Question: Ethan Allen Interiors Inc. a leading manufacturer

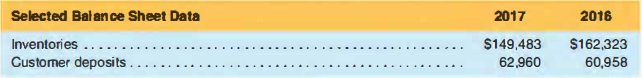

Ethan Allen Interiors Inc. a leading manufacturer and retailer of home furnishings and accessories sells products through an exclusive network of approximately 300 design centers. All of Ethan Allen’s products are sold by special order. Customers generally place a deposit equal to 25% 10 50% of the purchase price when ordering. Orders take 4 10 12 weeks to be delivered. Selected fiscal-year information from the company's balance sheets is as follows ($ thousands):

a. In fiscal 2017. Ethan Allen reported total sales revenue of$ 763.385 (thousand). Assume that the company collected customer deposits equal 10 $200.000 (thousand) over the year. Prepare entries using the financial statement effects template and in journal entry form, to record customer deposits and its sales revenue for fiscal year 2017.

b. Ethan Allen's cost of goods sold for 2017 was $343,662 (thousand). Prepare the adjusting entry, using the financial statement effects template and in journal entry form, that it made to record inventory acquisitions.

c. Where would you expect Ethan Allen to report its Customer Deposits'!

> Healy Corporation recorded service revenues of $100,000 in 2018, of which $70,000 were for credit and $30,000 were for cash. Moreover, of the $70,000 credit sales, it collected $20,000 cash on those receivables before year-end. The company also paid $60,

> For each of the following items, identify whether they would most likely be reported in the balance sheet (B) or income statement([).

> Refer to the transactions in M2-3 I. Set up T-accounts for each of the accounts referenced by the transactions and post the amounts for each transaction to those T-accounts.

> Refer to the transactions in M2-31. Prepare journal entries for each of the transactions (a) through (j).

> Report the effects for each of the following independent transactions using the financial statement effects template. If no entry should be made, answer "No entry."

> Report the effects for each of the following independent transactions using the financial statement effects template. If no entry should be made, answer "No entry."

> Report the effects for each of the following independent transactions using the financial statement effects template. If no entry should be made, answer "No entry."

> Guay Corp., a start-up company, provided services that were acceptable to its customers and billed those customers for $350,000 in 2018. However, Guay collected only $280,000 cash in 2018, and the remaining $70,000 of 2018 revenues were collected in 2019

> What are the five major steps in the accounting cycle? List them in their proper order.

> Following is financial information from Johnson & Johnson for the year ended December 31, 2017. Prepare the 2017 fiscal-year retained earnings reconciliation for Johnson & Johnson ($ millions).

> The Sarbanes-Oxley legislation requires companies to report on the effectiveness of their internal controls. What are internal controls and their purpose? Why do you think Congress felt it to be such an important area to monitor and report?

> Assume that you are a technology services provider and you must decide whether to record revenue from the installation of computer software for one of your clients. Your contract calls for acceptance of the soliware by the client within six months of ins

> Several line items and account titles are listed below. For each, indicate in which of the following financial statement(s) you would H.kely find the item or account: income statement (IS). balance sheet (BS). statement of stockholders· equity (SE). or s

> Access the fiscal 2017 I 0-K for Nike at the SEC's EDGAR database or financial reports (www.sec .gov). Using its consolidated statement of stockholders· equity, prepare a table similar to Exhibit 1.9 showing the articulation of its retained (reinvested)

> Access the most recent 10-K for Apple Inc .. at the SEC's EDGAR database for financial reports (www.sec.gov).What are Apple ·s dollar amounts for assets. liabilities, and equity at September 29.2018? Confirm that the accounting equation holds in this cas

> Use the accounting equation to compute the missing financial amounts (a), (b). and (c). Which of these companies is more owner-financed? Which of these companies is more nonowner-financed?

> Total assets of The Coca-Cola Company equals $87,896 million and its liabilities equal $68,919 million. What is the amount of its equity? Does Coke receive more financing from its owners or non-owners, and what percentage of financing is provided by its

> Total assets of Macy's, Inc. equals $19,381 million and its equity is $5,661 million. What is the amount of its liabilities? Does Macy's receive more financing from its owners or non-owners, and what percentage of financing is provided by its owners?

> Would each of the following transactions increase, decrease, or have no effect on equity? a. Paid cash to acquire supplies. b. Paid cash for dividends to shareholders. c. Paid cash for salaries. d. Purchased equipment for cash. e. Shareholders invested c

> Selected balance sheet and income statement information for McDonald's Corporation and Yum! Brands, Inc., follows. a. Compute the return on assets (ROA) for each company. Use the 35% statutory tax rate that was in force for 2017. b. Disaggregate ROA into

> Determine the following for each separate company case: a. The stockholders' equity of Jensen Corporation, which has assets of $450,000 and liabilities of $326,000. b. The liabilities of Sloan & Dechow, Inc., which has assets of $618,000 and stockholders

> Determine the missing amount in each of the following separate company cases.

> Determine the missing amount in each of the following separate company cases.

> The following information is reported for Kinney Corporation at the end of 2018. a. Compute the amount of retained earnings reported at the end of 20 18. b. If the amount of retained earnings at the beginning of 2018 was $30,000, and $12,000 in cash divi

> Bartov Corporation agreed to build a warehouse for $2,500,000. Expected (and actual) costs for the warehouse follow: 2019, $400,000; 2020, $1,000,000; and 2021, $500,000. The company completed the warehouse in 2021. Compute revenues, expenses, and income

> Income statements for The Gap, Inc., follow, along with selected balance sheet information ($ millions). a. Compute the return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for the fiscal year ended February 3, 2018. As

> Selected balance sheet and income statement information from Siemens, AG, for 2015 through 2017 follows (€ millions). a. Compute the current ratio for each year and discuss any trend in liquidity. Also compute the operating cash flow to

> Selected balance sheet, income statement and cash flow statement information from Tesla, Inc. for 2017 and 2016 follows ($ thousands). a. Compute the current ratio and quick ratio for each year and discuss any trend in liquidity. Do you believe the compa

> Selected balance sheet and income statement information from the software company, Intuit Inc., follows ($ millions). a. Compute the 2017 return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL). Use 35% as the incremental

> Selected balance sheet and income statement information from Office Depot, Inc., follows ($ millions). a. Compute the 2017 return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL). Use 35% as the incremental tax rate. b. Di

> Identify three intangible assets that are likely to be excluded from the balance sheet because they cannot be reliably measured.

> The following tables provide information from the recent annual reports of HD Rinker, AU. a. Calculate HD Rinker's return on equity (ROE) for fiscal years 2019, 2018, and 2017. b. Calculate HD Rinker's return on assets (ROA) and return on financial lever

> Selected fiscal year balance sheet and income statement information for the computer chip maker, Intel Corporation, follows($ millions). a. Calculate lntel's return on equity (ROE) for fiscal years 2017 and 2016. b. Calculate Intel's return on assets (RO

> Selected balance sheet and income statement information for the drug retailers CVS Health Corporation and Walgreens Boots Alliance follows. Assume an incremental tax rate of 35%. a. Compute the 2017 return on assets (ROA) for each company. b. Disaggregat

> Carter Company's income statement and cash flow from operating activities (indirect method) are provided as follows ($ thousands): a. For each of the four statements below, determine whether the statement is true or false. b. If the statement is false, p

> Refer to the information in Exercise 4-35. Calculate the net cash flow from operating activities using the direct method. Show a related cash flow for each revenue and expense. Also, compute its operating cash flow to current liabilities (OCFCL) ratio. (

> The following financial statements were issued by Hoskins Corporation for the fiscal year ended December 31, 2018. All amounts are in millions of U.S. dollars. Additional information: 1. During fiscal year 2018, Hoskins Corporation acquired new equipment

> Calculate the cash flow for each of the fol lowing cases. a. Cash paid for advertising: b. Cash paid for income taxes: c. Cash paid for merchandise purchased:

> The following table presents selected items from the 2016 and 2015 balance sheets and 2016 income statement of Golden Enterprises, Inc. Golden Enterprises reported expenditures for property and equipment of $ 1,182,854 in 2016. In addition, the company a

> During 2018, Paxon Corporation's long-term investments account (at cost) increased $ 15,000, which was the net result of purchasing stocks costing $80,000 and selling stocks costing $65,000 at a $6,000 loss. Also, its bonds payable account decreased $ 10

> The following table presents selected items from the 2017 and 20 I 6 balance sheets and 20 I 7 income statement of Walgreens Boots Alliance, Inc. a. Compute the cash paid for merchandise inventories in 20 17. Assume that trade accounts payable is only fo

> Sloan Company uses its own executive charter plane that originally cost $800,000. It has recorded straight-line depreciation on the plane for six full years, with an $80,000 expected salvage value at the end of its estimated 10-year useful life. Sloan di

> Kasznik Ltd. had the following balances for its property, plant, and equipment accounts (in millions of pounds): During 20 18, Kasznik Ltd. paid £28 million in cash to acquire property and equipment, and this amount represents all the acquis

> Meubles Fischer SA had the following balances for its property, plant, and equipment accounts (in thousands of euros): During fiscal year 2018, Meubles Fischer acquired € I 00 thousand in property by signing a mortgage, plus another &aci

> Lincoln Company owns no plant assets and reported the following income statement for the current year: Additional balance sheet information about the company follows: Use the information to a. calculate the net cash flow from operating activities under t

> Use the following information about the 2018 cash flows of Mason Corporation to prepare a statement of cash flows under the direct method. Refer to Exhibit 4.3 for the appropriate format.

> Consider the following data for several firms from 2017 ($ millions): a. Compute the operating cash flow to current liabilities (OCFCL) ratio for each firm. b. Compute the free cash flow for each firm. c. Comment on the results of your computations.

> Consider the following 2017 data for several pharmaceutical firms ($ mill ions). (None of the firms reported the proceeds from disposals of property, plant, and equipment.) a. Compute the operating cash flow to current liabilities (OCFCL) ratio for each

> Solomon Corporation ·s adjusted trial balance for the year ending December 31, 2018. is: a. Prepare its income statement and statement of stockholders' equity for the current year. and its balance sheet for the current year-end. Cash divide

> The adjusted trial balance of Parker Corporation. prepared December 31. 2018. contains the following selected accounts. a. Prepare entries to close these accounts in journal entry form. b. Set up T-accounts for each of the ledger accounts enter the balan

> Abercrombie & Fitch Co. (ANF) is a specialty retailer of casual apparel. The following information is taken from AN F's fiscal 10-K report for the fiscal year 2017. which ended February 3, 2018. (All amounts in$ thousands.) a. ANF reported Cost of Go

> Assets are recorded at historical costs even though current market values might, arguably, be more relevant to financial statement readers. Describe the reasoning behind historical cost usage.

> Jake Thomas began Thomas Refinishing Service on July I, 2019. Selected accounts are shown below as of July 31 before any adjusting entries have been made. Using the following information prepare the adjusting entries necessary on July 31 (a) using the f

> Selected T-account balances for Fields Company are shown below as of January 31, 2019; adjusting entries have already been posted. The firm uses a calendar-year accounting period but prepares monthly adjustments. a. If the amount in Supplies Expense repr

> Norton Company closes its accounts on December 31 each year. The company works a five-day work week and pays its employees every two weeks. On December 31, 2018, Norton accrued $4,700 of salaries payable. On January 7, 2019, the company paid salaries of

> For each of the following separate situations, prepare the necessary adjustments (a) using the financial statement effects template, and (b) in journal entry form. 1. Unrecorded depreciation on equipment is $610. 2. On the date for preparing financial st

> The adjusted trial balance as of December 31.2018, for Brooks Consulting Company contains the following selected accounts. 1. Prepare entries to close these accounts in journal entry form. 2. Set up T-accounts for each of the ledger accounts enter the ba

> For each of the four separate situations 1 through 4 below, compute the unknown amounts referenced by the letters a through d shown.

> The following balance sheet data are reported for Beaver, Inc., at May 31, 2019. Assume that on June 1, 2019. only the following two transaction occurred. June 1 Purchased additional equipment costing $15,000, giving $2,000 cash and a $13,000 note payabl

> Use the information in Exercise 2-47 to complete the following. a. Prepare journal entries for each of the transactions 1 through 9. b. Set up T-accounts for each of the accounts used in part a and post the journal entries to those T-accounts. (The T-acc

> Record the effect of each of the following independent transactions using the financial statement effects template provided. Confirm that Assets= Liabilities + Equity.

> The following balance sheet data are reported for Bettis Contractors at June 30, 2019. Assume that during the next two days only the following three transactions occurred: July 1 Paid $5,000 cash toward the notes payable owed. 2 Purchased equipment for $

> On January 2, Haskins Company purchases a laser cutting machine for use in fabrication of a part for one of its key products. The machine cost $80,000, and its estimated useful life is five years, after which the expected salvage value is $5,000. Compute

> Use the information in Exercise 2-44 to complete the following. a. Prepare journal entries for each of the transactions (I) through (9). b. Set up T-accounts for each of the accounts used in part a and post the journal entries to those T-accounts . (The

> Following are selected accounts for Kimberly-Clark Corporation for 2017. a. Indicate the appropriate classification of each account as appearing in either its balance sheet (B) or its income statement ( I). b. Using the data, compute its amounts for tota

> El Puerto de Liverpool (Liverpool) is a large retailer in Mexico. The following accounts are selected from its annual report for the fiscal year ended December 3 1, 2017. The amounts below are in thousands of Mexican pesos. a. Indicate the appropriate cl

> Shoprite Holdings Ltd is an African food retailer listed on the Johannesburg Stock Exchange. The following accounts are selected from its annual report for the fiscal year ended July 2, 2017. The amounts below are in millions of South African rand. a. In

> Following are selected accounts for The Procter & Gamble Company for June 30, 2017. a. Indicate the appropriate classification of each account as appearing in either its balance sheet (B) or its income statement (I). b. Using the data, compute the am

> The following balance sheet data are reported for Brownlee Catering at September 30, 2019. Assume that on October I, 2019, only the following two transactions occurred: October I Purchased additional equipment costing $11,000, giving $3,000 cash and sign

> Following is balance sheet information for Lynch Services at the end of 2018 and 2017. a. Prepare balance sheets at December 31 of each year. b. The firm declared and paid a cash dividend of $10,000 in December 2018. Compute its net income for 2018.

> Hewlett Packard Enterprise Company reports the following information on its cash-flow hedges (derivatives) in comprehensive income (net income plus other comprehensive income) in its 2018 10-K report: a. Identify and describe the usual applications for d

> Refer to the Easton Company acquisition described in El2-42. Instead of a 100% acquisition, assume that Easton purchased 40% of the outstanding shares of Harris Company on January I , 2019, for $ 156,000 in cash. Also assume that the undervalued building

> Easton Company acquires 100% of the outstanding voting shares of Harris Company on January 1, 2019. To obtain these shares, Easton pays $210,000 in cash and issues 5,000 of its $10 par value common stock. On this date, Easton's stock has a fair value of

> What does the term current denote when referring to assets?

> On January 1, 2019, Engel Company purchases I 00% of Ball Company for $16.8 million. At the a time of acquisition, Ball's stockholders' equity (and the fair value of its identifiable net assets) is reported at $ 10.2 million. Engel ascribes the excess of

> Rayburn Company purchased all of Kanodia Company's common stock for cash on January 1, at which time the separate balance sheets of the two corporations appeared as follows: During purchase negotiations, Rayburn determined that the appraised value of Kan

> On January 1 of the current year, Healy Company purchased all of the common shares of Miller Company for $500,000 cash. Balance sheets of the two firms at acquisition follow. During purchase negotiations, Miller's plant assets were appraised at $425,000;

> Merck & Co., Inc., reports a December 31, 2016, balance of $715 million in "Investments in affiliates accounted for using the equity method" ("Investments in affiliates"). Provide the entries for the following events for fiscal year 2017: a. Merck's shar

> Kasznik Company began operations on January 2, 2019, and by year-end (December 31) had made the following investments in financial securities. Year-end information on these investments follows. a. At what total amount are the trading stock investments re

> Refer to the data for Guay Company in Exercise 12-35. Assume that Guay Company reports under International Financial Reporting Standards (IFRS). Under IFRS, Guay can designate an equity investment for accounting based on FVOCI (fair value-other comprehen

> Guay Company had the following transactions and adjustment related to a passive equity investment. 2019 Nov. 15 Purchased 5,000 shares of Core, Inc.'s common stock at $16 per share plus a brokerage commission of $900. Guay Company expects to sell the sto

> On August 2 1, 2017, upon the completion of a tender offer, Intel Corporation acquired 97 .3% of the outstanding ordinary shares of Mobileye. This acquisition "combines Mobileye's leading computer vision expertise with Intel's high-performance computing

> During 2017, Amazon.com, Inc., made two significant acqu1s1t1ons intending to expand the company's retail presence. On May I 2, 2017, Amazon acquired Souq Group Ltd. ("Souq"), ane-commerce company, for approximately $583 million, net of cash acquired and

> On January 1, 2019, Ball Corporation purchased, as a stock investment, I 0,000 shares of Leftwich Company common stock for $ 15 cash per share. On December 3 1, 2019, Leftwich announced net income of $80,000 for the year and paid a cash dividend of $1.10

> Janice Utley is saving for a real estate investment. If she invests $1,000 now and then at the beginning of each of the next 35 months (36 months in total) at an interest rate of 1% per month, what will be the investment balance at the end of month 36?

> The following transactions involve investments in marketable securities and are accounted for using the equity method. (1) Healy Co. purchases 15,000 common shares of Palepu Co. at $8 cash per share; the shares represent 25% ownership of Palepu. (2) Heal

> The following transactions involve investments in marketable securities and are accounted for using the equity method. (1) Purchased 12,000 common shares of Barth Co. at $9 cash per share; the shares represent 30% ownership in Barth. (2) Received a cash

> CNA Financial Corporation provides the following information from its 2018 10-K report: Investments The Company classifies its fixed maturity securities as either available-for-sale or trading, and as such, they are carried at fair value. Changes in fair

> Baylor Company purchased 75% of the common stock of Reed Company for $600,000 in cash when the stockholders' equity of Reed Company consisted of $500,000 in common stock and $300,000 in retained earnings. On the acquisition date, the stockholders' equity

> Barclay, Inc., had the following transactions and adjustments related to a bond investment that is classified as a trading security. 2018 Nov. 1 Purchased $300,000 face value of Joos, Inc.'s 9% bonds at l02 plus a brokerage commission of $900. The bonds

> For the following transactions involving investments in marketable securities, assume that: (1) Ohlson Co. purchases 5,000 common shares of Freeman Co. at $ 16 cash per share. (2) Ohlson Co. receives a cash dividend of $ 1.25 per common share from Freema

> Four transactions involving investments in marketable debt securities classified as trading follow. (1) On July I, purchased US Treasury Bonds for $407,000 in cash. The bonds have a face value of $400,000 and pay interest semi-annually (June 30 and Decem

> The 2018 statement of stockholders' equity for Walt Disney Co. is presented bel ow. (Disney includes both par value and additional paid-in capital under the heading "Common Stock." Non-controlling interests have been excluded for simplicity, so the rows

> Warren Buffett, CEO of Berkshire Hathaway. and known as the "Sage of Omaha" for his investment success has stated that his firm is not interested in investing in a company whose business model he does not understand through reading its financial statemen

> What does the concept of liquidity refer to? Explain.

> Leslie Porter is planning a trip to Europe upon graduation in two years. She anticipates that her trip will cost $14,000. She would like to set aside an amount now to save for the trip. How much should she set aside if her savings earns 4% interest compo

> A portion of Note 2: Earnings per Share from Facebook, lnc.'s 10-K is as follows: a. Explain why employee stock options and restricted stock units are adjustments to the denominator for diluted EPS. b. Facebook computes EPS separately for its Class B sha

> Does a balance sheet report on a period of time or at a point in time? Also, explain the information conveyed in that report. Does an income statement report on a period of time or at a point in time? Also, explain the information conveyed in that report

> Following is the stockholders' equity section of the Merck & Co., Inc., balance sheet. / a. Explain the derivation of the $ 1,788 million in the common stock account. b. Using December 3 1, 20 17, balances, at what average issue price were the Merck comm

> Companies prepare four primary financial statements. What are those financial statements and what information is typically conveyed in each?