Question: The following information is reported for Kinney

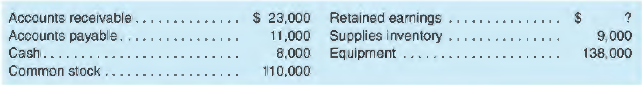

The following information is reported for Kinney Corporation at the end of 2018.

a. Compute the amount of retained earnings reported at the end of 20 18.

b. If the amount of retained earnings at the beginning of 2018 was $30,000, and $12,000 in cash dividends were declared and paid during 2018, what was its net income for 2018?

> Determine the missing amount from each of the separate situations (a). (b). and (c) below. Which of these companies is more owner-financed? Which of these companies is more creditor-financed?

> The following information was obtained from Galena Company's comparative balance sheets. Assume that Galena Company's 2018 income statement showed depreciation expense of $8,000. Again on sale of investments of $9.000, and net income of $45,000. Calculat

> For fiscal year 2018. Beyer GmbH had the following summary information available concerning its operating activities. The company had no investing or financing activities this year. REQUIRED a. Enter the i1ems above into the Financial Statement Effects T

> For each of the items below. indicate whether it is (1) a cash flow from an operating activity. (2) a cash flow from an investing activity. (3) a cash flow from a financing activity, (4) a noncash investing and financing activity or (5) none of the

> The following table presents selected items from a recent cash flow statement of General Mills, Inc . For each item, determine whether the amount would be disclosed in the cash flow statement under operating activities, investing activities, or financing

> For each of the items below, indicate whether the cash flow relates to an operating activity, an investing activity, or a financing activity. a. Cash receipts from customers for services rendered. b. Sale of long-term investments for cash. c. Acquisition

> The following account information was presented as adjustments to net income in a recent statement of cash flows for Target Corporation. Determine whether each item would be a positive adjustment or a negative adjustment to net income in determining cash

> Hatcher Company closes its accounts on December 31 each year. On December 31. 20 I 8. Hatcher accrued $600 of interest income that was earned on an investment but not yet received or recorded (the investment will pay interest of $900 cash on January 31.2

> Amazon.com Inc. is one of the world’s leading e-commerce companies. with almost $120 billion in revenues for the fiscal year ended December 31. 2017. For the year ended December 31. 20 I 7. Amazon's cost of goods sold was $111,934 milli

> The adjusted trial balance at December 31, 2018, for Smith Company includes the following selected accounts. a. Prepare entries to close these accounts in journal entry form. b. Set up T-accounts for each of these ledger accounts. enter the balances abov

> Assume you are in the process of closing procedures for Echo Corporation. You have already closed all revenue and expense accounts to the Retained Earnings account. The total debits to Retained Earnings equal $308,800 and total credits to Retained Earnin

> On January 1. Prepaid Insurance was debited with the cost of a two-year premium, $1,872. What adjusting entry should be made on January 31 before financial statements are prepared for the month?

> Matt Wilson has an investment opportunity that promises to pay him $24,000 in four years. He could earn 6% if he invested his money elsewhere. What is the maximum amount that he should be willing to invest in this opportunity?

> On December 31, 2017, the credit balances of the Common Stock and Retained Earnings accounts were $30,000 and $18,000, respectively, for Architect Services Company. Its stock issuances for 2018 totaled $6,000, and it paid $9,700 cash toward dividends in

> El Puerto de Liverpool (Liverpool) is a large retailer in Mexico. The following accounts are selected from its annual report for the fiscal year ended December 31, 2017. For the fiscal year ended December 31, 2017, Liverpool purchased merchandise invento

> Selected accounts of Ideal Properties, a real estate management firm, are shown below as of January 3 I, 2019, before any adjusting entries have been made. Monthly financial statements are prepared. Using the following information, record the adjusting e

> Deluxe Building Services offers custodial services on both a contract basis and an hourly basis. On January 1, 2019, Deluxe collected $20,100 in advance on a six-month contract for work to be performed evenly during the next six months. Assume that Delux

> Minute Maid, a firm providing housecleaning services, began business on April I, 2019. The following transactions occurred during the month of April. April I A. Falcon invested $9,000 cash to begin the business in exchange for common stock. 2 Paid $2,850

> Creative Designs, a firm providing art services for advertisers, began business on June I, 2019. The following transactions occurred during the month of June. June 1. Anne Clem invested $12.000 cash to begin the business in exchange for common stock. 2.

> Following the example in a below, indicate the effects of transactions b through ion assets, liabilities, and equity, including identifying the individual accounts affected. a. Paid cash to acquire a computer for use in office ANSWER: Increase assets (Of

> Following the example in a below, indicate the effects of transactions b through ion assets, liabilities, and equity, including identifying the individual accounts affected. a. Rendered legal services to clients for cash ANSWER: Increase assets (Cash) In

> Use your knowledge of accounting relations to complete the following table for L Brands, Inc. (All amounts in$ millions.)

> For each of the following items, indicate whether it is most likely reported on the balance sheet (B), the income statement (I), or the statement of stockholders' equity (SE).

> Basic income statement and balance sheet information is given below for six different cases. For each case, the assets are financed with a mix of non-interest-bearing liabilities, 10% interest bearing liability and stockholders' equity. In all cases, the

> For each of the following items, indicate whether it is most likely reported on the balance sheet (B), the income statement (I), or the statement of stockholders' equity (SE).

> Next to each item, indicate whether it would most likely be reported on the balance sheet (B), the income statement (I), or the statement of stockholders' equity (SE).

> Healy Corporation recorded service revenues of $100,000 in 2018, of which $70,000 were for credit and $30,000 were for cash. Moreover, of the $70,000 credit sales, it collected $20,000 cash on those receivables before year-end. The company also paid $60,

> For each of the following items, identify whether they would most likely be reported in the balance sheet (B) or income statement([).

> Refer to the transactions in M2-3 I. Set up T-accounts for each of the accounts referenced by the transactions and post the amounts for each transaction to those T-accounts.

> Refer to the transactions in M2-31. Prepare journal entries for each of the transactions (a) through (j).

> Report the effects for each of the following independent transactions using the financial statement effects template. If no entry should be made, answer "No entry."

> Report the effects for each of the following independent transactions using the financial statement effects template. If no entry should be made, answer "No entry."

> Report the effects for each of the following independent transactions using the financial statement effects template. If no entry should be made, answer "No entry."

> Guay Corp., a start-up company, provided services that were acceptable to its customers and billed those customers for $350,000 in 2018. However, Guay collected only $280,000 cash in 2018, and the remaining $70,000 of 2018 revenues were collected in 2019

> What are the five major steps in the accounting cycle? List them in their proper order.

> Following is financial information from Johnson & Johnson for the year ended December 31, 2017. Prepare the 2017 fiscal-year retained earnings reconciliation for Johnson & Johnson ($ millions).

> The Sarbanes-Oxley legislation requires companies to report on the effectiveness of their internal controls. What are internal controls and their purpose? Why do you think Congress felt it to be such an important area to monitor and report?

> Assume that you are a technology services provider and you must decide whether to record revenue from the installation of computer software for one of your clients. Your contract calls for acceptance of the soliware by the client within six months of ins

> Several line items and account titles are listed below. For each, indicate in which of the following financial statement(s) you would H.kely find the item or account: income statement (IS). balance sheet (BS). statement of stockholders· equity (SE). or s

> Access the fiscal 2017 I 0-K for Nike at the SEC's EDGAR database or financial reports (www.sec .gov). Using its consolidated statement of stockholders· equity, prepare a table similar to Exhibit 1.9 showing the articulation of its retained (reinvested)

> Access the most recent 10-K for Apple Inc .. at the SEC's EDGAR database for financial reports (www.sec.gov).What are Apple ·s dollar amounts for assets. liabilities, and equity at September 29.2018? Confirm that the accounting equation holds in this cas

> Use the accounting equation to compute the missing financial amounts (a), (b). and (c). Which of these companies is more owner-financed? Which of these companies is more nonowner-financed?

> Total assets of The Coca-Cola Company equals $87,896 million and its liabilities equal $68,919 million. What is the amount of its equity? Does Coke receive more financing from its owners or non-owners, and what percentage of financing is provided by its

> Total assets of Macy's, Inc. equals $19,381 million and its equity is $5,661 million. What is the amount of its liabilities? Does Macy's receive more financing from its owners or non-owners, and what percentage of financing is provided by its owners?

> Would each of the following transactions increase, decrease, or have no effect on equity? a. Paid cash to acquire supplies. b. Paid cash for dividends to shareholders. c. Paid cash for salaries. d. Purchased equipment for cash. e. Shareholders invested c

> Selected balance sheet and income statement information for McDonald's Corporation and Yum! Brands, Inc., follows. a. Compute the return on assets (ROA) for each company. Use the 35% statutory tax rate that was in force for 2017. b. Disaggregate ROA into

> Determine the following for each separate company case: a. The stockholders' equity of Jensen Corporation, which has assets of $450,000 and liabilities of $326,000. b. The liabilities of Sloan & Dechow, Inc., which has assets of $618,000 and stockholders

> Determine the missing amount in each of the following separate company cases.

> Determine the missing amount in each of the following separate company cases.

> Bartov Corporation agreed to build a warehouse for $2,500,000. Expected (and actual) costs for the warehouse follow: 2019, $400,000; 2020, $1,000,000; and 2021, $500,000. The company completed the warehouse in 2021. Compute revenues, expenses, and income

> Income statements for The Gap, Inc., follow, along with selected balance sheet information ($ millions). a. Compute the return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for the fiscal year ended February 3, 2018. As

> Selected balance sheet and income statement information from Siemens, AG, for 2015 through 2017 follows (€ millions). a. Compute the current ratio for each year and discuss any trend in liquidity. Also compute the operating cash flow to

> Selected balance sheet, income statement and cash flow statement information from Tesla, Inc. for 2017 and 2016 follows ($ thousands). a. Compute the current ratio and quick ratio for each year and discuss any trend in liquidity. Do you believe the compa

> Selected balance sheet and income statement information from the software company, Intuit Inc., follows ($ millions). a. Compute the 2017 return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL). Use 35% as the incremental

> Selected balance sheet and income statement information from Office Depot, Inc., follows ($ millions). a. Compute the 2017 return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL). Use 35% as the incremental tax rate. b. Di

> Identify three intangible assets that are likely to be excluded from the balance sheet because they cannot be reliably measured.

> The following tables provide information from the recent annual reports of HD Rinker, AU. a. Calculate HD Rinker's return on equity (ROE) for fiscal years 2019, 2018, and 2017. b. Calculate HD Rinker's return on assets (ROA) and return on financial lever

> Selected fiscal year balance sheet and income statement information for the computer chip maker, Intel Corporation, follows($ millions). a. Calculate lntel's return on equity (ROE) for fiscal years 2017 and 2016. b. Calculate Intel's return on assets (RO

> Selected balance sheet and income statement information for the drug retailers CVS Health Corporation and Walgreens Boots Alliance follows. Assume an incremental tax rate of 35%. a. Compute the 2017 return on assets (ROA) for each company. b. Disaggregat

> Carter Company's income statement and cash flow from operating activities (indirect method) are provided as follows ($ thousands): a. For each of the four statements below, determine whether the statement is true or false. b. If the statement is false, p

> Refer to the information in Exercise 4-35. Calculate the net cash flow from operating activities using the direct method. Show a related cash flow for each revenue and expense. Also, compute its operating cash flow to current liabilities (OCFCL) ratio. (

> The following financial statements were issued by Hoskins Corporation for the fiscal year ended December 31, 2018. All amounts are in millions of U.S. dollars. Additional information: 1. During fiscal year 2018, Hoskins Corporation acquired new equipment

> Calculate the cash flow for each of the fol lowing cases. a. Cash paid for advertising: b. Cash paid for income taxes: c. Cash paid for merchandise purchased:

> The following table presents selected items from the 2016 and 2015 balance sheets and 2016 income statement of Golden Enterprises, Inc. Golden Enterprises reported expenditures for property and equipment of $ 1,182,854 in 2016. In addition, the company a

> During 2018, Paxon Corporation's long-term investments account (at cost) increased $ 15,000, which was the net result of purchasing stocks costing $80,000 and selling stocks costing $65,000 at a $6,000 loss. Also, its bonds payable account decreased $ 10

> The following table presents selected items from the 2017 and 20 I 6 balance sheets and 20 I 7 income statement of Walgreens Boots Alliance, Inc. a. Compute the cash paid for merchandise inventories in 20 17. Assume that trade accounts payable is only fo

> Sloan Company uses its own executive charter plane that originally cost $800,000. It has recorded straight-line depreciation on the plane for six full years, with an $80,000 expected salvage value at the end of its estimated 10-year useful life. Sloan di

> Kasznik Ltd. had the following balances for its property, plant, and equipment accounts (in millions of pounds): During 20 18, Kasznik Ltd. paid £28 million in cash to acquire property and equipment, and this amount represents all the acquis

> Meubles Fischer SA had the following balances for its property, plant, and equipment accounts (in thousands of euros): During fiscal year 2018, Meubles Fischer acquired € I 00 thousand in property by signing a mortgage, plus another &aci

> Lincoln Company owns no plant assets and reported the following income statement for the current year: Additional balance sheet information about the company follows: Use the information to a. calculate the net cash flow from operating activities under t

> Use the following information about the 2018 cash flows of Mason Corporation to prepare a statement of cash flows under the direct method. Refer to Exhibit 4.3 for the appropriate format.

> Consider the following data for several firms from 2017 ($ millions): a. Compute the operating cash flow to current liabilities (OCFCL) ratio for each firm. b. Compute the free cash flow for each firm. c. Comment on the results of your computations.

> Consider the following 2017 data for several pharmaceutical firms ($ mill ions). (None of the firms reported the proceeds from disposals of property, plant, and equipment.) a. Compute the operating cash flow to current liabilities (OCFCL) ratio for each

> Solomon Corporation ·s adjusted trial balance for the year ending December 31, 2018. is: a. Prepare its income statement and statement of stockholders' equity for the current year. and its balance sheet for the current year-end. Cash divide

> Ethan Allen Interiors Inc. a leading manufacturer and retailer of home furnishings and accessories sells products through an exclusive network of approximately 300 design centers. All of Ethan Allen’s products are sold by special order.

> The adjusted trial balance of Parker Corporation. prepared December 31. 2018. contains the following selected accounts. a. Prepare entries to close these accounts in journal entry form. b. Set up T-accounts for each of the ledger accounts enter the balan

> Abercrombie & Fitch Co. (ANF) is a specialty retailer of casual apparel. The following information is taken from AN F's fiscal 10-K report for the fiscal year 2017. which ended February 3, 2018. (All amounts in$ thousands.) a. ANF reported Cost of Go

> Assets are recorded at historical costs even though current market values might, arguably, be more relevant to financial statement readers. Describe the reasoning behind historical cost usage.

> Jake Thomas began Thomas Refinishing Service on July I, 2019. Selected accounts are shown below as of July 31 before any adjusting entries have been made. Using the following information prepare the adjusting entries necessary on July 31 (a) using the f

> Selected T-account balances for Fields Company are shown below as of January 31, 2019; adjusting entries have already been posted. The firm uses a calendar-year accounting period but prepares monthly adjustments. a. If the amount in Supplies Expense repr

> Norton Company closes its accounts on December 31 each year. The company works a five-day work week and pays its employees every two weeks. On December 31, 2018, Norton accrued $4,700 of salaries payable. On January 7, 2019, the company paid salaries of

> For each of the following separate situations, prepare the necessary adjustments (a) using the financial statement effects template, and (b) in journal entry form. 1. Unrecorded depreciation on equipment is $610. 2. On the date for preparing financial st

> The adjusted trial balance as of December 31.2018, for Brooks Consulting Company contains the following selected accounts. 1. Prepare entries to close these accounts in journal entry form. 2. Set up T-accounts for each of the ledger accounts enter the ba

> For each of the four separate situations 1 through 4 below, compute the unknown amounts referenced by the letters a through d shown.

> The following balance sheet data are reported for Beaver, Inc., at May 31, 2019. Assume that on June 1, 2019. only the following two transaction occurred. June 1 Purchased additional equipment costing $15,000, giving $2,000 cash and a $13,000 note payabl

> Use the information in Exercise 2-47 to complete the following. a. Prepare journal entries for each of the transactions 1 through 9. b. Set up T-accounts for each of the accounts used in part a and post the journal entries to those T-accounts. (The T-acc

> Record the effect of each of the following independent transactions using the financial statement effects template provided. Confirm that Assets= Liabilities + Equity.

> The following balance sheet data are reported for Bettis Contractors at June 30, 2019. Assume that during the next two days only the following three transactions occurred: July 1 Paid $5,000 cash toward the notes payable owed. 2 Purchased equipment for $

> On January 2, Haskins Company purchases a laser cutting machine for use in fabrication of a part for one of its key products. The machine cost $80,000, and its estimated useful life is five years, after which the expected salvage value is $5,000. Compute

> Use the information in Exercise 2-44 to complete the following. a. Prepare journal entries for each of the transactions (I) through (9). b. Set up T-accounts for each of the accounts used in part a and post the journal entries to those T-accounts . (The

> Following are selected accounts for Kimberly-Clark Corporation for 2017. a. Indicate the appropriate classification of each account as appearing in either its balance sheet (B) or its income statement ( I). b. Using the data, compute its amounts for tota

> El Puerto de Liverpool (Liverpool) is a large retailer in Mexico. The following accounts are selected from its annual report for the fiscal year ended December 3 1, 2017. The amounts below are in thousands of Mexican pesos. a. Indicate the appropriate cl

> Shoprite Holdings Ltd is an African food retailer listed on the Johannesburg Stock Exchange. The following accounts are selected from its annual report for the fiscal year ended July 2, 2017. The amounts below are in millions of South African rand. a. In

> Following are selected accounts for The Procter & Gamble Company for June 30, 2017. a. Indicate the appropriate classification of each account as appearing in either its balance sheet (B) or its income statement (I). b. Using the data, compute the am

> The following balance sheet data are reported for Brownlee Catering at September 30, 2019. Assume that on October I, 2019, only the following two transactions occurred: October I Purchased additional equipment costing $11,000, giving $3,000 cash and sign

> Following is balance sheet information for Lynch Services at the end of 2018 and 2017. a. Prepare balance sheets at December 31 of each year. b. The firm declared and paid a cash dividend of $10,000 in December 2018. Compute its net income for 2018.

> Hewlett Packard Enterprise Company reports the following information on its cash-flow hedges (derivatives) in comprehensive income (net income plus other comprehensive income) in its 2018 10-K report: a. Identify and describe the usual applications for d

> Refer to the Easton Company acquisition described in El2-42. Instead of a 100% acquisition, assume that Easton purchased 40% of the outstanding shares of Harris Company on January I , 2019, for $ 156,000 in cash. Also assume that the undervalued building

> Easton Company acquires 100% of the outstanding voting shares of Harris Company on January 1, 2019. To obtain these shares, Easton pays $210,000 in cash and issues 5,000 of its $10 par value common stock. On this date, Easton's stock has a fair value of

> What does the term current denote when referring to assets?