Question: Franklin Corporation is a diversified company that

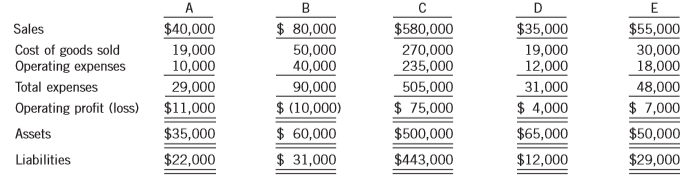

Franklin Corporation is a diversified company that operates in five different industries: A, B, C, D, and E. The following information relating to each segment is available for 2017. Sales of segments B and C included intersegment sales of $20,000 and $100,000, respectively.

Instructions:

(a) Determine which of the segments are reportable under IFRS based on each of the following:

1. Revenue test

2. Operating profit (loss) test

3. Assets test

(b) Prepare the necessary disclosures.

(c) The corporation’s accountant recently commented, “If I have to disclose our segments individually, the only people who will gain are our competitors and the only people who will lose are our present shareholders.†Evaluate this comment.

Transcribed Image Text:

E Sales $40,000 $ 80,000 $580,000 $35,000 $55,000 Cost of goods sold Operating expenses 19,000 10,000 50,000 40,000 270,000 235,000 19,000 12,000 30,000 18,000 Total expenses 29,000 505,000 $ 75,000 90,000 $ (10,000) $ 60,000 $ 31,000 31,000 48,000 Operating profit (loss) $11,000 $ 4,000 $ 7,000 Assets $35,000 $500,000 $65,000 $50,000 Liabilities $22,000 $443,000 $12,000 $29,000

> Refer to P14-11 and Taylor Corp. Instructions: Repeat the instructions of P14-11 assuming that Taylor Corp. uses the effective interest method. Provide an effective interest table for the bonds for two interest payment periods. Data from P14-11: On Ap

> On December 5, 2013, the Toronto-Dominion Bank (TD) announced, and on January 31, 2014 the bank paid, a stock dividend of one common share for each common share issued and outstanding. Access TD’s December 5, 2013 news release and its financial statement

> On April 1, 2017, Taylor Corp. sold 12,000 of its $1,000 face value, 15-year, 11% bonds at 97. Interest payment dates are April 1 and October 1, and the company uses the straight-line method of bond discount amortization. On March 1, 2018, Taylor extingu

> Four independent situations follow: 1. On March 1, 2017, Wilkie Inc. issued $4 million of 9% bonds at 103 plus accrued interest. The bonds are dated January 1, 2017 and pay interest semi-annually on July 1 and January 1. In addition, Wilkie incurred $27,

> Adventureland Incorporated purchased metal to build a new roller coaster on December 31, 2017. Adventureland provided a $500,000 down payment and agreed to pay the balance in equal instalments of $200,000 every December 31 for five years. Adventureland c

> Ramirez Inc., a publishing company, is preparing its December 31, 2017 financial statements and must determine the proper accounting treatment for the following situations. Ramirez has retained your firm to help with this task. 1. Ramirez sells subscript

> In preparing Sahoto Corporation’s December 31, 2017 financial statements under ASPE, the vice-president, finance, is trying to determine the proper accounting treatment for each of the following situations. 1. As a result of uninsured accidents during th

> Floral Gardens Incorporated is a nationwide chain of garden centres that operates as a private company. In 2017, it issued three new financial instruments. All three of these instruments are new to you (in your role as controller), and you are working on

> Huang Inc., a private business following ASPE, has a contract with its president, Ms. Shen, to pay her a bonus during each of the years 2017, 2018, and 2019. Huang has the practice of paying Ms. Shen her bonus in quarterly payments at the end of March, J

> The following is a payroll sheet for Bayview Golf Corporation for the first week of November 2017. The Employment Insurance rate is 1.88% and the maximum annual deduction per employee is $930.60. The employer’s obligation for Employment

> Sultanaly Limited, a private company following ASPE, pays its office employees each week. A partial list follows of employees and their payroll data for August. Because August is the vacation period, vacation pay is also listed. Assume that the income

> Healy Corp., a leader in the commercial cleaning industry, acquired and installed, at a total cost of $110,000 plus 15% HST, three underground tanks to store hazardous liquid solutions needed in the cleaning process. The tanks were ready for use on Febru

> Matta Leasing Limited, which has a fiscal year end of October 31 and follows IFRS 16, signs an agreement on January 1, 2017 to lease equipment to Irvine Limited. The following information relates to the agreement. 1. The term of the non-cancellable lease

> Hrudka Corp. has manufactured a broad range of quality products since 1988. The operating cycle of the business is less than one year. The following information is available for the company’s fiscal year ended February 28, 2017. Hrudka

> Bian Inc. financed the purchase of equipment costing $85,000 on January 1, 2017 using a note payable. The note requires Bian to make annual $23,971 payments of blended interest and principal on January 1 of the following four years, beginning January 1,

> Hamilton Airlines is faced with two situations that need to be resolved before the financial statements for the company’s year ended December 31, 2017 can be issued. 1. The airline is being sued for $4 million for an injury caused to a child as a result

> Dubois Steel Corporation, as lessee, signed a lease agreement for equipment for five years, beginning January 31, 2017. Annual rental payments of $41,000 are to be made at the beginning of each lease year (January 31). The insurance and repairs and maint

> Ramey Corporation is a diversified public company with nationwide interests in commercial real estate development, banking, copper mining, and metal fabrication. The company has offices and operating locations in major cities throughout Canada. With corp

> Refer to the information in P20-4. Follow the instructions under the assumption that Situ Ltd. follows IAS 17. Data from P20-4: Refer to the information in P20-3. Instructions: (a) Prepare the journal entries that Situ would make on January 1, 2017 an

> The shareholders’ equity section of Finley Inc. at the beginning of the current year is as follows: Common shares, 1,000,000 shares authorized, 300,000 shares issued and outstanding………………………………………………………………….$3,600,000 Retained earnings………………………………………………

> Refer to the information in P20-3. Follow the instructions under the assumption that Hunter Ltd. follows IAS 17. Data from P20-3: On January 1, 2017, Hunter Ltd. entered into an agreement to lease a truck from Situ Ltd. Both Hunter and Situ use IFRS 16

> On October 30, 2017, Truttman Corp. sold a five-year-old building with a carrying value of $10 million at its fair value of $13 million and leased it back. There was a gain on the sale. Truttman pays all insurance, maintenance, and taxes on the building.

> The head office of North Central Ltd. has operated in the western provinces for almost 50 years. North Central uses ASPE. In 2001, new offices were constructed on the same site at a cost of $9.5 million. The new building was opened on January 4, 2002, an

> You are a senior auditor auditing the December 31, 2017 financial statements of Hoang, Inc., a manufacturer of novelties and party favors and a user of ASPE. During your inspection of the company garage, you discovered that a 2016 Shirk automobile is par

> Use the information for P20-21. Instructions: Under Option 2: (a) Assume that at the signing of the original lease, Sanderson Inc. has no intention of exercising the lease renewal. Determine the classification of the three-year lease for BMW Canada, whi

> Sanderson Inc., a pharmaceutical distribution firm, is providing a BMW car for its chief executive officer as part of a remuneration package. Sanderson has a calendar year end, issues financial statements annually, and follows ASPE. You have been assigne

> Mulholland Corp., a lessee, entered into a non-cancellable lease agreement with Galt Manufacturing Ltd., a lessor, to lease special-purpose equipment for a period of seven years. Mulholland follows IFRS 16 and Galt follows ASPE. The following information

> Fram Fibre glass Corp. (FFC) is a private New Brunswick company, using ASPE, that manufactures a variety of fibre glass products for the fishing and food services industry. With the traditional fishery in decline over the past few years, FFC found itself

> Ali Reiners, a new controller of Luftsa Corp., is preparing the financial statements for the year ended December 31, 2017. Luftsa is a publicly traded entity and therefore follows IFRS. Ali has found the following information. 1. Luftsa has been offering

> Bayberry Corporation performs year-end planning in November each year before its fiscal year ends in December. The preliminary estimated net income following IFRS is $4.2 million. The CFO, Rita Warren, meets with the company president, Jim Bayberry, to r

> You have been asked by a client to review the records of Inteq Corporation, a small manufacturer of precision tools and machines that follows ASPE. Your client is interested in buying the business, and arrangements were made for you to review the account

> Chatham Inc. purchased an option to buy 10,000 of its common shares for $35 each. The option cost $750, and explicitly stipulates that it may only be settled by exercising the option and buying the shares. Instructions: (a) Provide the journal entry req

> Kitchener Corporation has followed IFRS and used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced b

> Jacobsen Corporation is in the process of negotiating a loan for expansion purposes. Jacobsen’s books and records have never been audited and the bank has requested that an audit be performed and that IFRS be followed. Jacobsen has prep

> On January 1, 2017, Lavery Corp., which follows ASPE, leased equipment to Flynn Ltd., which follows IFRS 16. Both Lavery and Flynn have calendar year ends. The following information concerns this lease. 1. The term of the non-cancellable lease is six yea

> Seneca Corporation, which uses IFRS, has contracted with you to prepare a statement of cash flows. The controller has provided the following information: Additional information related to 2017 is as follows: 1. Equipment that cost $10,500 and was 50% d

> The unclassified statement of financial position accounts for Sorkin Corporation, which is a public company using IFRS, for the year ended December 31, 2016 and its statement of comprehensive income and statement of cash flows for the year ended December

> Bradburn Corporation was formed five years ago through an initial public offering (IPO) of common shares. Daniel Brown, who owns 15% of the common shares, was one of the organizers of Bradburn and is its current president. The company has been successful

> At December 31, 2017, Bouvier Corp. has assets of $10 million, liabilities of $6 million, common shares of $2 million (representing 2 million common shares of $1.00 par), and retained earnings of $2 million. Net sales for the year 2017 were $18 million,

> You are compiling the consolidated financial statements for Vu Corporation International (VCI), a public company. The corporation’s accountant, Timothy Chow, has provided you with the following segment information. Note 7: Major Segment

> Leopard Corporation is currently preparing its annual financial statements for the fiscal year ended April 30, 2017, following IFRS. The company manufactures plastic, glass, and paper containers for sale to food and drink manufacturers and distributors.

> Three independent situations follow. Situation 1 A company received a notice from the provincial environment ministry that a site the company had been using to dispose of waste was considered toxic, and that the company would be held responsible for its

> The following excerpt is from the financial statements of H. J. Heinz Company and provides segmented geographic data: The company is engaged principally in one line of business—processed food products—that represents m

> Brondon Corp. purchased a put option on Mykia common shares on July 7, 2017 for $480. The put option is for 350 shares, and the strike price is $50. The option expires on January 31, 2018. The following data are available with respect to the put option:

> You have completed your audit of Khim Inc. and its consolidated subsidiaries for the year ended December 31, 2017, and are satisfied with the results of your examination. You have examined the financial statements of Khim for the past three years. The co

> Oakridge Leasing Corporation signs an agreement on January 1, 2017 to lease equipment to LeBlanc Limited. Oakridge and LeBlanc follow ASPE. The following information relates to the agreement. 1. The term of the non-cancellable lease is five years, with n

> Radiohead Inc. produces electronic components for sale to manufacturers of radios, television sets, and digital sound systems. In connection with her examination of Radiohead’s financial statements for the year ended December 31, 2017, Marg Zajic, CPA, c

> Your firm has been engaged to examine the financial statements of Samson Corporation for the year 2017. The bookkeeper who maintains the financial records has prepared all the unaudited financial statements for the corporation since its organization on J

> In an examination of Daniel Corporation Ltd. as of December 31, 2017, you have learned that the following situations exist. No entries have been made in the accounting records for these items. Daniel follows IFRS. 1. The corporation erected its present f

> Sayaka Tar and Gravel Ltd. operates a road construction business. In its first year of operations, the company obtained a contract to construct a road for the municipality of Cochrane West, and it is estimated that the project will be completed over a th

> The accounting for the items in the numbered list that follows is commonly different for financial reporting purposes than it is for tax purposes. 1. For financial reporting purposes, the straight-line depreciation method is used for plant assets that ha

> Hang Technologies Inc. held a portfolio of shares and bonds that it accounted for using the fair value through other comprehensive income model at December 31, 2017. This was the first year that Hang had purchased investments. In part due to Hang’s inexp

> Allen Corporation reports the following amounts in its first three years of operations. The difference between taxable income and accounting income is due to one reversing difference. The tax rate is 30% for all years and the company expects to continu

> The following are independent items. 1. The excess amount of a charge to the accounting records (allowance method) over a charge to the tax return (direct write off method) for uncollectible receivables. 2. The excess amount of accrued pension expense ov

> Refer to P16-1, but assume that Hing Wa wrote (sold) the call option for a premium of $480 (instead of buying it). Assume that the market price of the shares and the fair value of the option are otherwise the same. Instructions: Prepare the journal entr

> On January 1, 2018, Xu Ltd., which uses IFRS 16, entered into an eight-year lease agreement for a conveyor machine. Annual lease payments are $28,500 at the beginning of each lease year, which ends December 31, and Xu made the first payment on January 1,

> Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and the tax bases of its assets and liabilities at the end of 2017. It is estimated that the warranty liability will be settled in 2018. The differ

> Yen Inc.’s only temporary difference at the beginning and end of 2017 is caused by a $4.8-million deferred gain for tax purposes on an instalment sale of a plant asset. The related receivable (only one half of which is classified as a current asset) is d

> Zak Corp. purchased depreciable assets costing $600,000 on January 2, 2017. For tax purposes, the company uses CCA in a class that has a 40% rate. For financial reporting purposes, the company uses straight-line depreciation over five years. The enacted

> The following are independent situations for Bramwell Corp. 1. Estimated warranty costs (covering a three-year warranty) are expensed for financial reporting purposes at the time of sale but deducted for income tax purposes when they are paid. 2. Equity

> Use the information for Jenny Corporation in E18-16. Assume that the company reports accounting income of $155,000 in each of 2018 and 2019, and that there is no reversing difference other than the one identified in E18-16. In addition, assume now that J

> Refer to the information for Henry Limited in E18-11. Following the year ended December 31, 2017, Henry continued to actively trade its securities investments until the end of its 2018 fiscal year, when it was forced to sell several of them at a loss, be

> Use the information for Jenny Corporation in E18-16. Assume that the company reports accounting income of $155,000 in each of 2018 and 2019 and that the warranty expenditures occurred as expected. No reversing difference exists other than the one identif

> Jenny Corporation recorded warranty accruals as at December 31, 2017 in the amount of $150,000. This reversing difference will cause deductible amounts of $50,000 in 2018, $35,000 in 2019, and $65,000 in 2020. Jenny’s accounting income for 2017 is $135,0

> Zdon Inc. reports accounting income of $105,000 for 2017, its first year of operations. The following items cause taxable income to be different than income reported on the financial statements. 1. Capital cost allowance (on the tax return) is greater th

> Use the information for Sorpon Corporation in E18-12. Assume that the company reports accounting income of $180,000 in each of 2018 and 2019, and that there are no reversing differences other than the one identified in E18-12. In addition, assume now tha

> A lease agreement between Hebert Corporation and Russell Corporation is described in E20-3. Instructions: Provide the following for Hebert Corporation, the lessor. (a) Discuss the nature of the lease. (b) Calculate the amount of gross investment at the

> Ashley Limited, which follows IFRS, chooses to classify interest and dividends received as well as interest paid as operating activities and dividends paid as financing activities. Ashley had the following information available at the end of 2017: Ins

> Secord Limited has two classes of shares outstanding: preferred ($6 dividend) and common. At December 31, 2016, the following accounts and balances were included in shareholders’ equity: The contributed surplus accounts arose from net

> Use the information for Sorpon Corporation in E18-12. Assume that the company reports accounting income of $180,000 in each of 2018 and 2019, and that there are no temporary differences other than the one identified in E18-12. Instructions: (a) Calculat

> Sorpon Corporation purchased equipment very late in 2017. Based on generous capital cost allowance rates provided in the Income Tax Act, Sorpon Corporation claimed CCA on its 2017 tax return but did not record any depreciation because the equipment had n

> Henry Limited had investments in securities on its statement of financial position for the first time at the end of its fiscal year ended December 31, 2017. Henry reports under IFRS and its investments in securities are to be accounted for at fair value

> Christina Inc. follows IFRS and accounts for financial instruments based on IFRS 9. Christina holds a variety of investments, some of which are accounted for at fair value through net income and some of which are accounted for at fair value through other

> Instructions: Complete the following statements by filling in the blanks or choosing the correct answer in parentheses. (a) In a period in which a taxable temporary difference reverses, the reversal will cause taxable income to be (less than/ greater tha

> In 2016, Capstone Ltd. issued $50,000 of 8% bonds at par, with each $1,000 bond being convertible into 100 common shares. The company had revenues of $75,000 and expenses of $40,000 for 2017, not including interest and tax. (Assume a tax rate of 25%.) Th

> At January 1, 2017, Ming Limited’s outstanding shares included the following: 280,000 $50 par value, 7%, cumulative preferred shares 900,000 common shares Net income for 2017 was $2,130,000. No cash dividends were declared or paid during 2017. On Februar

> A portion of the combined statement of income and retained earnings of Snap Ltd. for the current year ended December 31, 2017 follows: Note 1. During the year, Snap Inc. suffered a loss from discontinued operations of $400,000 after the applicable inco

> Esau Inc. presented the following data: As of January 1, 2017, there were no dividends in arrears. On December 31, 2017, Esau declared and paid the preferred dividend for 2017. Instructions: (a) Calculate earnings per share for the year ended December

> The following facts are for a non-cancellable lease agreement between Hebert Corporation and Russell Corporation, a lessee: The collectability of the lease payments is reasonably predictable, and there are no important uncertainties about costs that ha

> On January 1, 2017, Trigson Ltd. had 580,000 common shares outstanding. During 2017, it had the following transactions that affected the common share account: Feb. 1……………………………………………………………..Issued 180,000 shares. Mar. 1…………………………………………………….Issued a 10%

> Some complex financial instruments require that the Black-Scholes formula be used to measure their fair value. Examples of these complex instruments include derivatives that are options, bonds issued by the entity that are convertible into shares of the

> The trustees of the IFRS Foundation reiterated and confirmed the organization’s vision in their 2012 Strategy Review Report: We remain committed to the belief that a single set of International Financial Reporting Standards (IFRS) is in the best interest

> On January 1, 2017, Logan Limited had shares outstanding as follows: 6% cumulative preferred shares, $100 par value, 10,000 shares issued and outstanding……………………………………………………….$1,000,000 Common shares, 200,000 shares issued and outstanding…………………..2,000,

> The payroll of Sumerlus Corp. for September 2017 is as follows. Total payroll was $485,000. Pensionable (CPP) and insurable (EI) earnings were $365,000. Income taxes in the amount of $85,000 were withheld, as were $8,000 in union dues. The EI tax rate wa

> The following items are to be reported on a balance sheet. 1. Accrued vacation pay 2. Income tax instalments paid in excess of the income tax liability on the year’s income 3. Service-type warranties issued on appliances sold 4. A bank overdraft, with no

> Financial information for Cao Inc. follows. Instructions: (a) Calculate the following ratios or relationships of Cao Inc. Assume that the ending account balances are representative unless the information provided indicates differently. 1. Current rati

> At December 31, 2017, Reddy Inc. has three long-term debt issues outstanding. The first is a $2.2-million note payable that matures on June 30, 2020. The second is a $4-million bond issue that matures on September 30, 2021. The third is a $17.5-million s

> The following items are found in Bogdan Limited’s financial statements: 1. Interest expense (debit balance) 2. Loss on restructuring of debt 3. Mortgage payable (payable in full in five years) 4. Debenture bonds payable (maturing in two years). The compa

> Koala Inc., a publicly traded company, had 210,000 common shares outstanding on December 31, 2016. During 2017, the company issued 8,000 shares on May 1 and retired 14,000 shares on October 31. For 2017, the company reported net income of $229,690 after

> On January 1, 2018, Khalid Ltd., which follows IAS 17, entered into an eight-year lease agreement for three dryers. Annual lease payments for the equipment are $28,500 at the beginning of each lease year, which ends December 31. Khalid made the first pay

> The following are various accounts: 1. Bank loans payable of a winery, due March 10, 2021 (the product requires aging for five years before it can be sold) 2. $10 million of serial bonds payable, of which $2 million is due each July 31 3. Amounts withhel

> Vargo Limited owes $270,000 to First Trust Inc. on a 10-year, 12% note due on December 31, 2017. The note was issued at par. Because Vargo is in financial trouble, First Trust Inc. agrees to extend the maturity date to December 31, 2019, reduce the princ

> Use the information in E14-24 and the assumptions in E14-26 and answer the following questions related to Green Bank (the creditor). Instructions: (a) What interest rate should Green Bank use to calculate the loss on the debt restructuring? (b) Using ti

> LEW Jewellery Corp. uses gold in the manufacture of its products. LEW anticipates that it will need to purchase 500 ounces of gold in October 2017 for jewellery that will be shipped for the holiday shopping season. However, if the price of gold increases

> Parsons Limited established a share appreciation rights program that entitled its new president, Brandon Sutton, to receive cash for the difference between the shares’ fair value and a pre-established price of $32 (also fair value on December 31, 2016),

> At the end of its fiscal year, December 31, 2017, Javan Limited issued 200,000 share appreciation rights to its officers that entitled them to receive cash for the difference between the fair value of its shares and a pre-established price of $12. The fa

> Barrett Limited established a share appreciation rights program that entitled its new president, Angela Murfitt, to receive cash for the difference between the Barrett Limited common shares’ fair value and a pre-established price of $32 (also fair value

> Anchovy Corp. issued a $1-million, four-year, 7.5% fixed-rate interest only, non prepayable bond on December 31, 2016. Anchovy later decided to hedge the interest rate and change from a fixed rate to variable rate, so it entered into a swap agreement wit

> On January 2, 2017, Yellowknife Corp. issues a $10-million, five-year note at LIBOR, with interest paid annually. To protect against the cash flow uncertainty related to interest payments that are based on LIBOR, Yellowknife entered into an interest rate

> On January 2, 2017, Thompson Corp. issued a $100,000, four-year note at prime plus 1% variable interest, with interest payable semi-annually. On the same date, Thompson entered into an interest rate swap where it agreed to pay 6% fixed and receive prime