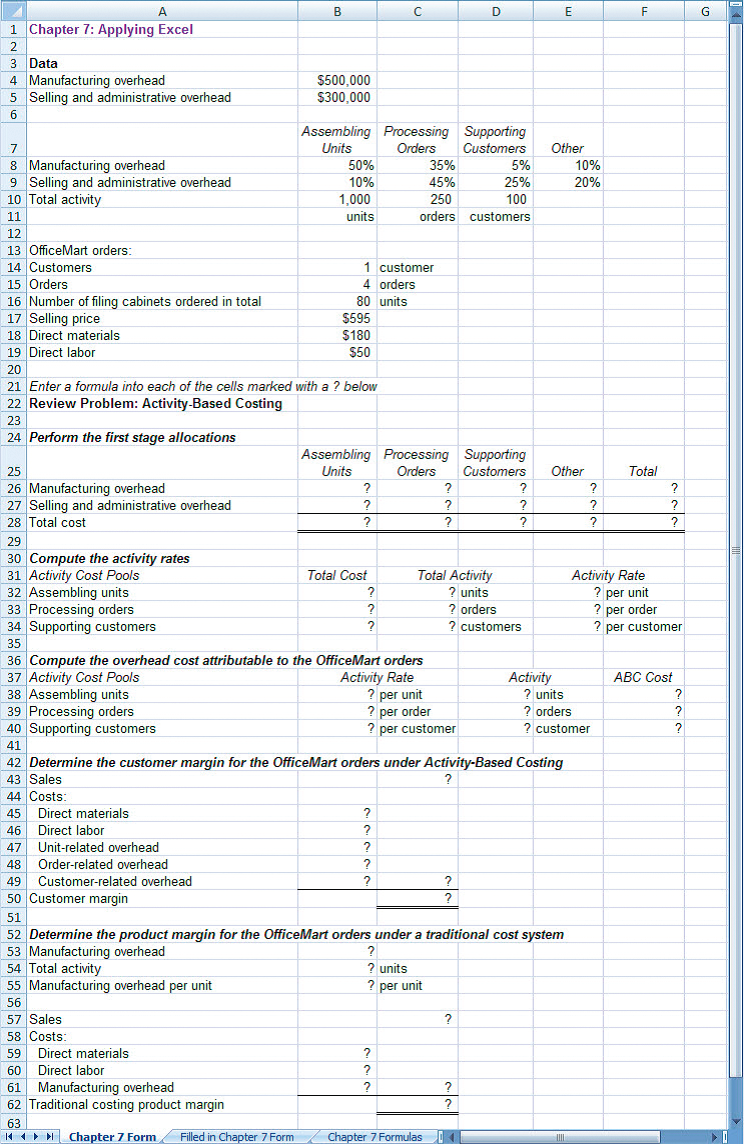

Question: The Excel worksheet form that appears below

The Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to Ferris Corporation. The workbook, and instructions on how to complete the file, can be found in Connect.

You should proceed to the requirements below only after completing your worksheet.

Required:

1. Check your worksheet by doubling the units ordered in cell B16 to 160. The customer margin under activity-based costing should now be $7,640 and the traditional costing product margin should be $(21,600). If you do not get these results, find the errors in your worksheet and correct them.

a. Why has the customer margin under activity-based costing more than doubled when the number of units ordered is doubled?

b. Why has the traditional costing product margin exactly doubled from a loss of $10,800 to a loss of $21,600?

c. Which costing system, activity-based costing or traditional costing, provides a more accurate picture of what happens to profits as the number of units ordered increases? Explain.

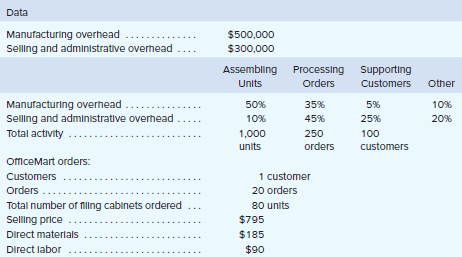

2. Let’s assume that Office Mart places different orders next year, purchasing higher-end filing cabinets more frequently, but in smaller quantities per order. Enter the following data into your worksheet:

a. What is the customer margin under activity-based costing?

b. What is the product margin under the traditional cost system?

c. Explain why the profitability picture looks much different now than it did when Office Mart was ordering less expensive filing cabinets less frequently, but in larger quantities per order.

3. Using the data you entered in part (2), change the percentage of selling and administrative overhead attributable to processing orders from 45% to 30% and the percentage attributable to supporting customers from 25% to 40%. That portion of the worksheet should look like this:

a. Relative to the results from part (2), what has happened to the customer margin under activity-based costing? Why?

b. Relative to the results from part (2), what has happened to the product margin under the traditional cost system? Why?

> What are the four types of costs summarized in a quality cost report? How do companies generally seek to lower their cost of quality?

> Below are listed various costs that are found in organizations. 1. Hamburger buns in a Wendy’s restaurant. 2. Advertising by a dental office. 3. Apples processed and canned by Del Monte. 4. Shipping canned apples from a Del Monte plant

> The Alpine House, Inc. is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31: ……………………………………………………………….Amount Sales ………………………………………………………… $150,000 Selling price per pair of skis ………………….………………

> Wollogong Group Ltd. of New South Wales, Australia, acquired its factory building 10 years ago. For several years, the company has rented out a small annex attached to the rear of the building for $30,000 per year. The renter’s lease wi

> Refer to the data given in Exercise 1-7. Answer all questions independently. Required: 1. If 18,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 22,000 units are produced and sold, what is the variable cost pe

> Refer to the data given in Exercise 1-7. Answer all questions independently. Required: 1. For financial accounting purposes, what is the total amount of product costs incurred to make 20,000 units? 2. For financial accounting purposes, what is the total

> Superior Micro Products uses the weighted-average method in its process costing system. During January, the Assembly Department completed its processing of 25,000 units and transferred them to the next department. The cost of beginning work in process in

> Alaskan Fisheries, Inc., processes salmon for various distributors and it uses the weighted average method in its process costing system. The company has two processing departments cleaning and Packing. Data relating to pounds of salmon processed in the

> The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: Each unit requires 0.2 direct labor-hours and direct laborers are paid $16.00 per hour. In addition, th

> Dawson Toys, Ltd., produces a toy called the Maze. The company has recently created a standard cost system to help control costs and has established the following standards for the Maze toy: During July, the company produced 3,000 Maze toys. The toy&aci

> Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: During the most recent month, the following activity was recorded: a. Twenty thousand pounds of ma

> What are the four categories of measures in a balanced scorecard?

> Quality Motor Company is an auto repair shop that uses standards to control its labor time and labor cost. The standard labor cost for a motor tune-up is given below: The record showing the time spent in the shop last week on motor tune-ups has been mis

> Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solution

> SkyChefs, Inc. prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 4,000 of these meals using 960 direct labor-

> Lindon Company is the exclusive distributor for an automotive product that sells for $40 per unit and has a CM ratio of 30%. The company’s fixed expenses are $180,000 per year. The company plans to sell 16,000 units this year. Required: 1. What are the

> Mauro Products distributes a single product, a woven basket whose selling price is $15 per unit and whose variable expense is $12 per unit. The company’s monthly fixed expense is $4,200. Required: 1. Calculate the company’s break-even point in unit sale

> Data concerning a recent period’s activity in the Prep Department, the first processing department in a company that uses process costing, appear below: A total of 20,100 units were completed and transferred to the next processing depa

> Bandar Industries manufactures sporting equipment. One of the company’s products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 35,000 helmets, using 22,500 kilograms of plastic. The plasti

> “I thought lean production was supposed to make us more efficient” commented Ben Carrick, manufacturing vice president of Vorelli Industries. “But just look at June’s manufacturing v

> Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an inc

> Darwin Company manufactures only one product that it sells for $200 per unit. The company uses plantwide overhead cost allocation based on the number of units produced. It provided the following estimates at the beginning of the year: During the year, t

> Why is using sales dollars as an allocation base usually a poor choice for allocating fixed costs to operating departments?

> Koontz Company manufactures two models of industrial components—a Basic model and an Advanced Model. The company considers all of its manufacturing overhead costs to be fixed and it uses plantwide manufacturing overhead cost allocation

> A comparative balance sheet and an income statement for Rowan Company are given below: Rowan also provided the following information: 1. The company sold equipment that had an original cost of $16 million and accumulated depreciation of $9 million. The

> Millen Corporation is a merchandiser that is preparing a master budget for the month of July. The company’s balance sheet as of June 30 is shown below: Millen’s managers have made the following additional assumptions

> Newton Company manufactures and sells one product. The company assembled the following projections for its first year of operations: During its first year of operations Newton expects to produce 25,000 units and sell 20,000 units. The budgeted selling p

> Hixson Company manufactures and sells one product for $34 per unit. The company maintains no beginning or ending inventories and its relevant range of production is 20,000 units to 30,000 units. When Hixson produces and sells 25,000 units, its unit costs

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The company sells its product to retailers throughout the northeastern quadrant of the United States. It is in the process of creating a master bu

> Why should a service department’s budgeted costs, rather than its actual costs, be charged to operating departments?

> Sendai Company has budgeted costs in its various departments as follows for the coming year: The company allocates service department costs to other departments in the order listed below. Machining and Assembly are operating departments; the other depa

> Hobart Company manufactures attaché cases and suitcases. It has five manufacturing departments. The Molding, Component, and Assembly departments convert raw materials into finished goods; hence, they are treated as operating departments. The

> The Bayview Resort has three operating departments—the Convention Center, Food Services, and Guest Lodging—that are supported by three service departments—General Administration, Cost Accounting, and

> Bend Corporation consists of three decentralized divisions—Grant Division, Able Division, and Facet Division. The division managers are evaluated and rewarded based on their division’s profit. They each can choose to sell their products to outside custom

> Morley Products is a wholesale distributor that competes in three markets—Commercial, Home, and School. It prepared the following segmented income statement: Although the Commercial Market has the highest sales, it reports much lower p

> Southside Pizzeria wants to improve its ability to manage the ingredient costs associated with making and selling its pizzas. For the month of June, the company plans to make 1,000 pizzas. It has created a planning budget that includes a cost formula for

> For the year just completed, Hanna Company had net income of $35,000. Balances in the company’s current asset and current liability accounts at the beginning and end of the year were as follows: The Accumulated Depreciation account had

> Labeau Products, Ltd., of Perth, Australia, has $35,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: The company’s discount rate is 18%. Required: 1. Compute the net present value o

> White Company has two departments, Cutting and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each department. The Cutting Department bases its rate on machine-hours, and the Finishing Department base

> Sigma Corporation applies overhead cost to jobs on the basis of direct labor cost. Job V, which was started and completed during the current period, shows charges of $5,000 for direct materials, $8,000 for direct labor, and $6,000 for overhead on its job

> What does suboptimization mean?

> Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: The planning budget for March was based on producing and selling 25,000

> Adger Corporation is a service company that measures its output based on the number of customers served. The company provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results for May as shown belo

> The Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to Codington Corporation. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements bel

> The Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to the Magnetic Imaging Division of Medical Diagnostics, Inc. The workbook, and instructions on how to complete the file, can be found in Connect. You sh

> The Excel worksheet form that appears below is to be used to recreate portions of Review Problem 1 relating to Dexter Corporation. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirement

> The Excel worksheet form that appears below is to be used to recreate part of the example relating to Turbo Crafters that appears earlier in the chapter. The workbook, and instructions on how to complete the file, can be found in Connect. You should pro

> This Excel worksheet form is to be used to recreate Exhibit 1–7. The workbook, and instructions on how to complete the file, can be found in Connect. Required: 1. Check your worksheet by changing the variable selling cost in the Data a

> The Excel worksheet form that appears below is to be used to recreate the Review Problem related to Mynor Corporation. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements below only

> The Excel worksheet form that appears below is to be used to recreate portions of the Review Problem relating to Voltar Company. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements

> Managers often assume a strictly linear relationship between cost and the level of activity. Under what conditions would this be a valid or invalid assumption?

> This exercise relates to the Double Diamond Skis’ Shaping and Milling Department that was discussed earlier in the chapter. The Excel worksheet form that appears below consolidates data from Exhibits 4–5 and 4â&#

> The Excel worksheet form that appears on the next page is to be used to recreate the main example in the text pertaining to Colonial Pewter Company. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed t

> This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5.The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements below only after completing your wo

> The Excel worksheet form that appears below is to be used to recreate Example E and Exhibit 14–8. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the requirements below only af

> The Excel worksheet form that appears below is to be used to recreate the example in the text related to Santa Maria Wool Cooperative. The workbook, and instructions on how to complete the file, can be found in Connect. You should proceed to the require

> The Excel worksheet form that appears on the next page is to be used to recreate the Review Problem relating to Harrald’s Fish House. The workbook, and instructions on how to complete the file, can be found in Connect. You should procee

> If variable manufacturing overhead is applied to production on the basis of direct labor hours and the direct labor efficiency variance is unfavorable, will the variable overhead efficiency variance be favorable or unfavorable, or could it be either? Exp

> What effect, if any, would you expect poor-quality materials to have on direct labor variances?

> “Our workers are all under labor contracts; therefore, our labor rate variance is bound to be zero.” Discuss.

> Should standards be used to identify who to blame for problems?

> What effect does an increase in the activity level have on— a. Average fixed costs per unit? b. Variable costs per unit? c. Total fixed costs? d. Total variable costs?

> If the materials price variance is favorable but the materials quantity variance is unfavorable, what might this indicate?

> The materials price variance can be computed at what two different points in time? Which point is better? Why?

> Who is generally responsible for the materials price variance? The materials quantity variance? The labor efficiency variance?

> Why are separate price and quantity variances computed?

> Why can undue emphasis on labor efficiency variances lead to excess work in process inventories?

> What is a quantity standard? What is a price standard?

> A business executive once stated, “Depreciation is one of our biggest operating cash inflows.” Do you agree? Explain.

> How do the direct and the indirect methods differ in their approach to computing the net cash provided by operating activities?

> Woodbury Hospital has three service departments and three operating departments. Estimated cost and operating data for all departments in the hospital for the forthcoming quarter are presented in the table below: The costs of the service departments are

> The Ferre Publishing Company has three service departments and two operating departments. Selected data from a recent period on the five departments follow: The company allocates service department costs by the step-down method in the following order: A

> Madison Park Co-op, a whole foods grocery and gift shop, has provided the following data to be used in its service department cost allocations: Required: Using the step-down method, allocate the costs of the service departments to the two operating depa

> Assume that a company repays a $300,000 loan from its bank and then later in the same year borrows $500,000. What amount(s) would appear on the statement of cash flows?

> Comparative financial statement data for Carmono Company follow: For this year, the company reported net income as follows: This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The

> Wiley Company’s income statement for Year 2 follows: The company’s selling and administrative expense for Year 2 includes $7,500 of depreciation expense. Selected balance sheet accounts for Wiley at the end of Years 1

> Shimada Products Corporation of Japan plans to introduce a new electronic component to the market at a target selling price of $15 per unit. The company is investing $5,000,000 to purchase the equipment it needs to produce and sell 300,000 units per year

> Baird Company makes classic Polish sausage. The company uses a standard cost system to help control costs. Manufacturing overhead is applied to production on the basis of standard direct labor-hours. According to the company’s planning

> Privack Corporation has a standard cost system in which it applies overhead to products based on the standard direct labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below: Required: 1. Compute the pre

> Stahl Company is conducting a time-driven activity-based costing study in its Shipping Department. To aid the study, the company provided the following data regarding its Shipping Department and the customers served by the department: Required: 1. Using

> Refer to the data in Exercises 7A–1 and 7A–2. Now assume that Saratoga Company would like to answer the following “what if” question using its time-driven activity-based costing syst

> Maria Chavez owns a catering company that serves food and beverages at parties and business functions. Chavez’s business is seasonal, with a heavy schedule during the summer months and holidays and a lighter schedule at other times. One

> Morrisey & Brown, Ltd., of Sydney is a merchandising company that is the sole distributor of a product that is increasing in popularity among Australian consumers. The company’s income statements for the three most recent months fol

> Professor John Morton has just been appointed chairperson of the Finance Department at Westland University. In reviewing the department’s cost records, Professor Morton has found the following total cost associated with Finance 101 over

> Why aren’t transactions involving accounts payable considered to be financing activities?

> Distinguish between (a) a variable cost, (b) a fixed cost, and (c) a mixed cost.

> Bargain Rental Car offers rental cars in an off-airport location near a major tourist destination in California. Management would like to better understand the variable and fixed portions of its car washing costs. The company operates its own car wash fa

> Selzik Company makes super-premium cake mixes that go through two processing departments Blending and Packaging. The following activity was recorded in the Blending Department during July: All materials are added at the beginning of work in the Blending

> Sunspot Beverages, Ltd., of Fiji uses the weighted-average method in its process costing system. It makes blended tropical fruit drinks in two stages. Fruit juices are extracted from fresh fruits and then blended in the Blending Department. The blended j

> Clonex Labs, Inc., uses the weighted-average method in its process costing system. The following data are available for one department for October: The department started 175,000 units into production during the month and transferred 190,000 completed u

> Jarvene Corporation uses the FIFO method in its process costing system. The following data are for the most recent month of operations in one of the company’s processing departments: The cost of beginning inventory according to the co

> Highlands Company uses the weighted-average method in its process costing system. It processes wood pulp for various manufacturers of paper products. Data relating to tons of pulp processed during June are provided below: Required: 1. Compute the number

> Pureform, Inc. uses the weighted-average method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: The beginning work in process inventory was 80% comple

> Alaskan Fisheries, Inc., processes salmon for various distributors and it uses the weighted average method in its process costing system. The company has two processing departments cleaning and Packing. Data relating to pounds of salmon processed in the

> MediSecure, Inc., uses the FIFO method in its process costing system. It produces clear plastic containers for pharmacies in a process that starts in the Molding Department. Data concerning that department’s operations in the most recen

> Data concerning a recent period’s activity in the Assembly Department, the first processing department in a company that uses the FIFO method in its process costing, appear below: A total of 26,000 units were completed and transferred