Question: Explain a key difference in the interpretation

Explain a key difference in the interpretation of the ABC data in Exhibit 5–7 (Patio Grill Company) and Exhibit 5–16 (Delaware Medical Center).

Exhibit 5-7:

Exhibit 5-16:

Transcribed Image Text:

E Microsoft Excel - Activity-Based Costing Data and Calculations E Ele Edit View Irsert Fgrmat Iools Data Window Help Type a question for help E6 A =B6/D6 A B F G 1 Product Activity Cost Cost Activity Activity Cost Driver Cost for Line Cost Cost Driver Pool Product Quantity for Product Production per Unit Activity Pool Driver Quantity Rate Line Product Line Line Volume of Product $ 1.242.000 Machine 6 Machine 7 Related 10.000 $ 8,000 230.000$ STD DEL 100,000 $ 540.000 96,000 34.000 5.40 54.00 Hours 518,400 64.80 ULT 183.600 2.000 91.80 Total 230,000 1,242,000 10 Setup 210.000 Production 200 1.050.00 8.40 10.50 STD 80 84,000 10.000 11 Runs DEL 80 84,000 8.000 12 ULT 40 42,000 2,000 21.00 13 Total 200 210,000 14 Purchasing 15 16 300,000 Purchase Orders 100,000 96, 600 500.00 STD 200 10,000 10.00 DEL 192 8,000 ULT 208 104,000 2.000 52.00 17 Total 600 300,000 340,000 Production 200| 1,700.00 18 Material 19 Handling 20 STD 80 136.000 10,000 13.60 Runs DEL 80 136,000 8,000 17.00 ULT 40 68,000 2,000 34.00 21 Total 200 340,000 22 Quality 23 Assurance 110,000 Inspection Hours 2,200 50.00 STD 800 40.000 10,000 4.00 DEL 800 40,000 8,000 5.00 24 ULT 600 30,000 2,000 15.00 25 Total 2,200 110,000 26 Packing 27 Shipping 28 264.000 Shipments 2,200 120.00 STD 1,000 120,000 10,000 12.00 8,000 2,000 DEL B00 96,000 12.00 ULT 400 48,000 24.00 29 Total 2,200 264,000 30 Engineering 31 Design 32 130,000 Engineering Hours 1,300 100.00 STD 500 50,000 10,000 5.00 DEL 400 40,000 8,000 5.00 ULT 400 40,000 2,000 20.00 33 Total 1,300 130,000 34 Facility 35 2,300,000 Machine Hours 230,000 10.00 STD 100,000 1,000,000 10,000 100.00 DEL 96,000 960,000 8,000 120.00 36 ULT 34,000 340,000 2,000 170.00 37 Total 230,000 2,300,000 38 39 Grand Total $ 4,896,000 Grand Total $4,896,000 Sheeti / Sheet2 Sheet3 14 4 Ready Microsoft Excel - Activity Based Costing Analysis - Delaware Medical Center Ee Eat yew sert Fermat Toos Data ndo eo E6 Type a queton fr help A B C DE F G H K Activity Cost per Visit Patient of J Activity Patient Quantity for Cost for Patient Туре Cost Driver Patient Activity Cost Pool Cost Driver Pool Quantity Rate Туре Patient Cost Driver Visit Activity 5 6 Physician 7 Time Туре Visit Type Volume Each Type 5 960.000 Physician Minutes With Patient 240,000 54.00 Routine Extended B0.000 |$ 320,000 400,000 240,000 960,000 8,000 5 5,000 2,000 40.00 80.00 120.00 100.000 60,000 Complex Total 240,000 90,000 NP Minutes With Patient 12,000 10.000 8,000 1,200 500 320 10 Nurse 30,000 3.00 Routine Extended 36,000 30,000 24,000 30.00 11 Practitioner 12 (NP) Time 13 14 Intern or 15 Resident 16 (UR) Time 17 18 Registered 60.00 Complex 75.00 Total 30,000 90,000 412.500 IR Minutes With Patient 3.30 Routine Extended Complex 132,000 165,000 33.00 66.00 115.50 125,000 40,000 50,000 35,000 4,000 2,500 1,000 115,500 Total 125.000 412,500 245,200 Routine 281,900 RN Minutes With Patient 13,200 8,000 3,320 11.50 11.50 11.50 1.15 132,000 151,000 92,000 38,180 19 Nurse Extended 80,000 20 RN) Time Complex 33,200 21 Total 245.200 22 Clerical Tim 23 New 24 Patients 135,300 New Patient Visits 781,980 79,200 33,000 12.300 11.00 Routine Extended 7,200 3,000 7,200 3,000 2,100 11.00 11.00 11.00 Complex 2,100 23,100 135,300 25 26 Clerical Tim 27 Continuing 28 Patients Total 12,300 61,100 Continuing Patient Visits 12.220 Routine Extended Complex Total 76,960 0.50 Routine Extended Complex Total 24,520 10.00 Routine Extended Complex Total 5.00 6,000 5,000 1,220 30,000 25,000 6,100 61,100 13,200 12,000 13,280 6,000 5,000 1,220 5.00 5.00 5.00 29 12.220 30 Billing 31 32 33 34 Facility 35 36 37 38,480 Billing Lines 26,400 24,000 13,200 8,000 3,320 1.00 1.50 4.00 26.560 76.960 38,480 245,200 Patient Visits (Both New & Continuing) 13,200 132,000 80,000 33,200 13,200 8,000 3,320 10.00 10.00 10.00 8,000 3,320 24.520 245,200 38 39 Grand Total $2.224.560 Grand Total $2.224,560 Sheetl/ Sheet2 / Sheet3 / Ready 234 5678

> What is meant by the term non-value-added costs?

> Distinguish between out-of-pocket costs and opportunity costs.

> Suggest an appropriate activity base (or cost driver) for each of the following organizations: (a) hotel, (b) hospital, (c) computer manufacturer, (d) computer sales store, (e) computer repair service, and (f) public accounting firm.

> Several costs incurred by Cape Cod Hotel and Restaurant are given in the following list. For each cost, indicate which of the following classifications best describe the cost. More than one classification may apply to the same cost item. Cost Classificat

> Briefly explain what is meant by each of the following ethical standards for managerial accountants: competence, confidentiality, integrity, and credibility.

> Which of the following costs are likely to be controllable by the chief of nursing in a hospital? a. Cost of medication administered. b. Cost of overtime paid to nurses due to scheduling errors. c. Cost of depreciation of hospital beds.

> Toledo Toy Company incurred the following costs during 20x4. The company sold all of its products manufactured during the year. Direct material .................................................................... $4,500,000 Direct labor ................

> Define and explain the significance of the term CMA.

> List three costs that are likely to be controllable by a city’s airport manager. List three costs that are likely to be uncontrollable by the manager.

> The Department of Natural Resources is responsible for maintaining the state’s parks and forest lands, stocking the lakes and rivers with fish, and generally overseeing the protection of the environment. Several costs incurred by the agency are listed b

> Evaluate the following statement: “If a resource has unused capacity, that capacity is lost forever.”

> What does the term sales mix mean? How is a weighted-average unit contribution margin computed?

> List three direct costs of the food and beverage department in a hotel. List three indirect costs of the department.

> Define the following terms, and explain the relationship between them: (a) cost estimation, (b) cost behavior, and (c) cost prediction.

> Refer to Exhibit 2–3, and answer the following questions. Required: 1. List the major differences between the income statements shown for Caterpillar, Walmart, and Southwest Airlines. 2. Explain how cost-accounting data were used to pr

> Explain the following terms: practical capacity, cost of resources supplied, cost of resources used, and cost of resources unused.

> Would each of the following characteristics be a volume-based or an operations-based cost driver in a college: a. Number of students b. Number of disciplines offered for study c. Urban versus rural location?

> Nantucket Tee manufactures T-shirts and decorates them with custom designs for retail sale on the premises. Several costs incurred by the company are listed below. For each cost, indicate which of the following classifications best describe the cost. Mor

> What is the chief difference between manufacturing and service industry firms?

> Distinguish between volume-based and operations based cost drivers in the airline industry.

> Air Frame Technology, Inc. incurs a variable cost of $16 per kilogram for raw material to produce a special alloy used in manufacturing aircraft. Required: 1. Draw a graph of the firm’s raw material cost, showing the total cost at the following product

> What is meant by the following statement? “Managerial accounting often serves an attention-directing role.”

> How does the variable cost per unit change as the level of activity (or cost driver) increases? Why?

> What is the difference between a manufacturing company’s gross margin and its total contribution margin?

> Describe the importance of cost behavior patterns in planning, control, and decision making.

> The following selected data were taken from the accounting records of Manitoba Manufacturing Company. The company uses direct-labor hours as its cost driver for overhead costs. June’s costs consisted of machine supplies ($153,000), depr

> Lone Mountain Extraction, which mines ore in Idaho, uses a calendar year for both financial-reporting and tax purposes. The following selected costs were incurred in December, the low point of activity, when 1,400 tons of ore were extracted: Peak activit

> Liberty Bell Fitness, Inc. operates a chain of fitness centers in Philadelphia. The firm’s controller is accumulating data to be used in preparing its annual profit plan for the coming year. The cost behavior pattern of the firmâ&

> The Piedmont School of Music has hired you as a consultant to help in analyzing the behavior of the school’s costs. Use the account-classification method of cost estimation to classify each of the following costs as variable, fixed, or semivariable. Befo

> For each of the following cost items (1 through 11), choose the graph (a through l) that best represents it. 1. The cost of utilities at a university. For low student enrollments, utility costs increase with enrollment, but at a decreasing rate. For larg

> Working in a group, use the Internet to identify a company that has been the subject of significant public discussion due to one or more ethical lapses in the last decade. Required: As a group, research what happened and then make a presentation to the

> Jefferson County Airport handles several daily commuter flights and many private flights. The county budget officer has compiled the following data regarding airport costs and activity over the past year. /\ Required: 1. Draw a scatter diagram of the ai

> Randolph Dana owns a catering company that prepares banquets and parties for business functions throughout the year. Dana’s business is seasonal, with a heavy schedule during the summer months and the year-end holidays. During peak peri

> Shortly after being hired as a cost analyst with Florida International Airlines, Kim Williams was asked to prepare a report that focused on passenger ticketing cost. The airline writes most of its own tickets, makes little use of travel agents, and has s

> The controller of Saratoga Auto Cylinder Company believes that the identification of the variable and fixed components of the firm’s costs will enable the firm to make better planning and control decisions. Among the costs the controlle

> Shenandoah Valley Golf Association is a nonprofit, private organization that operates three 18-hole golf courses in Virginia. The organization’s financial director has just analyzed the course maintenance costs incurred by the golf asso

> Refer to the data and accompanying information in the preceding case. Required: 1. Use the high-low method to estimate the cost behavior for the clinic’s administrative costs. Express the cost behavior in formula form (Y 5 a 1 bX). What is the variable

> “I don’t understand this cost report at all,” exclaimed Jeff Mahoney, the newly appointed administrator of Valley General Hospital. “Our administrative costs in the new pediatrics c

> Outside Environment, Inc. provides commercial landscaping services in San Diego. Sasha Cairns, the firm’s owner, wants to develop cost estimates that she can use to prepare bids on jobs. After analyzing the firm’s cost

> Give an example of a customer-value-added activity and a business-value-added activity in a hotel.

> What is a customer profitability profile?

> Why are product costs also called inventoriable costs?

> Explain the relationship between customer profitability analysis and activity-based costing.

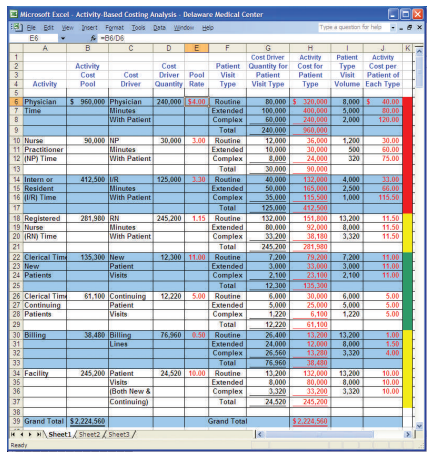

> How could the administration at Delaware Medical Center’s Primary Care Unit use the activity-based costing information developed by the ABC project team?

> What is the role of activity dictionary in an ABC project?

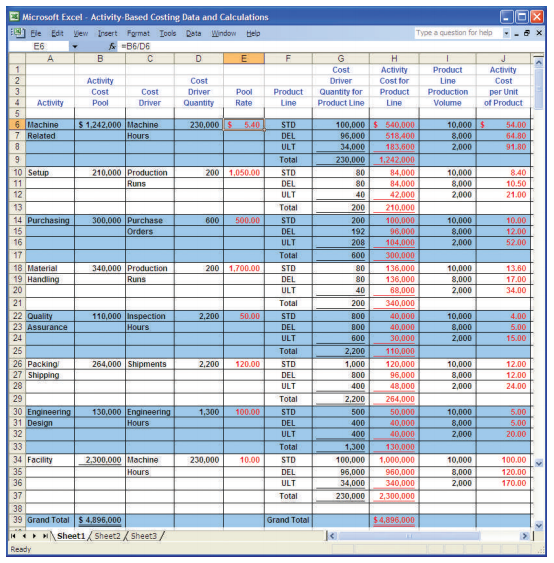

> Explain the concept of a pool rate in activity-based costing. (Refer to Exhibit 5–6 .) Exhibit 5-6: INFORMATION SUPPLIED BY ABC PROJECT TEAM Activity Cost driver quantity for each product line; drivers add column G to get total in

> Distinguish between an activity’s trigger and its root cause. Give an example of each.

> What is meant by the term activity analysis? Give three criteria for determining whether an activity adds value.

> Explain the concept of two-dimensional ABC. Support your explanation with a diagram.

> Explain why the maintenance of the medical-services provider network is treated as a product-sustaining level activity by Pennsylvania Blue Shield.

> Are activity-based costing systems appropriate for the service industry? Explain.

> Kaleidoscope Cutlery manufactures kitchen knives. One of the employees, whose job is to cut out wooden knife handles, worked 49 hours during a week in January. The employee earns $14 per hour for a 40-hour week. For additional hours the employee is paid

> Explain why a manufacturer with diverse product lines may benefit from an ABC system.

> Explain why a new product-costing system may be needed when line managers suggest that an apparently profitable product be dropped.

> List three factors that are important in selecting cost drivers for an ABC system.

> Briefly explain two factors that tend to result in product cost distortion under traditional, volume-based product costing systems.

> How is the distinction between direct and indirect costs handled differently under volume-based versus activity based costing systems?

> Why do product-costing systems based on a single, volume-based cost driver tend to overcost high-volume products? What undesirable strategic effects can such distortion of product costs have?

> How can an activity-based costing system alleviate the problems Patio Grill Company’s management was having under its traditional, volume-based product-costing system?

> List and briefly describe the four broad categories of activities identified in stage one of an activity-based costing system.

> What are cost drivers? What is their role in an activity-based costing system?

> Explain how an activity-based costing system operates.

> Pinellas Printer Company manufactures printers for use with home computing systems. The firm currently manufactures both the electronic components for its printers and the plastic cases in which the devices are enclosed. Jim Cassanitti, the production ma

> Why was Patio Grill Company’s management being misled by the traditional product-costing system? What mistakes were being made?

> Briefly explain how a traditional, volume-based product-costing system operates.

> What is meant by customer-profitability analysis? Give an example of an activity that might be performed more commonly for one customer than for another.

> FiberCom, Inc., manufactures fiber optic cables for the computer and telecommunications industries. At the request of the company vice president of marketing, the cost management staff has recently completed a customer-profitability study. The following

> Contemporary Kitchen Furnishings, Inc. (CKF) manufactures a variety of housewares for the consumer market in the midwest. The company’s three major product lines are cooking utensils, tableware, and flatware. CKF implemented activity-based costing four y

> Refer to the information given in the preceding problem for Bodacious Bagels, Inc. Data from Bodacious Bagels, Inc.: Bodacious Bagels, Inc., manufactures a variety of bagels, which are frozen and sold in grocery stores. The production process consists o

> Bodacious Bagels, Inc., manufactures a variety of bagels, which are frozen and sold in grocery stores. The production process consists of the following steps. 1. Ingredients, such as flour and raisins, are received and inspected. Then they are stored unt

> Refer to the product costs developed in requirement (5) of Problem 5–60. Prepare a table showing how Gigabyte’s traditional, volume-based product-costing system distorts the product costs of gismos, thingamajigs, and w

> Refer to the new target prices calculated in the preceding problem for Gigabyte’s three products, based on the new activity-based costing system. Data from previous problem: Required: Write a memo to the company president commenting

> Gigabyte, Inc., manufactures three products for the computer industry: Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units The company uses a tradition

> List two plausible goals for each of these organizations: Amazon.com, American Red Cross, General Motors, Walmart, the City of Seattle, and Hertz.

> Scott Manufacturing produces two items in its Virginia Beach plant: Tuff Stuff and Ruff Stuff. Since inception, Scott has used only one manufacturing-overhead cost pool to accumulate costs. Overhead has been allocated to products based on direct-labor ho

> Ultratech, Inc., manufactures several different types of printed circuit boards; however, two of the boards account for the majority of the company’s sales. The first of these boards, a television circuit board, has been a standard in t

> Queensland Electronics Company manufactures two large-screen television models, the Novelle, which has been produced for 10 years and sells for $910, and the Zodiac, a new model introduced in early 20x3, which sells for $1,160. Based on the following inc

> Pensacola Air Industries (PAI) manufactures aircraft parts for small aircraft. Over the past decade, PAI’s management has met its goal of reducing its reliance on government contract work to 50 percent of total sales. Thus, PAI’s sales are now roughly ev

> Gourmet Specialty Coffee Company (GSCC) is a distributor and processor of different blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. GSCC currently has 12 different coffees that it of

> Knickknack, Inc., manufactures two products: odds and ends. The firm uses a single, plantwide overhead rate based on direct-labor hours. Production and product-costing data are as follows: Manufacturing overhead budget: Machine-related costs. .........

> Refer to the original data given in the preceding problem for Rapid City Technology, Inc. Data from Rapid City Technology, Inc: An order for 1,000 boxes of a chemical product designated JLRP has the following production requirements. Machine setups....

> Rapid City Technology, Inc. manufactures chemicals used in agricultural pest control. The controller has established the following activity cost pools and cost drivers. An order for 1,000 boxes of a chemical product designated JLRP has the following pro

> John Patrick has recently been hired as controller of Valdosta Vinyl Company (VVC), a manufacturer of vinyl siding used in residential construction. VVC has been in the vinyl siding business for many years and is currently investigating ways to modernize

> Meditech, Inc. manufactures two types of medical devices, Medform and Procel, and applies overhead on the basis of direct-labor hours. Anticipated overhead and direct-labor time for the upcoming accounting period are $710,000 and 20,000 hours, respective

> Jay Maxey retired a few years ago at age 48, courtesy of the numerous stock options he had been granted while president of e-shops.com, an Internet start-up company. He soon moved to Montana to follow his dream of living in the mountains and Big-Sky coun

> Digital Light Corporation has just completed a major change in its quality control (QC) process. Previously, products had been reviewed by QC inspectors at the end of each major process, and the company’s 10 QC inspectors were charged a

> Wilmington Office Equipment Corporation manufactures two types of filing cabinets—Deluxe and Executive—and applies manufacturing overhead to all units at the rate of $80 per machine hour. Production information follows

> Refer to your solution to requirement (2) of the preceding problem. Exhibit 5-6: Required: Prepare an exhibit similar to Exhibit 5–6 in the text to explain the ABC calculations for the material-handling activity. Use your exhibit to e

> Kitchen King’s Toledo plant manufactures three product lines, all multi-burner, ceramic cook tops. The plant’s three product models are the Regular (REG), the Advanced (ADV), and the Gourmet (GMT). Until recently, the

> Clark and Shiffer LLP perform activities related to e-commerce consulting and information systems in Vancouver, British Columbia. The firm, which bills $140 per hour for services performed, is in a very tight local labor market and is having difficulty f

> Refer to the information given in the preceding problem for FiberCom, Inc., and two of its customers, Caltex Computer and Trace Telecom. Additional information for six of FiberCom’s other customers for the most recent year follows: Cust

> Since you have always wanted to be an industrial baron, invent your own product and describe at least five steps used in its production. Required: Explain how you would go about identifying non-value-added costs in the production process.

> Visit the website of a city, state, or Canadian province of your choosing (e.g., the City of Charlotte, www.charmeck.org ). Required: Read about the services offered to the public by this governmental unit. Then discuss how activity-based costing could

> Refer to the information given in the preceding exercise. For each of the activity cost pools identified, indicate whether it represents a unit-level, batch-level, product-sustaining-level, or facility-level activity. Information from previous exercise:

> Windy City Design Company specializes in designing commercial office space in Chicago. The firm’s president recently reviewed the following income statement and noticed that operating profits were below her expectations. She had a hunch

> Give an example of managerial accounting information that could help a manager make each of the following decisions. 1. The production manager in an automobile plant is deciding whether to have routine maintenance performed on a machine weekly or biweekl

> The customer-profitability analysis for Patio Grill Company, which is displayed in Exhibit 5–14 , ranks customers by operating income. An alternative, often-used approach is to rank customers by sales revenue. Exhibit 5-14: Exhibit

> Visit a restaurant for a meal or think carefully about a recent visit to a restaurant. List as many a activities as you can think of that would be performed by the restaurant’s employees for its customers. Required: For each activity on your list, indi

> List five activities performed by the employees of an airline on the ground. Required: For each of these activities, suggest a performance measure that could be used in activitybased management.

> Non-value-added costs occur in nonmanufacturing organizations, just as they do in manufacturing firms. Required: Identify four potential non-value-added costs in (1) an airline, (2) a bank, and (3) a hotel.