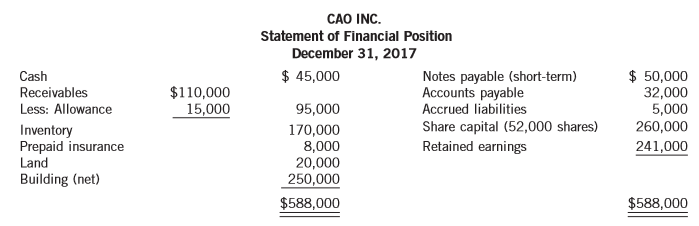

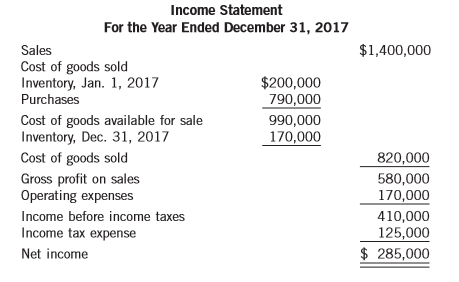

Question: Financial information for Cao Inc. follows. /

Financial information for Cao Inc. follows.

Instructions:

(a) Calculate the following ratios or relationships of Cao Inc. Assume that the ending account balances are representative unless the information provided indicates differently.

1. Current ratio

2. Inventory turnover

3. Receivables turnover

4. Average age of receivables (days sales outstanding)

5. Average age of payables (days payables outstanding)

6. Earnings per share

7. Profit margin on sales

8. Rate of return on assets

(b) For each of the following transactions, indicate whether the transaction would improve, weaken, or have no effect on the current ratio of Cao Inc. at December 31, 2017.

1. Writing off an uncollectible account receivable for $2,200

2. Receiving a $20,000 down payment on services to be performed in 2017

3. Paying $40,000 on notes payable (short-term)

4. Collecting $23,000 on accounts receivable 5. Purchasing equipment on account

6. Giving an existing creditor a short-term note in settlement of an open account payable

7. Recording an impairment loss on land

Transcribed Image Text:

CAO INC. Statement of Financial Position December 31, 2017 $ 45,000 $ 50,000 32,000 5,000 260,000 Cash $110,000 15,000 Notes payable (short-term) Accounts payable Accrued liabilities Receivables Less: Allowance 95,000 Inventory Prepaid insurance Land 170,000 8,000 20,000 250,000 Share capital (52,000 shares) Retained earnings 241,000 Building (net) $588,000 $588,000 Income Statement For the Year Ended December 31, 2017 Sales $1,400,000 Cost of goods sold Inventory, Jan. 1, 2017 Purchases $200,000 790,000 Cost of goods available for sale Inventory, Dec. 31, 2017 Cost of goods sold Gross profit on sales Operating expenses 990,000 170,000 820,000 580,000 170,000 Income before income taxes 410,000 125,000 $ 285,000 Income tax expense Net income

> Bradburn Corporation was formed five years ago through an initial public offering (IPO) of common shares. Daniel Brown, who owns 15% of the common shares, was one of the organizers of Bradburn and is its current president. The company has been successful

> At December 31, 2017, Bouvier Corp. has assets of $10 million, liabilities of $6 million, common shares of $2 million (representing 2 million common shares of $1.00 par), and retained earnings of $2 million. Net sales for the year 2017 were $18 million,

> You are compiling the consolidated financial statements for Vu Corporation International (VCI), a public company. The corporation’s accountant, Timothy Chow, has provided you with the following segment information. Note 7: Major Segment

> Leopard Corporation is currently preparing its annual financial statements for the fiscal year ended April 30, 2017, following IFRS. The company manufactures plastic, glass, and paper containers for sale to food and drink manufacturers and distributors.

> Three independent situations follow. Situation 1 A company received a notice from the provincial environment ministry that a site the company had been using to dispose of waste was considered toxic, and that the company would be held responsible for its

> The following excerpt is from the financial statements of H. J. Heinz Company and provides segmented geographic data: The company is engaged principally in one line of business—processed food products—that represents m

> Brondon Corp. purchased a put option on Mykia common shares on July 7, 2017 for $480. The put option is for 350 shares, and the strike price is $50. The option expires on January 31, 2018. The following data are available with respect to the put option:

> You have completed your audit of Khim Inc. and its consolidated subsidiaries for the year ended December 31, 2017, and are satisfied with the results of your examination. You have examined the financial statements of Khim for the past three years. The co

> Oakridge Leasing Corporation signs an agreement on January 1, 2017 to lease equipment to LeBlanc Limited. Oakridge and LeBlanc follow ASPE. The following information relates to the agreement. 1. The term of the non-cancellable lease is five years, with n

> Radiohead Inc. produces electronic components for sale to manufacturers of radios, television sets, and digital sound systems. In connection with her examination of Radiohead’s financial statements for the year ended December 31, 2017, Marg Zajic, CPA, c

> Your firm has been engaged to examine the financial statements of Samson Corporation for the year 2017. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on J

> In an examination of Daniel Corporation Ltd. as of December 31, 2017, you have learned that the following situations exist. No entries have been made in the accounting records for these items. Daniel follows IFRS. 1. The corporation erected its present f

> Franklin Corporation is a diversified company that operates in five different industries: A, B, C, D, and E. The following information relating to each segment is available for 2017. Sales of segments B and C included intersegment sales of $20,000 and $1

> Sayaka Tar and Gravel Ltd. operates a road construction business. In its first year of operations, the company obtained a contract to construct a road for the municipality of Cochrane West, and it is estimated that the project will be completed over a th

> The accounting for the items in the numbered list that follows is commonly different for financial reporting purposes than it is for tax purposes. 1. For financial reporting purposes, the straight-line depreciation method is used for plant assets that ha

> Hang Technologies Inc. held a portfolio of shares and bonds that it accounted for using the fair value through other comprehensive income model at December 31, 2017. This was the first year that Hang had purchased investments. In part due to Hang’s inexp

> Allen Corporation reports the following amounts in its first three years of operations. The difference between taxable income and accounting income is due to one reversing difference. The tax rate is 30% for all years and the company expects to continu

> The following are independent items. 1. The excess amount of a charge to the accounting records (allowance method) over a charge to the tax return (direct write off method) for uncollectible receivables. 2. The excess amount of accrued pension expense ov

> Refer to P16-1, but assume that Hing Wa wrote (sold) the call option for a premium of $480 (instead of buying it). Assume that the market price of the shares and the fair value of the option are otherwise the same. Instructions: Prepare the journal entr

> On January 1, 2018, Xu Ltd., which uses IFRS 16, entered into an eight-year lease agreement for a conveyor machine. Annual lease payments are $28,500 at the beginning of each lease year, which ends December 31, and Xu made the first payment on January 1,

> Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and the tax bases of its assets and liabilities at the end of 2017. It is estimated that the warranty liability will be settled in 2018. The differ

> Yen Inc.’s only temporary difference at the beginning and end of 2017 is caused by a $4.8-million deferred gain for tax purposes on an instalment sale of a plant asset. The related receivable (only one half of which is classified as a current asset) is d

> Zak Corp. purchased depreciable assets costing $600,000 on January 2, 2017. For tax purposes, the company uses CCA in a class that has a 40% rate. For financial reporting purposes, the company uses straight-line depreciation over five years. The enacted

> The following are independent situations for Bramwell Corp. 1. Estimated warranty costs (covering a three-year warranty) are expensed for financial reporting purposes at the time of sale but deducted for income tax purposes when they are paid. 2. Equity

> Use the information for Jenny Corporation in E18-16. Assume that the company reports accounting income of $155,000 in each of 2018 and 2019, and that there is no reversing difference other than the one identified in E18-16. In addition, assume now that J

> Refer to the information for Henry Limited in E18-11. Following the year ended December 31, 2017, Henry continued to actively trade its securities investments until the end of its 2018 fiscal year, when it was forced to sell several of them at a loss, be

> Use the information for Jenny Corporation in E18-16. Assume that the company reports accounting income of $155,000 in each of 2018 and 2019 and that the warranty expenditures occurred as expected. No reversing difference exists other than the one identif

> Jenny Corporation recorded warranty accruals as at December 31, 2017 in the amount of $150,000. This reversing difference will cause deductible amounts of $50,000 in 2018, $35,000 in 2019, and $65,000 in 2020. Jenny’s accounting income for 2017 is $135,0

> Zdon Inc. reports accounting income of $105,000 for 2017, its first year of operations. The following items cause taxable income to be different than income reported on the financial statements. 1. Capital cost allowance (on the tax return) is greater th

> Use the information for Sorpon Corporation in E18-12. Assume that the company reports accounting income of $180,000 in each of 2018 and 2019, and that there are no reversing differences other than the one identified in E18-12. In addition, assume now tha

> A lease agreement between Hebert Corporation and Russell Corporation is described in E20-3. Instructions: Provide the following for Hebert Corporation, the lessor. (a) Discuss the nature of the lease. (b) Calculate the amount of gross investment at the

> Ashley Limited, which follows IFRS, chooses to classify interest and dividends received as well as interest paid as operating activities and dividends paid as financing activities. Ashley had the following information available at the end of 2017: Ins

> Secord Limited has two classes of shares outstanding: preferred ($6 dividend) and common. At December 31, 2016, the following accounts and balances were included in shareholders’ equity: The contributed surplus accounts arose from net

> Use the information for Sorpon Corporation in E18-12. Assume that the company reports accounting income of $180,000 in each of 2018 and 2019, and that there are no temporary differences other than the one identified in E18-12. Instructions: (a) Calculat

> Sorpon Corporation purchased equipment very late in 2017. Based on generous capital cost allowance rates provided in the Income Tax Act, Sorpon Corporation claimed CCA on its 2017 tax return but did not record any depreciation because the equipment had n

> Henry Limited had investments in securities on its statement of financial position for the first time at the end of its fiscal year ended December 31, 2017. Henry reports under IFRS and its investments in securities are to be accounted for at fair value

> Christina Inc. follows IFRS and accounts for financial instruments based on IFRS 9. Christina holds a variety of investments, some of which are accounted for at fair value through net income and some of which are accounted for at fair value through other

> Instructions: Complete the following statements by filling in the blanks or choosing the correct answer in parentheses. (a) In a period in which a taxable temporary difference reverses, the reversal will cause taxable income to be (less than/ greater tha

> In 2016, Capstone Ltd. issued $50,000 of 8% bonds at par, with each $1,000 bond being convertible into 100 common shares. The company had revenues of $75,000 and expenses of $40,000 for 2017, not including interest and tax. (Assume a tax rate of 25%.) Th

> At January 1, 2017, Ming Limited’s outstanding shares included the following: 280,000 $50 par value, 7%, cumulative preferred shares 900,000 common shares Net income for 2017 was $2,130,000. No cash dividends were declared or paid during 2017. On Februar

> A portion of the combined statement of income and retained earnings of Snap Ltd. for the current year ended December 31, 2017 follows: Note 1. During the year, Snap Inc. suffered a loss from discontinued operations of $400,000 after the applicable inco

> Esau Inc. presented the following data: As of January 1, 2017, there were no dividends in arrears. On December 31, 2017, Esau declared and paid the preferred dividend for 2017. Instructions: (a) Calculate earnings per share for the year ended December

> The following facts are for a non-cancellable lease agreement between Hebert Corporation and Russell Corporation, a lessee: The collectability of the lease payments is reasonably predictable, and there are no important uncertainties about costs that ha

> On January 1, 2017, Trigson Ltd. had 580,000 common shares outstanding. During 2017, it had the following transactions that affected the common share account: Feb. 1……………………………………………………………..Issued 180,000 shares. Mar. 1…………………………………………………….Issued a 10%

> Some complex financial instruments require that the Black-Scholes formula be used to measure their fair value. Examples of these complex instruments include derivatives that are options, bonds issued by the entity that are convertible into shares of the

> The trustees of the IFRS Foundation reiterated and confirmed the organization’s vision in their 2012 Strategy Review Report: We remain committed to the belief that a single set of International Financial Reporting Standards (IFRS) is in the best interest

> On January 1, 2017, Logan Limited had shares outstanding as follows: 6% cumulative preferred shares, $100 par value, 10,000 shares issued and outstanding……………………………………………………….$1,000,000 Common shares, 200,000 shares issued and outstanding…………………..2,000,

> The payroll of Sumerlus Corp. for September 2017 is as follows. Total payroll was $485,000. Pensionable (CPP) and insurable (EI) earnings were $365,000. Income taxes in the amount of $85,000 were withheld, as were $8,000 in union dues. The EI tax rate wa

> The following items are to be reported on a balance sheet. 1. Accrued vacation pay 2. Income tax instalments paid in excess of the income tax liability on the year’s income 3. Service-type warranties issued on appliances sold 4. A bank overdraft, with no

> At December 31, 2017, Reddy Inc. has three long-term debt issues outstanding. The first is a $2.2-million note payable that matures on June 30, 2020. The second is a $4-million bond issue that matures on September 30, 2021. The third is a $17.5-million s

> The following items are found in Bogdan Limited’s financial statements: 1. Interest expense (debit balance) 2. Loss on restructuring of debt 3. Mortgage payable (payable in full in five years) 4. Debenture bonds payable (maturing in two years). The compa

> Koala Inc., a publicly traded company, had 210,000 common shares outstanding on December 31, 2016. During 2017, the company issued 8,000 shares on May 1 and retired 14,000 shares on October 31. For 2017, the company reported net income of $229,690 after

> On January 1, 2018, Khalid Ltd., which follows IAS 17, entered into an eight-year lease agreement for three dryers. Annual lease payments for the equipment are $28,500 at the beginning of each lease year, which ends December 31. Khalid made the first pay

> The following are various accounts: 1. Bank loans payable of a winery, due March 10, 2021 (the product requires aging for five years before it can be sold) 2. $10 million of serial bonds payable, of which $2 million is due each July 31 3. Amounts withhel

> Vargo Limited owes $270,000 to First Trust Inc. on a 10-year, 12% note due on December 31, 2017. The note was issued at par. Because Vargo is in financial trouble, First Trust Inc. agrees to extend the maturity date to December 31, 2019, reduce the princ

> Use the information in E14-24 and the assumptions in E14-26 and answer the following questions related to Green Bank (the creditor). Instructions: (a) What interest rate should Green Bank use to calculate the loss on the debt restructuring? (b) Using ti

> LEW Jewellery Corp. uses gold in the manufacture of its products. LEW anticipates that it will need to purchase 500 ounces of gold in October 2017 for jewellery that will be shipped for the holiday shopping season. However, if the price of gold increases

> Parsons Limited established a share appreciation rights program that entitled its new president, Brandon Sutton, to receive cash for the difference between the shares’ fair value and a pre-established price of $32 (also fair value on December 31, 2016),

> At the end of its fiscal year, December 31, 2017, Javan Limited issued 200,000 share appreciation rights to its officers that entitled them to receive cash for the difference between the fair value of its shares and a pre-established price of $12. The fa

> Barrett Limited established a share appreciation rights program that entitled its new president, Angela Murfitt, to receive cash for the difference between the Barrett Limited common shares’ fair value and a pre-established price of $32 (also fair value

> Anchovy Corp. issued a $1-million, four-year, 7.5% fixed-rate interest only, non prepayable bond on December 31, 2016. Anchovy later decided to hedge the interest rate and change from a fixed rate to variable rate, so it entered into a swap agreement wit

> On January 2, 2017, Yellowknife Corp. issues a $10-million, five-year note at LIBOR, with interest paid annually. To protect against the cash flow uncertainty related to interest payments that are based on LIBOR, Yellowknife entered into an interest rate

> On January 2, 2017, Thompson Corp. issued a $100,000, four-year note at prime plus 1% variable interest, with interest payable semi-annually. On the same date, Thompson entered into an interest rate swap where it agreed to pay 6% fixed and receive prime

> Instructions: Refer to the data and other information provided in E20-21, but now assume that Fine’s fiscal year end is May 31. Prepare the journal entries on Fine Corp.’s books to reflect the lease signing and to record payments and expenses related to

> On January 1, 2017, Kasan Corp. granted stock options to its chief executive officer. This is the only stock option that Kasan offers and the details are as follows: On January 1, 2022, 2,000 of the options were exercised when the fair value of the com

> Gogeon Inc. is publicly traded and uses a calendar year for financial reporting. The company is authorized to issue 50 million common shares. At no time has Gogeon issued any potentially dilutive securities. The following list is a summary of Gogeon’s co

> On January 1, 2017, Waldorf Corporation granted 40,000 options to key executives. Each option allows the executive to purchase one share of Waldorf’s common shares at a price of $30 per share. The options were exercisable within a two-year period beginni

> Brush Inc. recently purchased Paint Pro, a large home-painting corporation. One of the terms of the merger was that if Paint Pro’s net income for 2018 was $110,000 or more, 10,000 additional shares would be issued to Paint’s shareholders in 2019. Paint P

> On December 31, 2017, Master Corp. had a $10-million, 8% fixed-rate note outstanding that was payable in two years. It decided to enter into a two-year swap with First Bank to convert the fixed-rate debt to floating-rate debt. The terms of the swap speci

> Howard Corporation earned $480,000 during a period when it had an average of 100,000 common shares outstanding. The common shares sold at an average market price of $23 per share during the period. Also outstanding were 18,000 warrants that could each be

> Standard Corp’s net income for 2017 is $150,000. The only potentially dilutive securities outstanding were 1,000 call options issued during 2016, with each option being exercisable for one share at $20. None have been exercised, and 30,000 common shares

> Hayward Corporation had net income of $50,000 for the year ended December 31, 2017, and weighted average number of common shares outstanding of 10,000. The following information is provided regarding the capital structure: 1. 7% convertible debt, 200 bon

> Use the same information as in E17-13, except for the changes in part (c). Assume instead that 40% of the convertible bonds were converted to common shares on April 1, 2017. Instructions: (a) Calculate Mininova’s weighted average common shares outstandi

> Mininova Corporation is preparing earnings per share data for 2017. The net income for the year ended December 31, 2017 was $400,000 and there were 60,000 common shares outstanding during the entire year. Mininova has the following two convertible securi

> On January 1, 2017, Fine Corp., which follows IAS 17, signs a 10-year, non-cancellable lease agreement to lease a specialty loom from Sheffield Corporation. The following information concerns the lease agreement. 1. The agreement requires equal rental pa

> On January 1, 2017, Draper Inc. issued $4 million of face value, fi ve-year, 6% bonds at par. Each $1,000 bond is convertible into 20 common shares. Draper’s net income in 2017 was $200,000, and its tax rate was 25%. The company had 100,000 common shares

> Ottey Corporation issued $4 million of 10-year, 7% callable convertible subordinated debentures on January 2, 2017. The debentures have a face value of $1,000, with interest payable annually. The current conversion ratio is 14:1, and in two years it will

> On June 1, 2015, Gustav Corp. and Gabby Limited merged to form Fallon Inc. A total of 800,000 shares were issued to complete the merger. The new corporation uses the calendar year as its fiscal year. On April 1, 2017, the company issued an additional 400

> On January 1, 2017, Manfred Manufacturers had 300,000 common shares outstanding. On April 1, the corporation issued 30,000 new common shares to raise additional capital. On July 1, the corporation declared and distributed a 10% stock dividend on its comm

> The following are unrelated transactions. 1. On March 1, 2017, Loma Corporation issued $300,000 of 8% non-convertible bonds at 104, which are due on February 28, 2037. In addition, each $1,000 bond was issued with 25 detachable stock warrants, each of wh

> Vanstone Corp., a public company, adopted a stock option plan on November 30, 2017 that designated 70,000 common shares as available for the granting of options to officers of the corporation at an exercise price of $8 a share. The market value was $12 a

> The following situations occur independently. 1. A company knows that it will require a large quantity of euros to pay for some imports in three months. The current exchange rate is satisfactory, and as a result, the company purchases a forward contract

> Cambridge Ltd. paid $250 for the option to buy 1,000 of its common shares for $15 each. The contract stipulates that it may only be settled by exercising the option and buying the shares. Cambridge Ltd. follows IFRS. Instructions: (a) Provide the journa

> On January 1, 2017, Fresh Juice Ltd. entered into a purchase commitment contract to buy 10,000 oranges from a local company at a price of $0.50 per orange anytime during the next year. The contract provides Fresh Juice with the option either to take deli

> On April 1, 2017, Petey Ltd. paid $175 for a call to buy 700 shares of NorthernTel at a strike price of $27 per share any time during the next six months. The market price of NorthernTel’s shares was $27 per share on April 1, 2017. On June 30, 2017, the

> Refer to the financial statements and accompanying notes of Canadian Tire Corporation Limited for its year ended January 3, 2015. The financial statements are available on SEDAR (www.sedar.com). Instructions: (a) What are the issued and authorized share

> On January 2, 2017, Jackson Corporation purchased a call option for $500 on Walter’s common shares. The call option gives Jackson the option to buy 1,000 shares of Walter at a strike price of $30 per share any time during the next six months. The market

> Refer to E16-2. Assume the same facts except that the forward contract is a futures contract that trades on the Futures Exchange. On January 1, 2017, Roper is required to deposit $65 with the stockbroker as a margin. Instructions: (a) Prepare the journa

> On January 1, 2017, Roper Inc. agrees to buy 3 kilos of gold at $40,000 per kilo from Golden Corp on April 1, 2017, but does not intend to take delivery of the gold. On the day that the contract was entered into, the fair value of this forward contract w

> On November 1, 2016, Aymar Corp. adopted a stock option plan that granted options to key executives to purchase 45,000 common shares. The options were granted on January 2, 2017, and were exercisable two years after the date of grant if the grantee was s

> On January 1, 2017, Tiamund Corp. sold at 103, 100 of its $1,000 face value, five-year, 9% non-convertible, retractable bonds. The retraction feature allows the holder to redeem the bonds at an amount equal to three times net income, to a maximum of $1,2

> On September 1, 2017, Oxford Corp. sold at 102 (plus accrued interest) 5,200 of its $1,000 face value, 10-year, 9% non-convertible bonds with detachable stock warrants. Each bond carried two detachable warrants; each warrant was for one common share at a

> The treasurer of Hing Wa Corp. has read on the Internet that the stock price of Ewing Inc. is about to take off. In order to profit from this potential development, Hing Wa purchased a call option on Ewing common shares on July 7, 2017 for $480. The call

> On January 1, 2017, Olson Corporation issued $6 million of 10-year, 7% convertible debentures at 104. Investment bankers believe that the debenture would have sold at 102 without the conversion privilege. Interest is to be paid semi-annually on June 30 a

> Somerton Corporation had two issues of securities outstanding: common shares and a 6% convertible bond issue in the face amount of $6 million. Interest payment dates of the bond issue are June 30 and December 31. The conversion clause in the bond indentu

> On January 1, 2017, when the fair value of its common shares was $80 per share, Hammond Corp. issued $10 million of 8% convertible debentures due in 20 years. The conversion option allowed the holder of each $1,000 bond to convert the bond into five comm

> Rancour Ltd., which uses ASPE, recently expanded its operations into an adjoining municipality, and on March 30, 2017, it signed a 15-year lease with its Municipal Industrial Commission (MIC). The property has a total fair value of $450,000 on March 30,

> Dadayeva Inc. has $5 million of 6% convertible bonds outstanding. Each $1,000 bond is convertible into 50 no par value common shares. The bonds pay interest on January 31 and July 31. On July 31, 2017, the holders of $1,250,000 of these bonds exercised t

> Vargo Limited had $2.4 million of bonds payable outstanding and the unamortized premium for these bonds amounted to $44,500. Each $1,000 bond was convertible into 20 preferred shares. All bonds were then converted into preferred shares. The Contributed S

> Daisy Inc. issued $6 million of 10-year, 9% convertible bonds on June 1, 2017 at 98 plus accrued interest. The bonds were dated April 1, 2017, with interest payable April 1 and October 1. Bond discount is amortized semi-annually. Bonds without conversion