Question: Knickknack, Inc., manufactures two products: odds

Knickknack, Inc., manufactures two products: odds and ends. The firm uses a single, plantwide overhead rate based on direct-labor hours. Production and product-costing data are as follows:

Manufacturing overhead budget:

Machine-related costs. ......................................................... $1,800,000

Setup and inspection. ................................................................. 720,000

Engineering ................................................................................ 360,000

Plant-related costs ..................................................................... 384,000

Total ......................................................................................... $3,264,000

Predetermined overhead rate:

Knickknack, Inc., prices its products at 120 percent of cost, which yields target prices of $796.80 for odds and $1,195.20 for ends. Recently, however, Knickknack has been challenged in the market for ends by a European competitor, Bricabrac Corporation. A new entrant in this market, Bricabrac has been selling ends for $880 each. Knickknack’s president is puzzled by Bricabrac’s ability to sell ends at such a low cost. She has asked you (the controller) to look into the matter. You have decided that Knickknack’s traditional, volume-based product-costing system may be causing cost distortion between the firm’s two products. Ends are a high-volume, relatively simple product. Odds, on the other hand, are quite complex and exhibit a much lower volume. As a result, you have begun work on an activity-based costing system.

Required:

1. Let each of the overhead categories in the budget represent an activity cost pool. Categorize each in terms of the type of activity (e.g., unit-level activity).

2. The following cost drivers have been identified for the four activity cost pools.

You have gathered the following additional information:

• Each odd requires 8 machine hours, whereas each end requires 2 machine hours.

• Odds are manufactured in production runs of 25 units each. Ends are manufactured in 125 unit batches.

• Three-quarters of the engineering activity, as measured in terms of change orders, is related to odds.

• The plant has 3,840 square feet of space, 80 percent of which is used in the production of odds.

For each activity cost pool, compute a pool rate.

3. Determine the unit cost, for each activity cost pool, for odds and ends.

4. Compute the new product cost per unit for odds and ends, using the ABC system.

5. Using the same pricing policy as in the past, compute prices for odds and ends. Use the product costs determined by the ABC system.

6. Show that the ABC system fully assigns the total budgeted manufacturing overhead costs of $3,264,000.

7. Show how Knickknack’s traditional, volume-based costing system distorted its product costs. (Use Exhibit 5–10 for guidance.)

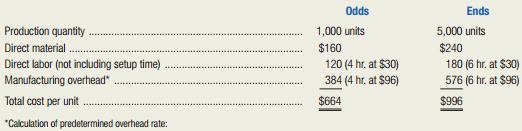

Exhibit 5–10:

Transcribed Image Text:

Odds Ends Production quantity. 1,000 units 5,000 units Direct material $160 $240 Direct labor (not including setup time) Manufacturing overhead" 120 (4 hr. at $30) 180 (6 hr. at $30) 576 (6 hr. at $96) 384 (4 hr. at $96) Total cost per unit $664 $996 "Calculation of predetermined overhead rate:

> Jefferson County Airport handles several daily commuter flights and many private flights. The county budget officer has compiled the following data regarding airport costs and activity over the past year. /\ Required: 1. Draw a scatter diagram of the ai

> Randolph Dana owns a catering company that prepares banquets and parties for business functions throughout the year. Dana’s business is seasonal, with a heavy schedule during the summer months and the year-end holidays. During peak peri

> Shortly after being hired as a cost analyst with Florida International Airlines, Kim Williams was asked to prepare a report that focused on passenger ticketing cost. The airline writes most of its own tickets, makes little use of travel agents, and has s

> The controller of Saratoga Auto Cylinder Company believes that the identification of the variable and fixed components of the firm’s costs will enable the firm to make better planning and control decisions. Among the costs the controlle

> Shenandoah Valley Golf Association is a nonprofit, private organization that operates three 18-hole golf courses in Virginia. The organization’s financial director has just analyzed the course maintenance costs incurred by the golf asso

> Refer to the data and accompanying information in the preceding case. Required: 1. Use the high-low method to estimate the cost behavior for the clinic’s administrative costs. Express the cost behavior in formula form (Y 5 a 1 bX). What is the variable

> “I don’t understand this cost report at all,” exclaimed Jeff Mahoney, the newly appointed administrator of Valley General Hospital. “Our administrative costs in the new pediatrics c

> Outside Environment, Inc. provides commercial landscaping services in San Diego. Sasha Cairns, the firm’s owner, wants to develop cost estimates that she can use to prepare bids on jobs. After analyzing the firm’s cost

> Give an example of a customer-value-added activity and a business-value-added activity in a hotel.

> What is a customer profitability profile?

> Why are product costs also called inventoriable costs?

> Explain the relationship between customer profitability analysis and activity-based costing.

> How could the administration at Delaware Medical Center’s Primary Care Unit use the activity-based costing information developed by the ABC project team?

> What is the role of activity dictionary in an ABC project?

> Explain the concept of a pool rate in activity-based costing. (Refer to Exhibit 5–6 .) Exhibit 5-6: INFORMATION SUPPLIED BY ABC PROJECT TEAM Activity Cost driver quantity for each product line; drivers add column G to get total in

> Distinguish between an activity’s trigger and its root cause. Give an example of each.

> What is meant by the term activity analysis? Give three criteria for determining whether an activity adds value.

> Explain the concept of two-dimensional ABC. Support your explanation with a diagram.

> Explain a key difference in the interpretation of the ABC data in Exhibit 5–7 (Patio Grill Company) and Exhibit 5–16 (Delaware Medical Center). Exhibit 5-7: Exhibit 5-16: E Microsoft Excel - Activity-Based Costing

> Explain why the maintenance of the medical-services provider network is treated as a product-sustaining level activity by Pennsylvania Blue Shield.

> Are activity-based costing systems appropriate for the service industry? Explain.

> Kaleidoscope Cutlery manufactures kitchen knives. One of the employees, whose job is to cut out wooden knife handles, worked 49 hours during a week in January. The employee earns $14 per hour for a 40-hour week. For additional hours the employee is paid

> Explain why a manufacturer with diverse product lines may benefit from an ABC system.

> Explain why a new product-costing system may be needed when line managers suggest that an apparently profitable product be dropped.

> List three factors that are important in selecting cost drivers for an ABC system.

> Briefly explain two factors that tend to result in product cost distortion under traditional, volume-based product costing systems.

> How is the distinction between direct and indirect costs handled differently under volume-based versus activity based costing systems?

> Why do product-costing systems based on a single, volume-based cost driver tend to overcost high-volume products? What undesirable strategic effects can such distortion of product costs have?

> How can an activity-based costing system alleviate the problems Patio Grill Company’s management was having under its traditional, volume-based product-costing system?

> List and briefly describe the four broad categories of activities identified in stage one of an activity-based costing system.

> What are cost drivers? What is their role in an activity-based costing system?

> Explain how an activity-based costing system operates.

> Pinellas Printer Company manufactures printers for use with home computing systems. The firm currently manufactures both the electronic components for its printers and the plastic cases in which the devices are enclosed. Jim Cassanitti, the production ma

> Why was Patio Grill Company’s management being misled by the traditional product-costing system? What mistakes were being made?

> Briefly explain how a traditional, volume-based product-costing system operates.

> What is meant by customer-profitability analysis? Give an example of an activity that might be performed more commonly for one customer than for another.

> FiberCom, Inc., manufactures fiber optic cables for the computer and telecommunications industries. At the request of the company vice president of marketing, the cost management staff has recently completed a customer-profitability study. The following

> Contemporary Kitchen Furnishings, Inc. (CKF) manufactures a variety of housewares for the consumer market in the midwest. The company’s three major product lines are cooking utensils, tableware, and flatware. CKF implemented activity-based costing four y

> Refer to the information given in the preceding problem for Bodacious Bagels, Inc. Data from Bodacious Bagels, Inc.: Bodacious Bagels, Inc., manufactures a variety of bagels, which are frozen and sold in grocery stores. The production process consists o

> Bodacious Bagels, Inc., manufactures a variety of bagels, which are frozen and sold in grocery stores. The production process consists of the following steps. 1. Ingredients, such as flour and raisins, are received and inspected. Then they are stored unt

> Refer to the product costs developed in requirement (5) of Problem 5–60. Prepare a table showing how Gigabyte’s traditional, volume-based product-costing system distorts the product costs of gismos, thingamajigs, and w

> Refer to the new target prices calculated in the preceding problem for Gigabyte’s three products, based on the new activity-based costing system. Data from previous problem: Required: Write a memo to the company president commenting

> Gigabyte, Inc., manufactures three products for the computer industry: Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units The company uses a tradition

> List two plausible goals for each of these organizations: Amazon.com, American Red Cross, General Motors, Walmart, the City of Seattle, and Hertz.

> Scott Manufacturing produces two items in its Virginia Beach plant: Tuff Stuff and Ruff Stuff. Since inception, Scott has used only one manufacturing-overhead cost pool to accumulate costs. Overhead has been allocated to products based on direct-labor ho

> Ultratech, Inc., manufactures several different types of printed circuit boards; however, two of the boards account for the majority of the company’s sales. The first of these boards, a television circuit board, has been a standard in t

> Queensland Electronics Company manufactures two large-screen television models, the Novelle, which has been produced for 10 years and sells for $910, and the Zodiac, a new model introduced in early 20x3, which sells for $1,160. Based on the following inc

> Pensacola Air Industries (PAI) manufactures aircraft parts for small aircraft. Over the past decade, PAI’s management has met its goal of reducing its reliance on government contract work to 50 percent of total sales. Thus, PAI’s sales are now roughly ev

> Gourmet Specialty Coffee Company (GSCC) is a distributor and processor of different blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. GSCC currently has 12 different coffees that it of

> Refer to the original data given in the preceding problem for Rapid City Technology, Inc. Data from Rapid City Technology, Inc: An order for 1,000 boxes of a chemical product designated JLRP has the following production requirements. Machine setups....

> Rapid City Technology, Inc. manufactures chemicals used in agricultural pest control. The controller has established the following activity cost pools and cost drivers. An order for 1,000 boxes of a chemical product designated JLRP has the following pro

> John Patrick has recently been hired as controller of Valdosta Vinyl Company (VVC), a manufacturer of vinyl siding used in residential construction. VVC has been in the vinyl siding business for many years and is currently investigating ways to modernize

> Meditech, Inc. manufactures two types of medical devices, Medform and Procel, and applies overhead on the basis of direct-labor hours. Anticipated overhead and direct-labor time for the upcoming accounting period are $710,000 and 20,000 hours, respective

> Jay Maxey retired a few years ago at age 48, courtesy of the numerous stock options he had been granted while president of e-shops.com, an Internet start-up company. He soon moved to Montana to follow his dream of living in the mountains and Big-Sky coun

> Digital Light Corporation has just completed a major change in its quality control (QC) process. Previously, products had been reviewed by QC inspectors at the end of each major process, and the company’s 10 QC inspectors were charged a

> Wilmington Office Equipment Corporation manufactures two types of filing cabinets—Deluxe and Executive—and applies manufacturing overhead to all units at the rate of $80 per machine hour. Production information follows

> Refer to your solution to requirement (2) of the preceding problem. Exhibit 5-6: Required: Prepare an exhibit similar to Exhibit 5–6 in the text to explain the ABC calculations for the material-handling activity. Use your exhibit to e

> Kitchen King’s Toledo plant manufactures three product lines, all multi-burner, ceramic cook tops. The plant’s three product models are the Regular (REG), the Advanced (ADV), and the Gourmet (GMT). Until recently, the

> Clark and Shiffer LLP perform activities related to e-commerce consulting and information systems in Vancouver, British Columbia. The firm, which bills $140 per hour for services performed, is in a very tight local labor market and is having difficulty f

> Refer to the information given in the preceding problem for FiberCom, Inc., and two of its customers, Caltex Computer and Trace Telecom. Additional information for six of FiberCom’s other customers for the most recent year follows: Cust

> Since you have always wanted to be an industrial baron, invent your own product and describe at least five steps used in its production. Required: Explain how you would go about identifying non-value-added costs in the production process.

> Visit the website of a city, state, or Canadian province of your choosing (e.g., the City of Charlotte, www.charmeck.org ). Required: Read about the services offered to the public by this governmental unit. Then discuss how activity-based costing could

> Refer to the information given in the preceding exercise. For each of the activity cost pools identified, indicate whether it represents a unit-level, batch-level, product-sustaining-level, or facility-level activity. Information from previous exercise:

> Windy City Design Company specializes in designing commercial office space in Chicago. The firm’s president recently reviewed the following income statement and noticed that operating profits were below her expectations. She had a hunch

> Give an example of managerial accounting information that could help a manager make each of the following decisions. 1. The production manager in an automobile plant is deciding whether to have routine maintenance performed on a machine weekly or biweekl

> The customer-profitability analysis for Patio Grill Company, which is displayed in Exhibit 5–14 , ranks customers by operating income. An alternative, often-used approach is to rank customers by sales revenue. Exhibit 5-14: Exhibit

> Visit a restaurant for a meal or think carefully about a recent visit to a restaurant. List as many a activities as you can think of that would be performed by the restaurant’s employees for its customers. Required: For each activity on your list, indi

> List five activities performed by the employees of an airline on the ground. Required: For each of these activities, suggest a performance measure that could be used in activitybased management.

> Non-value-added costs occur in nonmanufacturing organizations, just as they do in manufacturing firms. Required: Identify four potential non-value-added costs in (1) an airline, (2) a bank, and (3) a hotel.

> United Technologies Corporation is using activity-based costing in two of its subsidiaries: Otis Elevator Company and Carrier Corporation. The following table shows 27 activities and eight accounts identified at Carrier, along with the classification det

> Zodiac Model Rocketry Company sells model rocketry kits and supplies to retail outlets and through its catalog. Some of the items are manufactured by Zodiac, while others are purchased for resale. For the products it manufactures, the company currently b

> Seneca Falls Winery is a small, family-run operation in upstate New York. The winery produces two varieties of wine: riesling and chardonnay. Among the activities engaged in by the winery are the following: 1. Trimming: At the end of a growing seas

> Refer to the description given for Wheelco, Inc., in the preceding exercise. Suppose the firm’s president has decided to implement an activity-based costing system. Description for Wheelco, Inc.: Wheelco, Inc. manufactures automobile and truck wheels.

> Wheelco, Inc. manufactures automobile and truck wheels. The company produces four basic, h ighvolume wheels used by each of the large automobile and pickup truck manufacturers. Wheelco also has two specialty wheel lines. These are fancy, complicated whee

> Rainbow Spray Paints, Inc. has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 16 percent of direct-labor cost. Monthly direct-labor cost for the enamel paint line is $98,000. In an attempt

> SofTech, Inc., a developer and distributor of business applications software, has been in business for five years. SofTech’s sales have increased steadily to the current level of $25 million per year. The company has 250 employees. Jennifer Nolan joined

> What will happen to a company’s break-even point if the sales price and unit variable cost of its only product increase by the same dollar amount?

> Digitech, Ltd. manufactures various computer components in its Tokyo plant. The following costs are budgeted for January. (Yen is the Japanese monetary unit.) Insurance, plant ................................................................. 780,000 yen

> Precision Lens Company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the

> Service-industry firms can make effective use of ABC systems as well as manufacturers. For each of the following businesses, list five key activities that are important in the provision of the firm’s service. For each activity cost pool, suggest an appro

> Madison Electric Pump Corporation’s controller, Erin Jackson, developed new product costs for the three pump models using activity-based costing. It was apparent that the firm’s traditional product costing system had been under costing the advanced model

> Refer to the product costs developed in requirement (2) of the preceding problem. Prepare a table showing how Madison Electric Pump Corporation’s traditional, volume-based product-costing system distorts the product costs of the three p

> Madison Electric Pump Corporation manufactures electric pumps for commercial use. The company produces three models, designated as regular, advanced, and deluxe. The company uses a job-order cost accounting system with manufacturing overhead applied on t

> Cincinnati Cycle Company produces two subassemblies, JY-63 and RX-67, used in manufacturing motorcycles. The company is currently using an absorption costing system that applies overhead based on direct-labor hours. The budget for the current year ending

> Define the term equivalent unit and explain how the concept is used in process costing.

> List three nonmanufacturing businesses in which process costing could be used. For example, a public accounting firm could use process costing to accumulate the costs of processing clients' tax returns

> Distinguish between product costs and period costs.

> List five types of manufacturing in which process costing would be an appropriate product-costing system. What is the key characteristic of these products that makes process costing a good choice?

> Explain the concept of operation costing. How does it differ from process or job-order costing? Why is operation costing well suited for batch manufacturing processes?

> How would the process-costing computations differ from those illustrated in the chapter if overhead were applied on some activity base other than direct labor?

> How does process costing differ under normal or actual costing?

> Explain the reasoning underlying the name of the weighted-average method.

> A food processing company has two sequential production departments: mixing and cooking. The cost of the January 1 work in process in the cooking department is detailed as follows: Direct material .........................................................

> List and briefly describe the purpose of each of the four process-costing steps.

> What are the purposes of a product-costing system?

> Explain the primary differences between job-order and process costing.

> What is the purpose of a departmental production report prepared using process costing?

> The following cost data for the year just ended pertain to Heartstrings, Inc., a greeting card manufacturer: Required: 1. Compute each of the following costs for the year just ended: (a) total prime costs, (b) total manufacturing overhead costs, (c) to

> Moravia Company processes and packages cream cheese. The following data have been compiled for the month of April. Conversion activity occurs uniformly throughout the production process. Work in process, April 1—10,000 units: Direct material: 100% comple

> Toronto Titanium Corporation manufactures a highly specialized titanium sheathing material that is used extensively in the aircraft industry. The following data have been compiled for the month of June. Conversion activity occurs uniformly throughout the