Question: First Solar, Inc., designs and manufactures

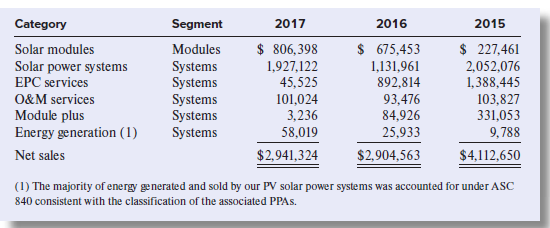

First Solar, Inc., designs and manufactures photovoltaic (PV) solar modules with an advanced thin film semiconductor technology; develops, designs, and constructs PV solar power systems that primarily use the modules it manufactures; and provides operations and maintenance (O&M) services to system owners. In 2017, First Solar adopted ASC Topic 606 (which it refers to in its disclosures as ASU 2014-09) one year before it was required to do so. In adopting the new revenue recognition standard, First Solar used the full retroactive restatement approach. The following is First Solar’s note disclosure related to revenue recognition: 16. Revenue from Contracts with Customers The following table represents a disaggregation of revenue from contracts with customers for the years ended December 31, 2017, 2016, and 2015 along with the reportable segment for each category (in thousands):

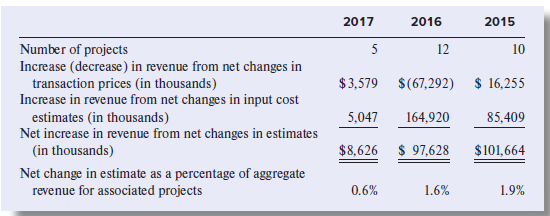

We generally recognize revenue for sales of solar power systems and/or EPC services over time using cost based input methods, in which significant judgment is required to evaluate assumptions including the amount of net contract revenues and the total estimated costs to determine our progress towards contract completion and to calculate the corresponding amount of revenue to recognize. If the estimated total costs on any contract are greater than the net contract revenues, we recognize the entire estimated loss in the period the loss becomes known. The cumulative effect of revisions to estimates related to net contract revenues or costs to complete contracts are recorded in the period in which the revisions to estimates are identified and the amounts can be reasonably estimated. Changes in estimates for sales of systems and EPC services occur for a variety of reasons, including but not limited to (i) construction plan accelerations or delays, (ii) module cost forecast changes, (iii) cost related change orders, or (iv) changes in other information used to estimate costs. Changes in estimates may have a material effect on our consolidated statements of operations. The following table outlines the impact on revenue of net changes in estimated transaction prices and input costs for systems related sales contracts (both increases and decreases) for the years ended December 31, 2017, 2016, and 2015 as well as the number of projects that comprise such changes. For purposes of the table, we only include projects with changes in estimates that have a net impact on revenue of at least $1.0 million during the periods presented. Also included in the table is the net change in estimate as a percentage of the aggregate revenue for such projects.

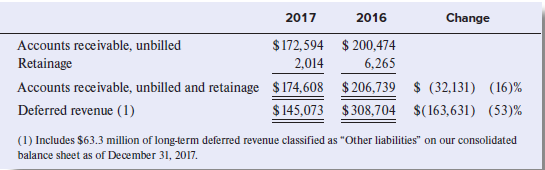

The following table reflects the changes in our contract assets, which we classify as “Accounts receivable, unbilled†or “Retainage,†and our contract liabilities, which we classify as “Deferred revenue,†for the year ended December 31, 2017 (in thousands):

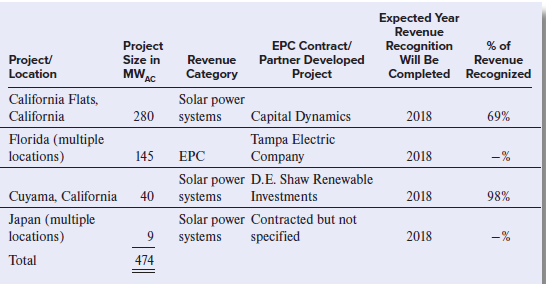

Accounts receivable, unbilled represents a contract asset for revenue that has been recognized in advance of billing the customer, which is common for long-term construction contracts. Billing requirements vary by contract but are generally structured around the completion of certain construction milestones. Some of our EPC contracts for systems we build may also contain retain age provisions. Retain age represents a contract asset for the portion of the contract price earned by us for work performed, but held for payment by the customer as a form of security until we reach certain construction milestones. When we receive consideration, or such consideration is unconditionally due, from a customer prior to transferring goods or services to the customer under the terms of a sales contract, we record deferred revenue, which represents a contract liability. Such deferred revenue typically results from billings in excess of costs incurred on long-term construction contracts and advance payments received on sales of solar modules. For the year ended December 31, 2017, our contract assets decreased by $32.1 million primarily due to final billings on the East Pecos project and additional billings on the Butler and Shams Ma’an projects following the completion of substantially all construction activities in 2016, partially offset by unbilled receivables associated with the sale of the California Flats project in 2017. For the year ended December 31, 2017, our contract liabilities decreased by $163.6 million primarily as a result of the completion of the sale of the Moapa project, on which we had received a significant portion of the proceeds in 2016, and revenue recognized from construction on the Helios project following the partial billing of such services in 2016, partially offset by advance payments received on sales of solar modules. During the years ended December 31, 2017 and 2016, we recognized revenue of $308.6 million and $98.3 million, respectively, that was included in the corresponding contract liability balance at the beginning of the periods. The following table represents our remaining performance obligations as of December 31, 2017 for sales of solar power systems, including uncompleted sold projects, projects under sales contracts subject to conditions precedent, and EPC agreements for partner developed projects that we are constructing or expect to construct. Such table excludes remaining performance obligations for any sales arrangements that had not fully satisfied the criteria to be considered a contract with a customer pursuant to the requirements of ASC 606. We expect to recognize $0.5 billion of revenue for such contracts through the later of the substantial completion or the closing dates of the projects.

As of December 31, 2017, we had entered into contracts with customers for the future sale of 6.5 GWDC of solar modules for an aggregate transaction price of $2.3 billion. We expect to recognize such amounts as revenue through 2020 as we transfer control of the modules to customers, which typically occurs upon shipment or delivery depending on the terms of the underlying contracts. As of December 31, 2017, we had also entered into long-term O&M contracts covering more than 7 GWDC of utility-scale PV solar power systems. We expect to recognize $0.6 billion of revenue during the non cancelable term of these O&M contracts over a weighted-average period of 11.7 years. As part of our adoption of ASU 2014-09 in the first quarter of 2017, we elected to use the practical expedient under ASC 606-10-65-1(f)(3), pursuant to which we have excluded disclosures of transaction prices allocated to remaining performance obligations and when we expect to recognize such revenue for all periods prior to the date of initial application of ASU 2014-09.

Required:

1. Discuss trends in First Solar’s revenue streams. For more information about First Solar’s results, you may want to consult the Management Discussion and Analysis in its Form 10-K for 2017, available at the SEC’s website at www.sec.gov.

2. Explain why First Solar recognizes revenue over time for many of its revenue streams.

3. Explain how and why revenue is affected by changes in estimates.

> Weir Company (a fictional company) uses straight-line depreciation for its property, plant, andequipment, which, stated at cost, consisted of the following: Weir’s depreciation expenses for 20X1 and 20X0 were $55,000 and $50,000, respec

> Kobe Company began constructing a building for its own use in February 20X1. During 20X1, Kobe incurred interest of $70,000 on specific construction debt and $15,000 on other borrowings. Interest computed on the weighted-average amount of accumulated exp

> Clay Company started construction on a new office building on January 1, 20X1, and it movedinto the finished building on July 1, 20X2. Of the building’s $2,500,000 total cost, $2,000,000was incurred in 20X1 evenly throughout the year. Clay’s incremental

> The income statement and statement of cash flows for ABC Equipment Company for 20X1 areprovided below. Supplemental Information: Other current liabilities represent obligations for general and administrative expenses. Required: Derive a direct method p

> Rosario Company’s International Division reported the following results: The constant currency growth rate for 20X2 represents what the year-over-year sales growth versus 20X1 would have been if exchange rates had not changed from 20X1

> Lindy, a calendar-year U.S. corporation, bought inventory items from a supplier in Germany on November 5, 20X1, for 100,000 euros, when the spot exchange rate was $1.40 per euro. At Lindy’s December 31, 20X1, year-end, the spot exchange rate was $1.38. O

> A wholly owned subsidiary of Ward Inc. has certain expense accounts for the year ended December 31, 20X3, stated in local currency units (LCUs) as follows: The exchange rates at various dates are as follows: Assume that the LCU is the subsidiaryâ&#

> On September 1, 20X1, Cano & Company, a U.S. corporation, sold merchandise to a foreign firm for 250,000 euros. Terms of the sale require payment in euros on February 1, 20X2. On September 1, 20X1, the spot exchange rate was $1.30 per euro. At Cano’s yea

> The CEO of Crawford, Inc., evaluates financial statement information for four distinct operating segments: Television stations, Television entertainment production, Movie entertainment production, and Merchandise sales. The Television stations segment ea

> The CEO of Mannix, Inc., evaluates financial statement information for five distinct operating segments: Appliances, Heathcare, Transportation, Financial services, and Other stuff. Operating profit for each segment follows: Required: Explain which of Ma

> Refer to the information about Clear One Communications in Case C2-2 from Chapter 2. Required: Obtain the Form 10-K Clear One filed with the SEC on August 18, 2005. (Go to www.sec.gov and select “Filings” and then “Search for Company Filings.” Search fo

> The CEO of Lannister, Inc., evaluates financial statement information for five distinct operating segments: Hardware sales, Consulting, Hardware servicing, Financing, and Rising technology. Revenue and assets for the segments expressed as percentages of

> United Company has two foreign subsidiaries, Cancorp and Britcorp. Cancorp operates in Canada and Britcorp operates in the United Kingdom. Both companies are 100% owned by United Company and their financial statements are translated into U.S. dollars usi

> Wick Corporation has a Mexican subsidiary that had the following balance sheet at December 31, 20X1 (stated in millions of pesos): At December 31, 20X1, it took 19.66 pesos to buy one U.S. dollar. At December 31, 20X2, it took only 19.50 pesos to buy one

> On December 31, 20X1, the Stockholders’ Equity section of Mercedes Corporation was as follows: On March 1, 20X2, the board of directors declared a 10% stock dividend and accordingly issued 900 additional shares. The stockâ€&#

> Newton Corporation was organized on January 1, 20X1. On that date, it issued 200,000 shares of its $10 par value common stock at $15 per share (400,000 shares were authorized). During the period from January 1, 20X1, through December 31, 20X3, Newton rep

> Warren Corporation was organized on January 1, 20X1, with an authorization of 500,000 shares of common stock ($5 par value per share). During 20X1, the company had the following capital transactions: Required: What should be the balance in the Additional

> Forever Yours, Inc., a manufacturer of wedding rings, issued two financial instruments at the beginning of 20X1: a $10 million, 40-year bond that pays interest at the rate of 11% annually and 10,000 shares of $100 preferred stock that pays a dividend of

> The stockholders’ equity section of Peter Corporation’s balance sheet at December 31, 20X1, follows: On January 2, 20X2, Peter purchased and retired 100,000 shares of its stock for $1,800,000. Required: What is the ba

> On July 1, 20X1, Amos Corporation granted nontransferable, nonqualified stock options to certain key employees as additional compensation. The options permit the purchase of 20,000 shares of Amos’s $1 par common stock at a price of $32 per share. On the

> Information concerning the capital structure of the Petrock Corporation is as follows: During 20X1, Petrock paid dividends of $1 per share on its common stock and $2.40 per share on its preferred stock. The preferred stock is convertible into 20,000 shar

> Refer to the salesforce.com financial statement excerpts given below to answer the questions. On January 31, 2019, the price of salesforce.com stock was $151.97, and there were 770 million shares of common stock outstanding. The price of its stock on Jan

> Fountain Inc. has 5,000,000 shares of common stock outstanding on January 1, 20X1. It issued an additional 1,000,000 shares of common stock on April 1, 20X1, and 500,000 more on July 1, 20X1. On October 1, 20X1, Fountain issued 10,000 convertible bonds;

> Tam Company’s net income for the year ending December 31, 20X1, was $10,000. During the year, Tam declared and paid $1,000 cash dividends on preferred stock and $1,750 cash dividends on common stock. At December 31, 20X1, the company had 12,000 shares of

> Effective April 27, 20X1, Dorr Corporation’s shareholders approved a two-for-one split of the company’s common stock and an increase in authorized common shares from 100,000 shares (par value of $20 per share) to 200,0

> The Retained earnings account for Nathan Corporation had a credit balance of $800,000 at the end of 20X0. Selected transactions during 20X1 follow: a. Net income was $130,000. b. Cash dividends declared were $60,000. c. Repurchased 100 shares of Nathan C

> Mason Manufacturing had 600,000 shares of common stock outstanding and 150,000 shares of $100 par value preferred stock outstanding January 1, 20X1. An additional 120,000 shares of common stock were issued on August 1 and 24,000 common shares were repurc

> On April 30, 20X1, Pound Corp. acquired for cash all 200,000 shares of the outstanding common stock of Shake Corp. for $20 per share. At April 30, 20X1, Shake’s balance sheet showed net assets with a $3,000,000 book value. On that date, the fair value o

> Sage Inc. bought 40% of Adams Corporation’s outstanding common stock on January 2, 20X1, for $400,000. The carrying amount of Adams’s net assets at the purchase date totaled $900,000. Fair values and carrying amounts were the same for all items except fo

> In January 20X1, Harold Corporation acquired 20% of Otis Company’s outstanding common stock for $400,000. This investment gave Harold the ability to exercise significant influence over Otis. The book value of Otis’s net assets was $1,500,000. The excess

> Information related to Jones Company’s portfolio of trading securities at December 31, 20X1, follows: Amortized cost of securities……………………………..$340,000 Gross unrealized gains (cumulative)………………… 8,000 Gross unrealized losses (cumulative)………………... 52,000

> The following data pertain to Tyne Company’s investments in marketable equity securities. (Assume that all securities were held throughout 20X0 and 20X1.) Required: 1. What amount should Tyne report as unrealized holding gain (loss) in

> Cephalon Inc. issued $750 million of zero-coupon convertible notes. Because the notes were issued at par, meaning that Cephalon received $750 million cash for the notes, they have a zero yield-to-maturity. Settlement in cash upon conversion is not permit

> Kramden Corporation acquired Norton Company several years ago for $500 million. Goodwill of $100 million was recognized on the transaction. Through 20X0, no goodwill impairment charges have been taken. At December 31, 20X1, the carrying value of Norton,

> Theo Corporation has the following sales and expenses in 20X1, excluding any amounts related to its investment in Caratini Corporation. Next to Theo’s amounts are the 20X1 sales and expenses for Caratini Corporation. There is no excess

> Massie Corporation has an investment in the common stock of Witzmann Corporation. Massie acquired its investment at Witzmann’s book value, so there was no excess cost associated with the investment. In 20X1, Witzmann reported $50 million of net income an

> Mills Corporation owns 90% of Morrow Corporation, and there is no excess cost associated with Mills ’s investment in Morrow. During 20X1, Mills reported in the income statement in its “Parent Only” financial statements, in which the investment in Morrow

> The following is an excerpt from the 2018 Form 10-K of Walgreens Boots Alliance, Inc. (Walgreens). It provides summary income statement data about the companies in which Walgreens has an equity method investment, as well as showing the amount of equity m

> The following were excerpted from Coca-Cola’s 2018 Form 10-K: THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (EXCERPT) THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (EXCERPTâ€

> On January 1, 20X1, Chesapeake Corporation issued common stock with a fair value of $810,000 in exchange for 90% of Dear don Corporation’s common stock. Following are the January 1, 20X1, separate balance sheets of Chesapeake and Dear d

> On January 5, 20X1, Alpha Inc. acquired 80% of the outstanding voting shares of Beta Inc. for $2,000,000 cash. Following are the separate balance sheets for the two companies immediately after the stock purchase, as well as fair value information regardi

> On July 1, 20X1, Pushway Corporation issued 100,000 shares of common stock in exchange for all of Stroker Company’s common stock. The Pushway stock issued had a market value of $500,000 on the date of the exchange. Following are the Jul

> Pate Corp. owns 80% of Strange Inc.’s common stock. During 20X1, Pate sold inventory to Strange for $600,000 on the same terms as sales made to outside customers. Strange sold the entire inventory purchased from Pate by the end of 20X1.

> Groupe Casino is a French multinational company that operates more than 9,000 multiform at retail stores—hypermarkets, supermarkets, discount stores, convenience stores, and restaurants— throughout the world. It has tw

> Founded on January 1, 20X1, Gehl Company had the following passive investments in equity securities at the end of 20X1 and 20X2: Required: If the company recorded a $4,000 debit to its Fair value adjustment account as its 20X2 fair value adjustment, wha

> Stone has provided the following information on its available-for-sale securities: Amortized cost as of 12/31/X1……………………………………$170,000 Unrealized gain as of 12/31/X1……………………………………….4,000 Unrealized losses as of 12/31/X1……………………………………26,000 Net realized g

> On January 1, 20X1, Pack Corp. acquired all of Slam Corp.’s common stock for $500,000. On that date, the fair values of Slam’s net assets equaled their book values of $400,000. During 20X1, Slam paid cash dividends of

> On January 1, 20X1, Pitt Company acquired an 80% investment in Saxe Company. The acquisition cost was equal to Pitt’s equity in Saxe’s recorded net assets at that date. On January 1, 20X1, Pitt and Saxe had retained earnings of $500,000 and $100,000, res

> On April 1, 20X1, Dart Company paid $620,000 for all issued and outstanding common stock of Wall Corporation in a transaction properly accounted for under the acquisition method. Wall’s recorded assets and liabilities on April 1, 20X1,

> On January 1, 20X1, LeMoyne Construction Company signs a contract to build an office building for Franklin Corporation for $10 million. Franklin remits $1 million to LeMoyne upon signing the contract, $5 million when the foundation and all outside compon

> Lyft, Inc., is an app-based ridesharing service. Users request rides via their smart phones and drivers, using their own cars, respond to the requests via the system. Lyft collects the fares from riders and remits the payments due to drivers, keeping a f

> Mystery Technologies, Inc., a hypothetical company, is a leading manufacturer of bar-code scanners and related information technology whose stock is traded on the New York Stock Exchange. In 20X3, the SEC filed allegations that during the previous five-y

> Corrpro Companies, Inc., founded in 1984, provides corrosion control–related services, systems, equipment, and materials to the infrastructure, environmental, and energy markets. Corrpro’s products and services include

> Etsy, Inc., provides a technology platform aimed at allowing sellers to turn their creative passions into economic opportunities. Presented below are excerpts from its December 31, 2018 Form 10-K. Sources of Liquidity In March 2018, we issued $345.0 mill

> The following is selected information from Bob Touret, Inc.’s financial statements. Solve for the missing amounts for each of the five years. You may have to use some numbers from the year before or the year after to solve for certain c

> Following is selected information from the balance sheet for Flaps Inc. Solve for the missing amounts for each of the five years.

> The following is the pre closing trial balance of Ralph Retailers, Inc.: The following additional information is provided: a. The company paid a salary advance of $5,000 to one of its employees, a total that was debited to the Salaries expense account. T

> a. On January 1, 20X1, Frances Corporation started doing business and the owners contributed $200,000 capital in cash. b. The company paid $24,000 to cover the rent for the office space for the 24-month period from January 1, 20X1, to December 31, 20X2.

> The following income statement and balance sheet information is available for the operating segments of Bogart, Inc. The segments do not sell goods or services to one another. The Flynn and Cagney segments have similar economic characteristics, products,

> Refer to the facts in problem P18-7. Required: 1. Translate Mavrogenes’s 20X1 Income Statement into U.S. dollars using the temporal method. 2. Translate Mavrogenes’s 20X1 Statement of Retained Earnings into U.S. dollars using the temporal method. 3. Tra

> Mavrogenes Corporation is a wholly owned Canadian subsidiary of a U.S. parent company. Mavrogenes was formed on January 1, 20X1, when the parent invested C$40 million and Mavrogenes issued 100 shares of common stock. The following are Mavrogenesâ&#

> Refer to Darvish Company in problem P18-5. Use the same information, except assume Cubbie translates Darvish’s financial statements into U.S. dollars using the temporal method. Required: 1. What is the amount of Darvish’s translation exposure at Decembe

> Darvish Company is a European subsidiary of Cubbie Corporation, a U.S. company. Darvish had the following balance sheet at December 31, 20X1: There are no differences between local GAAP and U.S. GAAP for Darvish. Cubbie Translates Darvishâ€

> Neville Company decides at the beginning of 20X3 to adopt the FIFO method of inventory valuation. It had used the LIFO method for financial reporting since its inception on January 1, 20X1, and had maintained records that are sufficient to retrospectivel

> Nagy Corporation’s International Division consists of two of Nagy’s subsidiaries. One of the subsidiaries operates in the United Kingdom and the other on the European continent. The U.K. subsidiary had identical sales revenue amounts, as measured in Brit

> Mack Company is a European subsidiary of Bear Down Corporation, a U.S. company. Mack had the following balance sheets at December 31, 20X2, and December 31, 20X1. Also provided above are the U.S. dollar amounts that appeared in Mack’s t

> Maples Corporation is a Canadian subsidiary of a U.S. parent company. Shown below is the company’s local currency income statement for 20X1. All transactions the company entered into should be considered to have occurred evenly througho

> Wilde Company acquired 30% of Micki, Inc., on January 1, 20X1, at a cost of $40 million. At the time, Micki’s balance sheet was as follows: Only one of Micki’s separately identifiable assets and liabilities had a fair

> On January 1, 20X1, Pluto Company acquired all of Saturn Company’s common stock for $1,000,000 cash. On that date, Saturn had retained earnings of $200,000 and common stock of $600,000. The book values of Saturn’s asse

> The following are the balance sheets for Plate and Salad immediately prior to Plate’s September 1, 20X1, acquisition of Salad: Consider the following cases: Case 1 Plate buys 100% of Salad’s common stock for $180,000 c

> Prince Corp. and Sprite Corp. reported the following balance sheets at January 1, 20X1: On January 2, 20X1, Prince issued $36,000 of stock and used the proceeds to purchase 90% of Sprite’s common stock. The excess of the purchase price

> On January 1, 20X1, Delta Inc. acquired 80% of Sigma Company’s outstanding stock for $80,000 cash. Following are the balance sheets for Delta and Sigma immediately before the acquisition, as well as fair value information regarding Sigm

> On January 1, 20X1, Newyork Capital Corporation purchased 30% of the outstanding common shares of Delta Crating Corp. for $250 million and accounts for this investment under the equity method. The following information is available regarding Delta Cratin

> On December 31, 20X1, Pate Corporation acquired 80% of Starmont Corporation’s common stock for $900,000 cash. Assume that the fair values of Starmont’s identifiable assets and liabilities equaled book values on the acq

> Following are Crash Zone Corporation’s balance sheet at the end of 20X0 and its cash flow statement for 20X1. Crash Zone manufactures safety equipment for race cars. Structure of the Balance Sheet and Statement of Cash Flows Additional

> Second National Insurance Company provided this information for its minority-passive equity securities: Required: 1. Provide the journal entries to record the fair value adjustment on December 31, 20X1. Assume that Second National uses an account entitl

> Amiel Company acquired 90% of the common stock of Talia Corporation on December 31, 20X0. The balance sheets of the two companies immediately after the acquisition was made are shown below: The following are the two companies’ income st

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Agranoff Corporation purchased two zero-coupon bonds on January 1, 20X1. The first bond was issued by Lilah Company. It had a face amount of $100,000 and was scheduled to mature on December 31, 20X5. Agranoff paid $80,245, resulting in an effective inter

> Terry Corporation reported fair values for its minority-passive equity investment portfolio at the last four year-ends as shown in the table below. The company did not buy or sell any investments in 20X1, 20X2, or 20X3. No dividends are paid on any of th

> On January 1, 20X1, Fig land Company purchased for cash 40% of Irene Company’s 300,000 shares of voting common stock for $1,800,000. At the time, 40% of the book value of the underlying equity in Irene’s net assets was $1,400,000; $50,000 of the excess w

> Rite Aid Corporation operates retail drugstores in the United States. It is one of the country’s largestretail drugstore chains with 3,333 stores in operation as of March 3, 20X3. The company’s drugstoresâ€&

> Omega Corporation’s comparative balance sheet accounts worksheet at December 31, 20X1and 20X0, follow, together with a column showing the increase (decrease) from 20X0 to 20X1. Additional Information: • On December 31

> The balance sheet and income statement for Bertha’s Bridal Boutique are presented along with some additional information about the accounts. You are to answer the questions that follow concerning cash flows for the period. a. All accoun

> A statement of cash flows for Friendly Markets, Inc., for 20X1 appears below. Required: Prepare the worksheet entry that would be made to prepare a cash flow statement for each ofthe numbered line items. For example, the worksheet entry for item (1) is

> Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 20X1and 20X0. Additional Information: • On January 2, 20X1, Bergen sold all of its marketable investment securities for $95,000 cash. â€&c

> The balance sheets of Global Trading Company follow: Additional Information: • The company reported a net loss of $279,500 during 20X1. • There are no income taxes. • Goodwill as of December 31, 20X0

> Neighborhood Supermarkets is preparing to go public, and you are asked to assist the firm bypreparing its statement of cash flows for 20X1. Neighborhood’s balance sheets at December 31, 20X0, and December 31, 20X1, and its income statem

> The following are selected balance sheet accounts of Zach Corporation at December 31, 20X1and 20X0, as well as the increases or decreases in each account from 20X0 to 20X1. Also presented is selected income statement information for the year ended Decemb

> The Barden Corporation’s comparative balance sheets for 20X1 and 20X0 are presented below. Additional Information: a. On January 11, 20X1, Barden purchased land for $170,000 cash. b. On January 23, 20X1, Barden extinguished long-term bo

> Karr, Inc., reported net income of $300,000 for 20X1. Changes occurred in several balance sheet accounts as follows: Additional Information: a. During 20X1, Karr sold equipment costing $25,000, with accumulated depreciation of $12,000, for a gain of $5,

> The management of Banciu Corporation provides you with comparative balance sheets at December 31, 20X1, and December 31, 20X0, appearing below. Supplemental Information: a. The following table presents a comparative analysis of retained earnings as of De

> Recall the Rombaurer Metals example in the chapter: On October 1, 20X1, Rombaurer has 10 million pounds of copper inventory on hand at an average cost of $0.65 a pound. The spotprice for copper is $0.90 a pound. Instead of selling copper now, Rombaurer d

> On January 1, 20X1, Four Brothers Manufacturing borrowed $10 million from Guiffrie Bankby signing a three-year, 8.0% fixed-rate note. The note calls for interest to be paid annually on December 31. The company then entered into an interest rate swap agre

> Provided below are excerpts from The Walt Disney Company Form 10-K for the fiscal year ended October 3, 2015. Description of the Business and Segment Information The Walt Disney Company, together with the subsidiaries through which businesses are conduct

> Basie Business Forms borrowed $5 million on July 1, 20X1, from First Kansas City Bank. Theloan required annual interest payments at the LIBOR rate, reset annually each June 30. Theloan principal is due in five years. The LIBOR rate for the first year is

> Newton Grains plans to sell 100,000 bushels of corn from its current inventory in March 20X2. The company paid $1 million for the corn during the fall 20X1 harvest season. On October 1, 20X1, Newton writes a forward contract to sell 100,000 bushels of co

> Silverado Inc. buys titanium from a supplier that requires a six-month firm commitment on allpurchases. On January 1, 20X1, Silverado signs a contract with the supplier to purchase 10,000 pounds of titanium at the current forward rate of $310 per pound w