Question: Terry Corporation reported fair values for its

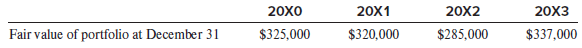

Terry Corporation reported fair values for its minority-passive equity investment portfolio at

the last four year-ends as shown in the table below. The company did not buy or sell any investments in 20X1, 20X2, or 20X3. No dividends are paid on any of the securities in the portfolio. The aggregate cost of the securities in the portfolio is $290,000. The corporate tax rate is 21%.

Required:

1. What amount of deferred tax asset or deferred tax liability does Terry report at December

31, 20X0, related to its portfolio?

2. Prepare the journal entries used to record the income tax effects of the portfolio in 20X1,

20X2, and 20X3. Assume Terry has substantial income from other sources and therefore

no valuation allowance.

3. Suppose Terry sells its investment in Myra Company common stock during 20X4 for $85,000. The investment had cost Terry $60,000 and had a fair value at December 31, 20X3, of $82,000. Prepare the journal entry to record the income tax effect of the sale.

> Kramden Corporation acquired Norton Company several years ago for $500 million. Goodwill of $100 million was recognized on the transaction. Through 20X0, no goodwill impairment charges have been taken. At December 31, 20X1, the carrying value of Norton,

> Theo Corporation has the following sales and expenses in 20X1, excluding any amounts related to its investment in Caratini Corporation. Next to Theo’s amounts are the 20X1 sales and expenses for Caratini Corporation. There is no excess

> Massie Corporation has an investment in the common stock of Witzmann Corporation. Massie acquired its investment at Witzmann’s book value, so there was no excess cost associated with the investment. In 20X1, Witzmann reported $50 million of net income an

> Mills Corporation owns 90% of Morrow Corporation, and there is no excess cost associated with Mills ’s investment in Morrow. During 20X1, Mills reported in the income statement in its “Parent Only” financial statements, in which the investment in Morrow

> The following is an excerpt from the 2018 Form 10-K of Walgreens Boots Alliance, Inc. (Walgreens). It provides summary income statement data about the companies in which Walgreens has an equity method investment, as well as showing the amount of equity m

> The following were excerpted from Coca-Cola’s 2018 Form 10-K: THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (EXCERPT) THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (EXCERPTâ€

> On January 1, 20X1, Chesapeake Corporation issued common stock with a fair value of $810,000 in exchange for 90% of Dear don Corporation’s common stock. Following are the January 1, 20X1, separate balance sheets of Chesapeake and Dear d

> On January 5, 20X1, Alpha Inc. acquired 80% of the outstanding voting shares of Beta Inc. for $2,000,000 cash. Following are the separate balance sheets for the two companies immediately after the stock purchase, as well as fair value information regardi

> On July 1, 20X1, Pushway Corporation issued 100,000 shares of common stock in exchange for all of Stroker Company’s common stock. The Pushway stock issued had a market value of $500,000 on the date of the exchange. Following are the Jul

> Pate Corp. owns 80% of Strange Inc.’s common stock. During 20X1, Pate sold inventory to Strange for $600,000 on the same terms as sales made to outside customers. Strange sold the entire inventory purchased from Pate by the end of 20X1.

> Groupe Casino is a French multinational company that operates more than 9,000 multiform at retail stores—hypermarkets, supermarkets, discount stores, convenience stores, and restaurants— throughout the world. It has tw

> Founded on January 1, 20X1, Gehl Company had the following passive investments in equity securities at the end of 20X1 and 20X2: Required: If the company recorded a $4,000 debit to its Fair value adjustment account as its 20X2 fair value adjustment, wha

> Stone has provided the following information on its available-for-sale securities: Amortized cost as of 12/31/X1……………………………………$170,000 Unrealized gain as of 12/31/X1……………………………………….4,000 Unrealized losses as of 12/31/X1……………………………………26,000 Net realized g

> On January 1, 20X1, Pack Corp. acquired all of Slam Corp.’s common stock for $500,000. On that date, the fair values of Slam’s net assets equaled their book values of $400,000. During 20X1, Slam paid cash dividends of

> On January 1, 20X1, Pitt Company acquired an 80% investment in Saxe Company. The acquisition cost was equal to Pitt’s equity in Saxe’s recorded net assets at that date. On January 1, 20X1, Pitt and Saxe had retained earnings of $500,000 and $100,000, res

> On April 1, 20X1, Dart Company paid $620,000 for all issued and outstanding common stock of Wall Corporation in a transaction properly accounted for under the acquisition method. Wall’s recorded assets and liabilities on April 1, 20X1,

> First Solar, Inc., designs and manufactures photovoltaic (PV) solar modules with an advanced thin film semiconductor technology; develops, designs, and constructs PV solar power systems that primarily use the modules it manufactures; and provides operati

> On January 1, 20X1, LeMoyne Construction Company signs a contract to build an office building for Franklin Corporation for $10 million. Franklin remits $1 million to LeMoyne upon signing the contract, $5 million when the foundation and all outside compon

> Lyft, Inc., is an app-based ridesharing service. Users request rides via their smart phones and drivers, using their own cars, respond to the requests via the system. Lyft collects the fares from riders and remits the payments due to drivers, keeping a f

> Mystery Technologies, Inc., a hypothetical company, is a leading manufacturer of bar-code scanners and related information technology whose stock is traded on the New York Stock Exchange. In 20X3, the SEC filed allegations that during the previous five-y

> Corrpro Companies, Inc., founded in 1984, provides corrosion control–related services, systems, equipment, and materials to the infrastructure, environmental, and energy markets. Corrpro’s products and services include

> Etsy, Inc., provides a technology platform aimed at allowing sellers to turn their creative passions into economic opportunities. Presented below are excerpts from its December 31, 2018 Form 10-K. Sources of Liquidity In March 2018, we issued $345.0 mill

> The following is selected information from Bob Touret, Inc.’s financial statements. Solve for the missing amounts for each of the five years. You may have to use some numbers from the year before or the year after to solve for certain c

> Following is selected information from the balance sheet for Flaps Inc. Solve for the missing amounts for each of the five years.

> The following is the pre closing trial balance of Ralph Retailers, Inc.: The following additional information is provided: a. The company paid a salary advance of $5,000 to one of its employees, a total that was debited to the Salaries expense account. T

> a. On January 1, 20X1, Frances Corporation started doing business and the owners contributed $200,000 capital in cash. b. The company paid $24,000 to cover the rent for the office space for the 24-month period from January 1, 20X1, to December 31, 20X2.

> The following income statement and balance sheet information is available for the operating segments of Bogart, Inc. The segments do not sell goods or services to one another. The Flynn and Cagney segments have similar economic characteristics, products,

> Refer to the facts in problem P18-7. Required: 1. Translate Mavrogenes’s 20X1 Income Statement into U.S. dollars using the temporal method. 2. Translate Mavrogenes’s 20X1 Statement of Retained Earnings into U.S. dollars using the temporal method. 3. Tra

> Mavrogenes Corporation is a wholly owned Canadian subsidiary of a U.S. parent company. Mavrogenes was formed on January 1, 20X1, when the parent invested C$40 million and Mavrogenes issued 100 shares of common stock. The following are Mavrogenesâ&#

> Refer to Darvish Company in problem P18-5. Use the same information, except assume Cubbie translates Darvish’s financial statements into U.S. dollars using the temporal method. Required: 1. What is the amount of Darvish’s translation exposure at Decembe

> Darvish Company is a European subsidiary of Cubbie Corporation, a U.S. company. Darvish had the following balance sheet at December 31, 20X1: There are no differences between local GAAP and U.S. GAAP for Darvish. Cubbie Translates Darvishâ€

> Neville Company decides at the beginning of 20X3 to adopt the FIFO method of inventory valuation. It had used the LIFO method for financial reporting since its inception on January 1, 20X1, and had maintained records that are sufficient to retrospectivel

> Nagy Corporation’s International Division consists of two of Nagy’s subsidiaries. One of the subsidiaries operates in the United Kingdom and the other on the European continent. The U.K. subsidiary had identical sales revenue amounts, as measured in Brit

> Mack Company is a European subsidiary of Bear Down Corporation, a U.S. company. Mack had the following balance sheets at December 31, 20X2, and December 31, 20X1. Also provided above are the U.S. dollar amounts that appeared in Mack’s t

> Maples Corporation is a Canadian subsidiary of a U.S. parent company. Shown below is the company’s local currency income statement for 20X1. All transactions the company entered into should be considered to have occurred evenly througho

> Wilde Company acquired 30% of Micki, Inc., on January 1, 20X1, at a cost of $40 million. At the time, Micki’s balance sheet was as follows: Only one of Micki’s separately identifiable assets and liabilities had a fair

> On January 1, 20X1, Pluto Company acquired all of Saturn Company’s common stock for $1,000,000 cash. On that date, Saturn had retained earnings of $200,000 and common stock of $600,000. The book values of Saturn’s asse

> The following are the balance sheets for Plate and Salad immediately prior to Plate’s September 1, 20X1, acquisition of Salad: Consider the following cases: Case 1 Plate buys 100% of Salad’s common stock for $180,000 c

> Prince Corp. and Sprite Corp. reported the following balance sheets at January 1, 20X1: On January 2, 20X1, Prince issued $36,000 of stock and used the proceeds to purchase 90% of Sprite’s common stock. The excess of the purchase price

> On January 1, 20X1, Delta Inc. acquired 80% of Sigma Company’s outstanding stock for $80,000 cash. Following are the balance sheets for Delta and Sigma immediately before the acquisition, as well as fair value information regarding Sigm

> On January 1, 20X1, Newyork Capital Corporation purchased 30% of the outstanding common shares of Delta Crating Corp. for $250 million and accounts for this investment under the equity method. The following information is available regarding Delta Cratin

> On December 31, 20X1, Pate Corporation acquired 80% of Starmont Corporation’s common stock for $900,000 cash. Assume that the fair values of Starmont’s identifiable assets and liabilities equaled book values on the acq

> Following are Crash Zone Corporation’s balance sheet at the end of 20X0 and its cash flow statement for 20X1. Crash Zone manufactures safety equipment for race cars. Structure of the Balance Sheet and Statement of Cash Flows Additional

> Second National Insurance Company provided this information for its minority-passive equity securities: Required: 1. Provide the journal entries to record the fair value adjustment on December 31, 20X1. Assume that Second National uses an account entitl

> Amiel Company acquired 90% of the common stock of Talia Corporation on December 31, 20X0. The balance sheets of the two companies immediately after the acquisition was made are shown below: The following are the two companies’ income st

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31, 20X8. The bond was purchased for $93,472, a price that

> Agranoff Corporation purchased two zero-coupon bonds on January 1, 20X1. The first bond was issued by Lilah Company. It had a face amount of $100,000 and was scheduled to mature on December 31, 20X5. Agranoff paid $80,245, resulting in an effective inter

> On January 1, 20X1, Fig land Company purchased for cash 40% of Irene Company’s 300,000 shares of voting common stock for $1,800,000. At the time, 40% of the book value of the underlying equity in Irene’s net assets was $1,400,000; $50,000 of the excess w

> Rite Aid Corporation operates retail drugstores in the United States. It is one of the country’s largestretail drugstore chains with 3,333 stores in operation as of March 3, 20X3. The company’s drugstoresâ€&

> Omega Corporation’s comparative balance sheet accounts worksheet at December 31, 20X1and 20X0, follow, together with a column showing the increase (decrease) from 20X0 to 20X1. Additional Information: • On December 31

> The balance sheet and income statement for Bertha’s Bridal Boutique are presented along with some additional information about the accounts. You are to answer the questions that follow concerning cash flows for the period. a. All accoun

> A statement of cash flows for Friendly Markets, Inc., for 20X1 appears below. Required: Prepare the worksheet entry that would be made to prepare a cash flow statement for each ofthe numbered line items. For example, the worksheet entry for item (1) is

> Presented next are the balance sheet accounts of Bergen Corporation as of December 31, 20X1and 20X0. Additional Information: • On January 2, 20X1, Bergen sold all of its marketable investment securities for $95,000 cash. â€&c

> The balance sheets of Global Trading Company follow: Additional Information: • The company reported a net loss of $279,500 during 20X1. • There are no income taxes. • Goodwill as of December 31, 20X0

> Neighborhood Supermarkets is preparing to go public, and you are asked to assist the firm bypreparing its statement of cash flows for 20X1. Neighborhood’s balance sheets at December 31, 20X0, and December 31, 20X1, and its income statem

> The following are selected balance sheet accounts of Zach Corporation at December 31, 20X1and 20X0, as well as the increases or decreases in each account from 20X0 to 20X1. Also presented is selected income statement information for the year ended Decemb

> The Barden Corporation’s comparative balance sheets for 20X1 and 20X0 are presented below. Additional Information: a. On January 11, 20X1, Barden purchased land for $170,000 cash. b. On January 23, 20X1, Barden extinguished long-term bo

> Karr, Inc., reported net income of $300,000 for 20X1. Changes occurred in several balance sheet accounts as follows: Additional Information: a. During 20X1, Karr sold equipment costing $25,000, with accumulated depreciation of $12,000, for a gain of $5,

> The management of Banciu Corporation provides you with comparative balance sheets at December 31, 20X1, and December 31, 20X0, appearing below. Supplemental Information: a. The following table presents a comparative analysis of retained earnings as of De

> Recall the Rombaurer Metals example in the chapter: On October 1, 20X1, Rombaurer has 10 million pounds of copper inventory on hand at an average cost of $0.65 a pound. The spotprice for copper is $0.90 a pound. Instead of selling copper now, Rombaurer d

> On January 1, 20X1, Four Brothers Manufacturing borrowed $10 million from Guiffrie Bankby signing a three-year, 8.0% fixed-rate note. The note calls for interest to be paid annually on December 31. The company then entered into an interest rate swap agre

> Provided below are excerpts from The Walt Disney Company Form 10-K for the fiscal year ended October 3, 2015. Description of the Business and Segment Information The Walt Disney Company, together with the subsidiaries through which businesses are conduct

> Basie Business Forms borrowed $5 million on July 1, 20X1, from First Kansas City Bank. Theloan required annual interest payments at the LIBOR rate, reset annually each June 30. Theloan principal is due in five years. The LIBOR rate for the first year is

> Newton Grains plans to sell 100,000 bushels of corn from its current inventory in March 20X2. The company paid $1 million for the corn during the fall 20X1 harvest season. On October 1, 20X1, Newton writes a forward contract to sell 100,000 bushels of co

> Silverado Inc. buys titanium from a supplier that requires a six-month firm commitment on allpurchases. On January 1, 20X1, Silverado signs a contract with the supplier to purchase 10,000 pounds of titanium at the current forward rate of $310 per pound w

> Exhibit 19.1 describes Chalk Hill’s use of an interest rate swap to hedge its cash flow exposureto interest rate risk from variable rate debt. The journal entries in the exhibit illustrate howspecial “hedge accounting” rules apply to the swap. Suppose in

> On July 1, 20X1, Stan Getz, Inc., bought call option contracts for 500 shares of Selmer Manufacturing common stock. The contracts cost $200, expire on September 15, and have anexercise price of $40 per share. The market price of Selmer’s stock that day w

> George Corporation has a defined benefit pension plan for its employees. The following information is available for 20X1: Required: 1. What was the January 1, 20X1, fair value of the plan assets? 2. What is the expected dollar return on plan assets for 2

> The following information pertains to the pension plan of Beatty Business Group: Note that the information in Columns (2) and (3) are as of the beginning of the year, whereasthe information in Column (4) is measured over the year. The AOCIâ€&#

> The following information is based on an actual annual report. Different names and years are being used. Bond and some of its subsidiaries provide certain postretirement medical, dental, and visioncare and life insurance for retirees and their dependents

> Use the same set of facts as in P15-5. In addition, assume that based on ERISA rules, Magee Corporation must contribute the following amounts to the pension fund: Magee intends to fund the pension plan only to the extent required by ERISA rules. Assumeth

> On January 1, 20X1, Magee Corporation started doing business by hiring R. Walker as an employeeat an annual salary of $50,000, with an annual salary increment of $10,000. Based on his currentage and the company’s retirement program, Walker is required to

> Excerpts from IBM’s 2012 segment disclosures are given below. Business Segments and Capabilities The company’s major operations consist of five business segments: Global Technology Services and Global Business Services

> You have the following information related to Chalmers Corporation’s pension plan: a. Defined benefit, noncontributory pension plan. b. Plan initiation, January 1, 20X3 (no credit given for prior service). c. Retirement benefits paid at

> Puhlman Inc. provides a defined benefit pension plan to its employees. It’s a smoothrecognition of its gains and losses when computing its market-related value to compute expected return. Additional information follows: During 20X1, the

> Turner Inc. provides a defined benefit pension plan to its employees. The company has 150employees. The remaining amortization period at December 31, 20X0, for prior service cost is 5 years. The average remaining service life of employees is 11 years at

> Berle Corp. has a defined benefit pension plan that features the following data: January 1, 20X1 (beginning of fiscal year): The CFO of Berle Corp. devises a plan to inflate artificially net income by using an estimate for expected return on plan assets

> Selected pension information extracted from the retirement benefits note that appeared in Green’s 20X1 annual report follows. (These numbers have been modified but are based on theactivities of a real company whose name has been disguis

> On January 1, 20X1, Cello Co. established a defined benefit pension plan for its employees. At January 1, 20X1, Cello estimated the service cost for 20X1 to be $45,000. At January 1, 20X2,it estimated 20X2 service cost to be $49,000. On the plan inceptio

> The following information pertains to Sparta Company’s defined benefit pension plan for 20X1: Service cost for 20X1 was $90,000. The Sparta pension plan did not receive any employercontributions or pay any benefits during the year. Spar

> In 20X1, Phillips Company reported $10,000,000 of pre-tax book income and also had $10,000,000 of taxable income. It incurred a $1,000,000 book expense that it deducted on itstax return. Assuming a 21% tax rate, this deduction results in a $210,000 tax b

> Mozart Inc.’s $98,000 taxable income for 20X1 will be taxed at the 21% corporate tax rate. Fortax purposes, its depreciation expense exceeded the depreciation used for financial reportingpurposes by $27,000. Mozart has $45,000 of purchased goodwill on it

> Bryan Trucking Corporation began business on January 1, 20X1, and consists of the parententity, domiciled and operating in Country X, and a subsidiary operating in Country Y. Bryanis required, as a listed company in Country X, to prepare financial statem

> The following is an excerpt from McDonald’s Corporation’s 2015 Management Discussion and Analysis. The MD&A, which is included in the Form 10-K annual report to the SEC, provides insight into the financial statemen

> On January 1, 20X1, the Dolan Company purchased a new office building in Las Vegas for $6,100,000, which it holds for rentals and capital appreciation. Dolan estimated the buildingwould have a useful life of 25 years and a residual value of $1,100,000. D

> Metge Corporation’s worksheet for calculating taxable income for 20X1 follows: The enacted tax rate for 20X1 is 21%, but it is scheduled to increase to 25% in 20X2 and subsequent years. All temporary differences are originating differen

> Nelson Inc. purchased machinery at the beginning of 20X1 for $90,000. Management used thestraight-line method to depreciate the cost for financial reporting purposes and the sum-of the years’ digits method to depreciate the cost for tax purposes. The lif

> For financial statement reporting, Lexington Corporation recognizes royalty income accordingto GAAP. However, royalties are taxed when collected. At December 31, 20X0, deferred royaltyincome of $400,000 was included in Lexington’s balance sheet. All of t

> Early in 2017, Altuve Corporation forecasted that it would report a deferred tax liability of $70million at December 31, 2017, representing the additional tax that would be due to U.S. authorities if its un repatriated foreign earnings were to be repatri

> The following information pertains to Ramesh Company for 20X1: The company has one permanent difference and one temporary difference between book andtaxable income. Required: 1. Calculate the amount of temporary difference for 20X1 and indicate whether

> In early 2017, Quintana Corporation prepared the following forecast of its earnings for 2017and 2018: Quintana’s pre-tax income forecasts include $40 million of nontaxable income in 2017 and $30million of nontaxable income in 2018. Thes

> Current tax law limits the amount of interest expense that corporations may deduct to the sumof (a) taxable interest income and (b) 30% of taxable income (excluding taxable interestincome) before any deductions for interest, depreciation, amortization, o

> Bortles Corporation’s U.S. operations have been in “steady state” for several years, whereby itspre-tax income has been constant (at $400 million each year) and its originating temporarydifferences and reversing temporary differences exactly offset. At D

> Trevathan Corporation has only one source of temporary differences—warranties. At December 31,2016, 2017, and 2018, the amounts of cumulative temporary differences were as follows: Temporary differences related to warranties arise becau

> The disclosure rules for business combinations complicate financial analysis. Trend analysis becomes difficult because comparative financial statements are not retroactively adjusted to include data for the acquired company for periods prior to the acqui

> Devers Corporation began operations in 20X1 and had the following partial income statements, which are complete only down to pre-tax income. Devers had no book-tax differences except for the effects of its net operating loss carryforward. The corporate t

> Cishek Corporation sold $100 million of gift cards in 20X1. The gift cards may be used to purchase goods from Cishek in the future. The gift cards never expire, and Cishek expects that none of the gift cards will go unused. Cishek projects the gift cards

> Goff Corporation has only one temporary difference, which is related to the use of accelerateddepreciation for income tax purposes and straight-line depreciation for financial reporting. Goff had the following amounts of cumulative temporary difference a