Question: Examine the financial statements for Oak Valley

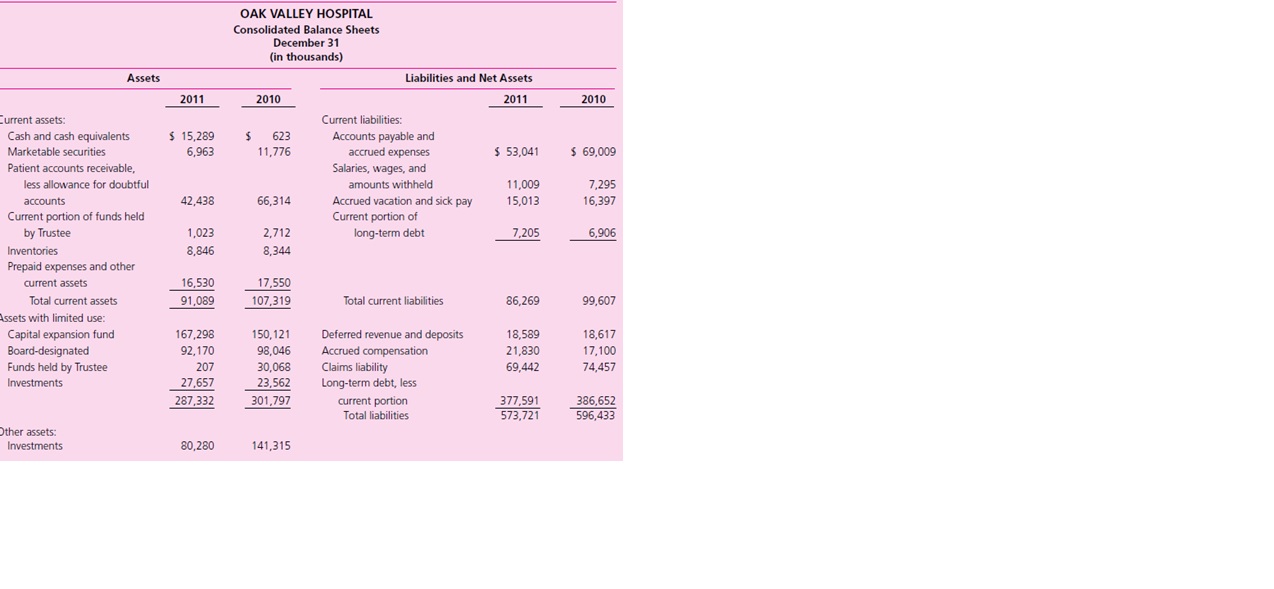

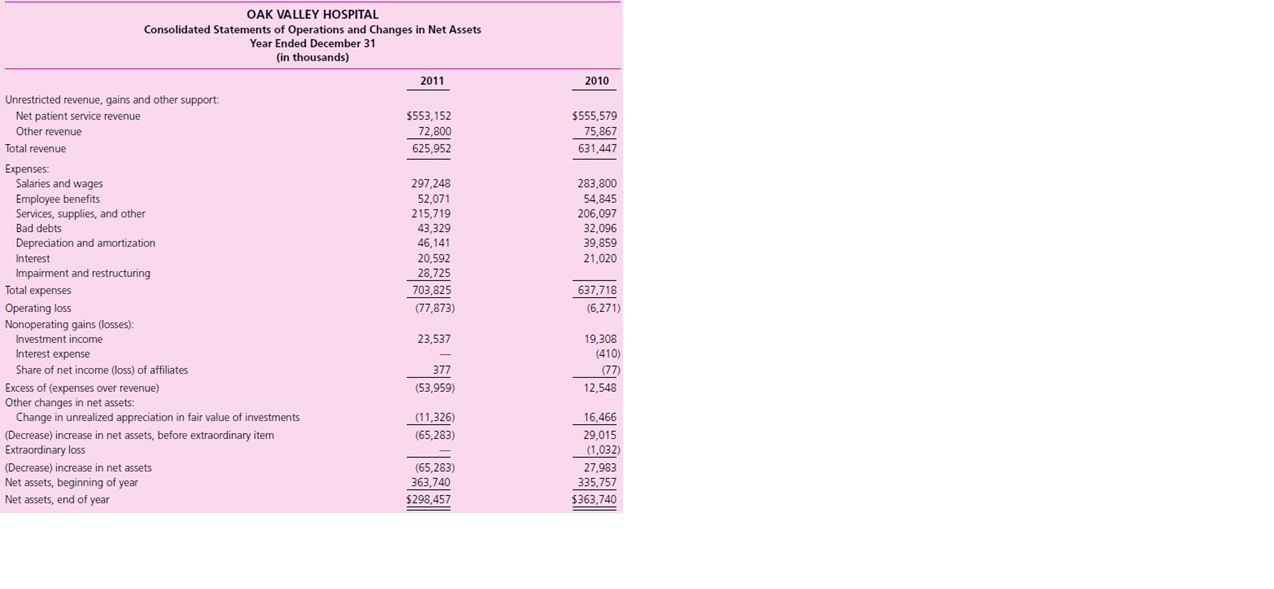

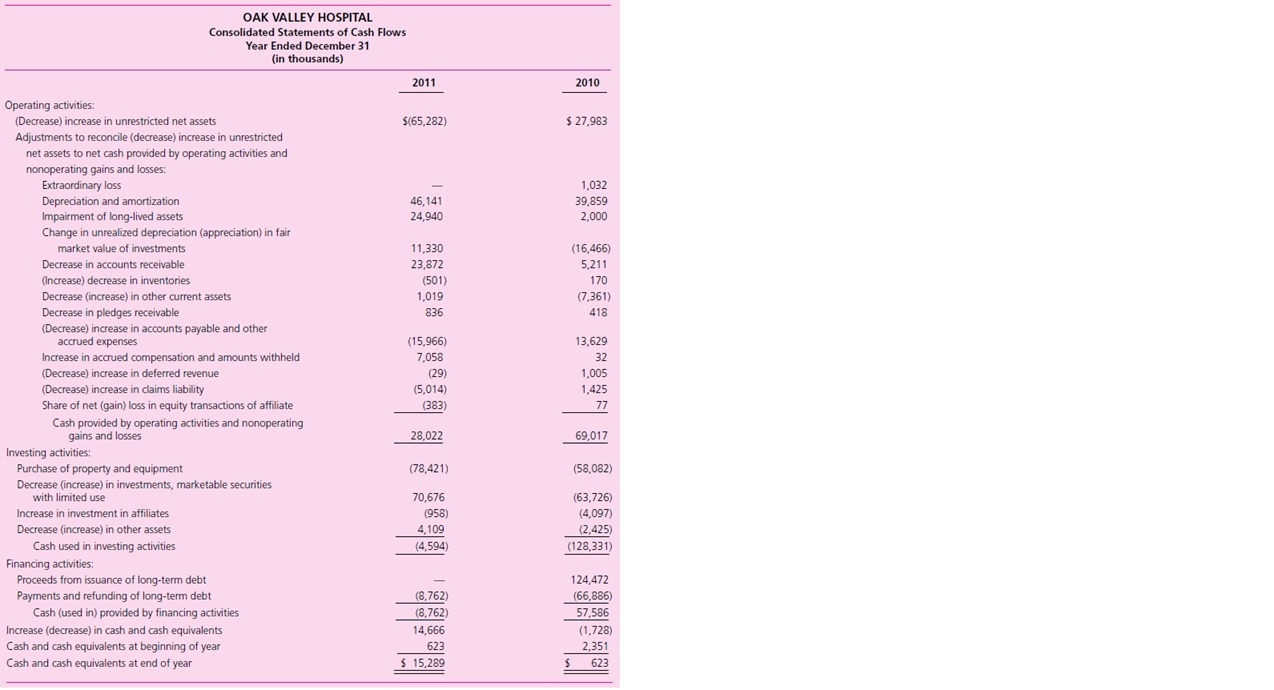

Examine the financial statements for Oak Valley Hospital for the years ended December 31, 2010, and 2011.

Required

Prepare a short answer to address each of the following questions.

a. Discuss the relative importance of different classifications of assets to total assets. What additional information would you expect to find in the notes to the financial statements about major classification of assets?

b. Describe how net patient service revenue likely differs from gross patient revenue.

c. Did this hospital have a profitable year? Why or why not?

d. What is the best explanation for the change in cash for the most recent year? For the previous year?

Transcribed Image Text:

OAK VALLEY HOSPITAL Consolidated Balance Sheets December 31 (in thousands) Assets Liabilities and Net Assets 2011 2010 2011 2010 Current assets: Cash and cash equivalents Marketable securities Current liabilities: $ 15,289 6,963 623 Accounts payable and 11,776 accrued expenses $ 53,041 $ 69,009 Patient accounts receivable, less allowance for doubtful Salaries, wages, and amounts withheld 11,009 7,295 accounts Current portion of funds held 42,438 66,314 16,397 Accrued vacation and sick pay Current portion of long-term debt 15,013 by Trustee 1,023 2,712 7,205 6,906 Inventories 8,846 8,344 Prepaid expenses and other 16,530 91,089 current assets 17,550 Total current assets 91,089 107,319 Total current liabilities s 86,269 99,607 Assets with limited use: Deferred revenue and deposits Accrued compensation Claims liability Long-term debt, less 167,298 18,589 18,617 Capital expansion fund Board-designated 150,121 98,046 30,068 23,562 21,830 69,442 92,170 17,100 Funds held by Trustee 207 74,457 27,657 287,332 Investments 377,591 573,721 301,797 current portion Total liabilities 386,652 596,433 Other assets: Investments 80,280 141,315 2011 2010 2011 2010 Deferred bond issue costs, less Unrestricted net assets 298,457 363,740 accumulated amortization of $4,783,225 in 2011 and $3,868,295 in 2010 Investment in affiliates 14,429 13,065 15,423 11,723 3,801 17,896 Pledges receivable Other 2,963 13,867 124,604 190,158 Property and equipment: 15,157 304,856 332,685 33,599 Land 16,038 Buildings and improvements Equipment 318,465 282,762 23,854 Construction in progress 686,297 (317,144) 641,119 Accumulated depreciation (280.220) 369,153 360,899 Total assets $872,178 $960,173 Total liabilities and net assets $872,178 $960,173 OAK VALLEY HOSPITAL Consolidated Statements of Operations and Changes in Net Assets Year Ended December 31 (in thousands) 2011 2010 Unrestricted revenue, gains and other support: Net patient service revenue $553,152 $555,579 Other revenue 72,800 75,867 Total revenue 625,952 631,447 Expenses: Salaries and wages Employee benefits Services, supplies, and other Bad debts depreciation and amortization 283,800 54,845 206,097 297.248 52,071 215,719 43,329 46,141 32,096 39,859 Interest 20,592 28,725 21,020 Impairment and restructuring 637,718 (6,271) Total expenses 703,825 Operating loss Nonoperating gains (losses): Investment income Interest expense Share of net income (loss) of affiliates (77,873) 19,308 (410) 23,537 377 (77) Excess of (expenses over revenue) Other changes in net assets: Change in unrealized appreciation in fair value of investments (Decrease) increase in net assets, before extraordinary item Extraordinary loss (53,959) 12,548 (11,326) 16,466 (65,283) 29,015 (1,032) (Decrease) increase in net assets Net assets, beginning of year (65,283) 363,740 $298,457 27,983 335,757 $363,740 Net assets, end of year OAK VALLEY HOSPITAL Consolidated Statements of Cash Flows Year Ended December 31 (in thousands) 2011 2010 Operating activities: (Decrease) increase in unrestricted net assets S(65,282) $ 27,983 Adjustments to reconcile (decrease) increase in unrestricted net assets to net cash provided by operating activities and nonoperating gains and losses: Ertraordioan, lerE Extraordinary loss 1,032 depreciation and amortization 46,141 39,859 Impairment of long-lived assets 24,940 2,000 Change in unrealized depreciation (appreciation) in fair 11,330 23,872 (501) (16,466) 5,211 market value of investments Decrease in accounts receivable (Increase) decrease in inventories 170 Decrease (increase) in other current assets 1,019 (7,361) Decrease in pledges receivable (Decrease) increase in accounts payable and other accrued expenses 836 418 (15,966) 13,629 Increase in accrued compensation and amounts withheld 7,058 32 (Decrease) increase in deferred revenue (29) 1,005 (Decrease) increase in claims liability (5,014) 1,425 Share of net (gain) loss in equity transactions of affiliate (383) 77 Cash provided by operating activities and nonoperating gains and losses 28,022 69,017 Investing activities: Purchase of property and equipment (78,421) (58,082) Decrease (increase) in investments, marketable securities with limited use (63,726) (4,097) (2,425) 70,676 Increase in investment in affiliates (958) Decrease (increase) in other assets 4,109 Cash used in investing activities (4,594) (128,331) Financing activities: Proceeds from issuance of long-term debt 124,472 (66,886) Payments and refunding of long-term debt (8,762) Cash (used in) provided by financing activities (8,762) 57,586 Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year 14,666 (1,728) 623 2,351 Cash and cash equivalents at end of year $ 15,289 623

> Eagleview City prepares a quarterly forecast of cash flows for its water service department. Data for the upcoming quarter (in alphabetical order) measured on the cash basis are presented below. The city maintains no more than the minimum cash balance

> The police chief of the Town of Meridian submitted the following budget request for the police department for the forthcoming budget year 2011–12. Upon questioning by the newly appointed town manager, a recent masters graduate with a

> The Little Feet Dance Association is a performing arts program in an urban area. It was established to increase appreciation for dance among youth and strengthen social bonds in the community. The association has been in existence for several years, and

> A portion of the General Fund operating budget for Southwest City’s Street Department follows here and on subsequent pages. Required After reading and evaluating the budget information for the Street Department of Southwest City, answe

> Choose the best answer. 1. An often used approach to budgeting that simply derives the New Year’s budget from the current year’s budget is called: a. Planning-programming-budgeting. b. Incremental budgeting. c. Zero-based budgeting. d. Performance budget

> On the basis of the following data, prepare a statement for the Town of Chippewa for the year ended June 30, 2011, showing the total cost of solid waste removal and the cost per ton of residential solid waste removed or cubic yard of commercial solid was

> The midsize City of Orangeville funds an animal control program intended to minimize the danger stray dogs pose to people and property. The program is under scrutiny because of current budgetary constraints and constituency pressure. An animal control wa

> The director of a not-for-profit organization was overheard saying that government auditing standards (GAGAS) were developed by the federal government to ensure that local governments were spending federal funds appropriately. Therefore, her organization

> What are the major types of auditor services described in the Government Accountability Office’s Government Auditing Standards (yellow book), and how do they differ?

> Define GAGAS, and describe how GAGAS differ from GAAS.

> A new board member for the Fire Protection District (a special purpose government) was reviewing the audit report for the district and noted that, although the district received an unqualified opinion, the audit report was longer than the one received by

> What is an opinion unit and of what significance is an opinion unit to the auditor?

> What are the three levels of audit to which a government or not-for-profit entity may be subject? Who is responsible for setting the standards or requirements for each of the three levels identified?

> The following is the pre-closing trial balance for Horton University as of June 30, 2011. Additional information related to net assets and the statement of cash flows is also provided. Additional information Net assets released from temporary restrict

> What are the benefits of having an audit committee?

> What is the National Single Audit Sampling Project and why is it important?

> Explain how federal award programs are selected for audit under the risk based approach.

> How is an OMB Circular A-133 audit related to a GAGAS audit? How is an OMB Circular A-133 audit different from a GAGAS audit?

> What is a revocable split-interest agreement and how is it recorded by a private college?

> What is an annuity agreement and how does it differ from a life income fund?

> Explain the conditions that must exist for a public or private college or university to avoid accounting recognition of the value of its collections of art, historical treasures, and similar assets.

> A private college has received a multi-year unconditional pledge from a major supporter. How will the college report the pledge in its financial statements?

> Compare the reporting of contributed services by private and public colleges and universities.

> What are some of the accounting and reporting differences between endowments and split-interest agreements?

> Following are several unrelated transactions involving a university. 1. In fiscal year 2011, the university was notified by the federal government that in 2012 it would receive a $500,000 grant for wetlands research. 2. The university received $234,000 i

> Private colleges and universities report temporarily and permanently restricted net assets. What, if any, comparable reporting is provided by public universities?

> Explain how restricted gifts and grants are reported by a public college or university. How would such restricted gifts and grants be recorded and reported by a private college or university?

> What are restricted assets and how are they shown in the financial statements?

> Describe some measures of performance that can be used in assessing whether a university operates effectively.

> Breyer Memorial Hospital received a $100,000 gift that was restricted by the donor for heart research. At fiscal year-end Breyer had incurred $25,000 in expenses related to this project. Explain how these transactions would be reported in Breyer’s balanc

> What is the difference in accounting for investments among investor-owned, not-for-profit, and governmental health care organizations?

> Elizabeth College, a small private college, had the following transactions in fiscal year 2011. 1. Billings for tuition and fees totaled $5,600,000. Tuition waivers and scholarships of $61,500 were granted. Students received tuition refunds of $101,670.

> Choose the best answer. 1. Under GASB standards, public colleges and universities engaged only in business-type activities present all of the following statements in their stand-alone reports except a: a. Statement of net assets. b. Statement of revenues

> The following balances come from the trial balance of Sherlock State College as of the end of the 2011 fiscal year. Required a. Prepare a statement of revenues, expenses, and changes in net assets for the year ended June 30, 2011, in good form. See Ill

> As part of your audit firm’s quality control policies, it maintains a record of continuing profession education (CPE) taken by professional staff members. Following is information on some of the classes, sessions, workshops, and conferences that the audi

> Choose the best answer. 1. Which of the following activities would always indicate that an auditor’s independence has been impaired? a. Providing advice on establishing an internal control system. b. Posting adjusting journal entries into the client’s ac

> Following is the unqualified audit report for the City of Sand Key. The Honorable Mayor Members of the City Commission and City Manager City of Sand Key We have audited the accompanying financial statements of the City of Sand Key (the City) as of and fo

> Indicate which of the following activities performed by an auditor for a governmental client are (a) allowable, (b) permitted if safeguards are in place, or (c) prohibited. 1. Serving as an adviser on the building subcommittee for the county. 2. Preparin

> Quad-States Community Service Agency expended federal awards during the most recent fiscal year in the following amounts for the programs shown: Additional information indicates that Programs 4 and 10 were audited as major programs in each of the two p

> The City of Topeka, Kansas, has received a Distinguished Budget Presentation Award for at least 12 years. An excerpt from the 2008 Budget is presented on the next page: Financial Policies, Guidelines, and Practices Budgeting, Accounting, and Audit Practi

> You are a governmental accountant for a large municipality, and you have recently been assigned to the Budget office and charged with building a better budget document—one that will be of the highest quality so that citizens and others with an interest i

> What is an example of a performance indicator and to what would it compare in investor-owned financial reporting?

> As a cost reimbursement accountant in a large public research university, you are aware that federal agencies have increased auditing efforts in the area of federal research grants to higher education institutions. In particular, OMB Circular A–21 detail

> The federal government through the Medicare and Medicaid programs is one of the largest providers of patient service revenues to health care organizations. Information concerning these programs is available through the Department of Health and Human Serv

> Responding to a growing need for medical care as its population grew in the early 1900s, Suffolk County founded the Suffolk County Hospital in 1920, financing construction of the original hospital building and equipment with a $500,000 general obligation

> The local newspaper of a large urban area printed a story titled “Charity Care by Hospitals Stirs Debate.” The story quotes one legislator who wants “to ensure that the state’s nonpr

> The U.S. Department of Health and Human Services maintains the Web site www.hospitalcompare.hhs.gov, which provides an array of process of care and outcome of care measures that report on how well individual hospitals are caring for their patients, compa

> Choose the best answer. 1. The organization assigned primary responsibility for establishing accounting and financial reporting standards for health care organizations is the: a. American Institute of CPAs (AICPA). b. Financial Accounting Standards Board

> The Phelps Community Hospital balance sheet as of December 31, 2010, follows. Required a. Record in general journal form the effect of the following transactions during the fiscal year ended December 31, 2011, assuming that Phelps Community Hospital is

> During 2011, the following selected events and transactions were recorded by Nichols County Hospital. 1. Gross charges for hospital services, all charged to accounts and notes receivable, were as follows: 2. After recording patient service revenues, it

> During its current fiscal year, Dearborn General Hospital, a not-for-profit health care organization, had the following revenue-related transactions (amounts summarized for the year). 1. Services provided to inpatients and outpatients amounted to $9,600,

> How do the accounting treatments for charity services, patient discounts, contractual adjustments, and provision for bad debts differ in terms of their effects on patient service revenues and related receivables? Explain any differences between not-for-p

> The following transactions occurred at Jackson Hospital: 1. Under the will of Samuel H. Samuels, a bequest of $100,000 was received for research on gerontology. The principal of the bequest, as well as any earnings on investments, is expendable for the s

> Renfrow Rehabilitation Center uses fund accounting for internal purposes. Presented is the December 31, 2011 balance sheet prepared from the funds the center uses. Required The controller asks that you prepare an aggregated balance sheet in accordance w

> Rosemont Hospital, a not-for-profit hospital, recorded the following transactions. For each transaction, indicate the appropriate revenue or gain classification by selecting the letter or letters of that (those) classification(s) from the list in the rig

> The Shelter Association of Jefferson County receives the majority of its funding from the local chapter of the United Way. That federated fund-raising organization has a policy that if a member agency reports unrestricted net assets in excess of one year

> For several years, Baytown Rehabilitative Camp for Disabled Children (hereafter referred to as the camp) has applied for an operating grant from the Baytown Area United Way. As the finance adviser for the local United Way allocation panel, it is your res

> Compass State University Foundation (CSUF) was incorporated as a not-for-profit organization to support a public university in its fund-raising efforts and the management of its endowment. The foundation has a self-perpetuating board, one-third of whose

> The financial manager of a not-for-profit child care center wants to improve the monthly report to the board and has decided to include performance measures. What issues should the manager consider in calculating and reporting measures of performance? Wh

> Why are the intermediate sanction regulations an important tool for the IRS to use in curbing abuses such as excessive management compensation?

> A new not-for-profit board member suggests that the NPO create a separate audit committee to work with the external auditors. The other board members feel that it is already difficult to find community people with financial expertise who have the time to

> How can a not-for-profit museum ensure that its gift shop activities will not result in an unrelated business income tax liability?

> What are the required financial statements for (a) a not-for-profit health care entity and (b) a governmental health care entity reporting only business-type activities?

> Describe the general ways that the revised Form 990, applicable for tax year 2008 and beyond, is different from previous versions.

> What are the distinguishing characteristics between a public charity and a private foundation? Why do these differences result in different federal reporting requirements?

> Using Illustration 15–3 as a guide, indicate under which Internal Revenue Code section each of the following public charities is most likely to be exempt from federal income tax. a. Ottowa County Credit Union. b. Midwest Rheumatoid Arth

> A local not-for-profit organization that provides shelter for the homeless favors proposed legislation in the state that would facilitate converting an old hotel into a transitional living facility. What actions can the organization take to ensure this l

> Explain why a state has regulatory authority over a not-for-profit organization. When does he federal government have regulatory authority over a not for- profit organization?

> What incorporating documents should an auditor examine in conducting an audit or preparing an annual Form 990 tax return of a not-for-profit organization? What information in these documents is most useful to stakeholders external to the not-for-profit o

> Following are the operating statements for a public and private university. The operating statements have been adapted from the annual reports of a public and a private university. As would be expected, the reports are somewhat different. Boca Bay State

> Review each of the following cases that describe a public university and a foundation related to it (i.e., an institutionally related foundation). Explain whether the GASB criteria are met so that the organizations should be discretely presented in the f

> UPMIFA stands for the Uniform Prudent Management of Institutional Funds Act. This Act was approved in July 2006 and replaces the Uniform Management of Institutional Funds Act (UMIFA). Subsequent to approval of UPMIFA, the FASB issued Staff Position (FSP)

> Describe the dual-track system used in federal agency accounting. Compare this to the system by the same name used in the discussion of state and local government reporting under GASB standards.

> “The American Institute of CPAs (AICPA) is the primary source of generally accepted accounting principles (GAAP) for all health care organizations.” Do you agree with this statement? Why or why not?

> The Statement of Net Assets of Green Tree State University, a governmentally owned university, as of the end of its fiscal year June 30, 2010, follows. The following information pertains to the year ended June 30, 2011: 1. Cash collected from students&

> The debt limit for general obligation debt for Milos City is 1 percent of the assessed property valuation for the city. Using the following information, calculate the city’s debt margin. Assessed property valuation $10,863,511,000

> In the current fiscal year, St. George County issued $3,000,000 in general obligation term bonds for 102. The county is required to use any accrued interest or premiums for servicing the debt issue. a. How would the bond issue be recorded at the fund and

> On July 20, 2011, the building occupied by Sunshine City’s Parks and Recreation Department suffered severe structural damage as a result of a hurricane. It had been 48 years since a hurricane had hit the Sunshine City area, although hurricanes in Sunshin

> Crystal City signed a lease agreement with East Coast Builders, Inc., under which East Coast will construct a new office building for the city at a cost of $12 million and lease it to the city for 30 years. The city agrees to make an initial payment of $

> Lynn County has prepared the following schedule related to its capital asset activity for the fiscal year 2011. Lynn County has governmental activities only, with no business-type activities. Required a. Does the above capital asset footnote disclosure

> Make all necessary entries in the appropriate governmental fund general journal and the government-wide governmental activities general journal for each of the following transactions entered into by the City of Fordache. 1. The city received a donation o

> Recent river flooding damaged a part of the Town of Brownville Library. The library building is over 70 years old and is located in a part of the town that is on the national historic preservation register. Some of the costs related to the damage include

> How does the modified accrual basis of accounting differ from the accrual basis?

> Desert City is a rapidly growing city in the Southwest, with a current population of 200,000. To cope with the growing vehicular traffic and the need for infrastructure expansion (e.g., streets, sidewalks, lighting, storm water drains, and sewage systems

> Compare the accounting for capital projects financed by special assessment bonds when (a) a government assumes responsibility for debt service should special assessment collections be insufficient, as opposed to (b) the government assumes no responsibi

> The county replaced its old office building with a new structure. Rather than destroy the old office building, the county decided to convert the old building and use it as a storage facility. Why would the old office building need to be evaluated for imp

> Which expenditures of a capital projects fund should be capitalized to Construction Work in Progress? Is Construction Work in Progress included in the chart of accounts of a capital projects fund? If not, where would it be found?

> What disclosures about long-term liabilities are required in the notes to the financial statements?

> If a capital project is incomplete at the end of a fiscal year, why is it considered desirable to close Encumbrances and all operating statement accounts at year-end? Why is it desirable to reestablish the Encumbrances account as of the first day of the

> What is the purpose of a capital projects fund? Give some examples of projects that might be considered capital projects.

> Compare the reporting of intangible assets under GASB and FASB standards.

> How does one determine whether a particular lease is a capital lease or an operating lease? What entries are required in the general journals of a governmental fund and governmental activities at the government-wide level to record a capital lease at its

> What is the difference between using the modified approach to accounting for infrastructure assets and depreciating infrastructure assets? Under the modified approach, what happens if infrastructure assets are not maintained at or above the established c

> Explain what disclosures the GASB requires for capital assets in the notes to the financial statements.

> Why do governmental fund financial statements use a different basis of accounting and measurement focus than the Governmental Activities column of the government-wide financial statements? Also, which basis of accounting and which measurement focus appli

> What are general capital assets? How are they reported?

> Annabelle Benton, great-granddaughter of the founder of the Town of Benton, made a cash contribution in the amount of $500,000 to be held as an endowment. To account for this endowment, the town has created the Alex Benton Park Endowment Fund. Under term

> The City of Ashland’s General Fund had the following post-closing trial balance at April 30, 2010, the end of its fiscal year: During the year ended April 30, 2011, the following transactions, in summary form, with subsidiary ledger d

> What are the three sections of a comprehensive annual financial report (CAFR)? What information is contained in each section? How do the minimum requirements for general purpose external financial reporting relate in scope to the CAFR?

> The following transactions occurred during the 2011 fiscal year for the City of Fayette. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures