Question: The following information pertains to Guy’s

The following information pertains to Guy’s Gear Company:

Required:

Present the operating activities section of the statement of cash flows for Guy’s Gear Company using the indirect method.

> Fairfield Company’s payroll costs for the most recent month are summarized here: 1. Calculate how much of the labor costs would be added to the following accounts: a. Work in Process Inventory. b. Manufacturing Overhead. c. Selling, Gen

> Refer to the information in M2–13. 1. Prepare the journal entry to record the purchase of raw materials. 2. Prepare the journal entry to record the issuance of raw materials to production. Data from M2-13: Fairfield Companyâ€

> Jenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs durin

> For each of the following sustainability initiatives, indicate whether it will impact social (S), environmental (En), or economic (Ec) factors in the triple bottom line. Include more than one factor as appropriate. 1. Implementing a health and wellness p

> Fairfield Company’s raw materials inventory transactions for the most recent month are summarized here: 1. How much of the raw materials cost would be added to the Work in Process Inventory account during the period? 2. How much of the

> Determine missing amounts to complete the following table:

> Cooper Billiards manufactures pool tables. Complete the following table to indicate which account increases or decreases as a result of each action. Note: An action may affect more than one account.

> Refer to M2–9 for Hamilton Company. 1. Compute over- or underapplied overhead. 2. Which accounts will be affected by the over- or underapplied manufacturing overhead? Will the accounts be increased or decreased to adjust for the over- or underapplied man

> Indicate whether each of the following companies is likely to use job order (J) or process costing (P). 1. Golf ball manufacturer. 2. Landscaping business. 3. Tile manufacturer. 4. Auto repair shop. 5. Pet food manufacturer. 6. Light bulb manufacturer. 7

> For each of the following independent cases A through D, compute the missing values:

> For each of the following independent cases A through D, compute the missing values:

> You recently had your car repaired and received the following bill: List three costs that likely would be included in the miscellaneous category.

> The following information is available for Rodriguez Industries: Manufacturing overhead is applied to production at 200 percent of direct labor cost. Determine the amount of direct materials used in production.

> The following information is available for Baker Industries: Compute the cost of goods sold.

> Refer to the information presented in E2–9. Required: 1. Prepare a Cost of Goods Manufactured report. 2. Prepare a Partial Income Statement if sales revenue was $1,250,000 and operating expenses were $210,000 for 2018. Data from E2-9: Manufacturing cost

> The following information is available for Walker Industries: Compute total current manufacturing costs.

> Refer to M2–17 for Fairfield Company. 1. Prepare the journal entry to close the Manufacturing Overhead account balance to Cost of Goods Sold. 2. Explain whether the entry in requirement 1 will increase or decrease Cost of Goods Sold and

> Refer to M2–16 for Fairfield Company. Its actual manufacturing costs for the most recent period are summarized here: 1. Post the preceding information to Fairfield Company’s Manufacturing Overhead T-account. 2. Compute

> Refer to M1-14. Choose one of the companies you classified as a merchandising company. For that company, identify two direct costs and two indirect costs. What is the cost object? Data from M1-14: Indicate whether each of the following businesses would

> Refer to M1-14. Choose one of the companies you classified as a service company. For that company, identify two direct costs and two indirect costs. What is the cost object? Data from M1-14: Indicate whether each of the following businesses would most l

> Indicate whether each of the following businesses would most likely be classified as a service company (S), merchandising company (Mer), or manufacturing company (Man). 1. Merry Maids. 2. Dell Computer. 3. Brinks Security. 4. Kmart. 5. PetSmart 6. Ford M

> For each of the following independent cases A through D, compute the missing values in the table below.

> Lighten Up Lamps, Inc., manufactures table lamps and other lighting products. For each of the following costs, use an X to indicate the category of product cost and whether it is a prime cost, conversion cost, or both.

> You are considering the possibility of pursuing a master’s degree after completing your undergraduate degree. 1. List three costs (or benefits) that would be relevant to this decision, including at least one opportunity cost. 2. List two costs that would

> Randy Inc. produces and sells tablets. The company incurred the following costs for the May: Determine each of the following: 1. Direct material. 2. Direct labor. 3. Manufacturing overhead. 4. Total manufacturing cost. 5. Total period cost. 6. Total vari

> Oak Creek Furniture Factory (OCFF), a custom furniture manufacturer, uses job order costing to track the cost of each customer order. On March 1, OCFF had two jobs in process with the following costs: Source documents revealed the following during March:

> Refer to M1-8. Assume that you have the following information about Top Shelf’s costs for the most recent month: Determine each of the following costs for Top Shelf. 1. Direct materials used. 2. Direct labor. 3. Manufacturing overhead.

> Top Shelf Company builds oak bookcases. Determine whether each of the following is a direct material (DM), direct labor (DL), manufacturing overhead (MOH), or a period (P) cost for Top Shelf. 1. Depreciation on factory equipment. 2. Depreciation on deli

> Jackson Lamps manufactures and sells table lamps. Determine whether each of the following is fixed (F) or variable (V). 1. Lamp shades. 2. Glue and screws. 3. CEO’s salary. 4. Assembler’s wages. 5. Rent for the factory. 6. Plant supervisor’s salary. 7. D

> The following is a short list of scenarios. Write a brief statement about whether you believe the scenario is an ethical dilemma and, if so, who will be harmed by the unethical behavior. 1. You are a tax accounting professional and a client informs you

> Match each of the following SOX requirements to the corresponding objective by entering the appropriate letter in the space provided. 1. Establish a hotline for employees to report questionable acts. 2. Increase maximum fines to $5 million. 3. Require ma

> You were recently hired as a production manager for Medallion Company. You just received a memo regarding a company meeting being held this week. The memo stated that one topic of discussion will be the basic management functions as they relate to the pr

> Procter & Gamble (P&G) manufactures and markets many products you use every day. In 2016, sales for the company were $65,300 (all amounts in millions). The annual report did not report the amount of credit sales, so we will assume that all sales

> Cintas Corporation is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2016 fiscal year, the company reported sales revenue of $4.9 billion and Cost of Goods Sold of $2.1 billion. Required: Assum

> Double West Suppliers (DWS) reported sales for the year of $300,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances follow: Required: 1. Compute the turnover ratios for accounts receivable and inventory (roun

> Match each ratio or percentage with its formula by entering the appropriate letter for each numbered item. Ratios or Percentages: 1. Current ratio 2. Net profit margin 3. Inventory turnover ratio 4. Gross profit percentage 5. Fixed asset turnover 6. Retu

> Panderia Homes builds single-family homes near Santa Fe, New Mexico. The company prides itself on designing beautiful homes that are built in ways that reduce environmental impact and provide energy savings, long-lasting value and comfort, at a price tha

> Use the information in E13–3 to complete the following requirement. Required: Compute the times interest earned ratios for 2016 and 2015. In your opinion, does Computer Tycoon generate sufficient net income (before taxes and interest) t

> Use the information in E13–3 to complete the following requirements. Required: 1. Compute the gross profit percentage for each year (rounded to one decimal place). Assuming that the change from 2015 to 2016 is the beginning of a sustain

> According to the producer price index database maintained by the Bureau of Labor Statistics, the average cost of computer equipment fell 3.8 percent between January and December 2016. Let’s see whether these changes are reflected in the

> Use the information for Chevron Corporation in E13–1 to complete the following requirements. Required: 1. Compute the gross profit percentage for each year (rounded to one decimal place). Assuming that the change from 2014 to 2015 is th

> A company has current assets that total $500,000, has a current ratio of 2.00, and uses the perpetual inventory method. Assume that the following transactions are then completed: (1) sold $12,000 in merchandise on short-term credit for $15,000, (2) decla

> Good Sports, Inc., is a private full-line sporting goods retailer. Assume one of the Good Sports stores reported current assets of $88,000 and its current ratio was 1.75, and then completed the following transactions: (1) paid $6,000 on accounts payable,

> In its most recent annual report, Sunrise Enterprises reported current assets of $1,090,000 and current liabilities of $602,000. Required: Determine for each of the following transactions whether the current ratio, and each of its two components, for Sun

> In its most recent annual report, Appalachian Beverages reported current assets of $54,000 and a current ratio of 1.80. Assume that the following transactions were completed: (1) purchased merchandise for $6,000 on account and (2) purchased a delivery tr

> Dollar General Corporation operates general merchandise stores that feature quality merchandise at low prices to meet the needs of middle-, low-, and fixed-income families in southern, eastern, and midwestern states. For the year ended January 29, 2016,

> The average price of a gallon of gas in 2015 dropped $0.94 (28 percent) from $3.34 in 2014 (to $2.40 in 2015). Let’s see whether these changes are reflected in the income statement of Chevron Corporation for the year ended December 31,

> Marsha Design is an interior design and consulting firm. The firm uses a job order cost system in which each client represents an individual job. Marsha Design traces direct labor and travel costs to each job (client). It assigns indirect costs to client

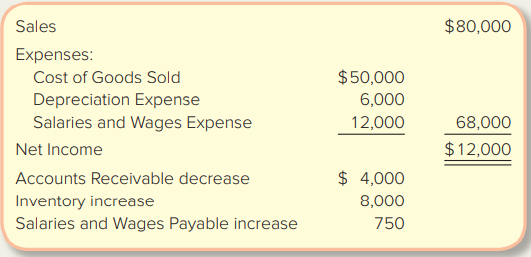

> New Vision Company completed its income statement and balance sheet and provided the following information: Required: 1. Present the operating activities section of the statement of cash flows for New Vision Company using the indirect method. 2. Of the p

> Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company’s comparative balance sheet

> Suppose your company reports $160 of net income and $40 of cash dividends paid, and its comparative balance sheet indicates the follow: Required: 1. Prepare the operating activities section of the statement of cash flows, using the indirect method. 2. Id

> Suppose your company sells goods for $300, of which $200 is received in cash and $100 is on account. The goods cost your company $125 and were paid for in a previous period. Your company also recorded salaries and wages of $70, of which only $30 has been

> Suppose your company sells services of $150 in exchange for $120 cash and $30 on account. Depreciation of $50 relating to equipment also is recorded. Required: 1. Show the journal entries to record these transactions. 2. Calculate the amount that should

> Suppose your company sells services for $325 cash this month. Your company also pays $100 in salaries and wages, which includes $15 that was payable at the end of the previous month and $85 for salaries and wages of this month. Required: 1. Show the jour

> Golf Universe is a regional and online golf equipment retailer. The company reported the following for the current year: ∙ Purchased a long-term investment for cash, $15,000. ∙ Paid cash dividend, $12,000. âˆ

> During the period, Teen’s Trends sold some excess equipment at a loss. The following information was collected from the company’s accounting records: No new equipment was bought during the period. Required: For the equ

> Cedar Fair operates amusement parks in the United States and Canada. During a recent year, it reported the following (in millions): Equipment costing $120 was purchased during the year. Required: For the equipment that was disposed of during the year, co

> Floyd’s Auto Repair Shop uses a job order cost system to track the cost of each repair. Floyd’s applies its garage or shop overhead at a rate of $20 per direct labor hour spent on each repair. Floyd’s

> Refer back to the information given for E12–10, plus the following summarized income statement for Pizza International, Inc. (in millions): Required: 1. Based on this information, compute cash flow from operating activities using the di

> Suppose your company sells services of $180 in exchange for $110 cash and $70 on account. Required: 1. Show the journal entry to record this transaction. 2. Identify the amount that should be reported as net cash flow from operating activities. 3. Identi

> Refer to the information for New Vision Company in E12–9. Required: 1. Present the operating activities section of the statement of cash flows for New Vision Company using the direct method. Assume that Accounts Payable relate to Utilit

> To compare statement of cash flows reporting under the direct and indirect methods, enter check marks to indicate which line items are reported on the statement of cash flows with each method.

> The Walt Disney Company reported the following in its 2016 annual report (in millions): Required: 1. Note that in all three years, net cash provided by operating activities is greater than net income. Given the above information and what you know about t

> Gibraltar Industries, Inc., is a manufacturer of steel products for customers such as Home Depot, Lowe’s, Chrysler, Ford, and General Motors. In the year ended December 31, 2016, it reported the following activities: Required: Based on

> Rowe Furniture Corporation is a Virginia-based manufacturer of furniture. In a recent quarter, it reported the following activities: Required: Based on this information, present the cash flows from investing and financing activities sections of the cash

> The following information was reported by three companies. When completing the requirements, assume that any and all purchases on account are for inventory. Required: 1. What amount did each company deduct on the income statement related to inventory? 2.

> Consultex, Inc., was founded in 2015 as a small financial consulting business. The company had done reasonably well in 2015–2017 but started noticing its cash dwindle early in 2018. In January 2018, Consultex had paid $16,000 to purchas

> A statement of cash flows contained the following information: Required: Determine whether the following account balances increased (I) or decreased (D) during the period: (a) Accounts Receivable, (b) Inventories, (c) Accounts Payable, and (d) Accrued Li

> A recent materials requisition form for Christopher Creek Furniture Manufacturers follows: Required: Prepare the journal entry to record the issuance of materials.

> Colgate-Palmolive was founded in 1806. Its statement of cash flows reported the following information (in millions) for the nine months ended September 30, 2016: Required: Based on the information reported in the operating activities section of the state

> Pizza International, Inc., reported the following information (in thousands): Required: 1. Based on this information, compute cash flow from operating activities using the indirect method. 2. What was the primary reason that Pizza International was able

> NIKE, Inc., is the best-known sports shoe, apparel, and equipment company in the world because of its association with athletes such as LeBron James, Roger Federer, and Madison Keys. Some of the items included in its recent statement of cash flows presen

> On January 1, 2018, you deposited $8,000 in a savings account. The account will earn 8 percent annual compound interest, which will be added to the fund balance at the end of each year. Required (round to the nearest dollar): 1. What will be the balance

> Shaylee Corp has $2 million to invest in new projects. The company’s managers have presented a number of possible options that the board must prioritize. Information about the projects follows: Required: 1. Is Shaylee able to invest in

> Your friend Harold is trying to decide whether to buy or lease his next vehicle. He has gathered information about each option but is not sure how to compare the alternatives. Purchasing a new vehicle will cost $26,500, and Harold expects to spend about

> After hearing a knock at your front door, you are surprised to see the Prize Patrol from a large, well-known magazine subscription company. It has arrived with the good news that you are the big winner, having won $20 million. You have three options: a.

> Consider the relationship between a project’s net present value (NPV), its internal rate of return (IRR), and a company’s cost of capital. For each scenario that follows, indicate the relative value of the unknown. If

> Linda’s Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting ra

> Merrill Corp. has the following information available about a potential capital investment: Required: 1. Calculate the project’s net present value. 2. Without making any calculations, determine whether the internal rate of return (IRR)

> Pental Manufacturing Company incurred the following transactions during the year: a. Purchased raw materials on account, $50,500. b. Requisitioned raw materials of $32,000 to the factory, which included $8,300 of indirect materials. c. Accrued factory la

> Bartlett Car Wash Co. is considering the purchase of a new facility. It would allow Bartlett to increase its net income by $53,000 per year. Other information about this proposed project follows: Required: Calculate and evaluate the following for Bartlet

> The following table contains information about four potential investment projects that Castle Corporation is considering. Required: 1. Rank the four projects in order of preference by using: a. Accounting rate of return. b. Payback period. c. Net present

> Robertson Resorts is considering whether to expand their Pagosa Springs Lodge. The expansion will create 24 additional rooms for rent. The following estimates are available: Robertson uses straight-line depreciation and the lodge expansion will have a re

> Traditionally, Granite Company has accepted a proposal only if the payback period is less than 50 percent of the asset’s useful life. Peggy Casteel is the new accounting manager. She suggested to management that capital budgeting decisions should not be

> Jill Harrington, a manager at Jennings Company, is considering several potential capital investment projects. Data on these projects follow: Required: 1. Compute the payback period for each project and rank order them based on this criterion. 2. Compute

> Tulsa Company is considering investing in new bottling equipment and has two options: Option A has a lower initial cost but would require a significant expenditure to rebuild the machine after four years; Option B has higher maintenance costs, but also h

> You are saving for a Porsche Carrera Cabriolet, which currently sells for nearly half a million dollars. Your plan is to deposit $15,000 at the end of each year for the next 10 years. You expect to earn 8 percent each year. Required: 1. Determine how muc

> Harwell Printing Co. is considering the purchase of new electronic printing equipment. It would allow Harwell to increase its net income by $45,000 per year. Other information about this proposed project follows: Required: Calculate and evaluate the foll

> Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6 percent. Selected operating data for the three divisions follow: Required: 1. Compute the return on investment for each division. 2. Compute the residual income f

> Orange Corp. has two divisions: Fruit and Flower. The following information for the past year is available for each division: Orange has established a hurdle rate of 12 percent. Required: 1. Compute each division’s return on investment

> StorSmart Company makes plastic organizing bins. The company has the following inventory balances at the beginning and end of March: Additional information for the month of March follows: Required: Based on this information, prepare the following for Sto

> Kaler Company has sales of $1,210,000, cost of goods sold of $735,000, other operating expenses of $148,000, average invested assets of $3,400,000, and a hurdle rate of 12 percent. Required: 1. Determine Kaler’s return on investment (ROI), investment tur

> Solano Company has sales of $500,000, cost of goods sold of $370,000, other operating expenses of $50,000, average invested assets of $1,600,000, and a hurdle rate of 6 percent. Required: 1. Determine Solano’s return on investment (ROI), investment turno

> Krall Company recently had a computer malfunction and lost a portion of its accounting records. The company has reconstructed some of its financial performance measurements including components of the return-on-investment calculations. Required: Help Kra

> Fleetwood Company recently had a computer malfunction and lost a portion of its accounting records. The company has reconstructed some of its financial performance measurements, including components of the return-on-investment calculations. Required: Hel

> Match the most likely type of responsibility center classification to each of the following positions. You may use a classification once, more than once, or not at all. Employment Positions: - Sales manager - Regional manager - Company president - Purcha

> Identify which perspective(s) of the balanced scorecard each of the following critical success factors relates to by placing an X in the appropriate cell. Each success factor could relate to more than one category.

> Tulip Company is made up of two divisions: A and B. Division A produces a widget that Division B uses in the production of its product. Variable cost per widget is $0.75; full cost is $1.00. Comparable widgets sell on the open market for $1.50 each. Divi

> Assume you are the vice president of operations for a local company. Your company is in the process of converting from a small, centralized organization in which its president makes all decisions to a larger, geographically dispersed one with decentraliz

> Shaw is a lumber company that also manufactures custom cabinetry. It is made up of two divisions: Lumber and Cabinetry. The Lumber Division is responsible for harvesting and preparing lumber for use; the Cabinetry Division produces custom-ordered cabinet