Question: Ferris Company began 2018 with 6,000

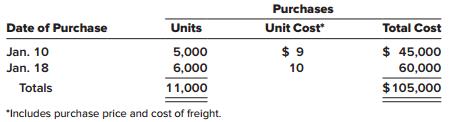

Ferris Company began 2018 with 6,000 units of its principal product. The cost of each unit is $8. Merchandise transactions for the month of January 2018 are as follows:

Sales

Date of Sale ______________Units

Jan. 5 …………………………………………… 3,000

Jan. 12 ………………………………………….. 2,000

Jan. 20 ……………………………………..….. 4,000

Total ………………………………………….... 9,000

8,000 units were on hand at the end of the month.

Required:

Calculate January’s ending inventory and cost of goods sold for the month using each of the following alternatives:

1. FIFO, periodic system

2. LIFO, periodic system

3. LIFO, perpetual system

4. Average cost, periodic system

5. Average cost, perpetual system

Transcribed Image Text:

Purchases Unit Cost $ 9 Date of Purchase Units Total Cost $ 45,000 60,000 Jan. 10 5,000 Jan. 18 6,000 10 Totals 11,000 $105,000 "Includes purchase price and cost of freight.

> Define each of the following retail terms: initial markup, additional markup, markup cancellation, markdown, markdown cancellation.

> What is a consignment arrangement? Explain the accounting treatment of goods held on consignment.

> Both the gross profit method and the retail inventory method provide a way to estimate ending inventory. What is the main difference between the two estimation techniques?

> The Rider Company uses the gross profit method to estimate ending inventory and cost of goods sold. The cost percentage is determined based on historical data. What factors could cause the estimate of ending inventory to be overstated?

> The fair value of depreciable assets of Penner Packaging Company exceeds their book value by $12 million. The assets’ average remaining useful life is 10 years. They are being depreciated by the straight-line method. Finest Foods Industries buys 40% of P

> Explain the gross profit method of estimating ending inventory.

> AAA Hardware uses the LIFO method to value its inventory. Inventory at the beginning of the year consisted of 10,000 units of the company’s one product. These units cost $15 each. During the year, 60,000 units were purchased at a cost of $18 each and 64,

> Describe the alternative approaches for recording inventory write-downs.

> Explain the (a) lower of cost or net realizable value (LCNRV) approach and the (b) lower of cost or market (LCM) approach to valuing inventory.

> Explain how purchase commitments are recorded for the lower of contract price or market price.

> Define purchase commitments. What is the advantage(s) of these agreements to buyers?

> In November 2018, the Brunswick Company signed two purchase commitments. The first commitment requires Brunswick to purchase 10,000 units of inventory at $10 per unit by December 15, 2018. The second commitment requires the company to purchase 20,000 uni

> Bell International can estimate the amount of loss that will occur if a foreign government expropriates some company property. Expropriation is considered reasonably possible. How should Bell report the loss contingency?

> On April 17, 2018, the Loadstone Mining Company purchased the rights to a coal mine. The purchase price plus additional costs necessary to prepare the mine for extraction of the coal totaled $4,500,000. The company expects to extract 900,000 tons of coal

> Identify any differences between U.S. GAAP and IFRS when applying the lower of cost or net realizable value rule to inventory valuation.

> Explain the accounting treatment of material inventory errors discovered in an accounting period subsequent to the period in which the error is made.

> In the application of the equity method, how should dividends from the investee be accounted for? Why?

> When a company changes its inventory method to LIFO, an exception is made for the way accounting changes usually are reported. Explain the difference in the accounting treatment of a change to the LIFO inventory method from other inventory method changes

> Explain the difference between the retail inventory method using LIFO and the dollar-value LIFO retail method.

> Discuss the treatment of freight-in, net markups, normal spoilage, and employee discounts in the application of the retail inventory method.

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015, are available in Connect. This m

> Identify four methods of assigning cost to ending inventory and cost of goods sold and briefly explain the difference in the methods.

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available in Connect. This material is also available under the Investor Relations li

> Refer to the situation described in BE 11–16. Assume that SCC’s fair value of $40 million approximates fair value less costs to sell and that the present value of SCC’s estimated future cash flows is $41 million. If WebHelper prepares its financial state

> Happlia Co. imports household appliances. Each model has many variations and each unit has an identification number. Happlia pays all costs for getting the goods from the port to its central warehouse in Des Moines. After repackaging, the goods are consi

> Determining the physical quantity that should be included in inventory normally is a simple matter because that amount consists of items in the possession of the company. The cost of inventory includes all necessary expenditures to acquire the inventory

> On July 15, 2018, Cottonwood Industries sold a patent and equipment to Roquemore Corporation for $750,000 and $325,000, respectively. The book value of the patent and equipment on the date of sale were $120,000 and $400,000 (cost of $550,000 less accumul

> The Austin Company uses the dollar-value LIFO inventory method with internally developed price indexes. Assume that ending inventory at year-end cost has been determined. Outline the remaining steps used in the dollar-value LIFO computations.

> The equity method has been referred to as a one-line consolidation. What might prompt this description?

> Merry-Go-Round Enterprises, the clothing retailer for dedicated followers of young men’s and women’s fashion, was looking natty as a company. It was March 1993, and the Joppa, Maryland-based outfit had just announced t

> You were recently hired to work in the controller’s office of the Balboa Lumber Company. Your boss, Alfred Eagleton, took you to lunch during your first week and asked a favor. “Things have been a little slow lately, and we need to borrow a little cash t

> Maxi Corporation uses the unit LIFO inventory method. The costs of the company’s products have been steadily rising since the company began operations in 2008 and cost increases are expected to continue. The chief financial officer of the company would l

> Income statement and balance sheet information abstracted from a recent annual report of Wolverine World Wide, Inc. appears below: The significant accounting policies note disclosure contained the following: Inventories The Company used the LIFO method

> In 2017 the Moncrief Company purchased from Jim Lester the right to be the sole distributor in the western states of a product called Zelenex. In payment, Moncrief agreed to pay Lester 20% of the gross profit recognized from the sale of Zelenex in 2018.

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015, are available in Connect. This m

> At the end of 2018, the Biggie Company performed its annual physical inventory count. John Lawrence, the manager in charge of the physical count, was told that an additional $22,000 in inventory that had been sold and was in transit to the customer shoul

> An accounting intern for a local CPA firm was reviewing the financial statements of a client in the electronics industry. The intern noticed that the client used the FIFO method of determining ending inventory and cost of goods sold. When she asked a col

> The Esquire Company employs a periodic inventory system. Indicate the effect (increase or decrease) of the following items on cost of goods sold: 1. Beginning inventory 2. Purchases 3. Ending inventory 4. Purchase returns 5. Freight-in

> You have just been hired as a consultant to Tangier Industries, a newly formed company. The company president, John Meeks, is seeking your advice as to the appropriate inventory method Tangier should use to value its inventory and cost of goods sold. Mr.

> Funseth Farms Inc. purchased a tractor in 2015 at a cost of $30,000. The tractor was sold for $3,000 in 2018. Depreciation recorded through the disposal date totaled $26,000. Prepare the journal entry to record the sale. Now assume the tractor was sold f

> Under what circumstances is the equity method used to account for an investment in stock?

> The inventory of Royal Decking consisted of five products. Information about the December 31, 2018, inventory is as follows: Costs to sell consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. Required: Wh

> Cansela Corporation uses a periodic inventory system and the LIFO method to value its inventory. The company began 2018 with inventory of 4,500 units of its only product. The beginning inventory balance of $64,000 consisted of the following layers: 2,000

> Capwell Corporation uses a periodic inventory system. The company’s ending inventory on December 31, 2018, its fiscal-year end, based on a physical count, was determined to be $326,000. Capwell’s unadjusted trial balance also showed the following account

> Taylor Corporation has used a periodic inventory system and the LIFO cost method since its inception in 2011. The company began 2018 with the following inventory layers (listed in chronological order of acquisition): 10,000 units @ $15 …………………….. $150,00

> Whaley Distributors is a wholesale distributor of electronic components. Financial statements for the year ended December 31, 2018, reported the following amounts and subtotals ($ in millions): In 2019 the following situations occurred or came to light

> Caterpillar, Inc., is one of the world’s largest manufacturers of construction, mining, and forestry machinery. The following disclosure note is included in the company’s 2015 financial statements: D. Inventories ($ in millions) Inventories are stated at

> Carlson Auto Dealers Inc. sells a handmade automobile as its only product. Each automobile is identical; however, they can be distinguished by their unique ID number. At the beginning of 2018, Carlson had three cars in inventory, as follows: Car ID _____

> Topanga Group began operations early in 2018. Inventory purchase information for the quarter ended March 31, 2018, for Topanga’s only product is provided below. The unit costs include the cost of freight. The company uses a periodic inv

> Johnson Corporation began 2018 with inventory of 10,000 units of its only product. The units cost $8 each. The company uses a periodic inventory system and the LIFO cost method. The following transactions occurred during 2018: a. Purchased 50,000 additio

> Reagan Corporation is a wholesale distributor of truck replacement parts. Initial amounts taken from Reagan’s records are as follows: Inventory at December 31 (based on a physical count of goods in Reagan’s warehouse o

> The following inventory transactions took place near December 31, 2018, the end of the Rasul Company’s fiscal year-end: 1. On December 27, 2018, merchandise costing $2,000 was shipped to the Myers Company on consignment. The shipment arrived at Myers’s

> Do U.S. GAAP and IFRS differ in the amount of flexibility that companies have in electing the fair value option? Explain.

> Altira Corporation uses a perpetual inventory system. The following transactions affected its merchandise inventory during the month of August 2018: Aug. 1 Inventory on hand—2,000 units; cost $6.10 each. 8 Purchased 10,000 units for $5.50 each. 14 Sold 8

> Samuelson and Messenger (SAM) began 2018 with 200 units of its one product. These units were purchased near the end of 2017 for $25 each. During the month of January, 100 units were purchased on January 8 for $28 each and another 200 units were purchased

> Almaden Valley Variety Store uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2018 are as follows: Required: Estimate the ending inventory and cost of goods sold for 2018, applying the conventional retail m

> James Company began the month of October with inventory of $15,000. The following inventory transactions occurred during the month: a. The company purchased merchandise on account for $22,000 on October 12, 2018. Terms of the purchase were 2/10, n/30. Ja

> The December 31, 2018, inventory of Tog Company, based on a physical count, was determined to be $450,000. Included in that count was a shipment of goods received from a supplier at the end of the month that cost $50,000. The purchase was recorded and pa

> At the beginning of 2018, Quentin and Kopps (Q&K) adopted the dollar-value LIFO (DVL) inventory method. On that date the value of its one inventory pool was $84,000. The company uses an internally generated cost index to convert ending inventory to b

> On January 1, 2018, Avondale Lumber adopted the dollar-value LIFO inventory method. The inventory value for its one inventory pool on this date was $260,000. An internally generated cost index is used to convert ending inventory to base year. Year-end in

> Kingston Company uses the dollar-value LIFO method of computing inventory. An external price index is used to convert ending inventory to base year. The company began operations on January 1, 2018, with an inventory of $150,000. Year-end inventories at y

> Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015, are available in Connect. This m

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available Connect. This material also is available under the Investor Relations link

> SFAC No. 6, “Elements of Financial Statements,” states that “an entity’s assets, liabilities, and equity (net assets) all pertain to the same set of probable future economic benefits.” Explain this statement.

> Herman Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows: Required: What unit values should Herman use for each of its products when applying the lower of cost or m

> The Zoo Doo Compost Company processes a premium organic fertilizer made with the help of the animals at the Memphis Zoo. Zoo Doo is sold in a specially designed plastic pail that may be kept and used for household chores or returned to the seller. The fe

> Consultants notified management of Goo Goo Baby Products that a crib toy poses a potential health hazard. Counsel indicated that a product recall is probable and is estimated to cost the company $5.5 million. How will this affect the company’s income sta

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available in Connect. This material is also available under the Investor Relations li

> WebHelper Inc. acquired 100% of the outstanding stock of Silicon Chips Corporation (SCC) for $45 million, of which $15 million was allocated to goodwill. At the end of the current fiscal year, an impairment test revealed the following: fair value of SCC,

> The December 31, 2018, year-end inventory balance of the Raymond Corporation is $210,000. You have been asked to review the following transactions to determine if they have been correctly recorded. 1. Goods shipped to Raymond f.o.b. destination on Decemb

> Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months e

> Under what conditions should an employer accrue an expense and the related liability for employees’ compensation for future absences? How do company custom and practice affect the accrual decision?

> Salaries of $5,000 have been earned by employees by the end of the period but will not be paid to employees until the following period. How should the expense and related liability be recorded? Why?

> How does commercial paper differ from a bank loan? Why is the interest rate often less for commercial paper?

> Banks sometimes loan cash under noninterest-bearing notes. Is it true that banks lend money without interest?

> Bank loans often are arranged under existing lines of credit. What is a line of credit? How does a noncommitted line of credit differ from a committed line?

> Bronson Distributors owes a supplier $100,000 on open account. The amount is payable in three months. What is the theoretically correct way to measure the reportable amount for this liability? In practice, how will it likely be reported? Why?

> What distinguishes current liabilities from long-term liabilities?

> At the beginning of the year, Patrick Company acquired a computer to be used in its operations. The computer was delivered by the supplier, installed by Patrick, and placed into operation. The estimated useful life of the computer is five years, and its

> What are the essential characteristics of liabilities for purposes of financial reporting?

> Refer to the situation described in BE 11–13. Assume that the present value of the estimated future cash flows generated from the division’s assets is $22 million and that their fair value approximates fair value less costs to sell. What amount of impair

> You are the plaintiff in a lawsuit. Your legal counsel advises that your eventual victory is inevitable. “You will be awarded $12 million,” your attorney confidently asserts. Describe the appropriate accounting treatment.

> Suppose the Environmental Protection Agency is in the process of investigating Ozone Ruination Limited for possible environmental damage but has not proposed a penalty as of December 31, 2017, the company’s fiscal year-end. Describe the two-step process

> Identify two advantages of dollar-value LIFO compared with unit LIFO.

> The Kwok Company’s inventory balance on December 31, 2018, was $165,000 (based on a 12/31/2018 physical count) before considering the following transactions: 1. Goods shipped to Kwok f.o.b. destination on December 20, 2018, were received on January 4, 20

> After the end of the reporting period, a contingency comes into existence. Under what circumstances, if any, should the contingency be reported in the financial statements for the period ended?

> At December 31, the end of the reporting period, the analysis of a loss contingency indicates that an obligation is only reasonably possible, though its dollar amount is readily estimable. During February, before the financial statements are issued, new

> Distinguish between the accounting treatment of a manufacturer’s warranty and an extended warranty. Why the difference?

> Name two loss contingencies that almost always are accrued.

> Portland Co. uses the straight-line depreciation method for depreciable assets. All assets are depreciated individually except manufacturing machinery, which is depreciated by the composite method. Required: 1. What factors should have influenced Portla

> Suppose the analysis of a loss contingency indicates that an obligation is not probable. What accounting treatment, if any, is warranted?

> What is the difference between the use of the term contingent liability in U.S. GAAP and IFRS?

> Refer to the situation described in BE 11–13. Assume that the sum of estimated future cash flows is $24 million instead of $28 million. What amount of impairment loss should C&R recognize? In BE 11–13 Collison and Ryder Company (C&R) has been experienci

> List and briefly describe the three categories of likelihood that a future event(s) will confirm the incurrence of the liability for a loss contingency.

> Define a loss contingency. Provide three examples.

> How do IFRS and U.S. GAAP differ with respect to the classification of debt that is expected to be refinanced?

> Campbell Corporation uses the retail method to value its inventory. The following information is available for the year 2018: Required: Determine the December 31, 2018, inventory that approximates average cost. Cost Retail Merchandise inventory, Ja

> How do companies account for gift cards?

> The Playa Company uses a periodic inventory system. The following information is taken from Playa’s records. Certain data have been intentionally omitted ($ in thousands). Required: Determine the missing numbers. Show computations whe

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available Connect. This material also is available under the Investor Relations link