Question: Orange Corp. has two divisions: Fruit and

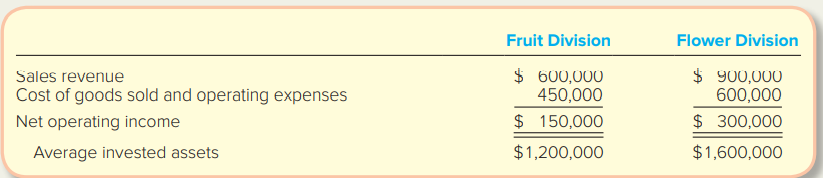

Orange Corp. has two divisions: Fruit and Flower. The following information for the past year is available for each division:

Orange has established a hurdle rate of 12 percent.

Required:

1. Compute each division’s return on investment (ROI) and residual income for last year. Determine which manager seems to be performing better.

2. Suppose Orange is investing in new technology that will increase each division’s operating income by $144,000. The total investment required is $1,600,000, which will be split evenly between the two divisions. Calculate the ROI and return on investment for each division after the investment is made.

3. Determine whether both managers will support the investment. Explain how their support will differ depending on which performance measure (ROI or residual investment) is used.

> A company has current assets that total $500,000, has a current ratio of 2.00, and uses the perpetual inventory method. Assume that the following transactions are then completed: (1) sold $12,000 in merchandise on short-term credit for $15,000, (2) decla

> Good Sports, Inc., is a private full-line sporting goods retailer. Assume one of the Good Sports stores reported current assets of $88,000 and its current ratio was 1.75, and then completed the following transactions: (1) paid $6,000 on accounts payable,

> In its most recent annual report, Sunrise Enterprises reported current assets of $1,090,000 and current liabilities of $602,000. Required: Determine for each of the following transactions whether the current ratio, and each of its two components, for Sun

> In its most recent annual report, Appalachian Beverages reported current assets of $54,000 and a current ratio of 1.80. Assume that the following transactions were completed: (1) purchased merchandise for $6,000 on account and (2) purchased a delivery tr

> Dollar General Corporation operates general merchandise stores that feature quality merchandise at low prices to meet the needs of middle-, low-, and fixed-income families in southern, eastern, and midwestern states. For the year ended January 29, 2016,

> The average price of a gallon of gas in 2015 dropped $0.94 (28 percent) from $3.34 in 2014 (to $2.40 in 2015). Let’s see whether these changes are reflected in the income statement of Chevron Corporation for the year ended December 31,

> Marsha Design is an interior design and consulting firm. The firm uses a job order cost system in which each client represents an individual job. Marsha Design traces direct labor and travel costs to each job (client). It assigns indirect costs to client

> New Vision Company completed its income statement and balance sheet and provided the following information: Required: 1. Present the operating activities section of the statement of cash flows for New Vision Company using the indirect method. 2. Of the p

> The following information pertains to Guy’s Gear Company: Required: Present the operating activities section of the statement of cash flows for Guy’s Gear Company using the indirect method.

> Suppose the income statement for Goggle Company reports $95 of net income, after deducting depreciation of $35. The company bought equipment costing $60 and obtained a long-term bank loan for $70. The company’s comparative balance sheet

> Suppose your company reports $160 of net income and $40 of cash dividends paid, and its comparative balance sheet indicates the follow: Required: 1. Prepare the operating activities section of the statement of cash flows, using the indirect method. 2. Id

> Suppose your company sells goods for $300, of which $200 is received in cash and $100 is on account. The goods cost your company $125 and were paid for in a previous period. Your company also recorded salaries and wages of $70, of which only $30 has been

> Suppose your company sells services of $150 in exchange for $120 cash and $30 on account. Depreciation of $50 relating to equipment also is recorded. Required: 1. Show the journal entries to record these transactions. 2. Calculate the amount that should

> Suppose your company sells services for $325 cash this month. Your company also pays $100 in salaries and wages, which includes $15 that was payable at the end of the previous month and $85 for salaries and wages of this month. Required: 1. Show the jour

> Golf Universe is a regional and online golf equipment retailer. The company reported the following for the current year: ∙ Purchased a long-term investment for cash, $15,000. ∙ Paid cash dividend, $12,000. âˆ

> During the period, Teen’s Trends sold some excess equipment at a loss. The following information was collected from the company’s accounting records: No new equipment was bought during the period. Required: For the equ

> Cedar Fair operates amusement parks in the United States and Canada. During a recent year, it reported the following (in millions): Equipment costing $120 was purchased during the year. Required: For the equipment that was disposed of during the year, co

> Floyd’s Auto Repair Shop uses a job order cost system to track the cost of each repair. Floyd’s applies its garage or shop overhead at a rate of $20 per direct labor hour spent on each repair. Floyd’s

> Refer back to the information given for E12–10, plus the following summarized income statement for Pizza International, Inc. (in millions): Required: 1. Based on this information, compute cash flow from operating activities using the di

> Suppose your company sells services of $180 in exchange for $110 cash and $70 on account. Required: 1. Show the journal entry to record this transaction. 2. Identify the amount that should be reported as net cash flow from operating activities. 3. Identi

> Refer to the information for New Vision Company in E12–9. Required: 1. Present the operating activities section of the statement of cash flows for New Vision Company using the direct method. Assume that Accounts Payable relate to Utilit

> To compare statement of cash flows reporting under the direct and indirect methods, enter check marks to indicate which line items are reported on the statement of cash flows with each method.

> The Walt Disney Company reported the following in its 2016 annual report (in millions): Required: 1. Note that in all three years, net cash provided by operating activities is greater than net income. Given the above information and what you know about t

> Gibraltar Industries, Inc., is a manufacturer of steel products for customers such as Home Depot, Lowe’s, Chrysler, Ford, and General Motors. In the year ended December 31, 2016, it reported the following activities: Required: Based on

> Rowe Furniture Corporation is a Virginia-based manufacturer of furniture. In a recent quarter, it reported the following activities: Required: Based on this information, present the cash flows from investing and financing activities sections of the cash

> The following information was reported by three companies. When completing the requirements, assume that any and all purchases on account are for inventory. Required: 1. What amount did each company deduct on the income statement related to inventory? 2.

> Consultex, Inc., was founded in 2015 as a small financial consulting business. The company had done reasonably well in 2015–2017 but started noticing its cash dwindle early in 2018. In January 2018, Consultex had paid $16,000 to purchas

> A statement of cash flows contained the following information: Required: Determine whether the following account balances increased (I) or decreased (D) during the period: (a) Accounts Receivable, (b) Inventories, (c) Accounts Payable, and (d) Accrued Li

> A recent materials requisition form for Christopher Creek Furniture Manufacturers follows: Required: Prepare the journal entry to record the issuance of materials.

> Colgate-Palmolive was founded in 1806. Its statement of cash flows reported the following information (in millions) for the nine months ended September 30, 2016: Required: Based on the information reported in the operating activities section of the state

> Pizza International, Inc., reported the following information (in thousands): Required: 1. Based on this information, compute cash flow from operating activities using the indirect method. 2. What was the primary reason that Pizza International was able

> NIKE, Inc., is the best-known sports shoe, apparel, and equipment company in the world because of its association with athletes such as LeBron James, Roger Federer, and Madison Keys. Some of the items included in its recent statement of cash flows presen

> On January 1, 2018, you deposited $8,000 in a savings account. The account will earn 8 percent annual compound interest, which will be added to the fund balance at the end of each year. Required (round to the nearest dollar): 1. What will be the balance

> Shaylee Corp has $2 million to invest in new projects. The company’s managers have presented a number of possible options that the board must prioritize. Information about the projects follows: Required: 1. Is Shaylee able to invest in

> Your friend Harold is trying to decide whether to buy or lease his next vehicle. He has gathered information about each option but is not sure how to compare the alternatives. Purchasing a new vehicle will cost $26,500, and Harold expects to spend about

> After hearing a knock at your front door, you are surprised to see the Prize Patrol from a large, well-known magazine subscription company. It has arrived with the good news that you are the big winner, having won $20 million. You have three options: a.

> Consider the relationship between a project’s net present value (NPV), its internal rate of return (IRR), and a company’s cost of capital. For each scenario that follows, indicate the relative value of the unknown. If

> Linda’s Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting ra

> Merrill Corp. has the following information available about a potential capital investment: Required: 1. Calculate the project’s net present value. 2. Without making any calculations, determine whether the internal rate of return (IRR)

> Pental Manufacturing Company incurred the following transactions during the year: a. Purchased raw materials on account, $50,500. b. Requisitioned raw materials of $32,000 to the factory, which included $8,300 of indirect materials. c. Accrued factory la

> Bartlett Car Wash Co. is considering the purchase of a new facility. It would allow Bartlett to increase its net income by $53,000 per year. Other information about this proposed project follows: Required: Calculate and evaluate the following for Bartlet

> The following table contains information about four potential investment projects that Castle Corporation is considering. Required: 1. Rank the four projects in order of preference by using: a. Accounting rate of return. b. Payback period. c. Net present

> Robertson Resorts is considering whether to expand their Pagosa Springs Lodge. The expansion will create 24 additional rooms for rent. The following estimates are available: Robertson uses straight-line depreciation and the lodge expansion will have a re

> Traditionally, Granite Company has accepted a proposal only if the payback period is less than 50 percent of the asset’s useful life. Peggy Casteel is the new accounting manager. She suggested to management that capital budgeting decisions should not be

> Jill Harrington, a manager at Jennings Company, is considering several potential capital investment projects. Data on these projects follow: Required: 1. Compute the payback period for each project and rank order them based on this criterion. 2. Compute

> Tulsa Company is considering investing in new bottling equipment and has two options: Option A has a lower initial cost but would require a significant expenditure to rebuild the machine after four years; Option B has higher maintenance costs, but also h

> You are saving for a Porsche Carrera Cabriolet, which currently sells for nearly half a million dollars. Your plan is to deposit $15,000 at the end of each year for the next 10 years. You expect to earn 8 percent each year. Required: 1. Determine how muc

> Harwell Printing Co. is considering the purchase of new electronic printing equipment. It would allow Harwell to increase its net income by $45,000 per year. Other information about this proposed project follows: Required: Calculate and evaluate the foll

> Luke Company has three divisions: Peak, View, and Grand. The company has a hurdle rate of 6 percent. Selected operating data for the three divisions follow: Required: 1. Compute the return on investment for each division. 2. Compute the residual income f

> StorSmart Company makes plastic organizing bins. The company has the following inventory balances at the beginning and end of March: Additional information for the month of March follows: Required: Based on this information, prepare the following for Sto

> Kaler Company has sales of $1,210,000, cost of goods sold of $735,000, other operating expenses of $148,000, average invested assets of $3,400,000, and a hurdle rate of 12 percent. Required: 1. Determine Kaler’s return on investment (ROI), investment tur

> Solano Company has sales of $500,000, cost of goods sold of $370,000, other operating expenses of $50,000, average invested assets of $1,600,000, and a hurdle rate of 6 percent. Required: 1. Determine Solano’s return on investment (ROI), investment turno

> Krall Company recently had a computer malfunction and lost a portion of its accounting records. The company has reconstructed some of its financial performance measurements including components of the return-on-investment calculations. Required: Help Kra

> Fleetwood Company recently had a computer malfunction and lost a portion of its accounting records. The company has reconstructed some of its financial performance measurements, including components of the return-on-investment calculations. Required: Hel

> Match the most likely type of responsibility center classification to each of the following positions. You may use a classification once, more than once, or not at all. Employment Positions: - Sales manager - Regional manager - Company president - Purcha

> Identify which perspective(s) of the balanced scorecard each of the following critical success factors relates to by placing an X in the appropriate cell. Each success factor could relate to more than one category.

> Tulip Company is made up of two divisions: A and B. Division A produces a widget that Division B uses in the production of its product. Variable cost per widget is $0.75; full cost is $1.00. Comparable widgets sell on the open market for $1.50 each. Divi

> Assume you are the vice president of operations for a local company. Your company is in the process of converting from a small, centralized organization in which its president makes all decisions to a larger, geographically dispersed one with decentraliz

> Shaw is a lumber company that also manufactures custom cabinetry. It is made up of two divisions: Lumber and Cabinetry. The Lumber Division is responsible for harvesting and preparing lumber for use; the Cabinetry Division produces custom-ordered cabinet

> The following is a list of various metrics used to measure performance. For each metric, identify the correct balanced scorecard perspective with which the metric is associated. For Learning and Growth, use LG; for Customer, use C; for Financial, use F;

> For each of the following independent cases (1 to 4), compute the missing values. Note: Complete the missing items in alphabetical order.

> Refer to the information presented in E10–15. Assume that the Molding Division has excess capacity, but the Assembly Division requires the casing to be made from a specific blend of plastics. This would raise the variable cost per unit to $20. Required:

> Refer to the information presented in E10–15. Assume that the Molding Division has enough excess capacity to accommodate the request. Required: 1. Explain whether the Molding Division should accept the $18 transfer price proposed by management. 2. Calcul

> The Molding Division of Cotwold Company manufactures a plastic casing used by the Assembly Division. This casing is also sold to external customers for $25 per unit. Variable costs for the casing are $12 per unit and fixed cost is $3 per unit. Cotwold ex

> The University of Dental Health (UDH) is a state-run university focusing on the education and training of dentists, dental assistants, dental hygienists, and other dental professionals. UDH has just hired a new controller who wants to organize UDH by res

> Refer to E10–12. Suppose Fred’s plant manufactures a component used by another division of the organization. He has approached you for help in understanding why everyone seems to be making such a big deal about the transfer price that he plans to charge

> Your brother-in-law, Fred Miles, has just taken a new position as the plant manager of a local production facility. He has been told that the company uses a balanced scorecard approach to evaluate its managers. Fred is not familiar with this approach bec

> Poseidon Corporation manufactures a variety of gear for water sports. Poseidon has three divisions: Lake, River, and Ocean. Each division is managed as an investment center. During the current year, the Ocean division experienced the following transactio

> Choose a company with which you regularly do business. Assume you have been hired as a consultant to help overhaul its performance evaluation system. Required: 1. Briefly outline a balanced scorecard approach that could be used to evaluate the performanc

> Match each of the terms by inserting the appropriate definition letter in the space provided. Not all definitions will be used. 1. Balanced Scorecard 2. Centralized Organization 3. DuPont Method 4. Hurdle Rate 5. Investment Center 6. Profit Center 7. Cos

> Refer to the information presented in E9–8 for Parker Plastic. Required: Calculate Parker Plastic’s direct labor rate and efficiency variances. Data from E9-8: Parker Plastic, Inc., manufactures plastic mats to use wi

> Reyes Manufacturing Company uses a job order cost system. At the beginning of January, the company had one job in process (Job 201) and one job completed but not yet sold (Job 200). Job 202 was started during January. Other select account balances follow

> Refer to E1-1. Suppose that, after a thorough investigation, Books on Wheels decided to go forward with the new product aimed at university students. The product, The Campus Cart, has gone into production, and the first units have already been delivered

> Parker Plastic, Inc., manufactures plastic mats to use with rolling office chairs. Its standard cost information for last year follows: Parker Plastic had the following actual results for the past year: Required: Calculate Parker Plasticâ€

> Betty’s Bakery has the following standard cost sheet for one unit of its most popular cake: During the month of May, the company made 600 cakes and incurred the following actual costs: Direct materials purchased and used (900 pounds), $

> Crystal Charm Company makes handcrafted silver charms that attach to jewelry such as a necklace or bracelet. Each charm is adorned with two crystals of various colors. Standard costs follow: During the month of January, Crystal Charm made 1,800 charms. T

> Suds & Cuts is a local pet grooming shop owned by Collin Bark. Collin has prepared the following standard cost card for each dog bath given: During the month of July, Collin’s employees gave 360 baths. The actual results were 725 ou

> Perfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 1.5 feet of leather and predicts leather will cost $2.50 per foot. Suppose Perfect Pet made 60 collars during February. For these 60 collars, the comp

> Gleason Guitars produces acoustic guitars. The table below contains budget and actual information for the month of June: Required: Complete the table.

> For each of the following independent cases, fill in the missing amounts:

> Olive Company makes silver belt buckles. The company’s master budget appears in the first column of the table. Required: Complete the table by preparing Olive’s flexible budget for 4,000, 6,000, and 7,000 units.

> Haives Manufacturing Company (HMC) bases its fixed overhead rate on practical capacity of 80,000 units per year. Budgeted and actual results for the most recent year follow: Required: Calculate the following for HMC: 1. Fixed overhead rate based on pract

> See Clear Company calculates a fixed overhead rate based on budgeted fixed overhead of $192,000 and budgeted production of 600,000 units. Actual results were as follows: Required: Calculate the following for See Clear: 1. Fixed overhead rate based on bud

> Refer to the information presented in E2–18 for Verizox Company. Required: 1. Prepare the journal entry to apply manufacturing overhead to Work in Process Inventory. 2. Prepare the journal entry to record actual manufacturing overhead c

> See Clear Company manufactures clear plastic CD cases. It applies variable overhead based on the number of machine hours used. Information regarding See Clear’s overhead for the month of December follows: During December, See Clear had

> Haines Manufacturing Company (HMC) bases its fixed overhead rate on practical capacity of 30,000 units per year. Budgeted and actual results for the most recent year follow: Required: Calculate the following for HMC: 1. Fixed overhead rate based on pract

> Amber Company produces iron table and chair sets. During October, Amber’s costs were as follows: Required: 1. Calculate the total cost of purchases for October. 2. Compute the direct materials price variance based on quantity purchased.

> Lamp Light Limited (LLL) calculates a fixed overhead rate based on budgeted fixed overhead of $32,400 and budgeted production of 24,000 units. Actual results were as follows: Required: Calculate the following for LLL: 1. Fixed overhead rate based on budg

> Lamp Light Limited (LLL) manufactures lampshades. It applies variable overhead on the basis of direct labor hours. Information from LLL’s standard cost card follows: During August, LLL had the following actual results: Required: Compute

> Refer to the information presented in E9–8 for Parker Plastic. Required: Prepare the journal entry to record the following for Parker Plastic: 1. Direct materials costs and related variances. Assume the company purchases raw materials a

> Refer to the information presented in E9–8 for Parker Plastic. Required: Calculate Parker Plastic’s fixed overhead spending and volume variances and its over- or underapplied fixed overhead. Data from E9-8: Parker Pla

> Refer to the information presented in E9–8 for Parker Plastic. Required: Calculate Parker Plastic’s variable overhead rate and efficiency variances and its over- or underapplied variable overhead. Data from E9-8: Park

> Ironwood Company manufactures cast-iron barbeque cookware. During a recent windstorm, I lost some of its cost accounting records. Ironwood has managed to reconstruct portions of its standard cost system database but is still missing a few pieces of infor

> In addition to the information in E8–5 through E8–8 regarding Shadee Corp., the following data are available: ∙ Selling costs are expected to be 6 percent of sales. ∙ Fixed administrative expenses per month total $1,200. Required: Prepare Shadee’s sellin

> Verizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours. At the beginning of the most recent year, the company estimated its manufacturing overhead cost at $300,000. Estimated direct labor

> Refer to E8–5 through E8–7 for Shadee Corp. Use the information and solutions presented to complete the requirements. Required: 1. Determine Shadee’s budgeted manufacturing cost per visor. (Note: Assume that fixed overhead per unit is $2.) 2. Prepare Sha

> Refer to the information in E8–5 for Shadee Corp. Suppose that each visor takes 0.30 direct labor hours to produce and Shadee pays its workers $9 per hour. Required: Prepare Shadee’s direct labor budget for May and June. Data from E8-5: Shadee Corp. exp

> Refer to the information in E8–5 for Shadee Corp. Each visor requires a total of $4.00 in direct materials that includes an adjustable closure that the company purchases from a supplier at a cost of $1.50 each. Shadee wants to have 30 closures on hand on

> Shadee Corp. expects to sell 600 sun visors in May and 800 in June. Each visor sells for $18. Shadee’s beginning and ending finished goods inventories for May are 75 and 50 units, respectively. Ending finished goods inventory for June will be 60 units. R

> Complete the following table: