records indicated a cost of $68,700 and a net realizable value of $61,625. All opening invento

> Antimatter Corporation has the following four items in its ending inventory: (a) Assume that Antimatter is a public company using IFRS. Determine the total value of ending inventory using the lower of cost and net realizable value model applied on an in

> Canali Corporation uses a perpetual inventory system. On November 19, the company sold 600 units. The following additional information is available: Calculate the November 30 inventory and the November cost of goods sold using (a) The moving average cost

> Instructions From SEDAR (www.sedar.com), or the company websites, access the financial statements of Loblaw Companies Limited for its year ended December 31, 2011, and of Empire Company Limited for its year ended May 5, 2012. Review the financial stateme

> Canadian Tire Corporation, Limited is one of Canada's best-known retailers. The company operates 488 "hard-goods" retail stores through associate dealers, and a total of 385 corporate and franchise stores under its subsidiary Mark's Work Wearhouse, and h

> The trial balance of Imotex Ltd. contains the following accounts: 1. Accounts receivable, trade 2. Accounts receivable, related company 3. Accounts receivable, to be exchanged for shares in another company 4. Note receivable, receivable in grams of a pre

> The trial balance before adjustment of Chloe Inc. shows the following balances: Instructions (a) Give the entry for bad debt expense for the current year assuming: 1. The allowance should be 4% of gross accounts receivable. 2. Historical records indicat

> Write a brief essay highlighting the differences between IFRS and ASPE noted in this chapter, discussing the conceptual justification for each.

> Who would have thought that musicians David Bowie and James Brown had anything to do with accounting? Asset- or artist-backed financing vehicles have been used by these performers and others as a means of securitizing royalties and rights to other intell

> Information on Janut Corp. follows: Instructions Prepare all necessary journal entries on Janut Corp.'s books. July 1 Janut Corp. sold to Harding Ltd. merchandise having a sales price of $9,000, terms 3/10, net/60. Janut records its sales and recei

> Rudolph Corp. is a subsidiary of Hundey Corp. The ethical accountant, working as Rudolph's controller, believes that the yearly charge for doubtful accounts for Rudolph should be 2% of net credit sales. The president, nervous that the parent company migh

> Soon after beginning the year-end audit work on March 10 for the 2014 year end at Arkin Corp., the auditor has the following conversation with the controller: Controller: The year ending March 31, 2014, should be our most profitable in history and, becau