Question: Fairfield Company’s payroll costs for the

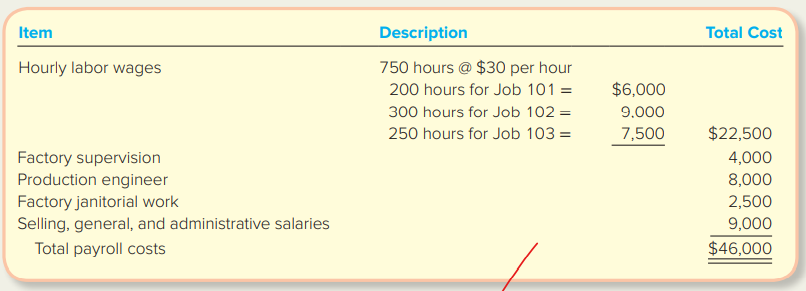

Fairfield Company’s payroll costs for the most recent month are summarized here:

1. Calculate how much of the labor costs would be added to the following accounts:

a. Work in Process Inventory.

b. Manufacturing Overhead.

c. Selling, General, and Administrative Expenses.

2. Explain why some labor costs are recorded as work in process, some as manufacturing overhead, and some as period costs.

> Acoma Co. has identified one of its cost pools to be quality control and has assigned $125,000 to that pool. Number of inspections has been chosen as the cost driver for this pool; Acoma performs 25,000 inspections annually. Suppose Acoma manufactures tw

> Halsted Corp. has identified three cost pools in its manufacturing process: equipment maintenance, setups, and quality control. Total cost assigned to the three pools is $214,500, $101,400, and $153,000, respectively. Cost driver estimates for the pools

> Match each of the definitions by inserting the appropriate term letter in the space provided. Not all terms will be used. Terms: A. Activity-Based Costing (ABC) B. Activity-Based Management C. Activity Proportion D. Activity Rate E. Appraisal or Inspecti

> Match each of the terms with the appropriate definition. Not all definitions will be used. Terms: 1. Activity-Based Costing 2. Appraisal or Inspection Costs 3. Batch-Level Activities 4. External Failure Costs 5. Facility-Level Activities 6. Just-in-Time

> Use the following terms to complete the sentences that follow; terms may be used once, more than once, or not at all. Activity proportion Activity rate Activity-based management (ABM) Batch-level Cost driver Cost-plus pricing External failure costs First

> For each of the following activities, indicate the appropriate category (unit, batch, product, or facility level) and suggest a possible cost driver for each pool: 1. Factory utilities. 2. Machine setups. 3. Research and development for a new product. 4.

> Patterson makes electronic components for handheld games and has identified several activities as components of manufacturing overhead: factory rent, factory utilities, quality inspections, materials handling, machine setup, employee training, machine ma

> Aquazona Pool Company is a custom pool builder. The company recently completed a pool for the Drayna family (Job 1324) as summarized on the incomplete job cost sheet below. The company applies overhead to jobs at a rate of $15 per direct labor hour. Requ

> Wilson’s Tax Service is tracking costs of quality. Classify each of the following as Prevention (P), Appraisal or Inspection (AI), Internal Failure (IF), or External Failure (EF) costs. 1. Review of tax return for missing items/errors. 2. Training of emp

> Refer to the activities presented in M4–16. Classify each cost as facility, product, batch, or unit level. Data from M4-16: Canterbury Corp. has identified the following activities in its manufacturing process. Indicate whether each activity is value-ad

> Canterbury Corp. has identified the following activities in its manufacturing process. Indicate whether each activity is value-added or non-value-added. ∙ Product design research ∙ Materials handling ∙ Machining ∙ Assembly of components ∙ Finished goods

> Refer to the information provided in M4–13. Using activity proportions, determine the amount of overhead assigned to Controller Services. Data from M4-13: Sunrise Accounting provides basic tax services and “rent-a-con

> Refer to the information provided in M4–13. Barry Gold, a tax client of Sunrise Accounting, requires 20 miles of transportation, 50 hours of processing time, and 3 hours of office support. Using the activity rates calculated in M4â

> Sunrise Accounting provides basic tax services and “rent-a-controller” accounting services. Sunrise has identified three activity pools, the related costs per pool, the cost driver for each pool, and the expected use f

> Refer to the information presented in M4–10. Suppose the Luxury boat requires 4,680 machine hours, 70 batches, and 208 inspections. Using activity proportions, determine the amount of overhead assigned to the Luxury product line. Data

> Refer to the information presented in M4–10. Suppose the Speedy boat requires 2,500 machine hours, 100 batches, and 300 inspections. Using the activity rates calculated in M4–10, determine the amount of overhead assign

> Lakeside Inc. manufactures four lines of remote-control boats and uses activity-based costing to calculate product cost. Compute the activity rates for each of the following activity cost pools:

> Catarina Company is considering a switch from its traditional costing system to an activity-based system. It has compiled the following information regarding its product lines: Explain why the overhead costs for each product could be so different between

> McBride and Associates employs two professional appraisers, each having a different specialty. Debbie specializes in commercial appraisals and Tara specializes in residential appraisals. The company expects to incur total overhead costs of $346,500 durin

> Laser Resources produces and sells laser components and accessories. All materials are added at the beginning of the process. It has compiled the following information regarding its physical units for the month of November: Using the weighted-average met

> Laser Resources produces and sells laser components and accessories. All materials are added at the beginning of the process. It has compiled the following information regarding its physical units for the month of November: Using the weighted-average met

> Refer to M3-6 for information regarding Stone Company. Using the FIFO method, reconcile the number of physical units and calculate the number of equivalent units. Data from M3-6: Stone Company produces carrying cases for CDs. It has compiled the followi

> Stone Company produces carrying cases for CDs. It has compiled the following information for the month of June: Stone adds all materials at the beginning of its manufacturing process. During the month, it started 180,000 units. Using the weighted-average

> For each of the following independent cases (A to D), compute the missing value in the table.

> Eagle Company had 1,150 units in work in process on January 1. During the month, Eagle completed 4,800 units and had 2,000 units in process on January 31. Determine how many units Eagle started during January.

> San Tan Company manufactures light bulbs. Once produced, the bulbs are packaged and sold to wholesalers for distribution to grocery stores and large retailers like Walmart. The following costs were incurred by San Tan Company during April: For the month

> Identify three manufacturing and one nonmanufacturing firms in which process costing is likely used. For each, explain the characteristics of that company that make it appropriate to use a process costing system.

> During its first month of operation, Portia Company purchased $90,000 of materials on account and requisitioned $64,000 of materials for use in production. The company recorded $30,000 of unpaid direct labor cost and applied $20,000 of manufacturing over

> Crayons Forever uses a three-department production process to produce its crayons. The Molding Department, Labeling Department and Packaging Department. During the month of May, the Molding Department completed and transferred 4,800,000 molded crayons, w

> Following is partial information for Delamunte Industries for the month of August: Jobs finished during August are summarized here: Required: At the end of August, only one job, Job 248, was still in process. The direct labor cost incurred on Job 248 as

> Determine whether each the following statements describes the weighted-average method (WA), the FIFO method (FIFO), or both methods (Both). Is simpler and more frequently used in the real world. Assumes the units in beginning inventory were completed bef

> The Cutting Department of Sonora’s Textiles has the following information about production and costs for the month of July: ∙ Beginning work in process, 9,200 units that are 100 percent complete as to materials and 35 percent complete as to conversion co

> The Cutting Department of Sonora’s Textiles has the following information about production and costs for the month of July: Beginning work in process, 9,200 units that are 100 percent complete as to materials and 35 percent complete as to conversion cost

> Refer to the information for Roland Corp. in M3-13. Prepare the journal entry to transfer the cost of completed units to Finished Goods Inventory. Data from M3-13: Roland Corp. had the following production information for August: Rolandâ€

> Roland Corp. had the following production information for August: Roland’s ending work in process is 100 percent complete for materials and 30 percent complete for conversion. Roland uses the weighted-average costing method and has comp

> Pearl Company has the following production information for October: 60,000 units transferred out and 20,000 units in ending work in process that are 100 percent complete for materials and 60 percent complete for conversion costs. Materials cost is $12 pe

> Refer to M3-10 for information regarding Cliff Company. Using the FIFO method, calculate Cliff’s cost per equivalent unit for materials and conversion during December. Data from M3-10: Cliff Company manufactures file cabinets. The foll

> Cliff Company manufactures file cabinets. The following cost information is available for the month of December: Cliff had 17,000 equivalent units of direct materials and 12,000 equivalent units of conversion cost. Using the weighted-average method, calc

> Match each of the terms with the appropriate definition. Not all definitions will be used. Terms: 1. Conversion Costs 2 Equivalent Unit 3. First-in, First-Out 4. Production Report 5. Weighted-Average Method Definitions: A. Provides information about the

> Hamilton Company applies manufacturing overhead costs to products based on direct labor hours. The company estimates manufacturing overhead cost for the year to be $250,000 and direct labor hours to be 20,000. Actual overhead for the year was $260,000. 1

> Optimum Health Inc. provides diet, fitness, and nutrition services to clients who want a healthier lifestyle. The company customizes a program for each client based on their individual goals that includes diet recommendations (prepackaged food and supp

> Refer to M2–6 for Carey Company. 1. Compute over- or underapplied overhead. 2. Explain how you would handle the over- or underapplied overhead at the end of the accounting period. Which accounts will be affected? Will the accounts be in

> Refer to M2–6 for Carey Company. 1. Determine how much overhead to apply to production. 2. Explain whether applied overhead was based on actual values, estimated values, or both. Data from M2-6: Carey Company applies manufacturing over

> Carey Company applies manufacturing overhead costs to products as a percentage of direct labor dollars. Estimated and actual values of manufacturing overhead and direct labor costs are summarized here: 1. Compute the predetermined overhead rate. 2. Inter

> Job 31 has a direct materials cost of $300 and a total manufacturing cost of $900. Overhead is applied to jobs at a rate of 200 percent of direct labor cost. Use the relationships among total manufacturing costs, conversion cost, and prime cost to determ

> Match each term with the best definition. Terms: 1. Actual Manufacturing Overhead 2. Applied Manufacturing Overhead 3. Cost of Goods Manufactured 4. Cost of Goods Sold 5. Direct Materials 6. Finished Goods 7. Indirect Materials 8. Raw Materials Inventory

> Matching Terms in Job Order Costing Terms: 1. Allocation Base 2. Direct Labor Time Ticket 3. Indirect Costs 4. Job Cost Sheet 5. Job Order Costing 6. Materials Requisition Form 7. Overapplied Overhead 8. Underapplied Overhead 9. Predetermined Overhead Ra

> For each of the following items, indicate whether it would appear on a materials requisition form (MRF), a direct labor time ticket (DLTT), and/or a job cost sheet (JCS). Note: An item may appear on more than one document. 1. Employee name. 2. Quantity o

> Refer to M2–15. 1. Prepare the journal entry to record Fairfield Company’s payroll costs. 2. The company applies manufacturing overhead to products at a predetermined rate of $50 per direct labor hour. Prepare the jour

> Refer to the information in M2–13. 1. Prepare the journal entry to record the purchase of raw materials. 2. Prepare the journal entry to record the issuance of raw materials to production. Data from M2-13: Fairfield Companyâ€

> Jenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs durin

> For each of the following sustainability initiatives, indicate whether it will impact social (S), environmental (En), or economic (Ec) factors in the triple bottom line. Include more than one factor as appropriate. 1. Implementing a health and wellness p

> Fairfield Company’s raw materials inventory transactions for the most recent month are summarized here: 1. How much of the raw materials cost would be added to the Work in Process Inventory account during the period? 2. How much of the

> Determine missing amounts to complete the following table:

> Cooper Billiards manufactures pool tables. Complete the following table to indicate which account increases or decreases as a result of each action. Note: An action may affect more than one account.

> Refer to M2–9 for Hamilton Company. 1. Compute over- or underapplied overhead. 2. Which accounts will be affected by the over- or underapplied manufacturing overhead? Will the accounts be increased or decreased to adjust for the over- or underapplied man

> Indicate whether each of the following companies is likely to use job order (J) or process costing (P). 1. Golf ball manufacturer. 2. Landscaping business. 3. Tile manufacturer. 4. Auto repair shop. 5. Pet food manufacturer. 6. Light bulb manufacturer. 7

> For each of the following independent cases A through D, compute the missing values:

> For each of the following independent cases A through D, compute the missing values:

> You recently had your car repaired and received the following bill: List three costs that likely would be included in the miscellaneous category.

> The following information is available for Rodriguez Industries: Manufacturing overhead is applied to production at 200 percent of direct labor cost. Determine the amount of direct materials used in production.

> The following information is available for Baker Industries: Compute the cost of goods sold.

> Refer to the information presented in E2–9. Required: 1. Prepare a Cost of Goods Manufactured report. 2. Prepare a Partial Income Statement if sales revenue was $1,250,000 and operating expenses were $210,000 for 2018. Data from E2-9: Manufacturing cost

> The following information is available for Walker Industries: Compute total current manufacturing costs.

> Refer to M2–17 for Fairfield Company. 1. Prepare the journal entry to close the Manufacturing Overhead account balance to Cost of Goods Sold. 2. Explain whether the entry in requirement 1 will increase or decrease Cost of Goods Sold and

> Refer to M2–16 for Fairfield Company. Its actual manufacturing costs for the most recent period are summarized here: 1. Post the preceding information to Fairfield Company’s Manufacturing Overhead T-account. 2. Compute

> Refer to M1-14. Choose one of the companies you classified as a merchandising company. For that company, identify two direct costs and two indirect costs. What is the cost object? Data from M1-14: Indicate whether each of the following businesses would

> Refer to M1-14. Choose one of the companies you classified as a service company. For that company, identify two direct costs and two indirect costs. What is the cost object? Data from M1-14: Indicate whether each of the following businesses would most l

> Indicate whether each of the following businesses would most likely be classified as a service company (S), merchandising company (Mer), or manufacturing company (Man). 1. Merry Maids. 2. Dell Computer. 3. Brinks Security. 4. Kmart. 5. PetSmart 6. Ford M

> For each of the following independent cases A through D, compute the missing values in the table below.

> Lighten Up Lamps, Inc., manufactures table lamps and other lighting products. For each of the following costs, use an X to indicate the category of product cost and whether it is a prime cost, conversion cost, or both.

> You are considering the possibility of pursuing a master’s degree after completing your undergraduate degree. 1. List three costs (or benefits) that would be relevant to this decision, including at least one opportunity cost. 2. List two costs that would

> Randy Inc. produces and sells tablets. The company incurred the following costs for the May: Determine each of the following: 1. Direct material. 2. Direct labor. 3. Manufacturing overhead. 4. Total manufacturing cost. 5. Total period cost. 6. Total vari

> Oak Creek Furniture Factory (OCFF), a custom furniture manufacturer, uses job order costing to track the cost of each customer order. On March 1, OCFF had two jobs in process with the following costs: Source documents revealed the following during March:

> Refer to M1-8. Assume that you have the following information about Top Shelf’s costs for the most recent month: Determine each of the following costs for Top Shelf. 1. Direct materials used. 2. Direct labor. 3. Manufacturing overhead.

> Top Shelf Company builds oak bookcases. Determine whether each of the following is a direct material (DM), direct labor (DL), manufacturing overhead (MOH), or a period (P) cost for Top Shelf. 1. Depreciation on factory equipment. 2. Depreciation on deli

> Jackson Lamps manufactures and sells table lamps. Determine whether each of the following is fixed (F) or variable (V). 1. Lamp shades. 2. Glue and screws. 3. CEO’s salary. 4. Assembler’s wages. 5. Rent for the factory. 6. Plant supervisor’s salary. 7. D

> The following is a short list of scenarios. Write a brief statement about whether you believe the scenario is an ethical dilemma and, if so, who will be harmed by the unethical behavior. 1. You are a tax accounting professional and a client informs you

> Match each of the following SOX requirements to the corresponding objective by entering the appropriate letter in the space provided. 1. Establish a hotline for employees to report questionable acts. 2. Increase maximum fines to $5 million. 3. Require ma

> You were recently hired as a production manager for Medallion Company. You just received a memo regarding a company meeting being held this week. The memo stated that one topic of discussion will be the basic management functions as they relate to the pr

> Procter & Gamble (P&G) manufactures and markets many products you use every day. In 2016, sales for the company were $65,300 (all amounts in millions). The annual report did not report the amount of credit sales, so we will assume that all sales

> Cintas Corporation is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2016 fiscal year, the company reported sales revenue of $4.9 billion and Cost of Goods Sold of $2.1 billion. Required: Assum

> Double West Suppliers (DWS) reported sales for the year of $300,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances follow: Required: 1. Compute the turnover ratios for accounts receivable and inventory (roun

> Match each ratio or percentage with its formula by entering the appropriate letter for each numbered item. Ratios or Percentages: 1. Current ratio 2. Net profit margin 3. Inventory turnover ratio 4. Gross profit percentage 5. Fixed asset turnover 6. Retu

> Panderia Homes builds single-family homes near Santa Fe, New Mexico. The company prides itself on designing beautiful homes that are built in ways that reduce environmental impact and provide energy savings, long-lasting value and comfort, at a price tha

> Use the information in E13–3 to complete the following requirement. Required: Compute the times interest earned ratios for 2016 and 2015. In your opinion, does Computer Tycoon generate sufficient net income (before taxes and interest) t

> Use the information in E13–3 to complete the following requirements. Required: 1. Compute the gross profit percentage for each year (rounded to one decimal place). Assuming that the change from 2015 to 2016 is the beginning of a sustain

> According to the producer price index database maintained by the Bureau of Labor Statistics, the average cost of computer equipment fell 3.8 percent between January and December 2016. Let’s see whether these changes are reflected in the

> Use the information for Chevron Corporation in E13–1 to complete the following requirements. Required: 1. Compute the gross profit percentage for each year (rounded to one decimal place). Assuming that the change from 2014 to 2015 is th

> A company has current assets that total $500,000, has a current ratio of 2.00, and uses the perpetual inventory method. Assume that the following transactions are then completed: (1) sold $12,000 in merchandise on short-term credit for $15,000, (2) decla

> Good Sports, Inc., is a private full-line sporting goods retailer. Assume one of the Good Sports stores reported current assets of $88,000 and its current ratio was 1.75, and then completed the following transactions: (1) paid $6,000 on accounts payable,

> In its most recent annual report, Sunrise Enterprises reported current assets of $1,090,000 and current liabilities of $602,000. Required: Determine for each of the following transactions whether the current ratio, and each of its two components, for Sun

> In its most recent annual report, Appalachian Beverages reported current assets of $54,000 and a current ratio of 1.80. Assume that the following transactions were completed: (1) purchased merchandise for $6,000 on account and (2) purchased a delivery tr

> Dollar General Corporation operates general merchandise stores that feature quality merchandise at low prices to meet the needs of middle-, low-, and fixed-income families in southern, eastern, and midwestern states. For the year ended January 29, 2016,

> The average price of a gallon of gas in 2015 dropped $0.94 (28 percent) from $3.34 in 2014 (to $2.40 in 2015). Let’s see whether these changes are reflected in the income statement of Chevron Corporation for the year ended December 31,

> Marsha Design is an interior design and consulting firm. The firm uses a job order cost system in which each client represents an individual job. Marsha Design traces direct labor and travel costs to each job (client). It assigns indirect costs to client

> New Vision Company completed its income statement and balance sheet and provided the following information: Required: 1. Present the operating activities section of the statement of cash flows for New Vision Company using the indirect method. 2. Of the p

> The following information pertains to Guy’s Gear Company: Required: Present the operating activities section of the statement of cash flows for Guy’s Gear Company using the indirect method.

> Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company’s comparative balance sheet

> Suppose your company reports $160 of net income and $40 of cash dividends paid, and its comparative balance sheet indicates the follow: Required: 1. Prepare the operating activities section of the statement of cash flows, using the indirect method. 2. Id