Question: Endless Mountain Company manufactures a single

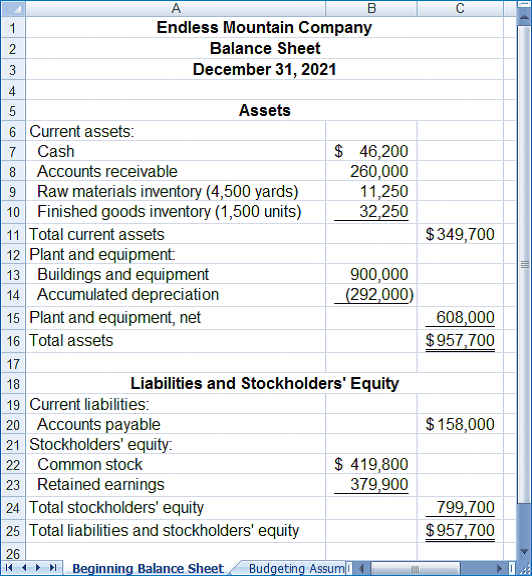

Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master budget for 2022 and reports a balance sheet at December 31, 2021, as follows:

The company’s chief financial officer (CFO), in consultation with various managers across the organization has developed the following set of assumptions to help create the 2022 budget:

1. The budgeted unit sales are 12,000 units, 37,000 units, 15,000 units, and 25,000 units for quarters 1-4, respectively. Notice that the company experiences peak sales in the second and fourth quarters. The budgeted selling price for the year is $32 per unit. The budgeted unit sales for the first quarter of 2023 is 13,000 units.

2. All sales are on credit. Uncollectible accounts are negligible and can be ignored. Seventyfive percent of all credit sales are collected in the quarter of the sale and 25% are collected in the subsequent quarter.

3. Each quarter’s ending finished goods inventory should equal 15% of the next quarter’s unit sales.

4. Each unit of finished goods requires 3.5 yards of raw material that costs $3.00 per yard. Each quarter’s ending raw materials inventory should equal 10% of the next quarter’s production needs. The estimated ending raw materials inventory on December 31, 2022, is 5,000 yards.

5. Seventy percent of each quarter’s purchases are paid for in the quarter of purchase. The remaining 30% of each quarter’s purchases are paid in the following quarter.

6. Direct laborers are paid $18 an hour and each unit of finished goods requires 0.25 direct labor-hours to complete. All direct labor costs are paid in the quarter incurred.

7. The budgeted variable manufacturing overhead per direct labor-hour is $3.00. The quarterly fixed manufacturing overhead is $150,000 including $20,000 of depreciation on equipment. The number of direct labor-hours is used as the allocation base for the budgeted plantwide overhead rate. All overhead costs (excluding depreciation) are paid in the quarter incurred.

8. The budgeted variable selling and administrative expense is $1.25 per unit sold. The fixed selling and administrative expenses per quarter include advertising ($25,000), executive salaries ($64,000), insurance ($12,000), and property tax ($8,000), and depreciation expense ($8,000). All selling and administrative expenses (excluding depreciation) are paid in the quarter incurred.

9. The company plans to maintain a minimum cash balance at the end of each quarter of $30,000. Assume that any borrowings take place on the first day of the quarter. To the extent possible, the company will repay principal and interest on any borrowings on the last day of the fourth quarter. The company’s lender imposes a simple interest rate of 3% per quarter on any borrowings.

10. Dividends of $15,000 will be declared and paid in each quarter.

11. The company uses a last-in, first-out (LIFO) inventory flow assumption. This means that the most recently purchased raw materials are the “first-out†to production and the most recently completed finished goods are the “first-out†to customers.

Required:

1. Assume that the company expects to collect all of its credit sales in the quarter of sale rather than the original assumption that it will collect 75% of credit sales in the quarter of sale and the remaining 25% in the subsequent quarter. Without changing any of the underlying assumptions in your budgeting assumptions tab, calculate the following revised figures related to the 2022 budget:

a. Net income (absorption basis)

b. Accounts receivable turnover

c. Net cash provided by operating activities

2. Go to the Budgeting Assumptions tab in your Microsoft Excel worksheet. Change the percentage of sales that are collected in the quarter of sale to 100% and the percentage of sales that are collected in the quarter after sale to 0%. Do your answers to 1a through 1c match the numbers that appear in your Excel worksheet? If not, why?

3. Refer to the original budgeting assumptions from Integration Exercise 16. Assume that the company expects to pay its direct laborers $19 per hour instead of the original estimate of $18 per hour. Without changing any of the underlying assumptions in your budgeting assumptions tab, calculate the following revised figures related to the 2022 budget:

a. Ending finished goods inventory at December 31, 2022.

b. The break-even point in unit sales.

c. Variable costing net operating income

4. Go to the Budgeting Assumptions tab in your Microsoft Excel worksheet. Change the direct labor cost per hour from $18 to $19. Do your answers to 3a through 3c match the numbers that appear in your Excel worksheet? If not, why?

> Each of the following workers is piece-rate workers at Golden Boats in Connecticut. If the employees have a standard 40-hour workweek, what is their effective hourly rate? Based on the state’s minimum wage in Connecticut, calculate each employee’s minimu

> Brian Packer worked the following schedule: Monday, 9 hours; Tuesday, 7 hours 30 minutes; Wednesday, 8 hours 48 minutes; Thursday, 8 hours 25 minutes; Friday, 8 hours. The employer pays overtime for all time worked in excess of 40 hours per week. Compute

> Ted McCormick is a full-time life insurance agent with Centixo Insurance, a small insurance company. The company has classified him as an employee, and he feels that he should be classified as an independent contractor because he receives no company bene

> Twinte Cars, a California corporation, has internal corporate requirements that stipulate a three-year payroll document retention period. They enter into a contract with an international company that mandates a six-year payroll document retention require

> Maria Rupert is the payroll supervisor at All Family Investments. Management is requesting to have the investment salespeople, who are paid on an hourly basis, be classified as exempt employees because their job duties occasionally require evening and we

> Aaron Tallchief is a citizen of the Northern Pomo Indian Nation. In completing his I-9, he provides an official Northern Pomo Nation birth certificate to establish identification and employment eligibility. Is this sufficient documentation? Why or why no

> Leona Figueroa is a new employee in the payroll department of Octolium Computers. After working at the company for one week, she asks you why it is so important to submit new hire documentation. What guidance will you offer her?

> You are the new payroll supervisor for your company. Which payroll documentation control procedures are now your responsibility?

> Louis Trivaldi is a Vice President of Sales at Fields Brothers Autos and earns a salary of $59,000. What is Louis’s period pay for each of the following pay frequencies:

> You have been hired as a consultant for Semiva Productions, a company facing an IRS audit of their accounting records. During your review, you notice anomalies in the payroll system involving overpayments of labor and payments to terminated employees. Wh

> Project labor agreements (PLAs) are used in certain states to promote pay and benefit equity for construction workers. Specifically, PLAs ensure that construction workers who choose not to join a union have access to the same pay and benefits as their un

> Jurvin Enterprises is a manufacturing company that had no beginning inventories. A subset of the transactions that it recorded during a recent month is shown below. a. $94,000 in raw materials were purchased for cash. b. $89,000 in raw materials were use

> Dillon Products manufactures various machined parts to customer specifications. The company uses a job-order costing system and applies overhead cost to jobs on the basis of machine-hours. At the beginning of the year, the company used a cost formula to

> The following information is taken from the accounts of Latta Company. The entries in the T-accounts are summaries of the transactions that affected those accounts during the year. The overhead that had been applied to production during the year is dist

> Refer to the data in Exercise 6–16. Assume that Minneapolis’ sales by major market are: The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The

> Refer to the data in Exercise 6–14 for Chuck Wagon Grills. Assume in this exercise that the company uses absorption costing. Required: 1. Compute the unit product cost for one barbecue grill. 2. Prepare an income statement for last year.

> Refer to the data in Exercise 6–1 for Ida Company. The absorption costing income statement prepared by the company’s accountant for last year appears as shown: Required: 1. Under absorption costing, how much fixed man

> Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $850. Selected data for the company’s operations last year follow: Required: 1. Assume that the company us

> The following cost data relate to the manufacturing activities of Chang Company during the just completed year: The company uses a predetermined overhead rate of $25 per machine-hour to apply overhead cost to jobs. A total of 19,400 machine-hours were u

> Osborn Manufacturing uses a predetermined overhead rate of $18.20 per direct labor-hour. This predetermined rate was based on a cost formula that estimates $218,400 of total manufacturing overhead for an estimated activity level of 12,000 direct labor-ho

> Primare Corporation has provided the following data concerning last month’s manufacturing operations. Required: 1. Prepare a schedule of cost of goods manufactured for the month. 2. Prepare a schedule of cost of goods sold for the mon

> What are the four types of costs summarized in a quality cost report? How do companies generally seek to lower their cost of quality?

> Below are listed various costs that are found in organizations. 1. Hamburger buns in a Wendy’s restaurant. 2. Advertising by a dental office. 3. Apples processed and canned by Del Monte. 4. Shipping canned apples from a Del Monte plant

> The Alpine House, Inc. is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: ……………………………………………………………….Amount Sales ………………………………………………………… $150,000 Selling price per pair of skis ………………….………………

> Wollogong Group Ltd. of New South Wales, Australia, acquired its factory building 10 years ago. For several years, the company has rented out a small annex attached to the rear of the building for $30,000 per year. The renter’s lease wi

> Refer to the data given in Exercise 1-7. Answer all questions independently. Required: 1. If 18,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 22,000 units are produced and sold, what is the variable cost pe

> Refer to the data given in Exercise 1-7. Answer all questions independently. Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 20,000 units? 2. For financial accounting purposes, what is the total

> Superior Micro Products uses the weighted-average method in its process costing system. During January, the Assembly Department completed its processing of 25,000 units and transferred them to the next department. The cost of beginning work in process in

> Alaskan Fisheries, Inc., processes salmon for various distributors and it uses the weighted average method in its process costing system. The company has two processing departments cleaning and Packing. Data relating to pounds of salmon processed in the

> The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: Each unit requires 0.2 direct labor-hours and direct laborers are paid $16.00 per hour. In addition, th

> Dawson Toys, Ltd., produces a toy called the Maze. The company has recently created a standard cost system to help control costs and has established the following standards for the Maze toy: During July, the company produced 3,000 Maze toys. The toy&aci

> Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: During the most recent month, the following activity was recorded: a. Twenty thousand pounds of ma

> What are the four categories of measures in a balanced scorecard?

> Quality Motor Company is an auto repair shop that uses standards to control its labor time and labor cost. The standard labor cost for a motor tune-up is given below: The record showing the time spent in the shop last week on motor tune-ups has been mis

> Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solution

> SkyChefs, Inc. prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 4,000 of these meals using 960 direct labor-

> Lindon Company is the exclusive distributor for an automotive product that sells for $40 per unit and has a CM ratio of 30%. The company’s fixed expenses are $180,000 per year. The company plans to sell 16,000 units this year. Required: 1. What are the

> Mauro Products distributes a single product, a woven basket whose selling price is $15 per unit and whose variable expense is $12 per unit. The company’s monthly fixed expense is $4,200. Required: 1. Calculate the company’s break-even point in unit sale

> Data concerning a recent period’s activity in the Prep Department, the first processing department in a company that uses process costing, appear below: A total of 20,100 units were completed and transferred to the next processing depa

> Bandar Industries manufactures sporting equipment. One of the company’s products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 35,000 helmets, using 22,500 kilograms of plastic. The plasti

> “I thought lean production was supposed to make us more efficient” commented Ben Carrick, manufacturing vice president of Vorelli Industries. “But just look at June’s manufacturing v

> Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an inc

> Darwin Company manufactures only one product that it sells for $200 per unit. The company uses plantwide overhead cost allocation based on the number of units produced. It provided the following estimates at the beginning of the year: During the year, t

> Why is using sales dollars as an allocation base usually a poor choice for allocating fixed costs to operating departments?

> Koontz Company manufactures two models of industrial components—a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation

> A comparative balance sheet and an income statement for Rowan Company are given below: Rowan also provided the following information: 1. The company sold equipment that had an original cost of $16 million and accumulated depreciation of $9 million. The

> Millen Corporation is a merchandiser that is preparing a master budget for the month of July. The company’s balance sheet as of June 30 is shown below: Millen’s managers have made the following additional assumptions

> Newton Company manufactures and sells one product. The company assembled the following projections for its first year of operations: During its first year of operations Newton expects to produce 25,000 units and sell 20,000 units. The budgeted selling p

> Hixson Company manufactures and sells one product for $34 per unit. The company maintains no beginning or ending inventories and its relevant range of production is 20,000 units to 30,000 units. When Hixson produces and sells 25,000 units, its unit costs

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Why should a service department’s budgeted costs, rather than its actual costs, be charged to operating departments?

> Sendai Company has budgeted costs in its various departments as follows for the coming year: The company allocates service department costs to other departments in the order listed below. Machining and Assembly are operating departments; the other depa

> Hobart Company manufactures attaché cases and suitcases. It has five manufacturing departments. The Molding, Component, and Assembly departments convert raw materials into finished goods; hence, they are treated as operating departments. The

> The Bayview Resort has three operating departments—the Convention Center, Food Services, and Guest Lodging—that are supported by three service departments—General Administration, Cost Accounting, and

> Bend Corporation consists of three decentralized divisions—Grant Division, Able Division, and Facet Division. The division managers are evaluated and rewarded based on their division’s profit. They each can choose to sell their products to outside custom

> Morley Products is a wholesale distributor that competes in three markets—Commercial, Home, and School. It prepared the following segmented income statement: Although the Commercial Market has the highest sales, it reports much lower p

> Southside Pizzeria wants to improve its ability to manage the ingredient costs associated with making and selling its pizzas. For the month of June, the company plans to make 1,000 pizzas. It has created a planning budget that includes a cost formula for

> For the year just completed, Hanna Company had net income of $35,000. Balances in the company’s current asset and current liability accounts at the beginning and end of the year were as follows: The Accumulated Depreciation account had

> Labeau Products, Ltd., of Perth, Australia, has $35,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: The company’s discount rate is 18%. Required: 1. Compute the net present value o

> White Company has two departments, Cutting and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department base

> Sigma Corporation applies overhead cost to jobs on the basis of direct labor cost. Job V, which was started and completed during the current period, shows charges of $5,000 for direct materials, $8,000 for direct labor, and $6,000 for overhead on its job

> What does suboptimization mean?

> Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: The planning budget for March was based on producing and selling 25,000

> Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for May as shown belo

> The Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to Codington Corporation. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements bel

> The Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to the Magnetic Imaging Division of Medical Diagnostics, Inc. The workbook, and instructions on how to complete the file, can be found in Connect. You sh

> The Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to Ferris Corporation. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements below o

> The Excel worksheet form that appears below is to be used to recreate portions of Review Problem 1 relating to Dexter Corporation. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirement

> The Excel worksheet form that appears below is to be used to recreate part of the example relating to Turbo Crafters that appears earlier in the chapter. The workbook, and instructions on how to complete the file, can be found in Connect. You should pro

> This Excel worksheet form is to be used to recreate Exhibit 1–7. The workbook, and instructions on how to complete the file, can be found in Connect. Required: 1. Check your worksheet by changing the variable selling cost in the Data a

> The Excel worksheet form that appears below is to be used to recreate the Review Problem related to Mynor Corporation. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements below only

> The Excel worksheet form that appears below is to be used to recreate portions of the Review Problem relating to Voltar Company. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements

> Managers often assume a strictly linear relationship between cost and the level of activity. Under what conditions would this be a valid or invalid assumption?

> This exercise relates to the Double Diamond Skis’ Shaping and Milling Department that was discussed earlier in the chapter. The Excel worksheet form that appears below consolidates data from Exhibits 4–5 and 4â&#

> The Excel worksheet form that appears on the next page is to be used to recreate the main example in the text pertaining to Colonial Pewter Company. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed t

> This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5.The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements below only after completing your wo

> The Excel worksheet form that appears below is to be used to recreate Example E and Exhibit 14–8. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements below only af

> The Excel worksheet form that appears below is to be used to recreate the example in the text related to Santa Maria Wool Cooperative. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the require

> The Excel worksheet form that appears on the next page is to be used to recreate the Review Problem relating to Harrald’s Fish House. The workbook, and instructions on how to complete the file, can be found in Connect. You should procee

> If variable manufacturing overhead is applied to production on the basis of direct labor hours and the direct labor efficiency variance is unfavorable, will the variable overhead efficiency variance be favorable or unfavorable, or could it be either? Exp

> What effect, if any, would you expect poor-quality materials to have on direct labor variances?

> “Our workers are all under labor contracts; therefore, our labor rate variance is bound to be zero.” Discuss.

> Should standards be used to identify who to blame for problems?

> What effect does an increase in the activity level have on— a. Average fixed costs per unit? b. Variable costs per unit? c. Total fixed costs? d. Total variable costs?

> If the materials price variance is favorable but the materials quantity variance is unfavorable, what might this indicate?

> The materials price variance can be computed at what two different points in time? Which point is better? Why?

> Who is generally responsible for the materials price variance? The materials quantity variance? The labor efficiency variance?

> Why are separate price and quantity variances computed?

> Why can undue emphasis on labor efficiency variances lead to excess work in process inventories?

> What is a quantity standard? What is a price standard?

> A business executive once stated, “Depreciation is one of our biggest operating cash inflows.” Do you agree? Explain.

> How do the direct and the indirect methods differ in their approach to computing the net cash provided by operating activities?

> Woodbury Hospital has three service departments and three operating departments. Estimated cost and operating data for all departments in the hospital for the forthcoming quarter are presented in the table below: The costs of the service departments are

> The Ferre Publishing Company has three service departments and two operating departments. Selected data from a recent period on the five departments follow: The company allocates service department costs by the step-down method in the following order: A

> Madison Park Co-op, a whole foods grocery and gift shop, has provided the following data to be used in its service department cost allocations: Required: Using the step-down method, allocate the costs of the service departments to the two operating depa

> Assume that a company repays a $300,000 loan from its bank and then later in the same year borrows $500,000. What amount(s) would appear on the statement of cash flows?

> Comparative financial statement data for Carmono Company follow: For this year, the company reported net income as follows: This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The