Question: For several years, Baytown Rehabilitative Camp for

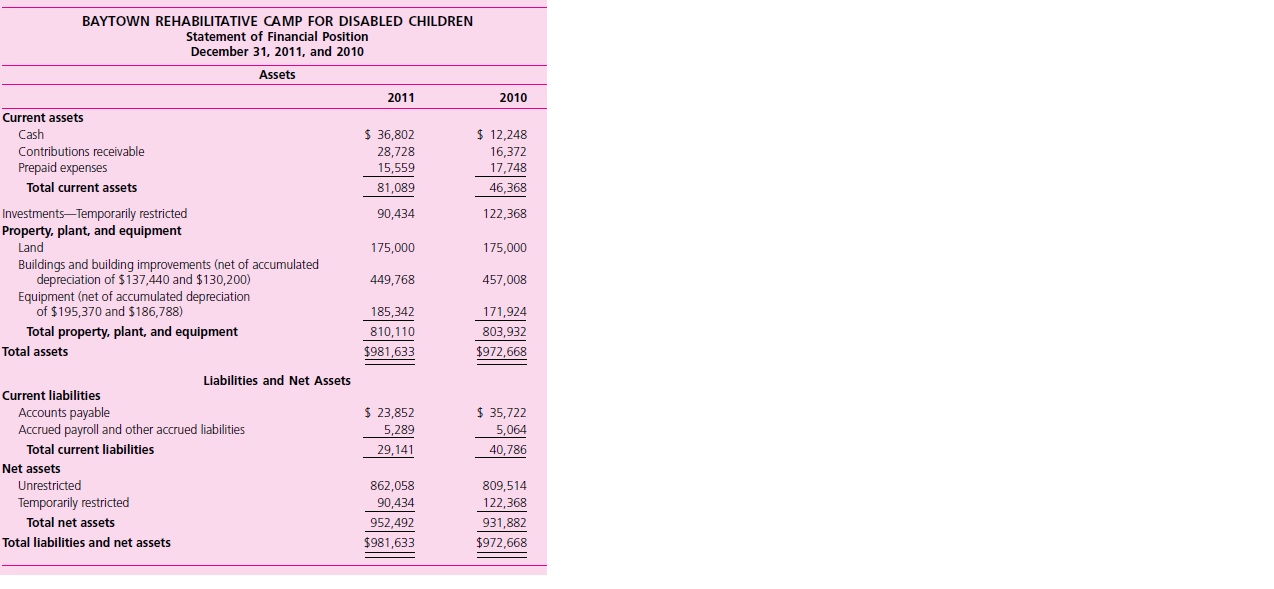

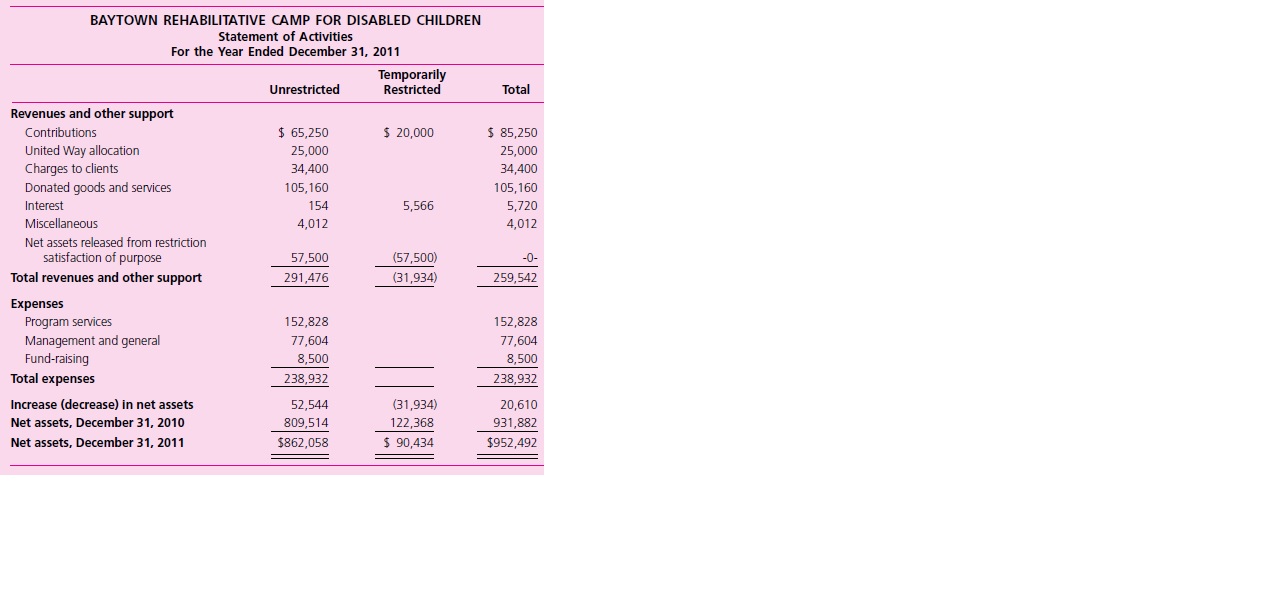

For several years, Baytown Rehabilitative Camp for Disabled Children (hereafter referred to as the camp) has applied for an operating grant from the Baytown Area United Way. As the finance adviser for the local United Way allocation panel, it is your responsibility to evaluate the camp’s budget request for the forthcoming year and its audited financial statements. The camp’s most recent comparative statement of financial position and statement of activities are presented below.

Additional Information: As reflected in the camp’s 2011 statement of activities, the United Way agency allocated $25,000 to the camp for fiscal year 2011. However, the amount allocated was $5,000 less than the camp had requested in its fiscal year 2011 budget, reflecting the allocation panel’s concern about the camp’s inadequate financial reserves and low ratio of program services expense to total expense (only 57 percent in 2010). As a condition for receiving the $25,000 fiscal year 2011 allocation, Baytown Rehabilitative Camp agreed to take actions to improve its financial reserves and its ratio of program services expense to total expense, including an increase in its fund-raising efforts and a reduction in its support payroll.

Another area of concern to the allocation panel has been the camp’s long delay in using a restricted contribution of $100,000 received several years earlier. This gift was restricted by the donor for future expansion of a building used as a dining hall and for rehabilitative activities. This contribution has been invested in CDs and has grown to $122,368 as of December 31, 2010.

The camp is requesting a $35,000 United Way allocation for fiscal year 2012, based on a growing demand for its services and improvement made in its financial condition. As financial adviser for the local United Way allocation panel, however, you note that much of the improvement in unrestricted net assets resulted from $37,500 of temporarily restricted net assets that were released from restriction during fiscal year 2011, with no corresponding increase in the balance of the Buildings and Building Improvements account. (Note: $20,000 of the $57,500 released from restriction related to $20,000 of temporarily restricted contributions received during 2011.) You immediately contact the camp administrator for an explanation, whereupon she explains that the board of directors voted to use $37,500 of previously restricted investments for operating purposes after the administrator reported to the board that the original agreement with the donor could not be located and the donor was now deceased. She further indicated that the board may continue to use this pool of resources to further improve the camp’s financial condition.

Required

a. As financial adviser, evaluate the camp’s statement of financial position and statement of activities and prepare a report for the chair of the allocation committee indicating the extent to which the camp’s financial situation has improved or worsened. You should base your recommendation on measures such as the current ratio and ratio of unrestricted net assets, net of total property, plant, and equipment, to total expenses for the year. In your analysis you should look at the camp’s unrestricted financial position, both including and excluding the questionable use of the $37,500 of restricted net assets for operating purposes.

b. Has the camp’s board of directors violated the terms of the $100,000 contribution that was restricted by the donor for future building expansion? What sanctions might be taken against the board and the camp administrator for not meeting their fiduciary responsibilities?

c. What amount of United Way funds would you recommend be allocated to the camp for fiscal year 2012? Explain your recommendation.

Transcribed Image Text:

BAYTOWN REHABILITATIVE CAMP FOR DISABLED CHILDREN Statement of Financial Position December 31, 2011, and 2010 Assets 2011 2010 Current assets $ 36,802 $ 12,248 16,372 17,748 Cash 28,728 15,559 Contributions receivable Prepaid expenses Total current assets 81,089 46,368 Investments-Temporarily restricted Property, plant, and equipment Land Buildings and building improvements (net of accumulated depreciation of $137,440 and $130,200) Equipment (net of Accumulated depreciation of $195,370 and $186,788) 90,434 122,368 175,000 175,000 449,768 457,008 185,342 171.924 Total property, plant, and equipment 810,110 803,932 Total assets $981,633 $972,668 Liabilities and Net Assets Current liabilities $ 23,852 $ 35,722 Accounts payable Accrued payroll and other accrued liabilities 5,289 5,064 Total current liabilities 29,141 40,786 Net assets 809,514 122,368 Unrestricted 862,058 Temporarily restricted 90,434 Total net assets 952,492 931,882 Total liabilities and net assets $981,633 $972,668 BAYTOWN REHABILITATIVE CAMP FOR DISABLED CHILDREN Statement of Activities For the Year Ended December 31, 2011 Temporarily Restricted Unrestricted Total Revenues and other support Contributions $ 65,250 $ 20,000 $ 85,250 United Way allocation Charges to clients Donated goods and services 25,000 25,000 34,400 34,400 105,160 105,160 Interest 154 5,566 5,720 Miscellaneous 4,012 4,012 Net assets released from restriction satisfaction of purpose 57,500 (57,500) -0- Total revenues and other support 291,476 (31.934) 259,542 Expenses Program services Management and general Fund-raising 152,828 152,828 77,604 77,604 8,500 8,500 Total expenses 238,932 238,932 52,544 809,514 Increase (decrease) in net assets (31,934) 20,610 Net assets, December 31, 2010 122,368 931,882 Net assets, December 31, 2011 $862,058 $ 90,434 $952,492

> What are the major types of auditor services described in the Government Accountability Office’s Government Auditing Standards (yellow book), and how do they differ?

> Define GAGAS, and describe how GAGAS differ from GAAS.

> A new board member for the Fire Protection District (a special purpose government) was reviewing the audit report for the district and noted that, although the district received an unqualified opinion, the audit report was longer than the one received by

> What is an opinion unit and of what significance is an opinion unit to the auditor?

> What are the three levels of audit to which a government or not-for-profit entity may be subject? Who is responsible for setting the standards or requirements for each of the three levels identified?

> The following is the pre-closing trial balance for Horton University as of June 30, 2011. Additional information related to net assets and the statement of cash flows is also provided. Additional information Net assets released from temporary restrict

> What are the benefits of having an audit committee?

> What is the National Single Audit Sampling Project and why is it important?

> Explain how federal award programs are selected for audit under the risk based approach.

> How is an OMB Circular A-133 audit related to a GAGAS audit? How is an OMB Circular A-133 audit different from a GAGAS audit?

> What is a revocable split-interest agreement and how is it recorded by a private college?

> What is an annuity agreement and how does it differ from a life income fund?

> Explain the conditions that must exist for a public or private college or university to avoid accounting recognition of the value of its collections of art, historical treasures, and similar assets.

> A private college has received a multi-year unconditional pledge from a major supporter. How will the college report the pledge in its financial statements?

> Compare the reporting of contributed services by private and public colleges and universities.

> What are some of the accounting and reporting differences between endowments and split-interest agreements?

> Following are several unrelated transactions involving a university. 1. In fiscal year 2011, the university was notified by the federal government that in 2012 it would receive a $500,000 grant for wetlands research. 2. The university received $234,000 i

> Private colleges and universities report temporarily and permanently restricted net assets. What, if any, comparable reporting is provided by public universities?

> Explain how restricted gifts and grants are reported by a public college or university. How would such restricted gifts and grants be recorded and reported by a private college or university?

> What are restricted assets and how are they shown in the financial statements?

> Describe some measures of performance that can be used in assessing whether a university operates effectively.

> Breyer Memorial Hospital received a $100,000 gift that was restricted by the donor for heart research. At fiscal year-end Breyer had incurred $25,000 in expenses related to this project. Explain how these transactions would be reported in Breyer’s balanc

> What is the difference in accounting for investments among investor-owned, not-for-profit, and governmental health care organizations?

> Elizabeth College, a small private college, had the following transactions in fiscal year 2011. 1. Billings for tuition and fees totaled $5,600,000. Tuition waivers and scholarships of $61,500 were granted. Students received tuition refunds of $101,670.

> Choose the best answer. 1. Under GASB standards, public colleges and universities engaged only in business-type activities present all of the following statements in their stand-alone reports except a: a. Statement of net assets. b. Statement of revenues

> The following balances come from the trial balance of Sherlock State College as of the end of the 2011 fiscal year. Required a. Prepare a statement of revenues, expenses, and changes in net assets for the year ended June 30, 2011, in good form. See Ill

> As part of your audit firm’s quality control policies, it maintains a record of continuing profession education (CPE) taken by professional staff members. Following is information on some of the classes, sessions, workshops, and conferences that the audi

> Choose the best answer. 1. Which of the following activities would always indicate that an auditor’s independence has been impaired? a. Providing advice on establishing an internal control system. b. Posting adjusting journal entries into the client’s ac

> Following is the unqualified audit report for the City of Sand Key. The Honorable Mayor Members of the City Commission and City Manager City of Sand Key We have audited the accompanying financial statements of the City of Sand Key (the City) as of and fo

> Indicate which of the following activities performed by an auditor for a governmental client are (a) allowable, (b) permitted if safeguards are in place, or (c) prohibited. 1. Serving as an adviser on the building subcommittee for the county. 2. Preparin

> Quad-States Community Service Agency expended federal awards during the most recent fiscal year in the following amounts for the programs shown: Additional information indicates that Programs 4 and 10 were audited as major programs in each of the two p

> The City of Topeka, Kansas, has received a Distinguished Budget Presentation Award for at least 12 years. An excerpt from the 2008 Budget is presented on the next page: Financial Policies, Guidelines, and Practices Budgeting, Accounting, and Audit Practi

> You are a governmental accountant for a large municipality, and you have recently been assigned to the Budget office and charged with building a better budget document—one that will be of the highest quality so that citizens and others with an interest i

> What is an example of a performance indicator and to what would it compare in investor-owned financial reporting?

> As a cost reimbursement accountant in a large public research university, you are aware that federal agencies have increased auditing efforts in the area of federal research grants to higher education institutions. In particular, OMB Circular A–21 detail

> The federal government through the Medicare and Medicaid programs is one of the largest providers of patient service revenues to health care organizations. Information concerning these programs is available through the Department of Health and Human Serv

> Responding to a growing need for medical care as its population grew in the early 1900s, Suffolk County founded the Suffolk County Hospital in 1920, financing construction of the original hospital building and equipment with a $500,000 general obligation

> The local newspaper of a large urban area printed a story titled “Charity Care by Hospitals Stirs Debate.” The story quotes one legislator who wants “to ensure that the state’s nonpr

> The U.S. Department of Health and Human Services maintains the Web site www.hospitalcompare.hhs.gov, which provides an array of process of care and outcome of care measures that report on how well individual hospitals are caring for their patients, compa

> Choose the best answer. 1. The organization assigned primary responsibility for establishing accounting and financial reporting standards for health care organizations is the: a. American Institute of CPAs (AICPA). b. Financial Accounting Standards Board

> The Phelps Community Hospital balance sheet as of December 31, 2010, follows. Required a. Record in general journal form the effect of the following transactions during the fiscal year ended December 31, 2011, assuming that Phelps Community Hospital is

> Examine the financial statements for Oak Valley Hospital for the years ended December 31, 2010, and 2011. Required Prepare a short answer to address each of the following questions. a. Discuss the relative importance of different classifications of asse

> During 2011, the following selected events and transactions were recorded by Nichols County Hospital. 1. Gross charges for hospital services, all charged to accounts and notes receivable, were as follows: 2. After recording patient service revenues, it

> During its current fiscal year, Dearborn General Hospital, a not-for-profit health care organization, had the following revenue-related transactions (amounts summarized for the year). 1. Services provided to inpatients and outpatients amounted to $9,600,

> How do the accounting treatments for charity services, patient discounts, contractual adjustments, and provision for bad debts differ in terms of their effects on patient service revenues and related receivables? Explain any differences between not-for-p

> The following transactions occurred at Jackson Hospital: 1. Under the will of Samuel H. Samuels, a bequest of $100,000 was received for research on gerontology. The principal of the bequest, as well as any earnings on investments, is expendable for the s

> Renfrow Rehabilitation Center uses fund accounting for internal purposes. Presented is the December 31, 2011 balance sheet prepared from the funds the center uses. Required The controller asks that you prepare an aggregated balance sheet in accordance w

> Rosemont Hospital, a not-for-profit hospital, recorded the following transactions. For each transaction, indicate the appropriate revenue or gain classification by selecting the letter or letters of that (those) classification(s) from the list in the rig

> The Shelter Association of Jefferson County receives the majority of its funding from the local chapter of the United Way. That federated fund-raising organization has a policy that if a member agency reports unrestricted net assets in excess of one year

> Compass State University Foundation (CSUF) was incorporated as a not-for-profit organization to support a public university in its fund-raising efforts and the management of its endowment. The foundation has a self-perpetuating board, one-third of whose

> The financial manager of a not-for-profit child care center wants to improve the monthly report to the board and has decided to include performance measures. What issues should the manager consider in calculating and reporting measures of performance? Wh

> Why are the intermediate sanction regulations an important tool for the IRS to use in curbing abuses such as excessive management compensation?

> A new not-for-profit board member suggests that the NPO create a separate audit committee to work with the external auditors. The other board members feel that it is already difficult to find community people with financial expertise who have the time to

> How can a not-for-profit museum ensure that its gift shop activities will not result in an unrelated business income tax liability?

> What are the required financial statements for (a) a not-for-profit health care entity and (b) a governmental health care entity reporting only business-type activities?

> Describe the general ways that the revised Form 990, applicable for tax year 2008 and beyond, is different from previous versions.

> What are the distinguishing characteristics between a public charity and a private foundation? Why do these differences result in different federal reporting requirements?

> Using Illustration 15–3 as a guide, indicate under which Internal Revenue Code section each of the following public charities is most likely to be exempt from federal income tax. a. Ottowa County Credit Union. b. Midwest Rheumatoid Arth

> A local not-for-profit organization that provides shelter for the homeless favors proposed legislation in the state that would facilitate converting an old hotel into a transitional living facility. What actions can the organization take to ensure this l

> Explain why a state has regulatory authority over a not-for-profit organization. When does he federal government have regulatory authority over a not for- profit organization?

> What incorporating documents should an auditor examine in conducting an audit or preparing an annual Form 990 tax return of a not-for-profit organization? What information in these documents is most useful to stakeholders external to the not-for-profit o

> Following are the operating statements for a public and private university. The operating statements have been adapted from the annual reports of a public and a private university. As would be expected, the reports are somewhat different. Boca Bay State

> Review each of the following cases that describe a public university and a foundation related to it (i.e., an institutionally related foundation). Explain whether the GASB criteria are met so that the organizations should be discretely presented in the f

> UPMIFA stands for the Uniform Prudent Management of Institutional Funds Act. This Act was approved in July 2006 and replaces the Uniform Management of Institutional Funds Act (UMIFA). Subsequent to approval of UPMIFA, the FASB issued Staff Position (FSP)

> Describe the dual-track system used in federal agency accounting. Compare this to the system by the same name used in the discussion of state and local government reporting under GASB standards.

> “The American Institute of CPAs (AICPA) is the primary source of generally accepted accounting principles (GAAP) for all health care organizations.” Do you agree with this statement? Why or why not?

> The Statement of Net Assets of Green Tree State University, a governmentally owned university, as of the end of its fiscal year June 30, 2010, follows. The following information pertains to the year ended June 30, 2011: 1. Cash collected from students&

> The debt limit for general obligation debt for Milos City is 1 percent of the assessed property valuation for the city. Using the following information, calculate the city’s debt margin. Assessed property valuation $10,863,511,000

> In the current fiscal year, St. George County issued $3,000,000 in general obligation term bonds for 102. The county is required to use any accrued interest or premiums for servicing the debt issue. a. How would the bond issue be recorded at the fund and

> On July 20, 2011, the building occupied by Sunshine City’s Parks and Recreation Department suffered severe structural damage as a result of a hurricane. It had been 48 years since a hurricane had hit the Sunshine City area, although hurricanes in Sunshin

> Crystal City signed a lease agreement with East Coast Builders, Inc., under which East Coast will construct a new office building for the city at a cost of $12 million and lease it to the city for 30 years. The city agrees to make an initial payment of $

> Lynn County has prepared the following schedule related to its capital asset activity for the fiscal year 2011. Lynn County has governmental activities only, with no business-type activities. Required a. Does the above capital asset footnote disclosure

> Make all necessary entries in the appropriate governmental fund general journal and the government-wide governmental activities general journal for each of the following transactions entered into by the City of Fordache. 1. The city received a donation o

> Recent river flooding damaged a part of the Town of Brownville Library. The library building is over 70 years old and is located in a part of the town that is on the national historic preservation register. Some of the costs related to the damage include

> How does the modified accrual basis of accounting differ from the accrual basis?

> Desert City is a rapidly growing city in the Southwest, with a current population of 200,000. To cope with the growing vehicular traffic and the need for infrastructure expansion (e.g., streets, sidewalks, lighting, storm water drains, and sewage systems

> Compare the accounting for capital projects financed by special assessment bonds when (a) a government assumes responsibility for debt service should special assessment collections be insufficient, as opposed to (b) the government assumes no responsibi

> The county replaced its old office building with a new structure. Rather than destroy the old office building, the county decided to convert the old building and use it as a storage facility. Why would the old office building need to be evaluated for imp

> Which expenditures of a capital projects fund should be capitalized to Construction Work in Progress? Is Construction Work in Progress included in the chart of accounts of a capital projects fund? If not, where would it be found?

> What disclosures about long-term liabilities are required in the notes to the financial statements?

> If a capital project is incomplete at the end of a fiscal year, why is it considered desirable to close Encumbrances and all operating statement accounts at year-end? Why is it desirable to reestablish the Encumbrances account as of the first day of the

> What is the purpose of a capital projects fund? Give some examples of projects that might be considered capital projects.

> Compare the reporting of intangible assets under GASB and FASB standards.

> How does one determine whether a particular lease is a capital lease or an operating lease? What entries are required in the general journals of a governmental fund and governmental activities at the government-wide level to record a capital lease at its

> What is the difference between using the modified approach to accounting for infrastructure assets and depreciating infrastructure assets? Under the modified approach, what happens if infrastructure assets are not maintained at or above the established c

> Explain what disclosures the GASB requires for capital assets in the notes to the financial statements.

> Why do governmental fund financial statements use a different basis of accounting and measurement focus than the Governmental Activities column of the government-wide financial statements? Also, which basis of accounting and which measurement focus appli

> What are general capital assets? How are they reported?

> Annabelle Benton, great-granddaughter of the founder of the Town of Benton, made a cash contribution in the amount of $500,000 to be held as an endowment. To account for this endowment, the town has created the Alex Benton Park Endowment Fund. Under term

> The City of Ashland’s General Fund had the following post-closing trial balance at April 30, 2010, the end of its fiscal year: During the year ended April 30, 2011, the following transactions, in summary form, with subsidiary ledger d

> What are the three sections of a comprehensive annual financial report (CAFR)? What information is contained in each section? How do the minimum requirements for general purpose external financial reporting relate in scope to the CAFR?

> The following transactions occurred during the 2011 fiscal year for the City of Fayette. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures

> The following transactions affected various funds and activities of the City of Atwater. 1. The Fire Department, a governmental activity, purchased $100,000 of water from the Water Utility Fund, a business-type activity. 2. The Municipal Golf Course, an

> At the end of a fiscal year, budgetary and operating statement control accounts in the general ledger of the General Fund of Dade City had the following balances: Appropriations, $6,224,000; Estimated Other Financing Uses, $2,776,000; Estimated Revenues,

> The City of Eldon applied for a competitive grant from the state government for park improvements such as upgrading hiking trails and bike paths. On May 1, 2011, the City was notified that it had been awarded a grant of $200,000 for the program, to be re

> The Village of Baxter uses the purchases method of accounting for its inventories of supplies in the General Fund. GASB standards, however, require that the consumption method be used for the government-wide financial statements. Because its computer sys

> The Village of Darby’s budget calls for property tax revenues for the fiscal year ending December 31, 2011, of $2,660,000. Village records indicate that, on average, 2 percent of taxes levied are not collected. The county tax assessor has assessed the va

> The City of Perrin collects its annual property taxes late in its fiscal year. Consequently, each year it must finance part of its operating budget using tax anticipation notes. The notes are repaid upon collection of property taxes. On April 1, 2011, th

> GASB financial reporting standards assist users in assessing the operational accountability of a government’s business-type activities and the fiscal accountability of its governmental activities.” Do you agree or disagree with this statement? Why or why

> Choose the best answer. 1. When equipment was purchased with General Fund resources, which of the following accounts would have been debited in the General Fund? a. Expenditures. b. Equipment. c. Encumbrances. d. No entry should be made in the General Fu